TIDMLSE

RNS Number : 3086Q

London Stock Exchange Group PLC

18 October 2019

18 October 2019

LONDON STOCK EXCHANGE GROUP plc

TRADING STATEMENT

INCLUDING REVENUES AND KPIs FOR THE THREE MONTHSED

30 SEPTEMBER 2019 (Q3)

-- Strong Q3 performance across all parts of the Group - LCH

continues to grow strongly in OTC products; FTSE Russell performing

well with growth in subscription revenues

-- Q3 total income up 12% to GBP587 million

-- On a nine-month year-to-date basis total income up 9% to GBP1,727 million

-- Proposed acquisition of Refinitiv continues to progress:

o Appointment of David Shalders as Chief Integration Officer

and member of the LSEG Executive Committee, reporting

to LSEG CEO

o Regulatory approvals process and integration planning

underway

o Integration Management Office established

o Shareholder circular posting soon with General Meeting

scheduled for November 2019

o Transaction remains on track for completion in H2 2020

Q3 summary

-- Information Services: revenues up 9% to GBP230 million. FTSE

Russell up 10%, with strong performance in subscription

revenues

-- Post Trade - LCH: income up 19% to GBP197 million. Strong

results driven by 22% revenue growth in OTC clearing with strong

volumes at SwapClear and continued growth in net treasury income,

up 16%

-- Post Trade - Italy: income up 8% to GBP39 million. Good

performance supported by growth in clearing; settlement, custody

and net treasury income, reflecting good volumes in fixed

income

-- Capital Markets: revenues up 14% to GBP102 million. On a

like-for-like basis (adjusting for last year's IFRS 15 change),

revenue increased 5%, with growth in Primary Markets and in fixed

income trading partly offset by subdued equity markets trading

-- Technology: revenues up 2% to GBP16 million

Commenting on performance in Q3, David Schwimmer, CEO, said:

"The Group continues to perform well and has delivered a strong

Q3 performance. LCH's OTC clearing services saw continued strong

volumes during the period in both member and client clearing. In

Information Services, FTSE Russell reported 10% growth as

subscription revenues remained strong. Capital Markets also

produced a good overall performance against a backdrop of continued

challenging market conditions.

"During the quarter, we announced the proposed acquisition of

Refinitiv, a leading global provider of data, analytics and

financial markets solutions. This is a transformational transaction

that accelerates our Group's strategy, positioning us in key areas

of future growth as a global financial markets infrastructure

leader. Together, we will create a multi-asset class capital

markets business and bring world class data content, management and

distribution capabilities to our customers on an open access basis.

The transaction offers substantial strategic and financial benefits

to our shareholders, customers, employees and other

stakeholders."

Developments in the period

-- FTSE Russell launched the first climate risk government bond

index, the FTSE Climate Risk-Adjusted World Government Bond

Index

-- FTSE Russell successfully implemented inclusion of the second

tranche of China A Shares in the FTSE GEIS (September 2019)

-- Expanded ForexClear offering by launching FX Forwards

clearing and also linked up with FX Connect TradeNeXus, enabling

simpler buy-side access to clearing

-- Published plans to launch clearing of products referencing

EURSTR, the new reference rate and announced plans to transition to

EURSTR discounting

Financial Position

The Group's financial position remains strong with a good level

of funding flexibility in place. As at 30 September 2019, the Group

had available committed facility headroom of c.GBP750 million

having paid the interim dividend to shareholders and met other

normal course payment obligations. The Group is therefore able to

fund the repayment of the 2009 GBP250 million Bond, due 19 October

2019, from existing resources. While LSEG's credit ratings are

unchanged (long term A3 and A), both Moody's and S&P moved

their rating outlooks, respectively, to "review for possible

downgrade" and "credit-watch negative" in early August as a result

of the debt component of the Refinitiv acquisition. Both agencies

were otherwise constructive on the strategic rationale for the deal

and positive towards the Group's arrangement of a c.$13.5 billion

bridge facility to de-risk refinancing of Refinitiv's debt at or

around closing of the transaction.

The euro was flat and the US dollar strengthened by 6% against

sterling compared with the same period last year. To illustrate our

exposure to movements in exchange rates, a EUR0.05 change in the

average Euro:Sterling rate would have resulted in a change to

continuing operations total income of GBP8 million for Q3, while a

US$0.05 move would have resulted in a GBP7 million change.

