TIDMSDI

RNS Number : 0454W

Scientific Digital Imaging Plc

20 December 2013

Scientific Digital Imaging plc

("SDI" or the "Company")

(AIM: SDI)

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHS TO 31 OCTOBER

2013

The Board of Scientific Digital Imaging plc, the AIM quoted

group focused on the application of digital imaging technology to

the needs of the scientific community, is pleased to announce its

unaudited interim results for the six months ended 31 October

2013.

Highlights

-- Successful equity fund raising of GBP850,000 to enable

repayment of a loan and to reinvest in the business

-- Loss before tax GBP74,000 (2012: profit GBP11,000)

-- The Board expects improvements in the second half of the year

as new product sales come through

-- ProReveal (a patented protein detection test) launched internationally

o 24 units being evaluated worldwide

o Appointment of five new international distributors

o New leasing capability put in place

o New secondary market in the washer and detergent sector

Ken Ford, Chairman of SDI, commented:

"The Board anticipates that the new products released during

this first half of our year together with on-going cost

efficiencies, should result in an improvement in margins and

profitability which should be reflected in the second half of this

financial year.

Enquiries

Scientific Digital Imaging plc 01223 727144

Ken Ford, Chairman

Mike Creedon, CEO

www.scientificdigitalimaging.com

finnCap 020 7220 0500

Ed Frisby/ Ben Thompson - Corporate Finance

Simon Starr - Corporate Broking

Copies of the interim report are being sent to shareholders and

can also be viewed on the Company's website:

www.scientificdigitalimaging.com

Scientific Digital Imaging plc ("SDI") is focused on the

application of digital imaging technology to the needs of the

scientific community.

SDI's subsidiaries are Synoptics and Artemis CCD are world class

businesses with broad product portfolios, design and engineering

capabilities.

SDI plans to continue to grow through its own technology

advancements as well as strategic, complementary acquisitions.

Interim highlights

-- Successful equity fund raising of GBP850,000 to enable

repayment of a loan and to reinvest in the business

-- Loss before tax GBP74,000 (2012: profit GBP11,000)

-- The Board expects improvements in the second half of the year

as new product sales come through

-- ProReveal internationally launched

o 24 units being evaluated worldwide

o Appointment of five new international distributors

o New leasing capability put in place

o New secondary market in the washer and detergent sector

-- ProReveal 2 launched in Q4 2013 at the Medica show

-- Three new touch screen versions of low cost PXi gel documentation equipment launched

-- Introduction of new versions of the G:BOX with better

performance and significantly lower build costs

-- Synbiosis launched aCOLyte 3, a new version of its well established automated colony counter

Synoptics

The principal subsidiary of SDI is Synoptics which designs and

manufactures special-purpose, innovative instruments and systems

for use in the life science industry. The Company exploits digital

imaging technologies for a range of disciplines and offers its

products through four brands:

-- Syngene - produces equipment for life scientists to image and

analyse electrophoresis gels used for DNA and protein analysis

-- Synbiosis - produces equipment for microbiologists to automate microbial colony counting

-- Syncroscopy - provides systems that apply digital imaging

techniques to microscopy applications, such as life and material

sciences

-- Synoptics Health - focuses on imaging techniques within the

hospital and clinical environments using their unique ProReveal

product

Artemis CCD

Artemis designs and manufactures high sensitivity cameras for

deep-sky astronomical and life science imaging under the Atik and

Artemis CCD brands.

Chairman's statement

OVERVIEW

In July 2013 SDI successfully raised GBP850,000 before expenses

(GBP760,000 net of expenses) by way of a placing of shares for cash

to enable it to repay a loan note and to reinvest in the business.

The new funding has ensured that we are able to fulfil our forward

orders, particularly for the ProReveal system, for which global

demand has increased. A number of units are now being demonstrated

both in the UK and internationally and we continue to receive

positive feedback.

SDI's revenue was GBP3,537,000 in the six months to 31 October

2013 (a reduction of GBP210,000, relative to revenue of

GBP3,747,000 for the six months to 31 October 2012). This was

predominantly due to a reduction in Synoptics revenues of

GBP353,000, despite Artemis CCD revenues increasing by GBP143,000.

Gross margin percentage increased due to sales mix and

re-engineering of products within the Synoptics division and

administrative expenses reduced to GBP2,151,000 (2012:

GBP2,165,000).

Despite the fall in Synoptics revenues, progress has been made

with new products that have yet to be reflected in sales revenues.

