TIDMOCTP

RNS Number : 5026E

Oxford Cannabinoid Tech.Holdings

11 March 2022

Oxford Cannabinoid Technologies Holdings plc

("OCTP", or the "Company")

Posting of Circular

&

Notice of Requisitioned General Meeting

Further to the announcement of 4 March 2022, Oxford Cannabinoid

Technologies Holdings plc (LSE: OCTP, OTCQB: OCTHF), the

pharmaceutical company developing prescription cannabinoid

medicines for approval by global regulatory agencies and targeting

the US$ multi-billion pain market, announces that it will today be

posting a circular (the "Circular") to Shareholders convening a

requisitioned general meeting (the "Requisitioned General

Meeting").

This follows the receipt of a letter from GHS Capital Limited

("GHS Capital"), the holder of 78,146,151 ordinary shares of

GBP0.01 each in the issued share capital of the Company ("Ordinary

Shares"), representing approximately 8.14 per cent. of the

Company's issued share capital, requisitioning a general meeting of

the Company, as announced on 18 February 2022.

The Requisitioned General Meeting will be held at the offices of

Penningtons Manches Cooper LLP, 125 Wood Street, London EC2V 7AW at

10.30 a.m. on 6 April 2022.

At the Requisitioned General Meeting Shareholders will be asked

to consider the following ordinary resolutions:

1. THAT James Brodie be and is hereby appointed as a director of

the Company (with such appointment taking immediate and

simultaneous effect).

2. THAT Richard Bedford be and is hereby appointed as a director

of the Company (with such appointment taking immediate and

simultaneous effect).

3. THAT Richard Grethe be and is hereby appointed as a director

of the Company (with such appointment taking immediate and

simultaneous effect).

4. THAT Julie Pomeroy be and is hereby removed as a director of the Company.

5. THAT Cheryl Dhillon be and is hereby removed as a director of the Company.

6. THAT John Lucas be and is hereby removed as a director of the Company.

7. THAT Neil Mahapatra be and is hereby removed as a director of the Company.

8. THAT Bishrut Mukherjee be and is hereby removed as a director of the Company.

9. THAT Richard Hathaway be and is hereby removed as a director of the Company.

10. THAT any person appointed as a director of the Company since

the date of the requisition of the Requisitioned General Meeting at

which this resolution is proposed, and who is not one of the

persons referred to in the resolutions numbered 1 through 10

(inclusive) above, be and is hereby removed as a director of the

Company.

The Board's unanimous recommendation is for shareholders to vote

AGAINST all of the resolutions being proposed by GHS Capital.

As announced on 4 March 2022, the Company is in receipt of

irrevocable undertakings to vote AGAINST the proposed resolutions

from Shareholders (including those of the Board) of 446,632,048

Ordinary Shares, representing approximately 46.5 per cent. of the

issued share capital of the Company.

Extracts from the Circular are set out below and should be read

in conjunction with the Circular. A copy of the Circular will

shortly be available from the Company's website:

www.oxcantech.com/investor-financial-results-centre and in hard

copy form at the Company's registered office

at Maddox House, 1 Maddox Street, London W1S 2PZ. It is also available for inspection at www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism .

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018).

The Directors of the Company accept responsibility for the

content of this announcement.

Enquiries:

Oxford Cannabinoid Technologies +44 (0)20 3034 2820

Holdings plc john@oxcantech.com

Dr John Lucas (CEO) clarissa@oxcantech.com

Clarissa Sowemimo-Coker (COO)

Cairn Financial Advisers LLP

Emily Staples +44 (0)20 7213 0897

Jo Turner +44 (0) 20 7213 0885

Walbrook PR Limited +44 (0)20 7933 8780

Paul Vann +44 (0)7768 807631

Nicholas Johnson oxcantech@walbrookpr.com

Harbor Access LLC (US/OTCB enquiries) +1 (203) 862 0492

Jonathan Paterson Richard.Leighton@harboraccessllc.com

Richard Leighton

About Oxford Cannabinoid Technologies Holdings Plc :

Oxford Cannabinoid Technologies Holdings plc is the holding

company of Oxford Cannabinoid Technologies Ltd, a pharmaceutical

company developing prescription cannabinoid medicines for approval

by key medicines regulatory agencies worldwide and targeting the U$

multi-billion pain market (together the "Group"). Cannabinoids are

compounds found in the cannabis plant that have been shown to have

a range of therapeutic effects on the body, including pain relief.

