TIDMCHAR

RNS Number : 3538A

Chariot Oil & Gas Ld

29 September 2020

29 September 2020

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

H1 2020 Results

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins

focused energy company, today announces its unaudited interim

results for the six-month period ended 30 June 2020.

-- New Executive Team appointed with new values, mission and

energy to create growth and deliver positive change through

investment in projects that are driving the energy revolution

-- Upgrade of audited total remaining recoverable resource to in

excess of 1 Tcf for Anchois, representing a 148% increase

(comprising 361 Bcf 2C contingent resources and 690 Bcf 2U

prospective resources)

-- New ventures are being evaluated, defined by Chariot's

values, strengths and the scalability of the opportunities

Adonis Pouroulis, Acting CEO of Chariot commented:

"This is an exciting phase in the evolution of the Company as

the new team takes action to drive the Lixus opportunity forward

and bring in value-accretive new ventures that play into the energy

transition theme. With each day that passes more potential in the

Lixus licence is uncovered, delineating a major gas resource with

strong ESG credentials and national significance for Morocco.

Africa is the one continent where population growth and demand

for power are rising rapidly and are projected to continue to rise

throughout this century. With this, Chariot is ideally placed with

its Moroccan gas development foothold to reach out and invest into

other alternative projects that embody our core values, demonstrate

our vision and create value for shareholders as we seek to make the

Company more relevant to future energy needs.

The work the team has undertaken to advance the Anchois project

during the period, in what is shaping up to be a multi-Tcf

prospective licence area, has served to enhance its commerciality

and bring a highly scalable, fundable development opportunity onto

the radar of institutional financing. We look forward to further

project endorsements and hope to announce more progress in the

coming months as the gap narrows between the market's perception of

the Company and what management feel is currently a vastly

undervalued clean energy investment proposition."

Further Information

Anchois Gas Field Development

Resources

-- 3D PSDM seismic reprocessing and updated Independent

Assessment completed, by Netherland Sewell & Associates Inc.

("NSAI"), with material upgrade of audited total remaining

recoverable resource to in excess of 1 Tcf for Anchois (comprising

361 Bcf 2C contingent resources and 690 Bcf 2U prospective

resources)

-- Ability for the low-risk prospective targets (C, M and O

sands) to be drilled at low cost as part of any appraisal or

development drilling activity on the Anchois Discovery (A and B

sands); the development of which brings the potential for material

free cash flow

-- Existing exploration upside of a combined 1.8Tcf 2U audited

prospective resource in other Lixus prospects further added to with

the identification of additional Mio-Pliocene gas play prospects,

with a preliminary internal Chariot estimate of c.1Tcf

Development Plan

-- Reservoir and integrated asset modelling completed, Pre-FEED

study commissioned and optimised development concept finalised with

a major engineering consultancy, with initial reference base case

economics highly encouraging

-- 70MMscfd base case production rate, equivalent to a power

generating potential of c.600MW electricity and with capex reduced

c.30% relative to 2019 feasibility study. Work continues to further

reduce uncertainties in the range of costs

Gas Market

-- Large and growing energy market in Morocco with attractive

indicative pricing of US$8/mmbtu in power generation and

US$10-11/mmbtu in industry based on public information of other

operators in Morocco

-- Engagement continues with potential off-takers both within

the domestic Moroccan gas market and through the Maghreb-Europe

pipeline to potential off-takers in the European gas market

Funding

-- Discussions continue with a variety of parties for the

provision of development debt finance. The feedback is encouraging

and demonstrates the project's fundability and materiality at an

institutional level

-- An active E&P partnering process is ongoing to fund the

appraisal well. New pre-stack depth migration ("PSDM") reprocessed

data with material resource upgrade has encouraged further groups

to come into the data room

New Business

-- Team continues to evaluate new value-accretive business

opportunities that play to our strengths as energy professionals

and our long-standing presence and experience across the African

continent

Capital Discipline Maintained

-- Unaudited cash balance as at 30 June 2020 of US$5.8 million

-- No debt or remaining work commitments

-- Restructuring in April 2020 brought organisational and other

savings to reduce annual cash overheads by c.45%, from US$4.5

million to US$2.5 million

-- Key skills retained and operating capability to scale up when

appropriate, with prevailing market conditions making preservation

of cash an imperative

Exploration Portfolio

-- Non-cash impairments of US$66.7 million in respect of Namibia

and Brazil, reflective of change in strategic direction and

Management's approach to non-core assets in the current challenging

market environment

-- Despite write-downs, Chariot will retain its interest in

Namibia and Brazil with no work commitments going forward and will

continue to host data-rooms for marketing of both assets

-- Key third-party offset wells are expected in 2020-2021 in

Brazil and Namibia which will help to inform prospectivity and

value of Chariot's acreage

-- A further non-cash impairment of US$0.5 million has been

booked against drilling inventory held from previous drilling

campaigns

Board Changes in the Post Period

-- Adonis Pouroulis, previously Non-Executive Director and the

Company founder, took over as Acting CEO in July 2020

-- To further strengthen the Company's leadership team, both

Julian Maurice-Williams and Duncan Wallace joined the Board in July

as executive directors in roles of Chief Financial Officer and

Technical Director respectively

This announcement contains inside information for the purposes

of Article 7 of Regulation 596/2014.