Board, Management and organisation changes

David Shalders is joining the Group in November 2019 as Chief

Integration Officer and a member of the LSEG Executive Committee,

reporting to LSEG's CEO. David brings to the Group over thirty

years' experience in Integration, Technology and Operations in the

financial services sector. He has successfully led a number of

global integration programmes. Most recently, David was Group

Operations and Technology Director at Willis Towers Watson, having

led the integration of Willis and Towers Watson. Prior to his six

years at Willis Towers Watson, David spent nineteen years at The

Royal Bank of Scotland in a number of senior operations and

technology roles, including as Group Head of Integration for the

ABN Amro acquisition. We also announced today that we have formed

the Integration Management Office (IMO). Led by David Shalders, the

IMO will be comprised of senior leaders from LSEG and

Refinitiv.

As of 1 January 2020, the Group's Post Trade businesses, which

are currently reported separately as LCH and Post Trade Italy, will

be aligned, in a manner consistent with the necessary regulatory

oversight, into one Post Trade Division. Daniel Maguire, CEO, LCH

Group will lead the division as Group Director, Post Trade, LSEG in

addition to his current responsibilities. The Post Trade Division

will include LCH Group, our Italian post trade businesses Monte

Titoli and CC&G, and UnaVista, our trade reporting business

that currently reports as part of the Information Services

Division. The new Division will ensure greater Group-wide

collaboration and aim to facilitate coordination amongst the

different businesses with a view to developing commercial

activities for the benefit of customers. We will continue to

operate all our businesses on an open access basis in partnership

with customers and stakeholders. The current local legal entity

governance, including decision-making processes and reporting

lines, will be unchanged.

Separately, today LSEG announced that David Warren, Group CFO

has informed the Group of his intention to retire from the company

and step down from the Board by the end of 2020. David will

continue in his current roles through the close of the Refinitiv

transaction to ensure a smooth transition to his successor. LSEG

will undertake a global search, which will be led by the Board's

Nomination Committee.

Further information is available from:

+44 (0) 20 7797

Gavin Sullivan/Lucie Holloway 1222

London Stock Exchange - Media +44 (0) 20 7797

Group plc Paul Froud - Investor Relations 3322

The Group will host a conference call for analysts and investors

today, Friday 18 October at 08:30am (UK time). On the call will be

David Schwimmer (CEO), David Warren (CFO) and Paul Froud (Group

Head of Investor Relations).

To access the telephone conference call please pre-register

using the following link and instructions below:

http://emea.directeventreg.com/registration/1079764

-- Please register in advance of the conference using the link

above. Upon registering with your full name, company name and email

address, you will be provided with participant dial-in numbers,

Direct Event passcode and unique registrant ID

-- In the 10 minutes prior to the call start time, you will need

to use the conference access information provided in the email

received at the point of registering

Note: Due to regional restrictions some participants may receive

operator assistance when joining this conference call and will not

be automatically connected.

For further information, please call the Group's Investor

Relations team on +44 (0) 20 7797 3322.

Q3 Revenue Summary

Revenues for three months and nine months ended 30 September

2019 refer to continuing operations, with comparatives against

performance for the same period last year, are provided below.

Growth rates for both Q3 and year to date performance are also

expressed on a constant currency basis. Income in all periods is on

an organic basis as there has been no inorganic income. All figures

are unaudited.

Three months Nine months

ended Constant ended Constant

30 September currency 30 September currency

--------------- ----------------

2019 2018 Variance variance 2019 2018 Variance variance

Continuing operations: GBPm GBPm % % GBPm GBPm % %

Revenue

Information Services 230 212 9% 5% 671 624 8% 4%

Post Trade Services -

LCH 144 120 20% 19% 410 357 15% 14%

Post Trade Services -

CC&G and Monte Titoli 27 25 8% 6% 78 77 2% 2%

Capital Markets 102 89 14% 14% 328 305 8% 8%

Technology Services 16 16 2% 1% 46 48 (3%) (5%)

Other 2 2 - - 6 7 - -

----------------------------- ------- ------ --------- ---------- ------- ------- --------- ----------

Total revenue 521 464 12% 10% 1,539 1,418 9% 7%

Net treasury income through

CCP businesses 65 57 15% 13% 185 160 16% 14%

Other income 1 1 - - 3 4 - -

---------

Total income 587 522 12% 10% 1,727 1,582 9% 7%

----------------------------- ------- ------ --------- ---------- ------- ------- --------- ----------

Cost of sales (58) (57) 2% - (167) (163) 3% 1%

Gross profit 529 465 14% 11% 1,560 1,419 10% 8%

----------------------------- ------- ------ --------- ---------- ------- ------- --------- ----------

The Group's principal foreign exchange exposure arises from

translating and revaluing its foreign currency earnings, assets and

liabilities into LSEG's reporting currency of Sterling.

