TIDMSYNC

RNS Number : 1295U

Syncona Limited

21 November 2019

21 November 2019

Syncona Limited

Interim Results for the six months ended 30 September 2019

Pivotal period validating the Syncona model; strong momentum

across high quality portfolio

Syncona Ltd, ("Syncona"), a leading healthcare company focused

on founding, building and funding a portfolio of global leaders in

life science, today announces its Interim Results for the period

ended 30 September 2019.

Martin Murphy, CEO of Syncona Investment Management Limited,

said:

"We have made good progress across the portfolio and

demonstrated a strong track record of success in the first half of

2019. The sales of Blue Earth and Nightstar, two companies we

founded, generated strong risk-adjusted returns, strengthened our

capital base and enabled us to invest significantly into our

exciting portfolio of companies as they scale. We continue to see a

strong pipeline of opportunities across a broad range of

therapeutic areas to found new companies and take products to

market, as we seek to build a sustainable, diversified portfolio of

15-20 companies in innovative areas of healthcare."

Financial performance

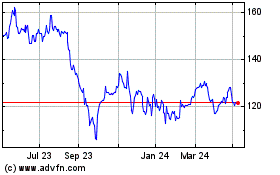

-- Net assets at 30 September 2019 of GBP1,336.8 million (31

March 2019: GBP1,455.1 million); 198.9p per share[1], a NAV total

return[2] of (7.2) per cent

-- Life science portfolio, valued at GBP481.3 million, a (11.8)

per cent return[3] over the six months

- Uplifts from the sale of Blue Earth Diagnostics (Blue Earth)

and a Series B financing in Achilles Therapeutics (Achilles)

- Outweighed by a 61 per cent decline in Autolus' (NASDAQ: AUTL)

share price; we continue to believe in the company's strong

fundamentals

Proven value creation through differentiated model

-- Blue Earth and Nightstar sales generated an aggregate of GBP592.6 million of proceeds

- Sale of Blue Earth to Bracco Imaging for $476.3 million,

represented a 10x return on invested capital[4] and an IRR of 87

per cent[5]

- Sale of Nightstar to Biogen for $877.0 million represented a

4.5x return on invested capital[6] and an IRR of 72 per cent[7]

Strengthened capital base to fund growing life science

portfolio

-- Capital base increased by GBP455.8 million to GBP855.5 million[8]

-- GBP127.2 million investment into our life science companies

in line with strategy, including:

- Investment of $24.0 million in a $109.0 million follow-on

financing in Autolus

- Committed GBP48.0 million to Gyroscope Therapeutics in a

GBP50.4 million Series B financing

- Achilles raised GBP100.0 million in an oversubscribed Series

B; Syncona was the largest investor in the round with GBP35.1

million commitment

-- Capital deployment for the full year to increase to

GBP200-GBP250 million; subject to timings of financings and

disciplined approach to capital allocation

Strong clinical progress

-- Ongoing progress in the clinical pipeline with seven live clinical trials, including:

- Encouraging initial data from Autolus (NASDAQ: AUTL) in AUTO1

adult ALL

- Freeline commenced second clinical programme in Fabry's

Disease

- Dose optimisation progressing in Freeline's B-AMAZE Phase 1/ 2

trial in Haemophilia B

- Dose escalation ongoing in Gyroscope Phase 1/2 trial in dry

AMD

Recent events post period end:

-- Committed GBP29.5 million to new portfolio company, Azeria

Therapeutics (Azeria), a company developing and commercialising

innovative cancer therapeutics

-- Achilles commenced patient enrolment in first programme in

Non-Small Cell Lung Cancer (NSCLC)

-- Autolus announced that it will present further data from its

pipeline of programmes at the American Society of Hematology (ASH)

conference including: AUTO1, AUTO2 and AUTO3

Outlook - long-term opportunity to create significant value

We see a rich pipeline of opportunities around which to found

new companies with the ambition of taking products to market,

including across areas such as gene therapy, cell therapy, small

molecules and biologics. In our existing portfolio, we provide

ambitious, long-term funding to our companies, which are scaling

rapidly and progressing through the development cycle enabling us

to retain significant ownership positions of strategic influence.

In line with this and subject to the timing of financings, we

expect our capital deployment for the full year to increase to

GBP200-GBP250 million (prior FY2020 guidance: GBP100-200

million).

In the short term, data generated from our clinical pipeline

will be a core driver of value, and we expect both Freeline's

B-AMAZE trial in Haemophilia B to publish data in this financial

year and Autolus to take a decision on whether to initiate a Phase

2 trial in AUTO3 DLBCL in mid CY2020.

Long-term, we believe there is an opportunity to create

significant value in life science through our differentiated model.

We are half way to our target of building an evolving, diversified

portfolio of 15-20 companies. Over the next 10 years, we expect to

deliver 3-5 companies from this portfolio which reach the point of

product approval and where Syncona remains a significant

shareholder. We believe this approach will maximise risk-adjusted

returns for shareholders.

Chris Hollowood, CIO, of Syncona Investment Management Limited,

said:

"Following the addition of new Syncona company, Azeria, we have

a high-quality portfolio of nine companies. Three are at clinical

stage, where the data generated will be a core driver of value.

Whilst clinical and regulatory processes involve significant risk,

we have a high level of conviction in our companies, and there is

strong momentum in the portfolio.

We have a highly expert team, strategic capital base and

differentiated model to found, build and fund businesses through

the translation of globally leading life science research as we

seek to deliver transformational treatments to patients and strong

risk-adjusted returns for shareholders."

[S]

Enquiries

Syncona Ltd

Annabel Clay / Siobhan Weaver

Tel: +44 (0) 20 3981 7940

FTI Consulting

Brett Pollard / Ben Atwell / Natalie Garland-Collins

Tel: +44 (0) 20 3727 1000

About Syncona:

Syncona is a leading FTSE250 healthcare company focused on

founding, building and funding a portfolio of global leaders in

life science. Our vision is to build a sustainable, diverse

portfolio of 15 - 20 companies focused on delivering

transformational treatments to patients in truly innovative areas

of healthcare, through which we are seeking to deliver strong

risk-adjusted returns for shareholders.

We seek to partner with the best, brightest and most ambitious

minds in science to build globally competitive businesses. We take

a long-term view, underpinned by a strategic capital base which

provides us with control and flexibility over the management of our

portfolio. We focus on delivering dramatic efficacy for patients in

areas of high unmet need.

Copies of this press release, a company results presentation,

and other corporate information can be found on the company website

at: www.synconaltd.com

Forward-looking statements - this announcement contains certain

forward-looking statements with respect to the portfolio of

investments of Syncona Limited. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon circumstances that may or may not occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. In particular, many companies

in the Syncona Limited portfolio are conducting scientific research

and clinical trials where the outcome is inherently uncertain and

there is significant risk of negative results or adverse events

arising. In addition, many companies in the Syncona Limited

portfolio have yet to commercialise a product and their ability to

do so may be affected by operational, commercial and other

risks.

Chairman's foreword

Syncona's differentiated approach has been validated in the

first half of this year. There is significant momentum in our

portfolio companies which are scaling rapidly. Our ability to

deliver strong risk-adjusted returns was demonstrated with the

realisation of two Syncona founded companies, which also

significantly strengthened our capital base.