We have also aligned our costs with our revenues and are confident

these improvements should be reflected in financial results in the

second half of the year.

The overall effect of the reduced sales but increased gross

margin and reduced cost of sales and administrative expenses was a

loss of GBP74,000 (2012: profit GBP11,000). The basic and fully

diluted loss per share was 0.33p (2012: basic and fully diluted

earnings per share 0.06p)

The successful fund raising in July 2013 strengthened the

Group's cash position from GBP388,000 at 30 April 2013 to

GBP541,000 at 31 October 2013 (after the repayment of a loan note

of GBP368,000 which matured on 31 July 2013).

PRODUCT PORTFOLIO

In the past six months, Synoptics Health has continued the

phased international launch of ProReveal, a fluorescence test to

detect proteins on surgical instruments, and has appointed a

worldwide network of dealers. There are currently 24 ProReveal

systems being demonstrated in the UK and internationally and the

system is being included in the budget cycle of several overseas

hospitals, where we are expecting orders in 2014.

To make it easier for wash room personnel to choose how they

wish to detect proteins on surgical instruments, Synoptics Health

has re-developed the ProReveal system software, and the new

ProReveal 2 launched in Q4 2013 at the major trade show,

Medica.

A secondary new market where we expect ProReveal sales to grow

is the washer and detergent sector. A ProReveal system has been

sold in the period to a leading healthcare detergent manufacturer

to help improve the efficacy of their detergent. Synoptics Health

is planning a promotion campaign to capitalise on this niche

application of the ProReveal in this sector in Q4 2013 and Q1

2014.

Syngene remains the largest of the Synoptics brands. The three

new touch screen versions of its PXi budget gel documentation

equipment were launched in the period. To ensure that the higher

end G:BOX imaging systems remain competitively priced in relation

to the PXi, Syngene has streamlined the range and introduced new

versions of the G:BOX which have a better performance and

significantly lower build cost. These will be promoted in 2014 and

should ensure the brand continues to provide a high margin revenue

stream in the latter half of the financial year.

Synbiosis launched a low end automated colony counter, aCOLyte 3

and is seeing steady sales growth in clinical and academic markets.

The high end colony counter ProtoCOL 3 continues to sell well in

the US and in emerging markets.

Artemis CCD is concentrating on its in house efforts to sell

cameras to OEM customers. It is in negotiation with a number of

potential OEM customers and expects to see the rewards in 2014.

While developing its life science OEM business, Artemis CCD

continues to work closely with Synoptics, providing cameras which

power the high performance advantage of many of Synoptics' systems,

thus maintaining cost-efficiency across the SDI group.

Under its original Atik brand, sales of established products to

amateur astronomers have grown steadily in the first half of the

year. This growth has been spread evenly across our major

territories in Europe and North America.

BUSINESS OPERATIONS

The Synoptics US group is being restructured to ensure that our

Syngene US dealer representative network is being fully utilised

and to assess new US distributors for both the Synbiosis and

Syngene Divisions. This will result in a significant cost reduction

in our US operations and a better coverage of the US market, where

Synbiosis products are increasingly sought after. The Synoptics

Health Division has added five new international distributors in

the period and has put in place a leasing agreement to allow

hospitals to rent the ProReveal system. This offers an alternative

for many hospitals to accessing the capital equipment budget; a

time consuming process, and enable them to assess the

technology.

The restructuring of our US office, the addition of new

Synoptics Health international distributors and new leasing

capabilities sets SDI in good stead to leverage the Company's

advantage with the superior product ranges in our portfolio and

secure growth for our stakeholders.

OUTLOOK

The Board anticipates that the new products released during this

half of our year, together with on-going cost efficiencies, should

result in an improvement in margins and profitability which should

be reflected in the second half of this financial year.

Ken Ford, Chairman

19 December 2013

Consolidated income statement

Unaudited for the six months ended 31 October 2013

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2013 2012 2013

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- ------------ ------------ ----------

Revenue 3,537 3,747 7,665

----------

Costs of sales (1,436) (1,539) (3,304)

------------------------------- ----- ------------ ------------ ----------

Gross profit 2,101 2,208 4,361

----------

Currency exchange loss (22) (10) (2)

----------

Administrative expenses (2,124) (2,155) (4,061)

----------

Share based payments (5) - (4)

----------

Reorganisation costs - - (14)

------------------------------- ----- ------------ ------------ ----------

Total administrative expenses (2,151) (2,165) (4,081)

