TIDMTIDE

RNS Number : 1268N

Crimson Tide PLC

28 September 2021

28 September 2021

Crimson Tide plc

Interim results for the six months ended 30 June 2021

Crimson Tide plc ("Crimson Tide" or "the Company"), the provider

of the mpro5 solution is pleased to announce its unaudited interim

results for the six months ended 30 June 2021.

Financial headlines

-- Turnover increase of 13.8% to GBP2,015k (H1 2020: GBP1,770k)

-- EBITDA increase of 12.5% to GBP529k (H1 2020: GBP470k)

-- Profit before tax increased by 11.3% to GBP286k (H1 2020: GBP257)

-- Fundraise of GBP5.6m (net of fees) finalised during April

2021, of which GBP250k spent in H1

Operational highlights

-- Expansion of food safety use of mpro5

-- Early progress on micro business version

-- UAT completed for patient version of mpro5

-- Raleigh, NC established as US base

-- Significant hires in sales, marketing and development

Barrie Whipp, Founder and Chairman, commented,

"With the completed fundraise for expansion purposes, we are set

to experience a new phase of growth as a business. We are now in a

position to deliver our version of mpro5 for micro/nano business

while mpro5 continues to perform strongly in our key enterprise

sectors of transport, facilities management and retail. We are

about to experience a period of significant expenditure on growth,

which will change our profile in H2 2021 and 2022, with the firm

belief that we have a bright future ahead".

About the Company

Crimson Tide plc is the provider of mpro5 - a leading,

cloud-based, cross-platform, SaaS mobile workflow solution. mpro5

enables organisations to drive efficiencies through mobile data

capture, Internet of Things sensors, process automation, and

real-time analytics. Supporting over 100,000 users across multiple

countries and industries, mpro5 is provided on multi-year

subscription basis driving immediate return on investment for its

users.

Enquiries:

Crimson Tide plc

Barrie Whipp / Luke Jeffrey +44 1892 542444

finnCap Ltd (Nominated Adviser and Broker)

Corporate Finance: Julian Blunt / James

Thompson +44 20 7220 0500

Corporate Broking: Andrew Burdis

Alma PR (Financial PR)

Josh Royston +44 7780 901979

Chairman's Statement

The first half of the year demonstrated the robustness of our

long-term subscription model for mpro5, whilst setting us up for

the largest capital raise in our history. With early wins in the

food safety sector as well as the utility vertical, we were able to

demonstrate the sound business model that attracted several highly

respected investors in the AIM market to participate in our

fundraising in April.

Our increased capital base and cash generated from mpro5's

existing operations saw cash increase to in excess of GBP6.5m, and

we are now in the early days of implementing the strategy presented

to investors. We are addressing client feature requests for the

core mpro5 platform which inherently enhances our sales process.

Our enterprise deals, by their nature, can have longer lead times,

however our abilities in IoT and dashboarding are making mpro5 even

more compelling. We are currently focused on the transport,

facilities management and retail sectors and our key model is to

"land and expand" with enterprise clients. Part of this strategy is

to be able to assist them wherever their business is located.

Internationally, we have established mpro5 Inc, based in

Raleigh, North Carolina. This is not a grand physical strategy but

a tactical approach, where our US CEO, Mark Self can approach

existing clients (or clients of clients) as well as establish

partnerships and relationships. Our mpro5 demo systems and

marketing material can help us add new business based upon existing

use cases. We have expanded into Scandinavia: whilst only in a very

small way to date, this is an excellent example of how mpro5's

value in the UK & Ireland is replicable with international

clients in their other geographic markets. Adding the World

Federation of Haemophilia to our subscription base also represents

a highly exciting opportunity. Our patient app, previously

applicable to patients with haemophilia has been completely

reengineered to suit any condition where patients need to report

usage of medication as well as verification that the medicine is in

date, applicable to them and not counterfeit. We are as excited

with the opportunities in this sector as any of our business

verticals.

Project wrkrz, our version of mpro5 for micro/nano business is

undergoing first stage development as well as market research,

branding and technical stack progress on an ongoing basis. We aim

for release in Q2, 2022 and it should be noted that many of the new

learnings are also relevant to future developments in mpro5. Our

market research indicates that there is a clear market for this low

touch version of mpro5 in the trades sector and will see

significant investment in the coming years.

This has been an important half year for Crimson Tide plc. With

the capital backing that we have previously lacked, we can now

invest in some of the opportunities that we know exist, as well as

major partner acquisition, integration and more aggressive R&D.

