Foresight Slr Fnd Ld Foresight Solar Fund Limited : Replacement Announcement Placing Price & Net Asset Value

March 03 2015 - 1:50PM

UK Regulatory

TIDMFSFL

The following amendment has been made to the "Placing Price and Net

Asset Value" announcement released on 3 March 2015 at 12.22 GMT.

The new Ordinary Shares to be issued will not carry any entitlement to

the second interim dividend of 3.0 pence approved on 2 March 2015 to be

paid on 27 March 2015. The Placing price has been updated to 99.9 pence

per New Share to allow for the pro forma reduction of the NAV upon which

the Placing price is based to 98.20 pence per Share.

All other details remain unchanged.

The full amended text is shown below.

Foresight Solar Fund Limited: Placing Price and Net Asset Value

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, TO

U.S. PERSONS, OR IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, SOUTH

AFRICA OR JAPAN

This announcement does not constitute an offer to sell, or the

solicitation of an offer to subscribe for, or to buy shares in any

jurisdiction.

This announcement is neither an advertisement, a prospectus nor a

financial promotion. Any investment in any shares referred to in this

announcement may be made only on the basis of information in the

prospectus (the "Prospectus") published by Foresight Solar Fund Limited

on 25 September 2014, in connection with a placing programme (the

"Placing Programme") for ordinary shares of no par value each ("Ordinary

Shares"), to be admitted to the Premium Listing segment of the Official

List of the UK Listing Authority and to trading on the Main Market for

listed securities of the London Stock Exchange.

Foresight Solar Fund Limited (the "Company") announces that as at 15

February 2015, the unaudited Net Asset Value ("NAV") per Ordinary Share

was 101.20 pence (31 December 2014: 100.90 pence).

The increase in NAV from 31 December 2014 includes accrued interest and

income earned during the period and incorporates the seasonality

inherent in solar energy production. All other valuation assumptions

remain consistent with those previously outlined in the NAV statement

released on 16 January 2015.

Placing Price

On 19 February 2015, the Board of the Company announced its intention to

raise additional capital by way of a placing of new Ordinary Shares

under the Placing Programme announced on 25 September 2014 in accordance

with the Prospectus (the "Placing"). The Placing price is equal to the

NAV per Share as at 15 February 2015 plus a premium of 1.75 per cent.,

rounded to the nearest decimal place.

The new Ordinary Shares to be issued will not carry any entitlement to

the second interim dividend of 3.0 pence approved on 2 March 2015 to be

paid on 27 March 2015. Following the announcement of NAV as at 15

February 2015, as reduced to 98.20 pence on a pro forma basis to exclude

this second interim dividend, the Board therefore announces that the

Placing price is 99.9 pence per New Share.

Timetable

The timetable is subject to change at the discretion of the Company,

Stifel Nicolaus Europe Limited ("Stifel") and J.P. Morgan Cazenove.

Qualified investors are invited to apply for new Ordinary Shares by

contacting either Stifel or J.P. Morgan Cazenove. The decision to allot

any shares to any qualified investors shall be at the discretion of the

Company, Stifel and J.P. Morgan Cazenove.

Event Date

Announcement of NAV and Placing price 3 March 2015

Placing Opens 3 March 2015

Latest time and date for receipt of Placing commitments 12:00pm on 12 March 2015

Results of Placing announced 13 March 2015

Admission and Settlement 17 March 2015

Crediting of CREST in respect of New Shares 8.00am on 17 March 2015

Share certificates in respect of New Shares despatched On or around 24 March 2014

(if applicable)

Placing Agreement

Oriel Securities Limited, who were appointed as Sponsor and Joint

Bookrunner under the Placing Programme, became part of Stifel Financial

Corp. in July 2014. Oriel Securities Limited's business was combined

with other group UK businesses with effect from 1 March 2015 and its

rights and obligations under the Placing Agreement have been novated to

Stifel. J.P. Morgan Cazenove has been appointed Joint Bookrunner along

with Stifel under the Placing Programme, having signed a restated

placing agreement with the Company.

