TIDMIHP

RNS Number : 9332I

IntegraFin Holdings plc

17 December 2020

IntegraFin Holdings plc - Full Year Results for the Year Ended

30 September 2020

IntegraFin Holdings plc is pleased to report its results for the

year to 30 September 2020.

Highlights

-- Profit after tax of GBP45.5m (+11%)

-- Funds under direction GBP41.09bn (+9%)

-- Gross inflows of GBP5.75bn in the year (+1%)

Alex Scott, Chief Executive Officer, commented:

"Given the events that unfolded over the second half of our

financial year, we are very pleased to deliver a robust set of

results.

Gross inflows of GBP5.75 billion remained at broadly the same

level as last year, while net inflows of GBP3.59 billion were 3%

higher. The increase in net inflows was driven by a reduction in

outflows in the second half of the year. I am pleased to report

that profit after tax increased by 11% to GBP45.5 million.

The Directors have declared an interim dividend of 5.6 pence per

ordinary share, taking the total dividend for the year to 8.3p per

share (2019: 7.8 pence per ordinary share).The dividend is payable

on 22 January 2021 to ordinary shareholders on the register on 29

December 2020. The ex-dividend date will be 24 December 2020.

I am also pleased to advise that Transact will be reducing

charges again. These reductions will benefit the majority of

Transact customers."

Financial Highlights

Year ended Year ended

30 September 30 September

2020 2019

GBPm GBPm

Funds under direction 41,093 37,799

Revenue 107.3 99.2

Profit before tax attributable

to shareholder returns 55.3 49.9

Operating profit attributable to

shareholder returns 55.3 49.6

Operating margin 51.5% 50.0%

Basic and diluted earnings per

share 13.7p 12.4p

Contacts

Media - Lansons

Tony Langham +44 (0)7979 692287

Maddy Morgan-Williams +44 (0)7947 364578

Investors

Jane Isaac +44 (0)20 7608 4937

Analyst Presentation

IntegraFin Holdings plc will be hosting an analyst presentation

on Thursday 17 December 2020 following the release of these results

for the year ended 30 September 2020. Attendance is by invitation

only. Slides accompanying the analyst presentation will be

available on the IntegraFin Holdings plc website.

Annual General Meeting

The Annual General Meeting 2020 is scheduled to be held at 4pm

on 4 March 2021 at 29 Clement's Lane, London EC4N 7AE and by

telephone.

Cautionary Statement

These results have been prepared in accordance with the

requirements of English Company Law and the liabilities of the

Directors in connection with these results shall be subject to the

limitations and restrictions provided by such law.

These results are prepared for and addressed only to the

company's shareholders as a whole and to no other person. The

company, its Directors, employees, agents or advisers do not accept

or assume responsibility to any other person to whom these results

are shown or into whose hands it may come and any such

responsibility or liability is expressly disclaimed.

These results contain forward looking statements, which are

unavoidably subject to risk and uncertainty because they relate to

events and depend upon circumstances that will occur in the future.

It is believed that the expectations set out in these forward

looking statements are reasonable but they may be affected by a

wide range of variables which could cause future outcomes to differ

from those foreseen. All statements in these results are based upon

information known to the company at the date of this report. Except

as required by law, the company undertakes no obligation to

publicly update or revise any forward looking statement, whether as

a result of new information, future events or otherwise.

CEO Review

I am pleased to introduce my first review as Chief

Executive.

Mike Howard and Ian built the business on a foundation of

recruiting high calibre staff to deliver the highest quality

customer service as efficiently as possible. I picked up the mantle

from Ian in early March as we entered a period of significant

change to the operating environment and my primary concerns have

been to ensure the ongoing wellbeing of our staff, and the

continuing delivery of that service to our clients. This will be an

ongoing theme as we negotiate our way through the coming months.

With the secure foundation we have built over many years, I believe

we can continue to develop our offering to the benefit of all our

stakeholders.

Headlines

Given the events that unfolded over the second half of our

financial year, we are very pleased to deliver a robust set of

results.

Gross inflows of GBP5.75 billion remained at broadly the same

level as last year, while net inflows of GBP3.59 billion were 3%

higher. The increase in net inflows was driven by a reduction in

outflows, as clients' spending patterns reduced in the second half

of the year.

FUD at the year-end totalled GBP41.09 billion, an increase of 9%

over the year. Other key metrics also continued to demonstrate

positive performance, with client numbers passing 190k (+7%) and

adviser numbers passing 6k (+6%). This drove an increase in revenue

to GBP107.3 million (+8%) and, coupled with sensible expense

management, has enabled us to report that profit before tax

increased by 11% to GBP55.3 million.

Market background

Strong equity market performance where the FTSE All-share index

rose 5% from October through to early March was matched by growth

in inflows in the platform market, reversing the softening that had

occurred throughout much of our previous financial year. This

continued through to the tax year end, but changed rapidly as the

impact of government measures to address COVID-19 took effect.

The second half, in a completely different, unparalleled

operating environment, was difficult for clients and their

advisers. Inflows fell across the retail advised platform sector as

advisers focused on delivery of service to their current clients.

Despite the difficulties, the market continued to function, with

services previously provided face-to-face being provided virtually,

and paper-based processes being replaced by digital processes.

Over the full year, the retail advised platform market FUD grew

by 6% from GBP433.61 billion (restated September 2019. Revised from

GBP427.7 billion, as stated in FY19's accounts, due to the

inclusion of two more competitors) to GBP460.52 billion (September

2020).

Our activity

Against this backdrop, we have seen a small increase in our

market share of FUD, and we consistently rank in the top three

firms for gross inflows. According to Fundscape statistics we have

achieved the highest 2020 net flows to date among retail advised

platforms.

We achieved this by enhancing our service offering with

incremental additions to functionality and responsible price

reductions creating more value for money for our clients.

For the eleventh year running, Transact retained the top spot in

the annual independent research studies by Investment Trends and

CoreData. This was especially rewarding as we have had to adapt to

delivering our service whilst working from home. As owners of

proprietary platform software, we were in full control of the

realignment of our technology development - so, from early March,

we concentrated on digital processing enhancements, better enabling

clients and advisers to manage financial plans with reduced need

for physical documents and wet signatures.

The outlook

T he outlook is clearly heavily dependent upon the economic

effects of the measures being taken to combat COVID-19 and their

impact upon equity markets, FUD and flows. The operating

environment has become more difficult and unpredictable and this

seems likely to remain the case in the coming months. Additionally,

there is still little certainty on the shape of the UK's trading

relationship with the European Union, despite the proximity of the

end of the transition period.

However, none of this changes the fundamental need of

individuals and their families to plan and take care of their

financial future, so we will continue to refine our systems and

processes and further develop and expand the financial

infrastructure and associated services that we have successfully

delivered for twenty years through both internal investment and

consideration of acquisition opportunities. We will keep investing

in our staff and supporting them, being especially mindful of their

mental welfare in these difficult times. We will continue to manage

our cost base prudently, to deliver fair returns for all of our

stakeholders, and we will leverage the agility that has helped

shape our approach to the events of the last few months, as we

advance into the new year.

