TIDMCTG

RNS Number : 4754J

Christie Group PLC

12 September 2016

12 September 2016

Christie Group plc

Interim Results for the six months ended 30 June 2016

Christie Group plc ('Christie' or the 'Group'), the leading

provider of Professional Business Services and Stock &

Inventory Systems & Services to the leisure, retail and care

markets, is pleased to announce its Interim Results for the six

months ended 30 June 2016.

Key points:

-- Revenue for the first half marginally lower than prior year at GBP31.6m (2015: GBP31.7m)

-- Operating loss of GBP0.9m (2015: operating profit of GBP1.7m)

-- Negative earnings per share of 4.95p per share (2015: 4.18p per share)

-- Board expects a stronger and profitable second half

-- Interim dividend maintained at 1.0p per share (2015: 1.0p per share)

-- UK transactional pipelines at end of first half up 19% on H1 2015

-- Strong European Hotel transaction activity

-- Christie Finance's pipeline of loan transactions has grown by

almost 50% on a year ago, while the average loan value arranged for

clients has increased by 9%

-- Impact of living wage on UK retail stocktaking operations

offset by successful fee negotiations

-- Christie & Co recognised as a "Superbrand" within the real estate sector

Commenting on the results, David Rugg, Chief Executive of

Christie Group, said:

"After a difficult first half in the run up to the EU

referendum, progress has resumed. We have stepped up the margin in

our stocktaking division and are seeing increased activity in our

transactional business. We look forward to a stronger finish to the

year."

Enquiries:

Christie Group plc

David Rugg

Chief Executive 020 7227 0707

Daniel Prickett

Chief Financial Officer 020 7227 0700

Panmure Gordon (UK) Limited

Dominic Morley / Charles Leigh-Pemberton

Nominated Adviser & Broker 020 7886 2980

Notes to Editors:

Christie Group plc, quoted on AIM, is a leading professional

business services group with 46 offices across the UK, Europe and

Canada, catering to its specialist markets in the leisure, retail

and care sectors.

Christie Group operates in two complementary business divisions:

Professional Business Services (PBS) and Stock & Inventory

Systems & Services (SISS). These divisions trade under the

brand names: PBS - Christie & Co, Pinders, Christie Finance and

Christie Insurance: SISS - Orridge, Venners and Vennersys.

Tracing its origins back to 1846, the Group has a long

established reputation for offering essential services to client

companies in agency, valuation services, investment, consultancy,

project management, multi-functional trading systems and online

ticketing services, stock audit and inventory management. The

diversity of these services provides a natural balance to the

Group's core agency business.

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulations (EU) No. 596/2014.

For more information, please go to www.christiegroup.com.

CHAIRMAN'S STATEMENT

As I envisaged in my AGM statement in June, reduced corporate

activity in the M & A market in the run-up to the EU Referendum

resulted in an operating loss of GBP0.9m (2015: GBP1.7m operating

profit) on revenue of GBP31.6m (2015: GBP31.7m).

The quantum of the first-half operating loss was compounded by

commissions foregone in a reaction to the EU referendum decision.

This subdued revenue, coupled with a higher operating cost base

which itself flowed from our decision to invest to drive further

growth following that achieved in 2014 and 2015, combined to move

our first-half performance back year-on-year. This investment has

augmented the capacity within our Professional Business Services

division.

Notwithstanding these factors, I am pleased to advise that

post-Brexit and the ensuing short period of political instability

which followed, business is returning towards more normal levels.

Our continental operations remain both integral and supportive of

what we do. European hotel transaction activity has been strong

from a number of the countries in which we are present, with

further territories expected to contribute as we move forwards.

The major UK banks which support our sectors have been

incentivised to lend by the Bank of England. We can also expect

strong inward UK investment based upon a rebased low sterling

exchange rate.

Across our sectors we expect that inbound tourism should boom,

whilst our hospitality businesses and petrol forecourts also

benefit from the staycation. An ageing population supports the Care

industry and even longer-working grandparents are boosting

occupancy for Children's Day Nurseries. Consumer staples will

ensure that convenience retailing continues to flourish.

Professional Business Services

Christie & Co has been identified by The Centre for Brand

Analysis as a "Superbrand" in a survey commissioned by The Estates

Gazette, a pleasing endorsement of its rebranding earlier this

year.

