TIDMOCTP

RNS Number : 3482C

Oxford Cannabinoid Tech.Holdings

22 February 2022

22 February 2022

Oxford Cannabinoid Technologies Holdings plc

("OCTP" or the "Company")

Interim Results for the six months ended 30 November 2021

London, 22 February 2022 : Oxford Cannabinoid Technologies

Holdings plc (LSE: OCTP, OTCQB: OCTHF, "OCT or the "Group") the

pharmaceutical company developing prescription cannabinoid

medicines for approval by global regulatory agencies and targeting

the US$ multi-billion pain market, announces its Interim Results

for the six months ended 30 November 2021 (the "Period").

Operational Highlights

-- Good progress made across all four of the Group's current drug development programmes.

-- OCT461201, a cannabinoid-like compound for neuropathic and

visceral pain, is expected to enter phase 1 clinical trials in Q1

2023.

-- OCT130401, a combination of inhaled phytocannabinoids for

Trigeminal Neuralgia, is expected to enter phase 1 clinical trials

in Q4 2022.

-- Timescales to phase 2 clinical trials remain on target, with

revenue generation expected to commence in 2027.

-- GBP2.6 million contract research agreement with Aptuit

(Verona) SRL, a subsidiary of Evotec SE.

-- Exclusive license agreement with Canopy Growth for

pharmaceutical cannabinoid derivative library, including 335

compounds and 14 patent families.

Financial Highlights

-- Robust balance sheet, debt-free with cash reserves of

approximately GBP12.0m at Period-end (31 May 2021: GBP14.6m). Cash

is still forecast to be fully utilised by March 2023.

-- Cost savings continue to be made, including closure of London

office, expected to generate savings of approximately GBP130k

p.a.

-- Research costs (excluding salary costs) of GBP935k incurred

during first half, of which GBP604k relates to OCT461201.

-- Administrative costs of GBP1.2m include salary and associated

costs of GBP677k and a share based (non-cash) payment charge of

GBP204k in advance of phase 1 clinical trials.

-- R&D tax credit in the first half of GBP269k (31 May 2021:

GBP139k), with tax losses surrendered for the R&D tax credit

payment.

-- Repayment of GBP50k government Bounce-Back loan in November 2021.

Post Period-end highlights

-- Admission to trading on the OTC QB market in the United

States under the ticker symbol "OCTHF".

-- Company currently finalising the organisation of its

Scientific Advisory Board with details expected to be announced in

the first half of 2022.

-- Change of Accounting year end to 30 April.

John Lucas, CEO of Oxford Cannabinoid Technologies Holdings plc,

said: " The Group has continued to build on the positive start made

to the current financial year. During the period, progress was made

on all four of the Group's programmes, particularly regarding the

Group's lead candidate OCT461201: a cannabinoid-like compound for

neuropathic and visceral pain.

"The several agreements signed across all of our drug

programmes, including with Aptuit (Verona) SRL, a subsidiary of

Evotec SE, Voisin Consulting SARL, Canopy Growth Corporation and

Oxford Stemtech Ltd all reflect the Company's core ethos: to

partner with organisations recognised as "best-in-class" that can

drive quality and shareholder value.

"The Board remains confident that OCTP is well placed to benefit

from the opportunities that lie ahead. The fundamentals of the

Group remain strong, delivering against the strategy laid out in

the IPO prospectus and with a strong financial base."

Analyst Briefing, 9:30am, Today 22 February 2022

A briefing for Analysts will be held at 9:30am GMT today.

Analysts interested in attending should contact Walbrook PR by

emailing oxcantech@walbrookpr.com or by calling 020 7933 8780.

Investor Presentation, 4.30pm, Today 22 February 2022

A live online presentation via the Investor Meet Company

platform will also be held at 4.30pm (BST) today, which is open to

all existing and potential shareholders. Questions can be submitted

at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Oxford Cannabinoid Technologies Holdings plc via:

https://www.investormeetcompany.com/oxford-cannabinoid-technologies-holdings-plc/register-investor

Investors who follow OCTP on the Investor Meet Company platform

will automatically receive an invitation to the event.

The unaudited interim report for the 6 months ended 30 November

2021 is available on the Company's website at: www.oxcantech.com

and in hard copy form at the Company's registered office at Maddox

House, 1 Maddox Street,

London W1S 2PZ . It is also available for inspection at www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism .

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information for the purposes of Article 7 of EU Regulation 596/2014

(which forms part of domestic UK law pursuant to the European Union

(Withdrawal) Act 2018) . With the publication of this announcement,

this information is now considered to be in the public domain.

The Directors of the Company accept responsibility for the

content of this announcement.

Enquiries:

Oxford Cannabinoid Technologies +44 (0)20 3034 2820

Holdings plc john@oxcantech.com

Dr John Lucas (CEO) clarissa@oxcantech.com

Clarissa Sowemimo-Coker (COO)

Cairn Financial Advisers

Emily Staples +44 (0)20 7213 0897

Jo Turner +44 (0) 20 7213 0885

Walbrook PR Limited +44 (0)20 7933 8780

Paul Vann +44 (0)7768 807631

Nicholas Johnson oxcantech@walbrookpr.com

Harbor Access LLC (US/OTCB enquiries)

Jonathan Paterson +1 (203) 862 0492

Richard Leighton Richard.Leighton@harboraccessllc.com

About Oxford Cannabinoid Technologies Holdings Plc

Oxford Cannabinoid Technologies Holdings plc is the holding

company of Oxford Cannabinoid Technologies Ltd, a pharmaceutical

company developing prescription cannabinoid medicines for approval

by key medicines regulatory agencies worldwide and targeting the U$

multi-billion pain market (together the "Group"). Cannabinoids are

compounds found in the cannabis plant that have been shown to have

a range of therapeutic effects on the body, including pain relief.