Alexander Scott

Chief Executive Officer

16 December 2020

FINANCIAL REVIEW

A robust set of results

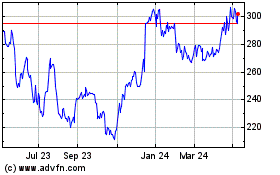

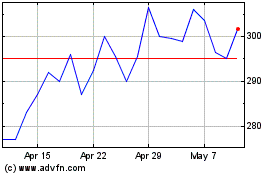

The FTSE All Share Index was buoyant at the end of our first

quarter, in part due to the decisive UK election result in December

2019. It peaked in mid-January, at 4,258 points, before crashing

36% by late March, as the COVID-19 pandemic took hold, many

countries went into lockdown and the economic impact was priced

into the markets. Recovery from the March low point was erratic,

but FUD ended the year 9% up, aided by solid net flows. This has

resulted in increased revenue and increased profits.

FUD increased to GBP41.09 billion (2019: GBP37.80 billion) with

g ross inflows of GBP5.75 billion (2019: GBP5.70 billion). Outflows

decreased slightly to GBP2.16 billion (2019: GBP2.20 billion)

resulting in increased net inflows of GBP3.59 billion (2019 GBP3.50

billion).

Income continued to grow. We generated revenue of GBP107.3

million (2019: GBP99.2 million) up 8%, leading to a 11% increase in

operating profit attributable to shareholders of GBP55.3 million

(2019: GBP49.6 million).

This performance was achieved through continuing focus on doing

what we do well, and continuing to make it better and more

efficient for the future. We continued to develop the delivery of

our high quality service by investing in our people and our

proprietary technology. These developments allowed us to benefit

from ongoing process efficiencies which are reflected in our

increased operating margin.

FUD , inflows and outflows

For the financial year ended

30 September

2020 2019

GBPm GBPm

Opening FUD 37,799 33,113

Inflows 5,750 5,700

Outflows (2,160) (2,203)

-------------------- --------------- --------------

Net flows 3,590 3,497

Market movements (224) 1,197

Other movements(1) (72) (8)

-------------------- --------------- --------------

Closing FUD 41,093 37,799

(1) Other movements includes dividends, interest, fees and tax

charges and rebates.

Financial year 2020 saw extreme levels of market volatility.

Despite this, the level of client inflows onto Transact marginally

improved when compared with FY19. Outflow rates for the year, as a

percentage of opening FUD, fell slightly from FY19, resulting in

strong net flows which were up 3% year on year. FUD ended the year

at GBP41.09 billion, up GBP3.29 billion from 2019, an increase of 9

%.

Financial performance

Financial year 2020 was another year of robust financial

performance. By continuing to generate positive net inflows,

through our ability to attract new inflows and retain business

already on the platform, we increased FUD. This drove revenue

growth and, when coupled with careful management of our expense

base, resulted in increased profits .

For the financial year ended

Income 30 September

2020 2019

(Restated)

GBPm GBPm

Revenue 107.3 99.2

Cost of sales (0.8) (0.8)

Gross profit 106.5 98.4

Operating expenses (51.2) (48.8)

Operating profit attributable

to shareholder returns 55.3 49.6

Net interest income 0.0 0.3

-------------------------------------- ------------- ----------------

Profit before tax attributable

to shareholder returns 55.3 49.9

Change in investment contract

liabilities 82.9 (554.8)

Fee and commission expenses (137.6) (125.6)

Investment returns 54.7 680.4

Net policyholder income attributable

to policyholder returns (3.1) 7.1

Policyholder tax 3.1 (7.0)

Tax on ordinary activities (9.8) (8.9)

-------------------------------------- ------------- ----------------

Profit after tax 45.5 41.1

-------------------------------------- ------------- ----------------

Total gross profit in the financial year to 30 September 2020

increased by GBP8.1 million, or 8%, to GBP106.5million from GBP98.4

million. This increase was achieved after reductions in the annual

commission income charge and the threshold at which we rebate buy

commission, and reflects the increases in the value of FUD, number

of clients and number of tax wrappers held on the platform.

Profit after tax for financial year 2019 has been restated to

GBP41.1 million, an increase from GBP40.1 million, and an

adjustment to 2019 opening retained earnings has been made of

GBP5.4m.

The restatement of profit after tax across prior years is due to

the identification of an error in the calculation of the

policyholder tax provision (over) in the subsidiary, ILUK, which is

one of the elements of the Group's insurance and life assurance

segment. The error was due to corporate expenses being deducted in

the policyholder tax calculation resulting in an overprovision of

tax reserves due back to policyholders. As a result there has been

a release of the policyholder tax provision to the retained

earnings as at 1 October 2018 and to the statement of profit or

loss and other comprehensive income in 2019.

In addition to the restatement explained above, certain

comparatives have been reclassified due to an error in presentation

in prior years. This has the effect of reflecting items of income,

expenses, gains and losses relating to the Group's insurance and

life assurance segment on a gross basis, rather than on a net

basis. In addition, cash held by the Group's insurance and life

assurance segment, for the benefit of policyholders has been

separately disclosed in cash and cash equivalents.

These changes have no effect on net assets or overall

profit.

Components of revenue

For the financial year ended

30 September

2020 2019

GBPm GBPm

Annual commission income 94.5 86.7

Wrapper fee income 9.7 9.0

Other income 3.1 3.5

Total fee income 107.3 99.2

-------------------------- ---------------- -------------

Our revenue comprises three elements and two of these elements,

annual commission income (an annual, tiered fee on FUD) and wrapper

fee income ( quarterly wrapper fees for each of the tax wrapper

types clients hold) constitute our recurring revenue. The third

element is other income and includes buy commission charged on

asset purchases.

Annual commission income increased by GBP7.8 million, or 9%, to

GBP94.5 million (2019: GBP86.7 million). This growth was achieved

through growth in average FUD of 12%, despite volatile market

conditions affecting asset values throughout the year.

Wrapper administration fee income increased by GBP0.7 million,

or 8%, to GBP9.7 million (2019: GBP9.0 million). This reflects the

net increase in the number of open tax wrappers on the

platform.

Recurring revenue streams constituted 97% (2019: 97%) of total

fee income.

Other income, mainly buy commission and dealing charges, reduced

by 11%, GBP0.4 million, to GBP3.1 million (2019: GBP3.5 million).

The primary reason for this fall was the reduction in the buy

commission rebate threshold, this was introduced to make our

charging structure more competitive. The required portfolio value

for clients to receive the rebate was reduced from GBP0.5 million

to GBP0.4 million, with effect from March 2020.

Operating expenses

Total operating expenses increased by GBP2.4 million, or 5%, to

GBP51.3 million (2019: GBP48.8 million). The increase was mainly

due to an increase in regulatory fees, professional fees and staff

costs.

For the financial year ended

30 September

2020 2019

(Restated)

GBPm GBPm

Staff costs 36.9 36.3

Occupancy 2.0 3.6

Regulatory and professional fees 7.0 5.5

Other income - tax relief due

to shareholders (1.1) (1.0)

Other costs 3.8 3.7

---------------------------------- ----------- ------------------

Total expenses 48.6 48.1

Depreciation and amortisation 2.6 0.7

---------------------------------- ----------- ------------------

Total operating expenses 51.2 48.8

---------------------------------- ----------- ------------------

Staff costs

Staff costs increased by GBP0.6 million, or 2%, to GBP36.9

million (2019: GBP36.3 million).

Average staff numbers decreased from 509 to 492, a drop of 3%.

The reduction was the result of natural attrition and efficiency

gains delivered through platform development. The small rise in

staff costs in the period was attributable to the net effects of

general inflationary increases.

Staff share scheme costs, both the Share Incentive Plan (SIP)

for all staff and the Performance Share Plan (PSP) for management,

did not increase materially.

We operate a defined contribution pension scheme for our staff.

The company-paid contribution was increased to 9% of annual salary

in FY19, it was not further increased in FY20.