Performance in the six months

Uplifts from the sale of Blue Earth and the recent financing of

Achilles were outweighed by the 61 per cent decline in Autolus'

share price, and net assets decreased to GBP1,336.8 million or

198.9p per share[9], a (7.2) per cent total return[10] in the six

months (31 March 2019: net assets of GBP1,455.1 million, 216.8 p

per share).

At the end of the period, we have a life science portfolio

valued at GBP481.3 million and a capital base supporting the growth

of this portfolio of GBP855.5 million. A strong balance sheet and

certainty of funding is key to delivering our strategy and our

capital base provides us with the flexibility to back our portfolio

companies as they scale, whilst allowing us to take a long-term

approach and maintain significant ownership positions.

Board transition

I am delighted that Melanie Gee will take over as Chair when I

retire from the Board on 31 December 2019. Melanie brings a wealth

of expertise from 30 years in investment banking and is an

experienced FTSE board member. She will be an excellent Chair as

the Company moves into its next stage of growth. I am very grateful

to my colleagues for their invaluable contribution and support over

my past seven years on the Board.

Long-term opportunity

In 2016, we acquired a portfolio of life science assets together

with a leading management team from the Wellcome Trust. We set out

our vision to found and build globally competitive life science

companies with the ambition to take products to market, deliver

transformational treatments to patients and generate strong

risk-adjusted returns for our shareholders. I am delighted that we

have seen rapid and significant progress over the last three years

and are well on the way towards achieving our vision.

Syncona has a unique model underpinned by a strategic pool of

capital and an expert team that continues to expand our

high-quality portfolio of life science companies which we expect to

continue to drive significant returns for shareholders. We have a

strong pipeline of exciting opportunities, leveraging the rich

landscape of science and innovation in the UK and beyond. I am

proud of what has been achieved so far and even more excited for

the future. I believe there is a huge opportunity for Syncona to

create significant value for shareholders over the long-term.

Jeremy Tigue

Chairman

20 November 2019

CEO Statement

Syncona has made strong progress as we continue to deliver on

our strategy of creating a portfolio of life science companies

based on founding, building and funding global leaders in

healthcare.

A growing track record of success:

Syncona has an expert team and a permanent capital base to

capture the out-return from the commercialisation of an exceptional

research base in life science in Europe, particularly the UK. This

platform is combined with a differentiated, long-term, product

focused strategy to maximise risk-adjusted returns for

shareholders. We believe that significant value creation in life

science comes by taking products into late development and to

approval - targeting the steepest part of the value creation curve.

To deliver this, we select science and innovation that will have a

transformational impact for patients, and which can be credibly

developed by innovative biotech companies all the way to product

approval. We found our companies with this ambition, build them for

global success and fund them ambitiously over the long-term,

maintaining significant ownership positions and thereby maximising

our opportunity to capture significant value for shareholders. It

is important that our companies know Syncona can fund them for the

long-term, as this gives us the ability to build globally

competitive businesses and attract the best management teams.

Having identified and financed Azeria post period end, we have a

portfolio of nine companies, which is diversified across a range of

therapeutic areas and are at various stages of the development

cycle. The sale of two of our most developed businesses, Blue Earth

and Nightstar, which completed during the half year demonstrated

our ability to deliver strong risk-adjusted returns for

shareholders. In the case of Blue Earth, we sold the business to

Bracco Imaging for $476.3 million in June, generating proceeds of

GBP336.8 million and a return of 10x original invested capital[11].

Syncona founded the business in 2014 and worked in close

partnership with the Blue Earth management team to successfully

develop, launch and commercialise an impactful product for prostate

cancer imaging, funding the business on a sole-basis. We also

completed the sale of Nightstar, a company we founded in 2014.

Nightstar also benefited from our long-term, operational and

hands-on approach and we accepted an offer of $877.0 million for

the business from Biogen earlier this year, crystallising proceeds

of GBP255.8 million (representing a return of 4.5x original

invested capital[12]).

The decisions to sell Blue Earth and Nightstar were driven by

our view of the balance of risk and reward facing these companies

and represented attractive opportunities to deliver out sized

returns for our shareholders. Our model enables us to redeploy the

proceeds, into our portfolio companies as they scale, and also

pursue exciting new opportunities as we look to build a sustainable

portfolio.

Strong progress across our portfolio:

We have seen significant financial, clinical and operational

progress inour portfolio companies during the first half of the

year. We have completed significant financings in three of our

portfolio companies, commenced a new clinical trial in Fabry

disease, have seen encouraging data reported in AUTO1 adult ALL and

now have seven active clinical trials in our promising clinical

pipeline. While the Autolus share price has declined during the

period, we are focused on long-term value creation and believe the

fundamentals of the company are strong.

Post-period end, we have committed GBP29.5 million in a GBP32.0

million Series B financing to a new Syncona company, Azeria

Therapeutics, which is focused on developing small molecules

designed to treat hormone resistant breast cancer. The company was

founded in 2017 by a world-leading academic, Dr Jason Carroll, who

is an expert in the study of pioneering factors in cancer. His

scientific insights have identified a new target and mechanism of

action in an area of high unmet need, namely the approximately 30

per cent of oestrogen receptor positive breast cancer patients, who

ultimately progress to late stage endocrine resistant

disease[13].

Azeria received GBP5.5 million of Series A funding from the CRT

Pioneer Fund in which Syncona is the largest investor. This gave us

unique insight and access to the investment, through which we saw

an opportunity to build a world-leading oncology company focused on

developing its lead programme through to commercialisation and

building a pipeline of further programmes. Syncona Partners, Magda

Jonikas and Michael Kyriakides are now developing the business plan

and clinical pipeline with the Azeria team. Through our investment

in the CRT Pioneer Fund, and directly through the Series B

financing, Syncona has a 75 per cent ownership holding in

Azeria[14].

A rapidly scaling portfolio

Successful life science companies scale rapidly. They require

increasing amounts of capital to achieve their ambitions as they

progress through the development cycle, secure globally leading

management teams and build industrial scale.

Our portfolio companies are progressing well meaning the scale

of the capital which they require is also increasing. We have three

companies in the clinic progressing seven programmes and have

deployed GBP127.2 million in the period. Our strategic capital

base, which has been significantly strengthened by the sale of Blue

Earth and Nightstar, provides us with the flexibility to back our

companies over the long-term, while retaining significant ownership

stakes.

Managing risk and reward

As our companies scale, we continue to take a disciplined

approach to capital allocation to optimise returns for our

shareholders. For any given company, we continually assess the

opportunity, the fundamental risk, the capital required to scale

ambitiously and the strength of our own balance sheet, to determine

the optimum financing approach or the right time to sell a

company.

We typically remain the sole investor throughout initial rounds

of investments. However, there will also be circumstances where the

right thing for the company, and Syncona, will be to bring in

likeminded investors to support the portfolio company, while

maintaining a significant ownership stake, for example where the

capital required is at a level beyond which we could prudently

invest from our balance sheet.

Equally, we will sell companies prior to product approval if we

have the opportunity to capture an out-sized risk-adjusted return

for our shareholders, applying our disciplined assessment of the

risk and future opportunity. We believe the sale of Nightstar is a

good example of this strategy. Importantly, our capital base

protects against the risk of being a forced seller and allows us to

make informed decisions around whether to invest alone or divest

our companies to realise value.