The Group has a clearly defined path to commercialisation,

revenues, and growth. The Group is developing drug candidates

through clinical trials to gain regulatory approval (FDA/MHRA/EMA)

that will enable medical professionals to prescribe them with

confidence.

The Group's portfolio aims to balance risk, value and time to

market, whilst ensuring market exclusivity around all its key

activities. The Group's lead compound, OCT461201, is a highly

potent and selective CB2 agonist and is being developed by OCT in a

solid oral dosage form. OCT is conducting pre-clinical testing and

development with clinical trials scheduled for Q1 2023. The Group's

product pipeline also uses a balanced drug product strategy that

employs both natural and synthetic compounds for the treatment of

rare diseases and includes chemically modified phytocannabinoids

with improved drug-like characteristics and a proprietary library

of cannabinoids.

OCTP operates a partnership model with external academic and

commercial partners.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

CEO's Interim Management Statement

Oxford Cannabinoid Technologies Holdings plc ("OCTP") is a

pharmaceutical company developing prescription cannabinoid

medicines for approval by global regulatory agencies and targeting

the US$ multi-billion pain market. The Group is comprised of Oxford

Cannabinoid Technologies Holdings plc ("OCTP") and its wholly owned

subsidiary Oxford Cannabinoid Technologies Ltd ("OCT").

This unaudited interim report for the six-month period ended 30

November 2021 should be read in conjunction with the Group's

published annual report for the period ended 31 May 2021 and the

public announcements made by the Group during the interim reporting

period (accessible at www.oxcantech.com ).

Programmes 1 and 2

The Group has continued to build on the positive start made to

the current financial year. During the period, progress was made on

all four of the Group's programmes, particularly regarding the

Group's lead candidate OCT461201: cannabinoid-like compound for

neuropathic and visceral pain ("Programme 1").

In July 2021, OCT entered into a GBP2.6 million contract

research agreement with Aptuit (Verona) SRL, a subsidiary of Evotec

SE (together "Evotec") with the planning phase now completed and

work having commenced on the manufacturing process development and

crystallisation development. The Group now expects to commence

phase 1 clinical trials in Q1 2023 rather than Q3 2022 as a result

of technical issues requiring additional optimisation of the

crystal development for scale-up manufacturing, which has been now

successfully implemented. However, the Board does not believe this

will impact the time to phase 2 clinical trials, there is no

material cash flow implications and, importantly, time to market is

currently expected/anticipated to remain the same.

The Group's development work with Voisin Consulting SARL

("VCLS") remains on track. VCLS has generated the risk and gap

analysis and the clinical roadmap to support the ongoing

pre-clinical package for Programme 1 and has also undertaken

activities in preparation for the commencement of the phase 1

clinical trials. In addition, VCLS is providing the Group with

regulatory support to address immediate priorities for filing and

registration of OCT130401's (Programme 2) metered dose inhaler in

the UK and US markets.

In October 2021, the Group announced trigeminal neuralgia ("TN")

as the initial target for OCT130401. TN is a chronic pain condition

that causes an excruciating, stabbing, electric shock-like facial

pain. It has a fast and unexpected onset and because of this has

been difficult to treat. Each episode may only last a few seconds,

but some people will suffer multiple (up to 100) episodes during

one day. It is on the rise with between approximately 10,000 and

15,000 new cases in the United States diagnosed each year. The

Directors estimate that in 2021 there were between 60,000 to 95,000

people living with the condition in the UK.

Post period-end, in January 2022 OCT entered into a drug

development agreement with Charles Rivers Laboratories Edinburgh

Ltd ("Charles Rivers"). Charles Rivers will complete the

preclinical safety and pharmacological work for the metered dose

inhaler developed with Purisys LLC, which provides the current Good

Manufacturing Practice ("cGMP") active product ingredients, and Oz

UK Ltd, which is developing the formulation and the device, as the

Company prepares OCT130401 for phase 1 clinical trials anticipated

in Q4 2022. This short delay from Q3 2022 is a result of unforeseen

challenges in the capacity of partners caused by increased demand

for laboratory time generated by the ongoing Covid-19 pandemic. The

Board does not believe this will affect the time to phase 2

clinical trials, there is no material cash flow impact and,

importantly, the time to market is currently anticipated to remain

the same.

Programmes 3 and 4

OCTP announced its exclusive agreement with Canopy Growth

Corporation ("Canopy Growth") in September 2021 for its

pharmaceutical cannabinoid derivative library, including 335

derivatives and 14 patent families. These cannabinoid derivatives

are at the centre of Programmes 3 and 4. OCTP has started multiple

screening programmes for the drug-like compounds with the aim of

targeting multiple therapeutic areas, including pain, neurology,

immune-inflammation and oncology. OCTP is working with Dalriada

Drug Discovery Inc ("Dalriada"), to screen the Canopy compounds and

OCT's existing proprietary cannabinoid library. Dalriada previously

designed, synthesised, and experimentally tested all of the

compounds in the Canopy library and as such, OCT will be able to

leverage Dalriada's existing knowledge and experience as it

continues its experimental research. The aim is to identify two

drug candidates for pre-clinical development by the end of

2022.

The drug development agreement with Oxford Stemtech Ltd

("Stemtech") is supporting R&D for all the Company's drug

development programmes, with a particular focus on Programmes 3 and

4. Stemtech's cutting-edge "Pain-in-a-dish" model replicates human

pain using stem cells from volunteers that are re-programmed into

pain neurons. This agreement also marks an evolution of OCTP's

relationship with Oxford University Professor, Dr Zameel Cader.