More detailed revenues by segment are provided in tables

below:

Information Services

Three months Nine months

ended Constant ended Constant

30 September currency 30 September currency

------------------------------------------ ---------------

2019 2018 Variance variance 2019 2018 Variance variance

GBPm GBPm % % GBPm GBPm % %

Revenue

Index - Subscription 108 94 15% 10% 311 279 12% 7%

Index - Asset based 61 59 3% (1%) 173 164 6% 1%

----------------------------- ----- ----- --------- --------- ------- ------ --------- -----------

FTSE Russell Indexes 169 153 10% 5% 484 443 9% 5%

----------------------------- ----- ----- --------- --------- ------- ------ --------- -----------

Real time data 24 23 4% 4% 72 70 4% 4%

Other information services 37 36 4% 2% 115 111 3% 2%

Total revenue 230 212 9% 5% 671 624 8% 4%

----------------------------- ----- ----- --------- --------- ------- ------ --------- -----------

Cost of sales (20) (17) 16% 11% (56) (52) 9% 4%

----- ----- ------- ------

Gross profit 210 195 8% 4% 615 572 7% 4%

----------------------------- ----- ----- --------- --------- ------- ------ --------- -----------

Post Trade Services - LCH

Three months Nine months

ended Constant ended Constant

30 September currency 30 September currency

--------------- ---------------

2019 2018 Variance variance 2019 2018 Variance variance

GBPm GBPm % % GBPm GBPm % %

Revenue

OTC - SwapClear, ForexClear

& CDSClear 80 65 22% 20% 228 196 17% 15%

Non-OTC - Fixed income,

Cash equities and Listed

derivatives 36 34 6% 5% 104 101 3% 3%

Other 28 21 38% 36% 78 60 29% 28%

------- ------ --------- --------- ------- ------ --------- ---------

Total revenue 144 120 20% 19% 410 357 15% 14%

----------------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Net treasury income 53 46 16% 14% 149 128 16% 14%

Other income - - - - - - - -

Total income 197 166 19% 17% 559 485 15% 14%

----------------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Cost of sales (33) (31) 6% 5% (93) (83) 12% 12%

------- ------ ------- ------

Gross profit 164 135 22% 20% 466 402 16% 14%

----------------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Post Trade Services - CC&G and Monte Titoli

Three months Nine months

ended Constant ended Constant

30 September currency 30 September currency

--------------- ---------------

2019 2018 Variance variance 2019 2018 Variance variance

GBPm GBPm % % GBPm GBPm % %

Revenue

Clearing 11 10 16% 14% 33 31 5% 5%

Settlement, Custody &

other 16 15 3% 2% 45 46 (1%) (0%)

Total revenue 27 25 8% 6% 78 77 2% 2%

----------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Net treasury income 12 11 10% 8% 36 32 13% 13%

Total income 39 36 8% 7% 114 109 5% 5%

----------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Cost of sales (2) (2) (11%) (11%) (5) (5) 4% 4%

------- ------ ------- ------

Gross profit 37 34 9% 8% 109 104 5% 5%

----------------------- ------- ------ --------- --------- ------- ------ --------- ---------

Capital Markets

Three months Nine months

ended Constant ended Constant

30 September currency 30 September currency

--------------- ---------------

2019 2018 Variance variance 2019 2018 Variance variance

GBPm GBPm % % GBPm GBPm % %

Revenue

Primary Markets(1 2) 30 20 53% 53% 120 83 45% 46%

Secondary Markets - Equities 39 39 (2%) (2%) 113 128 (12%) (12%)

Secondary Markets - Fixed

income, derivatives and

other 33 30 10% 9% 95 94 1% 1%

Total revenue 102 89 14% 14% 328 305 8% 8%

------------------------------ ------- ------ --------- --------- ------- ------ --------- ---------

Cost of sales (1) (4) (67%) (68%) (4) (13) (68%) (68%)

------- ------ ------- ------

Gross profit 101 85 18% 18% 324 292 11% 11%

------------------------------ ------- ------ --------- --------- ------- ------ --------- ---------

