TIDMNSCI

RNS Number : 3104B

NetScientific PLC

30 September 2022

NetScientific plc

("NetScientific" or "NSCI" or the "Company" or the "Group")

Interim Results for the six months ended 30 June 2022

London, UK - 30 September 2022: NetScientific Plc (AIM: NSCI),

the active international holding company, which invests in,

develops and commercialises life sciences/healthcare,

sustainability and technology companies, today announces its

interim results for the six months ended 30 June 2022.

The first half of the year has been a challenging period,

against a backdrop of declining markets across life sciences and

technology sectors, and a worsening macro-economic environment.

While there has been some inevitable slow-down on a few of the

portfolio companies, others are likely to benefit from an

environment of high-energy prices and weak Sterling. Overall,

although delayed in certain areas, the portfolio remains robust,

with plans in place for further growth, adapting to the changing

environment, through value inflection points and routes to

exit.

Highlights

Key operational and financial highlights include:

-- Fair Value of GBP29.2 million (2021: 31.0 million), slight

decrease as a result of recent market turmoil and the PDS

Biotechnology share price fall, mitigated by an increase in Fair

Value in other portfolio companies [1]

-- Capital light investment model has delivered over GBP2.5

million of syndicated new investment with Capital under advisory up

11% at GBP24.6 million (2021: 22.1 million)

-- Proactive management of well-balanced portfolio of 22

companies, with further development and additional direct balance

sheet investment of GBP1.3 million

-- Deeper involvement in selected companies

o Focused on delivering significant returns

o Modest balance sheet investments in portfolio companies

alongside EMV Capital syndicated third party investments to secure

portfolio company funding needs

o Key value inflection points identified for many companies for

profitable liquidity events and exits

o Acquisition of 30% in Vortex Biotech Holdings for a non-cash

consideration

o Progressed turnaround of Q-Bot

-- Raised GBP1.5 million in June 2022 PLC placing

o Strengthening the Company's balance sheet

o Limited dilution for existing shareholders

o Strong participation from the investor network of subsidiary,

EMV Capital

o Facilitating the continuation of the Company's capital light

investment strategy

-- Progress in "Trans-Atlantic bridges" phased programme, and international expansion

-- Loss for the period of GBP1.7 million (H1 2021: loss GBP1.4

million) reflecting further R&D investment in ProAxsis and

Glycotest (in the form of shareholder loans), a small increase in

headcount and considered building of the NetScientific platform

(including systems and people) to drive growth and deliver added

shareholder value

-- Secondary sale: Post-balance sheet, executed a secondary sale

of 5.8% of the Group's Q-Bot stake, realising a GBP110k profit

Commenting on Outlook and Future Prospects, Ilian Iliev, CEO of

NetScientific, said:

"We are pleased with progress in the first six months of the

year, following on from a successful 2021. Our portfolio of

high-growth companies is well funded, with our capital light model

and network of investors securing their finance needs without the

requirement to deploy significant amounts of NetScientific cash.

Our portfolio fundraising transactions generate returns through

increased value of direct company holdings and a carry fee on

"capital under advisory". We will build on this established

business model and operating template, to drive continued growth,

and realise shareholder value.

" We have a well-balanced portfolio across sectors and

geographies, with businesses at different stages of their

development, and adaptable for a changing sectoral and

macro-economic dynamics. Within several of our companies, we are

working on substantial liquidity events or routes to exit. ."

John Clarkson, Executive Chairman of NetScientific PLC added

:

"It is reassuring that NSCI's strategy and actions have proven

resilient and appropriate, even in difficult market conditions and

a challenging economic climate. Indeed, despite these factors and

some consequential delays, the fundamentals remain strong and the

company is well placed to take advantage of the opportunities, in

the current operating environment.

"With the benefits of a well-balanced portfolio, strong

proactive management and the capital light business model, we look

forward positively to continued progress, generating revenue,

adding value, then realising returns for shareholders"

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

For more information, please contact:

NetScientific

Ilian Iliev, CEO Via Walbrook PR

WH Ireland (NOMAD, Financial Adviser and Broker)

Chris Fielding / Darshan Patel +44 (0)20 7220 1666

Walbrook PR +44 (0)20 7933 8780 or netscientific@walbrookpr.com

Nick Rome / Joe Walker / Paul

McManus 07748 325 236

About NetScientific

NetScientific Plc ("NSCI") is an active holding Company that

proactively invests in a global portfolio of companies across the

healthcare, life science, ESG, and deep technology sectors.

NetScientific delivers shareholder returns through a proactive

and hands-on management approach to its portfolio companies;

identifying, investing in, and helping to build game-changing

companies. The Group targets value inflection points and the

release of value through partial or full exits from trade sales,

public listings, or equity sales. The Company has a strong

Trans-Atlantic and growing international presence, providing

attractive expansion prospects.

The Company differentiates itself by employing a capital-light

investment approach, making use of its wholly owned subsidiary, EMV

Capital's network of private, corporate, and institutional

investors. By syndicating investment and making minimal use of its

balance sheet, the Company is able to secure direct stakes, as well

as carried interest stakes, in its portfolio. This ultimately

creates a structure that can support a large portfolio with a

limited balance sheet.

NetScientific is headquartered in London, United Kingdom, and

was admitted to trading on AIM, a market operated by the London

Stock Exchange, in 2013.

www.netscientific.net

BUSINESS AND OPERATING OVERVIEW

Introduction

We are pleased to report our financial results and summary of

operations for the six months ended 30 June 2022. The first half of

2022 continued the progress made since the start of the Company's

turnaround in the past couple of years, in what have been extremely

tough market conditions.

We are focused on our next stage of growth, adding value and

delivering results for shareholders. Using our now established

business model, and with the benefit of additional funds, we are

exploiting the potential of existing and new opportunities. Based

on our detailed knowledge of the portfolio and individual

businesses, we have been selectively identifying portfolio

companies to build deeper ownership, influence and involvement, and

drive investment returns and realisations.

Our team has been busy providing operational as well as

financial support to help portfolio companies grow, offering

venture capital and corporate finance advice, strategic guidance,

and access to an established network of corporate and industry

partners in the UK and internationally.

A Differentiated Business Model

We can now be characterised as a truly active holding company

with a balanced, enhanced and expanded portfolio of companies

across several sectors. As well as being a pro-active manager,

generating returns through growth in the value of our direct

balance sheet holdings, we differentiate ourselves by employing a

capital-light investment approach, making use of our wholly owned

subsidiary, EMV Capital's network of private, corporate and

institutional investors, to provide venture capital investments,

corporate finance services, and management services to our

portfolio. By syndicating investment and making minimal use of our

balance sheet, we can secure direct stakes, and/or carried

interests in our portfolio. This not only earns revenues, but also

can deliver profit share and carry fees as a result of capital

under advisory. This ultimately creates a structure that can

support a larger portfolio with a limited balance sheet, offset by

ongoing fees.

Advantages of our model

Flexibility: As an active investment Company, the permanent

capital funding model means that NSCI is not driven by the usual

fund lifecycles on deployment and exit and can support investee

companies through their growth journey. We are therefore able to

take a longer and more strategic investment view, whilst still

remaining live to shorter-term opportunities including in the

secondary markets.

Capital efficient investment strategies for portfolio companies:

Through our proactive approach, we help portfolio companies

identify capital efficient investment strategies, using different

corporate finance tools and making particular use of non-dilutive

financing such as grants and corporate joint development

agreements.

Pro-active investment approach: Our team can open up value

opportunities which are not available in typical passive investment

approaches, such as identifying secondaries to participate in and

having early visibility on investment rounds.