Occupancy

Occupancy costs decreased by GBP1.6 million due to the

implementation of the new lease accounting standard, IFRS 16, which

came into effect on 1 October 2019.

IFRS 16 brings leases on-balance sheet and, in our case, applies

to the IHP Group property leases for offices in London, the Isle of

Man and Australia.

The accounting standard replaces rent expense with straight line

depreciation on a right of use asset and notional interest expense

on a corresponding lease liability.

Regulatory and professional fees

Regulatory and professional fees increased by GBP1.5 million, or

27%, to GBP7.0 million. The most significant increase was in UK

Financial Services Compensation Scheme (FSCS) levies, which

increased by GBP0.9 million, or 82%, year on year. There was a

smaller increase in professional fees of GBP0.6 million,

attributable to ad hoc project work performed throughout the

year.

Other income - tax relief due to shareholders

This relates to the release of tax provisions due back to

policyholders. Details of the 2019 restatement can be seen in the

financial performance section above.

Depreciation and amortisation

Depreciation and amortisation charges increased by GBP1.9m and

GBP1.6m of this was attributable to the depreciation arising on the

right of use asset on the balance sheet, required by IFRS 16.

An element of the remaining GBP300k increase in depreciation was

due to the purchase of new equipment required to enable staff to

work from home, but the majority was due to a full year of

deprecation on equipment bought in the latter half of financial

year 2019.

Total capitalised expenditure for the financial year was GBP0.9

million compared with GBP1.3 million in the prior year.

Net income attributable to policyholder returns, and

policyholder tax

Net income attributable to policyholder returns decreased by

GBP10.1m, from income of GBP8.1m in FY19 to an expense of GBP2.0m

in FY20. Policyholder tax decreased by GBP10.0m, from a tax charge

of GBP7.0m in FY19 to a tax credit of GBP3.1m in FY20. Both of

these reductions were due to a decrease in the gains on investments

held for the benefit of policyholders as a result of the downturn

in financial markets during FY20.

Profit before tax attributable to shareholder returns

In the financial year to 30 September 2020 our operating margin

increased to 52%.

After including interest income on corporate cash, the interest

expense arising from the implementation of IFRS 16 and returns on

corporate gilt holdings, profit before tax in the financial year to

30 September 2020 was GBP55.3 million, an increase of 11% on the

prior year.

Tax

The Group has operations in three tax jurisdictions, UK,

Australia and Isle of Man, meaning profits are subject to tax at

three different rates. However, the vast majority of the Group's

income, 95%, is earned in the UK.

Tax on ordinary activities described below solely comprises the

Group's 'shareholder corporation tax' which is distinguished from

the 'policyholder tax' that the Group collects and remits to HMRC

in respect of ILUK, which is taxed under the "I minus E" tax

regime.

Tax for the year increased by GBP0.8 million, or 9%, to GBP9.8

million (2019: GBP9.0 million) due to increased profits. Our

effective rate of tax over the period remained stable at 18%.

Our tax strategy can be found at: https://

www.integrafin.co.uk/legal-and-regulatory-information/

Earnings per share

2020 2019

(Restated)

GBPm GBPm

Operating profit attributable to

shareholder returns 55.3 49.6

Net interest income 0.0 0.3

-------------------------------------- ------- -----------

Profit before tax attributable

to shareholder returns 55.3 49.9

Net policyholder income attributable

to policyholder returns (3.1) 7.1

Policyholder tax 3.1 (7.0)

Tax on ordinary activities (9.8) (8.9)

Profit after tax for the period 45.5 41.1

Number of shares in issue 331.3m 331.3m

Earnings per share - basic and

diluted 13.7p 12.4p

Earnings per share increased to 13.7 pence, an increase of 10%

on prior year.

The 2019 EPS has been restated in line with t he restatement of

profit after tax noted in the financial performance section

above.

Consolidated statement of financial position

In the consolidated statement of financial position, the

material items that merit comment include the following:

Intangible assets (note 13)

The Group's intangible asset as at 30 September 2020 of GBP13.0

million (2019: GBP13.0 million) comprises goodwill arising from the

purchase of Integrated Application Development Pty Ltd ( IAD) in

July 2016. Goodwill is tested for impairment each financial

year.

Right of use asset and corresponding lease liability (notes 15

and 26)

On 1 October 2019, the Group recognised a right of use asset and

a lease liability on adoption of IFRS 16. The right of use asset

has been depreciated through the year and ends the year at GBP4.0

million. The lease liability has also reduced from the net effect

of rent payments under the terms of the respective lease agreements

and interest charges, and ends the year at GBP6.1 million.

Deferred acquisition costs and deferred income liability (notes

17 and 27)

Deferred acquisition costs and deferred income liability arise

in our life insurance subsidiaries, IntegraLife UK Limited (ILUK)

and IntegraLife International Ltd (ILInt). They are driven by the

level of adviser fees payable by clients from new insurance

wrappers opened in each year. These two line items are required to

be shown under IFRS, however, the timing and magnitude of movement

in the items always nets off exactly, resulting in zero net effect

in each of the companies and in the consolidated statements of

financial position. Both items increased by GBP3.1 million to

GBP53.5 million over the financial year.

Investments and cash held for the benefit of policyholders and

liabilities for linked investment contracts (notes 19, 20 and

21)

ILUK and ILInt write only unit-linked insurance policies. They

match the assets and liabilities of their linked policies such

that, in their own individual statements of financial position,

these items always net off exactly. These line items are required

to be shown under IFRS in the consolidated statement of profit or

loss, the consolidated statement of financial position and the

consolidated statement of cash flows, but have zero net effect.

Investments and cash held for the benefit of policyholders have

increased to GBP16.73 billion (2019: GBP15.45 billion) and GBP1.38

billion (2019: GBP1.21 billion) respectively. Liabilities for

linked investment contracts increased to GBP18.11 billion (2019:

GBP16.66 billion). This reflects the increase in the value of FUD

held in life insurance wrappers.

Deferred tax liabilities (note 28)

Deferred tax liabilities decreased by GBP4.2 million to GBP9.0

million (2019: GBP13.2 million). This decrease was primarily due to

market movements in the assets held in the ILUK's onshore bond tax

wrappers during the year. Sufficient cash is held by ILUK to meet

this liability.

Provisions (note 30)

Provisions have increased in financial year 2020 by GBP6.9

million. This is largely due to tax charges deducted from clients

not becoming payable to HMRC due to the downturn in the financial

markets. If no tax liability arises in the future then these

charges will be refunded to policyholders.

Cash and cash equivalents (note 21)

Shareholder cash increased from GBP132.3m 30 September 2019 to

GBP154.1m at 30 September 2020. The increase of 16% reflects the

cash-generative nature of the business and the strength of the

liquidity within the Group.

Liquidity and capital management

At 30 September 2020 the Group held cash and cash equivalents of

GBP154.1 million (2019: GBP132.3 million). Cash generated through

trading also covered dividend payments totaling GBP26.2 million.

This comprised GBP17.2 million second interim dividend in respect

of the financial year 2019, paid in January 2020 and GBP8.9 million

first interim dividend in respect of the first half of financial

year 2020 (2019: GBP8.6 million), paid in June 2020.

To enable the Group to offer a wide range of tax wrappers there

are three regulated entities within the Group; a UK investment

firm, a UK life insurance company and an Isle of Man life insurance

company. Each regulated entity maintains capital well above the

minimum level of regulatory capital required, ensuring sufficient

capital remains available to fund ongoing trading and future

growth. Cash and investments in short-dated gilts are held to cover

regulatory capital requirements and tax liabilities.