(1) Primary Markets 2018 Q3 on a like-for-like basis would be

GBP8 million higher than reported relating to the adoption of IFRS

15. The nine-month impact for 2018 was GBP9 million

(2) Primary Markets 2019 Q3 YTD includes a one-off change in

estimate for IFRS 15 accounting, with an impact of GBP32 million,

recognised in H1 2019

Technology Services

Three months Nine months

ended Constant ended Constant

30 September currency 30 September currency

---------------- ---------------

2019 2018 Variance variance 2019 2018 Variance variance

Revenue GBPm GBPm % % GBPm GBPm % %

MillenniumIT & other technology 16 16 2% 1% 46 48 (3%) (5%)

--------------------------------- ------- ------- --------- --------- ------- ------ --------- ----------

Cost of sales (2) (2) (11%) (11%) (6) (8) (23%) (23%)

------- ------- ------- ------

Gross profit 14 14 4% 2% 40 40 - (1%)

--------------------------------- ------- ------- --------- --------- ------- ------ --------- ----------

Basis of Preparation

Results for the period ended 30 September 2019 have been

translated into Sterling using the average exchange rates for the

period. Constant currency growth rates have been calculated by

translating prior period results at the average exchange rate for

the current period.

Average rate

9 months ended Closing rate

at

30 September 30 September

2019 2019

---------------

GBP : EUR 1.13 1.12

---------------

GBP : USD 1.27 1.23

--------------- -------------

Average rate

9 months ended Closing rate

at

30 September 30 September

2018 2018

GBP : EUR 1.13 1.12

GBP : USD 1.35 1.30

--------------- -------------

Appendix - Key performance indicators

Information Services

As at

30 September Variance

------------------

2019 2018 %

ETF assets under management

benchmarked ($bn)

FTSE 423 396 7%

Russell Indexes 273 267 2%

----------------------------- ---------

Total 696 663 5%

----------------------------- -------- -------- ---------

Terminals

UK 65,000 68,000 (4%)

Borsa Italiana Professional

Terminals 100,000 107,000 (7%)

Post Trade Services -

LCH

Three months ended Nine months ended

30 September Variance 30 September Variance

--------------------- --------------------

2019 2018 % 2019 2018 %

OTC derivatives

SwapClear

IRS notional cleared

($tn) 337 236 43% 997 811 23%

SwapClear members 121 110 10% 121 110 10%

Client trades ('000) 472 332 42% 1,280 1,103 16%

CDSClear

Notional cleared (EURbn) 219 138 59% 567 463 22%

CDSClear members 26 15 73% 26 15 73%

ForexClear

Notional value cleared

($bn) 4,795 4,282 12% 13,561 12,946 5%

ForexClear members 34 32 6% 34 32 6%

------------------------------- ---------- --------- --------- --------- --------- ---------

Non-OTC

Fixed income - Nominal

value (EURtn) 28.0 25.2 11% 80.7 74.1 9%

Listed derivatives (contracts

m) 36.3 36.4 - 109.2 113.3 (4%)

Cash equities trades

(m) 179 179 - 526 593 (11%)

------------------------------- ---------- --------- --------- --------- --------- ---------

Average cash collateral

(EURbn) 103.8 86.2 20% 96.3 86.0 12%

Post Trade Services - CC&G and

Monte Titoli

Three months ended Nine months ended

30 September Variance 30 September Variance

--------------------- --------------------

2019 2018 % 2019 2018 %

CC&G Clearing

Contracts (m) 24.7 23.8 4% 74.7 86.3 (13%)

Initial margin held (average

EURbn) 15.1 12.0 26% 14.3 10.5 36%

Monte Titoli

Settlement instructions

(trades m) 10.3 10.3 - 31.7 34.3 (8%)

Custody assets under

management (average EURtn) 3.33 3.30 1% 3.31 3.30 -

Capital Markets - Primary

Markets

Three months ended Nine months ended

30 September Variance 30 September Variance

--------------------- --------------------

2019 2018 % 2019 2018 %

New Issues

UK Main Market, PSM &

SFM 13 17 (24%) 41 55 (25%)

UK AIM 5 13 (62%) 20 49 (59%)

Borsa Italiana 11 12 (8%) 26 25 4%

----------

Total 29 42 (31%) 87 129 (33%)

--------------------------- ---------- --------- --------- --------- --------- ---------

Money Raised (GBPbn)

UK New 1.0 2.0 (50%) 3.7 3.9 (5%)

UK Further 1.9 3.1 (39%) 12.7 13.8 (8%)

Borsa Italiana new and

further 0.1 0.6 (83%) 2.0 3.1 (35%)

Total (GBPbn) 3.0 5.7 (47%) 18.4 20.8 (12%)

--------------------------- ---------- --------- --------- --------- --------- ---------