The Group has a clearly defined path to commercialisation, revenues

and growth. The Group is developing drug candidates through

clinical trials to gain regulatory approval (FDA/MHRA/EMA) that

will enable medical professionals to prescribe them with

confidence.

The Group's portfolio aims to balance risk, value and time to

market, whilst ensuring market exclusivity around all its key

activities. The Group's lead compound, OCT461201, is a highly

potent and selective CB2 agonist and is being developed by OCT in a

solid oral dosage form. OCT is conducting pre-clinical testing and

development with clinical trials scheduled for Q1 2023. The Group's

product pipeline also uses a balanced drug product strategy that

employs both natural and synthetic compounds for the treatment of

rare diseases and includes chemically modified phytocannabinoids

with improved drug-like characteristics and a proprietary library

of cannabinoids.

OCTP operates a partnership model with external academic and

commercial partners.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

LETTER FROM THE BOARD

Notice of Requisitioned General Meeting and unanimous

recommendation of your Board to

VOTE AGAINST all Resolutions

1. INTRODUCTION

On 18 February 2022, the Company received a notice ("Notice of

Requisition") from Gavin Sathianathan in his capacity as Chairman,

CEO and Director of GHS Capital Limited, which is the holder of

78,146,151 Ordinary Shares, representing approximately 8.14 per

cent. of the issued ordinary share capital in the Company,

requesting the Company to convene a general meeting of its

Shareholders pursuant to section 303 of the Act.

The Notice of Requisition requires the Directors to convene a

general meeting (the "Requisitioned General Meeting") for the

purpose of proposing ordinary resolutions to remove Julie Pomeroy,

Cheryl Dhillon, John Lucas, Neil Mahapatra, Bishrut Mukherjee and

Richard Hathaway as Directors of the Company and to appoint James

Brodie, Richard Bedford and Richard Grethe, as directors of the

Company.

On 24 November 2021, following the Company's Annual General

Meeting at which the entire Board was re-elected (save for Richard

Hathaway who has only recently been appointed), Mr Sathianathan

resigned from his role as a Non-Executive Director of the Company

stating that he remained "fully supportive of the Company" and that

he was looking forward "to playing an active role as a key

shareholder in the future".

Your Board is not aware of any change in circumstances over the

past three months since the Annual General Meeting that justify, in

any sense, the Notice of Requisition and we deal, in detail, with

each of the purported issues raised by Mr Sathianathan in paragraph

3 below. Since Admission, the Board has not deviated from the

strategy set out in the Company's Prospectus and operationally, the

Company has made good progress and is in strong financial health.

Cash resources remain within forecast at approximately GBP11m as at

the date of the Circular, with the Company on target to be in phase

1 clinical trials with both OCT461201 and OCT130401 by Q1 2023

which is anticipated by the Directors to drive value for the

Company and its Shareholders.

Your Board believes that Mr Sathianathan's proposals should be

firmly resisted in the interests of Shareholders as a whole and

that all Shareholders should vote AGAINST the Requisitioned

Resolutions. As announced on 4 March 2022, the Company is already

in receipt of irrevocable undertakings from holders (including

those of the Board) of 446,632,048 Ordinary Shares, representing

approximately 46.5 per cent. of the issued share capital of the

Company, to vote AGAINST the Requisitioned Resolutions.

A notice convening the Requisitioned General Meeting for 10.30

a.m. on 6 April 2022 is set out on page 14 of the Circular.