The agreements signed across all of the Group's drug programmes

reflect the Group's core ethos: to partner with organisations

recognised as "best-in-class" that can drive quality and

shareholder value. In a cannabis market where, unlicensed medicines

remain abundant and unproven, our underlying philosophy remains

unchanged: that it is only the development of cannabinoid-based

medicines through existing channels of licensed drug development

that allows the medical community to prescribe drugs with

confidence and in volume.

Principal Risks and Uncertainties

The principal risks and uncertainties of the Group are as

detailed in the annual report and are summarised below. These risks

and uncertainties are reviewed throughout the year and since the

annual report was issued for the period ended 31 May 2021 a new

principal risk has been added to the corporate risk register

relating to volatility of share price. The main change to

mitigating controls is in relation to key staff dependency risk,

where the notice periods of key staff were extended in January 2022

from 6 months to 9 months.

The principal risks are as follows:

-- Unsuccessful or delayed development;

-- Cash flow and cash resources;

-- Key staff dependency;

-- Quality assurance;

-- Legal claims;

-- Unlicensed medical cannabis;

-- Reputational damage; and

-- Volatile share price.

Related Parties

Related party disclosures are given in note 8.

Going Concern and Viability Statement

The Group's business activities, together with the factors

likely to affect its future development, performance and position,

are set out in the annual report (accessible via www.oxcantech.com

) and remain unchanged for the six months ended 30 November

2021.

The Group prepares budgets and cashflow forecasts to ensure that

the Group can meet its liabilities as they fall due. Cash resources

remain well within forecast at GBP12m and, in line with the IPO

prospectus, the Board anticipate conducting the next fund raising

within the 2022/23 financial year.

The uncertainty as to the future impact on the Group of the

continued COVID-19 pandemic has been considered as part of the

Group's adoption of the going concern basis. Whilst the Group has

not been significantly impacted by COVID-19 during the period, it

remains an inherent risk to the business. The Directors remain

confident that the Group is working in alignment with the

development plan set out in the IPO prospectus. Timelines are being

met, key partners have been onboarded and there is good progress

across all four programmes. The internal controls framework is

being continually refined and enhanced, and cash management remains

disciplined.

Outlook

The fundamentals of the Group remain strong, delivering against

the strategy laid out in the IPO prospectus and with a strong

financial base.

Dr John Lucas

Chief Executive Officer

21 February 2022

Financial and Operational Highlights

Operational and financial highlights for the six months ended 30

November 2021 are as follows:

-- research costs of GBP935k were incurred, of which GBP604k

relates to OCT461201 ("Programme 1"), with progress being made

across all four of the Group's programmes. The timescales set out

in the Company's IPO prospectus dated 17 May 2021, as updated by

subsequent announcements, for all four programmes remain on target,

with revenue generation expected in 2027;

-- OCTP is in the process of putting together its Scientific

Advisory Board and expects to announce details during the first

half of 2022;

-- OCT entered into a GBP2.6 million contract research agreement

with Aptuit (Verona) SRL, a subsidiary of Evotec SE (together

"Evotec") in July 2021 for Programme 1, and expects to be entering

phase 1 clinical trials by Q1 2023;

-- cost savings continue to be made, with the closure of the

London head office (from 31 March 2022) generating savings of over

GBP130k p.a. There was a write down of leasehold improvements

during the reporting period of GBP23k that relates to the office

closure.

-- overall, administrative costs increased to GBP1.2m with the

main costs in the six months relating to salaries and associated

expenses (GBP677k), and a shared based payment charge of GBP204k

(which is accounted for as an exceptional item);

-- the Group benefited from a Research and Development

("R&D") tax credit of GBP269k in the six months (compared to

GBP31k in the same period in the prior year), with tax losses

surrendered for the R&D tax credit payment. There was a debtor

of GBP408k at the period end relating to R&D tax credits (2021:

GBP139k);

-- cash absorbed by operations was GBP2.6m (31 May 2021: GBP1.9m);

-- cash reserves stood at GBP12.0m at 30 November 2021 (31 May

2021: GBP14.6m) and is still forecast to have been used up entirely

by March 2023. The Group repaid a GBP50k government Bounce-Back

loan in November 2021 and is now debt-free; and

-- after the period-end, on 1 December 2021, the Company's s

hares were admitted to trading on the OTC QB market in the United

States under the ticker symbol "OCTHF", providing more efficient

access for US investors and increased liquidity for all

shareholders. Harbor Access LLC were appointed as the Company's US

investor relations adviser, and introductory meetings with

potential US investors commenced in January 2022 .

Directors' Statements

Responsibility Statement

The Directors, whose names and functions are set out below, with

the registered office located at Maddox House, 1 Maddox Street,

London W1S 2PZ, accept responsibility for the information contained

in this unaudited interim report and condensed financial

statements, which have not been audited by an independent auditor,

for the six months ended 30 November 2021. To the best of the

knowledge of the Directors:

-- the unaudited condensed interim financial statements are

prepared in accordance with the applicable set of accounting

standards (including UK adopted IAS 34 Interim Financial

Reporting), and give a true and fair view of the assets,

liabilities, financial position and profit or loss of the Group and

the undertakings included in the consolidation taken as a whole;

and

-- the CEO's Interim Management Report includes a fair review of

the information required under rules 4.2.7 and 4.2.8 of the

Disclosure Guidance and Transparency Rules (being: (1) indication

of the important events during the first six months, and their

impact on the unaudited condensed interim financial statements: (2)

a description of principal risks and uncertainties for the

remaining six months of the year; (3) related parties' transactions

that have taken place in the first six months of the current

financial year and that have materially affected the financial

position or the performance of the entity during that period; and

(4) any changes in the related parties transactions described in

the last annual report that could have a material effect on the

financial position or performance of the enterprise in the first

six months of the current financial year).

