Half-Yearly Results

Octopus Titan VCT plc

Half-Yearly Results

Octopus Titan VCT plc announces the half-yearly

results for the six months ended 30 June 2024.

Titan’s mission is to invest in the people,

ideas and industries that will change the world.

Octopus Titan VCT plc (‘Titan’ or the ‘Company’)

is managed by Octopus AIF Management Limited (the ‘Manager’), which

has delegated investment management to Octopus Investments Limited

(‘Octopus’ or ‘Portfolio Manager’) via its investment team Octopus

Ventures.

Key financials

|

|

HY2024 |

HY2023 |

FY2023 |

|

Net assets (£’000) |

£892,520 |

£1,055,683 |

£993,744 |

|

Loss after tax (£’000) |

£(116,233) |

£(87,609) |

£(149,499) |

|

NAV per share |

53.5p |

68.2p |

62.4p |

|

Total value per share1 |

157.4p |

168.2p |

164.4p |

|

Total return per share (p)2 |

(7.0)p |

(5.7)p |

(9.5)p |

|

Total return per share %3 |

(11.2)% |

(7.4)% |

(12.4)% |

|

Dividends paid in the period |

1.9p |

3.0p |

5.0p |

|

Dividend yield %4 |

3.0% |

3.9% |

6.5% |

|

Dividend declared |

1.2p |

2.0p |

1.9p |

- Total value is an alternative performance measure,

calculated as NAV plus cumulative dividends paid since

launch.

- Total return is an alternative performance measure,

calculated as movement in NAV per share in the period plus

dividends paid in the period.

- Total return % is an alternative performance measure,

calculated as total return/opening NAV.

- Dividend yield is an alternative performance measure,

calculated as dividends paid/opening NAV.

Interim Management Report

Chair’s statement

Titan's Total Return for the six months to 30

June 2024 was -11.2% with net assets at the period end totalling

£892.5 million.

The Net Asset Value (‘NAV’) per share at 30 June

2024 was 53.5p which, adjusting for dividends paid of 1.9p per

share in 30 May 2024, represents a net decrease of 7.0p per share

from 31 December 2023 or a total return of –11.2%.

This decline in value has been caused by the

decrease in the valuation multiples applied to some of the

Company’s more mature portfolio companies as well as ongoing

private market volatility and the associated impact on capital

availability for our portfolio companies. Many of the portfolio

companies have experienced lower revenue growth rates as they have

prioritised extending cash runway, looking to either achieve

profitability or delay fundraising until more favourable market

conditions return. The Mergers and Acquisitions (M&A) and

Initial Public Offerings (IPO) markets for private companies remain

substantially below the levels seen in recent years, and as a

result, we have seen a marked decline in realisations from the

Titan portfolio with cash receipts from exits in the first half

totalling only £0.8 million.

With this further decline in NAV the 10-year

tax-free annual compound return for shareholders is now 2%. Since

the high watermark as at 31 December 2021, Titan’s total return per

share has been -38.1% with which the Board are, and shareholders

will be, deeply disappointed.

Considering the ongoing challenges in the

early-stage venture market to which the Company is exposed, and the

resultant performance issues faced, the Board, in conjunction with

the Manager, are currently reviewing the strategy of Titan. This

review, which will have the benefit of independent external advice,

will consider a wide range of issues including but not limited to

Titan’s investment strategy, dividend and share buy back policies

and fund raising plans. We look forward to sharing the results of

this review ahead of any potential fund raise in the 2024/25 or

2025/26 tax years.¹

In the six months to 30 June 2024, the fund

utilised £90.4 million of its cash resources, comprising £24.5

million in new and follow-on investments, £24.1 million in

dividends (net of the Dividend Reinvestment Scheme (DRIS)), £28.0

million in share buybacks and £13.8 million in investment

management fees and other running costs, and the fund received

disposal proceeds of £0.8 million. The cash and corporate bond

balance of £184.6 million at 30 June 2024 represented 21% of net

assets at that date, compared to 20% at 31 December 2023.

The total value (NAV plus cumulative dividends paid per share since

launch) at the end of the period was 157.4p (31 December 2023:

164.4p).

Dividends

Since inception, the Company has now paid 103.9p in tax-free

dividends per share. Following careful consideration and

recognising the value that shareholders’ place on receiving

tax-free dividends, I am pleased to confirm that the Board has

decided to declare an interim dividend of 1.2p per share (2023:

2.0p per share). This will be paid on 19 December 2024 to

shareholders on the register as at 29 November 2024, which equates

to 2% of the Company’s NAV as at 31 December 2023.

The Board has concluded, however, that in light

of the review being undertaken, the DRIS in respect of this interim

dividend will be suspended.

Fundraise and buybacks

We were pleased to raise over £107 million in the fundraise which

closed on 5 April 2024, which represented the largest VCT fundraise

in the market for the 2023/24 tax year. We would like to take this

opportunity to thank all shareholders for their support.

During the period, Titan repurchased 47.8

million shares for £28 million (representing 3% of the net asset

value as at 31 December 2023). Further details can be found in Note

6 of the financial statements. The Board will review the policy and

operation of any future share buy backs during the aforementioned

review.

The Board has also determined that decisions on

any future fundraising will take place at the end of the review

currently underway.

Principal Risks and

Uncertainties

The Board continues to review the risk environment in which Titan

operates on a regular basis. The principal risks as set out in the

Annual Report for the year ended 31 December 2023 on pages 46 to 49

remain. However, the risks around investment performance, loss of

key people, valuations and liquidity have all increased since the

year end. All the principal risks will be reported on in detail in

the annual report to 31 December 2024.

VCT Status

In November 2023, a ten-year extension was announced to the ‘sunset

clause’ (a retirement date for the VCT scheme), meaning VCT tax

reliefs will be available until 5 April 2035. This extension passed

through Parliament in February 2024 and on 3 September 2024 His

Majesty’s Treasury brought the extension into effect through The

Finance Act 2024.

