TIDMENOG

RNS Number : 4357P

Energean PLC

20 June 2022

Energean plc

("Energean" or the "Company")

Exercise of Drilling Options and KM-04 Update

London, 20 June 2022 - Energean plc (LSE: ENOG, TASE: ) is

pleased to announce that it has extended its growth drilling

programme by exercising its options to drill two further wells with

Stena Drilling Limited ("Stena") and to provide an update on the

initial results of the KM-04 appraisal well.

Mathios Rigas, Chief Executive Officer of Energean,

commented:

"Operations at the KM-04 appraisal well have been successfully

completed ahead of schedule and below budget, meeting the primary

objectives set pre-drill.

"We confirm today the extension of our 2022 growth drilling

campaign, on the back of success at Athena last month. We have

exercised our options with Stena to drill a further two wells,

commencing with Hermes, in line with our goal to continue to

provide competition and security of supply in the local Israel gas

and energy markets. The exercise of these options, will help us to

reach our target to double our Israel gas resource base in order to

also export to the broader region of the Eastern Mediterranean and

beyond."

Additional Drilling Targets

Energean has exercised its options to drill two further wells as

part of its 2022 growth drilling campaign.

The first well will target the Hermes prospect, located in Block

31, and is expected to spud in August 2022. The primary target is

the Tamar A sands. Hermes forms one segment of a larger cluster of

structures similar to how the Athena discovery is one segment of

the Olympus Area.

The target for the second well is still under consideration and

is largely contingent on the results of the Hermes well.

KM-04 Appraisal Results

Energean confirms that drilling of the KM-04 appraisal well has

been safely and successfully completed. The well was completed 15

days ahead of schedule and $9 million below budget at a cost of $36

million.

The primary objectives of the well were to;

-- further appraise gas volumes in the flanks of the structure; and

-- reduce uncertainties associated with liquid content in the central fault blocks.

The KM-04 appraisal well achieved the following;

-- Gas and associated liquids were encountered in the previously

undrilled fault block between Karish Main and Karish North;

-- Gas was encountered in the A-sands on the flanks of the

Karish Main structure, these sands were tested and fluid samples

obtained; and

-- An oil rim was confirmed in the central part of the field,

with thickness towards the lower end of the pre-drill expectation

range (5-10metres vs. 0-100metres pre-drill). A sample of oil was

obtained for testing. Energean expects to be able to commercialise

the oil volumes through the existing well stock.

Additional analysis will now be undertaken to further refine

reserve volumes and the liquids-to-gas ratio across the Karish

lease.

As planned, the Stena IceMAX will now move to complete the next

development well before moving to Hermes in August 2022.

Enquiries

For capital markets: ir@energean.com

Maria Martin, Head of Corporate Finance Tel: +44 7917 573

354

For media: pblewer@energean.com

Paddy Blewer, Head of Corporate Communications Tel: +44 7765 250

857

Forward looking statements

This announcement contains statements that are, or are deemed to

be, forward-looking statements. In some instances, forward-looking

statements can be identified by the use of terms such as

"projects", "forecasts", "on track", "anticipates", "expects",

"believes", "intends", "may", "will", or "should" or, in each case,

their negative or other variations or comparable terminology.

Forward-looking statements are subject to a number of known and

unknown risks and uncertainties that may cause actual results and

events to differ materially from those expressed in or implied by

such forward-looking statements, including, but not limited to:

general economic and business conditions; demand for the Company's

products and services; competitive factors in the industries in

which the Company operates; exchange rate fluctuations;

legislative, fiscal and regulatory developments; political risks;

terrorism, acts of war and pandemics; changes in law and legal

interpretations; and the impact of technological change.

Forward-looking statements speak only as of the date of such

statements and, except as required by applicable law, the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise. The information contained in this

announcement is subject to change without notice.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDKZGZVKGVGZZG

(END) Dow Jones Newswires

June 20, 2022 02:02 ET (06:02 GMT)

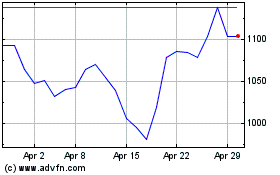

Energean (LSE:ENOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energean (LSE:ENOG)

Historical Stock Chart

From Apr 2023 to Apr 2024