TIDMGDR

RNS Number : 9816G

Genedrive PLC

21 November 2022

genedrive plc

("genedrive" or "the Company" or "the Group")

Audited Final Results

genedrive plc (AIM: GDR), the near patient molecular diagnostics

company, announces its audited Final Results for the year ended 30

June 2022.

Financial Highlights

-- Revenue for the year to 30 June 2022 of GBP0.05m (2021: GBP0.69m)

-- Loss for the year of GBP4.7m (2021: loss of GBP0.7m)

-- R&D spend of GBP3.9m (2021: GBP4.5m)

-- Debt free and cash at bank of GBP4.6m (2021: GBP2.6m)

Operational Highlights

-- JAMA Pediatrics' PALOH (Pharmacogenetics to Avoid Loss of

Hearing) paper published to support the implementation of the

Genedrive(R) MT-RNR1 test in the Neonatal Intensive Care

setting

-- First NHS Deployments and sales of the Genedrive(R) System

for Antibiotic Induced Hearing Loss at Manchester Hospitals

-- Launched 2nd generation Genedrive(R) system to support

strategy focus of assay development to emergency care settings

-- NICE accelerated evaluation of the Genedrive(R) MT-RNR1 ID test

-- NICE includes Genedrive(R) CYP2C19 ID Kit in Diagnostics Assessment Programme

-- Point-of-Care Genedrive(R) COV19-ID Kit received Coronavirus Test Device Approval ("CTDA")

-- New product development programme initiated for use of

Genedrive(R) Point-of-Care device for ischemic stroke treatment in

emergency care settings

-- Filed US FDA Pre-submission for the Genedrive(R) MT-RNR1 ID product range

David Budd, CEO of genedrive plc, said: The Company has made

good progress on advancing our strategy in pharmacogenetics, and

the opportunity to be leaders in the establishment of genetic

testing in acute point of care. Our Genedrive system delivers

unambiguous clinically actionable information on the wards by

nurses with no previous experience in molecular testing, making a

positive impact on health outcomes. Market development and

engagement is positive and growing, as we have unique products with

a positive health economic and clinical outcome."

For further details please contact:

genedrive plc +44 (0)161 989 0245

David Budd: CEO / Russ Shaw: CFO

Peel Hunt LLP (Nominated Adviser

and Joint Broker) +44 (0)20 7418 8900

James Steel / Oliver Duckworth

finnCap (Joint Broker) +44 (0)20 7220 0500

Geoff Nash / George Dollemore /

Nigel Birks / Alice Lane

Walbrook PR Ltd (Media & Investor +44 (0)20 7933 8780 or genedrive@walbrookpr.com

Relations)

+44 (0)7980 541 893 / +44 (0)7876

Paul McManus / Anna Dunphy 741 001

About genedrive plc ( http://www.genedriveplc.com ) genedrive

plc is a molecular diagnostics company developing and

commercialising a low cost, rapid, versatile, simple to use and

robust point of need molecular diagnostics platform for the

diagnosis of infectious diseases and for use in patient

stratification (genotyping), pathogen detection and other

indications. The Company has assays on market for the detection of

MT-RNR1, HCV, certain military biological targets, a high

throughput SARS-CoV-2 assay and a point of care test for

Covid-19.

Chairman's Statement

Resilient and innovating for the future

In response to the COVID-19 pandemic, global diagnostic needs

changed almost overnight and we refocussed the Company's resources

on developing COVID-19 tests to help support the fight against this

devastating virus. Prior to going through the restrictions and

testing regimes that hallmarked the pandemic, we conducted a review

of opportunities for the Genedrive system. That review led us to

identify opportunities to deploy Genedrive(R) in detecting defined

pharmacogenomic markers addressing unmet clinical needs of rapid

molecular diagnostics at the point of care in emergency medicine.

With that in mind, we have made excellent progress towards our

strategic goal of continuous innovation in our point-of-care

products.

Our Antibiotic Induced Hearing Loss (AIHL) test is the world's

first molecular test in an acute point-of-care setting. The test

delivers a molecular diagnostic result in under 30 minutes and

allows for treatment selection options depending on the genetic

variant of the patient. The Genedrive(R) MT-RNR1-ID Kit is now

being fast tracked for assessment in the UK by NICE. This is

testimony to the potential of both better health outcomes for

patients and positive health economic benefits to the NHS and

healthcare systems around the world. I find it hugely rewarding to

see our innovations setting new-borns off on a more positive

healthcare trajectory than was previously possible.

Our COVID-19 POC test was CE-marked in December 2021, later than

originally intended due to complexity of technical development and

regulatory delays but was in the end granted a CTDA (Coronavirus

Test Device Approval) in May 2022. Regrettably, the timing of these

approvals came as restrictions were being lifted, which meant that

we gained limited sales traction in the year. These restrictions

have remained lifted, but we are able to commercialise and supply

if market conditions change. In addition, during the course of our

development work on the COVID-19 POC test, we developed numerous

technical advances around the Genedrive(R) system which we are able

to apply in the development of other tests going forward.

