TIDMSOLI

RNS Number : 8142I

Solid State PLC

21 April 2022

Solid State plc

( "Solid State", the " Group " or the "Company" )

Trading Update

Solid State plc (AIM: SOLI), the specialist value added

component supplier and design-in manufacturer of computing, power,

and communications products, announces a trading update for the 12

months ended 31 March 2022 (the "Period" or "FY22").

Following an exceptionally strong finish to the Period, the

Company expects to announce record results with revenues for FY22

of approximately GBP85m (2021: GBP66.3m) up 28% over the prior

year, and adjusted profit before tax for the Period of

approximately GBP7.2m (2021: GBP5.4m) up 33%; both ahead of

recently upgraded consensus expectations(1) . The like for like

open orderbook at 31 March 2022 is up 106% over the prior year at a

record GBP85.5m (31 March 2021: GBP41.5m).

These results reflect a strong performance across the Group,

with notable contributions in electro-mechanical and imaging

systems resulting from the acquisition of Willow Technologies and

Active Silicon respectively. Both these companies have performed

ahead of management's expectations since their acquisition in March

2021.

Like for like organic revenue growth is in excess of 8%, which

is pleasing given the well publicised supply chain and

macro-economic challenges faced in the year and the more recent

conflict in Ukraine which, to date, has had negligible impact.

The Group has enjoyed particularly strong demand in the energy

and aerospace & defence sectors, with the latter now

representing approximately 15% of the Group's revenue. Contracts

awarded in Q4 of the Period by BAE Systems for marine platforms,

and a Component solutions contract for smart meters in India for

CyanConnode, illustrate the breadth of the customer base and

applications secured.

A s Solid State executes on its growth strategy, its favoured

approach to business development and the increased scale of the

Group is allowing it to compete for, and win, previously

inaccessible high value contracts as customers engage across a

broader product and service offering.

As previously reported, Solid State has navigated the long-term

supply chain challenges associated with semiconductor shortages

through careful inventory management and pro-active engagement with

customers to manage order scheduling. Given the success of this

experience, the Group is taking a similar approach to the

management of input cost pressures and inflationary effects of

recent global events, continuing to manage the ongoing supply

challenges and help mitigate potential margin erosion risks. This

is enabling the Group to share the risk with its customers and pass

on some of the cost increases.

The Group's continued strong cash generation has enabled it to

invest significantly in inventory to support its customers in

managing and mitigating the supply chain challenges the industry

has faced, and continues to face, as we enter FY23.

The Board, being mindful of the geo-political influences on both

domestic and international business and acknowledging the ongoing

challenges of COVID-19 in the Period, considers the Group's

performance for the Period to be a great credit to the staff and

the business as a whole.

Solid State continues to deliver on its organic growth strategy

through the targeting of structural growth markets and remains

focused on complementary acquisition opportunities. The record open

order book and trading momentum underpin the near-term prospects

and give the Directors optimism for the future.

(1) Analysts from brokers WH Ireland Limited, finnCap Limited,

and Edison Investment Research Limited, provide equity research on

Solid State, and the Company considers the average of their

research forecasts to represent market expectations, being, for

Solid State's 2021/22 financial year, revenue of GBP80m, and

adjusted profit before tax* of GBP6.5m.

* The adjustments relate to IFRS 3 acquisition amortisation,

share based payments charges, and non-recurring charges in respect

of redundancies and acquisition costs and fair value

adjustments

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

For further information please contact:

Solid State plc Via Walbrook

Gary Marsh - Chief Executive

Peter James - Group Finance Director

WH Ireland (Nominated Adviser & Joint

Broker)

Mike Coe / Sarah Mather (Corporate

Finance)

Fraser Marshall (Sales) 020 7220 1666

finnCap (Joint Broker)

Ed Frisby (Corporate Finance)

Rhys Williams / Tim Redfern (Sales

/ ECM) 020 7220 0500

Walbrook PR (Financial PR) 020 7933 8780

Tom Cooper / Nick Rome 0797 122 1972

solidstate@walbrookpr.com

Analyst Research Reports: For further analyst information and

research see the Solid State plc website:

https://solidstateplc.com/research/

Notes to Editors:

Solid State plc (SOLI) is a value added electronics group

supplying commercial, industrial and military markets with durable

components, assemblies and manufactured units for use in specialist

and harsh environments. The Group's mantra is - 'Trusted technology

for demanding applications'. To see an introductory video on the

Group - https://bit.ly/3kzddx7

Operating through two main divisions: Systems (Steatite &

Active Silicon) and Components (Solid State Supplies, Pacer, Willow

Technologies & AEC); the Group specialises in complex

engineering challenges often requiring design-in support and

component sourcing for computing, power, communications,

electronic, electro-mechanical and opto-electronic products.

Headquartered in Redditch, UK, Solid State employs approximately

300 staff across UK and US, serving specialist markets in

industrial, defence and security, transportation, medical and

energy.

Solid State was established in 1971 and admitted to AIM in June

1996. The Group has grown organically and by acquisition - having

made 12 acquisitions since 2002.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAXLEAEXAEFA

(END) Dow Jones Newswires

April 21, 2022 02:00 ET (06:00 GMT)

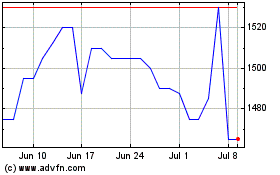

Solid State (LSE:SOLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Solid State (LSE:SOLI)

Historical Stock Chart

From Apr 2023 to Apr 2024