Audited Results for the year ended 31 December

2023

Serabi Gold plc (AIM:SRB,TSX:SBI), the

Brazilian-focused gold mining and development company, today

releases its audited results for the year ended 31 December

2023.

HIGHLIGHTS

- Revenue of US$63.7 million (2022:

US$58.7 million) reflecting higher production year on year as well

as positive movement in the average gold price of achieved, (2023:

US$1,945; 2022: US$1,785).

- Gold production for the full year of

2023 of 33,153 ounces (2022: 31,819 ounces).

- EBITDA for the year of US$13.78

million (2022: US$8.78 million), a 57% improvement year on

year.

- Post tax profit for the year of

US$6.58 million, (2022: Post tax loss of US$1.0 million).

- Cash held at 31 December 2022 of

US$11.6 million (31 December 2022: US$7.2 million).

- Profit per share of 8.68 cents

compared with a loss per share of 1.30 cents for the 2022 calendar

year.

- Net cash inflow from operations for

the year of US$7.7 million (after mine development expenditure of

US$4.4 million); (2022 net cash outflow from operations of US$1.7

after accounting for mine development of US$3.6 million).

- Cash Costs for the full year of

US$1,300 per ounce (2022: US$1,322) and AISC for the full year of

US$1,635 per ounce (2022: US$1,615).

- Robust first quarter of 2024 with

9,007 ounces of gold production. Production guidance of between

38,000 and 40,000 ounces of gold for the 2024 calendar year.

Use the following link to access the

2023 Serabi Gold Annual Report -

https://bit.ly/3wcNqqe

Key Financial Information

|

SUMMARY FINANCIAL STATISTICS FOR THE THREE AND TWELVE

MONTHS ENDING 31 DECEMBER 2023 |

|

|

12 months to31 Dec

2023US$ |

3 months to31 Dec

2023US$ |

12 months to31 Dec 2022US$ |

3 months to31 Dec 2022US$ |

|

Revenue |

63,707,468 |

15,810,204 |

58,709,328 |

14,321,024 |

|

Cost of Sales |

(43,414,739) |

(10,581,049) |

(44,262,769) |

(10,184,431) |

|

Gross Operating Profit |

20,292,729 |

5,229,155 |

14,446,559 |

4,136,593 |

|

Administration and share based payments |

(6,508,543) |

(1,806,076) |

(5,662,441) |

(1,218,799) |

|

EBITDA |

13,784,186 |

3,423,079 |

8,784,118 |

2,917,794 |

|

Depreciation and amortisation charges |

(6,239,556) |

(1,257,370) |

(6,572,461) |

(1,975,623) |

|

Operating profit before finance and tax |

7,544,165 |

2,165,709 |

2,211,657 |

942,171 |

|

|

|

|

|

|

|

Profit/(loss) after tax |

6,575,612 |

1,954,833 |

(983,047) |

(112,527) |

|

Earnings per ordinary share (basic) |

8.68 cents |

2.58 cents |

(1.30) cents |

(0.15) cents |

|

|

|

|

|

|

|

Average gold price received |

US$1,945 |

US$1,972 |

US$1,785 |

US$1,726 |

|

|

|

|

|

|

|

|

|

|

As at31

December2023 |

As at31 December2022 |

|

Cash and cash equivalents |

|

|

11,552,031 |

7,196,313 |

|

Net funds |

|

|

4,998,723 |

247,894 |

|

Net assets |

|

|

92,792,049 |

81,523,063 |

|

|

|

|

|

|

|

Cash Cost and All-In Sustaining Cost (“AISC”) |

|

|

|

|

|

|

12 months to31 December 2023 |

3 months to31 December 2023 |

12 months to31 December 2022 |

3 months to31 December 2022 |

|

Gold production for cash cost and AISC

purposes |

33,152 ozs |

7,891 ozs |

31,819 ozs |

7,798 ozs |

|

|

|

|

|

|

|

Total Cash Cost of production (per ounce) |

US$1,300 |

US$1,343 |

US$1,322 |

US$1,227 |

|

Total AISC of production (per ounce) |

US$1,635 |

US$1,721 |

US$1,615 |

US$1,473 |

Clive Line, CFO of Serabi

commented,

“Twelve months ago, I reported that 2022 had

been planned as a year of investment as the Group commenced the

development of Coringa, which will drive production growth over the

next couple of years. The reward for that investment has been

manifesting itself through the year. Production from Coringa was

over 8,800 ounces and we anticipate a further significant uplift

during 2024 as we target 38,000 to 40,000 ounces, with that

increase expected to be primarily attributable to Coringa. Whilst

overall gold production improved by four per cent, sales revenue

was up by almost nine per cent as we benefited from continued

improvement in the gold price. At the same time we were able to

maintain operating costs at a very similar level to the previous

year and as a result Operating Profit is up by US$5.3 million, a

241 per cent increase, with EBITDA of US$13.7 million being up by

US$4.9 million, a 57 per cent improvement year on year.