Working with strategic investors and multinational corporations

: Using our established network, we can broker and monetise

introductions between portfolio companies and appropriate

investors/multinational corporations, with a focus on both

corporate VC investment and collaboration opportunities.

Access to capital: As demonstrated in its own two previous

fundraisings, NSCI is able to introduce funding from its investor

network, supplementing its broker's activities.

Fee-generating activities: Our tailored approach provides a

range of fee sources, including corporate finance, consultancy,

board monitoring, and reimbursement fees help to offset the costs

of infrastructure.

Early liquidity/secondaries: We are able to broker and

participate in partial liquidity events, such as through the

secondary market sale of portfolio company stock to new investors

into portfolio companies. This can generate additional cash returns

well ahead of a full exit, with several secondary transactions

being actively pursued.

Early liquidity/secondaries: We are able to arrange and lead in

partial liquidity events, such as through the secondary market sale

of portfolio company stock to new investors into portfolio

companies. As well as providing liquidity to outgoing shareholders

and incoming new investors, this can generate additional cash

returns to the Group well ahead of a full exit. We have

successfully executed two significant profitable secondary

transactions, with several others being actively pursued.

Trans-Atlantic bridges: Our on the ground presence in the US

supports the business needs of core companies, helps expend market

access, and assists portfolio companies to 'land' and grow in the

US. This provides a differentiator for the Group and is attractive

to new companies looking to join the EMV Capital/NSCI

portfolio.

Infrastructure/team: Our small, focused, and effective core

team, and trusted network of venture partners and advisors, means

that NSCI/EMVC has an outsize impact against a relatively modest

cost base.

Routes to Exit: For a core six investee companies, we are

currently actively working on routes to exit, with the potential

for outsized returns.

Operational Review

Over the first half of 2022 the Company has continued its active

programme to deliver on its strategy and drive shareholder value.

The Company invested GBP1.26 million and raised over GBP2.5 million

in total for portfolio companies.

In accordance with the strategic plan, operational actions

include:

-- continued pro-active, commercial management of portfolio and individual companies;

-- judicious investments to protect and enhance NetScientific's

position in several of its existing portfolio companies;

-- clear and detailed evaluation of the Group's portfolio,

including business plans, timelines, milestones, associated funding

needs, value inflection points, the balance of risk and reward, and

the priorities and potential for each portfolio company;

-- an alignment of EMV Capital's operations to act in synergy

with NetScientific's investment and portfolio objectives;

-- a wider application of the company's "capital light"

approach, utilising the draw of the PLC brand, and the

NetScientific balance sheet, to anchor future investments or

secondaries, and achieve a multiplier effect with third party

investment adding to Capital Under Advisory;

-- selective investments, deeper stakes, greater involvement,

and focusing on realising enhanced returns in certain portfolio

companies and target areas;

-- extending our network, platform, and access to deal flow; and

-- building a pipeline of fund-raising engagements and

consultancy agreements for execution in the second half of 2022,

and into 2023.

Trans-Atlantic Bridges and internationalisation

Our combined US and UK portfolio has led to the identification

of a number of synergies and opportunities for operational

cross-over on both sides of the Atlantic, and further international

potential. We plan to consolidate our progress with specific 'on

the ground' initiatives, including facilitating for select

portfolio companies access to a proposed facility on the East Coast

of the USA, to help our existing portfolio companies and future

additions accelerate internationalisation and growth.

Both Glycotest and ProAxsis have an immediate need for a US lab,

with associated commercialisation and sales/marketing facilities.

Temporary space has already been secured, close to Washington DC

and plans are well advanced for suitable leased premises.

Several portfolio companies have accessed investments and

capital, product markets, and corporate and research relationships

on either side of the Atlantic, and beyond. For instance, we have

assisted Q-Bot, Sofant and Wanda in establishing corporate links in

the US construction industry, telecoms and healthcare markets

respectively, and have supported Vortex' continued operation of a

US-UK presence.

ESG/Impact Investment

The Group continues to be well positioned in the Environment,

Social and Corporate Governance ("ESG") and impact investment

space, as an investor in therapeutics and diagnostics for major

chronic diseases (such as PDS Biotechnology and Vortex in oncology,

ProAxsis in respiratory diseases), as well as investments in

sustainability companies (such as Q-Bot's carbon-mitigating

retrofit insulation, or Sofant's low-energy satellite

communications infrastructure).

We are focused on sustainable value creation from a strong base

and continue to build out key processes that enable increased

transactional, portfolio management, and investment realisation

capacity. Having completed a turnround in the past couple of years,

and having transformed the business, the Group is now in a strong

position, with the fundamentals in place for continued

progress.

Awards

We were delighted that EMV Capital has been nominated as a

Finalist in the 2022 Health Investor Awards for the Private Equity

Investor of the Year awards, and is a Finalist in the ESG Champion

of the Year category at the Growth Investor Awards 2022. ProAxsis

won the Best Established Small Business award at the Belfast

Telegraph Enterprise Awards 2022.

COVID-19

Although there was a general initial negative impact on the

Group, the consequences have varied across the portfolio, and the

sources of revenue and individual companies have been managed

accordingly. In the aftermath of the pandemic, new opportunities

have been opened for both the healthcare and broader technology

sectors. It was not seen as necessary to impair the carrying value

of any assets.

Global Economic Environment

The macro-economic environment remains exceedingly

unpredictable. The aftermath of the pandemic, capital markets

volatility, geopolitical issues and concerns, most notably Russia's

invasion of Ukraine, and the more recent macro-economic pressures,

continue to contribute to business uncertainty.

In this climate, the first half year has at times been a

challenging period, with some inevitable slow-down in a few of the

portfolio companies. At the same time, some of our portfolio

companies are likely to benefit from an environment of high-energy

prices and weak Sterling. Overall, although delayed in certain

areas, the portfolio remains robust, with plans in place for

further growth adapting to the changing environment, through value

inflection points and routes to exit.

Portfolio Summary

Following our capital-light investment model, the portfolio

consists of a combination of direct investments and capital under

advisory. This enhanced portfolio is well balanced, facilitates

risk management, and provides synergistic benefits, through

consolidated proactive management across the Group, as summarised

below.

Portfolio Country Sector Sub-Sector Stage Group Unaudited Capital Under

companies of Interest Directors' Advisory (At

Development % Estimated Value Cost to Third

Party)

--------------- -------- ---------------- ----------- ------------

31 Dec 30 Jun 31 Dec 30 Jun

21 22 21 22

--------------- -------- ---------------- ----------- ------------ --------- ----------- --------- ---------

Subsidiaries

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

EMV Capital Venture Financial

Ltd UK Capital Services Sales 100% Equity GBP3.5m GBP3.5m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

ProAxsis Respiratory Life

Ltd UK diagnostics Sciences Sales 100% Equity GBP3.5m GBP3.5m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Glycotest, Liver cancer Life Late stage

Inc. US diagnostics Sciences clinical 64% Equity GBP11.0m GBP11.0m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Cetromed Holding

Ltd UK Life Sciences Investment Company 75% Equity - - - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Sub Total GBP18.0m GBP18.0m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Direct/Advised

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

PDS

Biotechnology Life Phase II

Corporation US Immuno-oncology Sciences clinical 4.7% Equity GBP8.0m GBP4.0m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

23.7% GBP1.0m

Equity + GBP3.2m

+ 15.6% GBP0.3m + GBP0.1m

Q-Bot Ltd UK Robotics Technology Sales Advised CLA OD GBP2.3m GBP2.8m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

