TIDMCPG

RNS Number : 2373G

Compass Group PLC

24 November 2020

Annual Results Announcement

Legal Entity Identifier (LEI) No. 2138008M6MH9OZ6U2T68

Full year results announcement for the year ended 30 September

2020

Underlying(1) results Statutory results

2020 2019 Change 2020 2019(2) Change

GBP24.8

GBP20.2 billion GBP19.9 GBP24.9

Revenue billion (3) (18.8)%(4) billion billion (19.8)%

GBP1,852

million GBP294 GBP1,626

Operating profit GBP561 million (3) (69.7)%(3) million million (81.9)%

GBP1,852

Operating profit (IAS million

17 proforma) (5) GBP533 million (3) (71.2)%(3)

Operating margin 2.9% 7.4% (450)bps

Operating margin (IAS

17 proforma) (5) 2.8% 7.4% (460)bps

83.8 pence

Earnings per share 18.6 pence (3) (77.8)%(3) 8.0 pence 71.6 pence (88.8)%

Earnings per share (IAS 83.8 pence

17 proforma) (5) 19.1 pence (3) (77.2)%(3)

GBP1,247

Free cash flow GBP213 million million (82.9)%

Annual dividend per share - 40.0 pence - 40.0 pence

=============== =========== =========== ========== =========== ========

1. Reconciliation of statutory to underlying results can be

found on pages 49 to 50 .

2. Prior year comparatives have been restated as required by

IFRS 5 'Non-current assets held for sale and discontinued

operations' to account for joint ventures and associates using the

equity method retrospectively when they cease to be classified as

held for sale. Additional information is included in note 11.

3. Measured on a constant currency basis.

4. Organic revenue growth.

5. The Group has adopted IFRS 16 'Leases' with effect from 1

October 2019 without restating prior year comparatives. As a

result, the Group results for the year ended 30 September 2020 are

not directly comparable with those reported in the prior year under

IAS 17 'Leases'. To provide meaningful comparatives, the results

for the year ended 30 September 2020 have therefore also been

presented on a proforma IAS 17 basis, see notes 2 and 13 for

additional information.

Compass is well positioned for the future as it addresses the

challenges of COVID-19

Dominic Blakemore, Group Chief Executive, said:

"2020 was a challenging year for Compass. I am extremely proud

of how the organisation responded to the pandemic. I have been

humbled by the commitment of our people in the face of

unprecedented adversity and want to thank them for their continued

dedication and hard work.

We began the year on track to deliver our strongest performance

ever, and over the course of a fortnight in March, we saw the

containment measures to stop the spread of COVID-19 close half of

the business. We rapidly enhanced our health and safety protocols,

mitigated our costs, increased our liquidity and strengthened our

balance sheet. Through the summer, our performance began to improve

slowly as we helped clients in Education and Business &

Industry return to schools and offices safely.

Importantly, in the fourth quarter we returned the business to

profitability and are now cash neutral. This was achieved mainly

through contract renegotiations to reflect the difficult trading

environment, continued discipline in terms of costs and some

improvement in volumes. We are executing at pace and expect the

underlying operating margin in the first quarter of 2021 will be

around 2.5%.

Although the prospects of a vaccine are encouraging, the

resumption of lockdowns in some of our major markets shows that we

have to continue to take proactive actions to control the

controllable and ensure the business can thrive despite the ongoing

pandemic. We are innovating and evolving our operating model to be

more flexible and to provide our clients and consumers with an

exciting offer that is delivered safely and provides great value.

This combined with our existing scale, ability to flex costs and

focus on operational execution, will allow us to return to a Group

underlying margin above 7% before we return to pre-COVID

volumes.

The scope for growth from first time outsourcing and share gains

is significant. In addition, we have a strong pipeline of new

business in Healthcare & Seniors, Education and Defence,

Offshore & Remote that will diversify and broaden our revenue

base. We are investing in the business organically and

inorganically to support our long term growth prospects, enhance

our competitive advantages, and further consolidate our position as

the industry leader in food services.

We are improving the quality of the business and will emerge

from the pandemic stronger than we've ever been. We recognise the

importance of the dividend to our shareholders and the Board looks

forward to reinstating it when considered appropriate. Finally, we

remain as excited as ever about the significant structural growth

opportunities globally, the potential for further revenue and

profit growth, and returns to shareholders over time. "

Chief Executive's Statement

Although COVID-19 severely impacted the business from late Q2,

new business wins remained robust, and retention was high

-- Organic revenue down 18.8% year on year as COVID-19 related

restrictions reduced volumes in Business & Industry, Education

and Sports & Leisure in all three regions

-- In North America, new business wins of 6.9% and strong 96.4%

retention, despite significant disruption due to the pandemic

-- In Europe, good results in Healthcare & Seniors offset by

the significant impact of COVID-19 on Sports & Leisure and

Business & Industry

-- Greater exposure to Defence, Offshore & Remote in Rest of

World mitigated the impact of the pandemic on Business &

Industry throughout the region

-- Underlying operating margin of 2.9% or 3.5% (excluding

contract related non-current asset impairment and onerous contract

charges) with a return to profitability in Q4

-- Expect Q1 2021 margin to be around 2.5% and committed to

rebuilding the Group underlying margin to above 7% before we return

to pre COVID-19 volumes

COVID-19 response

-- Prioritised the safety of colleagues and customers and

enhanced operating protocols throughout the crisis

-- Moved rapidly to support clients in Healthcare & Seniors

and Education on the frontline of the pandemic

-- Adapted our cost base and renegotiated contracts to reflect the new trading environment

Strong and resilient balance sheet

-- GBP2 billion equity raise to reduce leverage - liquidity increased to around GBP5 billion

-- Free cash flow of GBP213 million and net debt to EBITDA ratio of 2.1x

Strategy - positioning for the future

-- Managing the business through the lens of People,

Performance, Purpose in the interests of all stakeholders

-- Adapting our operations to improve the offer, increase flexibility and manage costs

-- Significant structural growth opportunity in terms of first time outsourcing and share gains

-- Investing in digital, organic and inorganic growth opportunities to support future growth

Statutory results

-- Statutory revenue decreased by 19.8% due to the impact of

COVID-19 on volumes. Operating profit decreased by 81.9% as a

result of the impact of COVID-19, the resizing programme to adjust

our cost base, contract related non-current asset impairment and

onerous contract charges, as well as the negative impact of foreign

exchange.

Chief Executive's Statement (continued)

Results presentation today

A recording of the results presentation for investors and

analysts will be available on the Company's website today, Tuesday

24 November 2020, at 7.00 a.m.. There will be a question and answer

session at 9:00 a.m., accessible via the Company's website,

www.compass-group.com , and you will be able to participate by

dialing :

UK Toll Number: +44 330 336 9411

UK Toll-Free Number: 0800 279 7204

US Toll Number: +1 929 477 0324

US Toll-Free Number: +1 800 289 0571

Participant PIN Code: 7837121#

Please connect to the call at least 10-15 minutes prior to the

start time.

Financial calendar

Q1 Trading Update / Annual General 4 February 2021

Meeting

Half year results 12 May 2021

Enquiries

Sandra Moura, Agatha Donnelly & Helen

Investors Javanshiri +44 1932 573 000

Tim Danaher & Fiona Micallef-Eynaud,

Press Brunswick +44 2074 045 959

Website www.compass-group.com

Chief Executive's Statement (continued)

Basis of preparation

Throughout this preliminary results announcement, and consistent

with prior years, underlying and other alternative performance

measures are used to describe the Group's performance. These are

not recognised under International Financial Reporting Standards

(IFRS) or other generally accepted accounting principles (GAAP).

