ITM Power PLC Trading & Operational Update (7894M)

January 16 2023 - 2:00AM

UK Regulatory

TIDMITM

RNS Number : 7894M

ITM Power PLC

16 January 2023

16 January 2023

ITM Power PLC

("ITM" or the "Company")

Trading and operational update

Following the appointment of Dennis Schulz as new CEO on 1

December 2022, a detailed review of the Company's operations is

being undertaken. Whilst the process is ongoing, it has become

clear that the outcome for the financial year ending 30 April 2023

will be materially different from the current guidance, with lower

revenue and a higher EBITDA loss.

Our balance sheet remains in a strong position with net cash as

at 30 October 2022 of GBP318m.

Further details on guidance and importantly a strategic 12-month

priorities plan will be presented with the interim results

announcement scheduled for 31 January 2023.

We anticipate the strategic update to cover three main

areas:

-- Concentrating our portfolio on a core product suite, with

robust product validation, and preparing for manufacturing at

scale

-- Our plans for future testing capabilities and automation

-- A rigorous approach to capital allocation and costs

ITM has been going through a rapid transition phase towards

volume manufacturing. Our core electrochemical technology works

well. At this stage, we are testing and verifying the latest

iteration of our state-of-the-art MEP 30 bar stack which we expect

to deploy into existing projects.

The main factors which will impact the outcome for the financial

year relate to losses on customer contracts, legacy commitments for

earlier product generations causing on-site support costs, warranty

provisions, and inventory write-downs originating from iterations

of product designs during manufacturing. All the issues we have

encountered are surmountable, appreciating that the changes will

require focus, time and diligence.

In terms of warranty provisions, which were discussed at the

time of our trading update in October 2022, uncertainty arises from

the absence of long-duration field data for first-of-a-kind

technology and as such, we expect to take a prudent approach.

Projects that are nearing contract closing are impacted as costs

were underestimated when prices were originally negotiated and

committed to.

Crucially, our customers have been extremely helpful in jointly

minimising the impacts of delays to their projects and we are

grateful for their support and trust.

Dennis Schulz, CEO, said:

"This is the challenge I was expecting when I joined ITM. For

the Company to develop from an R&D and prototyping entity, to a

mature delivery organisation, we require firmer foundations. Our

12-month plan will make ITM a stronger, more focused and highly

capable company. The large-scale opportunities in the market are

yet to come, and by putting these foundations in place ITM will be

ready for the significant market demand ahead of us."

For further information please visit www.itm-power.com or

contact:

ITM Power PLC

James Collins, Investor Relations +44 (0)114 551 1205

Justin Scarborough, Investor Relations +44 (0)114 551 1080

Investec Bank plc (Nominated Adviser

and Broker) +44 (0)20 7597 5970

James Rudd / Chris Sim / Ben Griffiths

Tavistock (Financial PR and IR) +44 (0)20 7920 3150

Simon Hudson / Tim Pearson / Charlie

Baister

About ITM Power PLC:

ITM Power was founded in 2001 and ITM Power PLC was admitted to

the AIM market of the London Stock Exchange in 2004. Headquartered

in Sheffield, England, ITM Power designs and manufactures

electrolysers based on proton exchange membrane (PEM) technology to

produce green hydrogen, the only net zero gas, using renewable

electricity and water.

Linde, the leading industrial gases and engineering company

acquired a minority stake in ITM in 2019 and currently holds 16.2%

of the company. At the same time, Linde and ITM Power formed a

joint venture, ITM Linde Electrolysis (ILE), bringing together ITM

Power's expertise in PEM electrolysis and Linde's world class

engineering, procurement and construction (EPC) expertise to

deliver turnkey solutions to customers.

In March 2022, ITM Power's subsidiary, Motive Fuels, which

builds, owns and operates green hydrogen refuelling stations,

formed a joint venture with Vitol Holdings SARL, creating a

partnership which will help facilitate the scaling up of

production, distribution and demand stimulation for Hydrogen to

Transportation.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUNRRROVUAARR

(END) Dow Jones Newswires

January 16, 2023 02:00 ET (07:00 GMT)

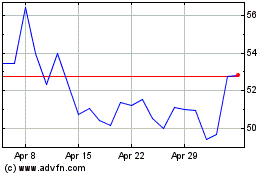

Itm Power (LSE:ITM)

Historical Stock Chart

From Mar 2024 to Apr 2024

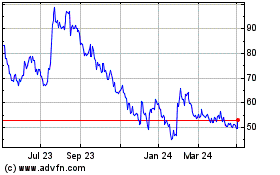

Itm Power (LSE:ITM)

Historical Stock Chart

From Apr 2023 to Apr 2024