SageTech

Medical Waste 5.9% Equity

Equipment anaesthetic Commercial + 25.14%

Ltd UK capture/recycle Healthcare stage Advised GBP0.9m GBP0.9m GBP3.5m GBP3.8m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

GBP0.3m

+ GBP0.3m

Epibone, Regenerative Life Early stage GBP0.5m + GBP0.6m GBP0.2m GBP0.2m

Inc. US medicine Sciences clinical 0.8% Equity CLA CLA CLA CLA

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

CytoVale, Medical Life Late stage

Inc. US biomarker Sciences clinical 1.0% Equity GBP0.4m GBP0.4m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

G - Tech

Medical, Waerable Life Early stage

Inc. US gut monitor Sciences clinical 3.8% Equity GBP0.4m GBP0.4m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

1.5% Equity

+ GBP75k

Convertible

Martlet Venture loan note

Capital Capital Holding + 10.3%

Ltd UK - Deeptech Investment Company Indirect GBP0.3m GBP0.3m GBP1.3m GBP1.3m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Fox Biosystems Research Life

* BEL Equipment Sciences Sales 5.1% Equity GBP0.3m GBP0.3m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Sofant Semiconductors

Technologies Satellite 25.1% GBP0.3m GBP0.4m

Ltd UK Coms Technology Pre sales Advised CLA CLA GBP3.0m GBP3.0m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

0.5% Equity

PointGrab, Smart building + 20.8%

Inc. IL automation Technology Sales Advised GBP0.1m GBP0.1m GBP4.1m GBP4.1m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Dname-iT Life 61.5%

* BEL Lab technology Sciences Pre sales Equity GBP0.1m GBP0.1m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

QuantalX Medical Life Late stage

Neuroscience IL diagnostics Sciences clinical 0.4% Equity GBP0.1m GBP0.1m - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Oncocidia Cancer Life Early stage 41.3%

* BEL therapeutics Sciences clinical Equity - - - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Longevity $250k

Biotech, Neurology Life Early stage Convertible

Inc. US therapeutics Sciences clinical loan note - - - -

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Sub Total GBP13.0m GBP11.2m GBP14.4m GBP15.2m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Advised

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Vortex Liquid

Biosciences, biopsy Life 96.0%

Inc. UK/US oncology Sciences Sales Indirect - - GBP3.9m GBP4.9m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Digital

Wanda Health, health 74.7%

Inc. UK/US monitoring Healthcare Sales Indirect - - GBP2.2m GBP2.9m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Insight

Photonic Semiconductors

Solutions, Akinetic $1.25m

Inc. US laser Technology Sales Warrants - - GBP0.9m GBP0.9m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Nanotech

Industrial $1.0m

Solutions, Material Convertible

Inc. US science Technology Sales loan note - - GBP0.7m GBP0.7m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

Sub Total - - GBP7.7m GBP9.4m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

TOTAL GBP31.0m GBP29.2m GBP22.1m GBP24.6m

-------- ---------------- ----------- ------------ ------------ --------- ----------- --------- ---------

On the Consolidated Statement of Financial Position, the owned

portfolio is shown as Equity investments classified as FVTOCI and

Financial assets classified as FVTPL.

The combination of direct and capital under advisory investments

gives the Group a greater influence in the portfolio companies,

access to follow-on funding, and enables greater financial and

value-added support for the portfolio companies. The amounts under

Capital Under Advisory are associated with carried interest or

profit share agreements, typically between 10% and 20%.

While it is difficult to value or estimate the current value of

these stakes, for demonstration purposes an average 2x portfolio

return on the Capital Under Advisory of GBP24.6 million could

result in carry returns to EMV Capital of over GBP4 million.

Subsidiaries and listed investment highlights

EMV Capital (100% owned subsidiary)

-- EMV Capital is the Venture Capital and Corporate Finance arm

of NetScientific, enabling the execution of the capital light

investment model of the Group (acquired in 2020).

-- Investment syndication occurs through its growing EIS

investment practice, a family office network, wealth managers,

institutional VCs and corporate venture capital - with the backing

of a PLC balance sheet and brand.

-- EMV Capital has in place a carried interest arrangement with

investors, providing additional potential investment returns and

fees to the Group.

-- During the period, EMVC executed several syndicated

transactions, increasing Capital Under Advisory by 11% to GBP24.6

million (2021: GBP22.1 million) following the successful completion

of several fundraising transactions (SageTech, Q-Bot and Sofant),

and continued funding of portfolio companies under existing

investor arrangements (Vortex, Wanda).

-- The company also provides paid-for management support

services to several of the portfolio companies, to support growth

and fund-raising initiatives, and planning routes to exit.

-- The company also signed several additional fundraising

mandates, and further incubation support and consultancy

engagements - building a pipeline for the rest of 2022 and

beyond.

-- EMV Capital was delighted to appoint Ed Hooper as an

Executive Director (in addition to his role as General Counsel for

NSCI), Ed brings a wealth of high-calibre transactional expertise,

providing further critical mass as we continue our structured

growth and realisation plans.

ProAxsis Ltd (100% owned subsidiary)

-- Belfast-based subsidiary, which specialises in respiratory,

other diagnostics, and building a significant expertise in the

measurement of inflammatory biomarkers, with a growing global

client list of pharmaceutical companies, and leading academic

laboratories.

-- Advances include further services to clinical trials and the

commercialisation of five novel or improved products, following

their successful CE marking in the first half of 2022.

-- The global licence agreement with AstraZeneca, in May 2022

was a "blue chip" validation of ProAxsis. This was further enhanced

by the successfully completed Performance Evaluation study of the

COVID-19 antibody test, with exceptional levels of sensitivity and

specificity of 100% and 99.3% respectively.

-- This COVID-19 antibody test gives ProAxsis a competitive

position in the COVID and the wider research and clinical trials

markets.

-- The company established the necessary infrastructure and

human resources and will continue its investment programme to

exploit its full business potential.

-- ProAxsis has already taken temporary lab space close to

Washington DC. Plans are well advanced for leasing a long-term

suitable full US lab, with associated commercialisation and

sales/marketing facilities.

-- This will enable the company to deliver consistent

high-quality service for clinical trials, either side of the

Atlantic and to access higher value US clinical trials. The

ProAxsis team has created a strong sales pipeline on either side of

the Atlantic.

-- In addition to grant finance, these developments are expected

to enhance the ability of the company to access third party

funding.

Glycotest (62% holding)

-- Focused on the development of early-stage liver cancer diagnostics.

-- Co-investment with Fosun Pharma as minority partner, with a

licensing agreement for the Chinese market.

-- Enrolment and progress in clinical trials has progressed well

even with COVID-19 delays, building up valuable samples, data, and

productive sites, and is now entering the final stage. The bulk of

the significant spend has already been deployed and becomes due for

reimbursement by Fosun, under the existing agreement. In 2021,

Fosun made a further payment on account of $1 million leaving a

balance of $3 million of milestone-based funding to Glycotest.

-- Glycotest management believes the clinical trials have

resulted in one of the world's largest databanks in the liver

cancer study space, providing a good basis for further

development.

-- The HCC Panel clinical validation study and algorithm

training set have continued to be delayed by technical issues,

problems with the outsourced lab, and operating arrangements. These

are being progressively tackled.

-- An expert contract lab has been commissioned to carry out

troubleshooting and assay optimisation to complete the training

set, which will be a significant value inflection point for the

company, now expected in the first half of 2023.

-- The company is exploring avenues for commercialisation and

opportunities, recognising the significant value inflection points

and continues to work closely with Fosun Pharma for the successful

development and realisation of returns from the business.

