Standard Chartered 2020 Pretax Underlying Profit Dropped 40%

February 25 2021 - 12:12AM

Dow Jones News

By Yifan Wang

Standard Chartered PLC said Thursday that its profit fell 40% in

2020, as sharply higher credit impairments and weak interest rates

hurt profitability in a pandemic-struck year.

The Asia-focused bank posted pretax underlying profit of $2.51

billion last year, compared with $4.17 billion in 2019.

Operating income fell 3% to $14.77 billion, with net interest

income declining 11% to $6.88 billion.

The lower interest income was mainly due to a narrower net

interest margin, which fell 0.31 percentage point to 1.31% in

2020.

The lender expects its overall income in 2021 to be similar to

the previous year, as the low-interest-rate environment continues

to weigh on its business.

However, the bank said it expects income to resume growth of

5%-7% annually from 2022, as the global economic recovery would be

led by large Asian markets, where Standard Chartered makes

two-thirds of its income.

Write to Yifan Wang at yifan.wang@wsj.com

(END) Dow Jones Newswires

February 24, 2021 23:57 ET (04:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

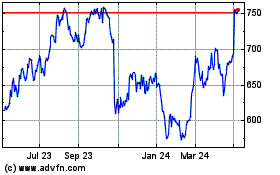

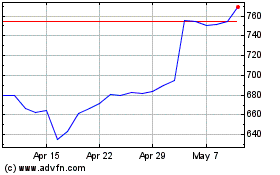

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024