The Directors confirm that the condensed interim financial

statements comply with the above requirements.

Directors and their functions:

-- Julie Pomeroy - Non-Executive Chairperson (appointed 12

February 2022, previously Non-Executive Director)

-- Dr John Lucas - Chief Executive Officer

-- Clarissa Sowemimo-Coker - Chief Operating Officer

-- Karen Lowe - Chief Finance Officer

-- Bishrut Mukherjee - Non-Executive Director

-- Neil Mahapatra- Non-Executive Director (Executive Chairperson until 11 February 2022)

-- Charanjit Cheryl Dhillon- Non-Executive Director

-- Richard Hathaway - Non-Executive Director (appointed 1 February 2022)

Forward Looking Statements

Certain statements in this announcement are forward-looking

statements. Such statements may relate to OCTP's business, strategy

and plans.

Statements that are not historical facts, including statements

about OCTP's or its management's beliefs and expectations, are

forward-looking statements. Words such as 'believe', 'anticipate',

'estimates', 'expects', 'intends', 'aims', 'potential', 'will',

'would', 'could', 'considered', 'likely', and variations of these

words and similar future or conditional expressions are intended to

identify forward-looking statements but are not the exclusive means

of doing so.

By their nature, forward-looking statements involve a number of

risks, uncertainties or assumptions, some known and some unknown,

many of which are beyond OCTP's control that could cause actual

results or events to differ materially from those expressed or

implied by the forward-looking statements. These risks,

uncertainties or assumptions could adversely affect the outcome and

financial effects of the plans and events described herein.

Forward-looking statements contained in these interim financial

accounts regarding past trends or activities should not be taken as

a representation that such trends or activities will continue in

the future. Nor are they indicative of future performance and

OCTP's actual results of R&D and financial condition and the

development of the industry and markets in which OCTP plan to

operate may differ materially from those made in or suggested by

the forward-looking statements.

You should not place undue reliance on forward-looking

statements because such statements relate to events and depend on

circumstances that may or may not occur in the future. Except as

required by law, OCTP is under no obligation to update (and will

not) or keep current the forward-looking statements contained

herein or to correct any inaccuracies which may become apparent in

such forward-looking statements. Forward-looking statements reflect

OCTP's judgement at the time of preparation of these unaudited

interim condensed financial statements and are not intended to give

any assurance as to future result.

Clarissa Sowemimo-Coker

Company Secretary

21 February 2022

Unaudited Consolidated Statement of Comprehensive Income

6 months 6 months ended 30 November

ended 30 November 2020 12 months ended 31 May

2021 2021

Notes GBP GBP GBP

Unaudited Unaudited Audited

Proforma

Revenue - - -

Research costs (934,513) (150,350) (445,400)

------------------ ------------------------------ ----------------------

Gross loss (934,513) (150,350) (445,400)

Administrative expenses (1,197,271) (679,716) (1,518,596)

Exceptional items 4 (204,317) - (1,381,949)

------------------ ------------------------------ ----------------------

Operating loss (2,336,101) (830,066) (3,345,945)

Finance income 35,910 15,571 47,021

Finance costs - - (67,713)

------------------ ------------------------------ ----------------------

Loss before taxation (2,300,191) (814,495) (3,366,637)

Income tax 5 269,146 30,938 138,651

------------------ ------------------------------ ----------------------

Loss for the period (2,031,045) (783,557) (3,227,986)

Other comprehensive income - - -

Items that may be reclassified - -

to profit or loss -

------------------ ------------------------------ ----------------------

Total comprehensive income for

the period attributable to

owners of the Group arising

from

continuing operations (2,031,045) (783,557) (3,227,986)

================== ============================== ======================

Loss per share attributable to

the ordinary equity holders of

the Company:

Basic loss per share from

continuing and total

operations 6 (0.211p) (0.124p) (0.504p)

Diluted loss per share from

continuing and total

operations (0.211p) (0.124p) (0.504p)

Unaudited Consolidated Statement of Financial Position

6 months ended 30 November 6 months ended 30 November 12 months ended 31 May

2021 2020 2021

Notes GBP GBP GBP

Unaudited Unaudited Audited

Proforma

Non-current assets

Intangible assets 82,251 125,174 101,657

Property, plant and equipment 16,961 54,711 46,826

Right-of-use assets 4,226 87,667 10,565

--------------------------- --------------------------- ----------------------

103,438 267,552 159,048

--------------------------- --------------------------- ----------------------

Current assets

Trade and other receivables 842,344 374,967 421,909

Cash and cash equivalents 12,014,856 71,151 14,630,801

--------------------------- --------------------------- ----------------------

12,857,200 446,118 15,052,710

--------------------------- --------------------------- ----------------------

Total assets 12,960,638 713,670 15,211,758

--------------------------- --------------------------- ----------------------

Current liabilities

Trade and other payables 518,146 833,408 824,114

Lease liabilities 55,461 58,305 123,885

Borrowings - - 3,136

--------------------------- --------------------------- ----------------------

Total current liabilities 573,607 891,713 951,135

--------------------------- --------------------------- ----------------------

Non-current liabilities

Lease liabilities - 22,713 -

Borrowings - - 46,864

--------------------------- --------------------------- ----------------------

Total non-current liabilities - 22,713 46,864

--------------------------- --------------------------- ----------------------

Total liabilities 573,607 914,426 997,999

--------------------------- --------------------------- ----------------------

Net assets / (liabilities) 12,387,031 (200,756) 14,213,759

--------------------------- --------------------------- ----------------------

Equity

Called up share capital 9,604,156 - 9,604,156

Share premium account 11,877,466 - 11,877,466

Share based payment reserve 9 1,362,327 136,534 1,158,010

Other reserve 10 643,455 6,287,609 643,455

Retained earnings (11,100,373) (6,624,899) (9,069,328)