Board of Directors and Portfolio

Manager

As announced in our annual report, Rupert Dickinson was appointed

to the Board with effect from 1 May 2024 and was elected by

shareholders at the Annual General Meeting (AGM) held in June.

Rupert has over 20 years’ experience in the wealth and investment

management industries. We look forward to benefiting from his

extensive experience.

In March 2024, Jo Oliver was appointed as lead

Fund Manager and Adviser to the Board on fund and strategy on an

interim basis. In August 2024, Jo stepped down from this interim

role. We wish to take this opportunity to thank Jo for his

contribution to the Company and wish him well for the future.

Outlook

The further decline in NAV is disappointing and has mainly been

driven by a decrease in the value of the Company’s largest

holdings. These holdings are typically valued using comparable

market multiples which fell significantly over the six-month

period. This is also evidenced by the Bessemer Index (a US

technology index) showing a 12% decline over this time². This has

been driven by factors such as high interest rates and economic and

political uncertainty.

The priority for our portfolio companies has

remained cash preservation to extend their runway to achieve

profitability whilst the fundraising and exit environment has been

subdued. A side-effect of this focus has, in some cases, been to

reduce growth rates. Titan’s largest companies have also had to

focus on profitability due to the funding scarcity. In the short

term, this has meant their valuations have been reduced to reflect

this slowed growth, but in the long run the disciplined focus on

sustainable growth should be beneficial. In these difficult

conditions, we have unfortunately seen more companies underperform

or fail as they have struggled to raise further funding or

successfully conclude an exit.

Despite this, the Board remains reasonably

optimistic about the potential within what is unquestionably a

diversified portfolio, with over 145 companies spanning a wide

range of sectors, business models and investment stages.

Furthermore, despite this slowing in growth across the portfolio,

recent analysis shows 23% of the portfolio generated an increase in

revenue of over 100% when comparing year-on-year 2023 to 2022 and

the portfolio overall saw 19% revenue growth³. Additionally, over

50% of the portfolio NAV is comprised of companies not expecting to

need further funding to achieve profitability. This figure rises to

88% when including those companies with more than 12 months’ cash

runway. This demonstrates that, despite the decline in NAV, the

portfolio is showing a degree of resilience. Some companies have

shown great agility and modified their business models to take

advantage of new opportunities, as we have seen examples of more

willingness to adopt new technologies in these turbulent times. As

detailed in the Portfolio Manager’s report, the Octopus Ventures

team is now focusing its resource on follow-on funding

opportunities within the portfolio to drive improved performance in

the short to mid-term.

In due course we will update you on the progress

of the strategic review, and ultimately share the results, but this

is not expected to be until early in 2025. I would like to conclude

by thanking both the Board and the Octopus team on behalf of all

shareholders for their hard work during this very challenging

period.

Tom Leader

Chair

1 The information contained within this

paragraph is deemed by the Company to constitute inside information

as stipulated under the Market Abuse Regulations (EU No. 596/2014)

(which forms part of UK domestic law pursuant to the European Union

(Withdrawal) Act 2018). Upon the publication of this announcement

via Regulatory Information Service this inside information is now

considered to be in the public domain.

2 https://cloudindex.bvp.com/

3 Data provided by portfolio companies,

based on information available for calendar year 2022 and

2023.

Portfolio Manager’s review

Focus on performance

The NAV of 53.5p per share at 30 June 2024

represents a decrease in NAV of 7.0p per share versus a NAV of

62.4p per share as at 31 December 2023, after adding back dividends

paid during the year of 1.9p per share, a decrease of 11.2% in the

period.

The performance over the five and a half years to 30 June 2024

is shown below:

|

|

Period1 ended 31 December 2019 |

Year ended 31 December 2020 |

Year ended 31 December 2021 |

Year ended 31 December 2022 |

Year ended 31 December 2023 |

Period ended 30 June 2024 |

|

NAV (p) |

95.2 |

97.0 |

105.7 |

76.9 |

62.4 |

53.5 |

|

Cumulative dividends paid (p) |

76.0 |

81.0 |

92.0 |

97.0 |

102.0 |

103.9 |

|

Total Value (p) |

171.2 |

178.0 |

197.7 |

173.9 |

164.4 |

157.4 |

|

Total return2 |

7.6% |

7.1% |

20.3% |

(22.5)% |

(12.4)% |

(11.2)% |

|

Dividend yield3 |

5.4% |

5.3% |

11.3% |

4.7% |

6.5% |

3.0% |

|

Equivalent dividend yield for a higher rate tax

payer4 |

8.0% |

7.8% |

16.8% |

7.0% |

9.8% |

4.6% |

1 The period to 31 December 2019 was 14 months.

2 Total return % is an alternative performance measure,

calculated as total return/opening NAV.

3 Dividend yield is an alternative performance measure,

calculated as dividends paid/opening NAV.

4 The equivalent dividend yield for higher rate taxpayers has

been calculated based on current tax rates and allowances. This

information is provided for illustrative purposes only and does not

constitute investment advice.

The decrease in valuation over the six month

period has been driven by downward valuation movements across 67

companies which saw a collective decrease in valuation of £141.8

million. The businesses that contributed most significantly to this

were Amplience, ManyPets and Big Health. Amplience has been through

some senior management changes and has led a cost reduction

exercise to increase its cash runway. The decline in valuation

reflects the lower market comparables and lower growth rate of the

business. ManyPets is focusing on stabilisation and has implemented

a range of initiatives to drive higher efficiency and target

profitability in the short term at the expense of growth. The

decline in valuation is driven by increased loss ratios and a

decline in its gross written premium. For Big Health, due to high

competition in the mental health space in the US and economic

pressures meaning a reduction in benefits being offered by

employers, the company has had to make cost reductions and

reforecast its growth plans. These three valuation movements

account for 33.2% of the total decline in the reporting period.