Alongside financial risk, there is also scientific, clinical,

execution and commercial risk in building life science companies.

The Syncona team's strong track record and expertise means that we

are highly qualified to understand and manage these risks both at

an early stage and through the development cycle, but it is the

nature of life science businesses that some of our companies won't

succeed. In these circumstances, we aim to take action quickly to

recover as much value as possible and limit further costs, so that

we can reallocate our time and investment capacity to other

opportunities.

At the portfolio level, we also seek to manage risk through the

creation of a portfolio of 15-20 companies which we would expect to

sit across a range of therapeutic areas and development stages. We

believe this level of diversification is appropriate to meet our

primary goal of delivering 3-5 companies to the point of

approval.

Significant opportunity over the long-term:

We continue to see a rich set of opportunities in the UK, where

there is a globally differentiated research base. These include

high quality opportunities in gene and cell therapy, areas where we

already have deep domain expertise and strong platform

capabilities, and attractive pipeline opportunities more broadly

across a range of therapeutic areas and modalities, including small

molecules and biologics. Our focus is on finding opportunities

where we can deliver our strategy to build global leaders aiming to

take their products to market and capture shareholder returns by

targeting the steepest part of the value creation curve. Our

proactive approach to identifying innovative areas of science and

then partnering with globally leading academics to found new

companies enables us to access the very best opportunities and

bring the Syncona team's differentiated expertise to bear from the

outset.

We enter the second half with strong momentum in the portfolio.

We remain focused on leveraging our expertise and differentiated

model to build globally competitive businesses. Over the next 10

years, we are seeking to build our high conviction portfolio to

15-20 companies, adding new companies at a rate of 2-3 a year. Our

goal is to deliver 3-5 companies, in which we retain a significant

ownership position, to the point of product approval. We believe

this will enable us to capture the significant value creation

opportunity available from commercialising life science innovation

and ultimately achieve our ambition to deliver transformational

treatments to patients and strong risk-adjusted returns for

shareholders.

Martin Murphy, CEO Syncona Investment Management Limited

20 November 2019

Life science portfolio review

There is good progress in the portfolio, which was valued at

GBP481.3 million at 30 September 2019, with eight companies at the

end of the period: three clinical stage companies and five

pre-clinical companies focused on establishing operations and

setting and implementing their strategic vision.

Clinical companies:

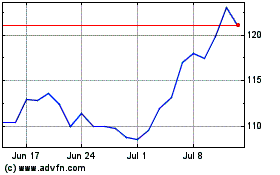

Autolus (11.0% of NAV, 29% shareholding):

-- Encouraging data in AUTO1 adult acute lymphoblastic leukaemia

(ALL) programme; the company completed a follow-on financing of

$109.0 million where Syncona invested $24.0 million

-- AUTO1 adult ALL expected to move to a pivotal programme in H1

2020; further data from AUTO1, AUTO2 and AUTO3 to be presented at

ASH in December 2019

Autolus is our biopharmaceutical company developing

next-generation programmed T cell therapies for the treatment of

cancer. During the period, the company reported initial positive

data from the AUTO1 adult ALL Phase 1/2 trial and confirmed that it

plans to initiate a pivotal programme in the first half of calendar

year 2020. It also reported that it will move to focus on a next

generation product targeting multiple myeloma as its AUTO2

programme is not differentiated from competitor programmes. Autolus

also intends to make a decision on whether to initiate a Phase 2

trial for AUTO3 in Diffuse Large B-cell lymphoma (DLBCL) in

mid-2020, whilst in paediatric ALL (pALL), it reported that it will

focus on its AUTO1 and AUTO NG products, where data currently

indicates a differentiated combination of efficacy, safety and

persistence. AUTO1NG is expected to commence a Phase 1 study in the

first half of 2020.

Autolus completed a $109.0 million follow-on financing in April

2019, in which Syncona invested $24.0 million. The business has

also been focused on expanding operations at its clinical

manufacturing site at the Catapult Cell and Gene facility in

Stevenage, to enable the company to meet its expected demand for

its clinical trials.

Post period end, the business published abstracts for the ASH

conference in November 2019, where it reported further early

encouraging data from its AUTO3 programme in DLBCL from the low

dose cohorts, with further data from patients in a higher dose

cohort expected to be presented at ASH. The business also reported

that it will publish data from its pipeline of programmes,

including AUTO1 (pALL and adult ALL), AUTO2 and AUTO3 (pALL and

DLBCL) at the conference.

Despite the recent share price fall, our view is that Autolus is

a strong company with positive fundamentals as it seeks to apply a

broad range of technologies to engineer a pipeline of precisely

targeted T cell therapies designed to better recognise and attack

cancer cells. The business is expecting to initiate a

registrational trial in its lead programme in AUTO1 in adult ALL in

H1 CY2020, where there is currently no CAR-T therapy approved.

Compared to the current standard of care in relapsed refractory

Adult ALL, Blincyto, a redirected T cell engager, AUTO1 has the

potential to have a highly differentiated efficacy profile with a

comparable safety profile. There is an addressable patient

population of 3,000 patients[15] and 8,400 new cases of adult ALL

diagnosed yearly worldwide and therefore this represents a

significant commercial opportunity for the business[16].

Freeline (8.9% of NAV, 80% shareholding):

-- Two clinical programmes; dose optimisation continues in lead

programme in Haemophilia B programme and first patient dosed in

second programme in Fabry's Disease

-- Further data from Haemophilia B programme is expected in this

financial year and early data from the Fabry programme is expected

to be reported in FY2021

Freeline, our gene therapy company focused on liver expression

for a range of chronic systemic diseases, is progressing its lead

programme in Haemophilia B through clinical development in which it

is seeking to deliver FIX activity in patients in the normal range.

The normal range of FIX activity in the general population's blood

is between 50% and 150%. The business continues to enrol patients

as part of its dose-ranging trial and is currently completing dose

optimisation with the goal of delivering FIX activity consistently

in the normal range for all patients. The business expects to

report further data in the trial in this financial year.

Freeline also dosed its first patient in a Phase 1/2 in its

second programme in Fabry Disease, which is estimated affects one

in every 40,000 people[17]. It is the first AAV gene therapy

clinical study in Fabry disease globally. Early data from the Fabry

programme is expected to be released in FY2021.

Freeline is also progressing pre-clinical programmes targeting

Gaucher disease and Haemophilia A, which are part of a broad

pipeline of systemic disorders, where achieving high expression of

FIX activity is crucial to achieving a functional cure for

patients.

Importantly, the business has also been focused on developing

its world leading manufacturing platform, so that it can deliver

high-quality, consistent product at commercial scale, supporting

its ambition to ultimately deliver product to patients.

Gyroscope (4.2% of NAV, 80% shareholding):

-- Syncona GBP48.0 million commitment in a GBP50.4 million Series B financing

-- Continued dosing in first programme in dry age-related

macular degeneration (AMD); expects to complete enrolment in the

FOCUS trial in FY2020, with initial data reported by FY2022

Gyroscope Therapeutics is developing gene therapy beyond rare

disease and using it to treat a leading cause of blindness, dry

age-related macular degeneration (dry-AMD). Dry-AMD is the leading

cause of permanent vision impairment for people aged 65 and older

and there are no approved treatments.