The purpose of this letter is to explain why your Board believes

these proposals are wholly unacceptable and strongly believes that

the Requisitioned Resolutions are not in the best interests of the

Company and its Shareholders as a whole and, given the irrevocable

undertakings already secured from Shareholders to vote against the

Requisitioned Resolutions, regrets the unnecessary expense, waste

of management time and damage to your Company caused by the actions

of former Non-Executive Director Mr Sathianathan and GHS Capital

Limited.

Accordingly, your Board recommends unanimously that Shareholders

VOTE AGAINST THE REQUISITIONED RESOLUTIONS at the Requisitioned

General Meeting.

2. REASONS GIVEN FOR THE REQUISITIONED GENERAL MEETING

In accordance with the Act, the letter from Mr Sathianathan in

his capacity as Chairman, CEO and Director of GHS Capital Limited

setting out his reasons for requesting the Company to convene the

Requisitioned General Meeting accompanies the Circular.

3. YOUR BOARD'S RESPONSE TO THE NOTICE OF REQUISITION

Your Board believes that the Requisitioned Resolutions proposed

by GHS Capital are completely without merit. They are also a

distraction to the Board whose focus should be on continuing to

execute the strategy communicated in the Prospectus it prepared in

support of its admission to the standard segment of the Official

List and to trading on the Main Market on 21 May 2021. Since

Admission, the Board has not deviated from this stated strategy and

the Directors believe that to change it at this time would be to

destroy the key value in the Company when the building blocks have

been put in place to create a successful participant in the

pharmaceutical cannabinoid market.

In the following paragraphs, the Board discusses the operational

status of the Company's wholly owned operating subsidiary Oxford

Cannabinoid Technologies Ltd ("OCT") and the Company's share price

performance, and addresses each point made in the statement by GHS

Capital.

A. Summary of the operational status of the Group communicated

via various announcements since Admission

The Company has made strong progress since Admission and is on

track to complete all workstreams outlined in the Prospectus.

Specific detail is provided on each drug development programme

below:

-- Programme 1 (OCT461201): OCT461201 has progressed through

pre-clinical development, in-line with plans communicated at

Admission. The Group has entered into research contracts with

Voisin Consulting SARL and a subsidiary of Evotec SE for

manufacturing, development and compound crystallisation, as

preparation for phase 1 clinical trials continues in earnest. The

Group expects to start phase 1 clinical trials in early Q1 2023

rather than late Q3 2022, a result of technical issues associated

with scale manufacturing that necessitated additional compound

optimisation. However, at this time the Board does not believe that

this will impact either the anticipated time to phase 2 clinical

trials nor the ultimate time to market;

Most importantly, as outlined in the Company's announcement of 8

March 2022, the results of a recent pre-clinical efficacy study

before human trials show OCT461201 successfully reduces pain in a

pre-clinical animal model of Chemotherapy Induced Peripheral

Neuropathy ("CIPN") induced by paclitaxel, a widely used

chemotherapy agent. Two common symptoms of CIPN are pain caused by

innocuous stimuli, like light touch (mechanical allodynia) and heat

or cold (thermal hyperalgesia). In the study, OCT461201

significantly reduced pain from both mechanical allodynia and

thermal hyperalgesia compared to untreated animals. This is a

positive result: whilst a compound's path through human clinical

trials always has uncertainty, the Directors believe the results

will translate to humans. It should also be noted that previous

animal safety data suggests that a three times more concentrated

dose of OCT461201 could have been administered. The Company's Chief

Executive Officer, John Lucas, was primarily responsible for the

identification, negotiation, licensing and development of

OCT461201;

-- Programme 2 (OCT 130401): The Company's other lead programme

has also progressed in-line with the plans communicated at

Admission. The Group has entered into development agreements with

Charles Rivers Laboratories Edinburgh Ltd, Purisys LLC, and OZ UK

Ltd, as OCT130401 and its inhaler delivery device are prepared for

phase 1 clinical trials, anticipated in Q4 2022. There has been a

short delay in development time (from Q3 2022), driven by partners'

capacity challenges caused by Covid, but the Board does not

currently believe that this will affect the time to phase 2

clinical trials, nor the ultimate time to market. The Group has

also announced the orphan indication Trigeminal Neuralgia as the

initial target for OCT130401, an indication in the growing

neuralgia market, which overall is worth approximately $1.8

billion. The Directors believe that this second primary programme

is as exciting as OCT461201, and being a phytocannabinoid

combination, adds balance to the Company's drug development

strategy;

