TIDMPRE

PENSANA Plc

25 May 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Pensana Plc

("Pensana" or the "Company")

Completion of FEED and Value Engineering Study

Pensana Plc (LSE: PRE) has completed a Front End Engineering Design (FEED) and

Value Engineering Study into establishing a UK-based world-class, independent

and sustainable supply of the magnet metal rare earths vital for the electric

vehicle, offshore wind turbine and other strategic industries.

Highlights

* Completion of FEED and Value Engineering Study for rare earth separation

hub at Saltend Chemicals Park and the Longonjo Operations.

* Study demonstrates sustainable operations with strong economics based on

the most recent independent base case NdPr oxide price forecasts:

* Generates an unleveraged post-tax NPV8% of US$3.5 billion

* Average annual EBITDA first five years steady state production US$630

million

* IRR of 71%

* Payback of 1.5 years

* Initial capital expenditure of US$494 million

* Study prepared by leading technical consultants WOOD, SRK, Snowden Mining

Industry Consultants and Paradigm Project Management.

Pensana Chairman, Paul Atherley commented:

"Completion of this study is another important step for Pensana in its plans to

establish an independent and sustainable rare earth processing hub in the UK.

The strong fundamentals and robust economics provide a solid platform for the

financing and development of the project.

The growing concerns over supply chain resilience and the burgeoning demand for

magnet metals from the electric vehicle and offshore wind sectors is reflected

in the growing customer demand for our products."

The study outlines the plans to establish the world's first independent and

sustainable magnet metal rare earth separation hub at the Saltend Chemicals

Park in the Humber Freeport, UK, treating material sourced from the Longonjo

Operations in Angola and third-party feedstock from a variety of other sources.

Saltend is targeting production of 12,500 tonnes per annum of separated rare

earths including 4,500 - 5,000 tonnes of neodymium and praseodymium (NdPr)

oxides, representing around 5% of the projected world demand in 2025.

The study has been prepared by Wood Plc, SRK Consulting, Snowden Mining

Industry Consultants (Pty) Limited and Paradigm Project Management (Pty) Ltd.

Financial and Production Summary

The key material assumptions and outcomes of the results of the study are set

out below.

Study Unit

Production Assumptions

Life of Mine (based on Measured and Indicated category 20 years

MRE)

Average grade, TREO1 (Year 1-5) 3.72 %

Average grade, TREO1 (Year 6-20) 2.18 %

Average grade, NdPr2 (Year 1-5) 0.78 %

Average grade, NdPr2 (Year 6-20) 0.48 %

Average strip ratio (LOM) 0.29 waste:feed

Design ROM throughput 1.5 mtpadry

Design concentrator production 107,000 tpadry

Design MRES Refinery production 41,100 tpadry

Design Saltend Refinery capacity 46,600 tpadry

Annual Production of Rare Earth Oxides (TREO) 12,500 tpa

Annual Production NdPr Oxides3 (included in TREO) 4,500 - 5,000 tpa

Average concentrator recovery (NdPr) 45 %

Average MRES recovery (NdPr) 72 %

Average SX recovery (NdPr) 92 %

Operating Costs4

Average annual operating cost 199 US$ million

Average operating (total rare earth oxide) 16 US$/kg

Capital Costs

Saltend Refinery 195 US$ million

Longonjo Mine Infrastructure 49 US$ million

Longonjo Concentrator Plant 123 US$ million

Longonjo MRES Refinery 127 US$ million

Total Capital Pre-production 494 US$ million

Average annual sustaining capital (year 1 - 5) 7 US$ million

Average annual sustaining capital (from year 6) 16 US$ million

Financial Metrics5

Revenue6 (average p.a. based on first five years steady 976 US$ million

state production)

EBITDA6 (average p.a. based on first five years steady 630 US$ million

state production)

NPV8 6 (un-leveraged, post-tax) 3.5 US$ billion

IRR 71 %

Payback from first production 1.5 years

The study estimates have been prepared by Wood Plc in conjunction with Paradigm

Project Management (Pty) Ltd under the review of Professional Cost Consultants

(PCC).

All costs are estimated in United States Dollars and are considered Class 3 as

defined in the American Association of Cost Engineers document 18R-97.

The key fiscal terms are:

* 2% royalty on revenue;

* 20% national tax and 5% municipal tax following an initial two-year tax

holiday;

* Custom duties exemption on imported mining and processing equipment;

* Full 5-year capital repayment allowance;

* Dividend tax exemption for 3 years.