During the period Gyroscope closed a GBP50.4 million Series B

financing, to continue the clinical development of both the

company's lead investigational gene therapy (GT005) and the

second-generation Orbit Subretinal Delivery System.

In line with our strategy to fund our companies ambitiously over

the long-term, Syncona committed GBP48 million in the Series B

financing, bringing its total commitment to Gyroscope since its

inception to GBP82 million.

Research suggests that when a part of the immune system, the

complement system, is overactive it leads to inflammation that

damages healthy eye tissues. Gyroscope's lead investigational gene

therapy, GT005, is designed to restore balance to the complement

system to hopefully slow, or possibly stop, the progression of

dry-AMD.

The company is currently enrolling in a Phase 1/2

dose-escalating clinical trial, known as the FOCUS study, and to

date there have not been any safety concerns.

Gyroscope is also conducting a natural history study, known as

the SCOPE study, that will enroll and genotype patients in Europe,

Australia, and the United States. The SCOPE study will provide

valuable genetic, biomarker and disease progression insight that

will inform the company's future clinical development plans.

Pre-clinical companies (8.4% of NAV):

Achilles (5.4% of NAV, 44% shareholding):

-- GBP100.0 million Series B financing cornerstoned by a GBP35.1

million commitment from Syncona

-- Enrolled first patients in first programme in Non-Small Cell

Lung Cancer (NSCLC); initial data in first two programmes in

non-small cell lung cancer and melanoma expected by FY2022

Achilles, our cell therapy company which is focused on

immunotherapy to treat solid tumours (initially lung cancer and

melanoma), continues to make progress.

Proceeds from the recent financing are expected to enable the

business to deliver two human proof-of-concept studies in Achilles'

first programmes in NSCLC and melanoma. The business has enrolled

the first patients in its NSCLC programme during the period. In

addition, the financing will enable Achilles to continue building

out its manufacturing capabilities as well as broaden its growing

solid tumour pre-clinical product pipeline.

SwanBio (1.4% of NAV; 70% shareholding)

SwanBio, our gene therapy company focused on neurological

disorders, has made good progress over the period, building out its

leadership team with a number of appointments in the period.

SwanBio's lead programme is focused on one of the most common

monogenic neurological disorders, which currently has no available

therapies and Syncona Partner Alex Hamilton is working with the

company to develop its pipeline of indications.

OMASS (0.7% of NAV; 46% shareholding)

OMASS Therapeutics, our biopharmaceutical company using

structural mass spectrometry to discover novel medicines, continued

to leverage its unique technology platform and it is now fully

deployed as a discovery engine for small molecule drug

therapeutics. Syncona Partners Ed Hodgkin and Magda Jonikas have

worked with the team and hired Ros Deegan, a highly experienced

senior executive in drug discovery, as Chief Executive Officer. The

business is now focused on building a pipeline of therapeutic

agents.

Quell (0.6% of NAV; 69% shareholding)

Quell Therapeutics has been established with the aim of

developing engineered T regulatory (Treg) cell therapies to treat a

range of conditions such as solid organ transplant rejection,

autoimmune and inflammatory diseases. The business appointed Iain

McGill as Chief Executive Officer during the period. Iain is a

leading pharmaceutical executive who has spent the majority of his

25 years in the industry in the area of solid organ and cell

transplantation. Syncona Partner Freddie Dear is working in the

company as Director of Operations. The team has expanded to 25

people and the company has been focused on building out R&D,

manufacturing operations and capabilities. The business is

targeting a first indication in liver transplant and candidate

nomination is anticipated in FY2021.

Anaveon (0.3% of NAV; 47% shareholding)

Anaveon is developing a selective Interleukin 2 ("IL-2")

Receptor Agonist, a type of protein that could therapeutically

enhance a patient's immune system to respond to tumours. The

business is expanding its operations and has recently moved into an

independent laboratory space at Technologie Park Basel. The

business has been focused on expanding the leadership team and is

progressing towards clinical trials with candidate nomination in

FY2021.

Life science investments (3.5% NAV):

Beyond Syncona's portfolio companies, where we typically have a

significant ownership stake and are a partner with operational and

strategic influence, we also have a small number of life science

investments which represent good opportunities to generate returns

for shareholders or provide promising options for the future in

areas where Syncona has deep domain knowledge.

The largest holding is the CRT Pioneer Fund, which is focused on

early stage investments in highly innovative oncology programmes

which were primarily sourced from its proprietary pipeline

agreement with Cancer Research UK. Syncona is the largest investor

in the fund and has contributed a net GBP4.8 million to the fund

during the period, with a further GBP10.1 million of uncalled

commitments remaining that we expect to be called within the next

24 months. Its investment period closed in March 2018 and the

manager is now focused on supporting the existing 11 investments in

the portfolio. This portfolio has a number of exciting investments,

notably Azeria, to which we have committed GBP29.5 million post

period end.

Active clinical pipeline at 30 September 2019

Programme / Indication Status and next steps

Autolus - cell therapy / oncology

AUTO1 / Adult ALL Phase 1/2 trial progressing; start pivotal

programme in this financial year

-----------------------------------------------------

AUTO1 / Paediatric Phase 1/2 trials progressing, (assessing safety,

ALL dose and efficacy) data anticipated this financial

year

-----------------------------------------------------

AUTO3 - Adult DLBCL

-----------------------------------------------------

AUTO4 - T cell Lymphoma Phase 1/2 trial progressing; expect to present

initial AUTO4 Phase 1 data H2 CY2020

-----------------------------------------------------

Freeline

B-AMAZE - Haemophilia Phase 1/2 trial progressing (assessing safety,

B dose and efficacy, dose escalation and optimisation

phase), further data anticipated this financial

year

-----------------------------------------------------

Fabry's Disease Phase 1/2 trial progressing (assessing safety,

dose and efficacy, dose escalation and optimisation

phase), early data expected in FY2021

-----------------------------------------------------

Gyroscope

-----------------------------------------------------

FOCUS - Dry Age-Related Phase 1/2 trial progressing (assessing safety,

Macular Degeneration dose response and efficacy of two doses of

GT005). Anticipate completing first dose escalation

this financial year

-----------------------------------------------------

Pre-clinical programmes anticipated to commence trials in

FY2020

Programme / Indication Status and next steps

Achilles

---------------------------------------------

Non-small cell lung Enrolling patients for its Phase 1/2 trial;

cancer expects to initiate Phase 1/2 trial in this

financial year and initial data expected by

FY2022

---------------------------------------------

Melanoma Enrolling patients for Phase 1/2 trial and

expects to initiate in this financial year

---------------------------------------------

Chris Hollowood, Chief Investment Officer, Syncona Investment

Management Limited

20 November 2019

Finance review

Strong commercial and financial momentum across our

portfolio

We continue to ambitiously fund and build our portfolio

companies. Gyroscope and Achilles, completed private financing

rounds in which Syncona was either the sole or largest

institutional investor, committing GBP83.1 million to fund these

companies as they move into the clinic. We invested GBP18.3 million

in the secondary placing of Autolus, as it progresses its pipeline

of trials through the clinic and remain its largest shareholder,

with a 29 per cent holding. We also materially strengthened our

capital base, which underpins our strategy and model, completing

the sales of Blue Earth to Bracco Imaging and of Nightstar to

Biogen.