------------------------------- ----- ------------ ------------ ----------

Operating (loss)/profit (50) 43 280

----------

Financial income - - -

----------

Financial expenses (24) (31) (67)

------------------------------- ----- ------------ ------------ ----------

(Loss)/Profit before taxation (74) 12 213

----------

Income tax expense - 1 21

------------------------------- ----- ------------ ------------ ----------

(Loss)/profit for the period (74) 11 192

------------------------------- ----- ------------ ------------ ----------

Earnings per share

----------

Basic (loss)/earnings per

share 2 (0.33p) 0.06p 1.05p

------------------------------- ----- ------------ ------------ ----------

Diluted (loss)/earnings

per share (0.33p) 0.06p 1.01p

------------------------------- ----- ------------ ------------ ----------

Consolidated statement of comprehensive income

Unaudited for the six months ended 31 October 2013

6 months 6 months 12 months

to to to

31 October 31 October 30 April

2013 2012 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------------- ------------ ------------ ----------

(Loss)/profit for the period (74) 11 192

----------

Other comprehensive income

Items that will be reclassified subsequently

to profit and loss

----------

Exchange differences on translating

foreign operations (30) (6) 39

----------------------------------------------- ------------ ------------ ----------

Total comprehensive (loss)/profit

for the period (104) 5 231

----------------------------------------------- ------------ ------------ ----------

Consolidated balance sheet

Unaudited at 31 October 2013

31 October 31 October 30 April

2013 2012 2013

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- ----------- ----------- ---------

Assets

---------

Non-current assets

---------

Property, plant and equipment 392 459 415

Intangible assets 884 718 896

Deferred tax asset 125 107 125

------------------------------- ----- ----------- ----------- ---------

1,401 1,284 1,436

Current assets

Inventories 1,061 934 947

Trade and other receivables 1,327 1,607 1,467

Cash and cash equivalents 541 169 388

------------------------------- ----- ----------- ----------- ---------

2,929 2,710 2,802

------------------------------- ----- ----------- ----------- ---------

Total assets 4,330 3,994 4,238

------------------------------- ----- ----------- ----------- ---------

Liabilities

---------

Current liabilities

---------

Trade and other payables 1,213 1,394 1,423

---------

Provisions for warranty 17 22 17

---------

Borrowings 3 115 529 472

------------------------------- ----- ----------- ----------- ---------

1,345 1,945 1,912

---------

Non-current liabilities

---------

Borrowings 3 35 23 38

---------

Deferred tax liability 164 132 164

------------------------------- ----- ----------- ----------- ---------

199 155 202

------------------------------- ----- ----------- ----------- ---------

Total liabilities 1,544 2,100 2,114

------------------------------- ----- ----------- ----------- ---------

Net assets 2,786 1,894 2,124

------------------------------- ----- ----------- ----------- ---------

Equity

---------

Share capital 250 194 194

Merger reserve 2,606 2,606 2,606

Share premium account 1,040 335 335

Foreign exchange reserve (64) (79) (34)

Own shares held by Employee

Benefit Trust (85) (85) (85)

Other reserves 105 96 100

Retained earnings (1,066) (1,173) (992)

------------------------------- ----- ----------- ----------- ---------

Total equity 2,786 1,894 2,124

------------------------------- ----- ----------- ----------- ---------

Consolidated statement of cash flows

Unaudited for the six months ended 31 October 2013

12 months

6 months to 6 months to to

31 October 31 October 30 April

2013 2012 2013

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------- -------------- ------------ ----------

Operating activities

----------

(Loss)/profit for the period (74) 11 192

Depreciation and amortisation 252 246 492

Profit on sale of property, plant

and equipment - - (2)

Finance costs and income 24 31 67

Taxation expense recognised in

the income statement - 1 21

Increase in provision - 5 -

Exchange difference (38) (6) 39

Employee share based payments 5 - 4

----------------------------------------- -------------- ------------ ----------

Operating cash flow before movement

in working capital 169 288 813

Increase in inventories (114) (108) (139)

Decrease in trade and other receivables 140 (80) 48

Decrease in trade and other payables (210) 110 153

----------------------------------------- -------------- ------------ ----------

Cash (used in)/generated from

operations (15) 210 875

Interest paid (24) (27) (67)

Income taxes paid - - -

----------------------------------------- -------------- ------------ ----------

Cash generated from operating

activities (39) 183 808

Cash flows from investing activities

Capital expenditure (96) (179) (356)

Investment in development (121) (132) (430)

