TIDMMER

RNS Number : 7938I

Mears Group PLC

13 August 2019

13 August 2019

Mears Group PLC

("Mears" or "the Group" or "the Company")

Interim Results for the six months ended 30 June 2019

Continued strategic progress and solid operational

performance

Mears Group PLC (LSE: MER), a leading provider of services to

the Housing and Care sectors in the UK, announces its financial

results for the period ended 30 June 2019.

Key highlights

-- Interim results are in line with management expectations and previous guidance.

-- Group revenues were up 10% at GBP480.8m (2018: GBP435.3m),

growth driven by the MPS business, acquired in November 2018.

-- Normalised diluted EPS as expected reduced to 12.27p (2018:

15.04p) impacted by a reduction in profitability in Development

where the Group is scaling back its activity, an increase in shares

issued in the equity placing funding MPS acquisition and the impact

of IFRS 16.

-- Strong working capital performance with average daily net

debt marginally better than expectations at GBP110.7m. (2018 H1:

GBP112.1m, 2018 FY: GBP113.2m)

-- Strong period of new contract bidding, securing 60% of the value of opportunities bid.

-- Order book up 43% to GBP3.0bn (2018: GBP2.1bn) reflecting a

successful period of bidding wins, including the one-off impact of

the Asylum Accommodation and Support Services Contract ('AASC'),

augmented by the acquisition of MPS.

-- The Board has declared an increased interim dividend of 3.65p per share (2018: 3.55p).

Financial highlights

Note: The 2019 figures reflect the impact of IFRS 16; earlier

periods have not been restated

Six months Six months

to to

June 2019 June 2018 Change

Revenue GBP480.8m GBP435.3m +10%

Statutory profit before tax GBP12.5m GBP12.9m -3%

Adjusted profit before tax* GBP17.1m GBP19.0m -10%

Statutory diluted EPS 9.12p 10.44p -13%

Normalised diluted EPS* 12.27p 15.04p -18%

Interim dividend per share 3.65p 3.55p +3%

Average daily net debt GBP110.7m GBP112.1m

---------------------------- ---------- ---------- ------

* Stated before amortisation of acquisition intangibles and

exceptional costs. The normalised diluted EPS measure is further

adjusted to reflect a full tax charge.

Commenting, David Miles, Chief Executive Officer, Mears,

said:

"I am satisfied with the progress made in the first half of

2019. Our financial and market position is robust as we seek to

build on existing strengths and take advantage of new

opportunities. The Board is confident of making further progress

for the full year and over the longer-term.

"A significant amount of time and focused effort has been

directed towards the integration of MPS and the mobilisation of

AASC. I am confident that the Group is well placed to benefit from

this up-front investment.

"The Group will accelerate the evolution of its Care business,

placing increasing emphasis on Housing with Care. We will also

continue the unwinding of the working capital absorbed within

Development activities, reducing the Group's indebtedness whilst

ensuring that we contribute to the housing development needs of our

customers.

"The Board remains confident of delivering its expectations for

the full year, in line with previous guidance."

Analyst presentation

A presentation for analysts will be held at 9.30am today at the

offices of Buchanan, 107 Cheapside, London, EC2V 6DN. Please

contact Buchanan on 020 7466 5000 or e-mail

mears@buchanan.uk.com.

For further information, contact:

Mears Group PLC

David Miles, Chief Executive Tel: +44(0)7778 220 185

Officer

Andrew Smith, Finance Director Tel: +44(0)7712 866 461

Alan Long, Executive Director Tel: +44(0)7979 966 453

www.mearsgroup.co.uk

Buchanan

Mark Court/Sophie Wills Tel: +44(0)20 7466 5000

mears@buchanan.uk.com

About Mears

Mears employs over 10,000 people and provides services in every

region of the UK. In partnership with our Housing clients, we

maintain, repair and upgrade the homes of hundreds of thousands of

people in communities from remote rural villages to large inner

city estates. Mears has extended its activities to provide broader

housing solutions to solve the challenge posed by the lack of

affordable housing and to provide accommodation for the most

vulnerable. Our Care teams provide support to over 15,000 people a

year, enabling the elderly and those living with disabilities to

continue living in their own homes.

We focus on long-term outcomes for people rather than short-term

solutions, and invest in innovations that have a positive impact on

people's quality of life and on their communities' social, economic

and environmental wellbeing. Our innovative approaches and market

leading positions are intended to create value for our customers

and the people they serve while also driving sustainable financial

returns for our providers of capital, especially our

shareholders.

Introduction

Mears has delivered a solid performance in the first half of

2019. Trading in the core Housing division has been in line with

expectations and these operations have been strengthened by the

mobilisation of the new Asylum Accommodation and Support contract

('AASC') and the integration of the business acquired from Mitie in

November 2018 ('MPS').

Group revenue for the six months to 30 June 2019 increased to

GBP480.8m (2018: GBP435.3m) with operating profit before the

amortisation of acquisition intangibles, exceptional costs and

before the impact of the new leasing accounting standard ('IFRS

16'), reducing to GBP19.3m (2018: GBP20.5m). This is in line with

expectations and reflects some margin dilution from the newly

acquired MPS business as well as a reduction in profitability in

Development where the Group is scaling back its activity. Pre-tax

profits, before the amortisation of acquisition intangibles and

exceptional costs reduced to GBP17.1m (2019: GBP19.0m), which is

stated after the impact of IFRS 16. The normalised diluted EPS, on

a similar basis reduced to 12.27p (2018: 15.04p) also impacted by

the increase in shares following the equity placing to fund the MPS

acquisition. Both profit and EPS are in line with expectations. The

MPS acquisition was profitable in the period and, in line with

guidance, is expected to be EPS neutral for the full 2019 financial

year with our programme for driving improvements and realising

synergies improving its performance further in the second half of

2019, reversing its loss making position on acquisition.

The Group delivered a good cash performance in the first six

months, with daily net debt slightly better than expected with the

daily average reducing to GBP110.7m (2018 H1: GBP112.1m, 2018 FY:

GBP113.2m).

The Board is declaring an increased dividend of 3.65p (2018:

3.55p) which reflects the Board's confidence in the future whilst

being mindful of the importance of maintaining a prudent capital

structure. The interim dividend will be payable, on 24 October

2019, to shareholders on the register on 4 October 2019.

Operations

Housing

2019* 2018

----------------------------- -------------------------------

Revenue Operating Margin Revenue Operating Margin

GBPm profit % GBPm profit %

/ (loss) GBPm

GBPm

------------- -------- ---------- ------- -------- ---------- -------

Maintenance 323.3 14.6 4.5% 292.9 14.5 4.9%

Management 78.7 3.9 5.0% 67.9 3.5 5.2%

Development 27.7 (0.9) (3.2%) 14.1 1.0 7.1%

------------- -------- ---------- ------- -------- ---------- -------

Total 429.7 17.6 4.1% 374.9 19.0 5.1%

------------- -------- ---------- ------- -------- ---------- -------

*before the impact of IFRS 16 and share based payments.

Maintenance

Maintenance revenue increased by 10% to GBP323.3m (2018:

GBP292.9m), with the newly acquired MPS business delivering

revenues of GBP57.5m. The core Mears Maintenance business saw

revenues reduce following our previously stated decision to exit a

small number of contracts during the second half of 2018. A number

of new mobilisations secured in the first half should reverse this

trend.

Operating margins reduced from 4.9% to 4.5%, due to margin

dilution from the newly acquired MPS business including the costs

of integration which were absorbed within normal trading.