The regulatory capital requirements and resources in ILUK and

ILInt are calculated by reference to economic capital-based

regimes, and therefore do not directly equate to IFAL's

expense-based regulatory capital requirements. These bases are

determined by the appropriate regulations that apply for each of

the companies.

Regulatory Capital

For the financial year ended

30 September 2020

Regulatory Capital Regulatory Capital

requirements resources Regulatory Cover

GBPm GBPm %

IFAL 24.0 34.1 141.8

ILUK 170.4 239.3 140.4

ILInt 18.5 33.4 180.7

All of the company's regulated subsidiaries continue to hold

regulatory capital resources well in excess of their regulatory

capital requirements. We will maintain sufficient regulatory

capital and an appropriate level of working capital. We will use

retained capital to further invest in the delivery of our service

to clients, pay dividends to shareholders and provide fair rewards

to staff.

Capital

For the financial year ended

30 September 2020

GBPm

Total equity 140.9

Loans and receivables, intangible

assets and property, plant and

equipment (22.0)

----------------------------------- -----------------------------

Available capital pre dividend 118.9

Interim dividend declared (18.6)

----------------------------------- -----------------------------

Available capital post dividend 100.3

Additional risk appetite capital (63.5)

----------------------------------- -----------------------------

Surplus 36.9

----------------------------------- -----------------------------

Additional risk appetite capital is capital the IHP Board

considers to be appropriate for it to hold to ensure the smooth

operation of the business such that it is able to meet future risks

to the business plan and future changes to regulatory capital

requirements without recourse to additional capital.

The board considers the impact of regulatory capital

requirements and risk appetite levels on prospective dividends from

all of its regulated subsidiaries. Our Group's Pillar 3 document

contains further details and can be found on our website at:

https://www.integrafin.co.uk/legal-and-regulatory-information/

Pillar 3 Disclosures.

As stated in the Chair's report, t he board has declared a

second interim dividend for the year of 5.6 pence per ordinary

share, taking the total dividend for the year to 8.3 pence per

share (2019: 7.8 pence)

Given the net cash, liquidity and capital coverage positions as

set out above, the Group is well positioned to fund the GBP18.6

million dividend.

2020 2019

Dividend Type Share Class GBPm GBPm

-------------------------- ------------- ---------- ----------

Ordinary All 27.5 25.8

Per share

Ordinary - first interim All 2.7 pence 2.6 pence

Ordinary - second All

interim 5.6 pence 5.2 pence

16 December 2020

Key risks

There are factors within and outside of our control that may

affect the achievement of our strategic objectives. We aim to

mitigate exposures that are outside our risk appetite where

possible. The key risks associated with our strategic objectives

are:

1. Stock market volatility : The COVID-19 pandemic created

immense uncertainty in stock markets throughout the year, with

large fluctuations from day to day, as news emerged. The shape and

implementation of the Brexit deal the UK agrees with the EU may

also continue to have a negative impact on stock markets for some

time. Stock market volatility impacts the value of our FUD.

Risk management and control : The risk of stock market

volatility, and the impact on revenue, is mitigated through a wide

asset offering which ensures we are not wholly correlated with one

market, and which enables clients to switch assets in times of

uncertainty. In particular, clients are able to switch into cash

assets, which remain on our platform. Our wrapper fees are not

impacted by stock market volatility as they are a fixed quarterly

charge. We also closely monitor and control expenses, which assists

in maintaining profit in turbulent times.

2. Service standards failure: Our high levels of client and

adviser retention are dependent upon our consistent and reliable

levels of service. Failure to maintain these service levels would

affect our ability to attract and retain business.

Risk management and control: We manage the risk of service

standards failure by ensuring our service standards do not

deteriorate. This is achieved by providing our client service teams

with extensive initial and ongoing training, supported by

experienced subject matter experts and managers. Service levels are

monitored and quality checked and any deviation from expected

service levels is addressed. We also conduct satisfaction surveys

to ensure our service levels are still perceived as excellent by

our clients and their advisers. Service standards are also

dependent on resilient operations, both current and forward

looking, ensuring that risk management is in place.

3. Increased competition: We operate in a competitive market.

Increased levels of competition for clients and advisers;

improvements in offerings from other investment platforms; and

consolidation in the adviser market may all make it more

challenging to attract and retain business.

Risk management and control: Competitor risk is mitigated by

focusing on providing exceptionally high levels of service and

being responsive to client and financial adviser demands through an

efficient expense base. This allows us to continue to increase the

value for money of our service by r educing client charges, subject

to profit and capital parameters when deemed appropriate.

4. Diversion of resources: Maintaining our quality and relevance

requires ongoing investment. Any reduction in investment due to

diversion of resources to other non-discretionary expenditure (for

example, a change in the taxation regime or other regulatory

developments) may affect our competitive position.

Risk management and control: The risk of reduced investment in

the platform is managed through a disciplined approach to expense

management and forecasting. We horizon scan for upcoming regulatory

and taxation regime changes and maintain contingency to allow for

unexpected expenses e.g. FSCS levies, which ensures we do not need

to compromise on investment in our platform to a degree that

affects our offering.

5. Uncontrolled expenses: Higher expenses than expected and

budgeted for would adversely impact cash profits. The key

constituent of expenses is salary costs, but other expenses are

more likely to change unexpectedly, for example legal, compliance

or regulatory costs and levies.

Risk management and control: The most significant element of our

expense base is staff costs. These are controlled through modelling

staff requirements against forecast business volumes, factoring in

efficiencies that it is expected will emerge through platform

development. Any expenditure request that deviates from plan is

rigorously challenged and must be approved before it is

incurred.

6. Capital strain: Unexpected, additional capital requirements

imposed by regulators may negatively impact our solvency coverage

ratio.

Risk management and control: We continuously monitor the current

and expected future regulatory environment and ensure that all

regulatory obligations are or will be met. This provides a

proactive control to mitigate this risk. Additionally, we carry out

an assessment of our capital requirements, which includes assessing

the regulatory capital required. We retain a capital buffer over

and above the regulatory minimum solvency capital requirements.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors are responsible for preparing the Annual Report

and the financial statements in accordance with the Companies Act

2006 and for being satisfied that the Annual Report and financial

statements, taken as a whole, give a fair, balanced and

understandable view which provides the information necessary for

shareholders to assess the company's position and performance,

business model and strategy.

Company law requires the directors to prepare financial

statements for each financial year.

Under that law the directors are required to prepare the group

financial statements and have elected to prepare the company

financial statements in accordance with International Financial

Reporting Standards (IFRSs) as adopted by the European Union.

Under company law the directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the group and company and of the

profit or loss for the group and company for that period.

In preparing the financial statements, the directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable and prudent;

-- state whether they have been prepared in accordance with

IFRSs as adopted by the European Union, , subject to any material

departures disclosed and explained in the financial statements;

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company and Group

will continue in business; and

-- prepare a director's report, a strategic report and

director's remuneration report which comply with the requirements

of the Companies Act 2006.

The directors are responsible for keeping adequate accounting

records that show and explain the Group's transactions, disclose

with reasonable accuracy at any time the financial position of the

company and enable them to ensure that the financial statements

comply with the Companies Act 2006 and, as regards the group

financial statements, Article 4 of the IAS Regulation.

