TIDMHTWS

RNS Number : 0777T

Helios Towers PLC

22 March 2021

Helios Towers plc

(the "Company")

2020 Annual Report and Accounts and 2021 Notice of Annual

General Meeting

In accordance with Listing Rule 9.6.1R and Disclosure and

Transparency Rule ("DTR") 4.1.3R, the Company announces that the

following documents have been posted and/or otherwise made

available to shareholders:

-- 2020 Annual Report and Accounts

-- 2020 Sustainable Business Report

-- 2021 Notice of Annual General Meeting

-- Form of Proxy for the 2021 Annual General Meeting

The above mentioned documents (except for the Form of Proxy) are

available on the Company's website at www.heliostowers.com and will

shortly be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

22 March 2021

LEI: 213800DGC7GS4XCHCU30

Identification Code: GB00BJVQC708

Enquiries:

For investor enquiries investorrelations@heliostowers.com

For media enquiries Edward Bridges, Stephanie Ellis

FTI Consulting LLP

+44 (0)20 3727 1000

Appendix

In compliance with DTR 6.3.5R, the information contained in this

appendix is extracted from the 2020 Annual Report and Accounts and

should be read in conjunction with the Company's 2020 Full Year

Results Announcement for the year ended 31 December 2020 issued on

10 March 2021. Both documents are available at

www.heliostowers.com/investors/results-reports-and-presentations/

and together constitute the material required by DTR 6.3.5R to be

communicated to the media in unedited full text through a

Regulatory Information Service. This material is not a substitute

for reading the 2020 Annual Report and Accounts in full. Page

numbers and cross references in the extracted information refer to

page numbers and cross references in the 2020 Annual Report and

Accounts.

1. Business principal risks

Summarised below are the key risks identified (not in order of

significance) which could have a material impact on the Group.

Risk status Risk description Impacts Risk mitigation

No change 1. Operational Strategic

resilience Reputational * Ongoing enhancements to data security and protection

Operational measures with third-party expert support;

The ability of the

Group to continue

operations is * Additional investment in IT resource and

heavily reliant on infrastructure to increase automation and workflow of

third parties, the business as usual activities;

proper

functioning of its

technology * Third-party due diligence, ongoing monitoring and

platforms and the regular supplier performance reviews;

capacity of its

available human

resources. * Alternative sources of supply are identified in

Failure in any of advance to mitigate any potential disruption to the

these three areas strategic supply chain;

could severely

affect its

operational * Ongoing review and involvement of the human resources

capabilities and department at an early stage in organisation design

ability to deliver and development activities.

on its strategic

objectives.

------------------ ------------------ -----------------------------------------------------------------

No change 2. Major quality Reputational

failure or breach Financial * Continued skills development and training programmes

of contract for the project and operational delivery team;

The Group's

reputation and * Detailed and defined project scoping and life cycle

profitability management through project delivery and transfer to

could be damaged ongoing operations;

if it fails to

meet its

customers' * Contract and dispute management processes in place;

operational

specifications,

quality standards * Continuous monitoring and management of customer

or delivery relationships;

schedules.

A substantial * Use of long-term contracting with minimal termination

portion of Group rights.

revenues is

generated from a

limited number of

large customers.

The loss of any of

these customers

would materially

affect the Group's

finances and

growth

prospects.

Many of the

Group's customer

tower contracts

contain liquidated

damage provisions,

which may

require the Group

to make

unanticipated and

potentially

significant

payments to its

customers.