Future developments are focused on maximising the unique

features of the Genedrive(R) device, being speed of result,

low-cost base, long shelf-life at ambient temperatures, and ease of

use as we target new areas for specific clinical opportunities.

Governance and People

I welcome Russ Shaw to the Board, who joined as Chief Financial

Officer on 7 April 2022, replacing Matthew Fowler. I would like to

thank Matthew for his contribution over the last five years and

wish him every success for the future.

The Board remains committed to ensuring its own effectiveness

and unwavering focus ensuring our governance framework, internal

controls, values and culture all align with our strategy and the

objectives of the Company.

Our people are the heart and soul of the Company and I would

like to thank everyone for their resilience, innovation and tenancy

in the development and delivery of our products.

Funding

We completed a placing and open offer in October 2021. The net

proceeds of GBP6.6m has extended our cash runway at least towards

the end of our 2023 financial year using a prudent forecasting

basis that excludes all revenues. Material revenues will extend our

runway further as we continuously assess our future funding options

and requirements. Given the inherent challenges of being first to

market in ground-breaking innovative products, compounded by the

size and complexity of dealing with the NHS, we will seek

additional funding before significant revenue traction is

achieved.

Outlook

Our Genedrive(R) AIHL test has been deployed first to the

Manchester University NHS Foundation Trust. This is a cornerstone

installation for us to act as a reference site to other NHS trusts.

We expect the NICE evaluation, given the health benefits and health

economics, will be the catalyst to springboard our AIHL test into

national commissioning by the NHS.

We have commenced the process for FDA approval, as we see huge

potential for AIHL which is additionally supported by the litigious

nature of the US market.

Finally, I would like to take this opportunity to thank you, as

Shareholders, for continued support and look forward to bringing

you further news as we deliver on our exciting strategy going

forward.

Dr Ian Gilham

Chairman

Chief Executive's Review

Innovation in Point-of-Care molecular diagnostics in Emergency

Medicine

Overview

This year has seen us take great strides towards changing the

way molecular diagnostics and personalised medicine can be

delivered. We continue to identify and tackle unmet clinical needs,

harnessing our expertise of in-vitro diagnostic assay development

and combining this with the advantages of our ever-evolving

Genedrive(R) platform, being small, easy to use, quick to result,

accurate and economical for wide adoption.

I would like to express my gratitude to the team for having the

ambition, innovation and relentless perseverance in bringing the

world's first molecular test to an emergency point-of-care setting.

I echo the Chairman's sentiment, that seeing the impact our AIHL

test is having to prevent deafness in infants is very gratifying

for everyone at the Company.

I am very positive about our Genedrive(R) CYP2C19-ID Kit - a

simple, rapid point-of-care test in development, with no

requirement for user result interpretation and provides results in

a clinically actionable timeframe for ischemic stroke patients.

Similar to AIHL, it uses our capabilities, chemistry and hardware

to rapidly produce a result at an emergency care bedside. By

analysing the genes of a patient's drug metabolic pathway, certain

poor drug options can be removed from the treatment regimen of each

individual patient, with the aim of providing reduced incidence of

subsequent strokes and clots, and better clinical outcomes.

We continue to evolve our Genedrive(R) platform, reducing sole

supplier dependency, onshoring and increasing our in-house

manufacturing capacity and capabilities.

Performance

Significant revenues are still to follow the success of our

product development, but our commercial rigour and market

visibility is greatly improved. Following the launch of MT-RNR1 in

the UK, there is a clear demand to implement the system in many

hospitals. But while a process of national commissioning can be

followed, in the interim each hospital needs to make its own

business case and establish funding for capital equipment and

tests. This process can be slow in an underfunded NHS despite the

very positive health economic case the Genedrive MT-RNR1 ID test

provides. Our process in establishing distributors outside of the

UK has been very targeted as its critical our partners know the

neonatal environment, and can also support point of care and

molecular diagnostics. Our commercial team has made solid progress

in the sales processes in the UK and also in 10 countries

internationally.

We created the fastest point-of-care COVID molecular test,

capable of delivering positive results as quickly as 7.5 minutes

and negative results at 17 minutes. Technical development delays as

well as with approval in the UK with CTDA meant that we received

our approval when the demand for testing had reduced and the world

was transitioning to "living with COVID" as the dominant Omicron

strain had reduced clinical impacts for most. Although we do not

know the trajectory that the pandemic will take, as immunity wanes

and if new variants continue to emerge, the could cause a change in

demand for testing during the winter months, which would present us

with commercial opportunities. As of today, COVID testing following

the summer months has not increased in the UK or

internationally.