They are also responsible for safeguarding the assets of the

company and Group and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

The directors are responsible for ensuring the annual report and

the financial statements are made available on a website. Financial

statements are published on the company's website in accordance

with legislation in the United Kingdom governing the preparation

and dissemination of financial statements, which may vary from

legislation in other jurisdictions. The maintenance and integrity

of the company's website is the responsibility of the directors.

The directors' responsibility also extends to the ongoing integrity

of the financial statements contained therein.

Directors' responsibilities pursuant to DTR4

The directors confirm to the best of their knowledge:

-- The group financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union and Article 4 of the IAS

Regulation and give a true and fair view of the assets,

liabilities, financial position and profit and loss of the

group.

The annual report includes a fair review of the development and

performance of the business and the financial position of the group

and the parent company, together with a description of the

principal risks and uncertainties that they face.

The current directors, at the date of approval of this report,

confirm that:

-- they have taken all of the steps that they ought to have

taken as directors to make themselves aware of any information

needed by the company's auditor for the purposes of the audit, and

to establish that the auditor is aware of that information;

-- they are not aware of any relevant audit information of which the auditor is unaware;

-- to the best of their knowledge, the financial statements,

prepared in accordance with the applicable set of accounting

standards, give a true and fair view of the assets, liabilities,

financial position and profit or loss of the issuer and the

undertakings included in the consolidation taken as a whole;

-- the management report includes a fair review of the

development and performance of the business and the position of the

issuer and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face; and

-- The Annual Report and financial statements, taken as a whole,

is fair, balanced and understandable and provides the information

necessary for shareholders to assess the performance, strategy and

business model of the company and Group.

The directors consider it appropriate to adopt the going concern

basis of accounting in preparing the consolidated financial

statements as they believe the Group will continue to be in

business, and meet any liabilities as they fall due, for a period

of at least twelve months from the date of approval of the

financial statements.

By order of the board,

Helen Wakeford

Company Secretary

16 December 2020

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

Note 2020 2019 (Restated)

GBP'000 GBP'000

Revenue

Fee income 5 107,320 99,165

Cost of sales (865) (806)

Gross profit 106,455 98,359

Administrative expenses 8 (51,016) (48,773)

Credit loss allowance on financial

assets 23 (176) (20)

Net income attributable to policyholder

returns 12 (3,066) 7,115

----------------------------------------- ----- ----------- ----------------

Operating profit 52,197 56,681

----------------------------------------- ----- ----------- ----------------

Operating profit attributable

to policyholder returns 12 (3,066) 7,115

Operating profit attributable

to shareholder returns 55,263 49,566

Change in investment contract

liabilities 20 82,895 (554,767)

Fee and commission expenses 20 (137,536) (125,618)

Investment returns 10 54,677 680,422

Interest expense 26 (233) -

Interest income 9 256 308

----------------------------------------- ----- ----------- ----------------

Profit on ordinary activities

before taxation 52,256 57,026

----------------------------------------- ----- ----------- ----------------

Profit on ordinary activities

before taxation attributable

to policyholder returns 12 (3,066) 7,115

Profit on ordinary activities

before taxation attributable

to shareholder returns 55,322 49,911

Policyholder tax 12 3,066 (6,969)

Tax on profit on ordinary activities 11 (9,838) (8,950)

Profit for the financial year 45,484 41,107

Other comprehensive income

Exchange gains/(losses) arising

on translation of foreign operations 22 (20)

Total other comprehensive income

for the financial year 22 (20)

Total comprehensive income for

the financial year 45,506 41,087

----------------------------------------- ----- ----------- ----------------

Earnings per share

Earnings per share - basic and

diluted 7 13.7p 12.4p

All activities of the Group are classed as continuing.

Notes 1 to 40 form part of these Financial Statements

COMPANY STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

Note 2020 2019

GBP'000 GBP'000

Revenue - -

Cost of sales - -

----------------- -----------------

Gross profit - -

Administrative expenses 8 (1,208) (1,096)

Credit loss allowance on financial

assets 18 (85) (24)

----------------- -----------------

Operating loss (1,293) (1,120)

Dividend income 38 32,326 30,118

Interest income 9 91 66

----------------- -----------------

Profit on ordinary activities

before taxation 31,124 29,064

Tax on profit on ordinary activities 11 - -

----------------- -----------------

Profit for the financial year 31,124 29,064

Other comprehensive income - -

Total comprehensive income for

the financial year 31,124 29,064

-------------------------------------- ----- ----------------- -----------------

All activities of the Company are classed as continuing.

Notes 1 to 40 form part of these Financial Statements

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Note 2020 2019 (restated) 1 October

2018

GBP'000 GBP'000 GBP'000

Non-current assets

Loans 18 2,647 1,185 1,189

Intangible assets 13 12,951 12,951 12,966

Property, plant and equipment 14 2,313 2,405 1,813

Right of use assets 15 3,961 - -

Deferred tax asset 28 489 157 44

Deferred acquisition costs 17 53,482 50,443 46,073

75,843 67,141 62,085

Current assets

Financial assets at fair value

through profit

or loss 22 5,051 5,066 6,219

Other prepayments and accrued

income 23 14,412 13,082 11,471

Trade and other receivables 24 3,556 7,189 4,591

Investments held for the benefit

of policyholders 19 16,727,208 15,454,769 13,376,481

Cash and cash equivalents 21 1,539,843 1,342,619 1,230,301

Current tax asset 53 - -

----------------------------------- ----- ----------- ---------------- -------------

18,290,123 16,822,725 14,629,063

Current liabilities

Trade and other payables 25 18,366 17,024 14,764

Lease liabilities 26 2,375 - -

Liabilities for linked investment

contracts 20 18,112,935 16,665,048 14,489,933

Current tax liabilities - 3,987 3,702

----------------------------------- ----- ----------- ---------------- -------------

18,133,676 16,686,059 14,508,399

Non-current liabilities

Provisions 30 25,208 18,230 13,756

Lease liabilities 26 3,712 -

Deferred income liability 27 53,482 50,443 46,073

Deferred tax liabilities 28 8,968 13,248 12,570

----------------------------------- ----- ----------- ---------------- -------------

91,370 81,921 72,399

Net assets 140,920 121,886 110,350

----------------------------------- ----- ----------- ---------------- -------------

Capital and reserves

Called up equity share capital 3,313 3,313 3,313

Capital redemption reserve 31 2 2 2

Share-based payment reserve 32 1,698 1,008 530

Employee Benefit Trust reserve 33 (1,103) (275) -

Foreign exchange reserve 34 (22) (44) (24)

Non-distributable reserves 34 5,722 5,722 5,722

Non-distributable insurance

reserves 34 501 501 501

Profit or loss account 130,809 111,659 100,306

----------------------------------- ----- ----------- ---------------- -------------

Total equity 140,920 121,886 110,350

----------------------------------- ----- ----------- ---------------- -------------

These Financial Statements were approved by the Board of

Directors on 16 December 2020 and are signed on their behalf

by:

Alexander Scott

Director

Company Registration Number: 08860879

Notes 1 to 40 form part of these Financial Statements

COMPANY STATEMENT OF FINANCIAL POSITION

Note 2020 2019

GBP'000 GBP'000

Non-current assets

Investment in subsidiaries 16 16,832 15,800

Loans 18 2,647 1,184

19,479 16,984

Current assets

Prepayments 23 56 30

Other receivables 24 342 86

Cash and cash equivalents 26,090 24,342

-------------------------------- ----- -------- --------

26,488 24,458

Current liabilities

Trade and other payables 25 491 518

-------------------------------- ----- -------- --------

491 518

Net assets 45,476 40,924

-------------------------------- ----- -------- --------

Capital and reserves

Called up equity share capital 3,313 3,313

Profit or loss account 41,962 37,006

Share-based payment reserve 32 1,070 880

Employee Benefit Trust reserve 33 (869) (275)