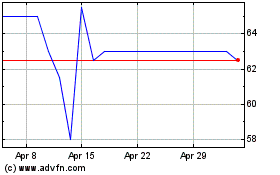

PDS Biotechnology (NASDAQ Listed, 4.7% holding)

-- NetScientific backed PDS Biotechnology in 2014 prior to its

NASDAQ listing and retains a shareholding of 4.7%.

-- The Immunotherapy biopharma company is developing novel

T-cell activating cancer treatment, and infectious disease vaccine

candidates.

-- After a successful fund-raise of $52m in 2021, PDS recently

raised $35m non-dilutive funding from Horizon Technology Finance

which extends its runway well into 2024.

-- The company has four phase 2 oncology clinical trials in

progress. Clinical partnerships are with Merck, MD Anderson Cancer

Center and National Cancer Institute.

-- Interim data presented in June 2022 at ASCO from the NCI-led

PDS0101 Phase 2 trial showed tumor reduction in c.67% of patients

(four of six subjects) who had failed prior treatment.

-- FDA fast-track status has been secured for phase 3, with

multiple near-term readouts expected in the second half of 2022 and

2023.

-- The fair value of the NetScientific stake was GBP4.0 million

at the end of period (2021: GBP8.0 million), broadly in line with

the biotech sector.

Portfolio Strategy and other company updates

-- In line with our stated strategy, a prioritised framework is

applied to the portfolio and the proactive management of the

companies.

-- Following a detailed review of the portfolio of 22 companies,

we have focused on several portfolio companies where we have made

greater direct and syndicated investments, increasing influence,

and value-added management support.

-- We are considered by many of our portfolio companies as the

'go to' investment partner, which provides us early access to

investment opportunities (including secondaries).

-- Consequently, the Group has invested GBP593,000 in

non-subsidiary companies and syndicated over GBP2.5 million in

total for portfolio companies over the past six months, as we

continue to grow and add value across the enhanced portfolio.

Several direct investments were made by NetScientific in the

portfolio companies as part of the capital light investment model,

and to enable the syndication of further funds by EMVC. These

included:

Q-Bot (24% direct stake, 16% indirect stake)

-- London-based Q-Bot, which is a leading UK developer of robots

for use in the retrofit construction industry, has successfully

closed a GBP1.62m investment round to fund the next stage of its

growth, primarily from existing investors.

-- The fair value of NSCI's c.24% stake (acquired for c.GBP1m in

Q3 2021) has increased by 108% to GBP2.1m.

-- The additional funds allowed Q-Bot to accelerate the rollout

of its unique solution of remotely applying underfloor insulation

across the UK and engage with growing overseas demand.

-- Q-Bot's growth is through an expansion of its network of

Accredited Installation Partners, industrialising robot

manufacturing at scale, and internationalisation to the EU and

US.

-- EMV Capital also supported a Board-led turnaround initiated

in Q3 2021 under a consultancy project with Q-Bot.

-- Revenues doubled in its most recent financial year to March

2022, and is expected to continue growing in the UK, with

international sales due to start later in 2022

-- As the UK's de facto leader in construction and retrofit

robotics, Q-Bot works with both social and private landlords, as

well as homeowners, having now insulated more than 3,000

properties.

-- Our VC arm EMV Capital led the investment round, with further syndicated investment planned.

-- The Group converted GBP500k of Q-Bot convertible loan notes

plus interest in the round at a 25% discount.

Vortex (30% direct stake)

-- Co-located in the UK and the US Bay Area, US, Vortex's

mission is to build a platform around its high-quality Circulating

Tumour Cell ("CTC") capture technology - providing researchers and

clinicians access to critical insights from whole cancer cells that

underpin one of the main causes of metastasis, treatment

resistance, and disease recurrence.

-- In May 2022 NetScientific announced the conditional

acquisition of its 30% stake, which has been now completed

-- Appointment of Paul Jones as CEO, an experienced senior

industry professional to lead the company's growth.

-- It has a growing international customer base for its

automated VTX-1 instrument and associated cartridges, an innovative

"no touch" microfluidic chip technology which captures high

quality, viable CTCs from blood with very high yields.

-- These can then provide input to further downstream molecular

analysis, ultimately informing patient access to therapy and

monitoring.

-- The company's development is taking place in a growing

market. The liquid biopsy market size was valued at $8.1 billion in

2021 and is projected to surpass $26.2 billion by 2030, growing at

14 percent over the period (Precedent Research).

We are working actively with several other promising companies,

exploring how best to progress their ambitious growth paths and

deliver results. At the time of writing, there are several

fundraisings underway, as well as a promising pipeline of further

consultancy engagements which will be announced in due course.

FINANCIAL OVERVIEW

In line with expectations, the Group made a loss of GBP1.7

million (H1 2021: GBP1.5 million) for the period, all from

continuing operations, including continued substantial expensed

investment in research and development at ProAxsis and Glycotest,

active management and considered additional headcount and building

of the NetScientific platform .

Income Statement

Revenue for the first half of 2022 was down a modest 4% to

GBP391,000 (H1 2021: GBP407,000), with a promising pipeline for the

second half of 2022. ProAxsis revenue at GBP115k (2021: GBP82k) is

up 40% on the prior year, with kit sales and new products up 49%,

and clinical research services up 30%.

Other operating income increased to GBP265,000 (H1 2021:

GBP53,000), as a result of fair value movement and adjustments on

derivative financial assets classified as "fair value through

profit and loss" (FVTPL) of GBP179,000 (H1 2021: GBPNil), grant and

other income of GBP65,000 (H1 2021: GBP7,000), and ProAxsis R&D

tax above the line of GBP21,000 (H1 2021: GBP46,000).

Research and development costs of GBP814,000 (H1 2021:

GBP651,000) were higher in the first half as Cetromed, Glycotest,

and ProAxsis continue development and clinical trials. Further

development costs on five projects of GBP280,000 (H1 2021:

GBP290,000) was capitalised at ProAxsis during the period.

Selling and administrative costs of GBP1.4 million (H1 2021:

GBP1.2 million) were higher, mainly due to increased headcount in

the subsidiaries and at head office, and increased spending in

drives towards commercialisation and eventual liquidity events.

Balance Sheet

Cash at the period end amounted to GBP2.4 million (2021: GBP2.7

million), following a fundraise of GBP1.44 million net of costs in

June 2022.

Cash used in operations during the period was GBP1.132 million

(H1 2021: GBP1.134 million). Cash held within the subsidiary

Glycotest is not freely available for use within the wider group as

it would need the consent of a minority shareholder. Intangible

assets stood at GBP3.221 million (2021: GBP3.045 million). ProAxsis

capitalised a further GBP280,000 of development costs during the

period (2021: GBP585,000) and amortisation during the period was

GBP105,000 (2021: GBP163,000). Refer to note 8 below for more

information.

Equity investments held for sale and classified as fair value

through other comprehensive income ("FVTOCI") stood at GBP9.435

million on 30 June 2022 (2021: GBP11.516 million). A decrease in

value of GBP2.081 million, relates predominately to the PDS

Biotechnology (NASDAQ: PDSB) price decline, and a trade investment

measured at fair value, was down GBP4.0 million during the period.

This is offset by an increase in fair value on Q-Bot of GBP1.1

million to GBP2.1 million during the period, reflecting the

increased share price in the fundraise of Q2 2022.

All equity investments not quoted on an active market have had

their fair values established using inputs other than quoted prices

that are observable, i.e., the price from the latest third party

round as publicly disclosed. Refer to note 9 below for further

information.