We feel that we can now market our business aggressively. I

encourage you to visit mpro5.com to view our case studies and

marketing material. This business has never been so well set. The

addition of a Head of Marketing, US CEO and Jacqueline Daniell, as

a new Non-Executive Director, has strengthened our executive and

board significantly.

We are keenly focused on expanding the business in our key

sectors, whilst exploring geographic opportunities and developing

our micro business and patient versions of the mpro5 platform. We

have strengthened our team, identified our marketing and

development partners and will press ahead with ambition and

optimism.

Barrie Whipp

Founder and Chairman

28 September 2021

Financial Review

Financial indicator Six months Six months Increase Year ended

ended 30 ended 31 December

June 2021 30 June % 2020

GBP'000 2020 GBP'000

GBP'000

Revenue 2,015 1,770 13.8% 3,542

----------- ----------- --------- -------------

Gross profit 1,652 1,404 17.7% 2,865

----------- ----------- --------- -------------

EBITDA 529 470 12.5% 946

----------- ----------- --------- -------------

Profit before tax 286 257 11.3% 532

----------- ----------- --------- -------------

The half-year financial results for 2021 reflect double-digit

growth across all the key financial indicators.

Revenue

Revenue growth remained robust during the period, with monthly

recurring revenue as at 30 June 2021 at cGBP300,000 (H1 2020:

cGBP235,000). Consultancy fees contributed GBP178,000 to revenue

during the period (H1 2020: GBP255,000). Revenue churn during the

period remained low at 1.4% (H1 2020: 3.9%). Geographically the

revenue split remained consistent to that of the prior year, with

the UK contributing 92% of revenue (H1 2020: 93%).

Cost of Sales and gross profit

The gross profit margin of 82% remained above the Board's target

rate of 80% (H1 2020: 79%).

Other income

Other income reflects the sale of legacy hardware devices. The

nature of this is not recurring.

Cashflow

Operating cash flows before movement in working capital

increased to GBP530,000 (H1 2020: GBP476,000). Although cash

generated by operations of GBP111,000 (H1 2020: GBP1.03 million)

appears to have decreased, this is mostly an effect of the measures

that the Board put in place during the first lockdown in 2020 to

preserve cash, with the subsequent correction taking place during

the current period. Cash prior to the fundraise in April was

cGBP1m. Following the successful raise of GBP5.6 million (net of

fees) at the end of April, the Company has spent approximately

GBP250,000 on initiatives highlighted during the fundraise process.

It is expected that this amount will increase during H2 2021.

Investment in marketing will also increase, under the guidance of

the newly appointed Head of Global Marketing.

Lease liabilities

Loans and leases decreased to GBP205,000 (H1 2020: GBP410,000)

and obligations will conclude during the following 18 months. No

new leases were entered into during the period under review.

Intangible asset

Software development costs of GBP259,000 (H1 2020: GBP229,000)

were capitalised during the period under review, while amortisation

amounted to GBP123,000 (H1 2020: GBP100,000). The value of the

capitalised software intangible asset at period-end was GBP1.8

million (H1 2020: GBP1.45 million).

Earnings per share

Following the issue of 200 million ordinary shares on 23 April

2021, the total number of ordinary shares in issue at period end

was 657,486,234 (H1 2020: 457,486,234). Basic and diluted earnings

per share was 0.05p (H1 2020: 0.06p) during the period under

review.

Crimson Tide plc

Condensed Consolidated Statement of Profit or Loss

for the 6 months to 30 June 2021

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2021 2020 2020

GBP000 GBP000 GBP000

Revenue 2,015 1,770 3,542

Cost of Sales (363) (366) (677)

Gross Profit 1,652 1,404 2,865

Other income 123 - 5

Administrative expenses (1,477) (1,128) (2,309)

---------- ---------- -----------

Operating profit 298 276 561

Finance costs (12) (19) (29)

Profit before taxation 286 257 532

Taxation - - 202

---------- ---------- -----------

Profit for the period attributable

to equity holders of the parent 286 257 734

========== ========== ===========

Earnings per share Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2021 2020 2020

Basic earnings per Ordinary Share 0.05p 0.06p 0.16p

Diluted earnings per Ordinary Share 0.05p 0.06p 0.16p

Condensed Consolidated Statement of Comprehensive Income

for the 6 months to 30 June 2021

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2021 2020 2020

GBP000 GBP000 GBP000

Profit for the period 286 257 734

Other comprehensive income/(loss)

for period:

Exchange differences on translating

foreign operations 1 6 4

Total comprehensive profit recognised

in the period and attributable to

equity holders of parent 287 263 738

========== ========== ===========

Condensed Consolidated Statement of Financial Position at 30

June 2021

Unaudited Unaudited Audited

As at As at As at 31

30 June 30 June December

2021 2020 2020

GBP000 GBP000 GBP000

ASSETS

Non-current assets

Intangible assets 2,577 2,247 2,441

Property, plant & equipment 189 291 235

Right-of-use asset 64 121 92

Deferred tax asset 32 32 32

---------- ---------- ----------

Total non-current assets 2,862 2,691 2,800

---------- ---------- ----------

Current assets

Inventories 6 6 6

Trade and other receivables 1,474 1,018 1,221

Cash and cash equivalents 6,596 1,052 1,175

---------- ---------- ----------

Total current assets 8,076 2,076 2,402

---------- ---------- ----------

Total assets 10,938 4,767 5,202

---------- ---------- ----------

LIABILITIES

Current liabilities

Trade and other payables 741 820 907

Borrowings 7 18 8

Lease liabilities 134 221 181

---------- ---------- ----------

Total current liabilities 882 1,059 1,096

---------- ---------- ----------

Non-current liabilities

Borrowings - 8 5

Lease liabilities 64 163 94

---------- ---------- ----------

Total non-current liabilities 64 171 9

Total liabilities 946 1,230 1,195

---------- ---------- ----------

Net assets 9,992 3,537 4,007

---------- ---------- ----------

EQUITY

Share capital 657 457 457

Share premium 5,644 148 148

Other reserves 481 480 479

Reverse acquisition reserve (5,244) (5,244) (5,244)

Retained profits 8,454 7,696 8,167

---------- ---------- ----------

Total equity 9,992 3,537 4,007

---------- ---------- ----------

Condensed Consolidated Statement of Changes in Equity

Six-month period ended 30 June 2021 (Unaudited)

Reverse

acquisi-tion

Share Share premium Other reserve Retained

capital reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31

December 2020 457 148 479 (5,244) 8,167 4,007

Shares issued 200 5,496 - - - 5,696

Profit for the

period - - - - 286 286

Translation

movement - - 2 - 1 3

Balance at

30 June 2021 657 5,644 481 (5,244) 8,454 9,992

Six-month period ended 30 June 2020 (Unaudited)

Reverse

acquisi-tion

Share Share premium Other reserve Retained

capital reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 31

December 2019 457 148 475 (5,244) 7,433 3,269

Profit for the

period - - - - 257 257

Translation

movement - - 5 - 6 11

Balance at

30 June 2020 457 148 480 (5,244) 7,696 3,537

Condensed Consolidated Statement of Changes in Equity

Year ended 31 December 2020 (Audited)

Reverse

acquisi-tion

Share Share premium Other reserve Retained

capital reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

January 2020 457 148 475 (5,244) 7,433 3,269

Profit for the

period - - - - 734 734

Translation

movement - - 4 - - 4

Balance at

31 December

2020 457 148 479 (5,244) 8,167 4,007

Condensed Consolidated Statement of Cash flows

For the 6 months to 30 June 2021

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP000 GBP000 GBP000

Cash flows from operating activities

Profit before tax 286 257 532

Adjustments for:

Amortisation of Intangible Assets 123 100 216

Depreciation of property, plant

and equipment 80 66 111

Depreciation of right-of-use assets 28 28 57

Unrealised currency translation

movement 1 6 4

Interest paid 12 19 29

--------- --------- ------------

Operating cash flows before movement

in working capital and provisions 530 476 949

Decrease in inventories - 6 6

(Increase)/decrease in trade and

other receivables (253) 202 (1)

(Decrease)/increase in trade and

other payables (166) 346 433

--------- --------- ------------

Cash generated by operations 111 1,030 1,387

Income taxes received - - 202

Interest paid in cash (10) (15) (27)

--------- --------- ------------

Net cash from operating activities 101 1,015 1,562

--------- --------- ------------

Cash flows from investing activities

Purchases of property, plant and

equipment (34) (32) (21)

Development expenditure capitalised (259) (229) (539)

--------- --------- ------------

Net cash used in investing activities (293) (261) (560)

--------- --------- ------------

Cash flows from financing activities

Net proceeds from share issues 5,696 - -

Repayments of borrowings (6) (14) (21)

Repayments of lease liability (77) (8) (126)

--------- --------- ------------

Net cash from financing activities 5,613 (22) (147)

--------- --------- ------------

Net increase in cash and cash equivalents 5,421 732 855

Net cash and cash equivalents at

beginning of period 1,175 320 320

--------- --------- ------------

Net cash and cash equivalents at

end of period 6,596 1,052 1,175

--------- --------- ------------

Crimson Tide Plc

Notes to the Unaudited Interim Results for the 6 months ended 30

June 2021

1. General information and basis of preparation

Crimson Tide plc is a public company, limited by shares, and

incorporated and domiciled in the United Kingdom. The Company has

its listing on AIM. The address of its registered office is

Oakhurst House, 77 Mt. Ephraim, Tunbridge Wells, Kent, TN4 8BS.