Regulatory update

Our in-house Quality and Regulatory specialists successfully

guided the transition from the EU's existing In Vitro Diagnostic

Directive ("IVDD") to the new In Vitro Diagnostic Regulation

("IVDR") which came into effect in May 2022. Our AIHL, COV19, and

HCV portfolio are in compliance with current regulations, and our

new CYP2C19 assay will be the first that needs to fully go through

the new Directive. Initial launch under the UK regulatory

scheme

is currently targeted for April 2023.

Outlook

I am excited for what we are achieving. Our focus on

pharmacogenetic testing and investment in the development of new

products will start to bear more fruit in the second half of the

current financial year. While there is a time delay in adoption by

the NHS for new innovations, our AIHL test is supported by the

outcomes which dramatically improve lives and has the potential to

save the NHS millions of pounds every year. The route to adoption

of new clinical tests however takes time, as healthcare systems are

conservative in their nature and face inevitable budgetary

constraints. The engagement level from the markets is

encouraging.

It is pleasing to see that our two new emergency point-of-care

genetic screening tests are being evaluated by NICE. The AIHL test

has been selected to be fast-tracked via NICE's Early Value

Assessment Programme ("EVA"). EVA is a new review process, created

to drive innovation into the hands of healthcare professionals by

actively drawing in digital products, medical devices and

diagnostics that address national unmet needs. This should expedite

the test being written into clinical guidelines and rolled out to

the NHS nationally, allowing clinicians and patients to benefit

from the test sooner.

The US is a particularly attractive market for our unique AIHL

test given the potential to save hundreds of individuals from

life-long deafness and reduce litigation costs relating to the

unwanted side effects from antibiotic use on those carrying the

gene variant. In 2021, 3.7 million babies were born in the USA,

with 10.5% born prematurely. It was estimated that malpractice

litigation settlements in cases related to deafness caused by the

use of aminoglycosides average over US$1.1 million per case,

further adding to the positive health economic case of providing

accurate and timely testing to reduce unwanted side effects of

gentamicin usage.

We recruited a new Business Development team in mid-2022 to

execute our commercial strategy alongside our distribution partners

and with an innovative R&D pipeline, we continue to add to our

menu of assays and remain confident to deliver success in the

future in both improving lives and creating shareholder value.

David Budd

Chief Executive Officer

Financial Review

Revenue for the year was GBP0.05m (2021: GBP0.69m) and was

adversely impacted by absence of COVID-19 revenue, due to the

timing of bringing an approved product to the market. In the prior

year, revenue also included DoD sales that were not recurring in

the current year. Research and development costs were GBP3.9m

(2021: GBP4.5m) successfully adding to our menu of assays and

pipeline for future innovative products. Net cash outflow from

operating activities before taxation was GBP5.7m, down on the

GBP6.2m in the prior year following reduced activity and tight cost

control especially in the second half of the year. The operating

loss for the year was GBP5.6m (2021: GBP5.5m).

Financing costs and income

Financing costs were GBP0.02m (2021: GBP3.6m income) with 2021

including non-cash movements on the loan notes outstanding at 30

June 2020. These loan notes were held by the Business Growth Fund

and were converted in part in September 2020 and then in full in

December 2020. The finance income on the loan notes had two

elements: one attached to the option to convert and the other

related to the discount on these long-term loan notes. The option

to convert the loan notes to ordinary shares had a value that

fluctuated as the share price of the entity rose and fell. Owing to

share price movements between 30 June 2020 and the date of

conversions the value of the option to convert fell and created a

GBP3.9m gain. Interest accruing and unwinding of the discount up to

the point of conversion was GBP0.2m, giving a net financing income

of GBP3.6m. These movements were non-cash.

Taxation

The tax credit for the year was GBP1.0m (2021: GBP1.2m). The

Group investment in R&D falls within the UK Government's

R&D tax relief scheme for small and medium sized companies

where it meets the qualifying criteria and as the Group did not

make a profit in the year it is collected in cash following

submission of tax returns. The GBP1.0m is a receivable on the

balance sheet at the year end. In the prior year the total amount

of qualifying costs for the research and development tax credit was

restricted by grant income that the Group received. There is no

grant income restriction to the size of the claim in 2022.

Cash resources

Net cash outflow from operating activities before taxation was

GBP5.8m (2021: GBP6.2m). The operating loss cashflows were GBP5.3m

(2021: GBP5.2m) with working capital consuming GBP0.4m (2021:

GBP0.9m) mainly due to the decrease in trade and other payables and

increase in inventory.

The tax credit received was GBP1.2m (2021: GBP1.0m) and relates

to cash received under the UK Government's R&D tax relief

scheme.