“More importantly despite continued development

of Coringa, cash has also improved with net cash up by US$4.75

million. Cash generated from operations and after capitalised mine

development expenditure was US$7.7 million, a significant

improvement on the net outflow of US$1.7 million of 2022.

“In my 2022 overview I indicated that we would

only be able to secure the necessary longer term funding for

Coringa once adequate progress had been made on the licencing

situation. Roll forward 12 months to today, and with the continued

support from existing lenders and the cash flow we expect to

generate given current market conditions, we are confident that we

can continue the planned development of Coringa without any

financing related delays. The ore sorter has been purchased and

cleared customs in Brazil in early April. The area for its

installation has been cleared and the civil works for installation

are already underway.

“2024 will nonetheless be another year of

investment. In addition to the purchase and installation of the

crushing and ore-sorting plant, we are undertaking an underground

drilling campaign on the Serra orebody at Coringa. This will allow

the Group to issue a new Technical Report with updated mineral

reserves and resources for the Coringa project later this year. We

are specifically drilling the down dip extension of the Serra

orebody. These investments will be key to the Group positioning

itself to deliver its continued growth plans for 2025 which in turn

can be expected to provide the opportunity to reduce unit

production costs. One of our largest cost items is power and in

particular the cost of diesel for generators to run the Palito

Complex and the process plant. In the latter part of 2023, we have

been increasingly reliant on these generators due to fluctuations

in the voltage of the power delivered by the grid, particularly

during the wet season. We are working with the local transmission

company, and anticipate that later in 2024 we will have a more

reliable and higher capacity transmission line connected to the

Palito Complex. This should in turn reduce our need for diesel

sourced power, providing both costs savings and improving our

environmental credentials as the grid power will come from

renewable sources.”

STATEMENT FROM THE CHAIR OF

SERABI

Dear Shareholders

Following a year in which the Company

achieved some key milestones, I am pleased to report that 2024 is

already well on track to build on these, create a solid platform

from which to execute its production growth and move Serabi into

the next phase of its development. At Coringa we have engaged with

all stakeholders culminating in the renewal of the trial mining

licence for three years, whilst the recent reserve and resource

estimation at Palito has significantly increased the reserves

compared with prior estimates and resulted in a global mineral

inventory for the Group of over one million ounces.

The outlook for continued strength in the gold

price remains positive and with the exception of a short period at

the end of the third quarter of last year, the price has remained

almost consistently above US$1,900 per ounce and for the year to

date above US$2,000 per ounce.

The change in government in Brazil at the start

of 2023 has not brought significant change to the regulations or

financial treatment of the mining sector and whilst the outlook for

the country as a whole is relatively good, as a company that incurs

much of its costs locally, our planning and budgeting processes

have been helped by the exchange rate remaining fairly stable over

the last 12 months.

In this industry, scale is important. Your Board

keenly recognises this and Serabi’s production growth over last few

years belies an exciting growth story. We have not sat still. We

have been building the team, strengthening the board, focussing on

our relationships with local indigenous groups, improving our

internal processes and governance, putting in place the building

blocks for the Coringa growth story and looking to leverage our

geological endowment for the benefit of shareholders. I believe we

are now reaping the benefits of all this hard work. But we continue

to look to grow further in a financially prudent manner. Our vision

is to become the premier, Brazil focussed, gold growth company

generating superior returns to our investors. In parallel with

organic opportunities, we continue to explore appropriate corporate

opportunities to accelerate our objective of transitioning to a

200,000 ounce per year producer over the next few years. In turn we

expect that building such a business will increase the capital

markets relevance of Serabi, increase daily trading volumes amongst

our shareholders, and attract institutional funds for long term

investment. Your Board considers that reaching this level of

critical mass, will open up our investor base, create greater

demand for our shares and result in an upward re-rating of our

market value. For this reason, and having strengthened the balance

sheet and operations in the last couple of years, selective M&A

activity will be required, in our view.

Our executive management is operationally

focussed and experienced at identifying and implementing innovative

solutions. Our focus remains Brazil where we have a long and

successful track record but we must remain open to looking at other

jurisdictions offering a stable legislative environment in which to

develop mining opportunities.

Whilst we feel that the best use of surplus cash

in the short-term would be to help drive growth, this assumes

suitable opportunities are available. We will always be evaluating

investment opportunities and risk against other options that can

generate rewards for our shareholders including the opportunity to

return funds potentially through dividends or share buyback

arrangements.