The Executive Committee of the Group manages and assesses the

performance of the business on these measures and believes they are

more representative of ongoing trading, facilitate meaningful year

on year comparisons, and hence provide more useful information to

shareholders. Underlying and other alternative performance measures

are defined in the glossary of terms on pages 53 and 54 . A summary

of the adjustments from statutory results to underlying results is

shown in note 12 on pages 49 and 50 and further detailed in the

consolidated income statement (page 30 ), reconciliation of free

cash flow (page 36), note 3 segmental reporting (page 42 ) and note

13 organic revenue and organic profit (page 51 ).

FY 2020 overview

The COVID-19 pandemic has had a profound impact on Compass. We

can only exist with the commitment of our colleagues around the

world, many of whom have been on the front line of the battle

against the pandemic. I am extremely proud of how the organisation

has responded, and I'm humbled by the commitment and dedication our

people are showing, day in day out.

I want to extend my deepest sympathies to the families of those

colleagues that have lost their lives to COVID-19. We continue to

be committed to doing all we can to support them.

2020 was a year of two halves. We began the year on track to

deliver our strongest performance ever when, in March, over the

course of a fortnight we saw the containment measures to control

the spread of COVID-19 close half of the business. The health and

safety of our employees and consumers has been, and remains, our

absolute priority. As the pandemic unfolded, sites that remained

open were operating with enhanced health and safety protocols and

Personal Protective Equipment (PPE). As restrictions were lifted

and clients returned to schools and offices, we have helped them

reopen and ensure they bring consumers back safely. Nevertheless,

throughout the year, in the face of unprecedented volatility, we

have continued to manage the business through the lens of People,

Performance and Purpose to ensure that we continue to protect the

interests of all our stakeholders.

Performance

Our 2020 results reflect the dramatic impact COVID-19 has had on

our business. Our revenue in FY2020 declined by 18.8% on an organic

basis as a result of the pandemic .

Organic revenue

Change % Q1 Q2 Q3 Q4 FY

============================ ===== ======== ======== ======== ========

Business & Industry 4.4% (3.8)% (50.7)% (44.1)% (23.9)%

Education 4.4% (5.1)% (60.2)% (35.1)% (21.7)%

Healthcare & Seniors 5.4% 5.5% (5.1)% 0.2% 1.5%

Sports & Leisure 9.0% (10.9)% (89.9)% (78.9)% (45.1)%

Defence, Offshore & Remote 4.3% 1.0% (8.8)% (7.6)% (2.9)%

============================ ===== ======== ======== ======== ========

Group 5.3% (2.1%) (44.3)% (34.1)% (18.8)%

============================ ===== ======== ======== ======== ========

After an excellent first five months, the business received a

shock when all our Sports & Leisure business and most of our

Education and Business & Industry sectors were closed in March.

In June, July and August we saw a gradual reopening of parts of the

business. By September, all sectors except Sports & Leisure

were partially or fully open representing about 65% of the

business. At that time, we also began to see the reintroduction of

local lockdowns as many markets started to experience a second wave

of infections.

New business (MAP 1) was up 5.7% reflecting the strong momentum

pre-pandemic. After a slowdown in the third quarter, in the fourth

quarter we saw an increase in new wins in Healthcare & Seniors

and Education in North America. This reflects a 'flight to trust'

as clients sought food service providers with best in class health

and safety protocols, robust supply chains and strong balance

sheets.

Retention was 95.1% as clients maintained their trusted food

service provider during the pandemic. Like for like revenue

declined by 19.6% due to the impact of site closures as well as

lower populations on site due to social distancing requirements. On

a statutory basis, revenue decreased by 19.8%, including the

negative impact of foreign currency translation.

Chief Executive's Statement (continued)

Costs

We have taken a series of measures to reduce our food (MAP 3)

costs, in unit labour and in unit overheads (MAP 4) and our

above-unit (MAP 5) costs to offset the impact of lower volumes. In

markets where little or no government support was available, we

acted quickly to adjust our cost base and are already seeing the

savings come through.

In markets where government support was available, we used it to

limit job losses. This year we received GBP437 million of

government support. However, whenever government support has ended,

we have evaluated our staffing needs and taken the necessary steps

to ensure that we avoid carrying excess costs.

Although resizing will be an ongoing task, actions taken thus

far will avoid annual in unit labour (MAP 4) costs of around GBP280

million and annual savings of above unit (MAP 5) costs of GBP70

million, both of which will be essential for us to rebuild our

margins back to above 7%.

Resizing action in the year totalled GBP122 million. In

addition, the cost action programme announced in November 2019 has

incurred GBP75 million of costs in the year and is delivering the

savings initially anticipated. Together, these initiatives will

allow us to rebuild our margins in 2021 and beyond. The costs

associated with both programmes have been excluded from the Group's

underlying results.

Operating profit and operating margin

Although margins were up 20 bps (10 bps excluding the impact of

IFRS 16) for the five months to March, the significant volume

impact of the lockdowns resulted in a negative third quarter

margin. Significant cost actions and contract renegotiations to

reflect the changes in the trading environment, combined with a

slight improvement in volumes, allowed us to return to

profitability in the fourth quarter (before any contract related

non-current asset impairment and onerous contract charges).

In light of the disruption to the business, we have reviewed our

contract portfolio and impaired GBP88 million of contract related

non-current assets and recognised GBP31 million of onerous contract

losses - together these represent around 3% of our GBP4 billion

contract related non-current assets (contract fulfilment assets and

contract costs, right of use assets, property, plant and equipment

and intangible assets).

Underlying operating profit decreased by 69.7% to GBP561 million

on a constant currency basis (or by 71.2% to GBP533 million

excluding the impact of IFRS 16) . Our underlying operating profit

margin was 2.9% or 3.5% after excluding contract related

non-current asset impairment and onerous contract charges (2.8% or

3.4% excluding the impact of IFRS 16) with a return to

profitability in the fourth quarter.

Strategy

The food services market remains very attractive. We estimate it

is around GBP220 billion, with about two thirds currently operated

by small regional players or operated in house. This means there is

a significant structural growth opportunity from first time

outsourcing as well as share gains. We are particularly attracted

to the more defensive sectors of Healthcare & Seniors ,

Education and Defence, Offshore & Remote where there are

meaningful first time outsourcing opportunities.

We have reviewed our strategy and remain confident about our

focus on food, and our pragmatic approach to providing support

services in the markets where we have the right capabilities. As

the industry leader, we have the greatest scale, which gives us an

advantage in terms of food procurement and our ability to leverage

our overheads. In addition, we go to market with a sector and sub

sector approach that allows us to get close to our clients and

create a bespoke food service solution that truly meets their

needs.

In response to the pandemic, we are innovating and evolving our

operating model. By innovating and adapting our offer and

operations to the 'new normal', this will allow us to reduce costs

and increase our flexibility, so that we can provide our clients

and consumers an exciting offer that is delivered safely and

provides great value. The three main areas of strategic focus

are:

-- digital: consumer facing use of apps and kiosks to pre-order,

pre-pay, click and collect as well as back of house apps for labour

management and food procurement

-- labour: increase labour flexibility, leverage our scale and

pool our workforce across sectors to better accommodate volume

volatility on site

-- central production units: hubs for development, training and

production to rationalise labour costs and reduce food waste

These three areas of focus combined with our existing scale and

competitive strengths, will allow us to return to industry leading

levels of performance.