The Longonjo mining licence is renewable for a period up to 35 years and has

the same basis as the internationally accepted oil and gas contracts through

which the country has successfully financed its main revenue industry.

Production assumptions: 1st 10 years:

Year: 1 2 3 4 5

Tonnes treated (Longonjo) Mt 1.0 1.5 1.5 1.5 1.5

TREO grade % 3.20 4.67 4.09 3.45 3.20

NdPr grade % 0.70 0.95 0.85 0.73 0.68

Concentrator recovery (NdPr) % 45 45 45 45 45

MRES recovery (NdPr) % 72 72 72 72 72

MRES tonnes produced Kt 21 41 37 32 30

(Longonjo)

Saltend design capacity Kt 46.6 46.6 46.6 46.6 46.6

3rd party MRES feed Kt 1 - 3 2 - 6 6 - 10 11 - 16 13 - 18

Saltend SX recovery (NdPr) % 92 92 92 92 92

NdPr oxide produced Kt 2.30 4.75 4.75 4.75 4.75

Year: 6 7 8 9 10

Tonnes treated (Longonjo) Mt 1.5 1.5 1.5 1.5 1.5

TREO grade % 3.16 2.88 2.97 2.62 2.60

NdPr grade % 0.69 0.65 0.62 0.57 0.58

Concentrator recovery (NdPr) % 45 45 45 45 45

MRES recovery (NdPr) % 72 72 72 72 72

MRES tonnes produced Kt 30 28 27 25 25

(Longonjo)

Saltend design capacity Kt 46.6 46.6 46.6 46.6 46.6

3rd party MRES feed Kt 13 - 17 15 - 19 16 - 20 18 - 22 18 - 22

Saltend SX recovery (NdPr) % 92 92 92 92 92

NdPr oxide produced Kt 4.75 4.75 4.75 4.75 4.75

Notes:

1. TREO = total rare earth oxides, the sum of La2O3, CeO2, Pr6O11, Nd2O3,

Sm2O3, Eu2O3, Gd2O3, Tb4O7, Dy2O3, Ho2O3, Er2O3, Tm2O3, Yb2O3, Lu2O3, Y2O3

2. NdPr = Neodymium + praseodymium oxide and is included within TREO (NdPr

OXIDE is expected to represent approximately 94% of total revenue)

3. Targeted annual production assumes sourcing third party MRES / MREC feed

to be processed at Saltend as an alternative to ramping Longonjo up to 2 Mtpa

4. Excludes the purchase cost of 3rd party feedstock. Total cost of US$200

million per annum is split US$135 million for Longonjo and $65 million for

Saltend.

5. Assumes third party feed to be purchased at same cost per tonnes of MRES

when compared to Longonjo.

6. Management estimates, inclusive of Angolan and UK operations, are based

on underlying independent studies undertaken by:

. SRK Consulting: Mineral resource estimates

. Snowden Mining Industry Consultants (Pty) Limited: Mine plan schedule and

pit optimisation

. Wood plc: Longonjo Operations and Saltend technical engineering and

design; CAPEX and OPEX cost estimates; supervision of metallurgical testwork

and pilot plant programmes

. Paradigm Project Management (Pty) Ltd: Longonjo Mine site infrastructure

and bulk services technical engineering, design and cost estimates

. HCV Africa: Environmental and Social Impact Assessment, Environmental

Management Programme, Relocation Action Plan, and hydrology

. Grupo Simples: Angolan Environmental and Social Impact Assessment

. Adamas Intelligence: Market Forecasts

7. Net Present Value is calculated at an operational level (pre-financing)

and is anticipated to be a blend of equity and long-term debt financing.

Revenue estimates are based on NdPr oxide prices as per Adamas Intelligence

base forecast (Q2 2022). NdPr oxide prices starting at $153/kg in 2022,

escalating at CAGR of 3.7% p.a. to 2035, flat real thereafter.

Establishing the World's First Independent and Sustainable Rare Earth Oxide

Separation Facility at the Saltend Chemicals Park in Humber, UK

The Saltend Refinery will be the first major new rare earth concentrate

facility to be established in over a decade once commissioned and would be one

of only three major producers located outside China when it comes into full

production in 2024.

Benefitting from Humber's Freeport status, the Saltend Refinery will be a major

step in establishing a magnet metal supply chain outside China and has the

potential to bring high-value manufacturing jobs back to the UK. The US$195

million facility will create over 150 permanent high value jobs, with over 500

jobs during the construction phase and an estimated 750 indirect jobs created

as a consequence of the investment.