The exploration alliance with Vale, during 2023

provided a source of exploration funding that allowed us to advance

our gold exploration opportunities whilst also giving the Group the

opportunity to progress an opportunity for copper exploration that

the Group would not otherwise have progressed. The results from the

Phase 1 programme, whilst giving us greater technical understanding

of the Matilda prospect, allowed us to advance other gold targets,

we can now advance further as well as generating other potential

copper porphyry targets. Whilst Vale have now decided to not

progress to Phase 2 we do have other parties interested to pick up

their position, giving the Group the potential for continued

exposure to copper exploration but allowing management to focus on

the Group’s core gold activities.

As part of our efforts to widen the shareholder

base of Serabi, in February 2024, Serabi was approved to have a

quotation of its shares on the OTCQX in the United States which we

hope will enhance the visibility, liquidity and accessibility of

the Company to U.S. investors. We see this as a cost-effective

option for expanding the shareholder base without increasing the

regulatory burden. In the near term, we view attracting new

investors as a key component to maintaining and growing value for

existing shareholders and we will be stepping up our efforts over

the next 12 months to grow our presence among the investment

communities in North America. As part of this programme, we

completely revamped our corporate website. I encourage investors to

acquaint themselves with our vision, strategy and the latest

updates on our operations and exploration opportunities. Our

management will be attending a number of investor events and

conferences over the next 12 months, details of which will be

listed on the website, and investors are encouraged to use these

opportunities where possible to meet with management.

Since being appointed as Chair for Serabi in

August 2022, I have sought to strengthen the role of the Board,

continue to challenge management and in the light of increased

regulation and accountability, reacted to the need to strengthen

the overall corporate governance processes. In January last year,

we welcomed Carolina Margozzini to the Board of Directors who was

also appointed as a member of the Remuneration Committee. This was

followed, in May 2023, by the appointment of Deborah Gudgeon, a

very experienced, non-executive director working with a number of

natural resources companies. Deborah has also taken on the role a

Chair of the Audit and Risk Committee. We also appointed, in August

2023, Kerin Williams to take on the role of Company Secretary,

relieving our CFO of this responsibility which, had over recent

years, become increasingly time consuming.

Whilst the Board works closely with management

to drive operational improvements we are also very focussed on

ensuring that this is done with safety as a priority. It is

pleasing to report that I have seen, during my own visits to site,

the quality and professionalism of our staff and their desire to

put health and safety very much in the forefront of thinking.

During the year, we have undertaken a full

review of our governance processes, updated the Terms of Reference

for the Board and its sub-committees and established new

Sustainability and M&A Committees, to help streamline the

decision making processes. With an ever-increasing level of

oversight by regulators and other governmental and non-governmental

bodies, the manner in which companies operate, particularly those

involved in natural resources, is under growing scrutiny. Serabi

prides itself on its constructive interaction with the neighbouring

communities, engaging in an open dialogue through multiple meetings

each month and supporting community programmes including

infrastructure, health and education. I was very pleased when, in

October 2023, our efforts were recognised at the gold symposium

hosted by the Associação Brasileira de Empresas de Pesquisa Mineral

e Mineração (“ABPM”) when Serabi overwhelmingly won the category

for Community Relations securing 73% of more than 5,000 votes that

were cast. Whilst visiting the operations earlier in the year, I

was privileged to meet the team responsible and witness the

excellent work they do and their levels of commitment.

My first 21 months as Chair have been very

exciting and rewarding. We have challenges ahead, but I am very

encouraged with what I have seen and the shared vision of the Board

and management for developing the Company. The next six months, as

we continue the development of the Coringa project, will be pivotal

for us and will provide the base for continued production growth in

2025 and 2026. I hope that I will be able to report further

positive progress at the Annual General Meeting to be held in June

and over the rest of the year.

Michael D Lynch-BellChair26 April 2024

The information contained within this

announcement is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014 as it forms part of UK Domestic Law by virtue of the

European Union (Withdrawal) Act 2018.

The person who arranged for the release of this

announcement on behalf of the Company was Clive Line, Director.

Annual Report

The Annual Report has been published by the

Company on its website at www.serabigold.com and printed copies are

expected to be available before 31 May 2024. Additional copies will

be available to the public, free of charge, from the Company's

offices at The Long Barn, Cobham Park Road, Downside, Surrey, KT11

3NE and will be available to download from the Company’s website at

www.serabigold.com.

The data included in the selected annual

information tables below is taken from the Company’s annual audited

financial statements for the year ended 31 December 2023, which

were prepared in accordance with international accounting standards

in conformity with the requirements of the Companies Act 2006. The

Parent Company financial statements have also been prepared in

accordance with those parts of the Companies Act 2006 applicable to

companies reporting under International Financial Reporting

Standards (“IFRS”).