NAV performance impacted by fall in Autolus share price

NAV performance in the six months was impacted by the 61 per

cent fall in the share price of Autolus, which outweighed the

GBP92.7 million positive impact of the sale of Blue Earth and

uplift in the value of Achilles. This resulted in a negative return

from the life science portfolio of 11.8 per cent[18] or a loss of

GBP108.7 million and we ended the period with net assets of

GBP1,336.8 million, or 198.9p per share[19], a 7.2 per cent

negative return over the six months[20].

From a valuation perspective, 60.9 per cent of the life science

portfolio[21] is valued on the basis of capital invested (cost) or

at the value of a recent third-party financing, in the case of

financing rounds that have been syndicated, calibrated for events

that have taken place since the initial transaction that indicate a

change in the investments' fair value. Companies which are publicly

listed, are valued at their period end share price. Volatility in

the value of early stage companies is to be expected, and in the

case of Autolus, which is listed on NASDAQ, we continue to believe

in company's strong fundamentals.

Capital deployment to increase to GBP200 - 250 million for this

financial year

We continue to maintain a rigorous and disciplined approach to

the allocation of capital to each portfolio company to maximise

risk adjusted returns for shareholders. In total, we deployed

GBP127.2 million of capital in the six months, funding milestone

payments in our portfolio companies and the initial tranche of our

Series B commitments to Gyroscope and Achilles. While the absolute

level of deployment is dependent on the timing of the financing

requirements, our current expectation is that capital deployment

will increase to between GBP200 - GBP250 million for this financial

year.

Looking forward, our portfolio companies are scaling rapidly and

subject to the portfolio and investment pipeline progressing, we

would expect our capital deployment to be in the range of GBP150 -

GBP250 million per year.

Increase in uncalled commitments reflect new financing

rounds

Uncalled commitments were GBP129.4 million at the end of the

period. Of the GBP129.4 million, GBP114.3 million relate to

milestone payments, which are subject to the satisfaction of key

commercial and clinical milestones, mitigating financial risk. The

remaining GBP15.1 million of commitments are split GBP10.1 million

to the CRT Pioneer Fund and GBP5.0 million to two legacy fixed term

funds.

Uncalled Commitment

Life Science Portfolio:

---------------------------------

Milestone payments to portfolio

companies 114.3

---------------------------------

CRT Pioneer Fund 10.1

---------------------------------

Fund Portfolio 5.0

---------------------------------

TOTAL 129.4

--------------------

Significant strengthening of the capital base

The completion of the sales of Blue Earth and Nightstar

generated proceeds of GBP592.6 million and significantly

strengthened our capital base, which stood at GBP855.5 million[22]

at the half year. The strength of our balance sheet is a strategic

differentiator and a competitive advantage. It allows the team to

take long term funding decisions, while retaining strategic

ownership positions as our companies scale.

Syncona's developing life science companies are capital

intensive, and the strength of our capital base protects against

the risk of being a forced seller and gives us the flexibility to

fund our companies over the long term, on a sole or partnered

basis. Certainty of funding is key and for our model to be

successful we believe our capital base needs to be sufficient to

provide funding for our life science companies and new

opportunities for a minimum of two to three years and hold at least

one year's deployment in cash and cash equivalents.

Liquidity profile GBPm

Net cash 22.2

------

< 1 month 356.6

------

1-3 months 395.4

------

3-12 months 7.6

------

>12 months 73.7

------

Total 855.5

------

The transition of the capital pool, away from fund investments

is now largely complete. The majority of our liquidity is held in

cash, cash equivalents, and fixed income products with a focus on

liquidity and capital preservation.

Expenses

The Company's ongoing charges ratio[23] reduced to 0.55 per cent

(30 September 2018: 0.82 per cent), a significant part of which

reflects effective cost management. Allowing for the costs

associated with the Incentive Plan, ongoing charges were 0.77 per

cent of NAV (30 September 2018: 1.29 per cent).

Incentive Plan

The incentive plan aligns the investment team with shareholders

and vests on a straight-line basis over a four-year period with

awards settled in cash and Syncona shares. The total liability for

the cash settlement element of the incentive plan was GBP14.2

million at 30 September 2019 (30 September 2018: GBP10.8 million),

with the GBP6.1 million payment made to participants in the period

partially offset by an increase in eligible MES, as the vesting

schedule matures. In addition, 1,583,138 (30 September 2018:20,836)

shares were issued to employees in connection with MES realisations

in the six months. At 30 September 2019, the number of Syncona

shares that could potentially be issued in connection with the MES

stood at 8,525,594, taking the total number of fully-diluted

shares, for the purposes of calculating NAV per share, to

672,191,131.

Foreign exchange

At the half year, we continued to hold the Company's foreign

exchange exposure in the life science portfolio unhedged, US dollar

denominated investments total GBP149.3 million and Swiss Franc

denominated investments total GBP3.9 million. We hedge EUR52.0

million of our euro exposure in legacy fixed term fund investments

and the unrealised gain on the associated forward contracts was

GBP1.8 million at 30 September 2019.

Recent events

Since the period end, Syncona has made a GBP29.5 million

commitment to new company, Azeria, of which GBP6.5 million has been

invested.

John Bradshaw, Chief Financial Officer, Syncona Investment

Management Limited

20 November 2019

Supplementary Information

Life science valuation table:

Company 31 March Net Valuation 30 %NAV Fair value Fully Focus Area

2019 Investment Change September basis[24] Diluted

Value in (GBPm) 2019 Ownership

(GBPm) Period Value %

(GBPm) (GBPm)

- fair

value

Life science

portfolio

companies

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Product

approval

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Advanced

Blue Earth 267.5 -336.8 69.3 0.0 0.0% Sale price 0% diagnostics

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Clinical

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Nightstar 255.8 -255.8 0.0 0.0% Sale price 0% Gene therapy

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Autolus 328.2 18.3 -199.1 147.4 11.0% Quoted 29% Cell therapy

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Freeline 93.5 25.0 118.5 8.9% Cost 80% Gene therapy

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Gyroscope 28.9 27.1 56.0 4.2% Cost 80% Gene therapy

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Pre-clinical

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Recent

financing

(within

Achilles 16.2 32.8 23.4 72.4 5.4% 0-6 months) 44% Cell therapy

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

SwanBio 5.3 12.9 0.5 18.7 1.4% Cost 70% Gene therapy

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Omass 3.5 6.3 9.8 0.7% Cost 46% Therapeutics

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Anaveon 3.7 0.2 3.9 0.3% Cost 47% Immunoncology

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Quell 8.3 8.3 0.6% Cost 69% Cell therapy

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Life Science

Investments

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

CRT Pioneer Adj Third

Fund 34.3 4.8 39.1 2.9% Party N/A

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Recent

financing

(within

6-12

CEGX 3.9 3.9 0.3% months) 9%

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Adaptimmune 4.9 -3.0 1.9 0.2% Quoted 0%

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Syncona

Collaborations 1.4 1.4 0.1% Cost 100%

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

TOTAL 1,055.4 -465.4 -108.7 481.3 36.0%

--------- ------------ ---------- ------------ ------ ------------ ----------- --------------

Supplementary portfolio company information:

Company Lead programme Opportunity Key Key potential

& investment & disease in and comparators([25]) risks([26])

thesis population differentiation

of lead programme

Autolus AUTO1 ALLCAR19 Unmet medical CAR-T active Differentiated

Applying Phase 1/2 need: only programmes product

a broad in Adult 30-40% of patients in clinical required

range of Acute Lymphoblastic with Adult development Complex

technologies Leukaemia ALL achieve for Adult manufacturing

to build 3,000 patients long term remission ALL include

a pipeline globally([27]) with combination Gilead([31])

of precisely p.a. chemotherapy,

targeted the current

T cell therapies standard of

designed care([28])

to better No CAR-T therapy

recognise approved for

and attack adult ALL for

cancer cells patients

AUTO1 targets

a differentiated

safety profile

(reduce high

grade CRS([29])

) and

improvedpersistence

to address

limitations

of current

T cell

therapies([30])

---------------------- ---------------------- ---------------------- ----------------------

Freeline B-AMAZE: Unmet medical Active clinical Highly competitive

Potential Phase 1/2 need: current programmes environment

to deliver in Haemophilia standard of for Haem Differentiated

constant B care, Enzyme B include: product

high protein 9,500 patients Replacement Spark/Pfizer([33]) required

expression (total) US Therapy (infusions UniQure([34]) Manufacturing

levels across and EU5([32]) of FIX into

a broad the blood),

pipeline requires regular

of systemic administration

diseases; and FIX activity

opportunity does not remain

to deliver stable

curative Opportunity

gene therapies to deliver

a single dose

cure for patients

by achieving

FIX levels

in the 'normal'

range in the

blood of 50-150%

Utilising a

novel, proprietary

capsid and

industrialised

proprietary

manufacturing

platform

---------------------- ---------------------- ---------------------- ----------------------

Gyroscope FOCUS Phase Unmet medical No directly Highly innovative

A novel 1/2 in need: age related competitive concept -

company Dry-Age-Related macular degeneration gene therapy currently

developing Macular Degeneration is one of the approach. unsupported

gene therapy 2 million leading causes Apellis by a significant

beyond rare patients of permanent (clinical)([37]) existing data set

disease (total) with vision impairment ;

by understanding geographic for people Gemini

the immune atrophy (late aged 65 and (pre-clinical)([38])

system and stage, older with Hemera([39])

the role dry-AMD)([35]) no approved (non-gene

genetics treatments([36]) therapy)

play in .

a patient's Research suggests

risk of that when a

developing part of the

late stage immune system,

AMD the complement

system, is

overactive

it leads to

inflammation

that can damage

healthy eye

tissues

Gene therapy

may stimulate

a patient's

cells to produce

the proteins

needed to restore

balance to

the complement

system

Developing

a subretinal

delivery system

to safely,

precisely and

consistently

deliver therapies

into the eye

and help scale

the surgical

procedure for

larger patient

populations.

---------------------- ---------------------- ---------------------- ----------------------

Achilles Phase 1/2: Unmet medical Key competitors Highly innovative

Differentiated Non-small need: lung in neoantigen/ concept in an

cell therapy cell lung cancer, of immunotherapy emerging

approach cancer which NSCLC include: space

targeting 234,000 patients accounts for Iovance([44]) Significant

solid tumours US and UK([40]) approximately Neon manufacturing

utilising p.a. 85%([41]) , Therapeutics([45]) challenge

Tumour Infiltrating with limited Gritstone([46]) Increasing

Lymphocytes treatment options Oncology competition

& clonal and is the

neoantigens leading cause

to develop of cancer

personalised deaths([42])

treatments .

TILs have shown

convincing

efficacy in

solid tumours([43])

Achilles' world

leading

bioinformatics

platform, PELEUS(TM)

is built on

exclusive access

to world largest

study of tumour

evolution in

lung cancer

(TRACERx)

Achilles process

uses the patient's

own genomic

information

to create a

truly personalised

medicine targeting

the clonal

neoantigens

specific to

that patient

---------------------- ---------------------- ---------------------- ----------------------

Company Syncona's Investment Thesis Key comparators Key risks

Swan Unmet medical need: one of Several Manufacturing

Gene therapy the most common monogenic clinical and delivery challenges

focused neurological disorders, with trials for in the CNS (substantial

on neurological no available therapies for gene therapy dose required)

disorders severely debilitating progressive within CNS Clinical endpoints

where there movement disorder field, including in slow progressing

is existing Gene therapy has the potential programmes diseases can be

proof of to be transformational in within Voyager[48] challenging to

concept neurology([47]) Uniqure[49], define

one-off delivery mechanism Amicus[50],

and hundreds of single gene Prevail

disorders Therapeutics[51]

First programme in preclinical and PTC

development for an inherited Therapeutics[52]

neurodegenerative disease

in which the causative gene

is definitively known and

well characterized

------------------------------------------ ---------------------- --------------------------

Quell Unmet medical need: current T Reg field Highly innovative

Engineered standard of care for prevention is nascent concept, limited

cell therapy of solid organ transplant TX Cell/Sangamo[55] clinical data

company rejection is life-long immunosuppression supporting application

addressing which results in an array of CAR-T technology

"immune of serious long-term side in Treg cells

dysregulation" effects (e.g. renal function,

malignancy, infection, cardiovascular

disease) materially impacting

patient quality of life and

long-term survival([53])

Novel cell therapy approach

using T-regulatory cells

with a suppressive action

to downregulate the immune

system to treat conditions

including solid organ transplant

rejection, autoimmune and

inflammatory diseases

Potential pipeline to treat

serious, chronic conditions

mediated by the immune system;

in the autoimmune setting

alone, there are are >70

chronic disorders estimated

to affect over 4% of the

population[54]

Pre-clinical stage: first

programme to address solid

organ transplant

------------------------------------------ ---------------------- --------------------------

Anaveon Unmet medical need: Human Companies Highly competitive

Immuno-oncology Interleukin 2 "IL-2" approved developing Innovative concept

company as a medicine for the treatment products which is currently

developing of metastatic melanoma and in the IL-2 unsupported by

a selective renal cancer, but with a field include: a significant

IL-2 Receptor frequent administration schedule Nektar[58], clinical data

Agonist and significant toxicity([56]) Roche[59], set

Preclinical stage, developing Alkermes[60],

a selective Interleukin 2 Synthorx[61].