Derivative financial instruments classified as fair value

through profit and loss ("FVTPL"), were fair valued and stood at

GBP1.651 million on 30 June 2022 (2021: GBP1.462 million). An

increase in value of GBP189,000 was obtained, which relates

predominately to a Vortex loan of GBP250,000. Refer to note 10

below for further information.

The Group ended the period with net assets of GBP15.836 million

(2021: GBP18.509 million), amounting to a decrease of GBP2.673

million. The movement is shown in the consolidated statement of

changes in equity and is mainly constituted by the loss in the

period of GBP1.448 million and the negative movement in equity

investments held for sale and derivative financial instruments of

GBP2.873 million, offset by the successful fundraise during June

2022 of GBP1.444 million net of costs.

Board and Senior Management

There were no Board changes during the period, and the Board

continues to work effectively providing the requisite corporate

governance, positive challenge, and strategic drive. Ed Hooper, a

senior City lawyer, was appointed as General Counsel and joined the

Board of EMV Capital as executive director.

Summary and Outlook

The Board will closely monitor the markets and relevant industry

developments. It maintains a flexible approach to new

opportunities, both for investment and generating returns from

investments.

NetScientific's portfolio is focused on businesses with high

growth prospects. These are expected to generate shareholder

returns through the increased value of direct company holdings and

a carry fee on "capital under advisory". We will build on this

established business model and operating template, to drive

continued growth, and realise shareholder value.

The Group also continues to be well positioned in both the ESG

and impact investment arenas, with long-standing investments in

sustainability and healthcare.

We will continue to benefit from our capital-light investment

approach, utilising EMV Capital's network of private, corporate,

and institutional investors and the judicious use of NSCI's balance

sheet. All the while, we are able to assist with the fund-raising

needs of our portfolio companies, with a significant percentage

added as Capital Under Advisory with carried interest. The Board

believes that the balanced investment approach, with advised and

carried interest stakes, leads to diversified investment returns

with a structure that can support a large portfolio and limited

balance sheet.

We are focused on progressing the various projects, including

fee-generating transactions, in the second half of 2022, and

beyond, building opportunities for growth and realising returns for

shareholders.

John Clarkson Ilian Iliev

Executive Chairman Chief Executive Officer

30 September 2022 30 September 2022

CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHSED 30 JUNE 2022

NetScientific plc

Unaudited Unaudited

Six months Six months

ended 30 ended 30

June June

Continuing Operations Notes 2022 2021

GBP000s GBP000s

------------------------------------------- -------- ------------ ------------

Total Income 656 460

Revenue 4 391 407

Cost of sales (30) (35)

------------------------------------------- -------- ------------ ------------

Gross profit 361 372

Other operating income 265 53

Research and development costs (814) (651)

Selling, general and administrative

costs (1,427) (1,205)

Other costs (103) (51)

Loss from operations (1,718) (1,482)

Finance income 51 2

Finance expense (20) (8)

Loss before taxation (1,687) (1,488)

Income Tax 29 40

------------------------------------------- -------- ------------ ------------

Total loss for the period from

continuing operations (1,658) (1,448)

------------------------------------------- -------- ------------ ------------

Loss attributable to:

Owners of the parent 5 (1,394) (1,195)

Non-controlling interests (264) (253)

------------------------------------------- -------- ------------ ------------

(1,658) (1,448)

------------------------------------------- -------- ------------ ------------

Basic and diluted loss per share

attributable to owners of the parent

during the period: 5

Total loss for the period from continuing

operations (6.6p) (7.9p)

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2022

Unaudited Unaudited

Six months Six months

ended 30 ended 30

June June

Notes 2022 2021

GBP000s GBP000s

Loss for the period (1,658) (1,448)

Items that may be subsequently

reclassified to profit or loss in

subsequent periods:

Exchange differences on translation

of foreign operations 352 (10)

Change in fair value of investments

classified as fair value through

other comprehensive income (2,873) 9,892

Total comprehensive profit/(loss)

for the period (4,179) 8,434

Attributable to:

Owners of the parent (3,887) 8,689

Non-controlling interests (292) (255)

---------------------------- ---------- --------

(4,179) 8,434

--------------------------- ---------- --------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

Unaudited Audited

30 June 31 December

2022 2021

Notes GBP000s GBP000s

Assets

Non-current assets

Property, plant and equipment 6 140 136

Right-of-use assets 7 142 158

Intangible assets 8 3,221 3,045

Equity investments classified as

FVTOCI* 9 9,435 11,516

Derivative financial assets classified

as FVTPL** 10 1,651 1,462

Total non-current assets 14,589 16,317

Current assets

Inventories 11 71 67

Trade and other receivables 12 1,159 1,598

Cash and cash equivalents 13 2,363 2,710

Total current assets 3,593 4,375

Total assets 18,182 20,692

Liabilities

Current liabilities

Trade and other payables 14 (1,742) (1,529)

Lease liabilities 15 (33) (32)

Loans and borrowings 16 (89) (59)

Total current liabilities (1,864) (1,620)

Non-current liabilities

Lease liabilities 15 (115) (131)

Loans and borrowings 16 (367) (432)

Total non-current liabilities (482) (563)

Total liabilities (2,346) (2,183)

Net assets 15,836 18,509

Issued capital and reserves

Attributable to the parent

Called up share capital 17 1,168 1,056

Warrants 42 42

Share premium account 74,124 72,792

Capital reserve account 237 237

Equity investment reserve 1,631 4,504

Foreign exchange and capital reserve 1,748 1,368

Retained earnings (62,831) (64,499)

Equity attributable to the owners

of the parent 16,119 18,500

Non-controlling interests (283) 9

Total equity 15,836 18,509

* Fair value through other comprehensive income

** Fair value through profit and loss

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2022

Shareholders' equity

Foreign

exchange

Equity and

Share Share Capital investment Retained capital Non-controlling Total

capital Warrants premium reserve reserve earnings reserve Total interests equity

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

1 January 2021 746 65,594 65,594 237 (1,505) (59,702) 1,368 6,738 158 6,896

Loss for the

period - - - - - (1,195) - (1,195) (253) (1,448)

Other

comprehensive

income -

Foreign

exchange

differences - - - - - - (8) (8) (2) (10)

Change in fair

value during

the period - - - - 9,892 - - 9,892 - 9,892

Total

comprehensive

income - - - - 9,892 (1,195) (8) 8,689 (255) 8,434

Issue of share

capital 303 - 7,492 - - - - 7,795 - 7,795

Cost of share

issue - - (436) - - - - (436) - (436)

Decrease in

subsidiary

shareholding - - - - - 215 2 217 128 345

Share-based

payments - - - - - 42 - 42 - 42

30 June 2021 1,049 - 72,650 237 8,387 (60,640) 1,362 23,045 31 23,076

Loss for the

period - - - - - (1,190) - (1,190) (224) (1,414)

Other

comprehensive

income -

Foreign

exchange

differences - - - - - - 8 8 (7) 1

Change in fair

value during

the period - - - - (3,883) - - (3,883) - (3,883)

Total

comprehensive

income - - - - (3,883) (1,190) 8 (5,065) (231) (5,296)

Issue of share

capital 7 - 143 - - - - 150 - 150

Cost of share

issue - - (1) - - - - (1) - (1)

Issue of

warrants - 42 - - - - - 42 - 42

Decrease in

subsidiary

shareholding - - - - - 232 (2) 230 209 439

Share-based

payments - - - - - 99 - 99 - 99

31 December

2021 1,056 42 72,792 237 4,504 (61,499) 1,368 18,500 9 18,509

Loss for the

period - - - - - (1,394) - (1,394) (264) (1,658)