Capital expenditure in the period was GBP0.06m (2021: GBP0.1m)

and cash paid to settle the loan notes converted during the year

was GBPnil (2021: GBP0.4m). Proceeds from sale of shares was

GBP6.7m (2021: GBP0.05m). The increase in cash for the year was

GBP2.0m (2021: GBP5.6m decrease) meaning a closing cash position of

GBP4.6m (2021: GBP2.6m).

Our unaudited cash balance as at the end of October 2022 was

GBP3m, reflecting a monthly burn rate of GBP0.4m since the year

end.

Balance sheet

Balance sheet net assets at 30 June 2022 were GBP5.6m (2021:

GBP3.6m). Fixed assets were GBP0.2m (2021: GBP0.3m) and include

right to use lease assets of GBP0.02m (2021: GBP0.2m).

Current assets of GBP6.4m (2021: GBP4.5m) included cash of

GBP4.6m (2021: GBP2.6m). Inventories of GBP0.7m (2021: GBP0.6m),

consisted mainly of raw materials used in manufacturing and

R&D. The remainder of current asset values were in receivables

of GBP0.1m (2021: GBP0.2m) and tax. The tax receivable was GBP1.0m

(2021: GBP1.2m) for the current year Corporation Tax Research and

Development tax claim.

Current liabilities were GBP1.0m (2021: GBP1.3m).

Net assets closed at GBP5.6m (2021: GBP3.6m). The comprehensive

loss for the year was GBP4.7m (2021: GBP0.7m).

Going concern

Following the equity fund raise which completed in October 2021

the Company has a cash runway to the end of the June 2023 financial

year. We are confident in gaining commercial traction and securing

significant revenues, but due to the time required to achieve this,

we will require additional funding in our 2023 financial year. As

described in the accounting policies, we continue to adopt a going

concern basis for the preparation of the accounts, but the above

condition represents a material uncertainty that may cast

significant doubt on the Group and Company's ability to continue as

a going concern.

Russ Shaw

Chief Financial Officer

Consolidated Statement of Comprehensive Income

for the year ended 30 June 2022

Year ended Year ended

30 June 30 June

2022 2021

Note GBP'000 GBP'000

--------------------------------------------------- ---- ---------- ----------

Continuing operations

--------------------------------------------------- ---- ---------- ----------

Revenue 2 49 687

--------------------------------------------------- ---- ---------- ----------

Research and development costs (3,871) (4,509)

--------------------------------------------------- ---- ---------- ----------

Administrative costs (1,793) (1,660)

--------------------------------------------------- ---- ---------- ----------

Operating loss (5,615) (5,482)

--------------------------------------------------- ---- ---------- ----------

Finance (costs)/income 3 (16) 3,630

--------------------------------------------------- ---- ---------- ----------

Loss on ordinary activities before taxation (5,631) (1,852)

--------------------------------------------------- ---- ---------- ----------

Taxation 4 956 1,161

--------------------------------------------------- ---- ---------- ----------

Loss for the financial year (4,675) (691)

--------------------------------------------------- ---- ---------- ----------

Loss/total comprehensive expense for the financial

year (4,675) (691)

--------------------------------------------------- ---- ---------- ----------

Loss per share (pence)

--------------------------------------------------- ---- ---------- ----------

- Basic and diluted 5 (5.5p) (1.2p)

--------------------------------------------------- ---- ---------- ----------

Consolidated Balance Sheet

as at 30 June 2022

30 June 30 June

2022 2021

Note GBP'000 GBP'000

------------------------------------ ---- -------- --------

Assets

------------------------------------ ---- -------- --------

Non-current assets

------------------------------------ ---- -------- --------

Plant and equipment 206 301

------------------------------------ ---- -------- --------

Contingent consideration receivable 6 - 47

------------------------------------ ---- -------- --------

206 348

------------------------------------ ---- -------- --------

Current assets

------------------------------------ ---- -------- --------

Inventories 748 556

------------------------------------ ---- -------- --------

Trade and other receivables 107 158

------------------------------------ ---- -------- --------

Contingent consideration receivable 6 15 75

------------------------------------ ---- -------- --------

Current tax asset 956 1,166

------------------------------------ ---- -------- --------

Cash and cash equivalents 4,589 2,574

------------------------------------ ---- -------- --------

6,415 4,529

------------------------------------ ---- -------- --------

Total assets 6,621 4,877

------------------------------------ ---- -------- --------

Liabilities

------------------------------------ ---- -------- --------

Current liabilities

------------------------------------ ---- -------- --------

Trade and other payables (994) (1,166)

------------------------------------ ---- -------- --------

Lease liabilities (16) (119)

------------------------------------ ---- -------- --------

(1,010) (1,285)

------------------------------------ ---- -------- --------

Non-current liabilities

------------------------------------ ---- -------- --------

Total liabilities (1,010) (1,285)

