Former Glencore Oil Trader Pleads Guilty to Manipulating Prices

March 24 2021 - 7:49PM

Dow Jones News

By Aruna Viswanatha

A former oil trader at mining company Glencore PLC pleaded

guilty Wednesday to conspiring to manipulate fuel prices, in a case

that signals a new front in a long-running crackdown by prosecutors

on efforts to improperly steer oil trading benchmarks that

influence real-world prices.

Appearing via videoconference from his lawyers' offices in

California, the ex-trader, Emilio Jose Heredia Collado, admitted to

allegations that accused him of working to manipulate an oil-price

benchmark by directing other traders to submit orders that would

push prices in the direction he wanted. "Guilty," Mr. Heredia said

when asked how he wished to plead to the one count of conspiracy

that prosecutors had charged him with. The case against Mr. Heredia

related to trading through a process managed by oil-price benchmark

publisher S&P Global Platts.

At the brief Zoom hearing before U.S. District Judge Charles

Breyer in San Francisco, Assistant U.S. Attorney Matthew Sullivan

said that Mr. Heredia was cooperating in the government's ongoing

investigation.

He faces up to five years in prison, but he could face less than

that if the government determined he had offered substantial

assistance, the judge noted. Prosecutors said Mr. Herdedia, 49

years old, worked to engineer benchmark prices between 2012 and

2016 that would improve the profitability of other transactions in

physical fuel oil.

The case echoes claims previously investigated in Europe and

targets conduct first revealed by The Wall Street Journal in 2013,

in an article that showed traders admitting they could manipulate

prices on the Platts system.

A Glencore spokesman said previously the company has cooperated

with the continuing federal investigation, and S&P Global

Platts has said it maintains a transparent methodology that allows

it to publish assessments that reflect market value.

Trades made during the daily "Platts window" -- the final 30 to

45 minutes of trading -- are reported by traders to Platts editors,

who determine a value at the end of the day.

The Justice Department's fraud section, which is prosecuting Mr.

Heredia, has steadily stepped up its oversight of commodity trading

and other markets that were lightly policed and mostly unregulated

until the 2008 financial crisis. The allegation that traders

manipulated a reference price in global oil markets mirrors those

in past cases finding that bank traders colluded to rig

interest-rate and foreign-exchange benchmarks.

Benchmark prices in the physical oil market are derived from

information volunteered by traders, since trading is done in

private and buyers and sellers aren't required to publicly report

prices. The benchmarks are then used around the world to set prices

for other purchases and sales of physical oil.

In one example cited by prosecutors, Mr. Heredia in 2016

directed a co-conspirator to submit offers to Platts during the

pricing window for a low-grade fuel known as "bunker" at the port

of Los Angeles. The other trader subsequently lowered the price

more than 40 times to push down the Platts benchmark, according to

prosecutors.

The goal was to lower the price so the company could buy fuel

oil more cheaply from another firm, prosecutors wrote in their

charging document.

The activity had the effect of moving down the price from an

average of $245 a metric ton to a final price of $204.50 a metric

ton, "resulting in an unlawful gain of hundreds of thousands of

dollars" for his employer, prosecutors said.

Write to Aruna Viswanatha at Aruna.Viswanatha@wsj.com

(END) Dow Jones Newswires

March 24, 2021 19:34 ET (23:34 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

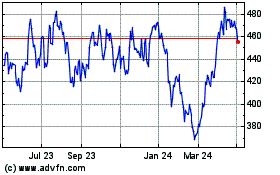

Glencore (LSE:GLEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

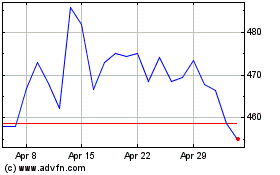

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2023 to Apr 2024