Saltend is set to become one of the world's largest rare earth processing hubs,

eventually importing sustainably sourced feedstock from around the globe, and

processing it into magnet metal and other rare earth products largely for

export to customers in South East Asia, Europe and the US, as companies look to

reorientate their supply chains in light of recent geopolitical events.

The Saltend Refinery will make use of the existing Saltend Chemicals Plant

infrastructure with the utilities and maintenance skills provided by the

pxGroup as its owner and operator.

The high value manufacturing process involves separating and purifying the

various rare earth metals. This is accomplished by dissolving the mixed rare

earth sulphate received from Longonjo and other sources treating the resulting

solution through several chemical dissolution and solvent extraction processes

before precipitating the separated elements back into a purified solid state

for sale.

Four products are to be separated, NdPr oxide, Lanthanum carbonate, Cerium

concentrate, and the mid and heavy rare earth elements including Terbium,

Dysprosium, Samarium, Europium, and Gadolinium carbonates.

The Saltend Refinery is designed in a manner to easily allow for an increase in

capacity, especially in the NdPr separation process and to allow for expansion

into separation of the heavy rare earths to cater for mixed rare earth

carbonates sourced from ionic clay deposits.

Ethically Sourced Rare Earths from the State-of-the-Art Longonjo Operations in

Angola

Pensana will establish the Longonjo Operations in Angola to supply the Saltend

Refinery. The free dig, at surface, weathered carbonatite resources will be

mined and treated through a flotation concentration plant followed by further

hydrometallurgical beneficiation to produce a high-grade mixed rare earth

sulphate (MRES) in the Mixed Rare Earth Sulphate Refinery.

The Longonjo Operations are adjacent to the fully recommissioned Caminho de

Ferro de Benguela railway line, which links directly to the Atlantic deep-water

port of Lobito and will use very low-cost hydro-electric power from the Angolan

National grid system, recently contracted at 2 cents per KWh for 10 years.

The Longonjo Operations will treat 1.5 million tonnes per annum for a period of

20 years, with the material being sourced from Measured (45%) and Indicated

(55%) Mineral Resources, producing approximately 40,000 tonnes per annum of

MRES for export to the Saltend Refinery.

The Longonjo design includes the open pit development, concentrator and MRES

Refinery plants, tailings storage facility (designed to meet the requirements

of the Global Industry Standard on Tailings Management), process water supply,

hydro-electric bulk power supply, mine infrastructure, workshops, offices,

accommodation village, recreational facilities, and other associated port and

rail side infrastructure.

The operations will represent a major investment in the Angolan mining sector

supporting the Government's policy to diversify the economy away from the

dominant oil and gas and diamond industries as well as providing employment in

an under-developed region.

In September 2020, a substantial upgrade to the Longonjo Mineral Resource

estimate was announced. International mining industry consultants SRK

Consulting reported an upgraded Measured, Indicated and Inferred Mineral

Resource estimate of 313 million tonnes at 1.43% REO including 0.32% NdPr for

4,470,000 tonnes of REO including 990,000 tonnes of NdPr making it one the

world's largest undeveloped rare earth deposits.

Mineral Tonnes REO grade NdPr grade Contained Contained

Resource (million) (%) (%) REO (Tonnes) NdPr

estimate (Tonnes)

category

Measured 26 2.58 0.55 664,000 141,000

Indicated 165 1.51 0.33 2,490,000 536,000

Inferred 123 1.08 0.25 1,320,000 313,000

Total: 313 1.43 0.32 4,470,000 990,000

Table 1: Summary of Longonjo Mineral Resource Estimate, at 0.1% NdPr lower

grade cut.

REO includes NdPr. Figures may not sum due to rounding.

Rapid Route to Production

The overall Development Schedule provides 14 months for main construction and

six months for commissioning and ramp-up to full production in mid-2024.

With a view to accelerating the Project execution phase, various activities

have been initiated to mitigate the post-Covid supply chain disruptions,

material price increases and other inflationary pressures including:

* Over 70% of the equipment packages for both Saltend and Longonjo have been

tendered and priced externally including all of the Tier 1, 2 and 3

packages.

* The EPCM contractual arrangements for Saltend and Longonjo are currently

being finalised. Key project execution personnel have been identified and

retained for both sites to enable a seamless transition from FEED.

The Saltend facility will be commissioned on third party feedstock ahead of

feeding the plant with high grade MRES when operations at Longonjo come online.