The introduction of the Living Wage in April increased the

operating costs of the businesses we sell where, in general, wage

costs are the largest variable operating cost. This will in many

cases have an effect on their short-term profitability. We have,

however, as yet seen no uptick in the level of distress-driven

sales mandates.

Volumes of UK business sales have remained subdued.

Notwithstanding this, we completed the sale of 6 regional Hilton

hotels on behalf of Oaktree Capital, Westmont and Paulsons to 6

individual buyers.

Across the Channel we have been busy selling the Radisson Sun

Gardens Dubrovnik to a group of Chinese investors, illustrating

once again our ability to close transactions outside of those

countries where we have physical locations.

Internationally, we have been provided with a number of key

instructions across Europe such as two Novotel hotels in Hungary,

Modlin Fortress in Warsaw and The Gresham in Dublin.

Christie & Co provided advisory services relating to one of

the largest hotel portfolio transactions completed in Q2 of this

year, continuing its trend of advising on a significant proportion

of the major UK hotel portfolio transactions that have taken place

in recent years.

Our valuers were also busy supporting the sale of Liberation

Group's owners LGV to Caledonia Group for GBP118m. A portfolio of

both UK and Channel Island pubs, as well as around 300 convenience

stores, were sold from Co-Op to McColls.

In the Medical sector, we continued to diversify and took

instructions on a major aesthetics dispensing business. We have

also been instructed to sell a portfolio of pharmacies on behalf of

Lloyds Pharmacy. Dental projects also included the sale of a

substantial pair of dental practices, Smile and Madeira Dental Care

in Dorset, for in excess of the asking price of GBP2.5m.

In the Care division, and more specifically our Childcare &

Education team, we successfully brokered the sale of Bush Babies

Children's Nurseries to Busy Bees Childcare as well as selling

First Class Child Care to Just Childcare in the first half. This

success has continued into the second half, where we recently

completed the sale of Positive Steps Children's Day Nurseries -

also to Busy Bees Childcare - in a deal believed to be the largest

in the sector this year.

Whilst corporate valuation instructions were lower, we saw an

overall net increase of 12.5% in the number of single asset

instructions received for SME owners, buyers and their banks.

Christie & Co's hotly anticipated research report entitled

Adult Social Care 2016: Funding, Staffing & The Bottom Line was

released in July 2016 at an event held at the Royal Nursing College

in London which was attended by over 70 key clients and industry

figures. It illustrates once again our skills and knowledge base

that stretches well beyond property.

Christie Finance's pipeline of loan transactions has grown by

almost 50% over the corresponding point last year, whilst the value

of Christie Insurance's renewals book increased by 9%.

Pinders, our business appraiser, undertook a significant volume

of business in the education sector, providing specialist advice

relating to assets with a combined value of some GBP100m, on behalf

of a number of lenders, who have increasingly targeted this

sector.

Stock & Inventory Systems & Services

In our hospitality stocktaking business, Venners, new client

wins have continued in 2016. Those we have added include Bravo Inns

and Arena Racing Company. Our Consultancy offering has been taken

on board by, amongst others, HQ Theatres, Lewis Partnership, Accor

and Macdonald Hotels and in Ireland by Rezidor Hotels.

Golf club additions in Ireland include Holywood, Banbridge, Fort

William and Lisburn, meaning that we now assist over 60 golf clubs

to maximise profit from their bars, dining rooms and shops across

the UK and Ireland.

In Retail stocktaking, new opportunities continue to arise for

Orridge, based upon quality of service. New work has been secured

with Englehorn, Habitat, Adidas and Hallhuber.

Our fee negotiations, triggered by the introduction of the

Living Wage, are now complete and we have been able to recover the

increased cost. Additionally, we have seen an encouraging response

from new counter and supervisor bonus schemes which have been

introduced alongside changes in working practices to increase

productivity. In Germany, we have invested in larger capacity

people carriers and more powerful technology to increase

efficiency.

Within Vennersys, VenPoS Cloud, our Visitor Attraction software

system, continues to attract new clients as we increase its wide

functionality. New functionality includes the new VenPoS handy

terminal which facilitates flexible stocktaking with linked

reporting in our site manager suite. Our third party ticket

generator allows our users to allocate tickets to the likes of

Amazon to sell tickets on the attraction operators' behalf.

We have introduced "My account" functionality to our consumer

site allowing visitor attractions to increase efficiency by

enabling their customers to self-manage their bookings as well as

allowing visitor attractions to tailor promotions and advance

purchase offers to members.