------------------------------------ ---- -------- --------

Net assets 5,611 3,592

------------------------------------ ---- -------- --------

Equity

------------------------------------ ---- -------- --------

Called-up equity share capital 7 1,388 950

------------------------------------ ---- -------- --------

Other reserves 51,294 45,000

------------------------------------ ---- -------- --------

Accumulated losses (47,071) (42,358)

------------------------------------ ---- -------- --------

Total equity 5,611 3,592

------------------------------------ ---- -------- --------

Consolidated Statement of Changes in Equity

for the year ended 30 June 2022

Share Other Accumulated Total

capital reserves losses equity

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- -------- --------- ----------- --------

Balance at 30 June 2020 780 42,620 (46,742) (3,342)

---------------------------------------- -------- --------- ----------- --------

Transactions with owners in their

capacity as owners:

Share issue - conversion of BGF bond 168 2,332 5,079 7,579

Share issue 2 44 - 46

Equity-settled share-based payments - 4 (4) -

---------------------------------------- -------- --------- ----------- --------

Transactions settled directly in equity 170 2,380 5,075 7,625

---------------------------------------- -------- --------- ----------- --------

Total comprehensive loss for the year - - (691) (691)

---------------------------------------- -------- --------- ----------- --------

Balance at 30 June 2021 950 45,000 (42,358) 3,592

---------------------------------------- -------- --------- ----------- --------

Transactions with owners in their

capacity as owners:

Share issue 426 6,186 - 6,612

Share issue - deferred consideration 8 (8) - -

Equity-settled share-based payments 4 116 (38) 82

---------------------------------------- -------- --------- ----------- --------

Transactions settled directly in equity 438 6,294 (38) 6,694

---------------------------------------- -------- --------- ----------- --------

Total comprehensive loss for the year - - (4,675) (4,675)

---------------------------------------- -------- --------- ----------- --------

Balance at 30 June 2022 1,388 51,294 (47,071) 5,611

---------------------------------------- -------- --------- ----------- --------

Consolidated Cash Flow Statement

for the year ended 30 June 2022

Year ended Year ended

30 June 30 June

2022 2021

Note GBP'000 GBP'000

-------------------------------------------------- ---- ---------- ----------

Cash flows from operating activities

-------------------------------------------------- ---- ---------- ----------

Operating loss for the year (5,615) (5,482)

-------------------------------------------------- ---- ---------- ----------

Depreciation, amortisation and impairment 63 60

-------------------------------------------------- ---- ---------- ----------

Depreciation, right-of-use assets 187 186

-------------------------------------------------- ---- ---------- ----------

ATL Research credits - (5)

-------------------------------------------------- ---- ---------- ----------

Share-based payment 38 4

-------------------------------------------------- ---- ---------- ----------

Operating loss before changes in working capital (5,327) (5,237)

-------------------------------------------------- ---- ---------- ----------

Increase in inventories (192) (143)

-------------------------------------------------- ---- ---------- ----------

Decrease in trade and other receivables 51 240

-------------------------------------------------- ---- ---------- ----------

Decrease in deferred revenue - (67)

-------------------------------------------------- ---- ---------- ----------

Decrease in trade and other payables (292) (963)

-------------------------------------------------- ---- ---------- ----------

Net cash outflow from operating activities

before taxation (5,760) (6,170)

-------------------------------------------------- ---- ---------- ----------

Tax received 1,166 1,018

-------------------------------------------------- ---- ---------- ----------

Net cash outflow from operating activities (4,594) (5,152)

-------------------------------------------------- ---- ---------- ----------

Cash flows from investing activities

-------------------------------------------------- ---- ---------- ----------

Finance income - 1

-------------------------------------------------- ---- ---------- ----------

Finance costs (16) (33)

-------------------------------------------------- ---- ---------- ----------

Acquisition of plant and equipment, net of

loss on disposals (62) (104)

-------------------------------------------------- ---- ---------- ----------

Proceeds from disposal of discontinued operations 6 107 137

-------------------------------------------------- ---- ---------- ----------

Net cash inflow from investing activities 29 1

-------------------------------------------------- ---- ---------- ----------

Cash flows from financing activities

-------------------------------------------------- ---- ---------- ----------

Proceeds from share issue 6,694 46

Repayment of lease liabilities (119) (144)

Cash paid to settle convertible bonds - (358)

-------------------------------------------------- ---- ---------- ----------

Net inflow/(outflow) from financing activities 6,575 (456)

-------------------------------------------------- ---- ---------- ----------

Net increase/(decrease) in cash equivalents 2,010 (5,607)

-------------------------------------------------- ---- ---------- ----------

Effects of exchange rate changes on cash and

cash equivalents 5 (37)