-------------------------------- ----- -------- --------

Total equity 45,476 40,924

-------------------------------- ----- -------- --------

These Financial Statements were approved by the Board of

Directors on 16 December 2020 and are signed on their behalf

by:

Alexander Scott

Director

Company Registration Number: 08860879

Notes 1 to 40 form part of these Financial Statements

CONSOLIDATED STATEMENT OF CASH FLOWS

2020 2019

GBP'000 GBP'000

(Restated)

Cash flows from operating activities

Profit before tax 52,256 57,026

Adjustments for :

Amortisation and depreciation 2,571 669

Share-based payment charge 1,776 1,237

Interest on cash held (256) (308)

Interest charged on lease 234 -

Investment returns (36) (37)

Increase in policyholder tax recoverable (1,515) -

Decrease in current asset investments 15 1,153

-------------------------------------------- ----------------- ------------

55,045 59,740

Decrease/(increase) in trade and

other receivables 2,305 (4,211)

Increase in trade and other payables 3,858 2,260

Increase in provisions 6,978 5,041

Decrease in share based payment (1,126) -

reserve

Increase in investments held for

the benefit of policyholders (1,272,440) (2,078,288)

Increase in liabilities for linked

investment contracts 1,447,887 2,175,115

Cash generated from operations 242,507 159,657

Income taxes paid (13,803) (15,633)

Interest paid on lease liabilities (234) -

------------------------------------------- ----------------- ------------

Net cash flows from operating activities 228,470 144,024

Investing activities

Acquisition of tangible assets (859) (1,246)

Decrease/(increase) in loans (1,462) 3

Interest on cash held 256 308

Investment returns 36 37

-------------------------------------------- ----------------- ------------

Net cash used in investing activities (2,029) (898)

Financing activities

Purchase of own shares in Employee

Benefit Trust (828) (275)

Settlement of share-based payment

reserve - (706)

Equity dividends paid (26,158) (29,807)

Repayment of lease liabilities (2,244) -

-----------------

Net cash used in financing activities (29,230) (30,788)

Net increase in cash and cash equivalents 197,211 112,338

Cash and cash equivalents at beginning

of year 1,342,619 1,230,301

Exchange gain/(losses) on cash

and cash equivalents 13 (20)

Cash and cash equivalents at end

of year 1,539,843 1,342,619

-------------------------------------------- ----------------- ------------

Notes 1 to 40 form part of these Financial Statements

COMPANY STATEMENT OF CASH FLOWS

2020 2019

GBP'000 GBP'000

Cash flows from operating activities

Loss before interest and dividends (1,293) (1,120)

Adjustments for:

Increase in trade and other

receivables (306) (30)

Decrease in trade and other

payables (4) (205)

Net cash flows from operating

activities (1,603) (1,355)

Investing activities

Dividends received 32,326 30,118

Interest received 91 66

Decrease/(increase) in loans (1,462) 3

--------------------------------------- --------- ---------

Net cash generated from investing

activities 30,955 30,187

Financing activities

Purchase of own shares in Employee

Benefit Trust (594) (275)

Settlement of share-based payment

reserve (843) (706)

Equity dividends paid (26,167) (29,818)

---------

Net cash used in financing

activities (27,604) (30,799)

Net increase/(decrease) in

cash and cash equivalents 1,748 (1,967)

Cash and cash equivalents at

beginning of year 24,342 26,309

Cash and cash equivalents at

end of year 26,090 24,342

--------------------------------------- --------- ---------

Notes 1 to 40 form part of these Financial Statements

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based Non-distributable Employee

Share Non-distributable Other payment insurance Benefit Retained Total

capital reserves reserves reserve reserves Trust earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance

at 1 October

2018 3,313 5,722 (22) 530 501 - 94,899 104,943

Correction

of retained

earnings - - - - - - 5,408 5,408

Restated

balance

at 1 October

2018 3,313 5,722 (22) 530 501 - 100,307 110,351

Comprehensive

income for

the year:

Profit for

the year - - - - - - 41,107 41,107

Movement

in currency

translation - - (20) - - - - (20)

Total

comprehensive

income for

the year - - (20) - - - 41,107 41,087

Distributions

to owners:

Dividends - - - - - - (29,807) (29,807)

Share based

payment

reserve - - - 1,237 - - - 1,237

Settlement

of share

based payment

expense - - - (707) - - - (707)

Purchase

of own shares

in EBT - - - - - (275) - (275)

Other movement - - - (52) - - 52 -

--------------- -------- ------------------ ---------- ------------ ------------------ --------- --------- ---------

Total

distributions

to owners - - - 478 - (275) (29,755) (29,552)

--------------- -------- ------------------ ---------- ------------ ------------------ --------- --------- ---------

Balance

at 1 October

2019 3,313 5,722 (42) 1,008 501 (275) 111,659 121,886

Impact of

IFRS 16 - - - - - - (240) (240)

Deferred

tax on IFRS

16 - - - - - - 31 31

Adjusted

balance

at 1 October

2019 3,313 5,722 (42) 1,008 501 (275) 111,450 121,677

Comprehensive

income for

the year:

Profit for

the year - - - - - - 45,484 45,484

Movement

in currency

translation - - 22 - - - - 22

Total

comprehensive

income for

the year - - 22 - - - 45,484 45,506

Distributions

to owners:

Share-based

payment

expense - - - 1,776 - - - 1,776

Settlement

of share

based payment - - - (1,126) - - - (1,126)

Purchase

of own shares

in EBT - - - - - (828) - (828)

Excess tax

relief

charged

to equity - - - 73 - - - 73

Other movement - - - (33) - - 33 -

Dividends

paid - - - - - - (26,158) (26,158)

--------------- -------- ------------------ ---------- ------------ ------------------ --------- --------- ---------

Total

distributions

to owners - - - 690 - (828) (26,125) (26,263)

--------------- -------- ------------------ ---------- ------------ ------------------ --------- --------- ---------

Balance

at 30

September

2020 3,313 5,722 (20) 1,698 501 (1,103) 130,809 140,920

--------------- -------- ------------------ ---------- ------------ ------------------ --------- --------- ---------

COMPANY STATEMENT OF CHANGES IN EQUITY

Share-based Employee

Share payment Benefit Retained Total

capital reserve Trust earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 October 2018 3,313 350 - 37,760 41,423

Comprehensive income for

the year:

Profit for the year - - - 29,064 29,064

Total comprehensive income

for the year - - - 29,064 29,064

Distributions to owners:

Dividends - - - (29,818) (29,818)

Share-based payment expense - 1,237 - - 1,237

Settlement of share-based

payments - (707) - - (707)

Purchase of own shares in

EBT - - (275) - (275)

------------------------------- --------- ------------ --------- ---------- ---------

Total distributions to owners - 530 (275) (29,818) (29,563)

------------------------------- --------- ------------ --------- ---------- ---------

Balance at 1 October 2019 3,313 880 (275) 37,006 40,924

------------------------------- --------- ------------ --------- ---------- ---------

Comprehensive income for

the year:

Profit for the year - - - 31,124 31,124

Total comprehensive income

for the year - - - 31,124 31,124

Distributions to owners:

Dividends - - - (26,167) (26,167)

Share-based payment expense - 1,032 - - 189

Settlement of share-based

payments - (843) - - -

Purchase of own shares in

EBT - - (594) - (594)

------------------------------- --------- ------------ --------- ---------- ---------

Total distributions to owners - 189 (594) (26,167) (26,572)

------------------------------- --------- ------------ --------- ---------- ---------

Balance at 30 September 2020 3,313 1,069 (869) 41,963 45,476

------------------------------- --------- ------------ --------- ---------- ---------

Notes 1 to 40 form part of these Financial Statements

NOTES TO THE FINANCIAL STATEMENTS

1. Basis of preparation and significant accounting policies

General information

IntegraFin Holdings plc (the "Company") a public limited company

incorporated and domiciled in the United Kingdom ("UK"), along with

its subsidiaries (collectively the "Group") offers a market leading

investment platform which enables advisers to implement financial

plans as simply and efficiently as possible.