Should there be delays, Saltend will continue to treat third party feedstock

until Longonjo comes online.

Design, costing, and contractor selection for the Longonjo Mine site

infrastructure, along with the provision of bulk services, have been completed

and ready to be mobilised.

Modularisation (by ADP in Cape Town, a company with 25 years of experience in

Angola modular processing plants) of the Longonjo plant to optimise the site

construction crew size and do pre-commissioning tests before despatch to site.

Strong Demand Growth from Electric Vehicles and Offshore Wind Leading to

Shortages Equivalent to 15 Times Saltend's Annual Production By 2035

The following are extracts from the recent "Adamas Intelligence - Rare Earth

Market Outlook to 2035":

* Adamas Intelligence (an independent research and advisory company and

leader in strategic metals and minerals sector) forecasts that global

demand for NdFeB magnets will increase at a CAGR of 8.6%, bolstered by

double-digit growth from electric vehicle and wind power sectors. This will

translate to comparable demand growth for the rare earth elements (i.e.,

neodymium, praseodymium, dysprosium and terbium).

* With total magnet rare earth oxide demand forecasted to increase at a CAGR

of 8.3% and prices projected to increase at CAGRs of 3.2% to 3.7% over the

same period, Adamas Intelligence forecasts that the value of global magnet

rare earth oxide consumption will triple by 2035, from US $15.1 billion

forecast for 2022 to US $46.2 billion by 2035.

* Constrained by a lack of new primary and secondary supply sources coming to

market from 2022 onward, coupled with the inability of existing producers

to increase output steadily at the rate of demand growth, Adamas forecasts

that global shortages of neodymium, praseodymium and didymium oxide (or

oxide equivalents) will collectively rise to 68,000 tonnes by 2035-an

amount roughly equal to China's total 2021 production.

The processing of rare earths is currently limited to a small number of Chinese

companies, which control nearly 90% of the global market. The market for

sustainably sourced concentrates is expected to grow as the magnet suppliers

come under pressure from their international automotive customers to diversify

away from environmentally damaging sources.

When it comes into production in 2024 Saltend will become one of three

significant rare earth producers outside China. Lynas Corporation of Australia,

(ASX: LYC, market capitalisation: US$6.1 billion) currently the world's largest

non-Chinese producer, last year produced around 5,461 tonnes of NdPr oxides

from its facility in Malaysia. MP Materials (NYSE: MP, market capitalisation:

US$7.3 billion) is planning to produce approximately 6,000 tonnes of NdPr

oxides from 2024.

Long-Term Production Profile from Longonjo and Third-Party Feedstock

The Longonjo Operations life may have the potential to be extended beyond the

current 20-year plan by the exposure of the underlying un-weathered carbonatite

material as mining progresses. Subject to favourable metallurgical studies,

this mineralisation has the potential to add a further dimension to the

operations and extend the life of mine significantly.

Pensana is in active discussion with a number of potential third party

feedstock suppliers including existing producers and mines that are either in

construction or planning to be developed in the near-term. Pensana will offer

an attractive alternative to selling to Chinese processors.

Marketing and Offtake

The Company is in discussions for 50% of Saltend's capacity of NdPr oxides to

supply directly to an Asian magnet manufacturer. In addition, the Company has

developed a marketing agreement with a major Asian trading house to market 30%

of the production capacity within Asia to secure direct offtake agreements with

customers.

The Company has been in talks with most of the major automotive original

equipment manufacturers (OEMs) within Europe and the US who are seeking to

secure a sustainable source of material independent from China and will update

the market on these developments in due course.

Within Europe, there has been a transition towards OEMs of both electric

vehicles and offshore wind purchasing rare earth materials directly to supply

the magnet manufacturers in order to secure supply of these critical materials.

Pensana has been approached by the offshore wind industry to secure 500 tonnes

per annum of NdPr oxide from 2024 in order to meet the increased demand of the

global wind energy market.

In addition, due to challenges securing the supply of Cerium and Lanthanum

products from China, the European customer base has approached Pensana to offer

an alternative supply from the Saltend facility. Furthermore, a UK based

manufacturer has shown interest in 1,000 tonnes per annum of Cerium carbonate

to be applied in the catalyst and water treatment industries.

It is anticipated that this growing interest in the products planned to be

produced from Saltend will be translated into formal offtake agreements over

the forthcoming weeks and months.

Study Underway for Heavy Rare Earth Separation

Heavy rare earths Dysprosium (Dy) and Terbium (Tb) are critical for high

technology magnets required for automotive industry.

