Mondi PLC Disposal

August 12 2022 - 6:46AM

UK Regulatory

TIDMMNDI

Mondi plc

(Incorporated in England and Wales)

(Registered number: 6209386)

LEI: 213800LOZA69QFDC9N34

LSE share code: MNDI ISIN: GB00B1CRLC47

JSE share code: MNP

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, IN, INTO OR

FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF THAT JURISDICTION.

THE GROUP EXPECTS TO PUBLISH IN DUE COURSE A CIRCULAR IN CONNECTION WITH THE

TRANSACTION, ANY VOTING DECISIONS BY SHAREHOLDERS IN CONNECTION WITH THE

TRANSACTION SHOULD BE MADE ON THE BASIS OF THE INFORMATION CONTAINED IN THAT

CIRCULAR.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

FOR IMMEDIATE RELEASE.

12 August 2022

Proposed disposal of Mondi Syktyvkar

Mondi plc ("Mondi" or the "Group") today announces that it has entered into an

agreement to sell its most significant facility in Russia, Joint Stock Company

Mondi Syktyvkar, together with two affiliated entities (together "Syktyvkar" or

the "Business") to Augment Investments Limited ("Augment") for a consideration

of RUB 95 billion (around ?1.5 billion at current exchange rate)[1], payable in

cash on completion (the "Disposal").

The Disposal is conditional on the approval of the Russian Federation's

Government Sub-Commission for the Control of Foreign Investments and customary

antitrust approvals. The Disposal is also subject to the approval of Mondi's

shareholders at a General Meeting.

The Syktyvkar assets to be transferred to Augment as part of the proposed

Disposal exclude a cash balance of RUB 16 billion (around ?255 million at

current exchange rate). The cash balance is planned to be distributed by form

of dividend to Mondi before completion. Remittance of this dividend requires

the approval of the Ministry of Finance of the Russian Federation. The net

proceeds from the Disposal and the RUB 16 billion dividend will be distributed

to Mondi's shareholders as soon as reasonably practicable following receipt.

The proposed Disposal follows Mondi's announcement on 4 May 2022 that, having

assessed all options for the Group's interests in Russia, it had decided to

divest its Russian assets. Accordingly, Mondi launched a competitive auction

process to find a suitable new owner for Syktyvkar.

Syktyvkar is a wholly owned integrated pulp, packaging paper and uncoated fine

paper mill located in Syktyvkar (Komi Republic). The Business employs

approximately 4,500 people and it is a leading provider of uncoated fine paper

and containerboard to the domestic Russian market. For the year ended 31

December 2021, Syktyvkar reported revenues of ?821 million, EBITDA of ?334

million and profit before tax of ?271 million. For the six months ended 30 June

2022, Syktyvkar reported EBITDA of ?225 million and as of 30 June 2022, the

gross assets of the Business were ?1,590 million while its net asset value was

?1,203 million. Mondi operates three converting plants in Russia, which are

much smaller in size, not affiliated with Syktyvkar and not part of the

Disposal. An update will be provided on the divestment of these plants in due

course.

Augment is an investment vehicle majority owned by Viktor Kharitonin,

comprising assets in the pharmaceutical and other sectors across Russia, Europe

and the United Kingdom.

The Disposal is expected to complete in the second half of 2022. However, the

divestment process for these significant assets is operationally and

structurally complex and is being undertaken in an evolving political and

regulatory environment. Therefore, there can be no certainty as to when the

proposed Disposal will be completed.

Further information regarding conditions of the disposal

As set out above, the Disposal is subject to the approval of the Russian

Federation's Government Sub-Commission for the Control of Foreign Investments

as well as customary antitrust approvals.

The Disposal is a Class 1 transaction under the Listing Rules and it is

therefore conditional upon the approval of Mondi's shareholders at a General

Meeting.

The date of the General Meeting will be confirmed in a Circular and notice of

General Meeting to be published following receipt of approval from the Russian

Federation's Government Sub-Commission for the Control of Foreign Investments.

Enquiries

Investors/analysts:

Clara Valera

+44 193 282 6357

Mondi Group Head of Strategy and Investor Relations

Media:

Kerry Cooper

+44 788 145 5806

Mondi Group Communication Director

Richard Mountain (FTI Consulting) +44

790 968 4466

Rothschild & Co (Financial Adviser and Sponsor to Mondi):

John

Deans

+44 207 280 5000

Neil Thwaites

Important Notice

This announcement is for information purposes only and does not constitute a

prospectus or prospectus equivalent document. Nothing in this announcement

shall constitute an offer or invitation to underwrite, buy, subscribe, sell or

issue of the solicitation of an offer to buy, sell, acquire, dispose or

subscribe for shares of any other securities. Nothing in this announcement

should be interpreted as a term or condition of the Disposal.

A circular is expected to be published in due course in connection with the

Disposal (the "Circular"). Copies of the Circular will, following publication,

be available through the website of Mondi at www.mondigroup.com. Neither the

content of Mondi's website nor any website accessible by hyperlinks on the

Group's website is incorporated in, or forms part of, this announcement.

Mondi urges its shareholders to read the Circular once published carefully as

it contains important information in relation to the Disposal. Any vote in

respect of resolutions to be proposed at the General Meeting to approve the

Disposal and related matters should be made only on the basis of the

information contained in the Circular.

