Petrofac Limited ( PFC) Petrofac Limited: Pricing of

USUSD600,000,000 Aggregate Principal Amount of Senior Secured Notes

Due 2026 01-Nov-2021 / 07:00 GMT/BST Dissemination of a Regulatory

Announcement, transmitted by EQS Group. The issuer is solely

responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

Press Release

1 November 2021

NOT FOR DISTRIBUTION OR RELEASE IN OR INTO ANY JURISDICTION IN

WHICH OFFERS OR SALES OF SECURITIES WOULD BE PROHIBITED BY

APPLICABLE LAW.

Announcement of the Pricing of USUSD600,000,000 Aggregate

Principal Amount of Senior Secured Notes Due 2026

Petrofac Limited (the "Company" or "Petrofac") today announces

the successful pricing of its offering of USUSD600,000,000

aggregate principal amount of 9.75% senior secured notes due 2026

(the "Temporary Notes") by a newly-formed financing entity,

Pyrenees Bondco Limited (the "Issuer"). The offering of the

Temporary Notes is subject to customary closing conditions, and

settlement is expected to occur on or around 9 November 2021.

Concurrently with the closing of the offering of the Temporary

Notes, and pending consummation of the proposed firm placing,

placing and open offer of new ordinary shares in the Company to

raise gross proceeds of approximately USUSD275,000,000 (the

"Capital Raise") and the satisfaction of certain other conditions,

the Initial Purchasers (being Goldman Sachs International, J.P.

Morgan Securities plc, NatWest Markets Securities Inc. and First

Abu Dhabi Bank PJSC) will deposit the gross proceeds of the

offering of the Temporary Notes (which have an issue price of

99.028%) into an escrow account.

On the date of admission of new shares pursuant to the Capital

Raise, all of the funds held in the escrow account will be released

to the Issuer and all of the Temporary Notes will be automatically

exchanged (the "Exchange") for an equal aggregate principal amount

of 9.75% senior secured notes due 2026 issued by Petrofac Limited

(the "Senior Secured Notes").

The issue of the Temporary Notes is part of a wider refinancing

plan (the "Refinancing Plan") comprising the Capital Raise, a new

USUSD180 million revolving credit facility, a new AED185 million

(USUSD50 million) bilateral facility and amendment of an existing

USUSD50 million bilateral term loan facility. The proceeds of the

Refinancing Plan, alongside available cash reserves, will be used

to pay, in January and February 2022, the USUSD106 million (GBP77

million) penalty imposed in relation to the SFO investigation and

to repay existing indebtedness. These actions will extend

Petrofac's debt maturities and strengthen the Company's platform to

execute its strategy.

The effectiveness of the Refinancing Plan is contingent on

completion of the Capital Raise, which is conditional on, among

other things, the passing of the shareholder resolutions by

shareholders in the Company at a General Meeting, which is

scheduled to take place at 10:00 a.m. on 12 November 2021.

Ends

For further information contact:

Petrofac Limited

+44 (0) 207 811 4900

Jonathan Yarr, Head of Investor Relations

jonathan.yarr@petrofac.com

Alison Flynn, Group Director of Communications and

Sustainability

alison.flynn@petrofac.com

The person responsible for arranging the release of this

announcement on behalf of Petrofac is Alison Broughton, Secretary

to the Board.

Tulchan Communications Group

+44 (0) 207 353 4200

petrofac@tulchangroup.com

Martin Robinson

petrofac@tulchangroup.com

Goldman Sachs

+44 (0) 207 774 1000

Bertie Whitehead

Chris Pilot

Tom Hartley

J.P. Morgan

+44 (0)20 7742 4000

Edmund Byers

Barry Weir

Will Holyoak

NOTES TO EDITORS

Petrofac

Petrofac is a leading international service provider to the

energy industry, with a diverse client portfolio including many of

the world's leading energy companies.

Petrofac designs, builds, manages and maintains oil, gas,

refining, petrochemicals and renewable energy infrastructure. Our

purpose is to enable our clients to meet the world's evolving

energy needs. Our four values - driven, agile, respectful and open

- are at the heart of everything we do.

Petrofac's core markets are in the Middle East and North Africa

(MENA) region and the UK North Sea, where we have built a long and

successful track record of safe, reliable and innovative execution,

underpinned by a cost effective and local delivery model with a

strong focus on in-country value. We operate in several other

significant markets, including India, South East Asia and the

United States. We have approximately 8,500 employees based across

31 offices globally.