The registered office address, and principle place of business,

is 29 Clement's Lane, London, EC4N 7AE.

a) Basis of preparation

The Financial Statements have been prepared and approved by the

Directors in accordance with International Financial Reporting

Standards ("IFRS") as endorsed by the European Union ("EU") and

those parts of the Companies Act 2006 applicable to companies

reporting under IFRS.

The Financial Statements have been prepared on the historical

cost basis, except for the revaluation of certain financial

instruments, which are stated at their fair value, have been

prepared in pound sterling, which is the functional currency of the

Company and are rounded to the nearest thousand.

Going concern

The financial statements have been prepared on a going concern

basis, following an assessment by the board.

Going concern is assessed over the 12 month period from when the

Annual Report is approved, and the board has concluded that the

Group has adequate resources to continue in operational existence

for the next 12 months. This is supported by:

-- The current financial position of the Group;

o The Group maintains a conservative balance sheet and manages

and monitors solvency and liquidity on an ongoing basis, ensuring

that it always has sufficient financial resources for the

foreseeable future.

o As at 30 September 2020, the Group had GBP154 million of

shareholder cash on the balance sheet, demonstrating that liquidity

remains strong.

-- Detailed cash flow and working capital projections; and

-- Stress-testing of liquidity, profitability and regulatory

capital, taking account of possible adverse changes in trading

performance, including the impact of COVID-19.

When making this assessment, the board has taken into

consideration both the Group's current performance and the future

outlook, including the impact of the COVID-19 pandemic. Market

volatility and uncertainty is expected to continue for some time,

due to the pandemic and the effect of measures taken to combat it,

but the Group's fundamentals remain strong.

Stress and scenario testing has been carried out, in order to

understand the potential financial impacts of severe, yet

plausible, scenarios on the Group. The following scenarios have

been considered that give specific consideration to COVID-19:

-- A prolonged economic downturn as COVID-19 cases increase,

leading to a reduced investor propensity for savings

-- Loss of investor confidence in capital and investment markets

due to an extended period of pandemic, combined with the end of the

transitional period with the EU

-- Loss of investor confidence (as above), combined with an internal cyber attack

Having conducted detailed cash flow and working capital

projections, and stress-tested liquidity, profitability and

regulatory capital, taking account of the impact of the COVID-19

pandemic and further possible adverse changes in trading

performance, the board is satisfied that the Group is well placed

to manage its business risks.

The board is also satisfied that it will be able to operate

within the regulatory capital limits imposed by the Financial

Conduct Authority (FCA), Prudential Regulation Authority (PRA), and

Isle Man Financial Services Authority (IoM FSA). Accordingly, the

board does not believe a material uncertainty exists that would

have an effect on the going concern of the Group and have prepared

the financial statements on a going concern basis.

Basis of consolidation

The consolidated Financial Statements incorporate the Financial

Statements of the Company and its subsidiaries. Where the Company

has control over an investee, it is classified as a subsidiary. The

Company controls an investee if all three of the following elements

are present: power over the investee, exposure to variable returns

from the investee, and the ability of the investor to use its power

to affect those variable returns. Control is reassessed whenever

facts and circumstances indicate that there may be a change in any

of these elements of control.

Subsidiaries are fully consolidated from the date on which

control is obtained by the Company and are deconsolidated from the

date that control ceases. Acquisitions are accounted for under the

acquisition method. Intercompany transactions, balances, income and

expenses, and profits and losses are eliminated.

The Financial Statements of all of the wholly owned subsidiary

companies are incorporated into the consolidated Financial

Statements. Two of these subsidiaries, IntegraLife International

Limited (ILInt) and IntegraLife UK Limited (ILUK) issue contracts

with the legal form of insurance contracts, but which do not

transfer significant insurance risk from the policyholder to the

Company, and which are therefore accounted for as investment

contracts.

In accordance with IFRS 9, the contracts concerned are therefore

reflected in the consolidated statement of financial position as

investments held for the benefit of policyholders, and a

corresponding liability to policyholders.

b) New accounting standards

IFRS 16 Leases

The Group adopted IFRS 16 on 1 October 2019. The Group used the

modified retrospective approach of transition, which uses the net

effect of applying IFRS 16 on the first day fof the first

accounting period in which the new standard is applied.

The recognised right of use assets all relate to rental leases

for the offices of the Group previously classified as "operating

leases". Such leases have varying terms, clauses and renewal

rights.

The Group recognises a right of use asset and corresponding

lease liability on the date a leased asset is made available for

use by the Group, except for short term leases (defined as leases

with a lease term of 12 months or less) and leases of low value

assets. For these leases, the Group recognises the lease payments

as an operating expenses on a straight line basis over the term of

lease.

On commencement date, the Group measured the lease liability as

the present value of all future lease payments, discounted using

the incremental borrowing rate of 3.2% at the date of transition.

The Group's incremental borrowing rate is the rate at which a

similar borrowing could be obtained from an independent creditor

under comparable terms and conditions.

The standard allows companies to apply practical expedients when

using the modified retrospective approach of transition. The Group

has chosen to use a single discount rate to its portfolio of leases

as they all have reasonably similar characteristics.

The right of use asset was measured at its net book value,

assuming it had been capitalised and depreciated from inception.

The net effect is recognised through an adjustment to retained

earnings. Prior periods have not been restated.

The table below shows the impact on retained earnings of

recognising the asset and the corresponding liabilities for each of

the leases, and the release of the rent free reserve.

Right of use assets - 1 October GBP5.6m

2019

Lease liabilities - 1 October (GBP8.3m)

2019

----------

Release of rent free reserve GBP2.5m

liability

----------

Reduction to retained earnings (GBP0.2m)

- 1 October

----------

Details of the right of use asset and the lease liability are

set out in Notes 15 and 26 respectively.

The following is a reconciliation of total operating lease

commitments at 30 September 2019 (as disclosed in the Annual Report

to 30 September 2019) to the lease liabilities recognised at

1 October 2019:

GBP'000

Lease commitments - 1 October 2019 8,841

Discounted using incremental borrowing rate (505)

------------------------------------------------------ --------

Lease liabilities on adoption of IFRS 16 - 1 October

2019 8,336

------------------------------------------------------ --------

No other standards or amendments adopted in the period had a

material effect on the financial statements.

c) Future standards, amendments to standards, and

interpretations not early-adopted in the 2020 annual Financial

Statements.

IFRS 17 Insurance Contracts

IFRS 17 was issued in May 2017 and will replace IFRS 4 Insurance

Contracts. An exposure draft was issued in June 2019. IFRS 17

establishes the principles for the recognition, measurement,

presentation and disclosure of insurance contracts within the scope

of the Standard. The Group would be required to provide information

that faithfully represents those contracts, such that users of the

financial statements can assess the effect insurance contracts have

on the entity's financial position, financial performance and cash

flows. The standard is effective for accounting periods beginning

on or after 1 January 2023, subject to EU endorsement.

