Reckitt Benckiser Swung to 1st Half Loss on Higher Costs

July 27 2021 - 2:38AM

Dow Jones News

By Matteo Castia

Reckitt Benckiser Group PLC reported Tuesday a swing to pretax

loss for the first half of the year on lower revenue and higher

costs.

The consumer-goods company--which houses Dettol, Harpic and

Durex among its brands--posted a pretax loss of 1.94 billion pounds

($2.68 billion) for the six months, including a hit of GBP3.20

billion from losses on assets held for sale and disposal of

goodwill and brands. This compares with a profit of GBP1.44 billion

in the year-earlier period.

Revenue came in at GBP6.60 billion, down from GBP6.91 billion

the prior year. A consensus estimate taken from FactSet and based

on three analysts' projections had forecast Reckitt Benckiser's

first-half revenue at GBP6.72 billion.

The board declared an interim dividend of 73 pence, flat on the

year.

"Cost inflation accelerated in the second quarter and it will

take time to offset this headwind with productivity and pricing

actions being implemented in the back half of the year and early

next year," the FTSE 100 company said.

The increasing costs will largely offset the margin accretion

from the $2.20-billion disposal of the IFCN China, which remains

scheduled for completion in the second half, Reckitt Benckiser

said.

Reckitt Benckiser also said it expects a weak third quarter due

to the tough year-earlier comparatives but that its flu and cold

business will pick up in the fourth quarter.

"Overall demand in the disinfectant category remains

significantly higher than pre-Covid levels and the two-year stacked

growth of our hygiene portfolio is up 34.1%," the company said.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

July 27, 2021 02:37 ET (06:37 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

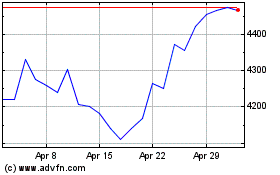

Reckitt Benckiser (LSE:RKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

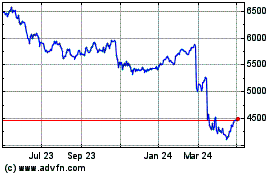

Reckitt Benckiser (LSE:RKT)

Historical Stock Chart

From Apr 2023 to Apr 2024