Octopus Ventures believes that many of the

companies which have seen decreased valuations in the period have

the potential to overcome the issues they face and get their growth

plans back on track. Octopus Ventures will continue to work with

them to help them realise their ambitions. In some cases, the

support offered could include further funding, to ensure a business

has the capital it needs to execute on its strategy.

Conversely, 38 companies saw an increase in

valuation in the period, delivering a collective increase in

valuation of £34.9 million. These valuation increases reflect

businesses which have successfully concluded further funding rounds

at increased prices, grown revenues or met certain important

milestones. Notable strong performers in the portfolio include

Vitesse and BondAval, both of which have shown impressive capital

efficient growth. These strong performers demonstrate that there

are opportunities available for companies to thrive, and Titan’s

diverse portfolio allows different routes for each company to

succeed in their market.

The gain on Titan’s uninvested cash reserves was £4.3 million

in the six months to 30 June 2024, primarily driven by a fair value

movement of £1.8 million in the corporate bond portfolio and a

return of £2.5 million on the money market funds. The objective for

the money market funds is to earn appropriate market rates on

highly-liquid treasury holdings, at limited risk to capital.

Disposals

In June 2024, Taxfix (a European focused tax return technology

platform) acquired TaxScouts, for a combination of cash and equity,

which has allowed it to enter the UK market. As a result, Titan now

holds shares in Taxfix. Outside of the reporting period in July,

cash consideration was received for the disposal of Taxscouts and

Foodsteps. Foodsteps was acquired by Registrar Corp (a provider of

regulatory and compliance software for the food, cosmetic and life

sciences industry). This transaction was also for a combination of

cash and equity, and has offered Registrar Corp access to

Foodsteps’ global market platform of over 32,000 companies in 190

countries. In June, it was agreed that Cobee will be acquired by

Pluxee Group (an employee benefits and engagement platform) as part

of its strategic growth plan. The transaction has now been approved

by the Spanish regulatory authorities, so we look forward to

reporting further after completion has taken place.

In the six months, Titan also received deferred

proceeds from the sale of Calastone (to The Carlyle Group in 2020)

which was held in Octopus Zenith Holding Company, and iSize (to

Sony Interactive Entertainment in 2023). In the six months,

disposals and deferred proceeds have returned £0.8 million to Titan

in cash during the period, including deferred amounts received in

cash relating to disposals from previous periods.

There have been two disposals made at a loss:

Titan sold its remaining shares in Cazoo, which was listed on the

New York Stock Exchange, and Unmade was acquired by High-Tech

Apparel. In aggregate, these losses generated negligible proceeds

compared to an investment cost of £8.8 million.

Unfortunately, Audiotelligence, Stackin (now

fully dissolved), Contingent, Phoelex, Excession and Dead Happy

were placed into administration having all been unsuccessful in

securing further funding and having explored and exhausted all

available options. In the six months since December 2023, Third Eye

and LifeBook were fully dissolved having been placed into

administration in previous reporting periods.

The underperformance of a portfolio company is

always disappointing for Octopus and shareholders alike, but it is

a key characteristic of a venture capital portfolio, and we believe

the successful disposals will continue to outweigh the losses over

the medium to long-term.

|

|

Period1 ended 31 December 2019 |

Year ended 31 December 2020 |

Year ended 31 December 2021 |

Year ended 31 December 2022 |

Year ended 31 December 2023 |

Period ended 30 June

2024 |

Total |

|

Disposal proceeds2 (£'000) |

26,334 |

23,915 |

221,504 |

62,213 |

45,637 |

767 |

380,370 |

1 The period to 31 December 2019 was 14

months.

2 This table includes proceeds received in the period.

VCT qualifying status

Shoosmiths LLP provides both the Board and Octopus with advice

concerning ongoing compliance with HMRC rules and regulations

concerning VCTs and has advised that Titan continues to be

compliant with the conditions set by HMRC for maintaining approval

as a VCT.

As at 30 June 2024, over 91% of the portfolio

(as measured by HMRC rules) was invested in VCT-qualifying

investments, above the 80% current VCT- qualifying threshold.

New and follow-on

investments

Titan completed 6 new investments and made 9 follow-on investments

in the reporting period. Together, these totalled £24.5 million

(made up of £16.2 million into new companies and £8.3 million

invested into the existing portfolio).

Below are details on our new investments:

Health

Manual is looking to become the go-to global

platform to increase healthy lifespan and build a series of

direct-to-consumer health brands for high importance, non-critical

areas of health. To achieve this, it will provide easy to access

advice and medical support for diagnosis, custom treatment plans

and holistic care to induce long-term behaviour change.

Bio

Expression Edits is using a proprietary AI

algorithm to design DNA sequences, named introns, which boost the

expressions of proteins in mammalian cells.

Climate

Drift Energy is designing sailing vessels and the

routing algorithms required to capture deep water wind energy and

convert it into onboard hydrogen gas. This would then be

transported back to shore using a fully integrated desalination,

electrolysis and storage system.

Fintech

Swiipr has developed a digital payments platform

specifically for the airline industry. The platform enables

airlines to instantly compensate passengers in cases of disrupted

or cancelled flights, using virtual or pre-paid cards. Swiipr aims

to streamline payment processing for airlines and improve the

reimbursement experience for affected passengers.

Bio

LabGenius is a next-generation platform leveraging

machine learning to develop novel therapeutic antibodies.

Fintech

Remofirst is an Employer of Record (EOR) and

compliance platform that allows companies to hire and pay employees

globally.

With a further decline in Titan’s NAV, the

Octopus Ventures team is highly focused on improving performance

and driving greater returns to shareholders. Given Titan’s scale,

the greatest returns are expected to be driven by its existing,

largest holdings, and brand-new investments will have less impact

in the near-term. As such, Titan will predominantly be looking to

invest to build value in its existing portfolio for at least the

coming six to twelve months. This will allow capital to be

prioritised on existing companies where the route to success is

clearer, as we have been closely involved with the businesses for

some time already. We believe that this will drive positive

near-term NAV performance as these portfolio companies are more

established, so have a greater potential to secure a successful

exit and drive meaningful returns, while significant investment in

more than 80 new companies in the last three years also provides

the foundations for targeting long-term returns.