-- Programmes 3 & 4: with regards to its earlier-stage

development programmes, the Company has surpassed the deliverables

communicated to investors at Admission. Cannabinoid derivatives are

at the core of both programmes and last September, the Company

announced the Group's exclusive agreement with Canopy Growth

Corporation ("Canopy Growth" or "Canopy") for its pharmaceutical

cannabinoid derivative library, comprising 335 derivatives and 14

patent families. This has jump-started both development programmes,

with multiple screening initiatives already underway across an

expanded therapeutic area set (including pain, neurology, and

oncology). The Group is working with the organisation that

previously synthesised the compounds for Canopy Growth (leveraging

existing knowledge) and the drug development agreement signed with

Oxford Stemtech Ltd ("Stemtech") is significant, with Stemtech's

cutting-edge in-vitro "pain-in-a-dish" model (using human adult

stem cells) allowing for high-throughput experiments to be

completed cost effectively.

Noting that there has been no deviation in strategy to that set

out in the Prospectus it is disappointing to receive the Notice of

Requisition, requested by a Shareholder who previously supported

this same strategy from before Admission up to as recently as four

months ago. Operationally, the Company has made good progress since

Admission and is in strong financial health. Cash resources remain

within forecast at approximately GBP11m as at the date of the

Circular, with the Company on target to be in phase 1 clinical

trials with both OCT461201 and OCT130401 by Q1 2023 which is

anticipated by the Directors to drive value for the Company and its

Shareholders.

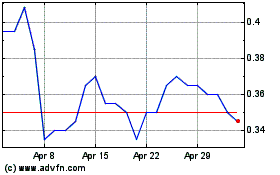

B. Share Price Performance

The share price performance of the Company since Admission is a

huge disappointment to the Board. However, we neither believe that

this represents the value of the Company nor is it a function of

poor strategy or any issue that is intrinsic to the Company. The

Board believes that the share price has largely decreased due to a

poor market backdrop and selling from short-term investors hoping

to make a quick return in the cannabis market. We do not believe

that the price is indicative of the operational or financial health

of the business nor the outlook in the medium term and beyond. In

particular:

-- Market backdrop: the market backdrop for all London-listed

cannabis companies has been extremely poor over the last nine

months. On average, between Admission and 18 February 2022 (the

date of the Notice of Requisition), the share prices of the

Company's London-listed cannabis-related peers have fallen by

approximately 47 per cent. (see chart below). Shares in

biotechnology companies have also fallen (with the Nasdaq

biotechnology index having fallen by approximately 14% over the

same period). As such, being both a cannabinoid company and a

biotechnology business, the Company has been caught in a "perfect

storm" of negative market performance. This goes some way to

explaining share price performance since Admission, but the

Directors believe that it is not representative of the long-term

prospects for the Company;

-- Cash to reach value inflection: when assessing the actual

prospects of the Company, your Board is of the view that the single

most important criteria is that the Company has the necessary

capital required to progress its drug development activities to

reach key value inflection points. These inflection points are the

completion of phase 1 clinical trials for the two primary drug

programmes. We do not currently believe that there will be any

requirement for additional capital raises in order for these

milestones to be met;

-- Positioning: The Board believes that the Company's

positioning remains a point of difference amongst its London-listed

cannabis peers. In a cannabis market where unlicensed medicines are

abundant and unproven, the Company's underlying philosophy is

unchanged and consistent: that it is only by developing cannabinoid

medicines through the existing channels of drug development that

the medical community can have the confidence to prescribe in

volume. The agreements that the Group has signed to date reflect

this core ethos: we have partnered with organisations that

represent the gold-standard in pharmaceutical development. The

Board believes that this positioning will be of increasing value as

the Company's drug programmes progress and drive share price

appreciation in the medium and long term;

-- Selling pressure: it is also worth noting that the selling

activity in the Company's shares since Admission has contributed to

a constant downwards pressure on the share price. We understand

that this consistent selling presence has been an impediment to any

share buying momentum in the Ordinary Shares.