Basis of preparation

The condensed consolidated interim financial statements

("interim financial statements") have been prepared in accordance

with International Accounting Standard 34 Interim Financial

Reporting using accounting policies that are consistent with those

applied in the previously published financial statements for the

year ended 31 December 2020, which have been prepared in accordance

with IFRS as adopted by the European Union.

The information for the period ended 30 June 2021 has neither

been audited nor reviewed and does not constitute statutory

accounts as defined in section 434 of the Companies Act 2006.

The interim financial statements should be read in conjunction

with the consolidated financial statements for the year ended 31

December 2020. A copy of the statutory accounts for that period has

been delivered to the Registrar of Companies. The auditor's report

on those accounts was unqualified and did not contain statements

under section 498 (2) or (3) of the Companies Act 2006.

Going concern

The financial statements are prepared on the going concern

basis. The financial position of the Company, its cash flows and

liquidity position are described in the interim financial statement

and notes. The Company has the financial resources to continue in

operation for the foreseeable future, a period of not less than 12

months from the date of this report.

2. Revenue and operating segments

The Group has two main regional centres of operation; one in the

UK, the other in Ireland but the Group's resources, including

capital, human and non-current assets are utilised across the Group

irrespective of where they are based or originate from. The Board

is the chief operating decision maker ("CODM"). The CODM allocates

these resources based on revenue generation, which due to its high

margin nature and the Group's reasonably fixed overheads, in turn

drives profitability and cashflow generation. The Board consider it

most meaningful to monitor financial results and KPIs for the

consolidated Group, and decisions are made by the Board

accordingly.

In due consideration of the requirements of IFRS 8 Operating

Segments, the Board consider segmental reporting by (i) business

activity, by turnover, and (ii) region, by turnover to be

appropriate. Business activity is best split between (i) the

strategic focus of the business, i.e. mobility solutions and the

resulting development services that emanate from that, (ii)

non-core software solutions, including reselling third party

software and related development and support services, and (iii)

hardware sales to existing customers.

Segment information for the reporting periods is as follows:

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2021 2020 2020

Revenue by business activity

Mobility solutions and related

development 1,837 1,290 3,212

Software consultancy 178 255 330

Hardware sales - 225 -

------------ ------------ ------------

2,015 1,770 3,542

------------ ------------ ------------

Revenue can be further analysed by geographic reason as

follows:

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2021 2020 2020

Revenue by geographic region

UK 1,855 1,640 3,233

European Union 140 118 275

Rest of the world 20 12 34

------------ ------------ ------------

2,015 1,770 3,542

------------ ------------ ------------

3. Earnings per share

The calculation of the basic earnings per share is based on the

profit attributable to ordinary shareholders and the weighted

average number of ordinary shares in issue during the period.

The calculation of the diluted earnings per share is based on

the profit per share attributable to ordinary shareholders and the

weighted average number of ordinary shares that would be in issue,

assuming conversion of all dilutive potential ordinary shares into

ordinary shares.

Reconciliations of the profit and weighted average number of

ordinary shares used in the calculation are set out below:

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2021 2020 2020

Earnings per share

Reported profit (GBP000) 286 257 734

Reported basic earnings per

share (pence) 0.05 0.06 0.16

Reported diluted earnings

per share (pence) 0.05 0.06 0.16

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2021 2020 2020

No. 000 No. 000 No. 000

Weighted average number of

ordinary shares

Shares in issue at start of

period 457,486 457,486 457,486

Effect of shares issued during 76,243 - -

the period*

------------ ------------ ------------

Weighted average number of

ordinary

shares for basic EPS 533,729 457,486 457,486

Effect of share options outstanding 291 - 2,939

------------ ------------ ------------

Weighted average number of

ordinary

shares for diluted EPS 534,020 457,486 460,425

------------ ------------ ------------

*200 million ordinary shares were issued on 23 April 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UBUNRAWUKUAR

(END) Dow Jones Newswires

September 28, 2021 01:59 ET (05:59 GMT)

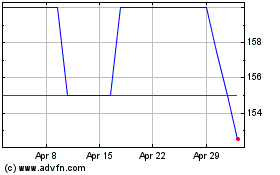

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Apr 2023 to Apr 2024