--------------------------- --------------------------- ----------------------

Total equity 12,387,031 (200,756) 14,213,759

--------------------------- --------------------------- ----------------------

These unaudited condensed six-monthly financial statements were

approved and authorised for issue by the Board of Directors on 21

February 2022 and were signed on behalf by:

Karen Lowe

Finance Director

Company Registration No. 13179529

Unaudited Consolidated Statement of Changes in Equity

Share premium Share based Other Retained

Share capital account payment reserve reserve earnings Total

GBP GBP GBP GBP GBP GBP

Unaudited

At 1 June 2020

(Proforma) - - 136,534 6,287,609 (5,841,342) 582,801

------------- ------------- ----------------------- --------- ----------- ---------

Loss for the period - - - - (783,557) (783,557)

Other comprehensive - - - - - -

income

------------- ------------- ----------------------- --------- ----------- ---------

Total comprehensive

loss - - - - (783,557) (783,557)

Transactions with

owners

Share-based payment - - - - - -

charge

(options)

------------- ------------- ----------------------- ----------- ---------

Total transactions - - - - - -

with

owners

------------- ------------- ----------------------- --------- ----------- ---------

Balance at 30 November

2020 (Proforma) - - 136,534 6,287,609 (6,624,899) (200,756)

------------- ------------- ----------------------- --------- ----------- ---------

Share premium Share based Other

Share capital account payment reserve reserve Retained earnings Total

GBP GBP GBP GBP GBP GBP

At 1 June 2021 9,604,156 11,877,466 1,158,010 643,455 (9,069,328) 14,213,759

Loss for the period - - - - (2,031,045) (2,031,045)

Other comprehensive - - - - - -

income

------------- -------------------- ---------------- --------- ----------------- -----------

Total comprehensive

loss - - - - (2,031,045) (2,031,045)

Transactions with

owners

Share-based payment

charge (warrants) - - 107,554 - - 107,554

Share-based payment

charge (options) - - 96,763 - - 96,763

Total transactions

with owners - - 204,317 - - 204,317

------------- -------------------- ---------------- --------- ----------------- -----------

Balance at 30

November 2021 9,604,156 11,877,466 1,362,327 643,455 (11,100,373) 12,387,031

------------- -------------------- ---------------- --------- ----------------- -----------

Unaudited Consolidated Statement of Cash Flows

6 months ended 30 November 6 months Year

2021 ended 30 November ended

GBP 2020 31 May

GBP 2021

GBP

Notes Unaudited Unaudited Audited

Proforma

Cash flows from operating activities

Cash absorbed from operations (2,584,779) (479,298) (1,936,955)

Interest paid - - (67,713)

Tax refunded - 225,726 225,726

-------------------------- ------------------ -----------

Net cash (outflow)/inflow from operating activities (2,584,779) (253,572) (1,778,942)

Cash flows from investing activities

Payments for property, plant and equipment - - (769)

Proceeds from disposal of property, plant and equipment - - 571

Interest received 35,910 15,571 47,021

-------------------------- ------------------ -----------

Net cash inflow from investing activities 35,910 15,571 46,823

-------------------------- ------------------ -----------

Cash flows from financing activities

Proceeds from issues of shares on IPO in May 2021 - - 16,500,000

Proceeds from issues of shares in January 2020 - - 250,000

Proceeds from borrowings - - 650,000

Share issue transaction costs - - (1,322,534)

Repayment of borrowings (50,000) - -

Lease liability payments (17,076) - (23,698)

-------------------------- ------------------ -----------

Net cash (used in)/ generated from financing activities (67,076) - 16,053,768

-------------------------- ------------------ -----------

Net increase/(decrease) in cash and cash equivalents (2,615,945) (238,001) 14,321,649

Cash and cash equivalents at the beginning of the period 14,630,801 309,152 309,152

-------------------------- ------------------ -----------

Cash and cash equivalents at end of the period 12,014,856 71,151 14,630,801

-------------------------- ------------------ -----------

Notes to the Interim Financial Statements

1 General Information

Oxford Cannabinoid Technologies Holdings Plc is a public limited

company limited by shares, incorporated and domiciled in England

and Wales. Its registered office and principal place of business is

Maddox House, 1 Maddox Street, London W1S 2PZ. Incorporated on 4

February 2021, the Company's shares were admitted to trading on the

London Stock Exchange on 21 May 2021.

All press releases, financial reports (including the Annual

Report and Financial Statements for the period ended 31 May 2021)

and other information are available at our Shareholder Centre on

our website: www.oxcantech.com .

The consolidated interim financial statements are presented in

Pound Sterling (GBP).

2 Summary of Significant Accounting Policies

The accounting policies applied by the Group in these condensed

consolidated interim financial statements are consistent with those

applied by the Group in its consolidated financial statements for

the period ended 31 May 2021 and are those which will form the

basis of the financial statements for the period ended 30 April

2022 .

2(a) Basis of preparation

Compliance with IFRS

These unaudited condensed consolidated interim financial

statements for the six months ended 30 November 2021 have been

prepared in accordance with IAS 34 'Interim Financial Reporting' as

adopted by the UK, and the Disclosures Guidance and Transparency

Rules ("DTR") of the Financial Conduct Authority, the Listing

Rules, and UK adopted international accounting standards.

