Petrofac Limited ( PFC) Petrofac Limited: RESULTS FOR THE SIX

MONTHS ENDED 30 JUNE 2021 26-Oct-2021 / 07:25 GMT/BST Dissemination

of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

PETROFAC LIMITED

RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2021

First half highlights

-- Improved profitability and conserved cash in challenging

market conditions

-- On track to deliver USUSD250 million of cost savings in

2021

-- Trading and new awards in line with expectations, continue to

be impacted by COVID-19

-- Business performance net profit (1)(2) of USUSD39 million

-- Reported net loss (2) of USUSD86 million, largely reflecting

the Court penalty

-- Maintaining full year net profit margin guidance

-- Net debt (3) of USUSD188 million and liquidity of USUSD1.0

billion

SFO resolution, launch of refinancing and outlook

-- Legacy SFO investigation into the company concluded following

plea agreement? Crown Court imposed a total penalty of GBPGBP77

million (c.USUSD106 million)(12), payable in 2022

-- Refinancing to create a long term, sustainable capital

structure, including:? USUSD275 million equity issue through an

underwritten Firm Placing and a Placing & Open Offer,

launchedthis morning ? USUSD550 million new debt facilities,

comprising USUSD500 million bridge to bond and a USUSD50 million

termloan; and ? USUSD180 million revolving credit facility

-- Petrofac well placed to benefit from the expected increased

activity levels over the coming years? Contract awards expected to

accelerate with a USD46 billion bidding pipeline, including USUSD7

billion innew energies, scheduled for award by December 2022

-- Medium term ambition to deliver USUSD4-5 billion revenue,

with over 20% from New Energies, andsector-leading Group EBIT

margins of 6-8%

Six months ended 30 June 2021 Six months ended 30 June 2020

USUSDm Business Exceptional items and certain Reported Business Exceptional items and certain Reported

performance re-measurements performance re-measurements

Revenue 1,595 n/a 1,595 2,103 n/a 2,103

EBITDA 82 n/a n/a 129 n/a n/a

Net profit/ 39 (125) (86) 21 (99) (78)

(loss) (2)

Sami Iskander, Petrofac's Group Chief Executive, commented:

"These results cover my first six months as Chief Executive of

Petrofac. During this time, our focus has been on aligning the

business behind a strategy that will deliver the Petrofac of the

future: a business known for consistent, best-in-class delivery,

growing in both core and new geographies with a competitive and

fast-growing proposition in new energies, and delivering superior

returns.

"While the first half performance reflects the challenges of the

market and Covid-19, we have continued to deliver successfully for

clients and enhance our delivery capability. Importantly, the

conclusion of the SFO investigation allows us to focus on the

future and unlock new opportunities - with an uncompromising

approach to compliance and ethics that will always be at the core

of how we operate. This rigorous approach to governance sits

alongside our environmental and social agenda and is critical to

our future success.

"We are excited about the future. We have a new management team,

an engaged and motivated staff, renewed purpose and a winning

strategy in place. As announced simultaneously this morning, we

have launched a refinancing plan to create a long-term, sustainable

capital structure. We have strong positions in highly attractive

markets at a time of exceptional growth potential. The Group has a

strong bidding pipeline which includes significant opportunities in

new energies, and contract awards are expected to accelerate in

2022. This supports our ambitious medium-term objectives, which

will create significant shareholder value over the coming

years."

Divisional Highlights

Engineering & Construction (E&C)

E&C's financial performance in the first half was impacted

by a continuation of challenging market conditions. A decline in

first half revenue and profitability reflected lower levels of

activity, a rescoping of the Sakhalin contract and disruption to

project schedules caused by the Covid-19 pandemic. The recent

recovery in oil prices is supportive of increased capital spending

by clients in our addressable markets, and we expect the pace of

awards to increase materially in 2022. Management has made good

progress in reshaping the E&C business and has continued to

take measures to improve its cost-competitiveness in anticipation

of a recovery in market conditions.

E&C financial results for the six months ended 30 June

2021:

-- Revenue down 32% to USUSD1.1 billion, driven by lower

activity and rescoping of Sakhalin

-- Net profit down 17% to USUSD29 million

-- Net margin up on prior year at 2.6%, in line with

guidance

-- USUSD75 million of new order intake(4), reflecting the

suspension of bidding activity in the UAE, as wellas delays and

deferrals of awards by clients in other markets. Order intake was

also reduced as a result of therescoping of the Sakhalin

contract.

-- Since period end, we have secured a c.USUSD100 million EPC

contract in Libya with the National Oil Company.This represents an

attractive entry point into a new market with great potential, with

material opportunities inour pipeline.