As an early stage pharmaceutical business, the Company has

always been positioned as a long-term investment. This has not

changed: the path of drug development is necessarily long, and

biotechnology companies typically face challenges associated with a

paucity of share price catalysts between developmental milestones.

However, the Board does not believe that this is representative of

the medium and long term prospects for the Company.

C. Addressing the Notice of Requisition

As set out above, the Board believes that the Requisitioned

Resolutions proposed by GHS Capital are without merit,

opportunistic, and poorly considered. We address each of the points

made in turn:

-- Strategic Review: it is disappointing to see a request for a

strategic review. The Company's strategy remains the same as that

communicated at Admission and is in line with the current trends in

cannabinoid drug development. Our strategy aims to employ a

balanced approach that combines previously successful strategies

(e.g. targeting orphan indications) with new strategies enabled by

recent advances in cannabinoid research (e.g. more focus on

individual molecules, cannabinoid derivatives and novel receptors).

This has already started to generate success: as announced on 8

March 2022, pre-clinical data for OCT461201 suggests a positive

dose dependant effect in CIPN, which affects, on average, an

estimated 60 per cent. of people undergoing chemotherapy at 3

months, our phytocannabinoid inhaler continues development for

Trigeminal Neuralgia, an orphan indication, and as previously

announced, Canopy Growth (one of the largest cannabis firms in the

world) has entrusted the Company with its library of cannabinoid

derivative compounds, providing strong validation of the Company's

derivative strategy;

We strongly believe that there is no need for the Company to

change direction and we continue to execute on exactly the strategy

that was outlined at Admission (which Mr Sathianathan previously

voted for whilst a Non-Executive Director of the Company). Any

deviation from this strategy would likely immediately negate the

financial investment that has been made into each development

programme and cause significant delays in taking any drugs to

market. As set out above, the Company has already received

irrevocable undertakings from Shareholders holding 46.5% of the

Ordinary Shares to vote against the Requisitioned Resolutions -

these are Shareholders that are long term investors in the Company

and their support is key;

-- Reduction of Costs: this point is entirely without merit and

unjustified. Firstly, as shown in the interim financial statements,

the administrative costs of the Company are under constant scrutiny

and efforts to generate cost savings are on-going. For example, as

set out in the Interim Results for the six months ended 30 November

2021, the Company has given notice on its London office, expiring

31 March 2022, which is expected to generate cost savings of circa

GBP130k per year. The Company also terminated a services agreement

with Kingsley Capital Partners LLP in December 2021, generating

further cost savings. Secondly, the anticipated costs were drawn-up

in detail, in preparation for Admission, and were agreed to by the

Company's advisers and approved by the Board, (including Mr

Sathianathan when he was a Non-Executive Director). Finally, as

announced on 4 March 2022, in light of the number of irrevocable

undertakings received, we gave Mr Sathianathan the opportunity to

withdraw the Notice of Requisition in an attempt to avoid

unnecessary expense but he declined to engage with us;

-- Replacement of Directors: it is disappointing to see Mr

Sathianathan actively championing a reduction of diversity with his

proposed replacement directors. We firmly believe that none of the

Directors need to be replaced and, indeed, all of them, save for

Richard Hathaway who has only recently been appointed, were

re-elected at the Company's Annual General Meeting on 24 November

2021, just over three months ago. The Board already comprises the

skillsets required to guide the business past the completion of

clinical trials and through to the marketing authorisation of its

drugs. Taking them in turn:

John Lucas - in John, we have a seasoned CEO who has identified

and in-licensed a compound with significant potential, driven the

development of all four drug programmes, is taking OCT's first two

drug programmes successfully through pre-clinical development, and

who was also instrumental in negotiating the agreement with Canopy

Growth for its pharmaceutical cannabinoid derivative library,

comprising 335 derivatives and 14 patent families , which has added

significant momentum to the Company's third and fourth

programmes;

Cheryl Dhillon - in Cheryl the Company is fortunate to have an

independent Non-Executive Director who is an experienced

pharmaceutical executive with three decades of experience in

companies including Ares Serono Group, Elan Corporation Plc,

Lorantis Ltd and a tenure of over 15 years with Otsuka

Pharmaceutical Europe Ltd; part of the Otsuka family of companies.