-------------------------------------------------- ---- ---------- ----------

Cash and cash equivalents at beginning of year 2,574 8,218

-------------------------------------------------- ---- ---------- ----------

Cash and cash equivalents at end of year 4,589 2,574

-------------------------------------------------- ---- ---------- ----------

Analysis of net funds

-------------------------------------------------- ---- ---------- ----------

Cash at bank and in hand 4,589 2,574

-------------------------------------------------- ---- ---------- ----------

Net funds 4,589 2,574

-------------------------------------------------- ---- ---------- ----------

Notes to the Financial Information

for the year ended 30 June 2022

General information

genedrive plc ('the Company') is a company incorporated and

domiciled in the UK. The registered head office is The CTF

Building, Grafton Street, Manchester M13 9XX, United Kingdom.

genedrive plc and its subsidiaries (together, 'the Group') is a

molecular diagnostics business developing and commercialising a

low-cost, rapid, versatile, simple-to-use and robust point-of-need

or point-of-care diagnostics platform for the diagnosis of

infectious diseases and for use in patient stratification

(genotyping), pathogen detection and other indications.

genedrive plc is a public limited company, whose shares are

listed on the London Stock Exchange Alternative Investment

Market.

1. Significant accounting policies

The financial information for the year ended 30 June 2021 has

been extracted from the Group's audited statutory financial

statements which were approved by the Board of Directors on 8

November 2021 and which have been delivered to the Registrar of

Companies for England and Wales. The report of the auditor on these

financial statements was unqualified, did not contain a statement

under Section 498(2) or Section 498(3) of the Companies Act

2006.

The report of the auditor on the 30 June 2022 statutory

financial statements was unqualified, did not contain a statement

under Section 498(2) or Section 498(3) of the Companies Act 2006,

but did draw attention to the Group's ability to continue as a

going concern by way of a material uncertainty paragraph.

The information included in this announcement has been prepared

on a going concern basis under the historical cost convention as

modified by the revaluation of financial assets and financial

liabilities (including derivative instruments) at fair value

through profit or loss, and in accordance with UK-adopted

International Accounting Standards.

The information in this announcement has been extracted from the

audited statutory financial statements for the year ended 30 June

2022 and as such, does not constitute statutory financial

statements within the meaning of section 435 of the Companies Act

2006 as it does not contain all the information required to be

disclosed in the financial statements prepared in accordance with

UK-adopted International Accounting Standards.

This announcement was approved by the board of directors and

authorised for issue via RNS on 21 November 2022.

Going concern

The Group's business activities, market conditions, principal

risks and uncertainties along with the Group's financial position

are described in the full annual accounts.. The Group funds its

day-to-day cash requirements from existing cash reserves. These

matters have been considered by the Directors in forming their

assessment of going concern.

The Directors have concluded that it is necessary to draw

attention to the revenue and cost forecasts in the business plans

during the period to June 2024. The Group and Company does not

currently have sufficient cash resources to continue as a going

concern during the forecast period due to the time expected to be

needed to gain commercial traction in its revenues. The forecasts

prepared by the Directors include a plan to raise additional funds

from shareholders or debt providers in the financial year to June

2023.

While the Board has a successful track record in raising funds,

there remains uncertainty as to the amount of funding that could be

raised from shareholders or debt providers. This condition

represents a material uncertainty that may cast significant doubt

on the Group and Company's ability to continue as a going

concern.

However, based on the progress being made towards bringing the

AIHL product to market and having made enquiries, the Directors

have reasonable confidence in their ability to raise additional

funds and therefore have a reasonable expectation that the Group

has access to adequate resources to continue in operational

existence for the foreseeable future.

Accordingly, the Directors have concluded that it is appropriate

to continue to adopt the going concern basis of accounting in

preparing these financial statements. These financial statements do

not include the adjustments that would result if the Group and

Company were unable to continue as a going concern.

2. Operating segments

For internal reporting and decision-making, the Group is

organised into one segment, Diagnostics. Diagnostics is

commercialising the Genedrive(R) point-of need molecular testing

platform. In future periods, and as revenue grows, the Group may

review management account information by type of assay and thus

split out Diagnostics into segments - however, for now, the single

segment is appropriate.

The chief operating decision-maker primarily relies on turnover

and operating loss to assess the performance of the Group and make

decisions about resources to be allocated to each segment.

Geographical factors are reviewed by the chief operating

decision-maker, but as substantially all operating activities are

undertaken in the UK, geography is not a significant factor for the

Group. Accordingly, only sales have been analysed into geographical

statements.

The results of the operating division of the Group are detailed

below.