Underlying margins from Maintenance remain within the historic 5-6%

range.

MPS has made good progress since acquisition in respect of

customer contract retention and operational performance. An

intensive integration programme, migrating all operations onto the

front-line Mears Contract Management system, has now reached an

advanced stage. Each contract migration brings an alignment of back

office processes and controls. A high level of synergy has already

been secured and the Group is confident about the underlying

profitability of the significant majority of contracts within the

business.

The first six months of 2019 has delivered new wins with a total

contract value in excess of GBP250m, an annual value of GBP35m, and

a success rate by value of 60%. Notable wins include Home Group

(South West), London Borough of Hammersmith & Fulham and

Longhurst Group. It is becoming an increasing trend that new

opportunities are created through the early termination of an

incumbent's contract. All three of these new wins have been secured

through this route, rewarding Mears' strict and disciplined bid

approach during the original tender process.

Service delivery remains our key differentiator and our

performance over the last six months has been maintained at

excellent levels.

Management

Management revenues reported an increase in activity, growing

from GBP67.9m to GBP78.7m, partly driven by the new AASC contract

which reported revenues of GBP5.0m in the first half, reflecting

the services delivered in respect of the new contract mobilisation.

The mobilisation of the AASC contract has been the focus of the

Management team.

This new contract adds significant scale to the Group's

Management operation and has also encouraged the Group to carry out

a wider review of its Management activities to ensure that this

area is sufficiently selective when developing new opportunities.

This will lead to an increasing focus on margin, working capital

requirement and risk.

The first half has been a strong period for the Group's

partnership with The Ministry of Housing, Communities and Local

Government in running the National Planning Portal. This service

commenced in 2015 and while it generated operating losses for the

initial period, the Group is now seeing a positive return on its

investment.

Development

The Group made a clear strategic decision to reduce its exposure

to this area of activity and exit from those new build activities

which require the Group to invest significant working capital.

Nevertheless, the revenues within this area have almost doubled in

the period to GBP27.7m, reflecting the phasing of the Group's

existing contractual commitments. As a result of the decision to

reduce our exposure to Development activities, the Group incurred a

small loss in the first half and a similar outcome is expected in

the second half of the year, as stated in previous guidance.

The Group's Development business is relatively small. There were

36 completed units unsold at 30 June 2019, compared with 25 units

at 31 December 2018 and 7 units at 30 June 2018, with a

corresponding increase in working capital absorbed in this area

over the last twelve months. The Group has secured an exit from two

sites where works were due to commence in late 2019. This brings

forward the final unwind of funded development to the first half of

2021. Whilst the number of unsold units is higher than planned, the

absolute numbers are of a sufficiently low level to allow the

Company to continue to withdraw from this activity through a

controlled unwinding of revenue and working capital as sites are

completed and sold.

Whilst the Group is committed to reducing its exposure to this

business, it remains important for the Group to retain a

development capability. Therefore, and as indicated, the Group will

continue to deliver solutions incorporating development where

funding is being provided by a third party. Milton Keynes

represents the best example of this model.

Care

2019* 2018

----------------------------- -------------------------------

Revenue Operating Margin Revenue Operating Margin

GBPm profit % GBPm profit %

GBPm GBPm

------ -------- ---------- ------- -------- ---------- -------

Care 51.0 1.7 3.4% 60.3 1.9 3.1%

------ -------- ---------- ------- -------- ---------- -------

*before the impact of IFRS 16 and share based payments.

Care revenues reported a reduction of 15% to GBP51.0m (2018:

GBP60.3m) as planned. Operating margins rose slightly, reflecting

the Group's disciplined policy to prioritise service quality and

margin ahead of revenue growth. The Group remains highly selective

in respect of bidding for new work but the availability of good

quality careworkers continues to constrain the business, and as a

result, carer retention and recruitment remain key areas of

focus.

Disappointingly, there has been little change in how standalone

care is procured, and even some potential deterioration in

commissioning methods. Continued underfunding and lack of progress

in Central Government policy development has led to short-term

decision making which is rarely positive for commissioners,

providers or service users.

In 2016, Mears took the decision to exit a large number of Care

contracts where Care commissioners had been unwilling to recognise

the cost of delivering excellent care. The Group directed its

activities towards those clients that were like-minded and wanted

to address the challenges being faced by Care providers, and those

whom we believed over time would make further improvements in how

Care is commissioned. This allowed Mears to offer improved pay and

working conditions to its care workers. In particular, the Group

focussed on opportunities to provide a full housing service with

much less focus on those opportunities which provide singular care

services in isolation. Our ability to deliver all elements of that

requirement is seen as a compelling offering.

Three years on, the tough decisions that we have taken have been

shown to be correct, with a smaller, better quality and profitable

Care business that has also played a part in offering an enhanced

Housing proposition and facilitating recent Group tender wins. The

Group continues to see a good pipeline of opportunities from

customers to procure new care services with accommodation, in the

majority of cases to build, manage, maintain and care for those

service users.

Mears continues to review its options around stand-alone care,

whilst extending its capability in housing with care services such

as Extra Care and the Group expects to make further progress over

the second half year. The Group's ability to support vulnerable

customers, many of whom have a Care requirement, has been central

to its success in Housing, and most recently in the Group securing

its Asylum housing contract. This continued bespoke skill set with

a deep understanding of the challenges faced by our service users

will underpin future success.

Business Development and Order Book

The order book stands at GBP3.0bn (2018: GBP2.1bn), having been

bolstered in the last twelve months by securing the AASC contract,

valued in excess of GBP1bn, together with the acquired MPS order

book of circa GBP200m and new orders secured during the first half

adding a further GBP350m.

As previously stated, the next two years are very significant

for the Group's Housing business as a number of existing contracts

come up for renewal, representing around GBP115m of annual revenue

in both 2020 and 2021. The Group has a good track record of

resecuring contracts on re-bid, and is well positioned on all

material opportunities.

The Group has a significant pipeline of new bidding

opportunities, in addition to our existing contracts that are

subject to renewal. A key strategy for the Group is to become a

provider of housing management, maintenance, repairs and upgrades

to the Ministry of Defence (MoD) and within this pipeline are five

housing-focused lots of which any bidder can win a maximum of

three. All lots are being let for an initial seven year period with

an extension option for a further three years. The bidding process

has commenced and is likely to be awarded in the first half of

2020.

Working capital

The Group has reported a reduction in its average net debt, key

to which is the tight control that the Group maintains over its

working capital balances. The working capital allocation of each

activity are set out below:

2019 2018 (full

year)

6-month average 12-month average

working capital working capital

GBPm GBPm

-------------- ------------------ ------------------

Maintenance* 14.5 19.0

Management 3.6 1.7

Development 22.7 15.6

Care 12.7 13.6

-------------- ------------------ ------------------

*Excludes MPS to assist comparability with 2018.

The Maintenance, Management and Care activities are

predominantly high volume and low value and cashflows are typically

uniform. Working capital balances in these three areas have been

maintained at consistent levels and are in line with previous

guidance with only small changes to reflect activity levels.

As highlighted at the 2018 year end, the Group reported a spike

in the working capital balances absorbed by the Development

activities in the second half of 2018. The net working capital

position within Development in the first half of 2019 is broadly

unchanged compared with the opening position, with average working

capital increasing to GBP22.7m compared with the opening spot

position of GBP21.4m. As detailed above, the Directors have

committed to delivering a controlled unwinding of working capital

allocated to this area over the next eighteen months. Cash flows

resulting from realisation of developments are by their nature not

uniform and are thus harder to predict but the expectation for the

full-year is to see a reduction in working capital utilisation,

with a more significant reduction in 2020.