Chief Executive's Statement (continued)

Regional performances

North America - 63.1% Group revenue (2019: 62.4%)

Underlying Change

Reported Constant Organic

Regional financial summary 2020 2019(1) rates currency

===================================== =========== =========== ========= ========== ========

Revenue GBP12,746m GBP15,694m (18.8)% (18.4)% (18.5)%

Regional operating profit (as

reported) GBP606m GBP1,290m (53.0)% (52.8)% (53.1)%

Regional operating profit (proforma

IAS 17)(1) GBP588m GBP1,290m (54.4)% (54.2)% (54.5)%

Regional operating margin (as

reported) 4.8% 8.2% (340)bps

Regional operating margin (proforma

IAS 17)(1) 4.6% 8.2% (360)bps

===================================== =========== =========== ========= ========== ========

1. The Group has adopted IFRS 16 'Leases' with effect from 1

October 2019 without restating prior year comparatives. As a

result, the Group results for the year ended 30 September 2020 are

not directly comparable with those reported in the prior year under

IAS 17 'Leases'. To provide meaningful comparatives, the results

for the year ended 30 September 2020 have therefore also been

presented on a proforma IAS 17 basis, see notes 2 and 13 for

additional information.

Organic revenues in our North American business declined by

18.5%, reflecting the volume impact of COVID-19 in the second half

of the year, which saw revenues decline by over 40%. Encouragingly,

new business for the full year was 6.9%, with significant levels of

growth from first time outsourcing and wins from smaller regional

players. Retention rates were high at 96.4%.

Our Sports & Leisure business - mainly stadia and

entertainment venues - remained closed throughout the second half

of the year. Our Education sector was significantly impacted by the

lockdown in March. As the new academic year began in August and

September we saw a mixed approach to reopening, especially within

our Higher Education sub sector where many clients are offering a

hybrid curriculum with online as well as live classes. Our Business

& Industry portfolio is more weighted towards 'Business' and

serving office based consumers where the return to work has been

slow. Our Healthcare & Seniors business grew by 4.5%, driven by

double digit new business wins. Most Defence, Offshore & Remote

locations have remained open during the year, however, changes to

working patterns have driven modest volume declines.

We have taken significant actions to mitigate the impact of

volume declines on our operating margin. We have renegotiated

contracts, furloughed employees and rightsized both in unit (MAP 4)

and above unit (MAP 5) costs. Underlying operating profit of GBP606

million, including GBP64 million of contract related non-current

asset impairment and onerous contract charges, decreased by 52.8%

on a constant currency basis. The full year underlying operating

margin was 4.8% ( 4.6% excluding the impact of IFRS 16 ), or 5.3%

before the impact of contract related non-current asset impairment

and onerous contract charges . The Q4 underlying margin, before the

impact of contract related non-current asset impairment and onerous

contract charges, was around 3%. With uncertainty around volume

recovery, the cost base remains under constant review to ensure

margin improvement in 2021.

Chief Executive's Statement (continued)

Europe - 25.0% Group revenue (2019(1,2) : 25.4%)

Underlying Change

Reported Constant Organic

Regional financial summary 2020 2019(1,2) rates currency

===================================== ========== ========== ========= ========== =========

Revenue GBP5,048m GBP6,391m (21.0)% (19.9)% (24.0)%

Regional operating (loss)/profit

(as reported) GBP(29)m GBP421m (106.9)% (107.0)% (104.8)%

Regional operating (loss)/profit

(proforma IAS 17)(1) GBP(35)m GBP421m (108.3)% (108.4)% (106.2)%

Regional operating margin (as

reported) (0.6)% 6.6% (720)bps

Regional operating margin (proforma

IAS 17)(1) (0.7)% 6.6% (730)bps

===================================== ========== ========== ========= ========== =========

1. The Group has adopted IFRS 16 'Leases' with effect from 1

October 2019 without restating prior year comparatives. As a

result, the Group results for the year ended 30 September 2020 are

not directly comparable with those reported in the prior year under

IAS 17 'Leases'. To provide meaningful comparatives, the results

for the year ended 30 September 2020 have therefore also been

presented on a proforma IAS 17 basis, see notes 2 and 13 for

additional information.

2. Prior year comparatives have reclassified Turkey and Middle

East from our Rest of World region into our Europe region.

Organic revenue declined by 24% for the full year. Revenues

declined by 44% in the second half given that 71% of Europe's

revenues are in Business & Industry (51%), Education (12%) and

Sports & Leisure (8%), the three sectors that have been most

impacted by the pandemic. Through the summer we saw a recovery in

Business & Industry as consumers returned to the office,

especially in continental Europe. In Education, the beginning of

the academic year in September has been positive especially in the

K-12 sub sector. Reopening of our clients in Higher Education has

been more mixed. Our Sports & Leisure business, which is

largely in the UK, remains closed.

Although new business wins were 2.8% and have been subdued

especially in the UK, France and Germany, we saw a higher

proportion of new business from small and regional players.

Retention has been broadly in line with previous years at

92.6%.

Across Europe, government schemes are supporting employees

during the pandemic. As these schemes end, we are having to take

resizing actions to adjust our cost base to reflect the current

trading environment.

The integration of Fazer, acquired in February, has proceeded at

a slightly slower pace than anticipated due to the pandemic.

Nevertheless, Fazer returned to profitability in September and is

on track to deliver the expected synergies.

As a result of the significant volume decline, the underlying

operating loss was GBP29 million. This includes GBP48 million of

contract related non-current asset impairment and onerous contract

charges . The underlying operating margin was 0.4% before the

contract related non-current asset impairment and onerous contract

charges, and negative 0.6% (negative 0.7% excluding the impact of

IFRS 16) including these impairments and charges. Encouragingly,

since the initial impact of lockdowns in March, the underlying

operating margin improved from negative 13% in Q3 to negative 4% in

Q4. We have taken the necessary actions to rebuild our margin in

the UK to offset the impact of lower reopening rates in Business

& Industry and the sustained closure of our Sports &

Leisure business with the benefits expected to come through in

2021.

Chief Executive's Statement (continued)

Rest of World - 11.9% Group revenue (2019(1,2) : 12.2%)

Underlying Change

Reported Constant Organic

Regional financial summary 2020 2019(1,2) rates currency

===================================== ========== ========== ========= ========== ========

Revenue GBP2,404m GBP3,067m (21.6)% (15.5)% (7.9)%

Regional operating profit (as

reported) GBP94m GBP232m (59.5)% (56.1)% (51.1)%

Regional operating profit (proforma

IAS 17)(1) GBP90m GBP232m (61.2)% (57.9)% (53.3)%

Regional operating margin (as

reported) 3.9% 7.6% (370)bps

Regional operating margin (proforma

IAS 17)(1) 3.7% 7.6% (390)bps

===================================== ========== ========== ========= ========== ========

1. The Group has adopted IFRS 16 'Leases' with effect from 1

October 2019 without restating prior year comparatives. As a

result, the Group results for the year ended 30 September 2020 are

not directly comparable with those reported in the prior year under

IAS 17 'Leases'. To provide meaningful comparatives, the results

for the year ended 30 September 2020 have therefore also been

presented on a proforma IAS 17 basis, see notes 2 and 13 for

additional information.

2. Prior year comparatives have reclassified Turkey and Middle

East from our Rest of World region into our Europe region.

Organic revenue declined by 7.9% as the volume impact of the

pandemic offset modest growth in Australia and in some countries

with Offshore and Remote businesses. The region was not as impacted

by the pandemic given that 54% of its revenues are in the Defence,

Offshore & Remote and Healthcare & Senior sectors.

New business wins in the year were 5.8%, with strong growth

rates in Brazil, Chile and India. Retention for the year was 93.4%,

however, we saw a significant improvement in the second half with

retention at around 95%.

We took swift actions to adjust our cost base to the new trading

environment, especially in Latin America.