Other

comprehensive

income -

Foreign

exchange

differences - - - - - - 380 380 (28) 352

Change in fair

value during

the period - - - - (2,873) - - (2,873) - (2,873)

Total

comprehensive

income - - - - (2,873) (1,394) 380 (3,887) (292) (4,179)

Issue of share

capital 112 - 1,388 - - - - 1,500 - 1,500

Cost of share

issue - - (56) - - - - (56) - (56)

Share-based

payments - - - - - 62 - 62 - 62

30 June 2022 1,168 42 74,124 237 1,631 (62,831) 1,748 16,119 (283) 15,836

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2022

Notes Unaudited Unaudited

Six months Six months

ended 30 ended 30

June June

2022 2021

GBP000s GBP000s

Cash flows from operating activities

Loss after income tax (1,658) (1,448)

Adjustments for:

Depreciation of property, plant

and equipment 20 25

Depreciation of right to use assets 16 16

Amortisation of intangibles 105 61

Estimated credit losses on trade

receivables 18 (9)

Change in fair value of financial (179) -

assets classified as FVTPL

Capitalisation of development costs (280) (255)

Share-based payments 62 42

R&D tax credit (21) -

Foreign exchange gain/(loss) 233 5

Finance income (61) (2)

Finance costs 4 8

Income Tax (29) (86)

(1,770) (1,643)

Changes in working capital

(Increase) in inventories (4) (15)

Decrease/(Increase) in trade and

other receivables 473 (117)

Increase in trade and other payables 169 563

Cash used in operations (1,132) (1,212)

Income tax received - 78

Net cash used in operating activities (1,132) (1,134)

Cash flows from investing activities

Purchase of property, plant and

equipment (24) (41)

Purchase of equity investments classified

as FVTOCI - (622)

Purchase of derivative financial

assets classified as FVTPL (593) (100)

Net cash (used in) investing activities (617) (763)

Cash flows from financing activities

Proceeds received on change in stake

in subsidiary - 345

Lease payments (19) (19)

Repayment of borrowings (35) (360)

Interest paid - (3)

Proceeds of loan - 550

Proceeds from share issue 1,500 7,641

Share issue cost (56) (436)

Net cash from financing activities 1,390 7,718

(Decrease)/Increase in cash and

cash equivalents (359) 5,821

Cash and cash equivalents at beginning

of the period 2,710 1,628

Exchange differences on cash and

cash equivalents 12 (9)

Cash and cash equivalents at end

of the period 13 2,363 7,440

NOTES TO THE UNAUDITED INTERIM FINANCIAL INFORMATION

FOR THE SIX MONTHSED 30 JUNE 2022

1. ACCOUNTING POLICIES

Basis of preparation

The interim financial information, which is unaudited, have been

prepared on the basis of the accounting policies expected to apply

for the financial year to 31 December 2022 and in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006. Policies have been

consistently applied to all periods presented apart from where new

standards have been adopted during the period, see below for

changes in accounting policies.

The financial information for the period ended 30 June 2022 does

not constitute the full statutory accounts for that period. The

Annual Report and Financial Statements for the year ended 31

December 2021 have been filed with the Registrar of Companies. The

Independent Auditor's Report on the Report and Financial Statements

for the year ended 31 December 2021 was unqualified and did not

contain a statement under sections 498(2) or 498(3) of the

Companies Act 2006.

Going Concern

The 2021 Annual Report audit report drew attention to the

material uncertainty relating to going concern as follows:

"We draw attention to note 2 to the financial statements, which

indicates the Directors' considerations over going concern. The

going concern of the Group and Parent Company is dependent on

additional funding being raised which is not yet secured. As stated

in note 2, these events or conditions, along with other matters as

set forth in note 2, indicate that a material uncertainty exists

that may cast significant doubt on the Group and the Parent

Company's ability to continue as a going concern. Our opinion is

not modified in respect of this matter.

In auditing the financial statements, we have concluded that the

Directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate."

The Directors have prepared and reviewed budget cashflows which

were approved by the Board of Directors in the Board meeting of 1

February 2022. The review included the key budget assumptions,

sensitivities, and contingency plans to cover eventualities,

including the associated cash flow projections. The review has been

updated and also taken into consideration the potential impact of

changing market conditions and other risks. Having made substantial

progress, including a GBP1.5m fund-raise in June, and as shown on

the balance sheet, the Group remains in a strong position. As a

result, The Directors do not believe going concern is an issue for

the next 12 months from the date of this report.

The financial statements do not include any adjustments that

would be necessary if the group or company was unable to continue

as a going concern.

1 ACCOUNTING POLICIES (continued)

Business Combinations

The Group recognises identifiable assets acquired and

liabilities assumed in a business combination, regardless of

whether they have been previously recognised in the acquiree's

financial statements prior to the acquisition. Assets acquired and

liabilities assumed are generally measured at their

acquisition-date fair values. Goodwill is stated after separate

recognition of identifiable intangible assets. It is calculated as

the excess of the sum of: a) fair value of consideration

transferred; b) the recognised amount of any non-controlling

interest in the acquiree; and c) acquisition-date fair value of any

existing equity interest in the acquiree, over the acquisition-date

fair values of identifiable net assets. If the fair values of

identifiable net assets exceed the sum calculated above, the excess

amount (i.e. gain on a bargain purchase) is recognised in profit or

loss immediately.

Change in accounting policies

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2021 annual financial statements.

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the Group has decided

not to adopt early.

The following amendments are effective for the period beginning

1 January 2022:

-- Onerous Contracts - Cost of Fulfilling a Contract (Amendments

to IAS 37);

-- Property, Plant and Equipment: Proceeds before Intended Use

(Amendments to IAS 16);

-- Annual Improvements to IFRS Standards 2018-2020 (Amendments

to IFRS 1, IFRS 9, IFRS 16 and IAS 41); and

-- References to Conceptual Framework (Amendments to IFRS

3).

The following amendments are effective for the period beginning

1 January 2023:

-- Disclosure of Accounting Policies (Amendments to IAS 1 and

IFRS Practice Statement 2);

-- Definition of Accounting Estimates (Amendments to IAS 8);

and

-- Deferred Tax Related to Assets and Liabilities arising from a

Single Transaction (Amendments to IAS 12).

In January 2020, the IASB issued amendments to IAS 1, which

clarify the criteria used to determine whether liabilities are

classified as current or non-current. These amendments clarify that

current or non-current classification is based on whether an entity

has a right at the end of the reporting period to defer settlement

of the liability for at least twelve months after the reporting

period. The amendments also clarify that 'settlement' includes the

transfer of cash, goods, services, or equity instruments unless the

obligation to transfer equity instruments arises from a conversion

feature classified as an equity instrument separately from the

liability component of a compound financial instrument. The

amendments were originally effective for annual reporting periods

beginning on or after 1 January 2022. However, in May 2020, the

effective date was deferred to annual reporting periods beginning

on or after 1 January 2023.

The Group does not expect any other standards issued by the

IASB, but not yet effective, to have a material impact on the

group.

Use of estimates and judgements

There have been no material revisions to the nature and amount

of estimates of amounts reported in prior periods, including:

(a) Impairment of goodwill;

(b) The valuation of intangibles;

(c) The valuation of equity investments; and

(d) The capitalisation of development costs

Impact of accounting standards to be applied in future

periods

There are a number of standards and interpretations which have

been issued by the International Accounting Standards Board that

are effective for periods beginning subsequent to 31 December 2021,

that the Group has decided not to adopt early. The Group does not

believe these standards and interpretations will have a material

impact on the financial statements once adopted.