We have signed our first distillery at Glenmorangie, our first

cemetery at Highgate, our first Maze - The Wizard Maze - and

further stately homes, including Floors Castle.

Outlook

The EU Referendum inevitably disrupted our first half trading.

Our markets in the UK remain steady, if unspectacular. The banks we

work with have been freed to lend. Our UK markets are attracting

inward investment based, in part, on a lower value of sterling.

Our team hails from 23 countries, many naturalised or with

permit rights of residence abroad. We value the collaboration of

all of our colleagues which is intrinsic to the success of our

business. I thank each of them on your behalf for their continuing

contribution.

We continue to expect a stronger and profitable second half's

trading.

Cash flow in the first half of the year reflects the first half

trading performance combined with anticipated working capital

outflow. The latter is expected to unwind in the second half of the

year, with stronger second half trading improving cash

generation.

We work in a real economy. Our underlying financial covenant is

the millions of customers our clients' businesses serve, so our

markets are both strong and soundly-based. We are optimistic of the

prospects for our markets and our businesses.

Severe storms on the night of 22 June flooded our head office

power supply forcing us to relocate to temporary accommodation for

five weeks. On your behalf I thank our continuity planners and

those who implemented our plans which enabled us to continue to

trade with extremely limited disruption.

The Board has declared a maintained interim dividend of 1.0p

(2015: 1.0p per share) which will be paid on 14 October 2016 to

shareholders on the register on 23 September 2016.

Philip Gwyn

Chairman

Consolidated interim income

statement

Half year Half year

to 30 to 30

June June

2016 2015

Year ended

31 December

GBP'000 GBP'000 2015

Note (Unaudited) (Unaudited) GBP'000

------------------------------------ ------ ------------- ------------- -------------

Revenue 4 31,575 31,738 63,743

Employee benefit expenses (23,260) (21,329) (42,888)

---------------------------------------- ------ ------------- ------------- -------------

8,315 10,409 20,855

Depreciation and amortisation (352) (266) (576)

Impairment credit - - 143

Other operating expenses (8,867) (8,427) (16,659)

---------------------------------------- ------ ------------- ------------- -------------

Operating (loss) / profit 4 (904) 1,716 3,763

Finance costs (47) (49) (91)

Pension scheme finance costs (216) (256) (511)

Total finance charge (263) (305) (602)

---------------------------------------- ------ ------------- ------------- -------------

(Loss) / profit before tax (1,167) 1,411 3,161

Taxation 5 (202) (409) (614)

---------------------------------------- ------ ------------- ------------- -------------

(Loss) / profit for the period

after tax (1,369) 1,002 2,547

All amounts derive from continuing

operations.

(Loss) / profit for the period after tax attributable to:

Equity shareholders of the

parent (1,301) 1,091 2,712

Non-Controlling interest (68) (89) (165)

----------------------------- -------- ------ ------

(1,369) 1,002 2,547

---------------------------- -------- ------ ------

Earnings per share attributable to equity holders - pence

- Basic 6 (4.95) 4.18 9.73

- Fully diluted 6 (4.95) 4.06 9.47

----------------- ------- ----- -----

Consolidated interim statement of comprehensive income

Half year Half year

to 30 to 30

June June

2016 2015

Year ended

31 December

GBP'000 GBP'000 2015

(Unaudited) (Unaudited) GBP'000

------------------------------------- ---- ------------- ------------- ----------------------------

(Loss) / profit for the period

after tax (1,369) 1,002 2,547

------------------------------------------- ------------- ------------- ----------------------------

Other comprehensive (losses)

/ income:

Items that may be reclassified

subsequently to profit or

loss:

Exchange differences on translating

foreign operations 143 (67) (72)

------------------------------------------- ------------- ------------- ----------------------------

Net other comprehensive income

/ (losses) to be reclassified

to profit or loss in subsequent

periods 143 (67) (72)

------------------------------------------- ------------- ------------- ----------------------------

Items that will not be reclassified

to profit or loss:

Re-measurement (losses) /

gains on defined benefit plans (3,046) 57 1,676

Income tax effect 459 (11) (335)

------------------------------------------- ------------- ------------- ----------------------------

Net other comprehensive (losses)

/ income not being reclassified

to profit or loss in subsequent

periods (2,587) 46 1,341

------------------------------------------- ------------- ------------- ----------------------------

Other comprehensive (losses)

/ income for the period, net

of tax (2,444) (21) 1,269

------------------------------------------- ------------- ------------- ----------------------------