The Company has initiated a design and cost estimate to produce the first

separated Dy and Tb independently of China and is actively looking to

accelerate this project due to the strong interest from the Japanese market.

Moving further down the supply chain within the EU region offers a competitive

advantage for magnet manufacturers who are investigating establishing magnet

production in the EU, further lowering the carbon footprint generated by

transporting volumes of material to and from Asia.

Positive climate impact

Increasing the supply of rare earths is essential to support the global drive

towards net zero.

Pensana has consciously embedded climate mitigation and adaptation to climate

change in its strategy and business operations.

The Company has become a partner of the Taskforce for Climate-related Financial

Disclosure (TCFD) and will disclose against the recommendations, including

highlighting risks and opportunities from climate change, with effect from its

2021-2022 reporting cycle.

Pensana will develop and annually report on a low greenhouse gas emission (GHG)

supply chain (scopes 1, 2 and 3) and will target continual reduction of GHG

emissions aligned to scientific expectations to support the global drive

towards net zero GHG emissions.

This will ensure that developed products meet the requirements of the EU

taxonomy for sustainable activities for the manufacture of low carbon

technologies.

Commitment to low greenhouse gas emissions was considered from the outset, and

was a key consideration with initial planning of the Longonjo and Saltend

operations, supporting infrastructure and across the value chain.

Positive Environmental, Social and Governance

Pensana takes its risks and opportunities from ESG seriously. The business has

an ESG sub-committee chaired by a non-executive director and the CEO is

responsible for the delivery of ESG related targets. Additionally, the business

has committed to developing digital traceability for Saltend feedstock which

will be traceable from source to end use to meet the demand from customers to

know the source and sustainability credentials of their raw materials.

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under the Market Abuse

Regulations (EU) No.596/2014. Upon the publication of this announcement via a

Regulatory Information Service, this inside information will be considered to

be in the public domain. The person responsible for arranging for the release

of this announcement on behalf of the Company is Paul Atherley, Chairman.

-ENDS-

For further information, please contact:

Shareholder/analyst enquiries:

Pensana Plc

Paul Atherley,

Chairman

IR@pensana.co.uk

Tim George, Chief Executive Officer

Rob Kaplan, Chief Financial Officer

Virginia Skroski, Head of Investor Relations & Communications

Media enquiries:

Finsbury Glover Herring:

Gordon Simpson / Richard Crowley

Pensana-LON@finsbury.com

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under the Market Abuse

Regulations (EU) No.596/2014. Upon the publication of this announcement via a

Regulatory Information Service, this inside information will be considered to

be in the public domain. The person responsible for arranging for the release

of this announcement on behalf of the Company is Paul Atherley (Chairman).

About Pensana Plc

The electrification of motive power is by far the most important part of the

energy transition and one of the biggest energy transitions in history. Magnet

metal rare earths are central to the transition away from internal combustion

engines and critical to electric vehicles and offshore wind turbines.

Pensana plans to establish Saltend as an independent and sustainable processing

hub supplying the key magnet metal oxides to a market which is currently

dominated by China. The US$195 million Saltend facility is being designed to

produce 12,500 tonnes per annum of rare earth oxides, of which 4,500 - 5,000

tonnes will be neodymium and praseodymium (NdPr), representing over 5% of the

world market in 2025.

Pensana's plug and play facility is located within the world class Saltend

Chemicals Park, a cluster of leading chemicals and renewable energy businesses

in the Humber Freeport and will create over 500 jobs during construction and

over 125 direct jobs once in production.

It will be the first major separation facility to be established in over a

decade and will become one of only three major producers located outside China.

Pensana is aiming to establish Saltend as an attractive alternative for mining

companies who may otherwise be limited to selling their products to China,

having designed the facility to be easily adapted to cater for a range of rare

earth feedstocks.

www.pensana.co.uk

END

(END) Dow Jones Newswires

May 25, 2022 02:01 ET (06:01 GMT)

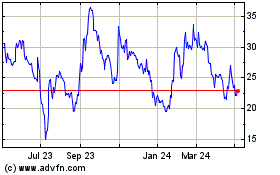

Pensana (LSE:PRE)

Historical Stock Chart

From Mar 2024 to Apr 2024

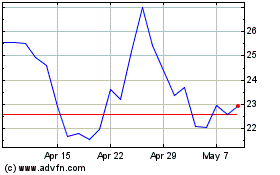

Pensana (LSE:PRE)

Historical Stock Chart

From Apr 2023 to Apr 2024