Cheryl's advice is already invaluable but will become even more so

when the Company starts clinical trials in a few months;

Richard Hathaway - Richard is currently Corporate Development

Director at FTSE-100 Imperial Brands plc where he is responsible

for leading M&A activity and other strategic initiatives and

projects across the business. He has extensive experience of

auditing and advising public and private companies across a wide

range of sectors, including transactions such as financing and

restructuring, acquisitions and disposals;

Bishrut Mukherjee - Bishrut has played a valuable role to date

in guiding the Company, not only in terms of its operational drug

development activities but also in evaluating the strategic

direction of the business. Following his resignation from Imperial

Brands Ventures Limited in September 2021, he also provides

valuable perspective as an independent Non-Executive Director and

his wide range of experience within operational delivery, M&A,

corporate strategy and investment analysis, principally across

regulated industries including those of manufacturing, energy,

pharmaceuticals and FMCG is an asset to the Board;

Neil Mahapatra - as the founder and previous Chairman, Neil

retains a deep knowledge of the business, its history and strategy.

Neil was responsible for approaching Oxford University and

negotiating the Company's research agreement with Oxford

University, launching the cannabinoid derivative creation programme

as a result. He liaised with the UK Home Office to obtain OCT's

first licence for cannabis handling and research and was

responsible for securing all private funding for the Company aside

from Imperial Brands and nearly 25 per cent. of funds at Admission

(the remainder secured by a capital raising firm);

Julie Pomeroy - in Julie the Company has a skilled and balanced

independent Non-Executive Chair with around 20 years' experience on

the boards of publicly quoted companies. She is a Non-Executive

Director at Dillistone Group Plc, an AIM quoted software business,

where until September 2021 she was the group finance director and

company secretary having joined in 2010. She also spent over 12

years as a non-executive director on two NHS Trust Boards. Julie is

a Chartered Accountant and also a Chartered Director and brings

governance experience for publicly listed companies;

-- Improve corporate governance: we strongly reject this

criticism and believe it to be a generic request due to its absence

of foundation. The Board places great emphasis on good corporate

governance and, as set out in the Prospectus, has not only

committed to comply with the Premium Listing Principles set out in

Chapter 7 of the Listing Rules (notwithstanding that they only

apply to companies with a Premium Listing) and to adopt and comply

with the QCA Code on a comply or explain basis but, as set out in

the 2021 Annual Report, the Company has complied with the QCA Code

to date and has no intention to deviate from this. In addition, the

Board is surprised that Mr Sathianathan would raise an issue such

as this in a requisition notice rather than engage directly with

the Board, either while he held the position of Non-Executive

Director or subsequently, through GHS Capital, as a large

Shareholder, where any concern he may have had could have been

discussed and implemented if deemed appropriate W e note that at

midnight on the day before the Company was required to post the

Circular, Mr Sathianathan sent a letter to the Chair making various

spurious allegations concerning the Board and the Company's

operations. We will consider these in full and address them

separately to the extent they merit a response.

4. IRREVOCABLE UNDERTAKINGS

As announced on 4 March 2022, the Directors are pleased to

report that they have received irrevocable undertakings (including

those of the Board) to vote against the Requisitioned Resolutions

from Shareholders representing approximately 46.5 per cent. of the

Company's issued share capital.

5. NOTICE OF REQUISITIONED GENERAL MEETING

A notice convening the Requisitioned General Meeting at which

the Requisitioned Resolutions will be proposed is set out on page

14 of the Circular.

