TIDMSYNC

RNS Number : 6161D

Syncona Limited

27 June 2019

Syncona Limited

Sale of Blue Earth Diagnostics to Bracco Imaging

27 June 2019

-- Blue Earth Diagnostics has agreed to be acquired by Bracco

Imaging for $450 million (GBP354.3 million)[1] plus closing

adjustment estimated at $25 million (GBP19.7 million)[2]

-- Syncona will receive net proceeds of GBP337 million[3] for

its 89 per cent holding; a 10.0x multiple, including prior

distributions,[4] on original investment of GBP35.3 million and an

internal rate of return (IRR) of 87 per cent[5]

-- These proceeds represent an uplift of GBP69.8 million (10.4p

per share) to Syncona's holding value of GBP267.5 million[6]

Syncona Ltd today announces that it has reached an agreement to

sell its portfolio company Blue Earth Diagnostics ("Blue Earth") to

Bracco Imaging, a global leader in diagnostic imaging for $450

million (GBP354.3 million) plus closing adjustment estimated at $25

million (GBP19.7 million). The sale delivers a 10.0x multiple,

including prior distributions, on invested capital for Syncona.

Blue Earth is a leader in the radio-diagnostic space. As a

commercial stage company which launched Axumin, the standard of

care for the diagnosis of recurrent prostate cancer patients in the

USA, Blue Earth demonstrates the benefits of Syncona's long-term

approach to founding, building, and funding companies developing

transformational products for patients. Since foundation in 2014,

the business has successfully completed phase 3 clinical

development, secured its first product approval, delivered a

successful commercial launch, achieved profitability and acquired a

second asset to embed its leadership in the prostate imaging space.

More than 50,000 patients have been dosed with Axumin since its

launch in 2017 enabling physicians to diagnose patients with

recurrent prostate cancer more effectively. Blue Earth will now

progress to a new strategic owner in the diagnostic imaging field

for the next stage of its growth.

The sale of Blue Earth will generate GBP337 million of net

proceeds, further strengthening Syncona's strategic capital pool

and enhancing its ability to build and fund its portfolio companies

to succeed over the long term. These companies are scaling rapidly,

with a number of significant financings anticipated in the current

financial year. In particular, Freeline, Gyroscope and Achilles

have recently received the final tranches of previously committed

funding and are expected to conduct new financings. Since 31 March

2019, Syncona has deployed GBP64.1 million([7]) of capital into its

portfolio companies and will continue to fund them ambitiously as

the companies scale to capitalise on the opportunities available to

them, subject to its disciplined approach to the allocation of

capital across the portfolio.

Martin Murphy, Chief Executive Officer of Syncona Investment

Management Limited, said, "Blue Earth clearly demonstrates the

success of Syncona's strategy to found, build and fund innovative

companies. In the five years since we founded the business

alongside Jonathan Allis and his team, we have successfully

delivered a high impact product which is transforming how patients

with recurrent prostate cancer are managed, having been used in

over 50,000 patients. We are proud of this landmark achievement,

which is testament to the utility of the product and the

exceptional work of the Blue Earth and Syncona teams.

"Having now grown Blue Earth into a profitable, marketed product

company with the foundations for sustainable long-term growth in

place, we are delighted that a new strategic owner will continue to

develop the business through its next chapter. Syncona looks

forward to redeploying the proceeds to fund both our growing

portfolio companies as they scale and exciting new opportunities as

they emerge, ultimately with the goal of bringing more

transformational products to patients."

Jonathan Allis, D.Phil., Chief Executive Officer, Blue Earth

Diagnostics said: "The acquisition of Blue Earth by Bracco Imaging

is a validation of the quality of our people, our pipeline of novel

diagnostic agents such as rhPSMA and the proven success of Axumin

for imaging in prostate cancer and potentially other future

indications. We believe this acquisition is excellent for Blue

Earth, as Bracco Imaging's global footprint and clinical research

and marketing support will enable us to expand the reach of our

high-value platform of innovative radiopharmaceuticals to inform

clinical management and guide care for even more people with cancer

around the world. We are so proud of our exceptional,

patient-focused team for building a successful radiopharmaceuticals

business in only five years. We also wish to acknowledge Syncona

for its role in the foundation of the company, and its operational

and financial acumen as we have built the business."