Petrofac is quoted on the London Stock Exchange (symbol:

PFC).

For additional information, please refer to the Petrofac website

at www.petrofac.com

IMPORTANT INFORMATION

This announcement (the "Announcement") does not constitute an

offer to sell or a solicitation of an offer to purchase any

securities in any jurisdiction.

The Temporary Notes have not been, and will not be, registered

under the US Securities Act of 1933, as amended (the "Securities

Act"), or the securities laws of any other jurisdiction, and may

not be offered or sold within the United States or to, or for the

account or benefit of US persons, except pursuant to an exemption

from, or in a transaction not subject to, the registration

requirements of the Securities Act. The Temporary Notes will be

offered only to qualified institutional buyers pursuant to Rule

144A and to non-U.S. persons outside the United States pursuant to

Regulation S under the Securities Act, subject to prevailing market

and other conditions. There is no assurance that the offering will

be completed or, if completed, as to the terms on which it is

completed. This press release is not an offer to sell the Temporary

Notes in the United States. The Temporary Notes to be offered have

not been and will not be registered under the Securities Act or the

securities laws of any other jurisdiction and may not be offered or

sold, directly or indirectly, in the United States or to or for the

account or benefit of U.S. persons, as such term is defined in

Regulation S of the Securities Act, absent registration or unless

pursuant to an applicable exemption from the registration

requirements of the Securities Act and any other applicable

securities laws. If any public offering of the Temporary Notes is

made in the United States, it will be by means of a prospectus that

may be obtained from the Issuer that will contain detailed

information about the Issuer, Petrofac and management, as well as

financial statements. No public offering of the Temporary Notes

will be made in the United States in connection with the

above-mentioned transaction.

This Announcement has been prepared on the basis that any offer

of the Notes in any Member State of the European Economic Area

("EEA") (each, a "Relevant State") will be made pursuant to an

exemption under Regulation (EU) 2017/1129, as amended (the

"Prospectus Regulation"), from the requirement to publish a

prospectus for offers of securities. This Announcement has been

prepared on the basis that any offer of the Temporary Notes in the

United Kingdom will be made pursuant to an exemption under the

Prospectus Regulation, as it forms part of domestic law by virtue

of the European Union (Withdrawal) Act 2018 (the "UK Prospectus

Regulation"), from the requirement to publish a prospectus for

offers of notes.

The Temporary Notes are not intended to be offered, sold or

otherwise made available to, and should not be offered, sold or

otherwise made available to, any retail investor in the EEA. For

these purposes, a retail investor means a person who is one (or

more) of: (i) a retail client as defined in point (11) of Article

4(1) of Directive 2014/65/EU (as amended, "MiFID II"); or (ii) a

customer within the meaning of Directive (EU) 2016/97 (as amended

or superseded, the "Insurance Mediation Directive"), where that

customer would not qualify as a professional client as defined in

point (10) of Article 4(1) of MiFID II; or (iii) not a "qualified

investor" within the meaning of Article 2(e) of Prospectus

Regulation. Consequently, no key information document required by

Regulation (EU) No 1286/2014 (as amended, the "PRIIPs Regulation")

for offering or selling the Temporary Notes or otherwise making

them available to retail investors in the EEA has been prepared and

therefore offering or selling the Temporary Notes or otherwise

making them available to any retail investor in the EEA may be

unlawful under the PRIIPs Regulation. This Announcement does not

constitute and shall not, in any circumstances, constitute an

offering to retail investors. The offer and sale of the Temporary

Notes in any member state of the EEA will be made pursuant to an

exemption under Directive 2003/71/EC (as amended or superseded, the

"Prospectus Directive") from the requirement to publish a

prospectus for offers of notes. The preliminary offering memorandum

produced for the offering of the Temporary Notes is not a

prospectus for the purposes of the Prospectus Directive.

(MORE TO FOLLOW) Dow Jones Newswires

November 01, 2021 03:00 ET (07:00 GMT)

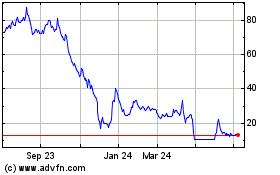

Petrofac (LSE:PFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

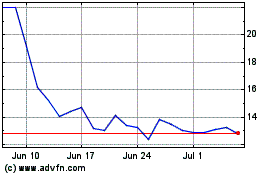

Petrofac (LSE:PFC)

Historical Stock Chart

From Apr 2023 to Apr 2024