Shareholders are asked to note that in line with the most recent

Institutional Shareholder Services' Proxy Voting Guidelines,

effective for meetings on are after 1 February 2022, the

Requisitioned General Meeting is being called on 21 days' notice

rather than 14 days to enable Shareholders to have as much notice

of the meeting with time for consideration as practicable.

6. ACTION TO BE TAKEN BY SHAREHOLDERS

Shareholders who hold their Ordinary Shares in certificated form

should check that they have received the following with the

Circular:

-- a Form of Proxy for use in relation to the Requisitioned General Meeting; and

-- a reply-paid envelope for use in connection with the return

of the Form of Proxy (in the UK only).

You are strongly encouraged to complete, sign and return your

Form of Proxy in accordance with the instructions printed thereon

so as to be received, by post or, during normal business hours

only, by hand to the Company's Registrar, Computershare Investor

Services PLC at The Pavilions, Bridgwater Road, Bristol BS99 6ZY ,

as soon as possible but in any event so as to arrive by not later

than 10:30 a.m. on 4 April 2022 (or, in the case of an adjournment

of the Requisitioned General Meeting, not later than 48 hours

before the time fixed for the holding of the adjourned meeting

(excluding any part of a day that is not a Business Day)).

Alternatively, register your vote online by visiting

www.investorcentre.co.uk/eproxy and following the instructions

provided.

7. DIRECTORS' RECOMMATION

The Company's share price performance in the ten months since

Admission is hugely disappointing. However, we believe this relates

to short term issues which are not reflective of the fundamentals

of the business: by continuing to execute on the strategy outlined

at Admission, the Board believes that the Company's prospects

remain positive, with enough capital raised at Admission to ensure

that important milestones of bringing OCT461201 and through to

completion of phase 1 clinical trials, as set out in the

Prospectus, can be reached. The Board is proud of the support shown

by its Shareholders, as evidenced by the irrevocable undertakings

to vote against all the Requisitioned Resolutions already received

representing over 46.5% of the issued share capital.

We believe that any Shareholders choosing to support the

Requisitioned Resolutions would be endorsing values that are not

consistent with the Company or its institutional investors:

short-termism and a seemingly active desire to reduce diversity,

promoted by a Shareholder who seems content for the Company to

incur unnecessary and significant costs in the calling of the

Requisitioned Meeting. None of these are values that the Company or

its Board stands for.

The Company has a clear strategy for drug development. The

Directors are committed to providing the management team with the

time and resource necessary to execute on the strategy outlined in

the Prospectus, without distractions such as these.

For all of the reasons given above, your Board believes that

these proposals should be firmly resisted in the interests of

Shareholders as a whole and that all Shareholders should vote

AGAINST the Requisitioned Resolutions to be proposed at the

Requisitioned General Meeting. As announced on 4 March 2022, the

Company is already in receipt of irrevocable undertakings from

holders (including those of the Board) of 446,632,048 Ordinary

Shares, representing approximately 46.5 per cent. of the issued

share capital of the Company, to vote AGAINST the Requisitioned

Resolutions.

Yours sincerely

Julie Pomeroy Cheryl Dhillon Richard Hathaway Bishrut Mukherjee

Chair NED NED NED

Neil Mahapatra John Lucas Karen Lowe Clarissa Sowemimo-Coker

NED CEO CFO COO

DEFINITIONS

The following de nitions apply throughout the Circular unless

the context otherwise requires:

"Act" the Companies Act 2006 (as amended);

"Admission" the admission of the Ordinary Shares

to the standard listing segment of the

Official List and to trading on the Main

Market that became effective on 21 May

2021;

"Board" or "Directors" the directors of the Company as at the

date of the Circular, whose names are

set out on page 4 of the Circular;

"Business Day" any day (excluding Saturdays and Sundays)

on which banks are open in London for

normal banking business and the London

Stock Exchange is open for trading;

"Cellular Goods" Cellular Goods plc;

"certificated" or "in where an Ordinary Share is not in uncertificated

certificated form" form (i.e. not held in CREST);

"Chair" the chair of the Board;