Proceeds from sale of property,

plant and equipment - - 93

----------------------------------------- -------------- ------------ ----------

Net cash used in investing activities (217) (311) (693)

Cash flows from financing activities

Capital element of finance leases 17 (7) (12)

Loan stock repaid (243) - -

Issue of shares net of costs 635 - -

Bank borrowings 8 19 -

----------------------------------------- -------------- ------------ ----------

Net cash used in financing activities 417 12 (12)

----------------------------------------- -------------- ------------ ----------

Net changes in cash and cash

equivalents 161 (116) 103

Cash and cash equivalents, beginning

of period 388 285 285

Foreign currency movements on (8) -

cash balances -

----------------------------------------- -------------- ------------ ----------

Cash and cash equivalents, end

of period 541 169 388

----------------------------------------- -------------- ------------ ----------

Consolidated statement of changes in equity

Unaudited for the six months ended 31 October 2013

6 months to 31 October Own shares

2013 - unaudited Share Merger Share held by Other Foreign Retained

capital reserve premium EBT reserves exchange earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 1 May 2013 194 2,606 335 (85) 100 (34) (992) 2,124

Share based payments - - - - 5 - - 5

Shares issue 56 - 705 - - - - 761

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Transactions with owners 56 - 705 - - - - 766

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Profit for the period - - - - - - (74) (74)

Foreign exchange on

consolidation

of subsidiary - - - - - (30) - (30)

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Total comprehensive

income for

the period - - - - - (30) (74) (104)

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 31 October

2013 250 2,606 1,040 (85) 105 (64) (1,066) 2,786

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

6 months to 31 October Own shares

2012 - unaudited Share Merger Share held by Other Foreign Retained

capital reserve premium EBT reserves exchange earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ---------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 1 May 2012 187 2,606 262 (85) 176 (73) (1,184) 1,889

---------

Shares issued as

deferred payment 7 - 73 - (80) - - -

------------------------ ---------- --------- --------- ----------- ---------- ---------- ---------- ---------

Transactions with

owners 7 - 73 - (80) - - -

------------------------ ---------- --------- --------- ----------- ---------- ---------- ---------- ---------

Profit for the period - - - - - - 11 11

---------

Foreign exchange on

consolidation

of subsidiary - - - - - (6) - (6)

------------------------ ---------- --------- --------- ----------- ---------- ---------- ---------- ---------

Total comprehensive

income for

the period - - - - - (6) 11 5

------------------------ ---------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 31 October

2012 194 2,606 335 (85) 96 (79) (1,173) 1,894

------------------------ ---------- --------- --------- ----------- ---------- ---------- ---------- ---------

12 months to 30 April Own shares

2013 - audited Share Merger Share held by Other Foreign Retained

capital reserve premium EBT reserves exchange earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 1 May 2012 187 2,606 262 (85) 176 (73) (1,184) 1,889

Shares issued as

deferred payment 7 - 73 - (80) - - -

Share based payments - - - - 4 - - 4

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Transactions with owners 7 - 73 - (76) - - 4

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Profit for the year 192 192

---------

Foreign exchange on

consolidation

of subsidiaries - - - - - 39 - 39

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Total comprehensive

income - - - - - 39 192 231

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Balance at 30 April 2013 194 2,606 335 (85) 100 (34) (992) 2,124

------------------------- --------- --------- --------- ----------- ---------- ---------- ---------- ---------

Notes to the interim financial statements

Unaudited for the six months ended 31 October 2013

The accompanying accounting policies and notes form an integral

part of these interim financial statements.

Reporting entity

Scientific Digital Imaging plc (the "Company"), a public limited

company, is the Group's ultimate parent. It is registered in

England and Wales. The consolidated interim financial statements of

the Company for the period ended 31 October 2013 comprise the

Company and its subsidiaries (together referred to as the

"Group").

Basis of preparation

The unaudited consolidated interim financial statements are for

the six months ended 31 October 2013. These interim financial

statements have been prepared using the recognition and measurement

principles of International Accounting Standards, International

Financial Reporting Standards and Interpretations adopted for use

in the European Union (collectively EU IFRS). The financial

information for the year ended 30 April 2013 is based upon the

audited statutory accounts for that year.

The consolidated interim financial information has been prepared

on the historical cost basis.

The consolidated interim financial statements are presented in

British pounds (GBP), which is also the functional currency of the

ultimate parent company.

The consolidated interim financial information was approved by

the Board of Directors on 19 December 2013.

