Helios Underwriting Plc Syndicate Forecasts (3011P)

June 05 2015 - 2:00AM

UK Regulatory

TIDMHUW

RNS Number : 3011P

Helios Underwriting Plc

05 June 2015

5 June 2015

Helios Underwriting plc

("HUW" or the "Company")

Syndicate Forecasts

Set out below are the aggregated 2013 and 2014 underwriting year

of account (YOA) forecasts of syndicate profits for HUW's portfolio

of syndicate participations:

2013 and 2014 open year of account forecasts

YOA HUW syndicate Previous forecast Current forecast

capacity of syndicate profit of syndicate profit

(GBP000) 31 December 2014 31 March 2015

------ -------------- ----------------------------- -----------------------------

Mid Mid Range Mid Mid Range

point point (%) point point (%)

(GBP000) (%) (GBP000) (%)

------ -------------- ---------- ------ --------- ---------- ------ ---------

4.65 6.87

2013 23,923 2,047 8.56 - 12.46 2,419 10.11 - 13.35

------ -------------- ---------- ------ --------- ---------- ------ ---------

2.93-

2014 25,568 NA NA NA 1,902 7.44 11.94

------ -------------- ---------- ------ --------- ---------- ------ ---------

Source: Syndicate data; Hampden Agencies Limited and HUW

analysis

Explanatory notes:

The table above shows the gross aggregated estimated profits at

syndicate level (before members' agent fees payable by HUW and its

subsidiaries) for the syndicates in which the Company participates

on a three year underwriting year of account (YOA) basis. The

figures are also before HUW's quota share and stop loss reinsurance

arrangements. The forecast YOA syndicate profit for HUW is obtained

by applying the mid-point of the relevant estimated profit range to

each of HUW's syndicate participations. The information presented

above is prepared on a three year YOA basis and should not be

considered as indicative of the Group's annually accounted

financial results prepared in accordance with International

Financial Reporting Standards. Further details, including quarterly

progression for all years and syndicate results for closed years,

will shortly be available on HUW's website at www.huwplc.com.

HUW syndicate participation

HUW's syndicate participations, on which YOA information is

based, is presented below and is also available on the Company's

website:

2013 2014 2015

---------- ----------------- ----------------- -----------------

Syndicate GBP'000 %* GBP'000 %* GBP'000 %*

---------- -------- ------- -------- ------- -------- -------

33 1,860 7.8% 2,001 7.8% 2,001 8.7%

---------- -------- ------- -------- ------- -------- -------

218 1,286 5.4% 1,286 5.0% 1,028 4.5%

---------- -------- ------- -------- ------- -------- -------

308 70 0.3% 85 0.3% - -

---------- -------- ------- -------- ------- -------- -------

386 701 2.9% 701 2.7% 598 2.6%

---------- -------- ------- -------- ------- -------- -------

510 3,993 16.7% 3,943 15.4% 3,943 17.1%

---------- -------- ------- -------- ------- -------- -------

557 529 2.2% 499 2.0% 499 2.2%

---------- -------- ------- -------- ------- -------- -------

609 2,329 9.7% 2,335 9.1% 2,338 10.2%

---------- -------- ------- -------- ------- -------- -------

623 2,561 10.7% 2,766 10.8% 2,578 11.2%

---------- -------- ------- -------- ------- -------- -------

727 592 2.5% 592 2.3% 592 2.6%

---------- -------- ------- -------- ------- -------- -------

779 20 0.1% - - - -

---------- -------- ------- -------- ------- -------- -------

958 736 3.1% 585 2.3% 74 0.3%

---------- -------- ------- -------- ------- -------- -------

1176 445 1.9% 447 1.7% 447 1.9%

---------- -------- ------- -------- ------- -------- -------

1200 106 0.4% 106 0.4% 41 0.2%

---------- -------- ------- -------- ------- -------- -------

1729 - - 58 0.2% 19 0.1%

---------- -------- ------- -------- ------- -------- -------

2010 745 3.1% 745 2.9% 652 2.8%

---------- -------- ------- -------- ------- -------- -------

2014 - - 137 0.5% 930 4.0%

---------- -------- ------- -------- ------- -------- -------

2121 12 0.0% - - - -

---------- -------- ------- -------- ------- -------- -------

2525 120 0.5% 120 0.5% 120 0.5%

---------- -------- ------- -------- ------- -------- -------

2526 60 0.2% - - - -

---------- -------- ------- -------- ------- -------- -------

2791 4,017 16.8% 3,537 13.8% 3,123 13.6%

---------- -------- ------- -------- ------- -------- -------

4242 122 0.5% 122 0.5% 138 0.6%

---------- -------- ------- -------- ------- -------- -------

5820 172 0.7% 118 0.5% 58 0.3%

---------- -------- ------- -------- ------- -------- -------

6103 517 2.2% 475 1.9% 191 0.8%

---------- -------- ------- -------- ------- -------- -------

6104 539 2.3% 946 3.7% 946 4.1%

---------- -------- ------- -------- ------- -------- -------

6105 74 0.3% 386 1.5% 400 1.7%

---------- -------- ------- -------- ------- -------- -------

6106 320 1.3% - - - -

---------- -------- ------- -------- ------- -------- -------

6107 33 0.1% 373 1.5% 373 1.6%

---------- -------- ------- -------- ------- -------- -------

6110 979 4.1% 925 3.6% - -

---------- -------- ------- -------- ------- -------- -------

6111 958 4.0% 1,206 4.7% 1,218 5.3%

---------- -------- ------- -------- ------- -------- -------

6113 30 0.1% 20 0.1% - -

---------- -------- ------- -------- ------- -------- -------

6117 - - 1,057 4.1% 698 3.0%

---------- -------- ------- -------- ------- -------- -------

Total 23,923 100.0% 25,568 100.0% 23,007 100.0%

---------- -------- ------- -------- ------- -------- -------

* Percentage of total syndicate portfolio

For further information please contact:

HUW Nigel Hanbury nigel.hanbury@huwplc.com

Smith & Williamson Corporate

Finance David Jones 020 7131 4000

Westhouse Securities Robert Finlay 020 7601 6100

About HUW

HUW provides a limited liability direct investment into the

Lloyd's insurance market and is quoted on the London Stock

Exchange's AIM market (ticker: HUW). HUW's subsidiary underwriting

vehicles trade within the Lloyd's insurance market as corporate

members of Lloyd's writing GBP23 million of capacity for the 2015

account. The portfolio provides a good spread of classes of

business being concentrated in property insurance and reinsurance.

For further information please visit www.huwplc.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUGUGPQUPAGQC

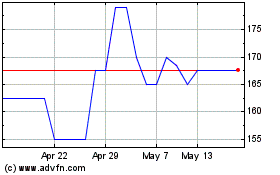

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Aug 2024 to Sep 2024

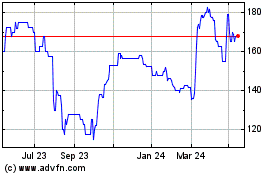

Helios Underwriting (LSE:HUW)

Historical Stock Chart

From Sep 2023 to Sep 2024