TIDMITRK

RNS Number : 9151Z

Intertek Group PLC

23 May 2019

For a printer friendly version of this announcement, please

click on the link below: -

http://www.rns-pdf.londonstockexchange.com/rns/9151Z_1-2019-5-22.pdf

TRADING STATEMENT

23 May 2019

Intertek Group plc ("Intertek" or "the Group"), a leading Total

Quality Assurance provider to industries worldwide, today releases

its May Trading Update for the period from 1 January to 30 April

2019 ("period"). All comparative comments in this statement reflect

comparisons with the corresponding period during 2018. The Group's

half year results to 30 June 2019 will be announced on 1 August

2019.

Good start to the year with Robust Revenue Growth of 5.3%(1)

-- Group revenue of GBP924.3m, up 5.3% at constant rates:

Products +5.5%, Trade +6.5%, Resources +2.9%

-- Broad-based organic revenue growth of 3.3% at constant rates:

Products +2.6%, Trade +5.3%, Resources +2.9%

-- 2.0% revenue growth at constant rates from Acquisitions in

attractive growth and margin sectors

-- 7.3% revenue growth at actual rates; 200bps foreign exchange translation benefit

-- Continuous operational discipline on margin management and cash conversion

-- On track to deliver full year revenue, margin and cash targets

André Lacroix: Chief Executive Officer statement, May 2019

"In the first four months of the year, the Group has delivered

revenue of GBP924.3m, up 7.3% year on year at actual rates and 5.3%

at constant rates, driven by broad-based organic growth of 3.3% at

constant rates, by the contribution of the acquisitions we made

recently in attractive growth and margin sectors and by a 200bps

benefit due to foreign exchange translation.

We are on track to deliver our 2019 targets of good organic

revenue growth at constant rates, with moderate margin expansion

and strong cash conversion. Given a good start to the year, we

expect good organic revenue growth at constant currency rates in

each of our three divisions: Products, Trade and Resources.

The $250 billion global quality assurance industry has

attractive structural growth prospects driven by an increased focus

of corporations on risk management, global trade flows, global

demand for energy, expanding regulations, more complex sourcing and

distribution operations, technological innovations, government

investments in large infrastructure projects, and increased

consumer demand for higher quality and more sustainable

products.

We are uniquely positioned to seize these exciting growth

opportunities with our Total Quality Assurance Value Proposition

that provides a superior service, offering global Assurance,

Testing, Inspection and Certification solutions to our customers

across multiple industries through our global network of

subject-matter experts and over 1,000 state-of-the-art facilities

in over 100 countries.

We operate a high quality and highly cash generative earnings

model delivering strong returns. Our '5x5' differentiated strategy

for growth will continue to move the centre of gravity of our

portfolio towards the attractive growth and margin opportunities in

the industry based on a disciplined approach to revenue, margin,

portfolio and cash performance management, and an accretive

disciplined capital allocation policy that delivers sustainable

shareholder value creation."

Note 1: At constant currency rates

Revenue Performance

4 months - January to April

2019 2018 Change at Change at

GBPm GBPm actual constant

====== ====== ========== ==========

Group

Revenue 924.3 861.2 7.3% 5.3%

====== ====== ========== ==========

Organic Revenue 906.4 861.1 5.3% 3.3%

====== ====== ========== ==========

Products

Revenue 549.7 508.1 8.2% 5.5%

====== ====== ========== ==========

Organic Revenue 534.4 508.1 5.2% 2.6%

====== ====== ========== ==========

Trade

Revenue 216.0 200.7 7.6% 6.5%

====== ====== ========== ==========

Organic Revenue 213.4 200.6 6.4% 5.3%

====== ====== ========== ==========

Resources

Revenue 158.6 152.4 4.1% 2.9%

====== ====== ========== ==========

Organic Revenue 158.6 152.4 4.1% 2.9%

====== ====== ========== ==========

Contacts

For further information, please contact:

Denis Moreau, Investor Relations

Telephone: +44 (0) 20 7396 3415 investor@intertek.com

Jonathon Brill, FTI Consulting

Telephone: +44 (0) 20 3727 1000 intertek@fticonsulting.com

Analysts' Call

A live audiocast for analysts and investors will be held today

at 7.45am UK time; +44 (0) 20 3003 2666 (Link to audiocast).

Details can also be found at http://www.intertek.com/investors/

together with a pdf copy of this report. A recording of the

audiocast will be available later in the day.

Intertek is a leading Total Quality Assurance provider to

industries worldwide.

Our network of more than 1,000 laboratories and offices and over

44,000 people in more than 100 countries, delivers innovative and

bespoke Assurance, Testing, Inspection and Certification solutions

for our customers' operations and supply chains supply chains.

Intertek Total Quality Assurance expertise, delivered

consistently, with precision, pace and passion, enabling

our customers to power ahead safely.

intertek.com

Products Divisional Review

Our Products related businesses delivered a trading performance

in line with expectations with revenue growth of 5.5% at constant

currency rates, driven by good organic growth of 2.6% at constant

rates and the benefits of acquisitions recently made in high growth

and high margin sectors.

-- Our Softlines business reported a solid organic growth

performance. We are leveraging the investments we have made to

support the expansion of our customers into new markets and to

seize the exciting growth opportunities in the footwear sector. We

continue to benefit from strong demand from our customers for

chemical testing as well as from a greater number of brands and

SKUs.

-- Our Hardlines and Toy business continues to take advantage of

our strong global account relationships, the expansion of our

customers' supply chains into new markets and our innovative

technology for factory inspections. We delivered solid organic

revenue growth performance across our main markets of China, Hong

Kong, India and Vietnam.

-- We delivered robust organic revenue growth in our Electrical

& Connected World business driven by higher regulatory

standards in energy efficiency and by the increased demand for

wireless devices and cybersecurity.