Closing of the sale is conditional upon, among other customary

closing conditions, the expiration or termination of any applicable

waiting periods under the Hart-Scott-Rodino Antitrust Improvements

Act. Closing is expected to occur in the third quarter of calendar

year 2019.

[ENDS]

Enquiries

Syncona Ltd

Siobhan Weaver / Annabel Clay

Tel: +44 (0) 20 3981 7940

FTI Consulting

Brett Pollard / Ben Atwell / Natalie Garland-Collins

Tel: +44 (0) 20 3727 1000

This announcement includes information that is inside

information as defined in Article 7 of the Market Abuse Regulation

(EU) No.596/2014. The person responsible for arranging for the

release of this announcement on behalf of Syncona Ltd is Andrew

Cossar, General Counsel, SIML.

Copies of this press release and other corporate information can

be found on the company website at: www.synconaltd.com

About Syncona

Syncona is a leading FTSE250 healthcare company focused on

founding, building and funding global leaders in life science. Our

vision is to deliver transformational treatments to patients in

truly innovative areas of healthcare while generating superior

returns for shareholders.

We seek to partner with the best, brightest and most ambitious

minds in science to build globally competitive businesses.

We take a long-term view, underpinned by a deep pool of capital,

and are established leaders in gene and cell therapy. We focus on

delivering dramatic efficacy for patients in areas of high unmet

need.

About Blue Earth Diagnostics

Blue Earth Diagnostics is a leading molecular imaging

diagnostics company focused on the development and

commercialization of novel PET imaging agents to inform clinical

management and guide care for cancer patients in areas of unmet

medical need. Formed in 2014, Blue Earth Diagnostics is led by

recognized experts in the clinical development and

commercialization of innovative nuclear medicine products. The

company's first approved and commercially available product is

Axumin(R) (fluciclovine F 18), a novel molecular imaging agent

approved in the United States and European Union for use in PET

imaging to detect and localize prostate cancer in men with a

diagnosis of biochemical recurrence. The company's pipeline

includes Prostate Specific Membrane Antigen (PSMA)-targeted

radiohybrid ("rh") agents. rhPSMA is a clinical-stage,

investigational class of theranostic compounds, with potential

applications in both the imaging and treatment of prostate

cancer.

About Bracco Imaging

Bracco Imaging S.p.A., part of the Bracco Group, is one of the

world's leading companies in the diagnostic imaging business with

2018 revenues exceeding EUR1 billion. Headquartered in Milan,

Italy, Bracco Imaging develops, manufactures and markets diagnostic

imaging agents and solutions.

Bracco Imaging offers a product and solution portfolio for all

key diagnostic imaging modalities: X-ray Imaging (including

Computed Tomography-CT, Interventional Radiology, and Cardiac

Catheterization), Magnetic Resonance Imaging (MRI), Contrast

Enhanced Ultrasound (CEUS), and Nuclear Medicine through

radioactive tracers. The diagnostic imaging portfolio is completed

by a range of medical devices and advanced administration systems

for contrast imaging products.

The Company operates in over 100 markets worldwide, either

directly or indirectly, through subsidiaries, joint ventures,

licenses and distribution partnership agreements. Bracco Imaging

has a strong presence in key geographies: North America, China,

Europe, Japan, Brazil, Mexico and South Korea. To learn more about

Bracco Imaging, visit www.braccoimaging.com.

[1] Foreign exchange rates at 26 June 2019

[2] As per footnote 1

[3] Including equity shares, repayment of preference shares and

accumulated dividends; final proceeds are subject to minor

adjustments ahead of closing

[4] GBP14.2m distribution in 2019 financial year

[5] Including the GBP14.2m distribution in 2019 financial year,

FX rates as at 26 June 2019, assuming closing August 2019; Syncona

Partners original cost.

[6] As at 31 March 2019

[7] At 26 June 2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQSEFSIWFUSEDM

(END) Dow Jones Newswires

June 27, 2019 02:01 ET (06:01 GMT)

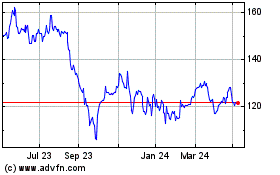

Syncona (LSE:SYNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

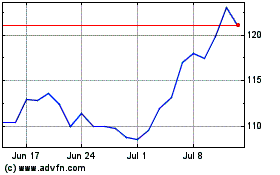

Syncona (LSE:SYNC)

Historical Stock Chart

From Apr 2023 to Apr 2024