TIDMLOOP

RNS Number : 5991U

LoopUp Group PLC

29 March 2023

29 March 2023

LOOPUP GROUP PLC

("LoopUp" or the "Group")

Trading update

Material uplift in Q4 revenue run-rate

LoopUp Group plc (AIM: LOOP), the cloud platform for premium

external communications, is pleased to announce a trading update

for its financial year ended 31 December 2022.

Material jump in revenue

The Group now expects a material jump in Q422 revenue to

approximately GBP7.2 million following the PGi Connect transaction

announced in September 2022, and so a strong run-rate heading into

FY23. However, the Directors note that they continue to expect

attrition over time to revenue from the Group's Meetings business,

including that from the PGi Connect transaction.

For the full financial year ended 31 December 2022, the Group

expects:

-- FY22 revenue above market expectations at approximately

GBP16.5 million (H122: GBP6.6 million; FY21: GBP19.5 million);

-- FY22 Adjusted EBITDA(1) loss in line with market expectations

at approximately GBP1.0 million (H122: GBP1.5 million

loss; FY21: GBP1.2 million profit); and

-- FY22 year-end gross cash of GBP1.7 million (FY21: GBP5.5

million) and net debt of GBP5.8 million (FY21: GBP2.5

million), following the successful subscription and placing

for approximately GBP3.5 million in September 2022.

Commercial traction in Cloud Telephony

Cloud Telephony now sits squarely at the heart of the Group's

forward-looking growth strategy, and the Group achieved strong

operational progress and commercial traction during FY22:

-- Customer numbers grew by 172%, a growth of 50 customers

from the 29 at the end of FY21 to 79 at the end of FY22.

-- Individual contract numbers with the Group's customers

grew 229%, a growth of 117 contracts from the 51 contracts

at the end of FY21 to 168 at the end of FY22. This reflects

the fact that the Group is targeting the multinational

mid-market and enterprise segments, where customer wins

generally involve geographic rollouts. As such, the ratio

of contracts per customer grew from 1.76 at the end of

FY21 to 2.13 at the end of FY22.

-- Booked Annual Recurring Revenue (ARR) from these 79 customers

at the end of FY22 stood at GBP1.8 million minimum contractually

guaranteed and c.GBP3.1 million expected. Nearly all customers

are on 3-year initial term licence contracts.

-- Net Revenue Retention (NRR) was 159% in FY22, being the

ratio of booked ARR at the end of FY22 to booked ARR at

the end of FY21 from the cohort of 29 customers in place

at the end of FY21.

-- The Group has experienced zero gross customer churn in

Cloud Telephony since entering the market.

-- Sales cycles can involve a Proof of Concept (POC), enabling

prospective customers to test our technology in their

own IT environment. The Group has achieved a 95 percent

POC conversion rate, with 19 out of 20 POC projects completed

by the Group having successfully converted into customer

wins.

The Group maintains a strong pipeline of future Cloud Telephony

sales opportunities (c.GBP100 million ARR) and is confident in the

growth prospects of this primary forward-looking line of

business.

Meetings

In September 2022, the Group announced a revenue sharing and

customer transfer agreement with PGi Connect, giving LoopUp the

rights to onboard materially all of PGi Connect's conferencing

services customers. While no initial or fixed consideration was

payable, the Group agreed to pay PGi Connect a share of invoiced

and received revenue(2) from successfully transferred customers for

a period of three years.

Since October 2021, approximately 7,000 customers have

transitioned from PGi Connect to LoopUp, leading to an increase in

the Group's revenue run rate of c.167% (c.GBP2.7 million in Q322 to

c.GBP7.2 million in Q422).

While this transitioned Meetings business is expected to decline

over time, it is nevertheless highly cash generative, with a gross

margin of 65-70 percent (after LoopUp COGS and PGi Connect revenue

share) and just c.GBP0.3 million in incremental quarterly staff and

overheads costs.

Outlook

Looking ahead, there are three primary factors influencing the

development of the Group's revenue progression, namely:

-- continued strong new business growth in the Group's primary

Cloud Telephony business;

-- a full year (rather than single quarter) of revenue from

the PGi Connect transaction; and

-- the continued projected decline in the Group's legacy

Meetings business (including PGi Connect).

Combining these factors, the Group expects:

-- approximately 25% revenue growth in FY23, driven primarily

by the full year impact of the PGi Connect transaction,

alongside a return to Adjusted EBITDA profitability;

-- marginal revenue growth in FY24 as Cloud Telephony growth

overtakes the decline in Meetings; and

-- strong double-digit revenue growth from FY25 onwards.

Market abuse regulation:

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act

2018.

(1) Earnings before interest, tax, depreciation and amortisation,

excluding share-based payments charges

(2) Approximately 13% on a weighted average basis

LoopUp Group plc via FTI

Steve Flavell, co-CEO

+44 (0) 20 7886

Panmure Gordon (UK) Limited 2500

Dominic Morley / Ivo Macdonald (Corporate

Finance)

+44 (0) 20 7397

Cenkos Securities Limited 8900

Giles Balleny / Dan Hodkinson (Corporate Finance)

Alex Pollen (Sales)

+44 (0) 20 3727

FTI Consulting, LLP 1000

Matt Dixon / Jamille Smith / Tom Blundell

About LoopUp Group plc

LoopUp (LSE AIM: LOOP) is a cloud platform for premium hybrid

communications. The Group's flagship Cloud Telephony solution for

Microsoft Teams enables multinational enterprises to consolidate

their global telephony provision into a single, consistently

managed cloud implementation rather than disparate implementations

from multiple carriers. The Group is listed on the AIM market of

the London Stock Exchange and is headquartered in London, with

offices in the US, Spain, Germany, Hong Kong, Barbados and

Australia. For further information, please visit:

www.loopup.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTJLMATMTBTMAJ

(END) Dow Jones Newswires

March 29, 2023 02:00 ET (06:00 GMT)

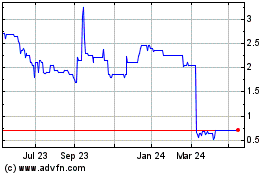

Loopup (LSE:LOOP)

Historical Stock Chart

From Nov 2024 to Dec 2024

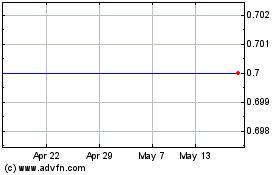

Loopup (LSE:LOOP)

Historical Stock Chart

From Dec 2023 to Dec 2024