Diagnostics Corporate

segment costs Total

Business segments GBP'000 GBP'000 GBP'000

-------------------------------------------- ----------- --------- --------

Year ended 30 June 2022

-------------------------------------------- ----------- --------- --------

Revenue 49 - 49

-------------------------------------------- ----------- --------- --------

Operating loss (3,822) (1,793) (5,615)

-------------------------------------------- ----------- --------- --------

Net finance costs (16)

-------------------------------------------- ----------- --------- --------

Loss on ordinary activities before taxation (5,631)

-------------------------------------------- ----------- --------- --------

Taxation 956

-------------------------------------------- ----------- --------- --------

Loss for the financial year (4,675)

-------------------------------------------- ----------- --------- --------

Total comprehensive expense for the year (4,675)

-------------------------------------------- ----------- --------- --------

Diagnostics Corporate

segment costs Total

Business segments GBP'000 GBP'000 GBP'000

-------------------------------------------- ----------- --------- --------

Year ended 30 June 2021

-------------------------------------------- ----------- --------- --------

Revenue 687 - 687

-------------------------------------------- ----------- --------- --------

Operating loss (3,822) (1,660) (5,482)

-------------------------------------------- ----------- --------- --------

Net finance costs 3,630

-------------------------------------------- ----------- --------- --------

Loss on ordinary activities before taxation (1,852)

-------------------------------------------- ----------- --------- --------

Taxation 1,161

-------------------------------------------- ----------- --------- --------

Loss for the financial year (691)

-------------------------------------------- ----------- --------- --------

Total comprehensive expense for the year (691)

-------------------------------------------- ----------- --------- --------

Diagnostics Corporate

segment costs Total

GBP'000 GBP'000 GBP'000

------------------------ ----------- --------- --------

Year ended 30 June 2022

------------------------ ----------- --------- --------

Segment assets 1,003 5,618 6,621

------------------------ ----------- --------- --------

Segment liabilities (905) (105) (1,010)

------------------------ ----------- --------- --------

Year ended 30 June 2021

------------------------ ----------- --------- --------

Segment assets 923 3,954 4,877

------------------------ ----------- --------- --------

Segment liabilities (937) (348) (1,285)

------------------------ ----------- --------- --------

Additions to non-current assets: Diagnostics segment GBP124k

(2021: GBP320k) and Corporate costs GBP31k (2021: GBP80k).

Geographical segments

The Group's operations are located in the United Kingdom. The

following table provides an analysis of the Group's revenue by

customer location:

Year ended Year ended

30 June 30 June

2022 2021

All on continuing operations GBP'000 GBP'000

----------------------------- ---------- ----------

United Kingdom 37 40

Europe 10 17

United States of America 2 613

----------------------------- ---------- ----------

Rest of the world - 17

----------------------------- ---------- ----------

49 687

----------------------------- ---------- ----------

Revenues from two customers accounted for more than 10% of total

revenue in the current and prior year.

3. Finance income/(costs)- net

Year ended Year ended

30 June 30 June

2022 2021

GBP'000 GBP'000

------------------------------------------------------------- ---------- ----------

Interest income on bank deposits - 1

Movement in fair value of derivative embedded in convertible

bonds - 3,864

------------------------------------------------------------- ---------- ----------

Finance cost on liabilities measured at amortised cost - (202)

------------------------------------------------------------- ---------- ----------

Finance lease costs (16) (33)

------------------------------------------------------------- ---------- ----------

(16) 3,630

------------------------------------------------------------- ---------- ----------

4. Taxation

(a) Recognised in the income statement

Year ended Year ended

30 June 30 June

2022 2021

Current tax: GBP'000 GBP'000

----------------------------------------- ---------- ----------

Research and development tax credits (956) (1,166)

----------------------------------------- ---------- ----------

Less: recognised as ATL Research credits - 5

----------------------------------------- ---------- ----------

Total tax credit for the year (956) (1,161)

----------------------------------------- ---------- ----------

(b) Reconciliation of the total tax credit

The tax credit assessed on the loss for the year is lower (2021:

higher) than the weighted average applicable tax rate for the year

ended 30 June 2022 of 19.0% (2021: 19.0%). The differences are

explained below:

Year

ended Year ended

30 June 30 June

2022 2021

GBP'000 GBP'000

--------------------------------------------------------- -------- ----------

Loss before taxation on continuing operations (5,631) (1,852)

--------------------------------------------------------- -------- ----------

Tax using UK corporation tax rate of 19.0% (2021: 19.0%) (1,070) (352)

--------------------------------------------------------- -------- ----------

Adjustment in respect of R&D tax credit recognised as

Above The Line ('ATL') - 1

--------------------------------------------------------- -------- ----------

Adjustment in respect of R&D tax credit claimed (412) (500)

--------------------------------------------------------- -------- ----------

Items (taxable) for tax purposes - permanent (7) (777)

--------------------------------------------------------- -------- ----------

Items not deductible for tax purposes - temporary (3) -

--------------------------------------------------------- -------- ----------

Deferred tax not recognised 703 467

--------------------------------------------------------- -------- ----------

Rate differences (167) -

--------------------------------------------------------- -------- ----------

Total tax credit for the year (956) (1,161)

--------------------------------------------------------- -------- ----------

No deferred tax assets are recognised at 30 June 2022 (2021:

GBPnil). Having reviewed future profitability in the context of

trading losses carried, it is not probable that there will be

sufficient profits available to set against brought forward

losses.