Underlying operating profit was GBP94 million, including GBP7

million in contract related non-current asset impairment and

onerous contract charges. The impact of disposals, mainly the

Highway business in Japan, accounted for around GBP30 million of

the underlying operating profit decline. The full year underlying

operating margin was 3.9% (3.7% excluding the impact of IFRS 16),

or 4.2% before the impact of contract related non-current asset

impairment and onerous contract charges. The underlying operating

margin in the fourth quarter before the impact of contract related

non-current asset impairment and onerous contract charges was

2.8%.

Chief Executive's Statement (continued)

Earnings per share and the dividend

Underlying earnings per share was 18.6 pence, down 77.8% (19.1

pence down 77.2% excluding the impact of IFRS 16) on a constant

currency basis due to the impact of the pandemic. Although we

recognise the importance of the dividend to our shareholders, we

need to balance this with the impact that COVID-19 has had on our

business. As a result, as previously reported on 23 April, the

Board has decided not to pay a final dividend in respect of the

financial year ended 30 September 2020. The Board will keep future

dividends under review and will restart payments when it is

considered appropriate to do so.

On a statutory basis, operating profit for the year decreased by

81.9% to GBP294 million due to our lower underlying operating

profit, resizing costs, the cost action programme and GBP24 million

negative impact of foreign currency translation, partially offset

by a GBP28 million benefit from the adoption of IFRS 16. Statutory

earnings per share was 8.0p, down 88.8%.

Cash

Underlying free cash flow was GBP213 million. This is

significantly lower than last year mainly due to the impact of

COVID-19 on profits. Gross capital expenditure for the year was

GBP749 million, 3.7% of revenues. This was spent primarily on

contractually committed investment including GBP70 million on new

wins and retention in North America in the fourth quarter. Working

capital was a GBP143 million outflow. This is slightly higher than

in previous years as sales and payroll tax deferrals and excellent

collections were offset by the impact of having most of our cash

business in Sports & Leisure, and Business & Industry

closed. Net M&A totalled GBP450 million. The largest

acquisition was Fazer Food Services in the Nordics for GBP363

million net of cash acquired, offset by GBP29 million of disposals

net of exit costs, with the largest disposal being our highways

service business in Japan.

Balance sheet

At 30 September 2020 net debt was GBP3,006 million, including an

additional GBP939 million due to the implementation of IFRS 16

'Leases'. Net debt to EBITDA was 2.1x (excluding the impact of IFRS

16, net debt to EBITDA would have been 0.4x lower). During the

year, we took a series of steps to increase the resilience of our

balance sheet. We increased the Group's liquidity from GBP2,381

million to GBP4,787 million through a GBP1,972 million equity raise

and GBP800 million of additional committed and undrawn credit

facilities.

We obtained waivers of the leverage covenant test in our US

Private Placement agreements for the September 2020 and March 2021

test dates. The interest cover covenant test was also waived for

September 2020 and reset at more than or equal to 3x on a six

months proforma basis for March 2021.

These measures have increased our resilience and will allow us

to weather the crisis, whilst continuing to invest in the business

to support our long term growth prospects and enhance our

competitive advantages so we can continue to create long term value

for all our stakeholders.

In March, we qualified for and drew down GBP600 million from the

Bank of England's Covid Corporate Financing Facility (CCFF). This

was repaid in June with proceeds from the equity raise. The GBP600

million limit remains available whilst the CCFF remains in

place.

We are targeting strong investment grade credit ratings and net

debt to EBITDA in the range of 1x -1.5x. Beyond this, our

priorities for cash are: (i) invest capital expenditure to support

organic growth, (ii) bolt-on M&A opportunities that improve our

sector exposure or strengthen our capabilities. At the appropriate

time, we will resume the dividend and other returns to

shareholders.

People

People are the foundation of our business. The global impact of

COVID-19 has tested the strength, resilience and adaptability of

our teams more than ever. Our overriding focus has been the safety

and wellbeing of our colleagues during these difficult times.

There have been a range of initiatives developed locally to

support our People through the crisis. Markets as varied as the UK,

Canada, India and Argentina are providing colleagues with support

and assistance programmes to help them cope with uncertainty, fear

and anxiety.

The pandemic has impacted some of our sectors more than others.

We have tried to protect as many jobs as possible. Employees

working in units that have been closed have, where possible, been

redeployed to other sites where critical work is still required

such as Healthcare & Seniors , Education and Defence. Where

redeployment has not been possible, support has been provided

locally through mechanisms such as employee assistance programmes

and hardship funds.

Chief Executive's Statement (continued)

We are committed to hiring, developing and retaining our diverse

talent to ensure we have a truly engaged, high performing and

fulfilled workforce so we can drive our business forward. This

year, we have signed the Race at Work Charter, which has been

designed to foster a commitment to improving outcomes for ethnic

minority employees in the workplace. Although we continue to

progress the levels of representation of women in our senior ranks,

there is more we need to do to fully reflect the rich diversity of

the communities in which we operate.

Purpose

Our purpose is mainly a social purpose: to keep our people and

our consumers safe and healthy, provide healthy food and nutrition,

while making the world a better place by protecting the environment

and supporting local communities.

We have introduced new protocols to help protect our people and

consumers from COVID-19. Working in partnership with our clients,

we have transformed thousands of sites around the world to be

COVID-19 secure, facilitating social distancing and introducing

enhanced hygiene measures. We continue to take measures to protect

our employees. Our global Lost Time Incident Frequency Rate has

dropped by 42% since 2016.

While the pandemic has resulted in some delays in climate change

action in some of our markets, we remain committed to reducing our

CO(2) footprint and getting ready to set Science Based Targets to

play our part in limiting global warming to below 1.5 (--) C.

During the pandemic our teams around the world have mobilised

resources at scale and with pace to allow us to support governments

and Healthcare clients. We have also prepared and delivered food to

critical and essential workers, the elderly, vulnerable and those

in financial distress, often working in partnership with grassroots

support organisations.

As we look ahead, we will focus our efforts further on three

priorities: food waste, environmental impact - including climate

change - and responsible and resilient sourcing.

Summary and outlook

The Group has responded admirably to unprecedented

circumstances. We supported the front line without compromising on

the health and safety of our people, clients and consumers. We

acted quickly to mitigate costs, increase our liquidity and

strengthen our balance sheet. We have renegotiated contracts to

reflect the difficult trading environment while continuing to

remain disciplined in terms of costs. These actions, combined with

some improvement in volumes, allowed us to return to profitability

in the fourth quarter and we are now cash neutral. We continue to

execute at pace and expect the underlying operating margin in the

first quarter of 2021 to be around 2.5%.

We are taking proactive actions to adapt our operations and

control the controllable to ensure the business can thrive despite

the pandemic and is well placed for the recovery. We are innovating

and evolving our operating model to be more flexible and to provide

our clients and consumers with an exciting offer that is delivered

safely and provides great value. This, combined with our existing

scale, ability to flex costs and focus on operational execution,

will allow us to return to a Group underlying margin of above 7%

before we return to pre-COVID volumes.

Although much has changed, the Compass model of value creation

remains the same. We leverage our scale and focus on best in class

operational execution to drive organic revenue growth and margins.

This is combined with a disciplined approach to capital allocation

that rewards shareholders while supporting reinvestment in the

business.

Whilst this crisis has placed significant pressure on the Group

in the short term, we are very confident in our medium and long

term growth prospects. We remain excited about the significant

structural growth opportunities globally, the potential for further

revenue and profit growth, and returns to shareholders over

time.

Dominic Blakemore

Group Chief Executive Officer

24 November 2020

Business Review

Compass is well positioned for the future as it addresses the

challenges of COVID-19.