Net debt

Six months Six months Six months

to June 2019 to June to June

before impact 2019 as 2018

of IFRS 16 reported

GBPm GBPm GBPm

------------------------------------------- --------------- ------------ ------------

EBITDA 23.4 42.7 24.6

------------------------------------------- --------------- ------------ ------------

Cash inflow from operating activities

before taxes paid 26.2 45.5 3.4

------------------------------------------- --------------- ------------ ------------

Total average daily net debt (operating)* (110.7) (110.7) (112.1)

*Excludes property acquisition facility

Net debt (operating) at 30 June (48.6) (48.6) (44.5)

Net debt (property acquisition facility)

at 30 June (15.0) (15.0) (30.0)

------------------------------------------- --------------- ------------ ------------

Total net debt at 30 June (63.6) (63.6) (74.5)

------------------------------------------- --------------- ------------ ------------

The Group has delivered a daily average net debt slightly better

than target and it is pleasing that all parts of the business have

reported solid working capital metrics to underpinning this. The

Group anticipates delivering improvements in the working capital

absorbed within the newly acquired MPS business, once it benefits

from the improved Mears IT systems and associated processes.

The property acquisition facility of GBP30m was introduced in

2017 to enable the Group to acquire and build portfolios of

properties prior to their disposal to long term funding partners.

The Board previously indicated its intention to unwind and cancel

this facility during the course of 2019. Good progress has been

made in this area with the facility being reduced to GBP15m during

the first half and there is visibility of a further reduction in

the second half.

The business is on track to deliver its targeted full year daily

average net debt of GBP105m and the Group continues to target a

pre-IFRS 16 average net debt to EBITDA of 1x ratio by the end of

2020.

New accounting standards; IFRS 16 'Leases'

IFRS 16 is a significant change in accounting standards and is

effective for all accounting periods beginning on or after 1

January 2019, meaning that the new standard applies for the 2019

financial year. This has introduced a single, on Balance Sheet

accounting model for leases and whilst there is no pre-tax cash

impact, it does have a significant impact on the Balance Sheet,

Income Statement and classification of cash flows.

Under IFRS 16, a lessee will recognise its right to use a leased

asset along with a lease liability representing its obligation to

make lease payments. The depreciation cost of the newly recognised

'right of use' lease asset will be charged to profit within

administrative costs, whilst the interest cost of the newly

recognised lease liability will be charged to net finance costs. On

the basis that depreciation is required to be charged on a

straight-line basis, whilst the interest element is charged on a

reducing balance basis, this results in a higher overall charge

being applied to the income statement in the early years of a

lease, with this impact reversing over the later years. The profit

impact over the life of a lease is neutral and IFRS 16 has no

impact on pre-tax cash flows.

The impact of IFRS 16 on the Group resulted in the recognition

of a right of use asset and an associated lease obligation of

GBP163.1m and GBP169.7m respectively at 1 January 2019, being the

point of transition. The Group adopted the modified retrospective

approach, meaning that the Group does not restate its comparative

figures, but recognises the cumulative effect of adopting IFRS 16

as an adjustment to equity at the beginning of the current period

as detailed in note 4. The application of IFRS 16 is complex and

sensitive to relatively small changes in the incremental borrowing

rate attached to each class of leased asset. The Group will

continue to review its application of this standard over the second

half year. Any revisions to the transitional adjustments would not

be expected to be material to the Income Statement.

The net debt measure excludes lease obligations which

principally relate to the Group's Housing Management activities,

where properties are a key service provision. Typically, the Group

enjoys nominations and other contractual agreements with its

customers which ensures a high level of occupancy. The Group will

often retain an option to cancel the lease and the Group follows a

disciplined approach to mitigate other associated risks such as

indexation, market rent levels, void properties and end of lease

obligations. Whilst the commitment is measurable under IFRS 16, it

is not appropriate to consider this in the same way as other debt

instruments.

The Group has identified significant growth opportunities

through the provision of Housing. The Group's Key Worker contract

involves the provision of circa 3,500 properties secured on short

term leases. The Group's recent success in securing three areas of

the AASC contract will see a further 4,500 properties secured

through leases with terms of between three and ten years although a

significant proportion of these will allow Mears the ability to

trigger an early break. One cannot estimate the Balance Sheet

impact without an accurate assessment of the mix of lease lengths,

but an increase in right of use assets and associated lease

obligations could be in the region of GBP150m.

IFRS 16 has impacted upon a number of commonly used financial

ratios and performance metrics including gearing, interest cover,

EBITDA, EBIT, operating profit and ROCE. The Group's banking

covenants are not affected by this accounting change as these are

'frozen' and are based on accounting standards at the time the

facility agreements came into force. The Group's bank facility runs

to 2022 which provides ample time for the banking community to

properly digest the impact of IFRS 16 on our performance

metrics.

Corporate Governance

The Chairman's statement in the 2018 Annual Report said that

Mears must be equipped with a Board that can provide a wide range

of views, skills and experience to work with and challenge the

Management team and accordingly that the balance of capabilities

around the Board table would be kept under review so as to ensure

that the Group had what it needed for effective leadership. The

Chairman's letter accompanying the notice of this year's AGM

recorded that the Board had acknowledged observations made by

shareholders in conversation with the Chairman early this year and

accordingly that searches had commenced to identify two new

Non-Executive Directors to add skills and experience in finance,

investor relations and commercial and general management.

The tabling by one of the Company's shareholders of resolutions

to appoint two individuals to the Board afforded the Chairman the

opportunity for further detailed conversations throughout May 2019

with almost all of the company's largest shareholders, representing

between them over 80% of the Company's share capital. Those

discussions were a very valuable interaction. They resulted in

shareholders collectively agreeing that the Board should continue

with its process to select new Non-Executive Directors with the

qualities and experience that Mears requires.

For the first such appointment, the Group sought an individual

with strong finance skills and a good understanding of effective

investor relations, gained as the Finance Director of a UK listed

company. The Board was pleased to announce on 2 July 2019 the

appointment of Jim Clarke as Non-Executive Director. Jim has spent

much of his career in senior finance roles in consumer facing

industries, having been Group Chief Financial Officer of

Countrywide plc for many years and, prior to that, Finance Director

at JD Wetherspoon and David Lloyd Leisure. Jim is also audit

committee Chair at Hansteen Holdings.

For the next appointment, we are seeking strong commercial and

senior general management experience gained from a role as the

Chief Executive of a business of scale. This search is proceeding

well and is now at a very advanced stage. We would expect to be

able to complete it around the end of this month.

Board development is a continuous process and the composition of

the Mears Board will be kept under review in the coming months and

into 2020. The objective remains to ensure that the Board maintains

an optimal balance of skills and experience to ensure effective

leadership and also that it continues to play a leading role in

demonstrating good corporate governance.

Results of AGM

Following the results of the Group's AGM in May 2019, the Group

is required to provide an update in accordance with the 2018 UK

Corporate Governance Code. The Board noted that Resolution 2

(concerning the approval of the remuneration report); Resolutions 6

to 15 (concerning the election or re-election of each of the

Directors); Resolution 17 (concerning the general authority to

allot relevant securities); Resolution 18 to 19 (concerning the

authority to issue ordinary shares without a pre-emptive offer),

Resolution 20 (concerning the holding of General Meetings on 14

days' clear notice); and Resolutions 21 and 22 (which were

requisitioned by PrimeStone Capital Irish Holdco DAC concerning the

appointment of two additional Non-Executive Directors), received

20% or more votes against the Board's recommendation.

