Lloyds Banking Group to Return Surplus Via Dividend, Share Buyback

May 21 2020 - 9:34AM

Dow Jones News

By Matteo Castia

Lloyds Banking Group PLC said Thursday that it will return

surplus capital to shareholders by way of dividends and a potential

share buyback program.

The bank said it has approved loans for more than 1.10 billion

pounds ($1.35 billion) under the Coronavirus Business Interruption

Scheme and more than GBP3.60 billion under the Bounce Back Loan

scheme. Both form part of the U.K. government's response to the

crisis.

The company said it is offering fee-free overdrafts of up to

GBP500.

In order to help the bank preserve liquidity, the executive

committee agreed not to receive an annual bonus under the group's

performance share award this year. Similarly, the chief executive

and the chief operating officer have waived their performance share

award for 2019.

Lloyds Banking said it is introducing a new long-term variable

reward called Long Term Share Plan to replace the current Group

Ownership Scheme. As a result of all these measures, the chief

executive's maximum total compensation will reduce by 30%.

Shares at 1300 GMT were down 1.26 pence, or 4.2%, at 28.61

pence.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

May 21, 2020 09:19 ET (13:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

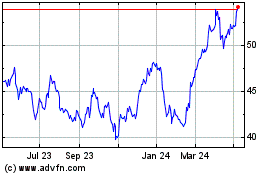

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024