Engineering & Production Services (EPS)

EPS has grown strongly in the period, driven by higher activity

and good cost discipline. Strong growth in revenue in the

Operations and Projects service lines resulted from high order

intake in the prior year and in Q1, reflecting improvements in both

underlying market conditions and EPS's cost-competitiveness. This

also resulted in a material increase in net margin.

EPS financial results for the six months ended 30 June 2021:

-- Revenue up 24% to USUSD526 million, mainly driven by strong

order intake

-- Net profit up 100% to USUSD34 million

-- Net margin up 2.5 ppts to 6.5%, reflecting higher revenues

and a lower overhead ratio, higher contractmargins, as well as

benefiting from higher income from associates(5)

-- USUSD437 million of new order intake(4) year to date,

representing a book-to-bill of 0.8x

-- Good order intake in Q3 and well positioned on several

material opportunities in Q4, expected to delivera full year

book-to-bill of at least 1.0x

Integrated Energy Services (IES)

IES' financial performance in the first half was driven by lower

production following an unplanned outage in the main Cendor field,

partly offset by a strong recovery in oil prices and lower

depreciation. First oil was achieved on the East Cendor development

in June 2021 and peak production is expected to be achieved by the

end of the year.

IES financial results for the six months ended 30 June 2021:

-- Revenue down 75% to USUSD15 million (down 34% on a

like-for-like basis) (6)? Average realised price up 88% to

USUSD70/boe (H1 2020: USUSD37/boe) (7) ? Equity production down 91%

to 0.2 mmboe (net) (down 60% on a like-for-like basis)

-- EBITDA down 82% to USUSD4 million (down 70% on a

like-for-like basis) (6)? Lower revenue ? Increase in operating and

other costs

-- Net loss reduced 60% to USUSD4 million (reduced 23% on a

like-for-like basis) (6)? Lower depreciation and finance costs

Separately Disclosed Items

The reported net loss of USUSD86 million (H1 2020: USUSD78

million net loss) was impacted by separately disclosed items and

certain re-measurements of USUSD(125) million (H1 2020: USUSD99

million expense). This is principally comprised of a provision of

USUSD106 million(12) relating to the penalty imposed by the court

on 4 October 2021. The total cash impact of separately disclosed

items and certain re-measurements was USUSD6 million (H1 2020:

USUSD11 million).

Financial Position

Net debt (3) was USUSD188 million at 30 June 2021 (31 December

2020: USUSD116 million net debt). A free cash outflow of USUSD51

million (30 June 2020: USUSD13 million outflow) principally

reflected the impact of lower EBITDA and an increase in working

capital, partly offset by lower interest and tax payments.

Liquidity was approximately USUSD1.0 billion at 30 June 2021 (8)

(31 December 2020: USUSD1.1 billion). The Group's leverage ratio

was 2.0x (9) at the period end.

Proposed equity raising and debt refinancing

Petrofac announced today a proposed equity raising of USUSD275

million. The net proceeds of the equity raise, together with other

components of the Group's refinancing plan, will be used to reduce

indebtedness and to pay the penalty imposed by the Crown Court in

relation to the SFO investigation.

The Group's refinancing plan, which becomes effective upon

completion of the equity raising, also includes entry into a new

USUSD180 million two-year revolving credit facility and a USUSD500

million debt bridge to a bond. Furthermore, the USUSD90 million

term loan with ADCB will be repaid and replaced with a new USUSD50

million term loan, maturing in October 2023.

The equity raising remains subject to approval by

shareholders.

Dividend

In April 2020, the Board suspended the payment of the final

dividend in response to the COVID-19 pandemic and the fall in oil

prices. The Board recognises the importance of dividends to

shareholders and expects to reinstate them in due course, once the

company's performance has improved, in line with our dividend

policy. Under the terms of the new debt facilities, the company

will be permitted to pay dividends from 1 January 2023, subject to

the satisfaction of certain covenant tests.

Backlog

(MORE TO FOLLOW) Dow Jones Newswires

October 26, 2021 02:26 ET (06:26 GMT)

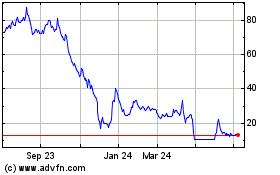

Petrofac (LSE:PFC)

Historical Stock Chart

From Mar 2024 to Apr 2024

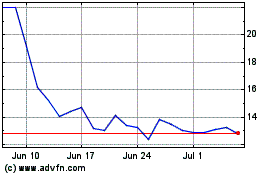

Petrofac (LSE:PFC)

Historical Stock Chart

From Apr 2023 to Apr 2024