("IL-2) Receptor Agonist

with improved administration

and tox burden

Wide potential utility across

multiple oncology indications

in large markets([57])

------------------------------------------ ---------------------- --------------------------

OMASS Opportunity to build a drug N/A Pre-clinical and

Drug Discovery discovery platform employing clinical attrition

platform a differentiated Modified of potential drugs

with differentiated Mass Spectrometry technology

technology with the potential to yield

high quality chemical hits

to discover novel small molecule

drug therapeutics for a variety

of complex targets, including

membrane receptors

------------------------------------------ ---------------------- --------------------------

Syncona life science portfolio returns (30 September 2019)

Company Cost Value Multiple IRR

Maturing

----------- ------------- --------- ----

Autolus GBP94.5m GBP147.4m 1.6 22%

----------- ------------- --------- ----

Freeline GBP118.5m GBP118.5m 1.0 0%

----------- ------------- --------- ----

Gyroscope GBP55.5m GBP56.0m 1.0 0%

----------- ------------- --------- ----

Sub-total

----------- ------------- --------- ----

Developing

----------- ------------- --------- ----

Achilles GBP49.0m GBP72.4m 1.5 61%

----------- ------------- --------- ----

SwanBio GBP17.8m GBP18.7m 1.1 10%

----------- ------------- --------- ----

Omass GBP9.8m GBP9.8m 1.0 0%

----------- ------------- --------- ----

Anaveon GBP3.7m GBP3.9m 1.1 0%

----------- ------------- --------- ----

Quell GBP8.3m GBP8.3m 1.0 0%

----------- ------------- --------- ----

Realised companies

----------- ------------- --------- ----

Nightstar GBP56.4m GBP255.8m 4.5 72%

----------- ------------- --------- ----

Blue Earth GBP35.3m GBP351.0m 9.9 87%

----------- ------------- --------- ----

Investments

----------- ------------- --------- ----

Unrealised investments GBP51.6m GBP46.3m 0.9 -6%

----------- ------------- --------- ----

Realised investments GBP12.4m GBP17.6m 1.4 27%

----------- ------------- --------- ----

Total GBP512.8m GBP1,105.7m 2.2 47%

----------- ------------- --------- ----

Valuation policy for life science investments and clinical trial

disclosure process

Valuation policy for life science investments

The Group's investments in life science companies are, in the

case of quoted companies, valued based on bid prices in an active

market as at the reporting date.

In the case of the Group's investments in unlisted companies,

the fair value is determined in accordance with the International

Private Equity and Venture Capital ("IPEV") Valuation Guidelines.

These include the use of recent arm's length transactions,

Discounted Cash Flow ("DCF") analysis and earnings multiples.

Wherever possible, the Group uses valuation techniques which make

maximum use of market based inputs.

The following considerations are used when calculating the fair

value of unlisted life science companies:

-- Cost is generally deemed to be fair value as of the transaction date. Similarly, where there

has been a recent investment in the unlisted company by third parties, the Price of Recent

Investment ("PRI") is generally deemed to be fair value as of the transaction date, although

further judgement may be required to the extent that the instrument in which the recent investment

was made is different from the instrument held by the Group.

-- The length of period for which it remains appropriate to deem cost or PRI fair value depends

on the specific circumstances of the investment and the stability of the external environment

and adequate consideration needs to be given to the current facts and circumstances. Where

this calibration process shows there is objective evidence that an investment has been impaired

or increased in value since the investment was made, such as observable data suggesting a

change of the financial, technical or commercial performance of the underlying investment,

the Group carries out an enhanced assessment based on one of the alternative methodologies

set out in the IPEV Valuation Guidelines.

-- DCF involves estimating the fair value of an investment by calculating the present value of

expected future cash flows, based on the most recent forecasts in respect of the underlying

business. Given the difficulty involved with producing reliable cash flow forecasts for seed,

start-up and early-stage companies, the DCF methodology will more commonly be used in the

event that a life science company is in the final stages of clinical testing prior to regulatory

approval or has filed for regulatory approval.

-- Independent Adviser - the Group's determination of the fair values of certain investments

at 31 March 2019 took into consideration multiple sources including management and publicly

available information and publications and certain input from independent advisers L.E.K.

Consulting LLP ("L.E.K."), who have undertaken an independent review of certain investments

and have assisted the Group with its valuation of such investments. The review was limited

to certain limited procedures that the Group identified and requested it to perform within

an agreed limited scope.

-- As with any review of investments these can only be considered in the context of the limited

procedures and agreed scope defining such review and are subject to assumptions which may

be forward looking in nature and subjective judgements. Upon completion of such limited agreed

procedures, L.E.K. estimated an independent range of fair values of those investments subjected

to the limited procedures. In making such a determination the Group considered the review

as one of multiple inputs in the determination of fair value. The limited procedures within

the agreed scope are limited by the information reviewed and did not involve an audit, review,

compilation or any other form of verification, examination or attestation under generally

accepted auditing standards and was based on the review of multiple defined sources. The Group

is responsible for determining the fair value of the investments, and the agreed limited procedures

in the review performed to assist the Group in its determination are supplementary to the

inquiries and procedures that the Group is required to undertake to determine the fair value

of the said investments for which the Directors are ultimately responsible.

Where the Group is the sole institutional investor and until

such time as substantial clinical data has been generated, the cost

or PRI will generally be deemed to be fair value subject to

adequate consideration being given to current facts and

circumstances. Once substantial clinical data has been generated

the Group will use input from an independent valuations advisor to

assist in the determination of fair value.

Valuation of the life science % of life science % of net assets

portfolio portfolio

------------------------------ ----------------- ---------------

Calibrated Cost 45.0 16.2

------------------------------ ----------------- ---------------

Calibrated PRI 15.0 5.4

------------------------------ ----------------- ---------------

Quoted 31.0 11.2

------------------------------ ----------------- ---------------

Adjusted Price of Recent

Investment 0.8 0.3

------------------------------ ----------------- ---------------

Third Party 8.2 2.9

------------------------------ ----------------- ---------------

Clinical trial disclosure process

Currently, Syncona's portfolio companies are progressing with

seven clinical trials. These trials represent both a significant

opportunity and risk for each company and for Syncona Ltd.

Unlike typical randomised controlled pharmaceutical clinical

trials, currently all seven clinical trials are open-label trials.

Open label trials are clinical studies in which both the

researchers and the patients are aware of the drug being given. In

some cases the number of patients in a trial may be relatively

small. Data is generated as each patient is dosed with the drug in

a trial and is collected over time as results of the treatment are

analysed and, in the early stages of these studies, dose-ranging

studies are completed.

Because of the trial design, clinical data in open-label trials

is received by our portfolio companies on a frequent basis.

However, individual data points need to be treated with caution,

and it is typically only when all or substantially all of the data

from a trial is available and can be analysed that meaningful

conclusions can be drawn from that data about the prospect of

success or otherwise of the trial. In particular it is highly

possible that early developments (positive or negative) in a trial

can be overtaken by later analysis with further data as the trial

progresses.

Our portfolio companies may decide or be required to announce

publicly interim clinical trial data, for example where the company

or researchers connected with it are presenting at a scientific

conference, and Syncona will generally also issue a simultaneous

announcement about that clinical trial data. Syncona would also

expect to announce its assessment of the results of a trial at the

point we conclude on the data available to us that it has succeeded

or failed. We would not generally expect to announce our assessment

of interim clinical data in an ongoing trial otherwise, although we

will review all such data to enable us to comply with our legal

obligations such as under the EU Market Abuse Regulation or

otherwise.

Principal Risks and Uncertainties

The principal risks and uncertainties facing the Company for the

second half of the financial year are substantially the same as

those disclosed in the Report and Accounts for the year ended 31

March 2019. These include:

- Failure to attract or retain key personnel

- Risk in making early stage investments

- Clinical trial risks

- General, commercial and technological risks

- Dominance of portfolio by a few larger investments and/or

sector focus

- Financing and exit risk

- Capital Pool risk

- Systems and controls

- Impact of political and economic uncertainty, and changes to

law and regulation

Going Concern

The factors likely to affect the Company's ability to continue

as a going concern were set out in the Report and Accounts for the

year ended 31 March 2019. As at 30 September 2019, there have been

no significant changes to these factors. Having reviewed the

Company's assets and liabilities and other relevant evidence, the

Directors have a reasonable expectation that the Company has

adequate resources to continue in operational existence for the 12

months following the approval of these half-yearly financial

statements. Accordingly, they continue to adopt the going concern

basis in preparing the half-yearly financial statements.