These unaudited condensed consolidated interim financial

statements should be read in conjunction with the Annual Report and

financial statements for the period ended 31 May 2021, which were

prepared in accordance with UK adopted international accounting

standards and the applicable legal requirements of the Companies

Act 2006. These condensed consolidated interim financial statements

do not comprise statutory accounts within the meaning of Section

435 of the Companies Act 2006.

The Annual Report and financial statements for the period ended

31 May 2021 were reported upon by the Group's auditor and delivered

to the Registrar of Companies. The report of the auditor on the

annual report and financial statements for the period ended 31 May

2021 was unqualified, did not include a reference to any matters to

which the auditor drew attention by way of emphasis without

qualifying their report and did not contain statements under

Section 498 (2) or (3) of the Companies Act 2006.

The accounting policies used and presentation of these condensed

consolidated half year financial statements (including principles

of consolidation and equity accounting) are consistent with the

accounting policies applied by the Group in its consolidated annual

report and financial statements as at, and for the period ended, 31

May 2021, and comply with UK adopted international accounting

standards.

The half year report for the six months ended 30 November 2021

was approved for release by the Directors on 21 February 2022. The

figures for the six months ended 30 November 2020 have been

reviewed by the auditor; those for the six months ended 30 November

2021 are neither audited nor reviewed by auditors pursuant to the

Financial Reporting Council guidance on Review of Interim Financial

Information.

2(b) Going concern

The Directors are required to satisfy themselves that it is

reasonable for them to conclude whether it is appropriate to

prepare the financial statements on a going concern basis, and as

part of that process they have followed the Financial Reporting

Council's guidelines ("Guidance on the Going Concern Basis of

Accounting and Reporting on Solvency and Liquidity Risk" issued

April 2016).

The Group's business activities together with factors that are

likely to affect its future development and position are set out in

the Chairman's statement, the CEO's Review and Financial Review of

the Annual Report and Financial Statements (accessible via

www.oxcantech.com), in addition to the CEO's Management Statement

in this interim report. Budgets and detailed cashflow forecasts

that look beyond twelve months from the date of these condensed

consolidated financial statements have been prepared and used to

ensure that the Group can meet its liabilities as they fall due.

The Directors have made various assumptions in preparing these

forecasts, using their view of both the current and future economic

conditions that may impact on the Group during the forecast

period.

Key risks and potential scenarios that could negatively impact

on the Group's ability to continue to research and ultimately

develop and retail prescribed medicines within the timescale

detailed within the IPO prospectus have been considered, and risks

mitigated as far as is practical and reasonable.

The Board anticipate making an equity fund raise within the

2022/23 financial year, in order to provide further financial

resources to progress with the next stages of the research

programmes.

The Directors have also considered the continued impact of the

COVID-19 pandemic and the impact of the measures taken to contain

it, on the Group. The Directors note the global supply chain issues

and challenges in the capacity of partners caused by the increased

demand in laboratory time generated by COVID-19 and they continue

to monitor the situation. Due to the nature of the Group's

activities, there has not been a significant on-going impact on the

business. Nonetheless, the Directors continue to monitor the

situation and, if required, will take steps to safeguard the assets

of the Group whilst the pandemic continues.

After making enquiries including detailed consideration of the

Group's cashflow, solvency and liquidity position, the Board has a

reasonable expectation that OCTP, OCT and the Group as a whole have

adequate resources to continue in operational existence for at

least twelve months from the date of signing of these unaudited

condensed six-monthly financial statements. As such, the Board

continues to adopt the going concern basis in preparing the

unaudited condensed six-monthly financial statements.

2(c) Leases

The Group leases the head office in London under a five-year

lease period and office equipment. In November 2021, the Group

exercised its right under the agreement to terminate the lease with

effect from 31 March 2022. This has not had any material impact on

the value of the right-of-use asset in the six-month period to 30

November 2021.

2(d) Property, plant and equipment

Property, plant and equipment is stated at historical cost less

depreciation. Historical cost includes expenditure that is directly

attributable to the acquisition of the items. Depreciation is

calculated using the straight-line method to allocate the cost or

revalued amounts of the assets, net of any residual values, over

the lease term for leasehold improvements and estimated useful

lives for office and computer equipment, being 5 years for all 3

categories.

The assets' residual values and useful lives are reviewed, and

adjusted if appropriate, at the end of each reporting period. Given

the early termination of the lease on the London Head Office, the

carrying value of the leasehold improvement has been written down

during the period to its recoverable amount.

2(e) Prior six-month period results

Differences between the prior six-month period results in the

IPO prospectus and the figures in the financial statements above

for the period ended 30 November 2020 are largely due to the

prospectus recording a GBP345k share-based payment charge in the

first half of the year (whereas this was recognised in the second

half of the year in the filed financial statements for year ended

31 May 2021). In addition to this, there are some presentational

and minor differences which are immaterial both individually and

when aggregated.

2(f) New and forthcoming standards and interpretations

New and amended standards adopted by the Group

There were no new or amended standards adopted by the Group

during the review period.

New standards and interpretations not yet adopted

A number of new accounting standards, amendments to accounting

standards and interpretations have been issued by the International

Accounting Standards Board with an effective date after the date of

these financial statements. The Directors have chosen not to early

adopt these standards and interpretations, the Directors do not

expect them to have a material impact on the entity in the current

or future reporting periods and on foreseeable future

transactions.