Total comprehensive (losses)

/ income for the period (3,813) 981 3,816

------------------------------------------- ------------- ------------- ----------------------------

Total comprehensive (losses) / income attributable to:

Equity shareholders of the

parent (3,745) 1,070 3,981

Non-Controlling interest (68) (89) (165)

----------------------------- -------- ------ --------

(3,813) 981 (3,816)

---------------------------- -------- ------ --------

Consolidated interim statement of changes in shareholders'

equity

Fair

value Cumulative Non -

Share and other translation Retained Controlling Total

capital reserves adjustments earnings interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- ----------- ------------- ---------- ------------- -----------

Half year to 30 June 2015 (Unaudited)

Balance at 1 January

2015 531 4,954 544 (12,473) (289) (6,733)

Profit / (loss)

for the period after

tax - - - 1,091 (89) 1,002

Items that will

not be reclassified

subsequently to

profit or loss - - - 46 - 46

Items that may be

reclassified subsequently

to profit or loss - - (67) - - (67)

Total comprehensive

(losses) / income

for the period - - (67) 1,137 (89) 981

Movement in respect

of employee share

scheme - 144 - - - 144

Employee share option

scheme:

- value of services

provided - 91 - - - 91

Dividends paid - - - (392) - (392)

------------------------------- --------- ----------- ------------- ---------- ------------- -----------

Balance at 30 June

2015 531 5,189 477 (11,728) (378) (5,909)

------------------------------- --------- ----------- ------------- ---------- ------------- -----------

Year ended 31 December 2015 (Audited)

--------------------------------------------------------------------------------------------------------------

Balance at 1 January

2015 531 4,954 544 (12,473) (289) (6,733)

Profit / (loss)

for the year after

tax - - - 2,712 (165) 2,547

Items that will

not be reclassified

subsequently to

profit or loss - - - 1,341 - 1,341

Items that may be

reclassified subsequently

to profit or loss - - (72) - - (72)

Total comprehensive

(losses) / income

for the year - - (72) 4,053 (165) 3,816

Movement in respect

of employee share

scheme - 69 - - - 69

Employee share option

scheme:

-value of services

provided - 184 - - - 184

Dividends paid - - - (653) - (653)

------------------------------- --------- ----------- ------------- ---------- ------------- -----------

Balance at 31 December

2015 531 5,207 472 (9,073) (454) (3,317)

------------------------------- --------- ----------- ------------- ---------- ------------- -----------

Half year to 30 June

2016 (Unaudited)

Balance at 1 January

2016 531 5,207 472 (9,073) (454) (3,317)

Profit / (loss) for

the period after tax - - - (1,301) (68) (1,369)

Items that will not

be reclassified subsequently

to profit or loss - - - (2,587) - (2,587)

Items that may be

reclassified subsequently

to profit or loss - - 143 - - 143

Total comprehensive

(losses) / income

for the period - - 143 (3,888) (68) (3,813)

Movement in respect

of employee share

scheme - 117 - - - 117

Employee share option

scheme:

- value of services

provided - 2 - - - 2

Dividends payable - - - (394) - (394)

Balance at 30 June

2016 531 5,326 615 (13,355) (522) (7,405)

------------------------------- --------- ----------- ------------- ---------- ------------- ---------

Consolidated interim statement of financial position

At 30 At 30 June At 31

June 2016 2015 December

2015

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited)

Note

------------------------------ ------ ------------- ------------- ----------

Assets

Non-current assets

Intangible assets -

Goodwill 1,790 1,674 1,703

Intangible assets -

Other 1,226 854 1,066

Property, plant and

equipment 1,251 994 1,095

Deferred tax assets 3,613 3,814 3,266

Available-for-sale

financial assets 635 635 635

Other receivables 451 465 451

------------------------------ ------ ------------- ------------- ----------

8,966 8,436 8,216

------------------------------ ------ ------------- ------------- ----------

Current assets

Inventories 8 4 6

Trade and other receivables 12,913 14,172 12,007

Current tax assets 243 12 45

Cash and cash equivalents 11 2,348 472 3,621

------------------------------ ------ ------------- ------------- ----------

15,512 14,660 15,679

------------------------------ ------ ------------- ------------- ----------

Total assets 24,478 23,096 23,895

------------------------------ ------ ------------- ------------- ----------

Equity

Capital and reserves attributable to

the Company's equity holders

Share capital 8 531 531 531

Fair value and other

reserves 5,326 5,189 5,207

Cumulative translation

reserve 615 477 472

Retained earnings (13,355) (11,728) (9,073)

