TIDMIGG

RNS Number : 9208L

IG Group Holdings plc

16 September 2021

16 September 2021

LEI No: 2138003A5Q1M7ANOUD76

IG GROUP HOLDINGS PLC

First Quarter Revenue Update

'IG delivered a strong first quarter performance driven by the

size and quality of the client base delivering adjusted Group

revenue of GBP221.7 million, in line with expectations'

IG Group Holdings plc ("IG", "the Group", "the Company"), a

global leader in online trading, today issues its scheduled revenue

update for the three months to 31 August 2021 ("Q1 FY22"),

representing the first quarter of the financial year ending 31 May

2022 ("FY22").

Business performance

Revenue for the quarter was GBP227.5 million. Excluding the

foreign exchange hedging gain associated with the financing of the

tastytrade acquisition which completed on 28 June 2021, adjusted

net trading revenue was GBP221.7 million, higher than both the same

period in the prior year (Q1 FY21: GBP209.0 million) as well as the

recent Q4 FY21 period (GBP214.1 million), and consistent with the

Group's previous guidance. tastytrade delivered another consecutive

record quarter of revenue. In the approximately two month period

since completion, it delivered revenue of GBP20.8 million.

Excluding tastytrade, adjusted net trading revenue for the quarter

was GBP200.9 million, 4% lower than Q1 FY21, reflecting anticipated

moderation in trading activity.

Adjusted net trading revenue Q1 Q1 %

by product (GBPm) FY22 FY21 Change

OTC leveraged 188.3 195.1 (3%)

Exchange traded derivatives 25.8 6.3 310%

Stock trading and investments 7.6 7.6 (1%)

------------------------------- --------- ------ --------

Group 221.7(1) 209.0 6%

------------------------------- --------- ------ --------

(1) Excludes GBP5.8 million of foreign exchange hedging gain

associated with the financing of the tastytrade acquisition

- Core Markets+ revenue was GBP192.1 million in the quarter (Q1

FY21: GBP199.9 million), down 4%, reflecting, as anticipated, the

impact of ASIC regulation in Australia which came into effect in

March 2021. The Japan business continued to perform strongly and

delivered growth ahead of expectations in the quarter.

- High Potential Markets revenue was GBP29.6 million in the

quarter, reflecting strong growth at tastytrade and Spectrum,

offset by revenues from Nadex, which experienced reduced client

activity. Pro forma revenue, which includes a full quarter of

tastytrade was GBP38.2 million (pro forma Q1 FY21: GBP32.9 million)

was up 16%.

Total active clients in the quarter were 287,200. Excluding

tastytrade, active clients were up 12% at 225,900 (Q1 FY21:

201,500) reflecting both elevated levels of client acquisition over

the 12 month period and new client retention levels tracking in

line with historical client cohorts.

As anticipated, the Group saw some moderation in the level of

new client acquisition compared to the exceptional levels seen

throughout FY21. The Group onboarded 27,500 new clients in the

period. Excluding tastytrade, 21,900 new clients were acquired,

down 37% on the prior year period (Q1 FY21: 34,600) however this

remains over 40% above the pre-pandemic quarterly average of 15,200

(Q1-Q3 FY20), which positions the Group well for the future.

The strong business performance in the quarter reflects the size

and quality of the Group's active client base. The Group remains

confident of achieving its medium term targets for the Core

Markets+ and High Potential Markets portolios.

The Group's next market announcement will be its half year FY22

results, to be released in January 2022.

For further information, please contact:

IG Group Investors IG Group Press FTI Consulting

Liz Scorer / Simon Wright Ramon Kaur Ed Berry

020 7573 0727 / 0099 020 7573 0060 07703 330 199

investors@ig.com press@ig.com ed.berry@fticonsulting.com

Disclaimer - Forward-looking statements

This statement, prepared by IG Group Holdings plc (the

"Company"), may contain forward-looking statements about the

Company and its subsidiaries (the "Group"). Such forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "projects",

"estimates", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

various or comparable terminology.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other factors which are beyond the

Company's control and are based on the Company's beliefs and

expectations about future events as of the date the statements are

made. If the assumptions on which the Group bases its

forward-looking statements change, actual results may differ from

those expressed in such statements. There are a number of factors

that could cause actual results and developments to differ

materially from those expressed or implied by these forward-looking

statements, including those set out under "Principal Risks" in the

Company's annual report for the financial year ended 31 May 2021.

The annual report can be found on the Company's website (

www.iggroup.com ).

Forward-looking statements speak only as of the date they are

made. Except as required by applicable law and regulation, the

Company undertakes no obligation to update these forward-looking

statements. Nothing in this statement should be construed as a

profit forecast.

About IG

IG Group has been at the forefront of trading innovation since

1974. Since then, we've evolved into a global fintech company

incorporating the IG, tastytrade, IG Prime, Spectrum, Nadex and

DailyFX brands, with a presence in Europe, North America, Africa,

Asia-Pacific and the Middle East.

Our award-winning products and platforms empower ambitious

people the world over to unlock opportunities around the clock,

giving them access to over 19,000 financial markets. Today, more

than 400,000 clients call IG Group home. IG Group Holdings plc is

an established member of the FTSE 250 and holds a long-term

investment grade credit rating of BBB- with a stable outlook from

Fitch Ratings.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRFFZGMLVKLGMZM

(END) Dow Jones Newswires

September 16, 2021 02:00 ET (06:00 GMT)

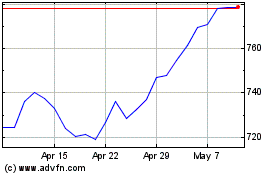

Ig (LSE:IGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ig (LSE:IGG)

Historical Stock Chart

From Apr 2023 to Apr 2024