"CIPN" Chemotherapy Induced Peripheral Neuropathy;

"Company" Oxford Cannabinoid Technologies Holdings

PLC, a company incorporated in England

and Wales under company number 13179529;

"CREST" the relevant system for the paperless

settlement of trades and the holding

of uncerti cated securities operated

by Euroclear in accordance with the CREST

Regulations;

"CREST participant ID" shall have the meaning given in the CREST

Manual;

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001/3755) including any enactment

or subordinate legislation which amends

or supersedes those regulations and any

applicable rules made under those regulations

or any such enactment or subordinate

legislation for the time being in force;

"Euroclear" Euroclear UK & International Limited;

"FCA" the Financial Conduct Authority of the

United Kingdom;

"Form of Proxy" the form of proxy for use by Shareholders

in relation to the Requisitioned General

Meeting, enclosed with the Circular;

"FSMA" the Financial Services and Markets Act

2000 (as amended);

"Group" the Company and its subsidiaries (as

defined in the Act);

"Kanabo" Kanabo Group plc;

"Listing Rules" the listing rules of the FCA;

"London Stock Exchange" London Stock Exchange Group plc;

"Main Market" the London Stock exchange's main market

for listed securities;

"MGC Pharma" MGC Pharmaceuticals Limited;

"Notice of Requisition the notice from Gavin Sathianathan in

" his capacity as Chairman, CEO and Director

of GHS Capital Limited dated 18 February

2022;

"Notice of Requisitioned the notice convening the Requisitioned

General Meeting " General Meeting as set out at the end

of the Circular;

" OCT " Oxford Cannabinoid Technologies Ltd,

the Company's wholly owned subsidiary;

" Official List " the Official List maintained by the FCA;

"Ordinary Shares" the ordinary shares of GBP0.01 each in

the capital of the Company in issue from

time to time;

"Oxford University" The Chancellor Masters and Scholars of

the University of Oxford;

"Pharma C" Pharma C Investments PLC;

"Premium Listing" a premium listing on the Official List

under Chapter 6 of the Listing Rules;

"Premium Listing Principles" the listing principles, applicable to

a company with a Premium Listing, contained

in Chapter 7 of the Listing Rules;

" Prospectus " the prospectus dated published by the

Company in connection with Admission

dated 17 May 2021;

" Prospectus Regulation the prospectus regulation rules of the

Rules " FCA made pursuant to

section 73A of the FSMA, as amended;

"QCA Code" the QCA Corporate Governance Code 2018,

published by the

Quoted Companies Alliance;

"Registrar" Computershare Investor Services PLC of

The Pavilions, Bridgwater, Road, Bristol

BS13 8AE;

"Regulatory Information one of the regulated information services

Service" authorised by the FCA to receive, process

and disseminate regulatory information

in respect of listed companies;

"Requisitioned General the Requisitioned General Meeting of

Meeting" the Company convened for 10:30 a.m. on

6 April 2022 or any adjournment thereof,

notice of which is set out at the end

of the Circular;

"Requisitioned Resolutions" the resolutions to be proposed at the

Requisitioned General Meeting, the full

text of which are set out in the Notice

of Requisitioned General Meeting;

"Shareholders" the holders of Ordinary Shares, and the

term "Shareholder" shall be construed

accordingly;

"uncerti cated" or "uncerti means recorded on the relevant register

cated form" or other record of the share or other

security concerned as being held in uncerti

cated form in CREST, and title to which,

by virtue of the CREST Regulations, may

be transferred by means of CREST;

"United Kingdom" or "UK" the United Kingdom of Great Britain and

Northern Ireland;

"GBP" or "Pounds" UK pounds sterling, being the lawful

currency of the United Kingdom;

"World High Life" World High Life plc.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGBKDBQCBKKCND

(END) Dow Jones Newswires

March 11, 2022 05:00 ET (10:00 GMT)

Oxford Cannabinoid Techn... (LSE:OCTP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oxford Cannabinoid Techn... (LSE:OCTP)

Historical Stock Chart

From Apr 2023 to Apr 2024