URU Metals Limited Extension of Convertible Loan Maturity Date (8698K)

August 31 2023 - 2:00AM

UK Regulatory

TIDMURU

RNS Number : 8698K

URU Metals Limited

31 August 2023

31 August 2023

URU Metals Limited

("URU" or "the Company")

Extension of Convertible Loan Maturity Date

URU announces that the date until which Boothbay Absolute Return

Strategies LP (" Boothbay ") will not convert sums due to under the

convertible loan note was extended from 30 August 2023 to on or

prior to 31 October 2023.

All other terms of the agreement remain the same as previously

notified including the 31 December 2023 date by which Boothbay has

the right to convert funds due under the loan note at GBP0.85 per

new ordinary share of the Company (" Ordinary Shares ") which is

also the repayment date and long-stop date for conversion of the

convertible loan notes held by Boothbay (the " Maturity Date

").

Details regarding the convertible loan note was announced by the

Company on 6 May 2020, and the maturity date for the note has been

extended on a number of occasions since this date by agreement of

the parties. As at 31 August 2023 the total amount advanced by

Boothbay Absolute Return Strategies LP to the Company is

US$500,000.

Unless repaid by the Company, amounts due to Boothbay under the

convertible loan note shall convert at or prior to the Maturity

Date:

(i) at a price that is a 35 per cent. discount to the Volume

Weighted Average Price ("VWAP") per share in the 5 trading days

prior to the noteholder serving a conversion notice;

(ii) on completion of an equity fundraising by the Company, at a

price that is a 35 per cent. discount to the price per share paid

by investors on such equity fundraising;

(iii) on a share sale (meaning a sale of Ordinary Shares giving

control of the Company, whether for cash and/or by way of exchange

for shares in another company and/or for other consideration, and

whether or not control of the Company changes as a result of such

transaction), a 35 per cent. discount to the price per share paid

on such a share sale; or

(iv) if there is no conversion notice served, equity fundraising

or share sale prior to the Maturity Date, at a 35 percent. discount

to the VWAP per share in the 5 trading days prior to the maturity

date.

In the event that Boothbay is issued with any new Ordinary

Shares pursuant to a conversion of the loan note, it will be issued

with one warrant attaching to each new Ordinary Share issued, with

an exercise period of 18 months from the date of grant and

exercisable at GBP0.85 per new Ordinary Share.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information, please contact:

URU Metals Limited

John Zorbas

(Chief Executive Officer) +1 416 504 3978

SP Angel Corporate Finance LLP

(Nominated Adviser and Broker)

Ewan Leggat / Harry Davies-Ball + 44 (0) 203 470 0470

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUROWROBUWOAR

(END) Dow Jones Newswires

August 31, 2023 02:00 ET (06:00 GMT)

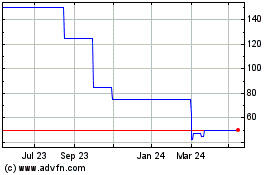

Uru Metals (LSE:URU)

Historical Stock Chart

From Nov 2024 to Dec 2024

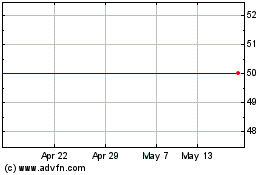

Uru Metals (LSE:URU)

Historical Stock Chart

From Dec 2023 to Dec 2024