Statement of Directors' Responsibilities

The directors confirm that the interim financial statements have

been prepared in accordance with IAS 34 as adopted by the European

Union and that the business review includes a fair review of the

information required by DTR 4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months of the financial year and their impact on the

interim financial statements, and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- material related-party transactions in the first six months

of the financial year and any material changes in the related-party

transactions described in the last annual report.

The Directors of Syncona Limited are listed in the Syncona

Limited Report & Accounts for the year ended 31 March 2019. A

list of current directors is maintained on the Syncona Limited

website:

https://www.synconaltd.com/about-us/our-people?b=true#profiles.

Jeremy Tigue, Chairman, Syncona Limited

20 November 2019

INDEPENT REVIEW REPORT TO SYNCONA LIMITED

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 September 2019 which comprises the Consolidated

Statement of Comprehensive Income, Consolidated Statement of

Financial Position, Consolidated Statement of Changes in Net Assets

Attributable to Holders of Ordinary Shares, Consolidated Statement

of Cash Flows and related notes 1 to 14. We have read the other

information contained in the half-yearly financial report and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the condensed set

of financial statements

This report is made solely to the company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Financial

Reporting Council. Our work has been undertaken so that we might

state to the company those matters we are required to state to it

in an independent review report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the company, for our review

work, for this report, or for the conclusions we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure and Transparency Rules of the United Kingdom's

Financial Conduct Authority. As disclosed in note 2, the annual

financial statements of the Group are prepared in accordance with

IFRSs as adopted by the European Union. The condensed set of

financial statements included in this half-yearly financial report

has been prepared in accordance with International Accounting

Standard 34 "Interim Financial Reporting" as adopted by the

European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Financial Reporting Council for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

September 2019 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the Disclosure and Transparency Rules of the

United Kingdom's Financial Conduct Authority.

Deloitte LLP

St Peter Port, Guernsey

20 November 2019

SYNCONA LIMITED

GROUP PORTFOLIO STATEMENT

As at 30 September 2019

% of

Fair Value Group NAV

GBP'000 2019

Life science portfolio

Life science companies

Autolus Therapeutics plc 147,446 11.0

Freeline Therapeutics Limited 118,500 8.9

Achilles Therapeutics Limited 72,413 5.4

Gyroscope Therapeutics Limited 55,975 4.2

Swanbio Therapeutics Limited 18,712 1.4

Companies of less than 1% of NAV 29,209 2.2

Total life science companies 442,255 33.1

CRT Pioneer Fund 39,089 2.9

Total life science portfolio (1) 481,344 36.0

---------- ----------

Capital pool investments

Fixed income funds 247,110 18.5

UK Treasury bills 479,678 35.9

Legacy funds 104,185 7.8

Open forward currency contracts 1,820 0.1

Total capital pool investments 832,793 62.3

---------- ----------

Other net assets

Cash and cash equivalents (2) 39,053 2.9

Charitable donations (2,020) (0.2)

Other assets and liabilities (14,368) (1.0)

Total other net assets 22,665 1.7

---------- ----------

Total net asset value of the Group 1,336,802 100.0

========== ==========

(1) The life science portfolio of GBP481,343,686 consists of

life science investments totalling GBP442,254,200 held by Syncona

Holdings Limited and the CRT Pioneer Fund of GBP39,089,486 held by

Syncona Investments LP Incorporated.

(2) Total cash held by the Group is GBP39,052,883. Of this

amount GBP12,570 is held by Syncona Limited. The remaining

GBP39,040,313 is held by its subsidiaries other than portfolio

companies ("Syncona Group Companies").

Cash held by Syncona Group Companies is not shown in Syncona

Limited's Consolidated Statement of Financial Position.

See note 1 for a description of Syncona Holdings Limited and

Syncona Investments LP Incorporated.

SYNCONA LIMITED

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period ended 30 September 2019

Unaudited Unaudited

six months six months Audited

to to year

30 September 30 September to 31 March

Notes Revenue Capital 2019 2018 2019

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment income

Other income 26,110 - 26,110 25,305 34,631

Total investment

income 26,110 - 26,110 25,305 34,631

------- --------- ------------- ------------- ------------

Net (losses)/gains

on financial assets

at fair value through

profit or loss 5 - (120,909) (120,909) 340,268 404,487

Total (losses)/gains - (120,909) (120,909) 340,268 404,487

------- --------- ------------- ------------- ------------

Expenses

Charitable donations 6 2,020 - 2,020 2,376 4,300

General expenses 8,361 - 8,361 12,949 23,556

Total expenses 10,381 - 10,381 15,325 27,856

------- --------- ------------- ------------- ------------

(Loss) / Profit for

the period 15,729 (120,909) (105,180) 350,248 411,262

======= ========= ============= ============= ============

Diluted Earnings

per Ordinary Share 9 2.38p (18.25)p (15.87)p 53.01p 62.24p

======= ========= ============= ============= ============

The total columns of this statement represent the Group's

Consolidated Statement of Comprehensive Income, prepared in

accordance with International Financial Reporting Standards as

adopted by the European Union and interpretations adopted by the

International Accounting Standards Board. Whilst the Company is not

a member of the Association of Investment Companies (the "AIC"),

the supplementary revenue and capital columns are both prepared

under guidance published by the AIC.

The profit for the period is equivalent to the "total

comprehensive income" as defined by IAS 1 "Presentation of

Financial Statements" ("IAS 1"). There is no other comprehensive

income as defined by IFRS.

All the items in the above statement derive from continuing

operations.

Notes 1 to 14 form an integral part of the Condensed

Consolidated Financial Statements.

SYNCONA LIMITED

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 September 2019

Unaudited Unaudited Audited

30 September 30 September 31 March

Notes 2019 2018 2019

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Financial assets at fair value

through profit or loss 7 1,347,503 1,405,839 1,470,078

Current assets

Bank and cash deposits 13 2,015 91

Trade and other receivables 4,496 4,489 8,833

Total assets 1,352,012 1,412,343 1,479,002

------------- ------------- -----------

LIABILITIES AND EQUITY

Non-current liabilities

Share based payment 8 6,716 9,475 10,834

Current liabilities

Share based payment 8 7,502 1,343 6,351

Payables 992 7,545 6,704

Total liabilities 15,210 18,363 23,889

------------- ------------- -----------

EQUITY

Share capital 9 767,999 766,037 766,037

Distributable capital reserves 568,803 627,943 689,076

Total equity 1,336,802 1,393,980 1,455,113

------------- ------------- -----------

Total liabilities and equity 1,352,012 1,412,343 1,479,002

------------- ------------- -----------

Total net assets attributable

to holders of Ordinary Shares 1,336,802 1,393,980 1,455,113

============= ============= ===========

Number of Ordinary Shares in

Issue 9 663,665,537 661,222,309 661,222,309

------------- ------------- -----------

Net assets attributable to

holders of Ordinary Shares

(per share) 9 GBP2.01 GBP2.11 GBP2.20

------------- ------------- -----------

Diluted NAV (per share) 9 GBP1.99 GBP2.08 GBP2.17