Valuations

Titan’s unquoted portfolio companies are valued in accordance with

UK Generally Accepted Accounting Principles (GAAP) accounting

standards and the International Private Equity and Venture Capital

(IPEV) valuation guidelines. This means we value the portfolio at

Fair Value, which is the price we expect people would be willing to

buy or sell an asset for at the reference date, assuming they had

all the information available we do, are knowledgeable parties with

no pre-existing relationship, and that the transaction is carried

out under the normal course of business.

The data below illustrates the split of

valuation methodology (shown as a percentage of portfolio value and

number of companies). ‘External price’ includes valuations based on

funding rounds that typically completed in the last 12 months to

the period end or shortly after the period end, and exits of

companies where terms have been agreed with an acquirer. ‘External

price’ also includes quoted holdings, which are held at their

quoted price as at the valuation date. ‘Multiples’ is predominantly

used for valuations that are based on a multiple of revenues for

portfolio companies. Where there is uncertainty around the

potential outcomes available to a company, a probability weighted

‘scenario analysis’ is considered.

Valuation methodology – by value:

- Multiples: 53%

- External price: 29%

- Scenario analysis: 18%

Valuation methodology – by number of

companies:

- Multiples: 33%

- External price: 23%

- Scenario analysis: 23%

- Write off: 21%

Top 20 investments

We are disappointed to report a net decrease in

the value of the portfolio of £106.9 million since 31 December

2023, excluding additions and disposals. This represents a decline

of 13.6% on the value of the portfolio at the start of the year.

Here, we set out the cost and valuation of the top 20 holdings,

which account for over 57.0% of the value of the portfolio.

|

|

Company |

Investment cost |

Total valuation

including cost |

Investment focus |

|

1 |

Skin+Me |

£11.5m |

£45.8m |

Health |

|

2 |

Pelago1 |

£17.9m |

£38.9m |

Health |

|

3 |

Permutive |

£19.0m |

£30.8m |

B2B software |

|

4 |

Vitesse |

£10.1m |

£30.6m |

Fintech |

|

5 |

Amplience |

£13.6m |

£28.3m |

B2B software |

|

6 |

ManyPets |

£10.0m |

£26.2m |

Fintech |

|

7 |

Elliptic |

£9.9m |

£22.6m |

Fintech |

|

8 |

vHive |

£8.0m |

£21.2m |

Deep tech |

|

9 |

Orbex |

£12.0m |

£17.7m |

Deep tech |

|

10 |

Token |

£12.6m |

£16.4m |

Fintech |

|

11 |

Legl |

£7.3m |

£16.2m |

B2B software |

|

12 |

Ometria |

£11.5m |

£13.9m |

B2B software |

|

13 |

Automata |

£12.3m |

£12.4m |

Health |

|

14 |

Seatfrog |

£9.6m |

£12.3m |

Consumer |

|

15 |

Full Circl |

£5.5m |

£12.3m |

B2B software |

|

16 |

XYZ |

£15.3m |

£12.2m |

Consumer |

|

17 |

Lapse |

£8.0m |

£11.8m |

Consumer |

|

18 |

Taster |

£8.1m |

£11.6m |

Consumer |

|

19 |

Bondaval |

£7.1m |

£10.6m |

Fintech |

|

20 |

Ibex |

£11.8m |

£10.0m |

Health |

- Digital Therapeutics, Inc., formerly Quit Genius, has

rebranded as Pelago.

Outlook

Some of the Company’s largest holdings have seen

their valuations decrease as market multiples have declined and

their growth rates have fallen. These early-stage companies require

significant investment to develop, however as investors have

retreated from the market over the last two years, it has been

increasingly challenging for such companies to raise funding, so

the focus has been on cash preservation to achieve

profitability.

Against this backdrop, the Octopus Ventures team

have undertaken a deep review of the entire portfolio, including

each company’s funding and exit plans, and worked to ascertain and

establish the most impactful actions which Octopus can support to

best drive performance. Titan’s capital and resource will be

prioritised for those portfolio companies which have the potential

to drive the greatest returns. The in-house People and Talent team

will be utilised to build high performing portfolio company teams

and support on key recruitment initiatives.

This portfolio focus will leverage the

advantages Titan has of being a very large and mature VCT holding a

highly diversified portfolio. With over 80 investments having been

made in the last three years, there is the opportunity for long

term returns to the Company. The ongoing focus will be optimising

growth plans for the portfolio and taking advantage of exit

opportunities.

Directors’ responsibilities

statement

The Directors confirm that to the best of their knowledge:

- the half-yearly financial

statements have been prepared in accordance with ‘Financial

Reporting Standard 104: Interim Financial Reporting’ issued by the

Financial Reporting Council;

- the half-yearly financial

statements give a true and fair view of the assets, liabilities,

financial position and profit or loss of the Company; and

- the half-yearly report includes a

fair review of the information required by the Financial Conduct

Authority Disclosure Guidance and Transparency Rules, being:

- we have disclosed an indication of

the important events that have occurred during the first six months

of the financial year and their impact on the condensed set of

financial statements;

- we have disclosed a description of

the principal risks and uncertainties for the remaining six months

of the year; and

- we have disclosed a description of

related party transactions that have taken place in the first six

months of the current financial year, that may have materially

affected the financial position or performance of the Company

during that period, and any changes in the related party

transactions described in the last annual report that could do

so.