Capital Markets - Secondary

Markets

Three months ended Nine months ended

30 September Variance 30 September Variance

---------------------------- --------------------

Equity 2019 2018 % 2019 2018 %

Totals for period

UK value traded (GBPbn) 309 329 (6%) 892 1,098 (19%)

Borsa Italiana (no of

trades m) 16.3 15.4 6% 47.4 54.8 (14%)

Turquoise value traded

(EURbn) 111 180 (38%) 423 644 (34%)

SETS Yield (basis points) 0.68 0.65 5% 0.69 0.63 10%

Average daily

UK value traded (GBPbn) 4.8 5.1 (6%) 4.7 5.8 (19%)

Borsa Italiana (no of trades

'000) 254 240 6% 249 288 (14%)

Turquoise value traded

(EURbn) 1.7 2.8 (39%) 2.2 3.4 (35%)

Derivatives (contracts

m)

LSE Derivatives 0.6 1.1 (45%) 2.2 5.2 (58%)

IDEM 7.2 7.5 (4%) 24.0 28.2 (15%)

Total 7.8 8.6 (9%) 26.2 33.4 (22%)

------------------------------ ------------------- ------- --------- --------- --------- -----------

Fixed Income

MTS cash and BondVision

(EURbn) 803 670 20% 2,453 2,558 (4%)

MTS money markets (EURbn

term adjusted) 31,759 21,134 50% 89,508 65,098 37%

Total Income - Quarterly

2018 2019

GBP millions Q1 Q2 Q3 Q4 2018 Q1 Q2 Q3

---------------- ---------------- ---------------- ---------------- ---------------- ----- -----

Index -

Subscription 89 96 94 94 373 99 104 108

Index - Asset

based 52 53 59 55 219 52 60 61

FTSE Russell 141 149 153 149 592 151 164 169

Real time

data 24 23 23 24 94 24 24 24

Other

information 36 39 36 44 155 39 39 37

-------------

Information

Services 201 211 212 217 841 214 227 230

OTC -

SwapClear,

ForexClear

& CDSClear 66 64 65 73 268 76 72 80

Non OTC -

Fixed

income,

Cash

equities &

Listed

derivatives 33 34 34 35 136 34 35 36

Other 19 21 21 22 83 24 25 28

------------- ---------------- ---------------- ---------------- ---------------- --------------- ---------------- ----- -----

Post Trade

Services -

LCH 118 119 120 130 487 134 132 144

Clearing 10 12 10 9 41 11 11 11

Settlement,

Custody &

other 18 12 15 16 61 14 15 16

------------- ---------------- ---------------- ---------------- ---------------- --------------- ---------------- ----- -----

Post Trade

Services -

CC&G

and Monte

Titoli 28 24 25 25 102 25 26 27

Primary

Markets 29 33 20 31 113 28 62 30

Secondary

Markets -

Equities 45 44 39 41 169 37 37 39

Secondary

Markets -

Fixed

income,

derivatives

& other 33 31 30 31 125 32 30 33

------------- ---------------- ---------------- ---------------- ---------------- --------------- ---------------- ----- -----

Capital

Markets 107 108 89 103 407 97 129 102

Technology 13 19 16 17 65 14 16 16

Other 3 2 2 2 9 2 2 2

Total Revenue 470 483 464 494 1,911 486 532 521

Net treasury

income

through

CCP:

CC&G 10 11 11 11 43 11 13 12

LCH 38 45 46 46 175 48 48 53

Other income 2 1 1 2 6 1 1 1

Total income 520 540 522 553 2,135 546 594 587

------------- ---------------- ---------------- ---------------- ---------------- --------------- ---------------- ----- -----

Cost of

sales (56) (50) (57) (64) (227) (56) (53) (58)

Gross profit 464 490 465 489 1,908 490 541 529

------------- ---------------- ---------------- ---------------- ---------------- --------------- ---------------- ----- -----

Note: Minor rounding differences may mean quarterly and other

segmental figures may differ slightly

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKMMMGRNGGLZM

(END) Dow Jones Newswires

October 18, 2019 02:00 ET (06:00 GMT)

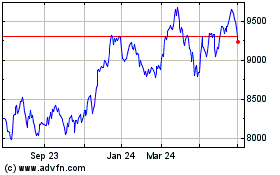

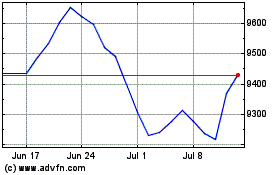

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024