Caledonian Trust PLC - Final Results

December 18 1997 - 1:18PM

UK Regulatory

RNS No 8700u

CALEDONIAN TRUST PLC

18th December 1997

CALEDONIAN TRUST - RESULTS TO 30 JUNE 1997

Caledonian Trust PLC, the Edinburgh based property investment company,

announces its audited results for the year to 30 June 1997.

1997 1996

Rents received #3.40m #3.27m

Property Sales #0.09m -

Profit #0.99m #0.60m

E.P.S. 8.1p 5.1p

Shareholders Capital and Reserves #10.1m #11.4m

Property Assets #31.7m #32.8m

The Director's Report and Accounts will be circularised to all shareholders

within the next few days and copies are available from the Company's Head Office

at 61 North Castle Street, Edinburgh, EH2 3LJ and will also be available for the

next fourteen days in the offices of Neill Clerk Capital Limited, 1 Portland

Place, London W1n 3AA

Douglas Lowe, Chief Executive of Caledonian Trust PLC says:

"Profits have risen by 65% to #0.99m and earnings per share by 59% to

8.1p as a result of higher rents and lower administration costs and

interest costs. Unfortunately, due primarily to shortening lease

lengths and the continued poor performance of Scottish offices, the

value of some of our investments has fallen and the NAV per share has

declined from 95.6p to 82.6p.

Short-term interest rates should peak soon and the drop in long-term

rates is not yet reflected in property yields. Rental growth is

returning to some of our markets, especially in Edinburgh where the

Parliament will increase demand, and this growth should increase

investment values.

We are selling some properties to reinvest in more attractive areas

and activities. Over the year the Group has benefited from its

take-over of CCL Developments plc and will benefit from agreed tax

losses from previous years of #4.75m, which are available to reduce

future taxation. I expect our strengthening markets to provide

opportunities for further corporate development.

Trading this year is very satisfactory despite the rise in short-term

interest rates."

END

FR FFDFWAUWUFFE

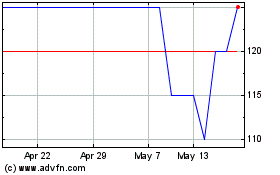

Caledonian (LSE:CNN)

Historical Stock Chart

From Aug 2024 to Sep 2024

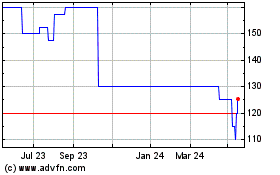

Caledonian (LSE:CNN)

Historical Stock Chart

From Sep 2023 to Sep 2024