On behalf of the Board

Tom Leader

Chair

Income statement

|

|

Unaudited |

Unaudited |

Audited |

|

|

Six months to 30 June 2024 |

Six months to 30 June 2023 |

Year to 31 December 2023 |

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Loss on disposal of fixed asset investments |

— |

(572) |

(572) |

— |

(1,922) |

(1,922) |

— |

(1,870) |

(1,870) |

|

Gain on disposal of current asset investments |

— |

17 |

17 |

— |

— |

— |

— |

355 |

355 |

|

Loss on valuation of fixed asset investments |

— |

(106,859) |

(106,859) |

— |

(72,556) |

(72,556) |

— |

(131,655) |

(131,655) |

|

Gain on valuation of current asset investments |

— |

1,836 |

1,836 |

— |

589 |

589 |

— |

8,098 |

8,098 |

|

Investment income |

2,446 |

— |

2,446 |

1,543 |

— |

1,543 |

4,467 |

— |

4,467 |

|

Investment management fees |

(504) |

(9,585) |

(10,089) |

(522) |

(9,917) |

(10,439) |

(1,054) |

(20,028) |

(21,082) |

|

Other expenses |

(3,022) |

— |

(3,022) |

(3,168) |

— |

(3,168) |

(6,264) |

— |

(6,264) |

|

Foreign exchange translation |

— |

10 |

10 |

— |

(1,656) |

(1,656) |

— |

(1,548) |

(1,548) |

|

Loss before tax |

(1,080) |

(115,153) |

(116,233) |

(2,147) |

(85,462) |

(87,609) |

(2,851) |

(146,648) |

(149,499) |

|

Tax |

— |

— |

— |

— |

— |

— |

— |

— |

— |

|

Loss after tax |

(1,080) |

(115,153) |

(116,233) |

(2,147) |

(85,462) |

(87,609) |

(2,851) |

(146,648) |

(149,499) |

|

Loss per share – basic and diluted |

(0.1)p |

(7.0)p |

(7.1)p |

(0.1)p |

(5.9)p |

(6.0)p |

(0.2)p |

(9.7)p |

(9.9)p |

- The ‘Total’ column of this statement is the profit and loss

account of the Company; the supplementary revenue return and

capital return columns have been prepared under guidance published

by the Association of Investment Companies.

- All revenue and capital items in the above statement derive

from continuing operations.

- The Company has only one class of business and derives its

income from investments made in shares and securities and from bank

and money market funds.

Titan has no other comprehensive income for the period.

The accompanying notes form an integral part of the financial

statements.

Balance sheet

|

|

Unaudited |

Unaudited |

Audited |

|

|

As at 30 June 2024 |

As at 30 June 2023 |

As at 31 December 2023 |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Fixed asset investments |

|

705,407 |

|

819,886 |

|

791,403* |

|

Current assets: |

|

|

|

|

|

|

|

Corporate bonds |

103,393 |

|

105,196 |

|

108,669 |

|

|

Cash at bank |

551 |

|

228 |

|

2,970 |

|

|

Applications cash1 |

21 |

|

338 |

|

17,842 |

|

|

Debtors |

3,396 |

|

4,246 |

|

1,218* |

|

|

Money market funds |

80,619 |

|

127,037 |

|

91,172 |

|

|

|

|

187,980 |

|

237,045 |

|

221,871* |

|

Current liabilities |

(867) |

|

(1,248) |

|

(19,530) |

|

|

Net current assets |

|

187,113 |

|

235,797 |

|

202,341* |

|

Net assets |

|

892,520 |

|

1,055,683 |

|

993,744 |

Share capital |

|

1,667 |

|

1,548 |

|

1,594 |

|

Share premium |

|

120,552 |

|

248,511 |

|

45,780 |

|

Special distributable reserve |

|

965,730 |

|

823,000 |

|

1,025,614 |

|

Capital redemption reserve |

|

122 |

|

52 |

|

74 |

|

Capital reserve realised |

|

(105,731) |

|

(65,269) |

|

(89,570) |

|

Capital reserve unrealised |

|

(47,328) |

|

88,667 |

|

51,674 |

|

Revenue reserve |

|

(42,492) |

|

(40,826) |

|

(41,422) |

|

Total equity shareholders’ funds |

|

892,520 |

|

1,055,683 |

|

993,744 |

|

Net asset value per share |

|

53.5p |

|

68.2 |

p |

62.4p |

- Cash held but not yet allotted.

* In line with accounting best practice, the opening balance

of accrued loan interest has been reclassified to be included in

the fair value of investments. This reclassification amends the

balance previously reported as of 31 December 2023.

The accompanying notes form an integral part of the financial

statements.

The statements were approved by the Directors and authorised for

issue on 28 September 2024 and are signed on their behalf by:

Tom Leader

Chair

Company Number 06397765

Statement of changes in equity

|

|

Share capital £’000 |

Share premium £’000 |

Capital redemption reserve

£’000 |

Special distributable

reserve1

£’000 |

Capital reserve

realised1

£’000 |

Capital reserve unrealised £’000 |

Revenue reserve1

£’000 |

Total

£’000 |

|

As at 1 January 2024 |

1,594 |

45,780 |

74 |

1,025,614 |

(89,570) |

51,674 |

(41,422) |

993,744 |

|

Comprehensive income for the year: |

|

|

|

|

|

|

|

|

|

Management fees allocated as capital expenditure |

— |

— |

— |

— |

(9,585) |

— |

— |

(9,585) |

|

Current year loss on disposal of fixed asset investments |

— |

— |

— |

— |

(572) |

— |

— |

(572) |

|

Current year gain on disposal of current asset investments |

— |

— |

— |

— |

17 |

— |

— |

17 |

|

Loss on fair value of fixed asset investments |

— |

— |

— |

— |

— |

(106,859) |

— |

(106,859) |

|

Gain on fair value of current asset investments |

— |

— |

— |

— |

— |

1,836 |

— |

1,836 |

|

Loss after tax |

— |

— |

— |

— |

— |

— |

(1,080) |

(1,080) |

|

Foreign exchange translation |

— |

— |

— |

— |

— |

— |

10 |

10 |

|

Total comprehensive income for the period |

— |

— |

— |

— |

(10,140) |

(105,023) |

(1,070) |

(116,233) |

|

Contributions by and distributions to owners: |

|

|

|

|

|

|

|

|

|

Share issue (includes DRIS) |

121 |

76,665 |

— |

— |

— |

— |

— |

76,786 |

|

Share issue costs |

— |

(1,893) |

— |

— |

— |

— |

— |

(1,893) |

|

Repurchase of own shares |

(48) |

— |

48 |

(28,008) |

— |

— |

— |

(28,008) |

|

Dividends paid (includes DRIS) |

— |

— |

— |

(31,876) |

— |

— |

— |

(31,876) |

|

Total contributions by and distributions to owners |

73 |

74,772 |

48 |

(59,884) |

— |

— |

— |

15,009 |

|

Other movements: |

|

|

|

|

|

|

|

|

|

Prior year fixed asset losses now realised |

— |

— |

— |

— |

(5,998) |

5,998 |

— |

— |

|

Prior year current asset losses now realised |

— |

— |

— |

— |

(23) |

23 |

— |

— |

|

Total other movements |

— |

— |

— |

— |

(6,021) |

(6,021) |

— |

— |

Balance as at

30 June 2024 |

1,667 |

120,552 |

122 |

965,730 |

(105,731) |

(47,328) |

(42,492) |

892,520 |

- Reserves available for distribution.

The accompanying notes form an integral part of the financial

statements.

|

|

Share capital £’000 |

Share premium £’000 |

Capital redemption reserve

£’000 |

Special distributable

reserve1

£’000 |

Capital reserve

realised1

£’000 |

Capital reserve unrealised £’000 |

Revenue reserve1

£’000 |

Total

£’000 |

|

As at 1 January 2023 |

1,368 |

92,896 |

27 |

887,288 |

(53,430) |

160,634 |

(37,023) |

1,051,760 |

|

Comprehensive income for the period: |

|

|

|

|

|

|

|

|

|

Management fees allocated as capital expenditure |

— |

— |

— |

— |

(9,917) |

— |

— |

(9,917) |

|

Current year loss on disposal of fixed asset investments |

— |

— |

— |

— |

(1,922) |

— |

— |

(1,922) |

|

Loss on fair value of fixed asset investments |

— |

— |

— |

— |

— |

(72,556) |

— |

(72,556) |

|

Gain on fair value of current asset investments |

— |

— |

— |

— |

— |

589 |

— |

589 |

|

Loss after tax |

— |

— |

— |

— |

— |

— |

(2,147) |

(2,147) |

|

Foreign exchange translation |

— |

— |

— |

— |

— |

— |

(1,656) |

(1,656) |

|

Total comprehensive income for the period |

— |

— |

— |

— |

(11,839) |

(71,967) |

(3,803) |

(87,609) |

|

Contributions by and distributions to owners: |

|

|

|

|

|

|

|

|

|

Share issue (includes DRIS) |

205 |

160,895 |

— |

— |

— |

— |

— |

161,100 |

|

Share issue costs |

— |

(5,280) |

— |

— |

— |

— |

— |

(5,280) |

|

Repurchase of own shares |

(25) |

— |

25 |

(18,161) |

— |

— |

— |

(18,161) |

|

Dividends paid (includes DRIS) |

— |

— |

— |

(46,127) |

— |

— |

— |

(46,127) |

|

Total contributions by and distributions to owners |

180 |

155,615 |

25 |

(64,288) |

— |

— |

— |

91,532 |

Balance as at

30 June 2023 |

1,548 |

248,511 |

52 |

823,000 |

(65,269) |

88,667 |

(40,826) |

1,055,683 |

- Reserves available for distribution.

The accompanying notes form

an integral part of the financial statements.

|

|

Share capital £’000 |

Share premium £’000 |

Capital redemption reserve

£’000 |

Special distributable

reserve1

£’000 |

Capital reserve

realised1

£’000 |

Capital reserve unrealised £’000 |

Revenue reserve1

£’000 |

Total

£’000 |

|

As at 1 January 2023 |

1,368 |

92,896 |

27 |

887,288 |

(53,430) |

160,634 |

(37,023) |

1,051,760 |

|

Comprehensive income for the year: |

|

|

|

|

|

|

|

|

|

Management fees allocated as capital expenditure |

— |

— |

— |

— |

(20,028) |

— |

— |

(20,028) |

|

Current year loss on disposal of fixed asset investments |

— |

— |

— |

— |

(1,870) |

— |

— |

(1,870) |

|

Current year gain on disposal of current asset investments |

— |

— |

— |

— |

355 |

— |

— |

355 |

|

Loss on fair value of fixed asset investments |

— |

— |

— |

— |

— |

(131,655) |

— |

(131,655) |

|

Gain on fair value of current asset investments |

— |

— |

— |

— |

— |

8,098 |

— |

8,098 |

|

Loss after tax |

— |

— |

— |

— |

— |

— |

(2,851) |

(2,851) |

|

Foreign exchange translation |

— |

— |

— |

— |

— |

— |

(1,548) |

(1,548) |

|

Total comprehensive income for the year |

— |

— |

— |

— |

(21,543) |

(123,557) |

(4,399) |

(149,499) |

|

Contributions by and distributions

to owners: |

|

|

|

|

|

|

|

|

|

Share issue (includes DRIS) |

273 |

207,132 |

— |

— |

— |

— |

— |

207,405 |

|

Share issue costs |

— |

(5,737) |

— |

— |

— |

— |

— |

(5,737) |

|

Repurchase of own shares |

(47) |

— |

47 |

(32,422) |

— |

— |

— |

(32,422) |

|

Dividends paid (includes DRIS) |

— |

— |

— |

(77,763) |

— |

— |

— |

(77,763) |

|

Total contributions by and distributions to owners |

226 |

201,395 |

47 |

(110,185) |

— |

— |

— |

91,483 |

|

Other movements: |

|

|

|

|

|

|

|

|

|

Share premium cancellation |

— |

(248,511) |

— |

248,511 |

— |

— |

— |

— |

|

Prior year current asset losses now realised |

— |

— |

— |

— |

(355) |

355 |

— |

— |

|

Transfer between reserves |

— |

— |

— |

— |

(14,242) |

14,242 |

— |

— |

|

Total other movements |

— |

(248,511) |

— |

248,511 |

(14,597) |

14,597 |

— |

— |

|

Balance as at 31 December 2023 |

1,594 |

45,780 |

74 |

1,025,614 |

(89,570) |

51,674 |

(41,422) |

993,744 |

- Reserves are available for distribution.