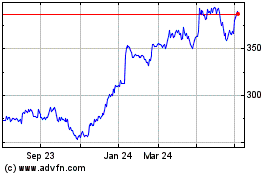

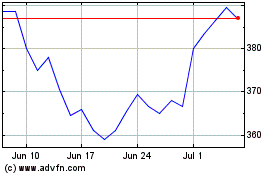

The Board recognises that a number of shareholders are

dissatisfied with the performance of the Company and its share

price. Their concerns were acknowledged by the Board in the full

year results announcement and it was made clear that the

composition of the Board would be kept under review to ensure that

it continues to provide effective leadership. Progress on the

appointment of two new Non-Executive Directors has been described

above.

The Board notes that Resolutions 17 to 20 also received 20% or

more votes against the Board's recommendation, despite engagement

with shareholders during the previous year on these matters. These

Resolutions are consistent with the latest investor guidelines and

with the Resolutions approved in previous years. Following

shareholder discussions during the previous year, the Board

understands that some shareholders vote against these resolutions

as a matter of policy. In addition, this year, a small number of

significant shareholders also voted against these Resolutions and,

as a result, they did not reach the threshold required to pass as

special resolutions. The Company is continuing to consult with

shareholders voting against these resolutions to understand their

views in relation to the specific authorities sought.

Social Value

Investing in local communities and our workforce has been

fundamental to Mears for over 25 years. There is increasing

evidence that satisfied customers and strongly motivated staff are

vital success factors for all businesses. For Mears, it is

especially important to demonstrate that it is a responsible and

trusted partner to its increasingly wide ranging public sector

customers. Mears' reputation for excellent service delivery

combined with a strong emphasis on social value is critical to our

business success and to delivering the outputs that create

consistent and long term shareholder value.

The Group's achievements have been recognised by numerous

accolades over the last six months, including:

-- Sunday Times Top 25 Big Companies to work for.

-- One of the highest scoring companies on FTSE4Good

demonstrating our approach to governance and transparency.

-- Achieving Institute of Customer Service (ICS) ServiceMark

& TrainingMark accreditations for our leading approach to

service delivery and colleague development.

-- Achieving Royal Society for the Prevention of Accidents

(ROSPA) Gold Award (16 consecutive years) for our health and safety

standards and training.

-- Achieving a high level of Housing Diversity Network

Accreditation for our work on inclusivity.

The first half of 2019 has seen many notable achievements but

most importantly Mears' ongoing commitment to local communities has

been shown to deliver GBP15.3m of social value across almost 400

activities. Recognising Mears' commitment and best practice, the

Group is delighted to have been invited by Central Government to be

the Social Mobility Pledge Champion for the 'Services' sector.

The Group's workforce commitment is highlighted by the desire to

make Mears a great place to work for everyone and thereby ensure

that it is able to recruit and retain the talent needed to achieve

its ambitious strategic goals. This is signalled by having an

Employee Director on the Group's main Board and equally by the

commitment of every Mears leader to provide opportunity and

positive working conditions for all staff at all levels.

Outlook

The Board commends all employees for their continued commitment

and the enormous part they have played in making Mears the business

that it is.

A significant amount of time and focused effort has been

directed towards the integration of MPS and the mobilisation of

AASC. We are confident that the Group is well placed to benefit

from this up-front investment.

The Group will accelerate the evolution of its Care business,

placing increasing emphasis on Housing with Care. We will also

continue the unwinding of the working capital absorbed within

Development activities and reducing the Group's indebtedness while

continuing to contribute to the housing development needs of our

customers.

The Board remains confident of delivering its expectations for

the full year, in line with previous guidance.

Half-year condensed consolidated income statement

For the six months ended 30 June 2019

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

Note GBP'000 GBP'000 GBP'000

---------------------------------------------------- ---- ---------- ---------- -----------

Sales revenue 3 480,755 435,257 869,843

Cost of sales (363,720) (333,924) (662,825)

---------------------------------------------------- ---- ---------- ---------- -----------

Gross profit 117,035 101,333 207,018

Other administrative expenses (93,916) (80,866) (166,177)

---------------------------------------------------- ---- ---------- ---------- -----------

Operating result before amortisation of acquisition

intangibles and exceptional costs 23,119 20,467 40,841

Exceptional costs - (3,975) (5,657)

Amortisation of acquisition intangibles (4,583) (2,159) (4,434)

---------------------------------------------------- ---- ---------- ---------- -----------

Total administrative costs (98,499) (87,000) (176,268)

---------------------------------------------------- ---- ---------- ---------- -----------

Operating profit 3 18,536 14,333 30,750

Finance income 5 660 259 1,154

Finance costs 5 (6,725) (1,737) (3,473)

---------------------------------------------------- ---- ---------- ---------- -----------

Profit for the period before tax, amortisation

of acquisition intangibles and exceptional costs 17,054 18,989 38,522

---------------------------------------------------- ---- -----------

Profit for the period before tax 12,471 12,855 28,431

Tax expense 6 (1,981) (2,044) (3,606)

---------------------------------------------------- ---- ---------- ---------- -----------

Profit for the period 10,490 10,811 24,825

---------------------------------------------------- ---- ---------- ---------- -----------

Attributable to:

Equity holders of the Company 10,121 10,864 24,064

Non-controlling interests 369 (53) 761

---------------------------------------------------- ---- ---------- ---------- -----------

Profit for the period 10,490 10,811 24,825

---------------------------------------------------- ---- ---------- ---------- -----------

Earnings per share

Basic 8 9.16p 10.49p 23.05p

Diluted 8 9.12p 10.44p 22.91p

---------------------------------------------------- ---- ---------- ---------- -----------

Half-year condensed consolidated statement of comprehensive

income

For the six months ended 30 June 2019

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

GBP'000 GBP'000 GBP'000

--------------------------------------------------------- ---------- ---------- -----------

Net result for the period 10,490 10,811 24,825

--------------------------------------------------------- ---------- ---------- -----------

Other comprehensive income for the period

Which will be subsequently reclassified to the Income

Statement:

Cash flow hedges:

- (losses)/gains arising in the period (115) 3 -

- reclassification to the Income Statement 7 244 325

Increase / (decrease) in deferred tax asset in respect

of cash flow hedges 21 (35) (45)

Which will not be subsequently reclassified to the

Income Statement:

Actuarial loss on defined benefit pension scheme (1,700) - (9,431)

Increase in deferred tax asset in respect of defined

benefit pension schemes 323 - 1,792

--------------------------------------------------------- ---------- ---------- -----------

Other comprehensive income for the period (1,464) 212 (7,359)

--------------------------------------------------------- ---------- ---------- -----------

Total comprehensive income for the period 9,026 11,023 17,466

--------------------------------------------------------- ---------- ---------- -----------

Attributable to:

Equity holders of the Parent 8,657 11,076 16,705

Non-controlling interests 369 (53) 761

--------------------------------------------------------- ---------- ---------- -----------

Total comprehensive income for the period 9,026 11,023 17,466

--------------------------------------------------------- ---------- ---------- -----------

