TIDMENOG

RNS Number : 8387M

Energean PLC

26 May 2022

Energean plc

("Energean" or the "Company")

Trading Statement & Operational Update

London, 26 May 2022 - Energean plc (LSE: ENOG, TASE: ) is

pleased to provide an update on recent operations and the Group's

trading performance in the 3-months to 31 March 2022.

Highlights

-- Revenues for the period were $170.7 million, an 80% increase versus Q1 2021 ($94.9 million)

-- EBITDAX for the period was $89.6 million, a 172% increase versus Q1 2021 ($32.9 million)

-- Group cash as of 31 March 2022 was $812.7 million (including

restricted amounts of $135.6 million)

-- Production in the four-months to 30 April 2022 was 36.1 kboed (73% gas)

o Within full-year guidance (excluding Israel) of 35-40

kboed

-- First gas from Karish on track for Q3 2022, development was

93.2% complete and the FPSO 99.3% complete as at 30 April 2022

o The Energean Power FPSO has sailed-away from Singapore and is

expected to arrive in Israel in early June

-- Inaugural dividend policy announced

-- Commercial discovery made by the Athena exploration well,

containing recoverable gas volumes of 8 bcm (283 bcf / 51 mmboe) on

a standalone basis.

o Discovery de-risks an additional 50 bcm (1.8 tcf / 321 mmboe)

of mean unrisked prospective resources across Energean's Olympus

Area (total 58 bcm / 372 mmboe including Athena).

-- New GSPA signed in May 2022 for up to 0.8 bcm/yr to supply

gas to the East Hagit Power Station

Mathios Rigas, Chief Executive Officer of Energean,

commented:

"I am pleased to report that Energean has had a strong start to

the year. We have delivered record quarterly revenue and EBITDAX,

our production performance is within guidance and our flagship

project Karish is on track for first gas in Q3 this year.

"2022 will be a transformational year for Energean and we have

already delivered on several of our 2022 milestones. We have

announced our inaugural dividend policy, we have made a commercial

gas discovery at Athena in our Israel drilling campaign, and we

have signed an additional commercialisation agreement for our gas

in Israel. I look forward to continuing to deliver on our promises

to our shareholders and broader stakeholder communities for the

remainder of the year."

Enquiries

For capital markets: ir@energean.com

Maria Martin, Head of Corporate Finance Tel: +44 7917 573

354

For media: pblewer@energean.com

Paddy Blewer, Head of Corporate Communications Tel: +44 7765 250

857

Energean Operational & Financial Review

Production

In the 4-months to 30 April 2022, average working interest

production was 36.1 kboed ( 73 % gas), within the full year

guidance range (excluding Israel) of 35.0 - 40.0 kboed.

Four-months to 30 FY 2022 guidance

April 2022 Kboed

Kboed

Israel - 25.0 - 30.0

(including 1.0 - 1.3

bcm of gas)

------------------ ----------------------

Egypt 25.1 25.0 - 28.0

------------------ ----------------------

Italy 9.7 9.0 - 10.0

------------------ ----------------------

Greece, Croatia and 1.3 1.0 - 2.0

UK

------------------ ----------------------

Total production (including N/A 60.0 - 70.0

Israel)

------------------ ----------------------

Total production (excluding 36.1 35.0 - 40.0

Israel)

------------------ ----------------------

Israel

Karish Project Progress

Energean remains on track to deliver first gas from the Karish

gas development project in Q3 2022. At 30 April 2022, the project

was approximately 93.2% complete [1] and the FPSO 99.3%

complete.

The Energean Power FPSO is expected to arrive in Israel in early

June and will immediately commence hook-up and offshore

commissioning operations, which includes risers and jumpers

installation as well as the commissioning of the sales gas

pipeline. Energean expects approximately three to four months of

commissioning and hook-up activities between the FPSO's arrival and

first gas.

% Completion at 30 April 2022

[2]

Production Wells 100.0

--------------------------------------------------

FPSO 99.3

--------------------------------------------------

Subsea 84.3

--------------------------------------------------

Onshore 100.0

--------------------------------------------------

Total 93.2

--------------------------------------------------

Growth Projects

1. Karish North

The KN-01 exploration well will be re-entered, side-tracked and

completed as a production well as part of the Israel growth

drilling campaign, expected during the summer 2022, following the

completion of the Karish Main-04 appraisal well.

Karish North is expected to commence production in H2 2023.

2. Second oil train & riser

The second oil train and second gas sales riser are progressing

on schedule and are on track to come onstream in H2 2023.

Drilling Campaign

1. Athena Gas Discovery

As announced on 9 May 2022, a commercial discovery was made by

the Athena exploration well, Block 12, in the A, B and C sands.

Preliminary analysis indicates that the Athena discovery contains

recoverable gas volumes of 8 bcm (283 bcf / (51 mmboe)) on a

standalone basis.

This discovery is particularly significant as it de-risks an

additional 50 bcm (1.8 tcf / (321 mmboe)) of mean unrisked

prospective resources across Energean's Olympus Area (total 58 bcm

/ 372 mmboe including Athena).

Multiple commercialisation options are under evaluation for a

standalone tie-back to the Energean Power FPSO or as part of a new

Olympus Area development.

2. Remaining Campaign

In May 2022, the Stena IceMAX re-spudded the Karish Main-04

exploration and appraisal well, of which the top hole had already

been drilled.