------------------ ------------------ -----------------------------------------------------------------

No change 3. Non-compliance Compliance

with various laws Financial * Constant monitoring of potential changes to laws and

and regulations Reputational regulatory requirements;

such as:

i) Health, safety * In-person and virtual training on health, safety and

and environmental environmental matters provided to employees and

laws relevant third-party contractors;

ii)Anti-bribery

and corruption * I S O 3 7 0 0 1 ( A n t i - B r i b e r y M ana g e m

provisions e n t S y s t e m ) c e r t i fi c a t i o n

retained;

Non-compliance

with applicable

laws and * Ongoing refresh of compliance and related policies i

regulations may m p l e m e n t e d i n 2018 , i n c l u d i n g s p

lead to e c i fi c d e t a il s c o v e r i n g Anti-Bribery

substantial fines and Corruption, Facilitation of Tax Evasion,

and penalties, Anti-Money-Laundering;

reputational

damage and adverse

effects on future * Compliance monitoring activities and periodic

growth prospects. reporting requirements introduced;

Sudden and

frequent changes * Ongoing engagement with external lawyers, consultants

in laws and ,

regulations, in and regulatory authorities, as necessary, to identify

respect of their and assess changes in the regulatory environment;

interpretation or

application and

enforcement, both * Third-Party Code of Conduct communicated and annual

locally and certifications required of all high and medium risk

internationally, third parties introduced and communicated;

may require the

Group to modify

its existing * Third-party monitoring through supplier audits and

business performance reviews.

practices, incur

increased costs

and subject it to

potential

additional

liabilities.

------------------ ------------------ -----------------------------------------------------------------

No change 4. Economic and Operational

political Financial * Ongoing market analysis and business intelligence

instability gathering activities;

A slowdown in the

growth of, or a * Market share growth strategy in place;

reduction in

demand for,

wireless * Long-term contracts with blue chip MNOs;

communication

services

could adversely * Close monitoring of any potential risks that may

affect the demand affect operations;

for communication

sites and tower

space, and could * Business continuity and contingency plans in place to

have respond to any emergency situations.

a material adverse

effect on the

Group's financial

condition and

results of

operations.

There are

significant risks

related to

political

instability,

security, ethnic,

religious

and regional

tensions in each

geography where

the Group has

operations.

------------------ ------------------ -----------------------------------------------------------------

No change 5. Significant Financial

exchange rate * USD and EUR pegged contracts;

movements

Fluctuations in, * 'Natural' hedge of local currencies (revenue vs.

or devaluations opex);

of, local market

currencies where

the Group operates * Monthly review of exchange rate differences.

could

have a significant

and negative

financial impact

on the Group's

business,

financial

condition

and results. Such

impacts may also

result from any

adverse effects

that these

movements have

on Group

third-party

customers and

strategic

suppliers.

------------------ ------------------ -----------------------------------------------------------------

No change 6. Non-compliance Operational

with permit * Inventory of required licences and permits maintained

requirements for each operating company;

The Group may not

always operate * Compliance registers maintained with any potential

with the necessary non-conformities identified by relevant government

required approvals authorities with a timetable for rectification;

and permits for

some

of its tower * Periodic engagement with external lawyers and

sites, advisors, and participation in industry groups;

particularly in

the case of tower

portfolios * Active and ongoing engagement with relevant

acquired from a regulatory authorities to proactively identify,

third-party. assess and manage actual and potential regulation

Vagueness, changes.

uncertainty and

changes in

interpretation of

regulatory

requirements are

frequent

and often arise

without warning.

As a result, the

Group may be

subject to

potential

reprimands,

warnings, fines

and penalties for

non-compliance

with the relevant

permitting and

approval

requirements.

------------------ ------------------ -----------------------------------------------------------------

No change 7. Loss of key People

personnel * Talent identification and succession planning are in

place for key roles;

The Group's

successful

operational * Competitively benchmarked performance-related

activities and remuneration plans;

growth are closely

linked to the

knowledge * Staff performance and development/support plans.

and experience of

key members of

senior management

and highly skilled

technical

employees.

The loss of any

such personnel, or

the failure to

attract, recruit

and retain equally

high-calibre

professionals,

could adversely

affect the Group's

operations,

financial

condition and

strategic

growth prospects.