Half-year condensed consolidated balance sheet

As at 30 June 2019

As at As at As at

30 June 30 June 31 December

2019 2018 2018

Note GBP'000 GBP'000 GBP'000

---------------------------------------------- ---- ------- ------- -----------

Assets

Non-current

Goodwill 197,380 193,642 197,073

Intangible assets 28,257 15,102 31,570

Property, plant and equipment 192,874 24,405 24,956

Pensions and other employee benefits 15,668 27,308 17,368

Deferred tax asset 6,721 8,188 5,500

---------------------------------------------- ---- ------- ------- -----------

440,900 268,645 276,467

---------------------------------------------- ---- ------- ------- -----------

Current

Assets classified as held for sale 12,592 30,886 12,442

Inventories 34,827 26,810 29,751

Trade and other receivables 174,715 132,300 178,194

Current tax assets - - 609

Cash at bank and in hand 40,121 75,495 27,876

---------------------------------------------- ---- ------- ------- -----------

262,255 265,491 248,872

---------------------------------------------- ---- ------- ------- -----------

Total assets 703,155 534,136 525,339

---------------------------------------------- ---- ------- ------- -----------

Equity

Equity attributable to the shareholders of

Mears Group PLC

Called up share capital 11 1,105 1,036 1,105

Share premium account 82,224 60,339 82,224

Share-based payment reserve 2,121 1,844 2,021

Hedging reserve (133) (114) (46)

Merger reserve 46,214 46,214 46,214

Retained earnings 72,820 77,260 79,189

---------------------------------------------- ---- ------- ------- -----------

Total equity attributable to the shareholders

of Mears Group PLC 204,351 186,579 210,707

Non-controlling interest (58) (529) (427)

---------------------------------------------- ---- ------- ------- -----------

Total equity 204,293 186,050 210,280

---------------------------------------------- ---- ------- ------- -----------

Liabilities

Non-current

Long-term borrowing and overdrafts 88,731 70,000 78,780

Pensions and other employee benefits 3,802 4,966 3,802

Deferred tax liabilities 6,823 6,688 7,710

Financing liabilities 76 22 15

Lease obligations 150,049 383 892

Other liabilities 5,849 4,653 6,586

---------------------------------------------- ---- ------- ------- -----------

255,330 86,712 97,785

---------------------------------------------- ---- ------- ------- -----------

Current

Borrowings related to assets classified as

held for sale 15,000 30,000 15,000

Short-term borrowings and overdrafts - 50,000 15,000

Trade and other payables 190,527 171,183 186,856

Lease obligations 25,895 122 377

Financing liabilities 89 126 41

Current tax liabilities 2,243 1,083 -

Dividend payable 9,778 8,860 -

---------------------------------------------- ---- ------- ------- -----------

243,532 261,374 217,274

---------------------------------------------- ---- ------- ------- -----------

Total liabilities 498,862 348,086 315,059

---------------------------------------------- ---- ------- ------- -----------

Total equity and liabilities 703,155 534,136 525,339

---------------------------------------------- ---- ------- ------- -----------

Half-year condensed consolidated cash flow statement

For the six months ended 30 June 2019

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

Note GBP'000 GBP'000 GBP'000

---------------------------------------------------- ---- ---------- ---------- -----------

Operating activities

Profit for the period before tax 12,471 12,855 28,431

Adjustments 12 30,688 8,329 15,641

Change in inventories (5,342) (8,105) (11,045)

Change in trade and other receivables 2,575 (9,385) (13,948)

Change in trade and other payables 5,071 (344) (17,490)

---------------------------------------------------- ---- ---------- ---------- -----------

Cash inflow from continuing operating activities

before taxes paid 45,463 3,350 1,589

Net cash outflow from operating activities

of discontinued operations (1,763) (950) (1,610)

Taxes received 52 846 665

---------------------------------------------------- ---- ---------- ---------- -----------

Net cash inflow from operating activities 43,752 3,246 644

---------------------------------------------------- ---- ---------- ---------- -----------

Investing activities

Additions to property, plant and equipment (4,309) (5,069) (7,667)

Additions to other intangible assets (898) (1,308) (3,089)

Proceeds from disposals of property, plant

and equipment - 1 144

Net cash (outflow) / inflow in respect of property

for resale (150) (16,944) 1,499

Acquisition of subsidiary undertaking - (11,163) (27,500)

Net cash acquired with subsidiary undertakings - - (4,185)

Net cash disposed of with subsidiary - (26) (26)

Loans made to other Group entities (non-controlled) (32) (1,006) (139)

Interest received 94 17 389

---------------------------------------------------- ---- ---------- ---------- -----------

Net cash outflow from investing activities (5,295) (35,498) (40,574)

---------------------------------------------------- ---- ---------- ---------- -----------

Financing activities

Proceeds from share issue 1 135 22,089

Receipts from borrowings related to assets

classified as held for sale - 16,059 1,059

Acquisition of non-controlling interests - - (6,163)

Net movement in revolving credit facility (5,049) 69,441 43,221

Discharge of lease liabilities (14,834) (435) (479)

Interest paid (6,330) (1,673) (3,602)

Dividends paid - Mears Group PLC shareholders - - (12,539)

Dividends paid - non-controlling interests - (550) (550)

---------------------------------------------------- ---- ---------- ---------- -----------

Net cash (outflow) / inflow from financing

activities (26,212) 82,977 43,036

---------------------------------------------------- ---- ---------- ---------- -----------

Cash and cash equivalents at beginning of period 27,876 24,770 24,770

Net increase in cash and cash equivalents 12,245 50,725 3,106

---------------------------------------------------- ---- ---------- ---------- -----------

Cash and cash equivalents at end of period 40,121 75,495 27,876

---------------------------------------------------- ---- ---------- ---------- -----------

The Group considers its revolving credit facility

to be an integral part of its cash management:

- cash at bank and in hand 40,121 75,495 27,876

- revolving credit facility (88,731) (120,000) (93,780)

---------------------------------------------------- ---- ---------- ---------- -----------

Cash and cash equivalents, including revolving

credit facility (48,610) (44,505) (65,904)

---------------------------------------------------- ---- ---------- ---------- -----------

Half-year condensed consolidated statement of changes in

equity

For the six months ended 30 June 2019

Attributable to equity shareholders

of the Company

---------------------------------------------------------

Called

up Share Share-based Non-

share premium payment Hedging Merger Retained controlling Total

capital account reserve reserve reserve earnings interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

At 1 January 2018 1,036 60,204 1,469 (326) 46,214 100,897 96 209,590

Impact of change in accounting

policies - - - - - (25,641) - (25,641)

------- ------- ----------- ------- ------- -------- ----------- --------

Adjusted balance at 1 January

2018 1,036 60,204 1,469 (326) 46,214 75,256 96 183,949

------- ------- ----------- ------- ------- -------- ----------- --------

Net result for the period - - - - - 10,864 (53) 10,811

Other comprehensive income - - - 212 - - - 212

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

Total comprehensive income

for the period - - - 212 - 10,864 (53) 11,023

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

Issue of shares - 135 - - - - - 135

Share option charges - - 375 - - - - 375

Changes in non-controlling

interests - - - - - - (22) (22)

Dividends - - - - - (8,860) (550) (9,410)

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

At 30 June 2018 1,036 60,339 1,844 (114) 46,214 77,260 (529) 186,050

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

At 1 January 2019 1,105 82,224 2,021 (46) 46,214 79,189 (427) 210,280

Impact of change in accounting

policies* - - - - - (5,335) - (5,335)

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

Adjusted balance at 1 January

2019 1,105 82,224 2,021 (46) 46,214 73,854 (427) 204,945

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

Net result for the period - - - - - 10,121 369 10,490

Other comprehensive income - - - (87) - (1,377) - (1,464)

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

Total comprehensive income

for the period - - - (87) - 8,744 369 9,026

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

Issue of shares - - - - - - - -

Share option charges - - 100 - - - - 100

Changes in non-controlling

interests - - - - - - - -

Dividends - - - - - (9,778) - (9,778)

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

At 30 June 2019 1,105 82,224 2,121 (133) 46,214 72,820 (58) 204,293

------------------------------- ------- ------- ----------- ------- ------- -------- ----------- --------

* The Group has applied IFRS 16 using the modified retrospective

approach on transition. Under this method, the comparative

information is not restated (see note 4).