The Group had trading losses, as computed for tax purposes, of

approximately GBP19,032k (2021: GBP14,356k) available to carry

forward to future periods; this excludes management expenses.

In accordance with the provisions of the Finance Act 2000 in

respect of research and development allowances, the Group is

entitled to claim tax credits for certain research and development

expenditure. These credits are disclosed partly as Above The Line

research and development credits ('ATL Research credits') within

research and development costs and partly as research and

development tax credits within taxation on ordinary activities. The

total amount included in the financial statements in respect of the

year ended 30 June 2022 was GBP956k (2021: GBP1,166k) which

included GBPnil (2021: GBP5k) disclosed as ATL Research credits

deducted from research and development costs with the balance of

GBP956k (2021: GBP1,161k) disclosed within taxation on ordinary

activities as detailed above.

5. Earnings per share

2022 2021

GBP'000 GBP'000

--------------------------------- -------- --------

Loss for the year after taxation (4,675) (691)

--------------------------------- -------- --------

2022 2021

Group Number Number

---------------------------------------------------- ---------- ----------

Weighted average number of ordinary shares in issue 84,860,240 58,987,344

---------------------------------------------------- ---------- ----------

Potentially dilutive ordinary shares - -

---------------------------------------------------- ---------- ----------

Adjusted weighted average number of ordinary shares

in issue 84,860,240 58,987,344

---------------------------------------------------- ---------- ----------

Loss per share on continuing operations

---------------------------------------------------- ---------- ----------

- Basic (5.5)p (1.2)p

---------------------------------------------------- ---------- ----------

- Diluted (5.5)p (1.2)p

---------------------------------------------------- ---------- ----------

The basic earnings per share is calculated by dividing the

earnings attributable to ordinary shareholders for the year by the

weighted average number of ordinary shares in issue during the

year.

As the Company is loss-making, no potentially dilutive options

have been added into the EPS calculation. Had the Company made a

profit in the period:

2022 2021

Group Number Number

------------------------------------------------------ --------- ---------

Potentially dilutive shares on deferred consideration - 500,000

Potentially dilutive shares from share options 971,238 3,027,508

------------------------------------------------------ --------- ---------

Potentially dilutive shares within the SIP 208,703 158,784

------------------------------------------------------ --------- ---------

Potentially dilutive ordinary shares 1,179,941 3,686,292

------------------------------------------------------ --------- ---------

6. Contingent consideration receivable

Greater

than Less than

12 months 12 months Total

GBP'000 GBP'000 GBP'000

------------------------ ---------- ---------- --------

Balance at 30 June 2020 47 212 259

------------------------ ---------- ---------- --------

Balance at 30 June 2021 47 75 122

------------------------ ---------- ---------- --------

Received in the period (47) (60) (107)

------------------------ ---------- ---------- --------

Balance at 30 June 2022 - 15 15

------------------------ ---------- ---------- --------

The amount provided on the balance sheet of GBP15k represents

contingent consideration held under the sale and purchase agreement

for the disposal of the Services business. The amount relates to

the remaining six months trading under the agreement and was

settled in October 2022.

7. Share capital

Allotted, issued and fully paid:

Number GBP'000

-------------------------------------------------- ---------- -------

Balance at 30 June 2020 51,986,071 780

-------------------------------------------------- ---------- -------

Share issue - equity-settled share-based payments 137,274 2

Share issue - conversion of BGF loan notes 11,196,703 168

-------------------------------------------------- ---------- -------

Balance at 30 June 2021 63,320,048 950

-------------------------------------------------- ---------- -------

Share issue - equity-settled share-based payments 271,546 4

Share issue - deferred consideration 500,000 8

Share issue 28,450,852 426

Balance at 30 June 2022 92,542,446 1,388

-------------------------------------------------- ---------- -------

On 1 October 2021 the Company issued 28,450,852 shares as part

of a placing and open offer to shareholders for net proceeds of

GBP6.6m.

On 10 December 2021 the Company issued 500,000 shares in

genedrive plc to the former owner of Visible Genomics as part of a

Deed of Amendment agreed in December 2018 to the Visible Genomics

Sale and Purchase Agreement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLFVFLTLIFIF

(END) Dow Jones Newswires

November 21, 2022 02:00 ET (07:00 GMT)

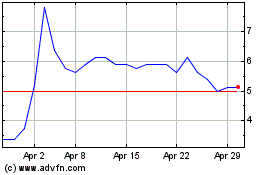

Genedrive (LSE:GDR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genedrive (LSE:GDR)

Historical Stock Chart

From Apr 2023 to Apr 2024