The audited financial statements for the year

ended 31 December 2023 will be presented to shareholders for

adoption at the Annual General Meeting of the Company’s

shareholders and filed with the Registrar of Companies.

The following information, comprising, the

Income Statement, the Group Balance Sheet, Group Statement of

Changes in Shareholders’ Equity, and Group Cash Flow, is extracted

from these financial statements.

Enquiries

SERABI GOLD plcMichael

Hodgson t

+44 (0)20 7246 6830Chief

Executive m

+44 (0)7799 473621

Clive

Line t

+44 (0)20 7246 6830Finance

Director m

+44 (0)7710 151692

Andrew Khov

m

+1 647 885 4874Vice President, Investor Relations & Business

Development e

contact@serabigold.com

www.serabigold.com

BEAUMONT CORNISH LimitedNominated

Adviser & Financial AdviserRoland Cornish / Michael

Cornish t

+44 (0)20 7628 3396PEEL HUNT LLPJoint UK

BrokerRoss

Allister t

+44 (0)20 7418 9000

TAMESIS PARTNERS LLPJoint UK

BrokerCharlie Bendon/ Richard

Greenfield t

+44 (0)20 3882 2868

CAMARCOFinancial PR -

EuropeGordon Poole / Emily

Hall t

+44 (0)20 3757 4980

HARBOR ACCESS Financial PR – North

AmericaJonathan Patterson / Lisa

Micali t

+1 475 477 9404

Copies of this announcement are available from

the Company's website at www.serabigold.com.

Neither the Toronto Stock Exchange, nor any

other securities regulatory authority, has approved or disapproved

of the contents of this announcement.

See

www.serabigold.com for more information

and follow us on twitter @Serabi_Gold

Statement of Comprehensive

IncomeFor the year ended 31 December 2023

| |

|

|

Group |

| |

|

|

For the year ended31 December 2023 |

For the year ended31 December 2022 |

|

|

Notes |

|

US$ |

US$ |

|

|

|

|

|

|

| Revenue from continuing

operations |

|

|

63,707,468 |

58,709,328 |

| Cost of sales |

|

|

(43,184,739) |

(43,110,870) |

| Stock impairment provision |

|

|

(230,000) |

— |

| Provision for impairment of taxes

receivable |

|

|

— |

(1,151,899) |

|

Depreciation and amortisation charges |

|

|

(6,239,556) |

(6,572,461) |

|

Total cost of sales |

|

|

(49,654,295) |

(50,835,230) |

|

Gross operating profit |

|

|

14,053,173 |

7,874,098 |

| Administration expenses |

|

|

(6,492,165) |

(5,447,224) |

| Share-based payments |

|

|

(197,344) |

(249,210) |

|

Gain on disposal of fixed assets |

|

|

180,966 |

33,993 |

|

Operating profit |

|

|

7,544,630 |

2,211,657 |

| Foreign exchange gain |

|

|

174,105 |

131,938 |

| Other income – exploration

receipts |

5 |

|

4,680,414 |

— |

| Other expenses – exploration

expenses |

5 |

|

(4,339,554) |

— |

| Finance expense |

6 |

|

(739,245) |

(3,411,784) |

|

Finance income |

6 |

|

847,523 |

291,885 |

|

Profit / (loss) before taxation |

|

|

8,167,873 |

(776,304) |

|

Income tax expense |

7 |

|

(1,592,261) |

(206,743) |

|

Profit / (loss) for the

period(1) |

|

|

6,575,612 |

(983,047) |

| |

|

|

|

|

| Other comprehensive

income (net of tax) |

|

|

|

|

| Items that may be

reclassified subsequently to profit or loss |

|

|

|

|

|

Exchange differences on translating foreign operations |

|

|

4,496,030 |

2,371,399 |

|

Total comprehensive profit for the

period(1) |

|

|

11,071,642 |

1,388,352 |

| Earnings per ordinary

share (basic) (1) |

8 |

|

8.68c |

(1.30c) |

|

Earnings per ordinary share (diluted) (1) |

8 |

|

8.68c |

(1.30c) |

(1) The Group has

no non-controlling interests, and all losses are attributable to

the equity holders of the parent company

.