The accompanying notes form an integral part of the financial

statements.

Cash flow statement

|

|

Unaudited |

Unaudited |

Audited |

|

|

Six months to |

Six months

to |

Year

to |

|

|

30 June |

30 June |

31 December |

|

|

2024 |

2023 |

2023 |

|

|

£’000 |

£’000 |

£’000 |

|

Reconciliation of profit to cash flows from operating

activities |

|

|

|

|

Loss before tax |

(116,233) |

(87,609) |

(149,499) |

|

Decrease in debtors |

129 |

1,246 |

3,671 |

|

Decrease in creditors |

(842) |

(1,217) |

(440) |

|

Gain on disposal of current asset investments |

(17) |

— |

(355) |

|

Gain on valuation of current asset investments |

(1,836) |

(589) |

(8,098) |

|

Loss/(gain) on disposal of fixed asset investments |

572 |

1,922 |

(1,111) |

|

Loss on valuation of fixed asset investments |

106,859 |

72,556 |

131,655 |

|

Outflow from operating activities |

(11,368) |

(13,691) |

(24,177) |

|

Cash flows from investing activities |

|

|

|

|

Purchase of current asset investments |

— |

(364) |

— |

|

Sale of current asset investments |

7,129 |

— |

4,028 |

|

Purchase of fixed asset investments |

(24,509) |

(64,993) |

(97,650) |

|

Sale of fixed asset investments |

767 |

39,960 |

45,637 |

|

Outflow from investing activities |

(16,613) |

(25,397) |

(47,985) |

|

Cash flows from financing activities |

|

|

|

|

Movement in applications account |

(17,821) |

(22,961) |

(5,457) |

|

Dividends paid (net of DRIS) |

(24,115) |

(34,378) |

(58,210) |

|

Purchase of own shares |

(28,008) |

(18,161) |

(32,422) |

|

Share issues (net of DRIS) |

69,025 |

149,351 |

187,852 |

|

Share issues costs |

(1,893) |

(5,280) |

(5,737) |

|

Inflow/(outflow) from financing activities |

(2,812) |

68,571 |

86,026 |

|

Increase/(decrease) in cash and cash

equivalents |

(30,793) |

29,483 |

13,864 |

|

Opening cash and cash equivalents |

111,984 |

98,120 |

98,120 |

|

Closing cash and cash equivalents |

81,191 |

127,603 |

111,984 |

|

Cash and cash equivalents comprise of: |

|

|

|

|

Cash at bank |

551 |

228 |

2,970 |

|

Applications cash |

21 |

338 |

17,842 |

|

Money market funds |

80,619 |

127,037 |

91,172 |

|

Closing cash and cash equivalents |

81,191 |

127,603 |

111,984 |

The accompanying notes form an integral part of the financial

statements.

Condensed notes to the financial statements

1. Basis of preparation

The unaudited half-yearly results which cover the six months to

30 June 2024 have been prepared in accordance with the Financial

Reporting Council’s (FRC) Financial Reporting Standard 104 Interim

Financial Reporting (January 2024) and the Statement of Recommended

Practice (SORP) for Investment Companies re-issued by the

Association of Investment Companies in July 2022.

2. Publication of non-statutory accounts

The unaudited half-yearly results for the six

months ended 30 June 2024 do not constitute statutory accounts

within the meaning of Section 415 of the Companies Act 2006 and

have not been delivered to the Registrar of Companies. The

comparative figures for the year ended 31 December 2023 have been

extracted from the audited financial statements for that year,

which have been delivered to the Registrar of Companies. The

independent auditor’s report on those financial statements, in

accordance with Chapter 3, Part 16 of the Companies Act 2006, was

unqualified. This half-yearly report has not been reviewed by

the Company’s auditor.

3. Loss per share

The loss per share is based on 1,630,116,808

Ordinary shares (30 June 2023: 1,458,917,593 and 31 December

2023: 1,506,111,802), being the weighted average number of shares

in issue during the period. There are no potentially dilutive

capital instruments in issue and so no diluted returns per share

figures are relevant. The basic and diluted earnings per share are

therefore identical.

4. Net asset value per share

|

|

30 June |

30 June |

31 December |

|

|

2024 |

2023 |

2023 |

|

Net assets (£’000) |

892,520 |

1,055,683 |

993,744 |

|

Ordinary shares in issue |

1,666,741,092 |

1,547,797,287 |

1,593,601,092 |

|

Net asset value per share |

53.5p |

68.2p |

62.4p |

5. Dividends

The interim dividend declared of 1.2p (2%) per

share for the six months ending 30 June 2024 will be paid

on 19 December 2024 to those shareholders on the register as at 29

November 2024.

On 30 May 2024, a 1.9p second interim dividend

relating to the 2023 financial year was paid.

6. Buybacks and allotments

During the six months to 30 June 2024, the

Company bought back 47,758,782 Ordinary shares at a weighted

average price of 58.6p per share (six months ended

30 June 2023: 24,948,066 Ordinary shares at a

weighted average price of 72.8p per share; year ended

31 December 2023: 46,895,882 Ordinary shares at a weighted

average price of 69.1p per share).