Notes to the half-year condensed consolidated statements

For the six months ended 30 June 2019

1. Corporate information

Mears Group PLC is a public limited company incorporated in

England and Wales whose shares are publicly traded. The half-year

condensed consolidated financial statements of the Company and its

subsidiaries for the six months ended 30 June 2019 were authorised

for issue in accordance with a resolution of the Directors on 12

August 2019.

2. Basis of preparation and accounting principles

(a) Basis of preparation

The half-year condensed consolidated financial statements for

the six months ended 30 June 2019 have been prepared in accordance

with the Disclosure and Transparency Rules (DTR) of the Financial

Conduct Authority, with IAS 34 'Interim Financial Reporting' and

with the Accounting Standards Board's 2017 statement 'Half-yearly

financial reports'. The half-year condensed consolidated financial

statements do not include all the information and disclosures

required in the annual financial statements and should be read in

conjunction with the Group's annual financial statements as at 31

December 2018, which have been prepared in accordance with IFRS as

adopted by the European Union.

This half-year condensed consolidated financial information does

not comprise statutory accounts within the meaning of Section 434

of the Companies Act 2006. Statutory accounts for the year ended 31

December 2018 were approved by the Board of Directors on 22 March

2019. Those accounts, which contained an unqualified audit report

under Section 495 of the Companies Act 2006 and which did not make

any statements under Section 498 of the Companies Act 2006, have

been delivered to the Registrar of Companies in accordance with

Section 441 of the Companies Act 2006.

The half-year condensed consolidated financial statements for

the six months ended 30 June 2019 have not been audited or reviewed

by an auditor pursuant to the Auditing Practices Board guidance on

the Review of Interim Financial Information.

There have been no significant changes to estimates of amounts

reported in prior financial years.

After reviewing the Group's performance against budget for the

current financial year, and longer-term plans, the Directors

consider that at the date of approving this half-year statement, it

is appropriate to adopt the going concern basis in its

preparation.

(b) Significant accounting policies

The accounting policies adopted in the preparation of the

half-year condensed consolidated financial statements are

consistent with those followed in the preparation of the Group's

annual financial statements for the year ended 31 December 2018,

except for the application of IFRS 16 'Leases'.

IFRS 16 'Leases'

IFRS 16 'Leases' (IFRS 16) replaces existing lease guidance,

including IAS 17, 'Leases'; IFRIC 4, 'Determining whether an

Arrangement Contains a Lease; SIC-15, 'Operating Leases -

Incentives'; and SIC-27, 'Evaluating the Substance of Transactions

Involving the Legal Form of a Lease' ('the former lease accounting

standard'). IFRS 16 is effective for annual periods beginning on or

after 1 January 2019. As stated in the Annual Report and Accounts

2018, the Group are adopting the modified retrospective approach to

transition. Applying the modified retrospective approach in IFRS 16

on transition, a company:

a) is not required to restate comparative information. Instead opening equity is adjusted;

b) can choose, on a lease by lease basis, between two

alternative methods of measuring lease assets. A company can either

measure lease assets as if IFRS 16 had always been applied or at an

amount based on the lease liability;

c) is not required to recognise lease assets and lease

liabilities for leases with a lease term ending within 12 months of

the date of initially applying IFRS 16.

The Group has chosen to measure lease assets as if IFRS 16 has

always been applied.

In addition, applying either transition approach, a company is

not required to reassess whether existing contracts contain a lease

based on the revised definition of a lease.

IFRS 16 introduces a single, on-balance sheet accounting model

for leases and for the most significant part of our leases, we will

recognise a right-of-use asset representing our right to use the

underlying asset, and a lease liability representing our obligation

to make future lease payments.

For the income statement the nature of expenses related to

leases, where the Company leases an asset (lessee), will change as

IFRS 16 replaces the operating lease expense with a depreciation

charge for right-of-use assets and interest expense on lease

liabilities.

Identifying a lease

A contract is, or contains, a lease if the contract conveys the

right to control the use of an identified asset for a period of

time in exchange for consideration. The Group has identified four

categories of lease:

a) Residential property (pertaining to the Group's Rental Income and AASC activities)

b) Commercial property (pertaining to local and central-service offices)

c) Vehicles

d) Office equipment

Lease term

The non-cancellable period of a lease are considered together

with periods covered by an option to extend and terminate the

lease, depending on the intention of the Group to enforce its right

to extend or terminate. The Group records the date of occupation

and expected date of vacation to incorporate the IFRS 16

requirements of lease term. The Group has utilised the practical

expedient IFRS 16 C10 (e) which allows the benefit of hindsight in

the determining the term of lease.

Measurement of right of use assets and lease liabilities

The lease liability is calculated by identifying, all future

lease payments, including variable lease payments, and discounting

these at the rate implicit in the lease. If this rate cannot be

readily determined, the Group's incremental borrowing rate will be

used. The incremental borrowing rate is defined as the rate of

interest that the Group would have to pay to borrow over a similar

term, and with a similar security, the funds necessary to obtain an

asset of a similar value to the right-of-use asset in a similar

economic environment. The Group has calculated the incremental

borrowing rate using the risk free rate, subsequently adjusted to

reflect; entity-specific credit risk, term premium, and asset

risk.

The right of use asset is calculated using the lease liability

plus, where applicable; any lease payments made before commencement

net of incentives, any initial direct costs incurred, an estimate

of costs to dismantle and remove the asset. The right of use asset

is subsequently measured using the cost model. Depreciation is

provided over the term of the lease.

Variable lease payments are defined as the portion of payments

made by the lessee for the right to use the underlying asset during

the lease term that varies because of changes in facts or

circumstances occurring after commencement. Some sub-categories of

residential property leases contain indexation clauses. The

indexation reference is commonly linked to the Groups ability to

increase rental income, such as the prevailing Local Housing

Allowance rate. Less commonly, the index reference is inflationary

or a pre-determined fixed rate.

Transitional adjustment

Under the modified retrospective approach, the Group does not

restate its comparative figures, but recognises the cumulative

effect of adopting IFRS 16 as an adjustment to equity at the

beginning of the current period, as detailed in note 4.

In calculating the lease liability to be recognised on

transition, the Group used a weighted average discount rate of

6.0%. A reconciliation between operating lease commitments as

defined by IAS 17 disclosed in the 2018 Annual Report and Accounts,

and the opening position reported under IFRS 16 is disclosed

below:

GBP'000

Operating lease commitments at 31 December 2018 discounted

at the weighted average incremental borrowing rate at 1

January 2019 137,543

Add: Lease payment increases reflecting future indexation 6,203

Add: Identification of additional lease payments applying

the likelihood of lease extension 25,979

Lease liabilities recognised at 1 January 2019 169,725

------------------------------------------------------------ -------

Significant judgements in the application of this standard

IFRS16 requires The Directors to include within the future lease

payments periods covered by an option to extend and terminate the

lease, depending on the intention of the Group to enforce its right

to extend or terminate.