Balance Sheet as at 31 December

2023

| |

|

|

|

Group |

| |

|

|

|

At 31 December2023 |

At 31 December2022 |

|

|

|

|

|

US$ |

US$ |

|

Non-current assets |

|

|

|

|

|

| Deferred exploration costs |

|

|

|

20,499,257 |

18,621,180 |

| Property, plant and

equipment |

|

|

|

53,340,903 |

48,482,519 |

| Right of use assets |

|

|

|

5,316,330 |

5,374,042 |

| Taxes receivable |

|

|

|

4,653,063 |

3,446,032 |

|

Deferred taxation |

|

|

|

1,791,983 |

1,545,684 |

|

Total non-current assets |

|

|

|

85,061,536 |

77,469,457 |

|

Current assets |

|

|

|

|

|

| Inventories |

|

|

|

12,797,951 |

8,706,351 |

| Trade and other receivables |

|

|

|

2,858,072 |

5,291,924 |

| Prepayments |

|

|

|

2,320,256 |

1,572,149 |

| Derivative financial assets |

|

|

|

115,840 |

— |

|

Cash and cash equivalents |

|

|

|

11,552,031 |

7,196,313 |

|

Total current assets |

|

|

|

29,644,150 |

22,766,737 |

|

Current liabilities |

|

|

|

|

|

| Trade and other payables |

|

|

|

8,626,292 |

5,830,872 |

| Interest-bearing liabilities |

|

|

|

6,403,084 |

6,111,126 |

|

Accruals |

|

|

|

649,225 |

461,857 |

|

Total current liabilities |

|

|

|

15,678,601 |

12,403,855 |

|

Net current assets |

|

|

|

13,965,549 |

10,362,882 |

|

Total assets less current liabilities |

|

|

|

99,567,085 |

87,832,339 |

|

Non-current liabilities |

|

|

|

|

|

| Trade and other payables |

|

|

|

3,960,920 |

3,800,886 |

| Provisions |

|

|

|

2,663,892 |

1,190,175 |

| Deferred tax liability |

|

|

|

— |

480,922 |

|

Interest-bearing liabilities |

|

|

|

150,224 |

837,293 |

|

Total non-current liabilities |

|

|

|

6,775,036 |

6,309,276 |

|

Net assets |

|

|

|

92,792,049 |

81,523,063 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

| Share capital |

|

|

|

11,213,618 |

11,213,618 |

| Share premium reserve |

|

|

|

36,158,068 |

36,158,068 |

| Share incentive reserve |

|

|

|

175,573 |

1,324,558 |

| Other reserves |

|

|

|

15,960,006 |

14,459,255 |

| Translation reserve |

|

|

|

(61,780,741) |

(66,276,771) |

|

Retained surplus |

|

|

|

91,065,525 |

84,644,335 |

|

Equity shareholders’ funds attributable to owners of the

parent |

|

|

|

92,792,049 |

81,523,063 |

Statements of Changes in Shareholders’

EquityFor the twelve month period ended 31 December

2023

| Group |

Sharecapital |

Sharepremium |

Shareincentivereserve |

Otherreserves |

Translationreserve |

Retained surplus |

Total equity |

|

|

US$ |

US$ |

US$ |

US$ |

US$ |

US$ |

US$ |

|

Equity shareholders’ funds at 31 December

2021 |

11,213,618 |

36,158,068 |

1,075,348 |

13,694,731 |

(68,648,170) |

86,391,906 |

79,885,501 |

|

Foreign currency adjustments |

– |

– |

– |

– |

2,371,399 |

– |

2,371,399 |

| Profit

for year |

– |

– |

– |

– |

– |

(983,047) |

(983,047) |

|

Total comprehensive income for the year |

– |

– |

– |

– |

2,371,399 |

(983,047) |

1,388,352 |

| Transfer to taxation

reserve |

– |

– |

– |

764,524 |

– |

(764,524) |

– |

| Share

based incentive expense |

– |

– |

249,210 |

– |

– |

– |

249,210 |

|

Equity shareholders’ funds at 31 December

2022 |

11,213,618 |

36,158,068 |

1,324,558 |

14,459,255 |

(66,276,771) |

84,644,335 |

81,523,063 |

|

Foreign currency adjustments |

– |

– |

– |

– |

4,496,030 |

– |

4,496,030 |

| Profit

for year |

– |

– |

– |

– |

– |

6,575,612 |

6,575,612 |

|

Total comprehensive income for the year |

– |

– |

– |

– |

4,496,030 |

6,575,612 |

11,071,642 |

| Transfer to taxation

reserve |

– |

– |

– |

1,500,751 |

– |

(1,500,751) |

– |

| Share based incentives lapsed

in period |

– |

– |

(1,346,329) |

– |

– |

1,346,329 |

– |

| Share

based incentive expense |

– |

– |

197,344 |

– |

– |

– |

197,344 |

|

Equity shareholders’ funds at 31 December

2023 |

11,213,618 |

36,158,068 |

175,573 |

15,960,006 |

(61,870,741) |

91,065,525 |

92,792,049 |

Other reserves comprise a merger reserve of US$361,461 and a

taxation reserve of US$15,598,545 (2022: merger reserve of

US$361,461 and taxation reserve of US$14,097,794).