The financial information set out in this interim report does

not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The figures for the year ended 30 April 2013

have been extracted from the statutory financial statements of

Scientific Digital Imaging plc which have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain a statement under

section 498(2) or 498(3) of the Companies Act 2006. The financial

information for the six months ended 31 October 2013 and for the

six months ended 31 October 2012 is unaudited.

1. Principal accounting policies

The principal accounting policies adopted in the preparation of

the condensed consolidated interim information are consistent with

those followed in the preparation of the Group's financial

statements for the year ended 30 April 2013.

The accounting policies have been applied consistently

throughout the Group the purposes of preparation of these interim

financial statements.

2. Earnings per share

The calculation of the basic (loss)/earnings per share is based

on the (losses)/profits attributable to the shareholders of

Scientific Digital Imaging plc divided by the weighted average

number of shares in issue during the year, excluding shares held by

the Synoptics Employee Benefit Trust. All (loss)/profit per share

calculations relate to continuing operations of the Group.

(Loss)/Profit Basic

attributable Weighted (loss)/earnings

to average per share

shareholders number of amount in

GBP'000 shares pence

------------------------------ -------------- ----------- -----------------

Period ended 31 October 2013 (74) 22,098,744 (0.33)

-----------------

Period ended 31 October 2012 11 18,051,793 0.06

-----------------

Year ended 30 April 2013 192 18,323,464 1.05

------------------------------ -------------- ----------- -----------------

The calculation of diluted earnings per share is based on the

profits attributable to the shareholders of Scientific Digital

Imaging plc divided by the weighted average number of shares in

issue during the year, as adjusted for dilutive share options,

dilutive deferred consideration and shares held by the Synoptics

Employee Benefit Trust.

Diluted

(loss)/earnings

per share

amount in

pence

------------------------------ -----------------

Period ended 31 October 2013 (0.33)

-----------------

Period ended 31 October 2012 0.06

-----------------

Year ended 30 April 2013 1.01

------------------------------ -----------------

The reconciliation of average number of ordinary shares used for

basic and diluted earnings is as below:

31 October 30 October 30 April

2013 2012 2013

------------------------------------- ----------- ----------- -----------

Weighted average number of ordinary

shares used

for basic earnings per share 22,098,744 18,051,793 18,323,464

Weighted average number of ordinary

shares under option 1,004,233 191,672 659,063

------------------------------------- ----------- ----------- -----------

Weighted average number of ordinary

shares used

for diluted earnings per share 23,102,977 18,243,465 18,982,527

------------------------------------- ----------- ----------- -----------

Due to the loss generated in the period ended 31 October 2013,

the diluted loss per share for that period is the same as the

undiluted loss per share.

3. Borrowings

31 October 31 October 30 April

2013 2012 2013

GBP'000 GBP'000 GBP'000

-------------------------------- ----------- ----------- ---------

Within one year:

---------

Bank finance 84 110 76

Finance leases 31 47 28

Loan stock - 372 368

-------------------------------- ----------- ----------- ---------

115 529 472

-------------------------------- ----------- ----------- ---------

After one year and within five

years:

Loan stock - - -

Finance leases 35 23 38

-------------------------------- ----------- ----------- ---------

35 23 38

-------------------------------- ----------- ----------- ---------

Over five years:

Finance leases - - -

-------------------------------- ----------- ----------- ---------

Total borrowings 150 552 510

-------------------------------- ----------- ----------- ---------

The Group utilises short-term facilities to finance its

operation. The Group has one principal banker with an invoice

discounting facility of up to GBP500,000. At the end of the period

the Group had utilised GBP84,000 of this facility.

During the period GBP243,000 of loan stock was repaid and the

balance of GBP125,000 was converted into shares

Scientific Digital Imaging plc

Beacon House

Nuffield Road

Cambridge

CB4 1TF

UK

Telephone: +44 (0)1223 727144

Fax: +44 (0)1223 727101

Email: info@scientificdigitalimaging.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZMMMZRLVGFZM

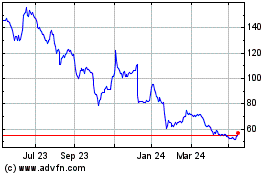

Sdi (LSE:SDI)

Historical Stock Chart

From Aug 2024 to Sep 2024

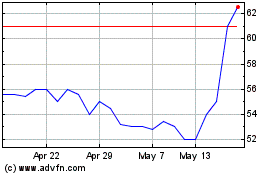

Sdi (LSE:SDI)

Historical Stock Chart

From Sep 2023 to Sep 2024