The information contained in this announcement is for background purposes only

and does not purport to be full or complete. No reliance may be placed for any

purpose on the information contained in this announcement or its accuracy or

completeness. The information in this announcement is subject to change.

N.M. Rothschild & Sons Limited ("Rothschild & Co") is authorised and regulated

in the United Kingdom by the Financial Conduct Authority (the "FCA") and is

acting exclusively for the Group and no one else in connection with the

contents of this document and any other matters referred to in this document

and will not regard any other person (whether or not a recipient of this

document) as a client in relation to any other matters referred to in this

document and will not be responsible to anyone other than the Group for

providing the protections afforded to its clients, or for providing advice, in

relation to the contents of this document or any other matter or arrangement

referred to in this document.

Rothschild & Co does not accept any responsibility whatsoever for the contents

of this document, including its accuracy, completeness or verification, or for

any other statement made or purported to be made by it, or on its behalf, in

connection with the Group and/or any other transaction or arrangement referred

to herein. Rothschild & Co accordingly disclaims, to the fullest extent

permitted by applicable law, all and any duty, liability, or responsibility

whatsoever whether arising in tort, contract or otherwise, which it might

otherwise have in respect of this document or any such statement. No

representation or warranty, express or implied, is made by Rothschild & Co or

any of its affiliates as to the accuracy, completeness, verification or

sufficiency of the information set out in this document, and nothing in this

document will be relied upon as a promise or representation in this respect,

whether or not to the past or future, provided that nothing in this paragraph

shall seek to exclude or limit any responsibilities or liabilities which may

arise under the FSMA or the regulatory regime established thereunder.

Forward-Looking Statements

This document includes forward-looking statements. All statements other than

statements of historical facts included herein, including, without limitation,

those regarding Mondi's financial position, business strategy, market growth

and developments, expectations of growth and profitability and plans and

objectives of management for future operations, are forward-looking statements.

Forward-looking statements are sometimes identified by the use of

forward-looking terminology such as "believe", "expects", "may", "will",

"could", "should", "shall", "risk", "intends", "estimates", "aims", "plans",

"predicts", "continues", "assumes", "positioned" or "anticipates" or the

negative thereof, other variations thereon or comparable terminology. Such

forward-looking statements involve known and unknown risks, uncertainties and

other factors which may cause the actual results, performance or achievements

of Mondi, or industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements and other

statements contained in this document regarding matters that are not historical

facts involve predictions and are based on numerous assumptions regarding

Mondi's present and future business strategies and the environment in which

Mondi will operate in the future. These forward looking statements speak only

as of the date on which they are made.

No assurance can be given that such future results will be achieved; various

factors could cause actual future results, performance or events to differ

materially from those described in these statements. Such factors include in

particular but without any limitation: (1) operating factors, such as continued

success of manufacturing activities and the achievement of efficiencies

therein, continued success of product development plans and targets, changes in

the degree of protection created by Mondi's patents and other intellectual

property rights and the availability of capital on acceptable terms; (2)

industry conditions, such as strength of product demand, intensity of

competition, prevailing and future global market prices for Mondi's products

and raw materials and the pricing pressures thereto, financial condition of the

customers, suppliers and the competitors of Mondi and potential introduction of

competing products and technologies by competitors; and (3) general economic

conditions, such as rates of economic growth in Mondi's principal geographical

markets or fluctuations of exchange rates and interest rates.

Mondi expressly disclaims a) any warranty or liability as to accuracy or

completeness of the information provided herein; and b) any obligation or

undertaking to review or confirm analysts' expectations or estimates or to

update any forward-looking statements to reflect any change in Mondi's

expectations or any events that occur or circumstances that arise after the

date of making any forward-looking statements, unless required to do so by the

Disclosure Guidance and Transparency Rules, the UK Market Abuse Regulation or

applicable law or any regulatory body applicable to Mondi, including the JSE

Limited, the FCA and the LSE.

Any reference to future financial performance included in this announcement has

not been reviewed or reported on by the Group's auditors.

Editor's notes

Mondi is a global leader in packaging and paper, contributing to a better world

by making innovative solutions that are sustainable by design. Our business is

integrated across the value chain - from managing forests and producing pulp,

paper and films, to developing and manufacturing sustainable consumer and

industrial packaging solutions using paper where possible, plastic when useful.

Sustainability is at the centre of our strategy, with our ambitious commitments

to 2030 focused on circular driven solutions, created by empowered people,

taking action on climate.

In 2021, Mondi had revenues of ?7.0 billion and underlying EBITDA of ?1.2

billion from continuing operations, and employed 21,000 people worldwide. Mondi

has a premium listing on the London Stock Exchange (MNDI), where the Group is a

FTSE100 constituent, and also has a secondary listing on the JSE Limited (MNP).

[1] Converted at FX rate of 61.7 RUB/EUR

END

(END) Dow Jones Newswires

August 12, 2022 06:46 ET (10:46 GMT)

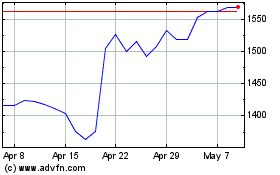

Mondi (LSE:MNDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mondi (LSE:MNDI)

Historical Stock Chart

From Apr 2023 to Apr 2024