Cash Flow Statement For the twelve month period

ended 31 December 2023

|

|

|

|

Group |

|

|

|

|

|

For theyear ended31 December2023 |

For theyear ended31 December2022 |

|

|

|

|

|

US$ |

US$ |

|

Cash outflows from operating activities |

|

|

|

|

|

| Profit/(loss) for the

period |

|

|

|

6,575,612 |

(983,047) |

| Net financial

(income)/expense |

|

|

|

(623,243) |

2,987,961 |

| Depreciation – plant,

equipment and mining properties |

|

|

|

6,239,556 |

6,572,461 |

| Provision for impairment of

taxes receivable |

|

|

|

– |

1,151,899 |

| Provision for inventory

impairment |

|

|

|

230,000 |

– |

| Taxation expense |

|

|

|

1,592,261 |

206,743 |

| Share-based payments |

|

|

|

197,344 |

249,210 |

| Gain on fixed asset sales and

other items |

|

|

|

(180,966) |

(33,993) |

| Taxation paid |

|

|

|

(1,400,365) |

(129,426) |

| Interest paid |

|

|

|

(426,366) |

(208,592) |

| Foreign exchange

(loss)/gain |

|

|

|

(82,829) |

(191,328) |

| |

|

|

|

|

|

| Changes in working

capital |

|

|

|

|

|

| Increase in inventories |

|

|

|

(2,830,651) |

(1,435,025) |

| Increase in receivables,

prepayments and accrued income |

|

|

|

1,614,497 |

(6,465,608) |

| Increase/(decrease) in

payables, accruals and provisions |

|

|

|

1,188,337 |

234,314 |

|

Increase in short-term intercompany payables |

|

|

|

– |

– |

|

Net cash inflow/(outflow) from operations |

|

|

|

12,093,187 |

1,955,569 |

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

| Purchase of property, plant,

equipment, and projects in construction |

|

|

|

(2,378,317) |

(4,447,588) |

| Mine development

expenditure |

|

|

|

(4,425,839) |

(3,629,505) |

| Geological exploration

expenditure |

|

|

|

(571,411) |

(855,607) |

| Pre-operational project

costs |

|

|

|

– |

(2,328,113) |

| Proceeds from sale of

assets |

|

|

|

326,727 |

171,824 |

| Investment in

subsidiaries |

|

|

|

– |

– |

|

Interest received and other finance income |

|

|

|

313,106 |

126,390 |

|

Net cash outflow on investing activities |

|

|

|

(6,735,734) |

(10,962,599) |

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

| Receipt of short-term

loan |

|

|

|

5,000,000 |

4,917,775 |

| Repayment of short-term

loan |

|

|

|

(5,096,397) |

– |

| Payment of lease

liabilities |

|

|

|

(1,171,602) |

(1,027,151) |

|

Net cash (outflow)/inflow from financing

activities |

|

|

|

(1,267,999) |

3,890,624 |

|

|

|

|

|

|

|

| Net

increase/(decrease) in cash and cash equivalents |

|

|

|

4,089,454 |

(5,116,406) |

| Cash and cash

equivalents at beginning of period |

|

|

|

7,196,313 |

12,217,751 |

|

Exchange difference on cash |

|

|

|

266,264 |

94,968 |

|

Cash and cash equivalents at end of period |

|

|

|

11,552,031 |

7,196,313 |

Notes1. General

Information

The financial information set out above for the

years ended 31 December 2023 and 31 December 2022 does not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006 but is derived from those accounts. Whilst the

financial information included in this announcement has been

compiled in accordance with UK-adopted international accounting

standards (UK IAS), this announcement itself does not contain

sufficient financial information to comply with UK IAS. A copy of

the statutory accounts for 2022 has been delivered to the Registrar

of Companies and those for 2023 will be delivered to the Registrar

of Companies following approval by shareholders at the Annual

General Meeting. The full audited financial statements for the

years end 31 December 2023 and 31 December 2022 comply with

IFRS.

2. Auditor’s

Opinion

The auditor has issued an unqualified opinion in

respect of the financial statements for both 2023 and 2022 which do

not contain any statements under the Companies Act 2006, Section

498(2) or Section 498(3).

3. Basis

of Preparation

The financial statements have been prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006. The parent and

consolidated financial statements have been prepared in accordance

with UK-adopted international accounting standards (UK IAS) and

with the requirements of the Companies Act 2006 as applicable to

companies reporting under those standards.

On 31 December 2020, IFRS as adopted by the

European Union at that date was brought into the UK law and became

UK-adopted international accounting standards, with future changes

being subject to endorsement by the UK Endorsement Board. The Group

prepares its consolidated financial statements in accordance with

UK IAS.

Accounting standards, amendments and

interpretations effective in 2022The Group has not adopted

any standards or interpretations in advance of the required

implementation dates.