-- Our Business Assurance business delivered good organic

revenue growth as we continue to benefit from the increased focus

of corporations on risk management, resulting in strong growth in

Supply Chain Audits and increased consumer and government focus on

ethical and sustainable supply.

-- Driven by the growing demand for more environmentally

friendly and higher quality buildings and infrastructure in the US

market, our Building & Construction business reported solid

organic revenue growth.

-- Our Transportation Technology business delivered robust

organic revenue growth as we capitalise on our clients' investments

in new powertrains to lower emissions and increase fuel

efficiency.

-- We continue to benefit from the increased focus of

corporations on food safety and delivered robust organic revenue

growth in our Food business.

-- We delivered an organic revenue performance below last year

in our Chemicals & Pharma business due to a base line effect in

2018 as we saw robust demand from our clients to meet the 1 June

2018 REACH registration deadline. Moving forward we will continue

to benefit from the structural growth opportunities in the

healthcare markets in both developed and emerging economies.

2019 outlook

We expect our Products division to benefit from good organic

revenue growth at constant currency.

Mid to long-term growth outlook

Our Products division will benefit from mid to long-term

structural growth drivers including product variety, brand and

supply chain expansion, product innovation and regulation, the

growing demand for quality and sustainability from developed and

emerging economies, the acceleration of e-commerce as a sales

channel, and the increased corporate focus on risk.

Trade Divisional Review

Our Trade related businesses delivered a trading performance

in-line with expectations with revenue growth of 6.5% at constant

currency rates, driven by robust organic revenue growth of 5.3% at

constant rates and the benefits of acquisitions recently made in

attractive growth and margin sectors.

-- Our Caleb Brett business reported good organic revenue

growth, reflecting the structural growth drivers in the Crude Oil

and Refined Product global trading markets.

-- Our Government and Trade Services business delivered

double-digit organic revenue growth driven by growth with existing

contracts and the benefits of new contracts.

-- Our AgriWorld business delivered good organic revenue growth.

2019 outlook

We expect our Trade related businesses to deliver a good organic

revenue growth performance at constant currency.

Mid to long-term growth outlook

Our Trade division will continue to benefit from both regional

and global trade-flow growth, as well as the increased customer

focus on quality, quantity controls and supply chain risk

management.

Resources Divisional Review

Our Resources related businesses delivered a trading performance

ahead of expectations with good organic revenue growth of 2.9% at

constant rates.

-- We delivered good organic revenue growth in our Capex

Inspection Services business which benefited from the increased

investment of our customers in exploration and production, while

the demand for Opex Maintenance Services remained stable.

-- We benefited from good organic revenue growth in our Minerals business.

2019 outlook

We expect our Resources related businesses to deliver good

organic revenue growth at constant currency.

Mid to long-term growth outlook

Our Resources division will grow in the medium to long-term as

we benefit from investments in exploration and production of oil

and minerals, to meet the demand of the growing population around

the world.

M&A

Intertek is well positioned to seize the attractive external

growth opportunities in a very fragmented industry and we continue

to make progress with our M&A strategy.

The acquisitions made recently in attractive growth and margin

sectors are performing well:

-- In March 2018, the Group acquired Aldo Abela Surveys, a

leading provider of quality and quantity cargo inspection services,

based in Malta.

-- In April 2018, the Group acquired Proasem, a leading provider

of laboratory testing, inspection, metrology and training services,

based in Colombia.

-- In June 2018, the Group acquired NTA Monitor, a leading

network security and assurance services provider, based in the UK

and Malaysia.

-- In August 2018, the Group acquired Alchemy, a leading

provider of SaaS-based People Assurance solutions, based in North

America.

In addition, the Group entered into an exclusive agreement with

the Certified Automotive Parts Association (CAPA) in March 2018, to

operate their automotive certification programme.

Investment & Financial Position

Our year end net debt guidance of GBP670-700m pre the impact of

IFRS 16, assuming no further acquisitions and no significant forex

changes, remains unchanged. The strength of Intertek's balance

sheet will enable the Group to seize attractive growth

opportunities ahead and continue to deliver strong shareholder

returns.

Outlook

We expect to deliver a good organic revenue growth performance

at constant currency in 2019 with moderate margin expansion and

strong cash generation. Given a good start to the year, we expect

good organic revenue growth at constant currency rates in each of

our three divisions: Products, Trade and Resources.

Looking further ahead, the global Assurance, Testing, Inspection

and Certification industry will continue to benefit from exciting

growth prospects driven by an increased focus of corporations on

risk management, global trade flows, global demand for energy,

expanding regulations, more complex supply chains, technological

innovations and increased demand for higher quality and more

sustainable products.

Intertek is well positioned to take advantage of these growth

opportunities in the Quality Assurance market. We offer a

high-quality Assurance, Testing, Inspection and Certification

service to our clients based on the depth and breadth of our

technical expertise, our global network of state-of-the-art

facilities and our customer-centric culture.

-ENDS-

The 2019 May Trading Statement Audiocast CEO Script will be

available after the call at www.intertek.com/investors/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTVLLFLKEFBBBE

(END) Dow Jones Newswires

May 23, 2019 02:00 ET (06:00 GMT)

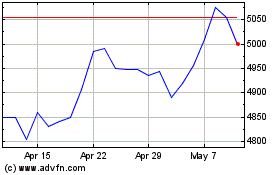

Intertek (LSE:ITRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

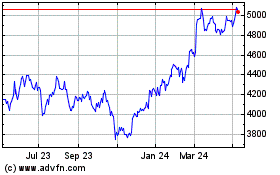

Intertek (LSE:ITRK)

Historical Stock Chart

From Apr 2023 to Apr 2024