Financial summary 2020 2019(1,2)

GBPm GBPm Decrease

Revenue

Underlying at constant currency 20,198 24,769 (18.5)%

Underlying at reported rates 20,198 25,152 (19.7)%

Statutory 19,940 24,878 (19.8)%

Organic change (18.8)% 6.4%

====================================================== ======== ========== =========

Total operating profit

Underlying at constant currency 561 1,852 (69.7)%

Underlying at constant currency (IAS 17 proforma)(1) 533 1,852 (71.2)%

Underlying at reported rates 561 1,882 (70.2)%

Statutory 294 1,626 (81.9)%

====================================================== ======== ========== =========

Operating margin

Underlying at reported rates 2.9% 7.4% (450)bps

Underlying at reported rates (IAS 17 proforma)(1) 2.8% 7.4% (460)bps

Profit before tax

Underlying at constant currency 427 1,743 (75.5)%

Underlying at reported rates 427 1,772 (75.9)%

Statutory 210 1,494 (85.9)%

====================================================== ======== ========== =========

Basic earnings per share

Underlying at constant currency 18.6p 83.8p (77.8)%

Underlying at constant currency (IAS 17 proforma)(1) 19.1p 83.8p (77.2)%

Underlying at reported rates 18.6p 85.2p (78.2)%

Statutory 8.0p 71.6p (88.8)%

====================================================== ======== ========== =========

Free cash flow

Underlying 213 1,247 (82.9)%

Reported 105 1,218 (91.4)%

====================================================== ======== ========== =========

Full year dividend per ordinary share - 40.0p

====================================================== ======== ========== =========

1. The Group has adopted IFRS 16 'Leases' with effect from 1

October 2019 without restating prior year comparatives. As a

result, the Group results for the year ended 30 September 2020 are

not directly comparable with those reported in the prior year under

IAS 17 'Leases'. To provide meaningful comparatives, the results

for the year ended 30 September 2020 have therefore also been

presented on a proforma IAS 17 basis, see notes 2 and 13 for

additional information.

2. Prior year comparatives have been restated as required by

IFRS 5 'Non-current assets held for sale and discontinued

operations' to account for joint ventures and associates using the

equity method retrospectively when they cease to be classified as

held for sale. Additional information is included in note 11.

Definitions of underlying measures of performance can be found

in the glossary on pages 5 3 and 54 .

Business Review (continued)

Segmental performance

Underlying revenue(1) Underlying revenue change(2)

======================== =================================

2020 2019(3) Reported Constant

GBPm GBPm rates currency Organic

=============== =========== =========== =========== ========== ========

North America 12,746 15,694 (18.8)% (18.4)% (18.5)%

Europe 5,048 6,391 (21.0)% (19.9)% (24.0)%

Rest of World 2,404 3,067 (21.6)% (15.5)% (7.9)%

=============== =========== =========== =========== ========== ========

Total 20,198 25,152 (19.7)% (18.5)% (18.8)%

=============== =========== =========== =========== ========== ========

Underlying operating profit(1) Underlying operating margin(1)

===================================

2020 2020(4) 2019(3,4) 2020 2020(4) 2019(3,4)

(proforma (proforma

IAS 17) IAS 17)

GBPm GBPm GBPm

========================= ====== ============== =========== ======== ============ ===========

North America 606 588 1,290 4.8% 4.6% 8.2%

Europe (29) (35) 421 (0.6)% (0.7)% 6.6%

Rest of World 94 90 232 3.9% 3.7% 7.6%

Unallocated overheads (85) (85) (80)

========================= ====== ============== =========== ======== ============ ===========

Total before associates 586 558 1,863 2.9% 2.8% 7.4%

======== ============ ===========

Associates (25) (25) 19

========================= ====== ============== ===========

Total 561 533 1,882

========================= ====== ============== ===========

Statutory and underlying results

2020 2019(4,5)

Statutory Adjustments Underlying Statutory Adjustments Underlying

GBPm GBPm GBPm GBPm GBPm GBPm

========== ============ =========== ========== ============ ===========

Revenue 19,940 258 20,198 24,878 274 25,152

====================== ========== ============ =========== ========== ============ ===========

Operating profit 294 267 561 1,626 256 1,882

Net gain/(loss)

on sale and closure

of businesses 59 (59) - (7) 7 -

Net finance costs (143) 9 (134) (125) 15 (110)

Profit before tax 210 217 427 1,494 278 1,772

Tax (75) (41) (116) (351) (62) (413)

====================== ========== ============ =========== ========== ============ ===========

Profit after tax 135 176 311 1,143 216 1,359

Non-controlling

interest (2) - (2) (8) - (8)

Attributable profit 133 176 309 1,135 216 1,351

====================== ========== ============ =========== ========== ============ ===========

Average number of

shares (millions) 1,658 - 1,658 1,586 - 1,586

Basic earnings per

share (pence) 8.0p 10.6p 18.6p 71.6p 13.6p 85.2p

====================== ========== ============ =========== ========== ============ ===========

EBITDA 1,418 2,459

Gross capex 749 853

Free cash flow 213 1,247

====================== ========== ============ =========== ========== ============ ===========

1. Definitions of underlying measures of performance can be

found in the glossary on pages 5 3 and 54 .

2. Reconciliation between the different growth rates is provided

in note 13 .

3. Prior year comparatives have reclassified Turkey and Middle

East from our Rest of World region into our Europe region.

4. The Group has adopted IFRS 16 'Leases' with effect from 1

October 2019 without restating prior year comparatives. As a

result, the Group results for the year ended 30 September 2020 are

not directly comparable with those reported in the prior year under

IAS 17 'Leases'. To provide meaningful comparatives, the results

for the year ended 30 September 2020 have therefore also been

presented on a proforma IAS 17 basis, see notes 2 and 13 for

additional information.

5. Prior year comparatives have been restated as required by

IFRS 5 'Non-current assets held for sale and discontinued

operations' to account for joint ventures and associates using the

equity method retrospectively when they cease to be classified as

held for sale. Additional information is included in note 11.

Further details of the adjustments can be found in the

consolidated income statement, note 3 segmental reporting and note

12 statutory and underlying results.

Business Review (continued)

Adoption of new accounting standards

The Group has applied the new accounting standard IFRS 16

'Leases' using the modified retrospective transition approach,

therefore the comparative information has not been restated and

continues to be reported under IAS 17 'Leases' and IFRIC 4

'Determining whether an arrangement contains a lease'.

Statutory results

Revenue

On a statutory basis, revenue was GBP19,940 million (2019:

GBP24,878 million), a decline of 19.8% due to the negative impact

of COVID-19.

Operating profit

Operating profit was GBP294 million (2019(1) : GBP1,626

million), a decrease of 81.9%, mainly reflecting the negative

impact of COVID-19, including a GBP119 million one off non-cash

charge in relation to contract related non-current asset impairment

and onerous contract charges . The reduction in operating profit

was also driven by the costs associated with the programmes aimed

at right sizing the business, partially offset by the savings

related to these programmes and a modest benefit from the

implementation of IFRS 16.

Statutory operating profit includes non-underlying items of

GBP267 million (2019(1) : GBP256 million), including a GBP75

million charge in relation to the continuation of the cost action

programme announced in November 2019 (2019: GBP190 million),

COVID-19 resizing costs of GBP122 million (2019: GBPnil) and

acquisition related costs of GBP70 million (2019: GBP54 million). A

full list of non-underlying items is included in note 12.

Net gain on sale and closure of businesses

As a result of the strategic review of the business, the Group

has continued to sell or exit its operations in a number of

countries, sectors or businesses in order to simplify its

portfolio. Activity in the period has included the sale of 50% of

the Japanese Highways business. The Group has recognised a net gain

of GBP115 million on the sale and closure of businesses (2019:

GBP50 million gain), offset by GBP56 million of exit costs and

asset write downs relating to committed or completed business exits

(2019: GBP57 million).