------------------ ------------------ -----------------------------------------------------------------

No change 8. Technology risk Strategic

* Strategic long-term planning;

Advances in

technology that

enhance the * Business intelligence;

efficiency of

wireless networks,

and potential * Exploring alternative technologies such as solar

active power;

sharing of

wireless spectrum,

may significantly * Continuously improving our product offering to adapt

reduce or negate to new wireless technologies;

the need for

tower-based

infrastructure or * Applying for new licenses to provide active

services. This infrastructure services in certain markets.

could reduce the

need for

telecommunications

operators to

add more

tower-based

antenna equipment

at certain tower

sites, leading to

a potential

decline

in tenancies,

service needs and

revenue streams.

Examples may

include spectrally

efficient

technologies,

which could

potentially

relieve certain

network capacity

problems, or

complementary

voice over

internet protocol

access

technologies

that could absorb

a portion of

subscriber traffic

from the

traditional

tower-based

networks.

------------------ ------------------ -----------------------------------------------------------------

No change 9. Failure to Financial

remain competitive * Key performance indicator ('KPI') monitoring and

benchmarking against competitors;

Competition in, or

consolidation of,

the * Total cost of ownership analysis for MNOs;

telecommunications

tower industry may

create pricing * Fair pricing structure;

pressures that

materially and

adversely affect * Business intelligence and review of competitors'

the Group. activities;

* Strong tendering team to ensure high win/retention

rate;

* Continuous capex investment to ensure that the Group

has sufficient capacity.

------------------ ------------------ -----------------------------------------------------------------

No change 10. Failure to Strategic

integrate new Financial * Pre-acquisition due diligence conducted with the

lines of business Operational assistance of external advisors with specific

in new markets geographic and industry expertise;

Multiple risks

exist with entry * Ongoing monitoring activities

into new markets post-acquisition/agreement;

and new lines of

business. Failure

to successfully * Detailed management, operations and technology

manage and integration plan;

integrate

operations,

resources and * Ongoing measurement of performance vs. plan and Group

technology could strategic objectives;

have material

adverse

implications * Implementation of a regional CEO and support function

for the Group's to governance and oversight structure.

overall growth

strategy, and

negatively impact

its financial

position and

corporate culture.

------------------ ------------------ -----------------------------------------------------------------

No change 11. Tax disputes Compliance

Financial * Frequent interaction and transparent communication

Our operations are Operational with relevant governmental authorities and

based in certain Reputational representatives;

countries with

complex,

frequently * Engagement of external legal and tax consultants to

changing and advise on legislative/tax code changes and assessed

bureaucratic liabilities or audits;

and

administratively

burdensome tax * Engagement with trade associations and industry

regimes. This may bodies and other international companies and

lead to organisations facing similar issues;

significant

disputes around

interpretation and * Defending against unwarranted claims;

application of tax

rules and may

expose us to * Recruitment of Group Tax Manager, and ongoing

significant recruitment of in-house tax expertise at both Group

additional and Opco levels.

taxation

liabilities.

------------------ ------------------ -----------------------------------------------------------------

New 12. Covid-19 Financial

Operational * Health and safety protocols established and

In addition to the implemented;

normal health and

safety risks to

our employees and * Business continuity plans implemented with ongoing

contractors, the monitoring;

ongoing

impact of the C o

v i d-19 p an d e * Financial modelling, scenario building and stress

m i c c o u l d m testing;

a t e r i a ll y

an d a d v e rs e

l * Continuous monitoring of the external environment;

y a ff e c t the

financial and

operational * Increased fuel and capex purchases;

performance of the

Group across all

its activities. * Review of contractual terms and conditions;

The effects of the

pandemic may also

disrupt the * Review and adaptation of our control environment for

achievement of the remote working.

Group's strategic

plans

and growth

objectives and

place additional

strain on its

technology

infrastructure.

There

is also an

increased risk of

litigation due to

the potential

effects of the

pandemic on

fulfilment

of contractual

obligations.