The Group has performed a preliminary assessment regarding the

impact of IFRS 17 on the Financial Statements and, due to the vast

majority of contracts written by the business being investment

contracts, it is expected such impact will be negligible.

No other f uture standards, amendments to standards, or

interpretations are expected to have a material effect on the

financial statements.

d) Principal accounting policies

Revenue from contracts with customers

Revenue represents the fair value of services supplied by the

Company. All fee income is recognised as revenue in line with the

provision of the services.

Fee income comprises:

Annual commission income

Annual commission is charged for the administration of products

on the Transact platform, and is levied monthly in arrears on the

average value of assets and cash held on the platform in the

month.

Wrapper fee income

Wrapper fees are charged for each of the tax wrappers held by

clients, and are levied quarterly in arrears based on fixed fees

for each wrapper type.

Annual commission and wrapper fees relate to services provided

on an on-going basis, and revenue is therefore recognised on an

on-going basis to reflect the nature of the performance obligations

being discharged.

Accrued income on both annual commission and wrapper fees is

recognised as a trade receivable on the statement of financial

position, as the Group's right to consideration is conditional on

nothing other than the passage of time.

Other income

This comprises buy commission and dealing charges. These are

charges levied on the acquisition of assets, due upon completion of

the transaction. Revenue is recorded on the date of completion of

the transaction, as this is the date the services are provided to

the customer.

Deferred acquisition costs and deferred income liabilities

Incremental costs directly attributable to securing investment

contracts are deferred. These costs consist of fees paid to

policyholders' financial advisers. The costs relating to Pension,

Onshore Life and Offshore Life contracts are capitalised as

deferred acquisition costs and are amortised over the Directors'

best estimates of the lives of the contracts which are deemed to be

fourteen, sixteen and eighteen years respectively (2019: fourteen,

sixteen and eighteen years), over which the services are provided.

Equal service provision is assumed over the lifetime of the

contract and, as such, the deferred costs are amortised on a linear

basis over the expected life of the contract, adjusted for expected

persistency.

A corresponding deferred income liability is recognised in

respect of charges taken from customers of the Company at the

contract's inception to meet obligations to financial advisers.

Deferred income liabilities are also amortised over the Directors'

best estimates of the lives of the contract, which are again deemed

to be fourteen, sixteen and eighteen years. At the end of each

reporting period, deferred acquisition costs are reviewed for

recoverability, against future margins from the

related contracts at the statement of financial position date.

An impairment loss is recognised in the statement of profit or loss

and other comprehensive income if the carrying amount of the

deferred acquisition costs is greater than the future margins from

the related contracts.

Deferred acquisition costs and deferred income liability are

required to be shown under IFRS, however, the timing and magnitude

of movement in the items always nets off exactly, resulting in zero

net effect in each of the companies and in the consolidated

statements of financial position.

Investment income

Interest on cash and coupon on shareholder gilts are the two

sources of investment income received. Interest income is accrued

on a time basis, by reference to the principal outstanding and at

the effective interest rate applicable, which is the rate that

exactly discounts estimated future cash receipts through the

expected life of the financial asset to that financial asset's

carrying amount.

Investments

Fixed asset investments in subsidiaries are stated at cost less

any provision for impairment.

Other investments comprise UK Government fixed interest

securities backing insurance contracts or held as shareholder

investments. These investments are mandatorily held at 'fair value

through profit or loss' at initial recognition and are stated at

quoted bid prices which equates to fair value, with any resultant

gain or loss recognised in profit or loss. Purchases and sales of

securities are recognised on the trade date.

Investment contracts - investments held for the benefit of

policyholders

Investment contracts are comprised of unit-linked contracts in

ILInt and ILUK. Investment contracts result in financial

liabilities whose fair value is dependent on the fair value of

underlying financial assets. They are designated at inception as

financial liabilities at 'fair value through profit or loss' in

order to reduce an accounting mismatch with the underlying

financial assets.

Valuation techniques are used to establish the fair value at

inception and each reporting date. The Company's main valuation

techniques incorporate all factors that market participants would

consider and are based on observable market data. The financial

liability is measured both initially and subsequently at fair

value. The fair value of a unit-linked financial liability is

determined using the fair value of the financial assets contained

within the funds linked to the financial liability.

Dividends

Equity dividends are recognised in the accounting period in

which the dividends are declared.

Intangible non-current assets

Intangible non-current assets, excluding goodwill, are stated at

cost less accumulated amortisation and comprise intellectual

property software rights. The software rights were amortised over

seven years on a straight line basis, as it was estimated that the

code would be replaced every seven years, and therefore have a

finite useful life. The software rights are now fully amortised,

but due to ongoing system development and coding updates no

replacement is required. Goodwill is held at cost and, in

accordance with IFRS, is not amortised but is subject to annual

impairment reviews.

Property, plant and equipment

Property, plant and equipment are stated at cost less

accumulated depreciation and accumulated impairment losses. Cost

includes expenditures that are directly attributable to the

acquisition of the asset. Subsequent costs are included in the

asset's carrying amount or recognised as a separate asset, as

appropriate, only when it is probable that future economic benefits

associated with the item will flow to the Company and the cost can

be measured reliably. Repairs and maintenance costs are charged to

the profit and loss and other comprehensive income statement during

the period in which they are incurred.

The major categories of property, plant, equipment and motor

vehicles are depreciated as follows:

Asset class All UK and Isle of Man Australian entity

entities

Leasehold improvements Straight line over the Straight line over

life of the lease 40 years

Fixtures & Fittings Straight line over 10 Reducing balance over

years 2 to 8 years

Equipment Straight line over 3 to Reducing balance over

10 years 3 to 10 years

Motor vehicles N/A Reducing balance over

2 to 8 years

Residual values, method of depreciation and useful lives of the

assets are reviewed annually and adjusted if appropriate.

Impairment of non-financial assets

Property, plant and equipment, right of use assets and

intangible assets are tested for impairment when events or changes

in circumstances indicate that the carrying amount may not be

recoverable. Recoverable amount is the higher of an asset's fair

value less costs to sell and value in use (being the present value

of the expected future cash flows of the relevant asset).

The Group evaluates impairment losses for potential reversals

when events or circumstances warrant such consideration.

Goodwill is tested for impairment annually, and once an

impairment is recognised this cannot be reversed. For more detailed

information in relation to this, please see note 13.

Pensions

The Group makes defined contributions to the personal pension

schemes of its employees. These are chargeable to profit or loss in

the year in which they become payable.

Foreign currencies

Transactions in foreign currencies are translated into the

functional currency at the exchange rate in effect at the date of

the transaction. Foreign currency monetary assets and liabilities

are translated to sterling at the year end closing rate.

Non-monetary assets denominated in a foreign currency that are

measured in terms of historical cost are translated using the

exchange rate in effect at the date when the fair value was

determined. Foreign exchange rate differences that arise are

reported net in profit or loss as foreign exchange

gains/losses.

The assets and liabilities of foreign operations are translated

to sterling using the year end closing exchange rate. The revenues

and expenses of foreign operations are translated to sterling at

rates approximating the foreign exchange rates ruling at the

relevant month of the transactions. Foreign exchange differences

arising on retranslation are recognised directly in the

reserves.

Taxation

The taxation charge is based on the taxable result for the year.