IFRS16 requires the Group to measure its general incremental

borrowing rate. This is defined as the rate of interest that the

Group would have to pay to borrow over a similar term, and with a

similar security, the funds necessary to obtain an asset of a

similar value to the right-of-use asset in a similar economic

environment. In formulating a methodology to calculate the

incremental borrowing rate, the following factors were considered,

and the judgements applied were:

a) Market-observed risk-free rate of interest.

b) Mears Group-specific credit spread.

c) Entity-specific credit rating where appropriate.

d) Management have applied an increase to certain asset types to

reflect specific circumstances relating to a particular asset

3. Segment reporting

The Group's revenue disaggregated by pattern of revenue

recognition is as follows:

Six months Six months

ended ended

30 June 30 June

2019 2018

GBP'000 GBP'000

--------------------------------------- ---------- ----------

Schedule of rates contracts 129,277 81,183

Contracting and variable consideration 159,271 157,305

Lump sum contracts 83,288 83,279

Rental income 57,875 53,153

Care services 51,044 60,337

--------------------------------------- ---------- ----------

480,755 435,257

--------------------------------------- ---------- ----------

All of the above categories fall exclusively within the Housing

segment with the exception of Care services, which falls

exclusively within the Care segment.

Segment information is presented in respect of the Group's

business segments. Segments are determined by reference to the

internal reports reviewed by the chief operating decision

maker.

The Group operated two business segments during the period:

-- Housing - services within this segment comprise a full

housing maintenance and management service predominately to Local

Authorities and other Registered Social Landlords; and

-- Care - services within this segment comprise personal care

services for people in their own homes.

All of the Group's activities are carried out within the UK and

the Group's principal reporting to its chief operating decision

maker is not segmented by geography.

The principal measures utilised by the chief operating decision

maker to review the performance of the operating segments are that

of revenue growth and operating margins in both core divisions of

Housing and Care. The operating result utilised within the key

performance measures is stated before amortisation of acquisition

intangibles, exceptional costs and costs relating to long-term

incentive plans.

Six months ended Six months

30 June 2019 ended

30 June 2018

-------------------------------- -------------------

Operating

result

before

impact Operating

of IFRS result Operating

Revenue 16 as reported Revenue result

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ------- --------- ------------ ------- ----------

Housing 429,711 17,643 21,222 374,920 18,983

Care 51,044 1,725 1,997 60,337 1,859

---------------------------------------- ------- --------- ------------ ------- ----------

480,755 19,368 23,219 435,257 20,842

Long-term incentive plans (100) (100) (375)

---------------------------------------- ------- --------- ------------ ------- ----------

Operating result before intangible

amortisation and exceptional costs 19,268 23,119 20,467

Exceptional costs - - (3,975)

Amortisation of acquisition intangibles (4,583) (4,583) (2,159)

---------------------------------------- ------- --------- ------------ ------- ----------

Operating profit 14,685 18,536 14,333

Net finance costs (1,432) (6,065) (1,478)

Tax expense (2,130) (1,981) (2,044)

---------------------------------------- ------- --------- ------------ ------- ----------

Profit for the period 11,123 10,490 10,811

---------------------------------------- ------- --------- ------------ ------- ----------

There has been no material change in segment assets and segment

liabilities to those reported at December 2018 except for the

changes as a result of the Group adopting IFRS 16. The right of use

asset and associate lease obligation may be almost entirely

allocated to the Housing segment.

4. Changes in accounting policies

As detailed in note 2, there has been a significant mandatory

accounting change which applies from 1 January 2019: the adoption

of IFRS 16 'Leases'. The impact to retained earnings as a result of

this change is detailed below:

Retained

earnings

GBP'000

Retained earnings as previously stated at 1 January 2019 79,189

Right of use assets recognised 163,139

Lease liabilities recognised (169,725)

Impact of restatement on Deferred tax asset 1,251

Retained earnings as restated at 1 January 2019 73,854

---------------------------------------------------------- ---------

The effect of the application of IFRS 16 on the six months ended

30 June 2019 is detailed below:

As would

have been

reported As reported

before the Impact under

impact of of IFRS new accounting

IFRS 16 16 standards

GBP'000 GBP'000 GBP'000

Income statement for the six months ended

30 June 2019

Cost of sales (366,141) 2,421 (363,720)

Other administration expenses (95,346) 1,430 (93,916)

Finance costs (2,092) (4,633) (6,725)

Tax expense (2,130) 149 (1,981)

Balance sheet as at 30 June 2019

Property, plant and equipment 25,398 167,476 192,874

Deferred tax asset 5,522 1,199 6,721

Retained earnings (78,788) 5,968 (72,820)

Lease obligations (non-current) (892) (149,157) (150,049)

Lease obligations (current) (208) (25,687) (25,895)

Current tax liabilities (2,444) 201 (2,243)

Cash flow statement for the six months ended

30 June 2019

Profit for the period before tax 13,253 (782) 12,471

Adjustments 10,608 20,080 30,688

Discharge of lease liabilities (169) (14,665) (14,834)

Interest paid (1,697) (4,633) (6,330)

---------------------------------------------- ----------- --------- ---------------

IFRS 16 has impacted upon a number of commonly used performance

metrics including PBT, EBIT and EBITDA. The effect of the

application of IFRS 16 on the six months ended 30 June 2019 on

these measures is detailed below:

Six months

ended

30 June

2019 before Six months Six months

impact ended 30 ended 30

of IFRS June 2019 June 2018

16 as reported as reported

GBP'000 GBP'000 GBP'000

-------------------------------------------------- ------------ ------------ ------------

Profit for the period before tax, amortisation

of acquisition intangibles and exceptional costs 17,836 17,054 18,989

Add net finance charge 1,432 6,065 1,478

-------------------------------------------------- ------------ ------------ ------------

EBIT 19,268 23,119 20,467

Add amortisation 1,244 1,244 1,313

Add depreciation 2,923 18,369 2,832

-------------------------------------------------- ------------ ------------ ------------

EBITDA 23,435 42,732 24,612

-------------------------------------------------- ------------ ------------ ------------

The change to IFRS 16 has no impact on the lifetime

profitability of the contracts and there are no cash flow impacts.

The impact of this standard has been to reduce the operating result

for the first half of 2019 by GBP0.8m. Moving forward, it is

expected to have a negative impact in respect of operating profit

in the short term.

Movement in the right of use asset and lease obligation during

the six months to 30 June 2019 is detailed below:

Right of Lease

use asset obligation

GBP'000 GBP'000

---------------------------------------- ---------- -----------

Balance on transition at 1 January 2019 163,139 (169,725)

New leases 19,783 (19,783)

Depreciation (15,446) -

Finance cost - (4,633)

Lease payments - 19,297

----------------------------------------- ---------- -----------

Closing balance at 30 June 2019 167,476 174,844

----------------------------------------- ---------- -----------

The Lease Obligation at 30 June 2019 is allocated to four

categories of leases; residential property GBP148.3m, commercial

property GBP8.4m, vehicles GBP17.8m and office equipment GBP0.3m.

An additional lease obligation of GBP1.1m relating to finance

leases is not included in the table above.