Effective date

IFRS 9 Financial Instruments - amendments resulting from Annual Improvements to IFRS Standards

2018-2020 1 January 2022

(fees in the "10 per cent." test for derecognition of financial liabilities)

IAS 1 Presentation of Financial Statements - amendments regarding the classification of 1 January 2023

liabilities

IAS 1 Presentation of Financial Statements - amendments regarding the disclosure of accounting

policies 1 January 2023

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors - amendments regarding the

definition of accounting estimates 1 January 2023

IAS 37 Provisions, Contingent Liabilities and Contingent Assets - amendments regarding the costs

to include when assessing whether a contract is onerous 1 January 2022

3 Critical Estimates and Judgements

The preparation of financial statements requires the use of

accounting estimates which, by definition, will seldom equal the

actual results. Management also needs to exercise judgement in

applying the Group's accounting policies. However uncertainty about

these assumptions and estimates could result in outcomes that would

require a material adjustment to the carrying amount of the asset

or liability in future periods.

Estimates and judgements are continually evaluated. They are

based on historical experience and other factors, including

expectations of future events that may have a financial impact on

the entity and that are believed to be reasonable under the

circumstances. The areas involving significant estimates or

judgements which management consider may have a significant risk of

causing a material adjustment to the reported amounts in the period

were:

Going concern basis

As outlined in note 2(b), judgement has been applied in

accounting for the Group as a going concern. In reaching the

decision the Directors have considered current cash reserves and

forecast cashflow, solvency and liquidity. The forecasts are based

on various assumptions including charges from research partners,

rate of progression through to commercialisation, and external

economic conditions.

Research & development costs

Judgement is used in the classification and hence treatment of

costs incurred in the research and development of the core

programmes outlined in the CEO's Review. During the period all of

the GBP935k costs incurred were accounted for as research costs and

expensed to profit or loss, on the basis that none of the

programmes were yet at a stage of having gained regulatory approval

for commercialisation.

R&D tax credits receivable

Judgement is applied in calculating the tax credits that the

Group consider to be receivable from HMRC in relation to research

costs incurred. Evidence is retained to support the methodology

adopted by the Group in calculating R&D tax relief claims, part

of which involves the judgement of experienced Senior Managers and

Directors in articulating the scientific advancements and

uncertainties for the wider market of the Group's research

programmes based on contemporaneous evidence . At the period end

there was a tax credit receivable of GBP408k (2021: GBP139k).

Lease accounting

In calculating the right-of-use asset value and lease liability,

a significant element of judgement and estimation are involved

including determining a comparable cost of capital interest rate

and lease term. In determining the lease term for example,

management considers all facts and circumstances that create an

economic incentive to exercise or not exercise a termination

option. As detailed in note 2(c) during the period notice was given

on the lease on the London head office, which will terminate on 31

March 2022. It has been assumed that the leasehold improvements

will not have a significant remaining value and hence an impairment

charge of GBP23k has been recognised in the period.

Impairment of intangible fixed assets

Judgement is involved in determining the useful economic life

and potential impairment of the licence intangible asset held by

the Group at a net book value of GBP82k. This includes

consideration of the continuing likelihood of the asset to generate

value to the Group and the adherence to the terms of the agreement

or any other event which may have a detrimental effect on the

carrying value of the asset. The Directors have carried out an

impairment review of the asset during the period with no charge

considered necessary.

Warrants and share options

The Black-Scholes model is used to calculate the appropriate

charge of the warrants and share options. The calculation involves

a number of estimates and judgements to establish the appropriate

inputs to be entered into the model, including the use of an

appropriate interest rate, expected volatility, exercise

restrictions and behavioural considerations. A significant element

of judgement is therefore involved in the calculation of the

charge. The estimates used remain unchanged from those applied in

the Annual Report and Financial Statements.

4 Exceptional Items

The Consolidated Statement of Comprehensive Income includes

exceptional items totalling GBP204k (31 May 2021: GBP1,382k

included IPO costs) comprised entirely of a share-based payment

charge (31 May 2021: GBP1,021k).

The Group operates two share option schemes for its Directors

and senior employees one relating to options transferred from OCT

and a new scheme for OCTP. In addition, warrants were issued as

part of the listing in May 2021 (as detailed in the Annual Report

and Financial Statements).

5 Income Tax

The Group is pre-revenue generating, but on target to reach

commercialisation of their products in 2027. The Group benefits

from research and development corporation tax relief in both the

current period and prior years claimed by the Group on allowable

research expenditure. A deferred tax asset is not recognised due to

the uncertainty of the timing of future taxable profits.

6 Earnings Per Share

6 months 6 months 12 months

to 30 Nov 2021 to 30 Nov 2020 to 31 May 2021

GBP GBP GBP

Unaudited Unaudited Audited

Proforma

6(a) Basic loss per share

Basic loss per share attributable to the ordinary equity holders of

the Company (0.00211) (0.00124) (0.00504)

--------------- --------------- ---------------

6(b) Diluted loss per share

From continuing operations attributable to the ordinary equity

holders of the Company (0.00211) (0.00124) (0.00504)

--------------- --------------- ---------------

Total diluted loss per share attributable to the ordinary equity

holders of the Company (0.00211) (0.00124) (0.00504)

--------------- --------------- ---------------

6(c) Reconciliations of loss used in calculating loss per

share

6 months to 6 months 12 months to

30 Nov to 31 May

2021 30 Nov 2021

GBP 2020 GBP

Unaudited GBP Audited

Unaudited

Basic loss per share

Loss attributable to the ordinary equity holders of the Company used in

calculating basic

loss per share: (2,031,045) (783,557) (3,227,986)

----------- ---------- ------------

Diluted loss per share

Loss from continuing operations attributable to the ordinary equity holders of

the Company:

Used in calculating basic loss per share (2,031,045) (783,557) (3,227,986)

----------- ---------- ------------

Used in calculating diluted loss per share (2,031,045) (783,557) (3,227,986)

