TIDMFORT

RNS Number : 5661F

Forterra plc

11 July 2023

11 July 2023

FORTERRA PLC

Post close half year trading update

In advance of the publication of our half year results on 27

July 2023 Forterra plc (the 'Group'), a leading UK manufacturer of

essential clay and concrete building products, provides this

trading update for the six-month period ending 30 June 2023 (the

'period').

Key points

-- Resilient H1 results broadly in line with our expectations,

delivered against a backdrop of challenging trading conditions

-- We expect to report H1 revenues of approximately GBP183m,

adjusted EBITDA of approximately GBP30m and adjusted PBT of

approximately GBP18m

-- Progressive signs of market improvement seen through May and

June, although this improvement has been less pronounced than

previously anticipated

-- Considering the increasingly uncertain macroeconomic outlook

we now expect to deliver full year 2023 EBITDA with a more balanced

H1 / H2 split, reflecting only a modest improvement in trading

conditions in H2

H1 results

-- Subject to review by our auditors, we expect to report

revenues for the period of approximately GBP183m, a decrease of 18%

relative to the prior year (2022: GBP222.8m)

-- We expect to report a resilient H1 result broadly in line

with management expectations, with adjusted EBITDA of approximately

GBP30m (2022: GBP46.1m) and adjusted PBT of approximately GBP18m

(2022: GBP37.3m)

-- Whilst market conditions remain competitive, our selling

prices have remained firm and our cost base stable

-- As planned, we have rebuilt our inventory, with stock levels

increasing by approximately GBP30m in the period, leaving us well

placed to deliver the service levels our customers expect

-- We have maintained a strong and flexible balance sheet and

expect to report a period end net debt before leases of

approximately GBP50m (2022 year end: GBP5.9m) which is below 1x

adjusted EBITDA on a LTM basis

Management actions

-- In response to the challenging market conditions, and with

our brick production capacity increasing with the opening of the

new Desford factory, as previously announced, we have mothballed

our Howley Park brick factory and implemented other production

reductions which will reduce our fixed costs by around GBP10m on an

annualised basis

-- In addition, we are consulting with affected individuals on a

restructuring of our commercial and support functions, aligning

them to anticipated demand, which we expect to save approximately

GBP3m annually

-- The demand for our products in H2 will influence our

production decisions. Having replenished our inventories in H1 we

expect to limit our inventory growth in H2 and will continue to

take appropriate action to ensure our output is aligned to

demand

-- Our strategy remains to maximise the ramp up of production at

the new Desford factory, such that we can benefit from the market

leading efficiencies it will offer once fully commissioned

Market backdrop and outlook

-- UK brick industry despatches, as published by the Department

of Business and Trade, were 31% adverse to the prior year in the

five months to May 2023, with the month of May showing signs of an

improving trend which is further evidenced by our own despatches

for June, albeit this improvement is less pronounced than

previously anticipated

-- Encouragingly, imports of bricks to the UK have fallen

significantly, decreasing 44% relative to 2022 in the four months

to April, although they still remain high as a proportion of

overall demand

-- Although customer inventory reduction has been more prolonged

than anticipated, we still expect this to ease in H2

-- Demand for our products for the rest of the year remains

subject to significant uncertainty with rising interest rates

widely expected to adversely impact the demand for new homes for

the foreseeable future

-- Contrary to the wider macroeconomic backdrop, our precast

flooring business, which can be regarded as a leading indicator for

future brick and block demand is performing strongly, with

despatches presently only 20% below prior year levels with current

order intake running ahead of this

-- As set out at the start of the year, our expectations for

2023 were based upon an underlying fall in full year market demand

of 20% relative to 2022, with a slow start to the year followed by

a meaningful recovery strengthening into H2

-- However, we are now assuming only a modest improvement in

trading conditions, and therefore expect to deliver full year

EBITDA with a more balanced H1 / H2 split

-- The impacts of greater borrowing, inventory build, and rising

interest rates are also expected to drive an increase in our

financing costs

-- Notwithstanding a weaker market in the short-term, looking

further ahead, the Board remains confident that the Group remains

well positioned to benefit from attractive market fundamentals of a

shortage of UK housing supply, a shortfall of domestic brick

production capacity and cross-party political support for

increasing housing supply

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) No 596/2014.

ENQUIRIES

Forterra plc +44 1604 707 600

Neil Ash, Chief Executive Officer

Ben Guyatt, Chief Financial Officer

FTI Consulting +44 203 727 1340

Richard Mountain / Nick Hasell

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFZGMNRGRGFZM

(END) Dow Jones Newswires

July 11, 2023 02:00 ET (06:00 GMT)

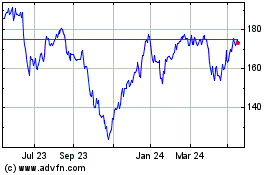

Forterra (LSE:FORT)

Historical Stock Chart

From Jan 2025 to Feb 2025

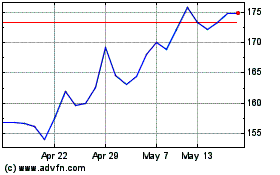

Forterra (LSE:FORT)

Historical Stock Chart

From Feb 2024 to Feb 2025