2. SIGNIFICANT EVENTS AND TRANSACTIONS

COVID

The consequences of the COVID pandemic have varied across the

portfolio, the negative impact has been managed, with new

opportunities opening up and the individual companies have adjusted

accordingly. Group companies have received minimal amounts of

Government Covid-19 business support. The approach has been to

respond proactively to the operating environment, particularly to

minimise downside risks and concentrate on upside opportunities.

Given the core focus of the Group, the Board believes that in the

aftermath of the COVID pandemic there is increased potential across

several of its portfolio companies.

Global Environment

The Group is operating in an increasingly uncertain

macroeconomic environment. The after-effects of the pandemic,

significant turmoil in the tech and capital sectors, the

geopolitical concerns, most notably the conflict in Ukraine, and

the more recent economic pressures are causing additional market

volatility and uncertainty.

The impact to these and downturn in global environment on the

Group's interim consolidated financial statements for the six

months ended 30 June 2022 are summarised as follows.

(a) No impairment of group assets.

The carrying value of the Group's assets have been assessed in

light of current events and the long-term impacts that these may

have on the investments of the Group. Overall, we believe that the

sectors the group is active in are in a strong position and it was

not seen as necessary to impair the carrying value of any assets

further. The recoverable amount was determined based on values in

use, which utilises current budgets/reforecasts and cash flow

projections. We are closely monitoring and managing the events, and

will take further actions if required, as the situation continues

to evolve. Cash planning and management is in place for all

businesses, which have been stress tested based on a number of

scenarios. Importantly as a result of the various factors,

NetScientific and several of its portfolio companies are seeing new

sustainable opportunities, offering potential for future

growth.

3. SEGMENTAL REPORTING

An operating segment is a component of the group that engages in

business activities from which it may earn revenues and incur

expenses, for which separate financial information is available and

whose operating results are evaluated by the Chief Operating

Decision Maker to assess performance and determine the allocation

of resources. The Chief Operating Decision Maker has been

identified as the Board of Directors.

The Board of Directors assess the performance of the operating

segment using financial information which is measured and presented

in a manner consistent with that in the financial statements.

Revenue from contracts with customers by segment

30 June 2022 Delivered Service Fees Total

Goods GBP000s GBP000s

GBP000s

-------------- ---------- ------------- ---------

EMV Capital - 276 276

ProAxsis 67 48 115

67 324 391

-------------- ---------- ------------- ---------

30 June 2021 Delivered Goods Service Fees Total

GBP000s GBP000s GBP000s

-------------- ---------------- ------------- ---------

EMV Capital - 325 325

ProAxsis 45 37 82

45 362 407

-------------- ---------------- ------------- ---------

Total Loss for the period by segment

Unaudited Unaudited

Six months Six months

ended 30 June ended 30 June

2022 2021

GBP000s GBP000s

--------------- --------------- ---------------

NetScientific (541) (772)

EMV Capital (154) 18

ProAxsis (236) (88)

Glycotest (654) (606)

Cetromed (73) -

(1,658) (1,448)

--------------- --------------- ---------------

The above losses reflect investment in R&D by Glycotest and

ProAxsis, which add value for the future through new product and

clinical trials. ProAxsis has seen further investment through

proportional Grant funding. The investment by the Group has been

done through shareholder loans, which are expected to be repaid in

due course.

4. REVENUE

Revenue from contracts with customers: United Kingdom

Delivered Service Fee's Total

Goods GBP000s GBP000s

GBP000s

-------------- ---------- -------------- ---------

30 June 2022 67 324 391

30 June 2021 45 362 407

5. LOSS PER SHARE

The basic and diluted loss per share is calculated by dividing

the loss for the financial period by the weighted average number of

ordinary shares in issue during the period. Potential ordinary

shares from outstanding options at 30 June 2022 of 1,120,010 (30

June 2021: 620,729; 31 December 2021: 1,064,498) are not treated as

dilutive as the group is loss making.

Unaudited Unaudited

Six months Six months

ended 30 ended 30

June June

2022 2021

GBP000s GBP000s

------------------------------------------- ------------ ------------

Loss attributable to equity holders

of the Company

Continuing operations (1,475) (1,195)

Total Loss attributable to equity holders

of the Company (1,475) (1,195)

------------ ------------

Number of shares

Weighted average number of ordinary

shares in issue 21,146,591 15,067,947

On 29 June 2022 the Company issued 2,238,807 of 5p ordinary

shares at 67p per share, raising gross funds of GBP1,500k and net

funds of GBP1,444k. On 29 June 2021 the Company issued 5,958,123 of

5p ordinary shares at 130p per share, raising gross funds of

GBP7,746k and net funds of GBP7,309k. The total number of voting

rights in the Company at 30 June 2022 is 23,360,660 5p ordinary

shares (30 June 2021: 20,975,311, 31 December 2021: 21,121,853.

6. PROPERTY, PLANT AND EQUIPMENT

Furniture,

Leasehold fittings Plant

Improvement and equipment and machinery Totals

GBP000s GBP000s GBP000s GBP000s

----------------------- ------------- --------------- --------------- ---------

Cost

----------------------- ------------- --------------- --------------- ---------

At 1 January 2021 100 35 170 305

----------------------- ------------- --------------- --------------- ---------

Additions - 5 36 41

----------------------- ------------- --------------- --------------- ---------

At 30 June 2021 100 40 206 346

----------------------- ------------- --------------- --------------- ---------

Additions - 15 6 20

----------------------- ------------- --------------- --------------- ---------

At 31 December 2021 100 55 212 367

----------------------- ------------- --------------- --------------- ---------

Exchange adjustments - 1 - 1

----------------------- ------------- --------------- --------------- ---------

Additions - 3 21 24

----------------------- ------------- --------------- --------------- ---------

At 30 June 2022 100 59 233 392

----------------------- ------------- --------------- --------------- ---------

Depreciation

----------------------- ------------- --------------- --------------- ---------

At 1 January 2021 42 18 117 177

----------------------- ------------- --------------- --------------- ---------

Charge for the period 6 2 17 25

----------------------- ------------- --------------- --------------- ---------

At 30 June 2021 48 20 134 202

----------------------- ------------- --------------- --------------- ---------

Charge for the period 4 9 16 29

----------------------- ------------- --------------- --------------- ---------

At 31 December 2021 52 29 150 231

----------------------- ------------- --------------- --------------- ---------

Charge for the period 6 4 11 20

----------------------- ------------- --------------- --------------- ---------

At 30 June 2022 58 33 161 252

----------------------- ------------- --------------- --------------- ---------

Net book value

----------------------- ------------- --------------- --------------- ---------

At 30 June 2022 42 26 72 140

----------------------- ------------- --------------- --------------- ---------

At 31 December 2021 48 26 62 136

----------------------- ------------- --------------- --------------- ---------

At 30 June 2021 52 20 72 144

----------------------- ------------- --------------- --------------- ---------

ProAxsis leasehold improvements of GBP100k are funded by a

third-party loan.

7. RIGHT-OF-USE-ASSETS

Unaudited

Six months Audited

ended 30 Year ended

June 31 December

2022 2021

GBP000s GBP000s

------------------------------------ ------------ --------------

Cost

Opening balance at start of period 253 253

Closing balance at end of period 253 253

Amortisation

Opening balance at start of period (95) (64)

Add:

Charge for the period (16) (31)

Closing balance at end of period (111) (95)

------------------------------------ ------------ --------------

Net Book Value

As at end of period 142 158

------------------------------------ ------------ --------------

There is one long term lease, the Group has decided it will

apply the modified retrospective approach to IFRS 16. In addition,

it has decided to measure right-of-use assets by reference to the

measurement of the lease liability on that date.