------------------------------ ------ ------------- ------------- ----------

(6,883) (5,531) (2,863)

Non-Controlling interest (522) (378) (454)

------------------------------ ------ ------------- ------------- ----------

Total equity (7,405) (5,909) (3,317)

------------------------------ ------ ------------- ------------- ----------

Liabilities

Non-current liabilities

Retirement benefit

obligations 9 14,721 13,728 11,958

Borrowings 3 - 7

Provisions 281 313 155

------------------------------ ------ ------------- ------------- ----------

15,005 14,041 12,120

------------------------------ ------ ------------- ------------- ----------

Current liabilities

Trade and other payables 9,438 8,747 9,052

Current tax liabilities 73 808 -

Borrowings 6,479 3,397 4,288

Provisions 888 2,012 1,752

------------------------------ ------ ------------- ------------- ----------

16,878 14,964 15,092

------------------------------ ------ ------------- ------------- ----------

Total liabilities 31,883 29,005 27,212

------------------------------ ------ ------------- ------------- ----------

Total equity and liabilities 24,478 23,096 23,895

------------------------------ ------ ------------- ------------- ----------

Consolidated interim statement of cash flows

Half year

to 30

June 2016

GBP'000 Half Year ended

year to

30 June

2015

(Unaudited) GBP'000 31 December

2015

(Unaudited) GBP'000

Note

----------------------------------- ------ ------------- ------------- --------------

Cash flow from operating

activities

Cash (used in) / generated

from operations 10 (2,735) (1,274) 2,681

Interest paid (47) (49) (91)

Tax paid (129) (11) (831)

----------------------------------- ------ ------------- ------------- --------------

Net cash (used in) / generated

from operating activities (2,911) (1,334) 1,759

----------------------------------- ------ ------------- ------------- --------------

Cash flow from investing

activities

Purchase of property, plant

and equipment (PPE) (373) (291) (571)

Proceeds from sale of PPE 14 9 21

Intangible assets expenditure (297) (244) (574)

Net cash used in investing

activities (656) (526) (1,124)

----------------------------------- ------ ------------- ------------- --------------

Cash flow from financing

activities

Proceeds from invoice discounting 1,158 291 56

Payment of finance lease

liabilities (4) - (10)

Dividends paid - (392) (653)

Net cash generated from /

(used in) financing activities 1,154 (101) (607)

----------------------------------- ------ ------------- ------------- --------------

Net (decrease) / increase

in cash and cash equivalents (2,413) (1,961) 28

Cash and cash equivalents

at beginning of period 17 6 6

Exchange gain / (losses)

on Euro bank accounts 107 (58) (17)

----------------------------------- ------ ------------- ------------- --------------

Cash and cash equivalents

at end of period 11 (2,289) (2,013) 17

----------------------------------- ------ ------------- ------------- --------------

Notes to the consolidated interim financial statements

1. General information

Christie Group plc is the parent undertaking of a group of

companies covering a range of related activities. These fall into

two divisions - Professional Business Services and Stock &

Inventory Systems & Services. Professional Business Services

principally covers business valuation, consultancy and agency,

mortgage and insurance services, and business appraisal. Stock

& Inventory Systems & Services covers stock audit and

counting, compliance and food safety audits and inventory

preparation and valuation, hospitality and cinema software.

2. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the European Union. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and the IFRS Interpretations Committee (IFRIC) and there is

an ongoing process of review and endorsement by the European

Commission. The financial information has been prepared on the

basis of IFRS that the Directors expect to be adopted by the

European Union and applicable as at 31 December 2016.

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 31 December 2015,

except for those noted below and except for the adoption of new

standards and interpretations effective as of 1 January 2016. Taxes

on income in the interim periods are accrued using the tax rate

that would be applicable to expected total annual earnings.

A number of amendments apply for the first time in 2016.

However, they do not materially impact the annual consolidated

financial statements of the Group or the interim condensed

consolidated financial statements of the Group.

Non-statutory accounts

These consolidated interim financial statements have been

prepared in accordance with IAS 34 'Interim Financial Reporting'.