The Group's consolidated balance sheet includes assets of GBP13

million (2019(1) : GBP135 million) and liabilities of GBP7 million

(2019: GBP30 million) in respect of businesses held for sale. This

decrease is driven by the Group's decision to pause the disposal of

the remaining US laundries and some businesses in Rest of World due

to the market volatility caused by COVID-19. As a result,

management no longer considers these disposals are highly probable

and likely to be completed within 12 months and therefore these

businesses are no longer classified as held for sale.

Finance costs

Net finance costs increased to GBP143 million (2019: GBP125

million), mainly due to the adoption of IFRS 16 which resulted in

an additional GBP36 million of net interest payable, partially

offset by lower interest rates compared to the prior year and a

reduction in net debt following the equity raise.

Tax charge

Profit before tax was GBP 210 million (2019(1) : GBP1,494

million), giving rise to an income tax expense of GBP75 million

(2019: GBP351 million), equivalent to an effective tax rate of 35.7

% (2019(1) : 23.5%). The increase in rate primarily reflects the

mix of profits by country taxed at different rates and the higher

effective tax rate on sale and closure of businesses.

Earnings per share

Basic earnings per share were 8.0 pence (2019(1) : 71.6 pence),

a decrease of 88.8%, mainly as a result of the negative impact of

COVID-19 and an increase in the number of ordinary shares in issue

following the placing of shares in May 2020 .

1. Prior year comparatives have been restated as required by

IFRS 5 'Non-current assets held for sale and discontinued

operations' to account for joint ventures and associates using the

equity method retrospectively when they cease to be classified as

held for sale. Additional information is included in note 11.

Business Review (continued)

Underlying results

We track our performance against underlying and other

alternative performance measures, which we believe better reflect

our strategic priorities of growth, efficiency and shareholder

returns.

A summary of adjustments from statutory results to underlying

results is shown in note 12 on pages 49 and 50 and further detailed

in the consolidated income statement (page 30 ), reconciliation of

free cash flow (page 36 ), note 3 segmental reporting (page 42 )

and note 13 organic revenue and organic profit (page 51 ).

Revenue

On an organic basis, revenue decreased by 18.8%, reflecting the

negative impact of COVID-19. The steps taken to contain the spread

of the virus impacted our sectors in different ways. Revenues in

Healthcare & Seniors and Defence, Offshore & Remote were

good. Our Education and Business & Industry sectors were mostly

closed in April and May, and started to cautiously reopen in June,

while Sports & Leisure remained fully closed. In the last

quarter of the year, the Group's organic revenue performance

improved as clients in Education and Business & Industry began

to return to schools and offices in our main markets. By September,

all sectors except Sports & Leisure were partially or fully

open, representing about 65% of the business. Retention was robust

at 95.1% and we have started to see attractive new first time

outsourcing opportunities. New business wins were 5.7 % and

like for like revenue decline was 1 9.6 %.

Operating profit

Underlying operating profit was GBP561 million (2019: GBP1,882

million), a decrease of 70.2%, reflecting the impact from COVID-19

and the resulting lower volumes. Operating profit for the year has

been negatively impacted by a non-cash charge of GBP119 million

comprising contract related non-current asset impairment (GBP88

million) and onerous contract charges (GBP31 million) for contracts

impacted by COVID-19 and that are now considered to be structurally

loss making.

If we restate 2019's profit at the 2020 average exchange rates,

it would decrease by GBP30 million to GBP1,852 million. On a

constant currency basis, underlying operating profit has therefore

decreased by GBP1,291 million, or 69.7%.

The impact of IFRS 16 for the twelve months of 2020 was to

increase underlying operating profit by GBP28 million.

Operating margin

The operating profit margin was 2.9% (2.8% excluding the impact

of IFRS 16), reflecting the impact of COVID-19 (2019: 7.4%). As our

business started to reopen and after strong mitigating actions to

compensate for lower volumes and relentless focus on cost

efficiencies, the business returned to profitability in the fourth

quarter.

Finance costs

The underlying net finance cost increased to GBP134 million

(2019: GBP110 million), mainly due to the adoption of IFRS 16 which

resulted in an additional GBP36 million of net interest payable,

partially offset by lower interest rates compared to the prior year

and a reduction in net debt following the equity raise.

Tax charge

On an underlying basis, the tax charge was GBP 116 million

(2019: GBP413 million), equivalent to an effective tax rate of

27.2% (2019: 23.3%). The increase in rate primarily reflects the

mix of profits by country taxed at different rates. The tax

environment continues to be uncertain, with more challenging tax

authority audits and enquiries globally.

Earnings per share

On a constant cu rrency basis, the underlying basic earnings per

share fell by 77.8% to 18.6 pence (2019: 83.8 pence). The decrease

is mainly driven by the negative impact of COVID-19 and an increase

in the number of ordinary shares in issue following the placing of

shares in May 2020 .

Business Review (continued)

Shareholder returns

Dividends

As a result of the impact of the COVID-19 pandemic, in April

2020, the Board decided not to recommend an interim or final

dividend. The Board understands the importance of the dividend to

our shareholders and will keep future dividends under review and

will restart payments when it is appropriate to do so.

In determining the level of dividend in any year, the Board

considers a number of factors, which include but are not limited

to:

-- the level of available distributable reserves in the Parent

Company

-- future cash commitments and investment requirements to

sustain the long term growth prospects of the business

-- potential strategic opportunities

-- the level of dividend cover

Further surpluses, after considering the matters set out above,

may be distributed to shareholders over time by way of special

dividend payments, share repurchases or a combination of both.

Compass Group PLC, the Parent Company of the Group, is a

non-trading investment holding company which derives its

distributable reserves from dividends paid by subsidiary companies.

The level of distributable reserves in the Parent Company is

reviewed annually and the Group aims to maintain distributable

reserves that provide adequate cover for dividend payments. The

distributable reserves of the Parent Company include the balance on

the profit and loss account reserve, which at 30 September 2020

increased to GBP2,935 million (2019: GBP1,252

million) mainly due to the placing of new equity on 21 May 2020.

The ability of the Board to maintain its future dividend policy

will be influenced by a number of the principal risks identified on

pages 21 to 29 that could adversely impact the performance of the

Group, although we believe we have the ability to mitigate those

risks as outlined on pages 25 to 29.

The Group continues to have substantial available liquidity and

it is our ambition to resume dividend payments. While the current

uncertainty caused by the COVID-19 situation makes it difficult to

accurately forecast the timing and extent of profit recovery, we

continue to see good long term opportunities for the business.

Placing of shares

The Group raised net proceeds of GBP1,972 million through a

placing of new ordinary shares on 21 May 2020. The placing

comprised 195,667,352 new ordinary shares at a price of GBP10.25

per share, representing a discount of 3.3% to the middle market

price at the time at which the placing price was agreed. The total

number of new shares issued represented approximately 12.3% of

Compass' existing issued ordinary share capital prior to the

capital raise. The proceeds from the placing have strengthened the

Group's balance sheet and liquidity position, reducing leverage to

deal with the challenging environment and ensure Compass remains

resilient in the event of further negative developments in the

pandemic. These measures will enable Compass to continue to invest

in the business to support long term growth, ensuring it is well

positioned for the eventual recovery.

Share buyback programme

The Group did not buy any shares during the period under the

share buyback programme (2019: GBPnil). The directors' authority to

purchase the Company's shares in the market was renewed by the

shareholders at the Company's Annual General Meeting held on 6

February 2020.