During the six months to 30 June 2024,

120,898,782 shares were issued at a weighted average price of 65.5p

per share (six months ended 30 June 2023: 204,539,959 shares at a

weighted average price of 81.0p per share; year ended

31 December 2023: 272,547,045 shares at a weighted average

price of 78.6p per share).

7. Related party transactions

Octopus acts as the Portfolio Manager of the Company. Under the

management agreement, Octopus receives a fee of 2% per annum of the

net assets of the Company for the investment management services,

but in respect of funds raised by the Company under the 2018 Offer

and thereafter (and subject to the Company having a cash reserve of

10% of its NAV), the annual management charge on uninvested cash

will be the lower of either (i) the actual return that the Company

receives on its cash and funds that are the equivalent of cash

subject to a 0% floor and (ii) 2%. During the period, the Company

incurred management fees of £10,089,000 payable to Octopus

(30 June 2023: £10,439,000; 31 December 2023:

£21,082,000), which were fully settled by

30 June 2024.

Octopus provides non-investment services to the

Company and receives a fee for these services which is capped at

the lower of (i) 0.3% per annum of the Company’s NAV or (ii) the

administration and accounting costs of the Company for the year

ended 31 December 2020 with inflation increases in line with

the Consumer Price Index. During the period, the Company incurred

non-investment services fees of £1,047,000 payable to Octopus (30

June 2023: £1,046,000; 31 December 2023: £2,020,000), which were

fully settled by 30 June 2024.

In addition, Octopus is entitled to

performance-related incentive fees. The incentive fee arrangements

were designed to make sure that there were significant tax-free

dividend payments made to shareholders as well as strong

performance in terms of capital and income growth, before any

performance-related fee payment was made. There were no

performance-related fees accrued for the six months to 30 June 2024

(30 June 2023: £nil; 31 December 2023: £nil).

Titan owns Zenith Holding Company Limited, which

owns a share in Zenith LP, a fund managed by Octopus.

In the period, Octopus Investments Nominees

Limited (OINL) purchased Titan shares from shareholders to correct

administrative issues, with the intention that the shares will be

sold back to Titan in subsequent share buybacks. As at 30 June

2024, no Titan shares were held by OINL (30 June 2023: no shares;

31 December 2023: no shares) as beneficial owner. Throughout the

period to 30 June 2024, OINL purchased 7,840 shares (30 June 2023:

1,602,591; 31 December 2023: 1,883,000 shares) at a cost of £5,000

(30 June 2023: £1,372,000; 31 December 2023: £1,563,000) and sold

7,840 shares (30 June 2023: 1,602,591; 31 December 2023:

1,883,000 shares) for proceeds of £5,000 (30 June 2023: £1,171,000;

31 December 2023: £1,353,000). This is classed as a related party

transaction as Octopus, the Portfolio Manager, and OINL are part of

the same group of companies. Any such future transactions, where

OINL takes over the legal and beneficial ownership of Company

shares, will be announced to the market and disclosed in annual and

half-yearly reports.

Several members of the Octopus investment team

hold non-executive directorships as part of their monitoring roles

in Titan’s portfolio companies, but they have no controlling

interests in those companies.

The Directors received the following dividends

from Titan:

|

|

Period to |

Period to |

Year to |

|

|

30 June |

30 June |

31 December |

|

|

2024 |

2023 |

2023 |

|

Tom Leader (Chair) |

1,792 |

1,625 |

1,889 |

|

Matt Cooper1 |

19,893 |

70,597 |

— |

|

Jane O'Riordan |

4,268 |

4,428 |

6,901 |

|

Lord Rockley |

2,945 |

2,126 |

2,776 |

|

Julie Nahid Rahman |

85 |

— |

89 |

|

Gaenor Bagley |

904 |

733 |

901 |

|

Rupert Dickinson2 |

— |

— |

— |

- Matt Cooper stepped down as a Director on 14 June 2023.

- Rupert Dickinson was appointed as a Director on 1 May

2024.

8. Voting rights and equity management

The following table shows the percentage voting

rights held by Titan of each of the top ten investments held in

Titan, on a fully diluted basis.

|

|

% voting rights |

|

Investments |

held by Titan |

|

Mr & Mrs Oliver Ltd (trading as Skin+Me)1 |

20.6% |

|

Digital Therapeutics (trading as Pelago, formerly Quit Genius) |

14.0% |

|

Permutive Inc.1 |

17.8% |

|

Vitesse PSP Limited |

14.6% |

|

Amplience Limited |

20.5% |

|

Many Group Limited (trading as Many Pets)1 |

7.5% |

|

Elliptic Enterprises Limited1 |

11.3% |

|

vHive Tech Limited |

19.0% |

|

Orbital Express Launch Limited (trading as Orbex) |

10.0% |

|

Token.IO Limited1 |

13.5% |

1 These companies have also been invested in by

other funds managed by Octopus.

9. Post balance sheet events

The following events occurred between the balance sheet date and

the signing of this half‑yearly report:

- a final order to cancel share premium amounting to £120.6

million was granted on 30 July 2024.

10. Half-Yearly Report

The unaudited half-yearly report for the six months

ended 30 June 2024 will shortly be available to view at

octopustitanvct.com.

A copy of the report will be submitted to the

National Storage Mechanism and will shortly be available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information please contact:

Rachel Peat

Octopus Company Secretarial Services Limited

Tel: +44 (0)80 0316 2067

LEI: 213800A67IKGG6PVYW75

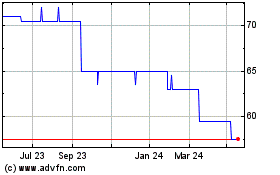

Octopus Titan Vct (LSE:OTV2)

Historical Stock Chart

From Oct 2024 to Nov 2024

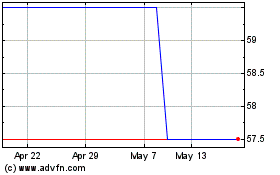

Octopus Titan Vct (LSE:OTV2)

Historical Stock Chart

From Nov 2023 to Nov 2024