The financial information for the year ended 31 December 2015 set

out in this interim report does not constitute the Group's

statutory accounts for that period. The statutory accounts for the

year ended 31 December 2015 have been delivered to the Registrar of

Companies. The auditors reported on those accounts; their report

was unqualified, did not contain a statement under either section

498(2) or section 498(3) of the Companies Act 2006 and did not

include references to any matters to which the auditor drew

attention by way of emphasis. The financial information for the

periods ended 30 June 2016 and 30 June 2015 is unaudited.

3. Critical accounting estimates and judgements

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal the related actual results. The estimates and assumptions

that have a significant risk of causing a material adjustment to

the carrying amounts of assets and liabilities within the next

financial year are consistent with those applied to the

consolidated financial statements for the year ended 31 December

2015.

4. Segment information

The Group is organised into two main business segments:

Professional Business Services and Stock & Inventory Systems

& Services.

The reportable segment results for continuing operations for the

period ended 30 June 2016 are as follows:

Professional Stock &

Business Inventory Other Group

Services Systems GBP'000 GBP'000

GBP'000 & Services

GBP'000

--------------------- --------------- ------------- ---------- ----------

Total gross segment

revenue 16,440 15,188 1,538 33,166

Inter-segment

revenue (53) - (1,538) (1,591)

--------------------- --------------- ------------- ---------- ----------

Revenue 16,387 15,188 - 31,575

--------------------- --------------- ------------- ---------- ----------

Operating loss (414) (116) (374) (904)

Net finance charge (263)

--------------------- --------------- ------------- ---------- ----------

Loss before tax (1,167)

Taxation (202)

--------------------- --------------- ------------- ---------- ----------

Loss for the period after

tax (1,369)

-------------------------------------- ------------- ---------- ----------

The reportable segment results for continuing operations for the

period ended 30 June 2015 are as follows:

Professional Stock &

Business Inventory Other Group

Services Systems GBP'000 GBP'000

GBP'000 & Services

GBP'000

--------------------- --------------- ------------- ---------- ----------

Total gross segment

revenue 17,574 14,216 1,520 33,310

Inter-segment

revenue (52) - (1,520) (1,572)

--------------------- --------------- ------------- ---------- ----------

Revenue 17,522 14,216 - 31,738

--------------------- --------------- ------------- ---------- ----------

Operating profit

/ (loss) 2,444 (394) (334) 1,716

Net finance charge (305)

--------------------- --------------- ------------- ---------- ----------

Profit before

tax 1,411

--------------------- --------------- ------------- ---------- ----------

Taxation (409)

--------------------- --------------- ------------- ---------- ----------

Profit for the period after

tax 1,002

-------------------------------------- ------------- ---------- ----------

The reportable segment results for continuing operations for the

year ended 31 December 2015 are as follows:

Professional Stock &

Business Inventory Other Group

Services Systems GBP'000 GBP'000

GBP'000 & Services

GBP'000

--------------------- --------------- ------------- ---------- ----------

Total gross segment

revenue 36,369 27,478 4,312 68,159

Inter-segment

revenue (104) - (4,312) (4,416)

--------------------- --------------- ------------- ---------- ----------

Revenue 36,265 27,478 - 63,743

--------------------- --------------- ------------- ---------- ----------

Operating profit

/ (loss) 4,646 (953) 70 3,763

Net finance charge (353) (179) (70) (602)

--------------------- --------------- ------------- ---------- ----------

Profit before

tax 3,161

Taxation (614)

--------------------- --------------- ------------- ---------- ----------

Profit for the

year after tax 2,547

--------------------- --------------- ------------- ---------- ----------

The Group is not reliant on any key customers.

5. Taxation

Deferred tax assets have been recognised in respect of tax

losses and other temporary differences giving rise to deferred tax

assets where it is probable that these assets will be

recovered.

The tax on the Group's profit before tax differs from the

theoretical amount that would arise using the standard rate of

corporation tax in the UK of 20%, based on the Group's profit

before tax and before pension scheme finance costs, due to

GBP44,000 arising from the reduction in the value of the brought

forward deferred tax asset and a further GBP259,000 arising from

other movements in the deferred tax asset.

6. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period, which

excludes the shares held in the Employee Share Ownership Plan

(ESOP) trust.

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The Company

has only one category of potential dilutive ordinary shares: share

options. Where a loss for the year has been recognised the share

options are considered anti-dilutive and so not included in the

calculation of diluted earnings per share.