The lease liabilities were measured at the present value of the

remaining lease payments, discounted using the Group's incremental

borrowing rate as at 1 January 2019. The Group's incremental

borrowing rate is the rate at which a similar borrowing could be

obtained from an independent creditor under comparable terms and

conditions. The rate applied was 3.5%.

Right-of-use assets are amortised on a straight-line basis over

the remaining term of the lease or over the remaining economic life

of the asset.

Short term leases still expensed as operating amount to GBP9k

(H1 2021: GBP20k) with a maturity of two months.

8 . INTANGIBLE ASSETS

Development Investment

Carry Interest costs Acquisition

Goodwill Arrangements Costs Patents Total

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

-------------------------- --------- --------------- ------------ ------------- -------- --------

Cost

-------------------------- --------- --------------- ------------ ------------- -------- --------

At 1 January 2021 669 1,627 337 17 50 2,700

Additions - - 585 - - 585

At 31 December

2021 669 1,627 922 17 50 2,700

-------------------------- --------- --------------- ------------ ------------- -------- --------

Additions - - 280 - - 280

At 30 June 2021 669 1,627 1,202 17 50 2,955

-------------------------- --------- --------------- ------------ ------------- -------- --------

Accumulated amortisation

and impairment

-------------------------- --------- --------------- ------------ ------------- -------- --------

At 1 January 2021 - 76 - - 1 77

Amortisation charge - 140 18 - 5 163

-------------------------- --------- --------------- ------------ ------------- -------- --------

At 31 December

2021 - 216 18 - 6 240

-------------------------- --------- --------------- ------------ ------------- -------- --------

Amortisation charge - 81 19 - 4 105

-------------------------- --------- --------------- ------------ ------------- -------- --------

At 30 June 2021 - 297 37 - 10 345

-------------------------- --------- --------------- ------------ ------------- -------- --------

Net book value

-------------------------- --------- --------------- ------------ ------------- -------- --------

At 30 June 2022 669 1,330 1,165 17 40 3,221

-------------------------- --------- --------------- ------------ ------------- -------- --------

At 31 December

2021 669 1,411 904 17 44 3,045

-------------------------- --------- --------------- ------------ ------------- -------- --------

The main factors leading to the recognition of these intangibles

are resulting from the acquisition by NetScientific of EMV Capital,

ProAxsis and Cetromed.

ProAxsis acquired a key patent as part of the buyout of the

founders and Queens University for GBP50k which will be amortised

over the economic life of the patent. A further GBP280k of ProAxsis

development costs have been capitalised during the period taking

the total capitalised to GBP1,202k in line with the accounting

policy as certain projects now meet all the criteria for

development costs to be recognised as an asset as it is probable

that future economic value will flow to the Group.

9. EQUITY INVESTMENTS CLASSIFIED AS FAIR VALUE THROUGH OTHER COMPREHENSIVE INCOME (FVTOCI)

NetScientific makes direct investments into portfolio companies

through a mixture of equity and loans. The tables below outline the

Group's positions.

Represents equity securities

Unaudited Audited

Six months Year ended

ended 30 31 December

June 2021

2022 GBP000s

GBP000s

------------------------------------------------------------------------- ------------- --------------

Opening balance at start of period 11,516 2,970

Additions - 2,192

Acquired through business combinations - 342

Conversion of derivative financial assets 652 -

Change in fair value during the period (2,733) 6,012

Closing balance at end of period 9,435 11,516

Unaudited

Six months Audited

% of ended 30 Year ended

issued June 2022 31 December

Country share Currency GBP000s 2021

Name of incorporation capital denomination GBP000s

---------------------- ------------------- ------------- ------------- ------------- --------------

PDS Biotechnology

Corp USA 4.72% US$ 4,024 8,047

Q-Bot Ltd UK 23.70% UKGBP 2,778 1,025

SageTech Medical

Equipment Ltd UK 2.25% UKGBP 887 887

CytoVale, Inc. USA 1.00% US$ 412 371

Fox Biosystems

NV BEL 5.06% EUREUR 400 335

G-Tech Medical,

Inc. USA 3.04% US$ 351 317

Epibone, Inc. USA 0.84% US$ 322 290

Martlet Capital

Ltd UK 1.51% UK 175 175

PointGrab Israel 0.49% US$ 76 68

Oncocidia BEL 41.27% EUREUR 10 1

9,435 11,516

----------------------- --------------------------------- ------------- ------------- --------------

Equity investments classified as fair value through other

comprehensive income are held for sale, fair valued and stand at

GBP9,435k (2021: GBP11,516k). A decrease in value of GBP2,081k,

which relates predominately to the decrease in fair value of PDS

Biotechnology Corporation offset by a GBP1.1m increase in fair

value on Q-Bot Ltd.

10. DERIVATIVE FINANCIAL ASSETS CLASSIFIED AS FAIR VALUE THROUGH PROFIT AND LOSS (FVTPL)

Warrants, convertible loans and loans Unaudited

classified as FVTPL Six months Audited

ended 30 Year ended

June 31 December

2022 2021

GBP000s GBP000s

---------------------------------------------------- ------------- --------------

Opening balance at start of period 1,462 78

Additions 593 1,332

Additional accrued interest 51 24

Conversion to Equity Investments classified (652) -

as FVTOCI

Change in fair value during the period 197 28

Closing balance at end of period 1,651 1,462

----------

30 June

Currency 2022 2021

Name Country of incorporation denomination GBP000s GBP000s

------------------------ ------------------------- -------------- -------------- --------

EpiBone, Inc. USA US$ 604 543

Sofant Technologies

Ltd UK UKGBP 351 324

Vortex Biotech Holdings

Ltd UK UKGBP 253 -

Fox Biosystems NV BEL EUREUR 135 128

Q-Bot Ltd UK UKGBP 143 312

G-Tech Medical, Inc. USA US$ 87 79

Martlet Capital Ltd UK UKGBP 78 76

1,651 1,462

----------------------------------------------------------------- -------------- --------

Derivative financial assets classified as fair value through

profit and loss are GBP1,651k (2021: GBP1,462k). An increase in

fair value of GBP189k, which mainly relates to the increase in fair

value of Vortex Biotech Holdings.

11. INVENTORY

Unaudited

Six months Audited

ended 30 Year ended

June 31 December

2022 2021

GBP000s GBP000s

---------------------------------- ------------ --------------

Finished products 71 67

Closing balance at end of period 71 67

Inventories are held at net realisable value. ProAxsis finished

products constitute ProteaseTag active neutrophil elastase

immunoassay kits.

During the period the impairment charges totalled GBPNil (H1

2021: GBPNil).

12. TRADE AND OTHER RECEIVABLES

Current Unaudited

Six months Audited

ended 30 Year ended

June 31 December

2022 2021

GBP000s GBP000s

---------------------------------- ------------ --------------

Trade receivables 159 140

Taxation 138 88

Other receivables 66 815

Prepayments 97 77

Accrued income 699 478

Closing balance at end of period 1,159 1,598

The carrying value of trade and other receivables classified at

amortised cost approximates fair value. The Group does not hold any

collateral as security against any trade and other receivables.

Estimated credit losses have been calculated as follows:

Unaudited

Six months Audited

ended 30 Year ended

June 31 December

2022 2021

GBP000s GBP000s