5. Finance costs and finance income

Six months Six months

ended Ended

30 June 30 June

2019 2018

GBP'000 GBP'000

---------------------------------------------------------- ---------- ----------

Interest charge on overdrafts and short-term loans (1,685) (1,393)

Interest charge on lease liabilities (4,633) -

Interest charge on interest rate swap (effective hedges) (7) (244)

Interest charge on defined benefit obligation (400) (100)

---------------------------------------------------------- ---------- ----------

Finance costs (6,725) (1,737)

Interest income resulting from short-term bank deposits 10 9

Interest income resulting from defined benefit obligation 650 250

---------------------------------------------------------- ---------- ----------

Finance income 660 259

---------------------------------------------------------- ---------- ----------

Net finance charge (6,065) (1,478)

---------------------------------------------------------- ---------- ----------

6. Tax expense

The tax charge for the six months ended 30 June 2019 has been

based on the estimated tax rate for the full year.

Tax recognised in the Income Statement:

Six months Six months

ended Ended

30 June 30 June

2019 2018

GBP'000 GBP'000

---------------------------------------------------------------- ---------- ----------

United Kingdom corporation tax and total current tax recognised

in the Income Statement 2,800 348

Adjustment in respect of previous periods - -

---------------------------------------------------------------- ---------- ----------

Total current tax recognised in the Income Statement 2,800 348

Total deferred tax recognised in the Income Statement (819) 1,696

---------------------------------------------------------------- ---------- ----------

Total tax expense recognised in the Income Statement 1,981 2,044

---------------------------------------------------------------- ---------- ----------

7. Dividends

The interim dividend of 3.65p (2018: 3.55p) per share is not

recognised as a liability at 30 June 2019 and will be payable on 24

October 2019 to shareholders on the register of members at the

close of business on 4 October 2019. The dividend disclosed within

the half-year condensed consolidated statement of changes in equity

represents the final dividend of 8.85p (2018: 8.55p) per share

proposed in the 31 December 2018 financial statements and approved

at the Group's Annual General Meeting on 31 May 2019 (not

recognised as a liability at 31 December 2018).

8. Earnings per share

Basic Diluted

---------------------- ----------------------

Six months Six months Six months Six months

ended ended ended Ended

30 June 30 June 30 June 30 June

2019 2018 2019 2018

p p p P

-------------------------------------------------- ---------- ---------- ---------- ----------

Earnings per share 9.16 10.49 9.12 10.44

Effect of amortisation of acquisition intangibles 4.14 2.08 4.13 2.08

Effect of exceptional costs (including tax

impact) - 3.17 - 3.15

Effect of full tax adjustment (0.98) (0.64) (0.98) (0.63)

-------------------------------------------------- ---------- ---------- ---------- ----------

Normalised earnings per share 12.32 15.10 12.27 15.04

-------------------------------------------------- ---------- ---------- ---------- ----------

A normalised earnings per share (EPS) is disclosed in order to

show performance undistorted by amortisation of acquisition

intangibles and adjusted to reflect a full tax charge. The

Directors believe that this normalised measure better allows the

assessment of operational performance, the analysis of trends over

time, the comparison of different businesses and the projection of

future performance.

The profit attributable to shareholders before and after

adjustments for both basic and diluted EPS is:

Six months Six months

ended ended

30 June 30 June

2019 2018

GBP'000 GBP'000

------------------------------------------- ---------- ----------

Profit attributable to shareholders: 10,121 10,864

- amortisation of acquisition intangibles 4,583 2,159

- exceptional costs (including tax impact) - 3,278

- full tax adjustment (1,088) (659)

------------------------------------------- ---------- ----------

Normalised earnings 13,616 15,642

------------------------------------------- ---------- ----------

The calculation of EPS is based on a weighted average of

ordinary shares in issue during the year. The diluted EPS is based

on a weighted average of ordinary shares calculated in accordance

with IAS 33 'Earnings Per Share', which assumes that all dilutive

options will be exercised. The additional normalised basic and

diluted EPS use the same weighted average number of shares as the

basic and diluted EPS.

Six months Six months

ended ended

30 June 30 June

2019 2018

Millions Millions

---------------------------------------------------------- ---------- ----------

Weighted average number of shares in issue: 110.49 103.60

- dilutive effect of share options 0.49 0.40

---------------------------------------------------------- ---------- ----------

Weighted average number of shares for calculating diluted

earnings per share 110.98 104.00

---------------------------------------------------------- ---------- ----------

9. Fair value measurement of financial instruments

IAS 34 requires that interim financial statements include

certain of the disclosures about fair value of financial

instruments set out in IFRS 13 and IFRS 7. These disclosures

include the classification of fair values within a three-level

hierarchy. The three levels are defined, based on the observability

of significant inputs to the measurement, as follows:

-- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

-- Level 2: inputs other than quoted prices included within

Level 1 that are observable for the asset or liability, either

directly or indirectly; and

-- Level 3: unobservable inputs for the asset or liability.

The following table shows the levels within the hierarchy of

financial assets and liabilities measured at fair value on a

recurring basis at 30 June 2019, 31 December 2018 and 30 June

2018:

As at As at As at

30 June 30 June 31 December

2019 2018 2018

GBP'000 GBP'000 GBP'000

---------------------------------------------------- --------- --------- -----------

Financial assets

Loans and receivables

Trade receivables 55,555 42,651 63,787

Cash at bank and in hand 40,121 75,495 27,876

95,676 118,146 91,663

---------------------------------------------------- --------- --------- -----------

Financial liabilities

Fair value (Level 2)

Interest rate swaps - effective (165) (148) (56)

Fair value (Level 3)

Contingent consideration in respect of acquisitions (1,250) - (2,000)

Amortised cost

Borrowings related to assets held for sale (15,000) (30,000) (15,000)

Bank borrowings and overdrafts (88,731) (120,000) (93,780)

Trade payables (123,086) (109,847) (100,664)

Lease liabilities (175,944) (505) (1,269)

Other creditors (12,882) (5,197) (10,445)

---------------------------------------------------- --------- --------- -----------

(417,058) (265,697) (223,214)

---------------------------------------------------- --------- --------- -----------

(321,382) (147,551) (131,551)

---------------------------------------------------- --------- --------- -----------

The fair values of interest rate swaps and forward commodity

contracts have been calculated by a third party expert discounting

estimated future cash flows on the basis of market expectations of

future interest rates (Level 2).

The fair values of deferred and contingent consideration have

been calculated by the Directors by reference to expected future

income and expenditure in respect of the acquired businesses.

There were no transfers between Level 1 and Level 2 during the

six-month period to 30 June 2019 or the year to 31 December

2018.

The reconciliation of the carrying values of financial

instruments classified within Level 3 is as follows:

Deferred Contingent Total

GBP'000 GBP'000 GBP'000

--------------------------------------------- -------- ---------- --------

At 1 January 2018 11,163 - 11,163

Paid in respect of acquisitions (11,163) - (11,163)

At 30 June 2018 - - -

Increase due to new acquisitions in the year - 2,000 2,000

--------------------------------------------- -------- ---------- --------

At 31 December 2018 - 2,000 2,000

Released on reassessment - (750) (750)

--------------------------------------------- -------- ---------- --------

At 30 June 2019 - 1,250 1,250

--------------------------------------------- -------- ---------- --------

Contingent consideration represents an estimate of future

consideration likely to be payable in respect of acquisitions.

Contingent consideration is discounted for the likelihood of

payment and for the time value of money. Contingent consideration

becomes payable based upon the profitability of acquired

businesses.

The carrying value of the following financial assets and

liabilities is considered a reasonable approximation of fair

value:

-- trade and other receivables;

-- cash and cash equivalents;

-- trade and other payables; and

-- lease liabilities.

10. Acquisitions

On 30 November 2018 the Group acquired certain business assets

and contracts from the Mitie property services division. The

estimated fair value of net assets acquired remains provisional and

will be finalised before the year end. Adjustments have been made