TIDMSYNC

RNS Number : 0185L

Syncona Limited

03 September 2019

Syncona Limited

Syncona cornerstones GBP100 million financing in Achilles

03 September 2019

-- Syncona is the largest investor in GBP100m Series B financing

in Achilles committing GBP35.1million, with the remainder raised

from specialist global institutional investors

-- Syncona's holding in Achilles written up by GBP23.4 million

(3.5p per share); 91.4 per cent uplift to the holding value of

GBP25.6 million[1]

-- Syncona holding value following first tranche investment of

GBP72.4 million; on drawdown of the full Series B financing

Syncona's ownership stake in the business will be 44 per

cent[2]

Syncona Ltd, a leading healthcare company focused on founding,

building and funding global leaders in life science, today

announces that it has committed GBP35.1 million to Achilles

Therapeutics ("Achilles"), a biopharmaceutical company developing

personalised cancer immunotherapies, in an oversubscribed GBP100

million Series B financing. Specialist global institutional

investors including RA Capital, Forbion, Invus, Perceptive Advisors

and Redmile Group, amongst others, also participated in the

financing, which resulted in a GBP23.4 million uplift (3.5p per

Syncona share) to Syncona's holding value of Achilles. Including

the drawdown of the first tranche of Syncona's Series B investment

(GBP23.4 million), Syncona's holding value of Achilles is now

GBP72.4 million. On drawdown of the full Series B financing,

Syncona's ownership stake in Achilles will be 44 per cent

(previously 69 per cent).

Achilles is developing personalised T-cell therapies for solid

tumours targeting clonal neoantigens; protein markers unique to

each patient that are present on the surface of all cancer cells.

Achilles uses DNA sequencing data, together with a proprietary

bioinformatics platform, to identify clonal neoantigens specific to

the patient. By targeting multiple clonal neoantigens that are

present on all cancer cells, but not on healthy cells, Achilles is

seeking to deliver individualised treatments to target and destroy

tumours without harming healthy tissues.

The Series B financing brings Achilles' total committed funding

to GBP128.3 million to date. Proceeds from the financing are

expected to enable the business to deliver two human

proof-of-concept studies in Achilles' first two programmes in

non-small cell lung cancer and melanoma. There are 228,150 patients

newly diagnosed with lung cancer in the US each year[3] and 96,480

patients diagnosed with melanoma[4]. The company expects its first

two programmes to enter the clinic this year. In addition, the

financing will enable Achilles to continue building out its

manufacturing capabilities as well as broaden its growing solid

tumour pre-clinical product pipeline.

Martin Murphy, CEO of Syncona Investment Management Limited,

said: "In 2016, we saw an opportunity to work with world-leading

experts to found a company harnessing unique insight into the

understanding of cancer evolution, bioinformatics and the

development of cell-based immunotherapies to target the treatment

of solid tumours. We are delighted with the strong progress

Achilles has made over the last three years and are excited about

its potential.

There is a significant opportunity for the business to develop

its next generation approach to bring innovative therapies to

patients in areas of high unmet need. We believe in maximising our

companies ambitions to take products to market and we are committed

to supporting Achilles over the long-term as it continues to

scale."

Dr Iraj Ali, CEO of Achilles Therapeutics, said: "Achilles is

leading the next wave of immuno-oncology drug development. We have

moved from concept to clinic-ready in less than three years. We are

extremely pleased to welcome this excellent group of new investors

to Achilles and I would like to personally thank our existing

founding investors for their continued support. With this

fundraising we have made a clear statement about the scale and

nature of our ambitions to bring novel cancer therapies rapidly to

patients with a high unmet medical need."

[ENDS]

Enquiries

Syncona Ltd

Siobhan Weaver / Annabel Clay

Tel: +44 (0) 20 3981 7940

FTI Consulting

Brett Pollard / Ben Atwell / Natalie Garland-Collins

Tel: +44 (0) 20 3727 1000

Copies of this press release and other corporate information can

be found on the company website at: www.synconaltd.com

Forward-looking statements - this announcement contains certain

forward-looking statements with respect to the portfolio of

investments of Syncona Limited. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon circumstances that may or may not occur in the future.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements. In particular, many companies

in the Syncona Limited portfolio are conducting scientific research

and clinical trials where the outcome is inherently uncertain and

there is significant risk of negative results or adverse events

arising. In addition, many companies in the Syncona Limited

portfolio have yet to commercialise a product and their ability to

do so may be affected by operational, commercial and other

risks.

About Syncona

Syncona is a leading FTSE250 healthcare company focused on

founding, building and funding global leaders in life science. Our

vision is to deliver transformational treatments to patients in

truly innovative areas of healthcare while generating superior

returns for shareholders.

We seek to partner with the best, brightest and most ambitious

minds in science to build globally competitive businesses.

We take a long-term view, underpinned by a deep pool of capital,

and are established leaders in gene and cell therapy. We focus on

delivering dramatic efficacy for patients in areas of high unmet

need.

About Achilles

Achilles Therapeutics is a biopharmaceutical company developing

personalised T cell therapies targeting clonal neoantigens: protein

markers unique to the individual that are expressed on the surface

of every cancer cell. Achilles uses DNA sequencing data from each

patient, together with the proprietary PELEUS(TM) bioinformatics

platform, to identify clonal neoantigens specific to that patient,

and then develop personalised T cell-based therapies specifically

targeting those clonal neoantigens.

Achilles was founded by lead investor Syncona Ltd and its

shareholders include the CRT Pioneer Fund, UCL Technology Fund,

Cancer Research Technology, with the support of UCL Business (UCLB)

and the Francis Crick Institute. For further information please

visit the Company's website at: www.achillestx.com.

[1] As at 30 June 2019

[2] Percentage holding reflects Syncona's ownership stake at the

point full current commitments are invested on a fully-diluted

basis.

[3] https://seer.cancer.gov/statfacts/html/lungb.html; non-small

cell lung accounts for an estimated c.85% of all lung cancers

(https://www.cancer.org/cancer/small-cell-lung-cancer/about/key-statistics.html)

[4] https://seer.cancer.gov/statfacts/html/melan.html

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PFULIFVEARIVIIA

(END) Dow Jones Newswires

September 03, 2019 02:01 ET (06:01 GMT)

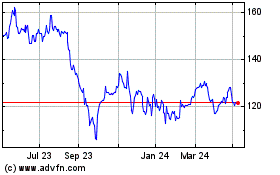

Syncona (LSE:SYNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

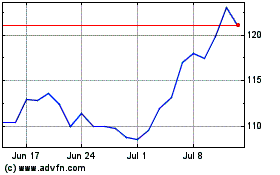

Syncona (LSE:SYNC)

Historical Stock Chart

From Apr 2023 to Apr 2024