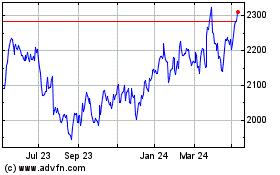

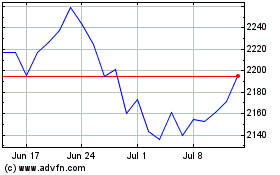

Share price

The market price of the Group's ordinary shares at 30 September

2020 was GBP11.69 per share (2019: GBP20.93 per share).

Business Review (continued)

Free cash flow

Free cash flow totalled GBP105 million (2019: GBP1,218 million).

During the year, we made cash payments of GBP108 million in

relation to the programmes aimed at right sizing the business

(2019: GBP29 million). Adjusting for this, underlying free cash

flow was GBP213 million, an 82.9% decrease as a result of the

impact of COVID-19 on profitability and cash generation. Underlying

free cash flow conversion was 38 % (2019: 66%).

Gross capital expenditure of GBP749 million (2019: GBP853

million) is equivalent to 3.7% (2019: 3.4%) of underlying

revenue.

The working capital outflow, excluding provisions and pensions,

was GBP143 million (2019: GBP59 million inflow) and includes a

GBP234 million benefit from COVID-19 indirect and payroll tax

payment deferral schemes available in different countries .

The outflow related to post employment benefit obligations net

of service costs was GBP9 million (2019: GBP15 million).

The net interest outflow was GBP137 million (2019: GBP107

million), of which GBP 36 million relates to interest on lease

obligations.

The net tax paid was GBP228 million (2019: GBP328 million),

equivalent to an underlying cash tax rate of 53 % (2019: 19%). The

percentage increase is due to changes in the UK's corporation tax

instalment regime and tax payments made based on higher profits

arising before the COVID-19 outbreak, partially offset by corporate

income tax payments deferred as a result of COVID-19.

Acquisitions

The total cash spent on acquisitions in the year, net of cash

acquired, was GBP479 million (2019: GBP478 million), comprising

GBP480 million of bolt-on acquisitions and investments in

associates and GBP24 million of contingent consideration relating

to prior years' acquisitions, offset by GBP25 million of cash

acquired net of transaction costs.

The main acquisition during the year was the purchase of 100% of

the issued share capital of Fazer Food Services for an initial

consideration of GBP363 million (EUR414 million) net of cash

acquired. The remaining contingent consideration is payable within

seven years and is dependent on the operation of an earn-out. The

net present value of the contingent consideration was GBP56 million

(EUR66 million) at the date of acquisition. Fazer Food Services is

a leading food service business in the Nordic region with

operations in Finland, Sweden, Norway and Denmark across several

sectors including Business & Industry, Education, Healthcare

& Seniors and Defence.

Disposals

The Group has continued to simplify its portfolio and has sold

50% of its interest in the Japanese Highways business during the

year. The Group received GBP 29 million (2019: GBP101 million) in

respect of disposal proceeds net of exit costs.

At 30 September 2020, the Group has net assets and liabilities

totalling GBP6 million classified as held for sale in relation to

certain businesses as these disposals are highly probable and

expected to be completed within 12 months.

Financial position

Liquidity

The Group finances its operations through cash generated by the

business and borrowings from a number of sources including the

bank, the public and the private placement markets. The Group has

developed long term relationships with a number of financial

counterparties with the balance sheet strength and credit quality

to provide credit facilities as required. The Group seeks to avoid

a concentration of debt maturities in any one period to spread its

refinancing risk. The maturity profile of the Group's principal

borrowings at 30 September 2020 shows that the average period to

maturity is 4.6 years (2019: 5.4 years).

We have taken steps to strengthen the Group's financial

position. In March 2020, the Group qualified for and drew down

GBP600 million from the Bank of England's Covid Corporate Financing

Facility (CCFF) which was repaid in June. In April, we put in place

an additional Revolving Credit Facility(1) (RCF) of GBP800 million

and as at 30 September 2020 had total undrawn committed credit

facilities of GBP2,800 million. The GBP600 million CCFF limit

remains available whilst the CCFF is open.

We have obtained a waiver of the leverage covenant test in our

US Private Placement agreements for the September 2020 and March

2021 test dates. The interest cover covenant test has also been

waived for September 2020 and reset at more than or equal to 3x on

a six months proforma basis for March 2021. Finally, Standard &

Poor reaffirmed our long term (A) and short term (A-1) credit

ratings on 24 March (the outlook was changed to Negative) and

Moody's A3/P-2 long and short term credit ratings and Stable

Outlook remain unchanged.

1. Contains no financial covenants.

Business Review (continued)

In May 2020, the Group completed a GBP 1,972 million equity

raise to strengthen the balance sheet and liquidity position,

reducing leverage to deal with the challenging environment and

ensure Compass remains resilient in the event of further negative

developments in the pandemic. These measures will enable Compass to

continue to invest in the business to support long term growth,

ensuring it is well positioned for the eventual recovery.

Proceeds from the equity raised were used to repay: GBP600

million of CCFF, GBP350 million of drawn credit facilities and

GBP214 million maturing Commercial Paper.

As of 30 September 2020, the Group had access to GBP4,787

million in total liquidity, including GBP2,800 million in undrawn

committed bank facilities (2019: GBP2,000 million), GBP600 million

available in CCFF and GBP1,387 million in cash net of overdrafts.

Our solid financial position will allow us to weather the crisis

whilst continuing to invest in the business to strengthen our

competitive advantages and support our long term growth

prospects.

Net debt

The ratio of net debt to market capitalisation of GBP20,871

million at 30 September 2020 was 14.4% (2019: 9.8%).

Net debt decreased to GBP3,006 million (2019: GBP3,272 million)

despite GBP995 million of net debt added on the adoption of IFRS

16, offset by GBP1,972 million from the equity raise. The ratio of

net debt to EBITDA was 2.1x. Our leverage policy is to maintain

strong investment grade credit ratings and to target net debt to

EBITDA in the range of 1x to 1.5x.

The Group generated GBP213 million of underlying free cash flow

(2019: GBP1,247 million), including investing GBP706 million in net

capital expenditure, and spent GBP450 million on acquisitions net

of disposal proceeds. GBP427 million was paid in respect of the

final dividend for the 2019 financial year. The remaining GBP47

million increase in net debt related predominantly to cash spent in

relation to the cost action programme and resizing costs (GBP108

million) partially offset by other non-cash movements and currency

translation (GBP61 million).

Return on capital employed

Return on capital employed was 4.7% (2019: 19.5%) based on net

underlying operating profit after tax at the underlying effective

tax rate of 27.2% (2019: 23.3%). This decrease mainly reflects the

impact of COVID-19 and a

30 bps decrease due to the implementation of IFRS 16. The

average capital employed was GBP8,683 million (2019: GBP7,380

million).

Post employment benefit obligations

The Group has continued to review and monitor its pension

obligations throughout the period, working closely with the

trustees and actuaries of all schemes around the Group to ensure

appropriate assumptions are used and adequate provision and

contributions are made.

The Compass Group Pension Plan (UK) surplus of GBP441 million

(2019: GBP448 million) and the deficit in the rest of the Group's

defined benefit pension schemes of GBP251 million (2019: GBP259

million) have remained relatively unchanged year on year.

The total pensions charge for defined contribution schemes in

the year was GBP118 million (2019: GBP126 million) and GBP21

million (2019: GBP33 million) for defined benefit schemes.

Financial management

The Group manages its liquidity, foreign currency exposure and

interest rate in accordance with the policies set out below.

The Group's financial instruments comprise cash, borrowings,

receivables and payables that are used to finance the Group's

operations. The Group also uses derivatives, principally interest

rate swaps, forward currency contracts and cross currency swaps, to

manage interest rate and currency risks arising from the Group's

operations. The Group does not trade in financial instruments. The

Group's treasury policies are designed to mitigate the impact of

fluctuations in interest rates and exchange rates and to manage the

Group's financial risks. The Board approves any changes to the

policies.

