TIDMTOM

RNS Number : 2734E

TomCo Energy PLC

10 March 2022

10 March 2022

TOMCO ENERGY PLC

("TomCo" or the "Company")

TSHII Lease Agreement with Vivakor

MoU between Greenfield and Vivakor

TSHII Drilling Update and Warrant Term Correction

TomCo Energy plc (AIM: TOM), the US operating oil development

group focused on using innovative technology to unlock

unconventional hydrocarbon resources, is pleased to announce that

the Company's wholly owned subsidiary, Greenfield Energy LLC

("Greenfield"), has entered into a Memorandum of Understanding

("MoU") with Vivakor Inc. ("Vivakor") covering, inter alia, the

proposed development by Vivakor of an enhanced oil sands processing

plant on the Tar Sands Holdings II LLC ("TSHII") site located in

the Uinta Basin, Utah, United States and the provision of

professional services by Greenfield . In addition, Vivakor has

entered into a lease with TSHII covering approximately three acres

of the TSHII site to accommodate its planned operations, which

includes the future supply of oil sands by TSHII.

As previously announced, TomCo, via Greenfield, currently owns a

10% Membership Interest in TSHII with an exclusive option, at its

sole discretion, to acquire the remaining 90% of the Membership

Interests for certain additional cash consideration in the period

up to 31 December 2022.

TSHII Lease Agreement with Vivakor

Vivakor has entered into a renewed lease (the "Lease"), covering

approximately three acres of land (the "Property"), with TSHII for

a term of five years, with an option to extend for a further five

years, effective from 9 March 2022, to, inter alia, accommodate

Vivakor's storage needs and planned plant operations at the TSHII

site.

It is Vivakor's intention, with the assistance of Greenfield, to

develop and enhance a pre-exisiting oil sands processing plant that

it owns on the Property. Such upgraded plant, to be operated by

Vivakor, would be designed to produce at least 1,000 barrels of oil

per day or equivalent tonnage of asphalt cement.

Under the Lease, TSHII shall supply Vivakor with such quantity

of oil sands as Vivakor determines each month, at a set minimum

saturation quality, with a maximum supply of 2,000 tons per day.

Vivakor will cover the cost of mining the oil sands and will pay

TSHII US$3 per ton of oil sands processed by way of a rental

payment for the Lease. Vivakor has paid a US$30,000 advance against

future rental payments on signing of the Lease.

MoU between Greenfield and Vivakor

The MoU covers a proposed professional services agreement

between Vivakor and Greenfield for the potential supply of certain

operating and engineering services, including sand treatment and

oil upscaling to Vivakor, such services to be provided by Valkor

LLC through Greenfield.

In exchange for its services in respect of the enhancement of

Vivakor's plant, Greenfield would be entitled to receive 50% of net

revenues received by Vivakor for any post-processed sand material

from the plant sold through offtake agreements procured by

Greenfield.

The MoU includes a binding five-year exclusivity period for

agreeing and entering into any definitive agreements covering the

abovementioned matters.

TSHII Drilling Update

Further to the Company's announcement of 10 February 2022 that

the permits required from the Utah Division of Oil, Gas and Mining

to drill three exploration wells on the TSHII site had been

received by Greenfield's wholly owned subsidiary, AC Oil LLC, the

Company is pleased to report that the drilling of such wells has

now commenced.

Initial results from the drilling have met the Company's

expectations, with confirmation that no water was encountered in

the target formation. Approximately 120 feet of cores have been

produced so far from the first well drilled (AC1) and 80 feet of

cores from the second well (AC6). The third well (AC2) is expected

to be completed next week, following which tests will be conducted

to confirm the oil saturation.

Warrant Term Correction

As announced on 4 December 2019, the Company issued 8,538,462

warrants (the "Warrants") to Turner Pope Investments (TPI) Ltd

("TPI") in connection with their services in respect of the placing

announced therein. The Warrants give TPI the right to acquire

8,538,462 new ordinary shares in the Company at an exercise price

of 0.65 pence per share, for an aggregate exercise cost of

GBP55,500. The announcement on 4 December 2019 erroneously stated

that the Warrants were exercisable for a period of two years rather

than three years as detailed in the underlying Warrant

documentation. All other terms were correctly stated and remain as

previously disclosed.

Enquiries :

TomCo Energy plc

Malcolm Groat (Chairman) / John Potter (CEO) +44 (0)20 3823 3635

Strand Hanson Limited (Nominated Adviser)

James Harris / Matthew Chandler +44 (0)20 7409 3494

Novum Securities Limited (Broker)

Jon Belliss / Colin Rowbury +44 (0)20 7399 9402

IFC Advisory Limited (Financial PR)

Tim Metcalfe / Florence Chandler +44 (0)20 3934 6630

For further information, please visit www.tomcoenergy.com .

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCJLMJTMTBMTMT

(END) Dow Jones Newswires

March 10, 2022 02:00 ET (07:00 GMT)

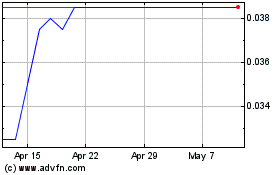

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Apr 2023 to Apr 2024