After KM-04 the following wells will be drilled, in order of

sequence:

-- Karish North - Development - Firm

-- Hermes (Block 31) - Exploration - Optional

-- Hercules (Block 23) - Exploration - Optional

A decision on whether to drill the optional wells, as part of

this drilling campaign, will be made by the end of Q2 2022.

Gas Contracts

In May 2022, further to the claims raised by the parties in the

related arbitration proceedings (including the counterclaim filed

by Energean seeking a declaration that Energean is entitled to

terminate the GSPA as well as damages), Dalia and Energean Israel

agreed to end all claims and disputes between them. Both companies

agreed that the Dalia GSPA (which represents up to 0.8 Bcm/yr) was

lawfully terminated, that the arbitration proceedings are

terminated, and that neither party owes or will be liable to the

other for any payment in connection with and due to the Dalia GSPA,

the arbitration proceedings and the facts subject thereof. This was

agreed to be final and unappealable.

In May 2022, Energean announced that it had signed a new GSPA,

representing up to 0.8 Bcm/yr, to supply gas to the East Hagit

Power Plant Limited Partnership, a partnership between the Edeltech

Group and Shikun & Binui Energy.

Also in May 2022, Energean Israel signed an amendment to the OPC

GSPAs with OPC Rotem and OPC Hadera. The amendment has secured

additional near-term cash flows for Energean following first gas

during the transition period, which is the period when the buyers

transition from their existing agreements in the ramp-up period to

the full total annual contracted quantities of 0.7 bcm/yr.

Egypt

In the 4-months to 30 April 2022, w orking interest production

from the Abu Qir area averaged 25.1 kboed ( 87 % gas), within the

full year production guidance (25.0 - 28.0 kboed).

NEA/NI was 53.1 % complete as of 30 April 2022. Subsea

installation operations began in late May, after which the first

well will be drilled. First gas from the first well is expected in

H2 2022.

Italy

In the 4-months to 30 April 2022, w orking interest production

from Italy averaged 9.7 kboed ( 41 % gas), at the upper end of the

full year production guidance (9.0 - 10.0 kboed).

First gas from Cassiopea remains on track for H1 2024.

Rest of Portfolio

In the 4-months to 30 April 2022, w orking interest production

from the rest of the portfolio averaged 1.3 kboed (32% gas), at the

lower end of the full year production guidance of 1.0-2.0 kboed due

to a delay in the re-start of the Prinos Assets in Greece to ensure

full health and safety compliance.

Greece

First oil from the Epsilon development is expected in

mid-2023.

Pre-FEED for the Prinos CCS project is progressing well and is

expected to complete during Q2 2022.

Croatia

Energean is continuing FEED activities for the development of

the Irena gas field, located five kilometres north of the Izabela

field offshore Croatia, with the target to take FID on the project

in Q4 2022. Energean is also undertaking an assessment of the

adjacent Ivona prospect, which has the potential to add additional

gas volumes in Croatia.

United Kingdom

Energean has received interest from third parties with respect

to the potential sale of its UK assets portfolio and is continuing

to consider and develop its options.

Montenegro

Energean is continuing to assess potential farm-out options for

the drilling of a cluster of near shore gas prospects for Blocks 26

and 30 ahead of the licence expiry date of 14 July 2022.

Financial

The table below presents Energean's key results to 31 March

2022.

Three months to 31

March 2022

Revenues $ million 170.7

----------- -------------------

Cost of production

(including flux) $ million 62.3

----------- -------------------

Cost of production

(including flux) $/boe 19.2

----------- -------------------

G&A $ million 8.2

----------- -------------------

EBITDAX $ million 89.6

----------- -------------------

Capital expenditure $ million 74.3

----------- -------------------

Exploration expenditure $ million 5.8

----------- -------------------

Decommissioning expenditure $ million 0.6

----------- -------------------

Cash (including restricted

amounts) [3] $ million 812.7

----------- -------------------

Net debt - consolidated $ million 2,148.3

----------- -------------------

Net debt - plc excluding

Israel $ million 119.8

----------- -------------------

Net debt - Israel $ million 2,028.4

----------- -------------------

Forward looking statements

This announcement contains statements that are, or are deemed to

be, forward-looking statements. In some instances, forward-looking

statements can be identified by the use of terms such as

"projects", "forecasts", "on track", "anticipates", "expects",

"believes", "intends", "may", "will", or "should" or, in each case,

their negative or other variations or comparable terminology.

Forward-looking statements are subject to a number of known and

unknown risks and uncertainties that may cause actual results and

events to differ materially from those expressed in or implied by

such forward-looking statements, including, but not limited to:

general economic and business conditions; demand for the Company's

products and services; competitive factors in the industries in

which the Company operates; exchange rate fluctuations;

legislative, fiscal and regulatory developments; political risks;

terrorism, acts of war and pandemics; changes in law and legal

interpretations; and the impact of technological change.

Forward-looking statements speak only as of the date of such

statements and, except as required by applicable law, the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise. The information contained in this

announcement is subject to change without notice.

[1] As measured by project milestones under the TechnipFMC

EPCIC

[2] As measured by project milestones under the TechnipFMC

EPCIC

[3] Restricted amounts of $135.6 million

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTAAMRTMTTTBMT

(END) Dow Jones Newswires

May 26, 2022 02:00 ET (06:00 GMT)

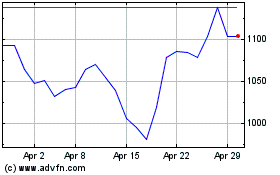

Energean (LSE:ENOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Energean (LSE:ENOG)

Historical Stock Chart

From Apr 2023 to Apr 2024