Regulator Allows UK Banks to Restart Dividend Payouts, Share Buybacks

December 11 2020 - 2:28AM

Dow Jones News

By Adria Calatayud

The U.K.'s Prudential Regulation Authority said late Thursday

that there is scope for U.K. banks to restart some capital

distributions, after lenders suspended dividends and buybacks

earlier this year due to the coronavirus pandemic.

The regulator said it believes an extension of the exceptional

action taken in March isn't necessary, allowing boards of large

U.K. banks to restart dividend payouts and resume share buybacks if

they choose to do so.

However, the PRA asked banks' boards to operate within a

framework of temporary guardrails. Under the new framework set out

by the regulator, distributions by large U.K. banks for 2020

shouldn't exceed 20 basis points of risk-weighted assets as of the

end of 2020 or 25% of cumulative eight-quarter profits covering

2019 and 2020 after deducting prior shareholder distributions over

that period, it said.

The PRA said any distributions should be prudent, reflecting

high uncertainty and the need for banks to continue to support

households and businesses through the continuing economic

disruption. It also said banks are expected to exercise a high

degree of caution and prudence in determining the size of any cash

bonuses granted to senior staff.

The regulator said it plans to go back to its standard approach

to capital-setting and shareholder distributions through 2021.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

December 11, 2020 02:13 ET (07:13 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

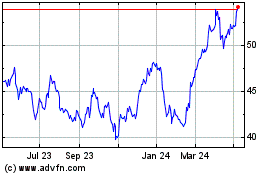

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024