Loss attributable to the ordinary equity holders of the Company used in

calculating diluted

loss per share (2,031,045) (783,557) (3,227,986)

----------- ---------- ------------

6(d) Weighted average number of shares used as the

denominator

30 Nov 2021 30 Nov 2020 31 May 2021

Number Number Number

------------- ------------- -------------

Weighted average number of ordinary shares used as the denominator in

calculating basic loss

per share 960,415,644 630,415,444 640,378,738

Adjustments for calculation of diluted loss per share: - - -

Weighted average number of ordinary shares and potential ordinary shares

used as the denominator

in calculating diluted loss per share 960,415,644 630,415,444 640,378,738

------------- ------------- -------------

The prior six-month period calculation has been based on the

shares issued in respect of the share for share exchange that took

place between OCTP and OCT in May 2021 as part of the Group

restructuring.

7 Events Occurring After the Reporting Period

On 1 December 2021 the Company's s hares were admitted to

trading on the OTC QB market in the United States, providing more

efficient access for US investors and increased liquidity for all

shareholders. At the same time, Harbor Access LLC were appointed as

its US investor relations adviser.

As outlined in the CEO's Interim Management Statement, in

January 2022, the Group entered into a drug development agreement

with Charles Rivers, who will complete the preclinical safety and

pharmacological work for the metered dose inhaler developed with

Purisys LLC and Oz UK Ltd as OCT prepares OCT130401 for phase 1

clinical trials anticipated in Q4 2022.

Also in January 2022, the notice periods for Chief Financial

Officer, Karen Lowe, Chief Scientific Officer, Valentino

Parravicini, Chief Executive Officer, John Lucas and Chief

Operating Officer, Clarissa Sowemimo-Coker

were extended from six to nine months to better allow for succession planning.

Following his exit from Imperial Brands Ventures Limited in

September 2021, non-executive Director, Bishrut Mukherjee, has been

paid the commensurate non-executive director fee of GBP 25,000 per

year as from October 2021.

8 Related Party Transactions

There were no related party transactions in the period or

changes in the related party transactions described in the last

annual report that have had or could have a material effect on the

financial position or performance of the Group.

During the period, notice was given on the management services

agreement with Kingsley Capital Partners LLP ("KCP") which was

terminated on 31 December 2021.

9 Share based payments

During the six-month period ended 30 November 2021, no new

options or warrants were issued and none of the existing options

and warrants were exercised.

As detailed in the Annual Report, the Group operates an

equity-settled share-based remuneration scheme for employees. On 21

May 2021, OCTP issued a total of 33,307,275 warrants all with an

exercise price of GBP0.05 and a five-year exercise period, vesting

on the day of issue.

During the period, the Group recognised share-based payment

expense of:

-- GBP96,763 (31 May 2021: GBP924,926) in relation to options; and

-- GBP107,554 (31 May 2021: GBP96,650) in relation to the warrants.

10 Accounting for group reconstruction

As detailed in the Annual Report on 17 May 2021 OCTP

unconditionally acquired the shares of OCT in a share for share

exchange, prior to the admission of the Group on the main market of

the London Stock Exchange on 21 May 2021. The transaction did not

meet the definition of a business combination as the Company was

not a business and therefore fell outside the scope of IFRS 3

(Revised) Business Combinations (IFRS 3). However although the

transaction was not a reverse acquisition as defined in IFRS 3, the

Directors accounted for the transaction on a similar basis as

detailed in guidance issued by the IFRS Interpretation

Committee.

As the transaction was not a business combination, no fair value

adjustments were made and no goodwill was recognised. The

difference on consolidation, between the value of the shares issued

and the value of shares acquired, has been included as an other

reserve of GBP643,455. The prior year results have been presented

on a similar basis to a reverse acquisition method of accounting,

with the share capital and share premium of the legal acquiror

being presented rather than that of the accounting acquiror.

Directors and Professional Advisers

Directors

Julie Pomeroy

Dr John Lucas

Clarissa Sowemimo-Coker

Karen Lowe

Neil Mahapatra

Bishrut Mukherjee

Charanjit Cheryl Dhillon

Gavin Sathianathan (resigned 24 November 2021)

Richard Hathaway (appointed 1 February 2022)

Secretary

Clarissa Sowemimo-Coker

Company number

13179529

Registered office

Maddox House

1 Maddox Street

London W1S 2PZ

Auditor

Moore Kingston Smith LLP

Devonshire House

60 Goswell Road

London EC1M 7AD

Financial Advisers

Cairn Financial Advisers LLP

107 Cheapside

London EC2V 6DN

Principal Bankers

Metro Bank Plc

247-249 Cromwell Road

London SW5 9GA

Co Operative Bank Plc

St Pauls House

10 Warwick Lane

London EC4M 7BP

Public Relations Advisers

Walbrook PR Limited

75 King William Street

London EC4N 7BE

Brokers

States Bridge Capital Ltd (until 30 November 2021)

Blackwell House

Guildhall Yard

London EC2V 5AE

Harbor Access LLC (appointed 1 December 2021)

283 Tresser Blvd 9(th) floor

Stamford

Connecticut 06901

USA

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SESESFEESEEE

(END) Dow Jones Newswires

February 22, 2022 02:00 ET (07:00 GMT)

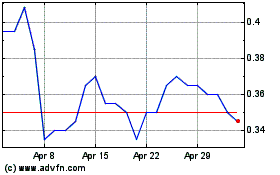

Oxford Cannabinoid Techn... (LSE:OCTP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oxford Cannabinoid Techn... (LSE:OCTP)

Historical Stock Chart

From Apr 2023 to Apr 2024