The calculation is performed for the share options to determine

the number of shares that could have been acquired at fair value

(determined as the average annual market share price of the

Company's shares) based on the monetary value of the subscription

rights attached to outstanding share options. The number of shares

calculated as above is compared with the number of shares that

would have been issued assuming the exercise of the share

options.

Half year Half year

to to Year ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

-------------------------------- ----------- ------------ --------------

(Loss) / profit from total

operations attributable to

equity holders of the Company (1,301) 1,091 2,712

-------------------------------- ----------- ------------ --------------

30 June 30 June 31 December

2016 2015 2015

Thousands Thousands Thousands

-------------------------------- ----------- ------------ --------------

Weighted average number of

ordinary shares in issue 26,279 26,113 26,171

Adjustment for share options - 716 714

-------------------------------- ----------- ------------ --------------

Weighted average number of

ordinary shares for diluted

earnings per share 26,279 26,829 26,885

-------------------------------- ----------- ------------ --------------

30 June 30 June 31 December

2016 2015 2015

Pence Pence Pence

-------------------------------- ----------- ------------ --------------

Basic earnings per share (4.95) 4.18 9.73

Fully diluted earnings per

share (4.95) 4.06 9.47

-------------------------------- ----------- ------------ --------------

7. Dividends

A final dividend in respect of the year ended 31 December 2015

of 1.5p per share, amounting to a total dividend of GBP394,000, was

approved and paid to the Christie Group plc registrar on 4 July

2016. The funds were transferred to shareholders on 8 July

2016.

An interim dividend in respect of 2016 of 1.0p per share,

amounting to a dividend of GBP265,000, was declared by the

directors at their meeting on 7 September 2016. These financial

statements do not reflect this dividend payable.

The dividend of 1.0p per share will be payable to shareholders

on the record on 23 September 2016. The ex-dividend date will be 22

September 2016. The dividend will be paid on 14 October 2016.

8. Share capital

30 June 2016 30 June 2015 31 December

2015

Ordinary shares of 2p Number GBP'000 Number GBP'000 Number GBP'000

each

-------------------------- ----------- -------- ----------- -------- ----------- --------

Allotted and fully paid:

At beginning and end

of period 26,526,729 531 26,526,729 531 26,526,729 531

-------------------------- ----------- -------- ----------- -------- ----------- --------

The Company has one class of ordinary shares which carry no

right to fixed income.

Investment in own shares

The Group has established an Employee Share Ownership Plan

(ESOP) trust in order to meet its future contingent obligations

under the Group's share option schemes. The ESOP purchases shares

in the market for distribution at a later date in accordance with

the terms of the Group's share option schemes. The rights to

dividend on the shares held have been waived.

At 30 June 2016 the total payments by the Group to the ESOP to

finance the purchase of ordinary shares were GBP2,639,000 (30 June

2015: GBP2,658,000; 31 December 2015: GBP2,643,000). This figure is

inclusive of shares purchased and subsequently issued to satisfy

employee share awards. The market value at 30 June 2016 of the

ordinary shares held in the ESOP was GBP203,000 (30 June 2015:

GBP487,000; 31 December 2015: GBP299,000). The investment in own

shares represents 247,000 shares (30 June 2015: 368,000; 31

December 2015: 235,000) with a nominal value of 2p each.

9. Retirement benefit obligations

The obligation outstanding of GBP14,721,000 (30 June 2015:

GBP13,728,000; 31 December 2015: GBP11,958,000) includes GBP962,000

(30 June 2015: GBP980,000; 31 December 2015: GBP986,000) relating

to David Rugg who transferred 80% of his accrued benefits out of

the Christie Group Pension and Assurance Scheme during 2014 leaving

the residual benefit payable to Mr Rugg under agreement of the

Christie Group plc Remuneration Committee.

The Group operates two defined benefit schemes (closed to new

members) providing pensions on final pensionable pay. The

contributions are determined by qualified actuaries on the basis of

triennial valuations using the projected unit method.

When a member retires, the pension and any spouse's pension is

either secured by an annuity contract or paid from the managed

fund. Assets of the schemes are reduced by the purchase price of

any annuity purchase and the benefits no longer regarded as

liabilities of the scheme.

The amounts recognised in the statement of comprehensive income

and the movement in the liability recognised in the statement of

financial position have been based on the forecast position for the

year ended 31 December 2016 after adjusting for the actual

contributions to be paid in the period.