The following Accounting standards came into effect as of 1

January 2023

| IFRS 17 Insurance Contracts,

including Amendments to IFRS 17 |

1 January 2023 |

| Classification of Liabilities as

Current or Non-current (Amendments to IAS 1) and Classification of

Liabilities as Current or Non-current – Deferral of Effective

Date |

1 January 2023 |

There is no material impact on the financial

statements from the adoption of these new accounting standards or

amendments to accounting standards,

Certain new accounting standards and

interpretations have been published that are not mandatory for the

current period and have not been early adopted. These standards are

not expected to have a material impact on the Company’s current or

future reporting periods.

4. Going

concern and availability of finance

The Group’s business activities, together with

the factors likely to affect its future development, performance

and position, are set out in the Group Strategic Report. The

financial position of the Group, its cash flows, and liquidity

position are described in the Chief Financial Officer’s Review and

set out in the Group Financial Statements. Further details of the

Group’s commitments and maturity analysis of financial liabilities

are set out in note 24 and 26 respectively of the Group Financial

Statements. In addition, note 23 to the Group Financial Statements

includes the Group’s objectives, policies and processes for

managing its capital; its financial risk management objectives;

details of its financial instruments; and its exposures to credit

risk and liquidity risk.

The Directors have a reasonable expectation

that, after taking into account reasonably possible changes in

trading performance, and the current macroeconomic situation, the

Group has adequate resources to continue in operational existence

for the foreseeable future. Thus, they continue to adopt the going

concern basis of accounting in preparing the Financial Statements.

Further details are provided in Going Concern section of the Group

Strategic Report on pages 26 and 27.

5 Other

income and expense

Under its copper exploration alliance with Vale announced on 10

May 2023, the related exploration activities being undertaken by

the Group under the management of a working committee (comprising

representatives from Vale and Serabi), are being funded in their

entirety by Vale up to a value of US$5 million during Phase 1 of

the programme. The Group at this time has no certainty that the

exploration for copper deposits will result in a project that is

commercially viable recognising that exploration and development of

copper deposits is not the core activity of the Group, there is a

significant cost involved in developing new copper deposits and it

is unlikely that without the financial support of Vale that the

Group would independently seek to develop a copper project in

preference to any of its existing gold projects and

discoveries.

As a result, it is recognising both the funding received from

Vale and the related exploration expenditures through its income

statement. As this is not the principal business activity of the

Group these receipts and expenditures are classified as other

income and other expenses.

6. Finance

expense and income

|

|

Group |

|

|

12 months ended31 December 2023 |

12 months ended31 December 2022 |

|

|

US$ |

US$ |

| Interest and fines on state sales

tax |

— |

(1,819,909) |

| Provision for interest on

disputed tax refunds claimed |

— |

(1,090,586) |

| Interest on short term unsecured

bank loan |

(453,675) |

(211,793) |

| Interest in finance leases |

(103,568) |

(148,650) |

| Interest on short term trade

loan |

(90,586) |

(59,942) |

| Variation on discount on

rehabilitation provision |

(91,416) |

(80,904) |

|

Total finance expense |

(739,245) |

(3,411,784) |

| Gain on revaluation of

warrants |

— |

165,495 |

| Gain on revaluation of

derivatives |

431,348 |

— |

| Realised gain on hedging

activities |

103,069 |

— |

|

Interest income |

313,106 |

126,390 |

|

Total finance income |

847,523 |

291,885 |

|

Net finance (expense)/income |

108,278 |

(3,119,899) |

7.

TaxationThe

Group has incurred a tax charge on profits in Brazil for the year

to 31 December 2023 of US$2,199,658 (31 December 2022 -

US$890,176)

The Group has also recognised a deferred tax

asset to the extent that the Group has reasonable certainty as to

the level and timing of future profits that might be generated and

against which the asset may be recovered. The Group has registered

a net deferred tax credit of US$607,397 during the year to 31

December 2023 (31 December 2022 – credit of US$683,433).

8. Earnings

per share

|

|

|

For the year ended 31 December 2023 |

For the year ended 31 December 2022 |

|

(Loss) / profit attributable to ordinary shareholders (US$) |

6,575,612 |

(983,047) |

| Weighted

average ordinary shares in issue |

75,734,551 |

75,734,551 |

| Basic

profit per share (US cents) |

8.68 |

(1.30) |

| Diluted

ordinary shares in issue (1) |

75,734,551 |

81,488,078 |

| Diluted

profit per share (US cents) |

8.68 |

(1.30)(2) |

(1) At 31

December 2023 there were 2,075,400 conditional share awards in

issue (31 December 2022 864,500). These are subject to performance

conditions which may or not be fulfilled in full or in part. These

CSA’s have not been included in the calculation of the diluted

earnings per share.. At 31 December 2022: there were also 1,750,000

options and 4,003,527 unexercised warrants in issue.

