Pantheon Resources PLC Lease Award (2591B)

June 01 2023 - 2:00AM

UK Regulatory

TIDMPANR

RNS Number : 2591B

Pantheon Resources PLC

01 June 2023

1 June, 2023

Pantheon Resources plc

Lease Award

Upcoming Webinar

Pantheon Resources plc ("Pantheon" or "the Company"), the

AIM-quoted oil and gas company with a 100% working interest in all

of its oil projects spanning c. 193,000 acres adjacent and near to

transportation and pipeline infrastructure on the Alaska North

Slope ("ANS"), is pleased to announce that it has formally accepted

and paid for the award by the State of Alaska Department of Natural

Resources (DNR) for the 39,540 acres that it was the successful

bidder of in last year's state lease sale. The Company awaits

formal granting of the leases from the DNR, expected in the near

term, subject to standard formalities.

25,460 acres of this award is the northern extension (the

Chimney) and updip portion of our Theta West Basin Floor Fan.

14,080 acres of the award fills in around Pantheon's Alkaid and

Talitha Units along the Dalton Highway and Trans Alaska Pipeline.

The new acreage covers an extension of the existing discoveries

which Pantheon was able to delineate off its existing proprietary

3D seismic. Whilst a full evaluation of this new acreage is

ongoing, Pantheon expects an upgrade in its resource base from this

addition of new acreage in due course. In December 2022, SLB

completed phase 1 of its Static and Dynamic reservoir model where

it ascribed 10.9 billion barrels of oil in place to the portion of

the Basin Floor Fan ("BFF") complex within Pantheon's existing

leases. The extension into this new acreage was not part of the

original SLB estimates.

The BFF resources in this additional acreage are structurally

higher, or 'updip' from the Theta West #1 discovery well. Being

structurally higher in shallower reservoir depths yields an

expected improvement in the reservoir properties because of less

compaction due to a shallower Dmax (Maximum Depth of Burial). The

expected improvement in reservoir qualities should lead to

increased recovery and better reservoir productivity. The Company

intends to test the BFF reservoir in these new leases at a depth of

approximately 6,200 feet, some 750 feet higher than where it was

discovered in Theta West #1, in the next Theta West appraisal well.

Shallower drilling targets reduce drilling costs and, combined with

expected higher productivity, should enhance the economics of any

development in this location. The Theta West #1 well demonstrated

that the Company's pre-drill expectation for the northern extent of

the accumulation was likely too conservative and hence the move to

secure the additional leases in what should prove to be the best

quality resources in this giant discovery.

SLB will incorporate these additional resources into their

models, and Netherland Sewell & Associates will incorporate

these additional resources into their assessment of Contingent

Resources on the Theta West and Alkaid projects, expected over the

summer (Theta West), autumn (Alkaid), which will represent the

first independent assessment of the recoverable resources

identified by Pantheon's appraisal programmes over the past two and

a half years.

Webinar

A webinar is scheduled for late June/early July to present an

overall plan for Pantheon and the following:

1. Discussion on Pantheon's corporate strategy to deliver

greater value out of its significant resources including a

discussion of corporate and operational initiatives.

2. Discussion on scope for potential resource upgrades

associated with this additional (new) acreage.

3. Discussion on findings from further analysis of Alkaid #2 and

the Company's assessment of ultimate recoveries based on Alkaid #2

production and potential for future wells.

4. Discussion on initiatives for improvements to operational

performance and cost control, including an introduction to recent

key hires. The discussion will include an analysis of well cost of

Alkaid #2 and steps to work towards a targeted $13 million cost per

development well.

5. Discussion on Frac design improvements based on Alkaid #2 results.

6. Discussion on data expected from the re-entry completion and

production test at the SMD horizon at Alkaid #2.

The Company will provide an update at a later date regarding the

date for the webinar.

Jay Cheatham, CEO of Pantheon Resources, said: "Pantheon will

soon have c. 193,000 acres under lease with a material resource

base in the billions of barrels. In the past we have limited our

public profile to reduce competition for offset acreage while we

acquired the current acreage position. Pantheon and its predecessor

Great Bear have made significant investments over the past decade

securing this vast acreage position, assisted through the advantage

of having sole use of c. 1,000 square miles of high quality 3D

seismic. Having now secured the desired acreage, Pantheon now

intends to increase the profile of its project geology without fear

of competition and to assist in attracting potential farm-in

partners. This process commenced last week where AHS/Baker Hughes

presented a case study using the Theta West volatiles analysis to

the Society of Petroleum Engineers (SPE) Western Regional Meeting

in Anchorage. We will also begin participating in other relevant

industry meetings to raise the profile of the assets."

-ENDS-

Further information, please contact:

Pantheon Resources plc +44 20 7484 5361

Jay Cheatham, CEO

Justin Hondris, Director, Finance and Corporate

Development

Canaccord Genuity Limited (Nominated Adviser

and broker)

Henry Fitzgerald-O'Connor

James Asensio

Gordon Hamilton +44 20 7523 8000

BlytheRay

Tim Blythe, Megan Ray, Matthew Bowld +44 20 7138 3204

In accordance with the AIM Rules - Note for Mining and Oil &

Gas Companies - June 2009, the information contained in this

announcement has been reviewed and signed off by Robert Rosenthal,

a qualified Petroleum Geologist, who has over 40 years' relevant

experience within the sector.

Notes to Editors

Pantheon Resources plc is an AIM listed Oil & Gas company

focused on several large projects located on the North Slope of

Alaska ("ANS"), onshore USA where it has a 100% working interest in

193,000 highly prospective acres with potential for multi billion

barrels of oil recoverable. A major differentiator to other ANS

projects is its close proximity to transport and pipeline

infrastructure which offers a significant competitive advantage to

Pantheon, allowing for materially lower capital costs and much

quicker development times. The Group's stated objective is to

create material value for its stakeholders through oil exploration,

appraisal and development activities in high impact, highly

prospective conventional assets, in the USA; a highly established

region for energy production with infrastructure, skilled personnel

and low sovereign risk. All operations are onshore USA, with

drilling costs materially below that of offshore wells.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAFSFDLDDEAA

(END) Dow Jones Newswires

June 01, 2023 02:00 ET (06:00 GMT)

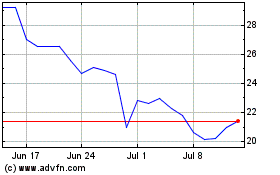

Pantheon Resources (LSE:PANR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pantheon Resources (LSE:PANR)

Historical Stock Chart

From Apr 2023 to Apr 2024