Tissue Regenix Group PLC Proposed placing of new -7-

January 22 2015 - 2:00AM

UK Regulatory

9.1.26 that in making any decision to subscribe for the Placing

Shares, it has knowledge and experience in financial, business and

international investment matters as is required to evaluate the

merits and risks of subscribing for or purchasing the Placing

Shares. It further confirms that it is experienced in investing in

securities of this nature in this sector and is aware that it may

be required to bear, and is able to bear, the economic risk of

participating in, and are able to sustain a complete loss in

connection with, the Placing. It further confirms that it relied on

its own examination and due diligence of the Company and its

associates taken as a whole, and the terms of the Placing,

including the merits and risks involved, and not upon any view

expressed or information provided by or on behalf of Jefferies;

9.1.27 that in connection with the Placing, Jefferies and any of

its affiliates acting as an investor for its own account may take

up Placing Shares in the Company and in that capacity may retain,

purchase or sell for its own account such Placing Shares in the

Company and any securities of the Company or related investments

and may offer or sell such securities or other investments

otherwise than in connection with the Placing. Jefferies do not

intend to disclose the extent of any such investment or

transactions otherwise than in accordance with any legal or

regulatory obligation to do so;

9.1.28 that these terms and conditions and any agreements

entered into by it pursuant to these terms and conditions and any

non-contractual obligations arising out of or in connection with

such agreements shall be governed by and construed in accordance

with the laws of England and Wales and it submits, on its own

behalf and on behalf of any person on whose behalf it is acting, to

the exclusive jurisdiction of the English courts as regards any

claim, dispute or matter arising out of any such contract, except

that enforcement proceedings in respect of the obligation to make

payment for the Placing Shares (together with any interest

chargeable thereon) may be taken by the Company or Jefferies in any

jurisdiction in which it is incorporated or in which any of its

securities have a quotation on a recognised stock exchange;

9.1.29 that the Company, Jefferies and their respective

affiliates and others will rely upon the truth and accuracy of the

representations, warranties and acknowledgements set forth herein

and which are given to Jefferies on its own behalf and on behalf of

the Company and are irrevocable and it irrevocably authorises the

Company and Jefferies to produce this announcement, pursuant to, in

connection with, or as may be required by any applicable law or

regulation, administrative or legal proceeding or official inquiry

with respect to the matters set forth herein; and

9.1.30 that it will indemnify and hold the Company and Jefferies

and their respective affiliates harmless from any and all costs,

claims, liabilities and expenses (including legal fees and

expenses) arising out of or in connection with any breach of the

representations, warranties, acknowledgements, agreements and

undertakings in this announcement and further agrees that the

provisions of this announcement shall survive after completion of

the Placing.

9.2 By participating in the Placing, each Placee (and any person

acting on the Placee's behalf) subscribing for Placing Shares

acknowledges that: (i) the Placing Shares are being offered and

sold only pursuant to Regulation S under the Securities Act, or

another exemption from the registration requirements of the

Securities Act, in a transaction not involving a public offering of

securities in the United States and the Placing Shares have not

been and will not be registered under the Securities Act; and (ii)

the offer and sale of the Placing Shares to it has been made

outside of the United States in an "offshore transaction" (as such

term is defined in Regulation S under the Securities Act) and it is

outside of the United States during any offer or sale of Placing

Shares to it.

9.3 Please also note that the agreement to allot and issue

Placing Shares to Placees (or the persons for whom Placees are

contracting as agent) free of stamp duty and stamp duty reserve tax

in the UK relates only to their allotment and issue to Placees, or

such persons as they nominate as their agents, direct from the

Company for the Placing Shares in question. The Company and

Jefferies are not liable to bear any transfer taxes that arise on a

sale of Placing Shares subsequent to their acquisition by Placees

or for transfer taxes arising otherwise than under the laws of the

United Kingdom. Each Placee should, therefore, take its own advice

as to whether any such transfer tax liability arises. Furthermore,

each Placee agrees to indemnify on an after-tax basis and hold

Jefferies and/or the Company and their respective affiliates

harmless from any and all interest, fines or penalties in relation

to stamp duty, stamp duty reserve tax and all other similar duties

or taxes to the extent that such interest, fines or penalties arise

from the unreasonable default or delay of that Placee or its

agent.

9.4 Each Placee and any person acting on behalf of each Placee

acknowledges and agrees that Jefferies or any of its respective

affiliates may, at their absolute discretion, agree to become a

Placee in respect of some or all of the Placing Shares.

9.5 When a Placee or person acting on behalf of the Placee is

dealing with Jefferies, any money held in an account with Jefferies

on behalf of the Placee and/or any person acting on behalf of the

Placee will not be treated as client money within the meaning of

the rules and regulations of the FCA made under FSMA. The Placee

acknowledges that the money will not be subject to the protections

conferred by the client money rules; as a consequence, this money

will not be segregated from Jefferies' money in accordance with the

client money rules and will be used by Jefferies in the course of

its own business; and the Placee will rank only as a general

creditor of Jefferies.

9.6 All times and dates in this announcement may be subject to

amendment. Jefferies shall notify the Placees and any person acting

on behalf of the Placees of any changes.

9.7 9.69.7 The rights and remedies of Jefferies and the Company

under these Terms and Conditions are in addition to any rights and

remedies which would otherwise be available to each of them and the

exercise or partial exercise of one will not prevent the exercise

of others.

9.8 Past performance is no guide to future performance and

persons needing advice should consult an independent financial

adviser.

DEFINITIONS

The following definitions apply throughout this announcement

unless the context requires otherwise:

"Admission" the admission of the Placing

Shares to trading on AIM

and such admission becoming

effective in accordance

with the AIM Rules;

------------------------------ -----------------------------------

"AIM" the AIM market of the

London Stock Exchange

plc;

------------------------------ -----------------------------------

"AIM Rules" the AIM rules for companies

published by the London

Stock Exchange;

------------------------------ -----------------------------------

"Business Day" any day on which banks

are generally open in

England and Wales for

the transaction of business,

other than a Saturday,

Sunday or public holiday;

------------------------------ -----------------------------------

"Circular" the circular to be published

by the Company on or around

22 January in relation

to the Placing which includes

notice of convening the

General Meeting at which

the Shareholder Resolution

will be proposed.

------------------------------ -----------------------------------

"Company" or "Tissue Regenix" Tissue Regenix Group plc,

a company incorporated

in England and Wales with

registered number 5969271,

with its registered office

at The Biocentre, Innovation

Way, Heslington, York,

YO10 5NY;

------------------------------ -----------------------------------

"CREST" a relevant system (as

defined in the CREST Regulations)

in respect of which Euroclear

is the Operator (as defined

in the CREST Regulations);

------------------------------ -----------------------------------

"CREST Regulations" the Uncertificated Securities

Regulations 2001 (SI 2001/3755)

as amended from time to

time;

------------------------------ -----------------------------------

"Directors" or "Board" the existing directors

of the Company;

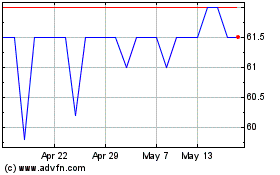

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Aug 2024 to Sep 2024

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Sep 2023 to Sep 2024