The movement in the liability recognised in the statement of

financial position is as follows:

Half year

to Year ended

Half year to 30 June 31 December

30 June 2016 2015 2015

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------- -------------

Beginning of the period 11,958 13,970 13,970

Expenses included in the employee

benefit expense 303 314 657

Contributions paid (778) (743) (1,468)

Finance costs 216 256 511

Pension paid (24) (12) (36)

Actuarial losses / (gains)

recognised 3,046 (57) 1,676

End of the period 14,721 13,728 11,958

----------------------------------- ------- ---------- -------------

The amounts recognised in the income statement and statement of

comprehensive income are as follows:

Half year

to Year ended

Half year to 30 June 31 December

30 June 2016 2015 2015

GBP'000 GBP'000 GBP'000

-------------------------------------- ---------- -------------

Current service cost 303 314 657

---------------------------- -------- ---------- -------------

Total included in employee

benefit expenses 303 314 657

---------------------------- -------- ---------- -------------

Net interest cost 216 256 511

---------------------------- -------- ---------- -------------

Total included in finance

costs 216 256 511

---------------------------- -------- ---------- -------------

Actuarial (losses) / gains (3,046) 57 (1,676)

Total included in other

comprehensive (losses)

/ income (3,046) 57 (1,676)

---------------------------- -------- ---------- -------------

The principal actuarial assumptions used were as follows:

Half year to 30 June 2016 Half year to 30 June 2015 Year ended 31 December 2015

% % %

-------------------------- -------------------------- ---------------------------- ------------------------------

Inflation rate 2.70 3.00 3.00

Discount rate 3.10 4.00 4.00

Future salary increases 2.70 3.00 3.00 - 3.10

Future pension increases 1.90 - 2.70 2.20 - 3.40 2.20 - 3.40

-------------------------- -------------------------- ---------------------------- ------------------------------

Assumptions regarding future mortality experience were

consistent with those disclosed in the financial statements for the

year ended 31 December 2015.

10. Note to the cash flow statement

Cash (used in) / generated from operations

Half year Half year

to to Year ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

Continuing operations

(Loss) / profit for the period (1,369) 1,002 2,547

Adjustments for:

- Taxation 202 409 614

- Finance costs 47 49 91

- Depreciation 216 179 371

- Amortisation of intangible

assets 136 87 205

- Profit on sale of property,

plant and equipment (9) (3) (6)

- Foreign currency translation (102) (44) (55)

- (Decrease) / increase in

provisions (738) 34 (384)

- Movement in share option

charge 117 91 184

- Retirement benefits (283) (185) (336)

- Decrease in non-current

other receivables - - 14

Changes in working capital

(excluding the effects of

exchange differences on consolidation):

- Increase in inventories (2) (2) (4)

- Increase in trade and other

receivables (919) (3,059) (970)

- (Decrease) / increase in

trade and other payables (31) 168 410

------------------------------------------ ---------- ---------- -------------

Cash (used in) / generated

from operations (2,735) (1,274) 2,681

------------------------------------------ ---------- ---------- -------------

11. Cash and cash equivalents include the following for the

purposes of the cash flow statement:

Half year Half year

to to Year ended

30 June 30 June 31 December

2016 2015 2015

GBP'000 GBP'000 GBP'000

--------------------------- ---------- ---------- -------------

Cash and cash equivalents 2,348 472 3,621

Bank overdrafts (4,637) (2,485) (3,604)

--------------------------- ---------- ---------- -------------

(2,289) (2,013) 17

--------------------------- ---------- ---------- -------------

12. Related-party transactions

There is no controlling interest in the Group's shares.

During the period rentals of GBP164,000 (30 June 2015:

GBP162,000; 31 December 2015: GBP325,000) were paid to Carmelite

Property Limited, a company incorporated in England and Wales, and

jointly owned by The Christie Group Pension and Assurance Scheme,

The Venners Retirement Benefit Fund and The Fitzroy Square Pension

Fund, by Christie Group plc in accordance with the terms of a

long-term lease agreement.

13. Publication of Interim Report

The 2016 Interim Financial Statements are available on the

Company's website www.christiegroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFLEAIIAIIR

(END) Dow Jones Newswires

September 12, 2016 02:00 ET (06:00 GMT)

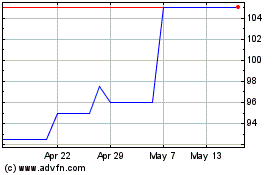

Christie (LSE:CTG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Christie (LSE:CTG)

Historical Stock Chart

From Sep 2023 to Sep 2024