ENDS

For further information, please contact:

Foresight Group

Elena Palasmith epalasmith@foresightgroup.eu +44 (0)203 667 8100

Stifel (Sponsor and Joint Bookrunner) +44 (0)20 7710 7600

Mark Bloomfield

Neil Winward

Tunga Chigovanyika

J.P. Morgan Cazenove (Joint Bookrunner)

William Simmonds +44 (0)20 7742 4000

Notes to Editors

About Foresight Solar Fund Limited ("The Company" or "FSFL")

FSFL is a Jersey-registered closed-end investment company. The Company

invests in ground based UK solar power assets to achieve its objective

of providing Shareholders with a sustainable and increasing dividend

with the potential for capital growth over the long-term.

The Company raised proceeds of GBP150m through an initial public

offering ("IPO") of shares on the main market of the London Stock

Exchange in October 2013, and a further GBP60.1m through an Initial

Placing and Offer for Subscription in October 2014.

About Foresight Group

Foresight Group was established in 1984 and today is a leading

independent infrastructure and private equity investment manager with

over GBP1.3 billion of assets under management. As one of the UK's

leading solar infrastructure investment teams Foresight funds currently

manage c. GBP1 billion in over 40 separate operating Photovoltaic ("PV")

plants in the UK, the USA and southern Europe.

In May 2013 Foresight executed an innovative refinancing of its existing

UK solar assets through the issue of a GBP60m London Stock Exchange

listed index-linked Solar Bond.

Foresight Group has offices in London, Nottingham, Guernsey, Rome and

the USA.

www.foresightgroup.eu

This announcement is not for distribution, directly or indirectly, in or

into the United States of America (including its territories and

possessions, any state of the United States of America and the District

of Columbia) (the "United States"), Australia, Canada, Japan or South

Africa. This announcement does not constitute, or form part of, an offer

to sell, or a solicitation of an offer to purchase, any securities in

the United States, Australia, Canada, Japan or South Africa. The

securities of the Company have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the "Securities Act") or

the US Investment Company Act of 1940, as amended and may not be offered

or sold directly or indirectly in or into the United States or to or for

the account or benefit of any US Person (within the meaning of

Regulation S under the Securities Act). The securities referred to

herein have not been registered under the applicable securities laws of

Australia, Canada, Japan or South Africa and, subject to certain

exceptions, may not be offered or sold within Australia, Canada, Japan

or South Africa or to any national, resident or citizen of Australia,

Canada, Japan or South Africa.

This announcement has been issued by and is the sole responsibility of

the Company. No representation or warranty, express or implied, is or

will be made as to, or in relation to, and no responsibility or

liability is or will be accepted by, Stifel or J.P. Morgan Cazenove or

by any of their respective affiliates or agents as to or in relation to

the accuracy or completeness of this announcement or any other written

or oral information made available to or publicly available to any

interested party or their advisers and any liability therefore is

expressly disclaimed.

Stifel, which is authorised and regulated in the United Kingdom by the

Financial Conduct Authority, is acting as sponsor to the Company and is

acting for no-one else in connection with the Placing and the contents

of this announcement and will not be responsible to anyone other than

the Company for providing the protections afforded to clients of Stifel

Nicolaus Europe Limited nor for providing advice in connection with the

Issues and the contents of this announcement or any other matter

referred to herein.

J.P. Morgan Cazenove which is authorised by the Prudential Regulation

Authority and regulated by the Prudential Regulation Authority and the

Financial Conduct Authority and Stifel (together, the "Joint

Bookrunners"), are each acting exclusively for the Company and no-one

else in connection with the Placing or the matters referred to in this

announcement, will not regard any other person as their respective

client in relation to the Placing and will not be responsible to anyone

other than the Company for providing the protections afforded to their

respective clients or for providing advice in relation to the Placing or

any transaction or arrangement referred to in this announcement.

This announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Foresight Solar Fund Limited via Globenewswire

HUG#1899229

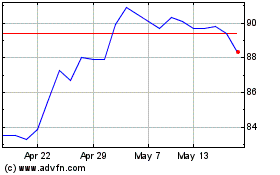

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Aug 2024 to Sep 2024

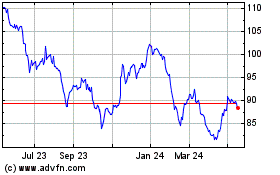

Foresight Solar (LSE:FSFL)

Historical Stock Chart

From Sep 2023 to Sep 2024