------------------ ------------------ -----------------------------------------------------------------

New 13. Information Financial

technology failure Operational * Ongoing implementation and enhancement of security

and cyber-attack Reputational and remote access processes, policies and procedures;

risk

We are * Regular security testing regime established,

increasingly validated by independent third parties;

dependent on the

performance and

effectiveness of * Annual staff training and awareness programme in

our IT systems. place;

Failure

of our key

systems, exposure * Security controls based on industry best practice

to the increasing frameworks such as NCSC, and validated through

threat of internal audit assessments;

cybercrime attacks

and threats, loss

or theft of * Specialist security third parties engaged to assess

sensitive cyber risks and mitigation plans;

information,

whether

accidentally or * Incident management and response processes aligned to

intentionally, In f or ma t i on T e c hn o l ogy In f r a s t ruc t

expose the Group u r e L i b r ar y ( ' I T I L (R) ' ) b es t

to operational, practice - identification, containment, eradication,

strategic, recovery and lessons learned;

reputational and

financial risks.

These risks are * New supplier risk management assessments and due

increasing due diligence carried out.

to greater

interconnectivity,

reliance on

technology

solutions to drive

business

performance,

use of third

parties in

operational

activities and

continued adoption

of remote working

practices.

Cyber-attacks are

becoming more

sophisticated and

frequent and may

compromise

sensitive

information

of the Group, its

employees,

customers or other

third parties.

Failure to prevent

unauthorised

access or to

update processes

and IT security

measures may

expose the Group

to potential

fraud,

inability to

conduct its

business, damage

to customers as

well as regulatory

investigations

and associated

fines and

penalties.

------------------ ------------------ -----------------------------------------------------------------

2. Related party transactions

During the year, the Group companies entered into the following

commercial transactions with related parties:

2020 2019

----------------------- -----------------------

Purchase Purchase

Income from of goods Income from of goods

towers US$m US$m towers US$m US$m

------------------------------------------ ------------ --------- ------------ ---------

Millicom Holding B.V. and subsidiaries(1) 72.2 - 70.4 -

Ecost Building Management Pty - - - 1.4

Vulatel (Pty) Ltd - - 0.2 0.3

Nepic Pty - 0.2 0.3 -

------------------------------------------ ------------ --------- ------------ ---------

Total 72.2 0.2 70.9 1.7

------------------------------------------ ------------ --------- ------------ ---------

2020 2019

------------------ ------------------

Amount Amount Amount Amount

owed by owed to owed by owed to

US$m US$m US$m US$m

------------------------------------------ -------- -------- -------- --------

Millicom Holding B.V. and subsidiaries(1) 37.1 - 22.9 -

Vulatel (Pty) Ltd(2) - - 0.2 -

Nepic Pty(2) - - 0.3 0.1

SA Towers Proprietary Limited(2) - - - 1.5

------------------------------------------ -------- -------- -------- --------

Total 37.1 - 23.4 1.6

------------------------------------------ -------- -------- -------- --------

(1) Millicom Holding B.V is a shareholder of Helios Towers plc.

(2) No longer classified as related parties as of November 2020.

See Note 13 for further details.

The amounts outstanding are unsecured and will be settled in

cash. No guarantees have been given or received. Based on the ECL

model, no provisions have been made for loss allowances in respect

of the amounts owed by related parties.

Amounts receivable from the related parties related to other

Group companies are short term and carry interest varying from 0%

to 15% per annum charged on the outstanding trade and other

receivable balances (Note 15).

3. Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and Financial Statements, and the Group's Financial Statements, in

accordance with applicable United Kingdom law and those applicable

accounting standards.

The Directors have elected to prepare the Company Financial

Statements in accordance with United Kingdom Generally Accepted

Accounting Practice ('UK GAAP'), which is the United Kingdom

Accounting Standards and applicable law, including the Financial

Reporting Standard Applicable in the UK and Republic of Ireland

('FRS 102').