Foreign currency risk

The Group's policy is to balance its principal projected cash

flows by currency to actual or effective borrowings in the same

currency. As currency cash flows are generated, they are used to

service and repay debt in the same currency. Where necessary, to

implement this policy, forward currency contracts and cross

currency swaps are taken out which, when applied to the actual

currency borrowings, convert these to the required currency.

Business Review (continued)

The borrowings in each currency can give rise to foreign

exchange differences on translation into sterling. Where the

borrowings are either less than, or equal to, the net investment in

overseas operations, these exchange rate movements are treated as

movements on reserves and recorded in the consolidated statement of

comprehensive income rather than in the consolidated income

statement.

Non-sterling earnings streams are translated at the average rate

of exchange for the year. Fluctuations in exchange rates have

given, and will continue to give, rise to translation differences.

The Group is only partially protected from the impact of such

differences through the matching of cash flows to currency

borrowings.

Interest rate risk

As set out above, the Group has effective borrowings in a number

of currencies and its policy is to ensure that, in the short term,

it is not materially exposed to fluctuations in interest rates in

its principal currencies. The Group implements this policy either

by borrowing fixed rate debt or by using interest rate swaps so

that the interest rates on

at least 80% of the Group's projected debt are fixed for one

year. For the second and third year, interest rates are fixed

within ranges of 30%-70% and 0%-40% respectively.

Group tax policy

As a Group, we are committed to creating long term shareholder

value through the responsible, sustainable and efficient delivery

of our key business objectives. This will enable us to grow the

business and make significant investments in the Group and its

operations.

We therefore adopt an approach to tax that supports this

strategy and also balances the various interests of our

stakeholders including shareholders, governments, employees and the

communities in which we operate. Our aim is to pursue a principled

and sustainable tax strategy that has strong commercial merit and

is aligned with our business strategy. We believe this will enhance

shareholder value whilst protecting Compass' reputation.

In doing so, we act in compliance with the relevant local and

international laws and disclosure requirements, and we conduct an

open and transparent relationship with the relevant tax authorities

that fully complies with the Group's Code of Business Conduct and

Code of Ethics.

After many years of operations, the Group has numerous legacy

subsidiaries across the world. Whilst some of these entities are

incorporated in low tax territories, Compass does not seek to avoid

tax through the use of tax havens. Details of the Group's related

undertakings are listed in note 36 of the Annual Report.

In an increasingly complex international corporate tax

environment, a degree of tax risk and uncertainty is, however,

inevitable. Tax risk can arise from differences in interpretation

of regulations, but most significantly where governments apply

diverging standards in assessing intragroup cross border

transactions. This is the situation for many multinational

organisations. We manage and control these risks in a proactive

manner and, in doing so, exercise our judgement and seek

appropriate advice from relevant professional firms. Tax risks are

assessed as part of the Group's formal governance process and are

reviewed by the Board and the Audit Committee on a regular

basis.

Risks and uncertainties

The Board takes a proactive approach to risk management with the

aim of protecting its employees and customers and safeguarding the

interests of the Group, its shareholders, employees, clients,

consumers and other stakeholders.

The principal risks and uncertainties that face the business and

the activities the Group undertakes to mitigate these are set out

on pages 21 to 29.

Related party transactions

Details of transactions with related parties are set out in note

31 of the consolidated financial statements in the 2020 Annual

Report. These transactions have not had, and are not expected to

have, a material effect on the financial performance or position of

the Group.

Business Review (continued)

Going concern

The uncertainty as to the future impact on the financial

performance and cash flows of the Group as a result of the recent

COVID-19 outbreak has been considered as part of the Group's

adoption of the going concern basis in its financial statements.

The factors considered by the directors in assessing the ability of

the Group to continue as a going concern are included in note

1.

The Group has access to considerable financial resources

together with longer term contracts with a number of customers and

suppliers across different geographic areas and industries. As a

consequence, the directors believe that the Group is well placed to

manage its business risks successfully during this period of

uncertainty.

Based on the assessment discussed in note 1, the directors have

a reasonable expectation that the Group has adequate resources to

continue in operational existence for the 12 months from the date

of approval of the financial statements. For this reason, they

continue to adopt the going concern basis in preparing the

financial statements.

Viability statement

In accordance with provision 31 of the UK Corporate Governance

Code 2018, the directors have assessed the viability of the Group,

taking into account the Group's current position, the latest three

year strategic plan, and the potential impact of the principal

risks documented on pages 21 to 29. Based on this assessment, the

directors confirm that they have a reasonable expectation that the

Group will be able to continue in operation and meet its

liabilities as they fall due over the period to 30 September

2023.

Group's strategic planning process

The Board considers annually and on a rolling basis a three

year, bottom up strategic plan. Current year business performance

is reforecast during the year and a more detailed budget is

prepared for the following year. The most recent financial plan was

approved by the Board in September 2020 and subsequently updated in

November 2020 in the light of the recent resumption of lockdowns in

some of our major markets. The directors acknowledge the heightened

uncertainty of the Group's strategic plans in the current

environment and as a result have considered a range of different

scenarios. The plan is reviewed and approved by the Board, with

involvement throughout from the Group CEO, Group CFO and the

management team. Part of the Board's role is to consider the

appropriateness of key assumptions, considering the external

environment, business strategy and model including the impact of

COVID-19.

Period of assessment

The directors have determined that a three year period to 30

September 2023 is an appropriate period over which to provide its

viability statement. Having considered whether the assessment

period of three years should be extended in light of COVID-19, it

is the directors' view that three years is an appropriate period

given this is the period reviewed by the Board in its strategic

planning process and is also aligned to the Group's typical

contract length (three to five years). The directors believe that

this presents the Board and readers of the Annual Report with a

reasonable degree of confidence over this longer term outlook.

Viability assessment and COVID-19

In making this assessment, the Board carried out a robust

evaluation of the principal risks facing the Group, including those

that would threaten its business model, future performance,

solvency or liquidity. The output of the strategic plan is used to

perform a central debt and headroom profile analysis, which

includes a review of sensitivity to 'business as usual' risks and

severe but plausible events. It also considers the ability of the

Group to raise finance and deploy capital. The results consider the

availability and likely effectiveness of the mitigating actions

that could be taken to avoid or reduce the impact or occurrence of

the identified underlying risks.

While the review has considered all the principal risks

identified by the Group, there was a focus on how the COVID-19

pandemic risk could impact the Group's future financial performance

and cash flows under different scenarios. As a result, COVID-19

severe yet plausible downside sensitivities have been applied to

the three year plan approved by the Board. These were based on the

potential financial impact of the Group's principal risks and

uncertainties and the specific risks associated with the COVID-19

pandemic.

The COVID-19 downside sensitivities have been assumed to occur

over the same three year period in order to assess the Group's

ability to withstand multiple challenges.

In the three year plan approved by the Board, consistent with

current trading patterns, the business that is closed is assumed to

continue reopening in a phased manner and gradually recover. Given

the three year plan is most sensitive to changes in the duration

and severity of the impact of the pandemic, a prudent approach has

been taken to stress test this three year plan with downside

scenarios as explained below:

Business Review (continued)

-- 'additional global wave' scenario : assumption that a further

global wave of infections and government enforced restrictions

occurs in financial year 2021 and lasts for a full quarter, with

trading patterns and subsequent recovery mirroring that experienced

during the first global wave. This scenario mirrors the experience

of the first global wave experienced in all major markets at the

same time

-- 'prolonged downturn' scenario: assumes that, after an