Secure Trust Bank PLC Completion of Loan Portfolio sale (3133N)

May 31 2022 - 2:01AM

UK Regulatory

TIDMSTB

RNS Number : 3133N

Secure Trust Bank PLC

31 May 2022

PRESS RELEASE

Secure Trust Bank PLC

LEI: 213800CXIBLC2TMIGI76

31 May 2022

Embargoed release at 07:00 am

SECURE TRUST BANK PLC

Completion of Loan Portfolio sale

Secure Trust Bank PLC ('Secure Trust Bank') announces that its

subsidiary, Debt Managers (Services) Limited ('DMS'), completed the

sale of its portfolio of loans ('Portfolio') to Intrum UK Finance

Limited on 30 May 2022.

The gross value of the Portfolio as at 30 September 2021 was

GBP84.7 million and the value of the consideration for the

Portfolio as at 30 September 2021 was GBP94.0 million.

Secure Trust Bank expects that the sale will generate a net PBT

benefit (taking into account anticipated market exit costs) in the

current financial year and release around GBP72 million of risk

weighted assets, with the associated capital release being

reinvested into Secure Trust Bank 's remaining specialist lending

businesses and for other general corporate purposes.

Enquiries:

Secure Trust Bank PLC

David McCreadie, Chief Executive Officer

Rachel Lawrence, Chief Financial Officer

Tel: 0121 693 9100

Stifel Nicolaus Europe Limited (Joint Broker)

Robin Mann

Gareth Hunt

Stewart Wallace

Tel: 020 7710 7600

Canaccord Genuity Limited (Joint Broker)

Andrew Potts

Tel: 020 7523 8000

Tulchan Communications

Tom Murray

Misha Bayliss

Tel: 020 7353 4220

ENDS

The person responsible for the release of this information on

behalf of STB is Mark Stevens, Company Secretary.

About the Company

Secure Trust Bank is an established, well--funded and

capitalised UK retail bank with a 70 year trading track record.

Secure Trust Bank operates principally from its head office in

Solihull, West Midlands, and had an average of 973 employees

(full-- time equivalent) during 2021. The Group's diversified

lending portfolio currently focuses on two sectors:

(I) Business Finance through its Real Estate Finance and

Commercial Finance divisions, and

(II) Consumer Finance through its Vehicle Finance and Retail Finance divisions.

As at 31 December 2021 the Group's loans and advances to

customers totalled GBP2,531.9 million (66.6% of which is secured on

assets and property), customer deposits totalled GBP2,103.2 million

and the Group's total customer base was over 1.5 million customers.

As these figures are as at 31 December 2021, they include 212

employees, GBP79.6 million in loans and advances to customers, and

approximately GBP0.6 million customers which relate to Debt

Managers (Services) Ltd (DMS). As announced, DMS agreed to sell its

loan portfolio and expects, in the second half of 2022, to migrate

its customers and transfer its employees to the purchaser of the

portfolio.

Secure Trust Bank PLC is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct Authority and the

Prudential Regulation Authority.

Secure Trust Bank PLC, One Arleston Way, Solihull, B90 4LH.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISSDFESSEESEEI

(END) Dow Jones Newswires

May 31, 2022 02:01 ET (06:01 GMT)

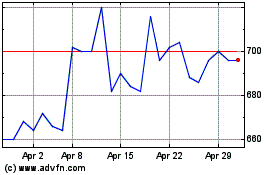

Secure Trust Bank (LSE:STB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Secure Trust Bank (LSE:STB)

Historical Stock Chart

From Apr 2023 to Apr 2024