The Directors are required to prepare Financial Statements for

each financial year which present a true and fair view of the

financial position of the Company and of the Group, and of the

financial performance and cash flows of the Group. In preparing

those Financial Statements, the Directors are required to:

-- select suitable accounting policies in accordance with IAS 8

('Accounting policies, changes in accounting estimates and errors')

and FRS 102 then apply them consistently;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- provide additional disclosures when compliance with the

specific requirements in IFRS for Group and FRS 102 for Company is

insufficient to enable users to understand the impact of particular

transactions, other events and conditions on the Company and of the

Group's financial position and financial performance;

-- state that the Company has complied with FRS 102 and the

Group has complied with IFRS, subject to any material departures

disclosed and explained in the Financial Statements; and

-- prepare the accounts on a going concern basis unless, having

assessed the ability of the Company and the Group to continue as a

going concern, management either intends to liquidate the entity or

to cease trading, or have no realistic alternative but to do

so.

The Directors are responsible for keeping proper accounting

records which disclose with reasonable accuracy at any time the

financial position of the Company and of the Group, and which

enable them to ensure that the Financial Statements comply with the

Companies Act 2006 and Article 4 of the IAS Regulation. They are

also responsible for safeguarding the assets of the Company and the

Group, and hence for taking reasonable steps for

the prevention and detection of fraud and other irregularities.

Under applicable UK law and regulations, the Directors are

responsible for the preparation of a Directors' report, Directors'

remuneration report and corporate Governance Report that comply

with that law and regulations. In addition, the Directors are

responsible for the maintenance and integrity of the corporate and

financial information included on the Company's website.

Legislation in the UK governing the preparation and

dissemination of Financial Statements may differ from legislation in other jurisdictions.

Neither the Company nor the Directors accept any liability to

any person in relation to the Annual Report and Financial

Statements except to the extent that such liability could arise

under English law. Accordingly, any liability to a person who has

demonstrated reliance on any untrue or misleading statement or

omission shall be determined in accordance with section 90A a nd s

c h e d u le 10A of t he F i n a n c i al Services

and Markets Act 2000.

Directors' responsibility statement under the UK Corporate

Governance Code:

In accordance with Provision 27 of the 2018 UK C o r po r a te

Go v e r n a n ce C od e, the Directors consider that the Annual

Report and Financial Statements, taken as a whole, is fair,

balanced and understandable and provides information to enable

shareholders to assess the Company's performance, business model

and strategy.

Responsibility statement of the Directors in respect of the

Annual Report and Financial Statements Each of the Directors whose

names are listed on pages 72-74 confirm that to t he b e st of t h

e ir k n o w l e dg e:

a) the Group Financial Statements, prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union, and the Company Financial Statements prepared u n d

er F RS 102, g i ve a t r ue a nd f a ir view of the assets,

liabilities, financial position and profit and loss of the Group

and Company and the undertakings included in the consolidation

taken as a whole; and

b) the management report (encompassed within the Overview,

Strategic Report, and Governance sections) includes a fair review

of the development and performance of the business, and the

position of the Group and the undertakings included in the

consolidation taken as a whole, together with a description of the

principal risks and uncertainties that they face.

The Strategic Report and the Statement of Directors'

Responsibilities were approved by the Board and signed on its

behalf by the Chief Executive Officer.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOAZZGZFDZGGMZM

(END) Dow Jones Newswires

March 22, 2021 10:23 ET (14:23 GMT)

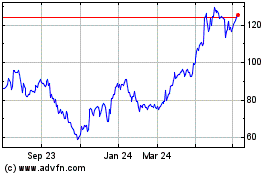

Helios Towers (LSE:HTWS)

Historical Stock Chart

From Mar 2024 to Apr 2024

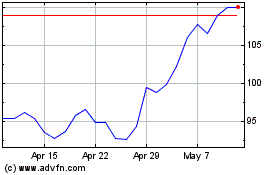

Helios Towers (LSE:HTWS)

Historical Stock Chart

From Apr 2023 to Apr 2024