(2) As the

effect of dilution is to reduce the loss per share, the diluted

loss per share is considered to be the same as the basic loss per

share

9. Post

balance sheet eventsOn 7 January 2024, the Group completed

a US$5.0 million unsecured loan arrangement with Itau Bank in

Brazil. The loan is repayable as a bullet payment on 6 January 2025

and carries an interest coupon of 8.47 per cent. The proceeds

raised from the loan are being used for working capital and secure

adequate liquidity to repay a similar arrangement which was repaid

on 22 February 2023.

Except as set out above, there has been no item,

transaction or event of a material or unusual nature likely, in the

opinion of the Directors of the Company, to affect significantly

the continuing operation of the entity, the results of these

operations, or the state of affairs of the entity in future

financial periods.

Assay ResultsAssay results reported within this

release include those provided by the Company's own on-site

laboratory facilities at Palito and have not yet been independently

verified. Serabi closely monitors the performance of its own

facility against results from independent laboratory analysis for

quality control purpose. As a matter of normal practice, the

Company sends duplicate samples derived from a variety of the

Company's activities to accredited laboratory facilities for

independent verification. Since mid-2019, over 10,000 exploration

drill core samples have been assayed at both the Palito laboratory

and certified external laboratory, in most cases the ALS laboratory

in Belo Horizonte, Brazil. When comparing significant assays with

grades exceeding 1 g/t gold, comparison between Palito versus

external results record an average over-estimation by the Palito

laboratory of 6.7% over this period. Based on the results of this

work, the Company's management are satisfied that the Company's own

facility shows sufficiently good correlation with independent

laboratory facilities for exploration drill samples. The Company

would expect that in the preparation of any future independent

Reserve/Resource statement undertaken in compliance with a

recognised standard, the independent authors of such a statement

would not use Palito assay results without sufficient duplicates

from an appropriately certificated laboratory.

Forward-looking statementsCertain statements in

this announcement are, or may be deemed to be, forward looking

statements. Forward looking statements are identified by their use

of terms and phrases such as ‘‘believe’’, ‘‘could’’, “should”

‘‘envisage’’, ‘‘estimate’’, ‘‘intend’’, ‘‘may’’, ‘‘plan’’, ‘‘will’’

or the negative of those, variations or comparable expressions,

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors’ current expectations and assumptions regarding the

Company’s future growth, results of operations, performance, future

capital and other expenditures (including the amount, nature and

sources of funding thereof), competitive advantages, business

prospects and opportunities. Such forward looking statements reflect

the Directors’ current beliefs and assumptions and are based on

information currently available to the Directors. A number of

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions, competition, environmental and other regulatory

changes, actions by governmental authorities, the availability of

capital markets, reliance on key personnel, uninsured and

underinsured losses and other factors, many of which are beyond the

control of the Company. Although any forward-looking statements

contained in this announcement are based upon what the Directors

believe to be reasonable assumptions, the Company cannot assure

investors that actual results will be consistent with such forward

looking statements.

Qualified Persons StatementThe scientific and

technical information contained within this announcement has been

reviewed and approved by Michael Hodgson, a Director of the

Company. Mr Hodgson is an Economic Geologist by training with over

30 years' experience in the mining industry. He holds a BSc (Hons)

Geology, University of London, a MSc Mining Geology, University of

Leicester and is a Fellow of the Institute of Materials, Minerals

and Mining and a Chartered Engineer of the Engineering Council of

UK, recognizing him as both a Qualified Person for the purposes of

Canadian National Instrument 43-101 and by the AIM Guidance Note on

Mining and Oil & Gas Companies dated June 2009.

NoticeBeaumont Cornish Limited, which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting as nominated adviser to the Company in

relation to the matters referred herein. Beaumont Cornish Limited

is acting exclusively for the Company and for no one else in

relation to the matters described in this announcement and is not

advising any other person and accordingly will not be responsible

to anyone other than the Company for providing the protections

afforded to clients of Beaumont Cornish Limited, or for providing

advice in relation to the contents of this announcement or any

matter referred to in it.

Neither the Toronto Stock Exchange, nor any other securities

regulatory authority, has approved or disapproved of the contents

of this news release

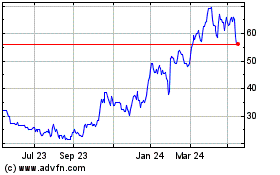

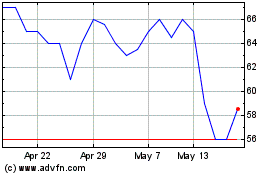

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Serabi Gold (LSE:SRB)

Historical Stock Chart

From Nov 2023 to Nov 2024