For further information please contact:

Chariot Oil & Gas Limited

Adonis Pouroulis, Acting CEO

Julian Maurice-Williams, CFO +44 (0)20 7318 0450

finnCap (Nominated Adviser and Broker)

Christopher Raggett (Corporate Finance)

Andrew Burdis (ECM) +44 (0)20 7220 0500

Celicourt Communications (Financial

PR)

Mark Antelme

Jimmy Lea +44 (0)20 8434 2754

NOTES TO EDITORS

ABOUT CHARIOT

Chariot Oil & Gas Limited is an independent energy company

which holds a high value, low risk gas development project with

strong ESG credentials in a fast growing emerging economy with a

clear route to early monetisation, delivery of free cashflow and

material exploration upside.

The ordinary shares of Chariot Oil & Gas Limited are

admitted to trading on the AIM Market of the London Stock Exchange

under the symbol 'CHAR'.

Chariot Oil & Gas Limited

Chief Executive's Review

Covid-19 and the global social and economic upheaval this year

has brought pause for thought for the E&P sector, as in many

other areas of business, trends that had been gradual are now

accelerating. Consumer preferences for energy consumption have

shifted dramatically towards a more sustainable, clean, renewable

and alternative fuels driven solutions to demand. At the same time,

retail and institutional investors now apply environmental, social

and governance ("ESG") principles to portfolios to such an extent

that those who have not adapted risk becoming irrelevant. Since

being founded we have partnered with majors, drilled four

potentially transformational but dry wells, including two as

operator, and secured c.1 Tcf gas resource. However, investor

appetite for a pure E&P play has declined and been overtaken by

an approach that considers ESG metrics in all investment decisions.

This impact is felt in all levels of funding to the company,

including direct equity investment into Chariot but also partnering

with companies across the energy value chain at the asset level

and, most importantly, providers of debt finance for

development.

We believe the Anchois Gas Development Project possesses these

highly sought-after ESG criteria due to its potential as an enabler

of Morocco's stated aim to transition to renewables and increase

the use of gas in power generation. Gas has been a growing

component of the power generation mix as part of the national

strategy to reduce imports and transition to lower carbon energy,

however, facilities in Morocco are underutilised and coal still

dominates, accounting for around two thirds of power generation in

2019. Much of the installed power capacity in the form of Combined

Cycle Gas Turbines ("CCGT"), which are a form of highly efficient

energy generation technology that combines a gas-fired turbine with

a steam turbine, are not fully utilised. Connection into these

installed power stations could be easily achieved through the

nearby Mahgreb-Europe gas pipeline. By increasing the proportion of

gas in that energy mix there is potential for substantial savings

in carbon emissions throughout the time of transition to a wider

uptake of renewable energy. In a market where quality ESG

investments with a clear path to free cashflow are scarce, we see

this development as a rare opportunity to help a country deliver on

its stated energy transition goals but also build a high performing

business supplying a reliable source of cheap, sustainable energy

to the population of a power hungry, growing economy. Chariot wants

to be part of the

energy transition solution for Morocco.

The Company has gone through significant change this year.

Firstly, steps were taken in April to restructure to a lower cost

base whilst retaining key skills and operational capabilities.

Secondly, and more fundamentally, the changes to the Board and new

Executive Team have ushered in a new vision and energy for future

growth. Building on the already strong technical skills and dynamic

culture in place, the new team is taking an entrepreneurial

approach as it seeks out new ventures that are value accretive and

play to our strengths as energy professionals with a wide footprint

across the continent of Africa.

We believe this change in strategy will yield near term

cashflow, bring superior financial performance, high growth in

shareholder value, helping to accelerate the transition to a

lower-carbon global economy and redraw the profile of the Company

as it seeks to invest in projects that are driving the new energy

revolution.

Lixus Offshore Licence - Building a Sustainable Moroccan Energy

Business

The completion of the reprocessing of the 3D PSDM seismic data

has resulted in a significant upgrade of audited total remaining

recoverable resource to in excess of 1 Tcf for Anchois (comprising

361 Bcf 2C contingent resources and 690 Bcf 2U prospective

resources). The reprocessed data has derisked existing exploration

prospects and also uncovered new prospects in the Mio-Pliocene gas

play, with early internal estimates of c.1 Tcf. Adding these

further exploration targets could lift the total licence resources

to c.4 Tcf (sum of 2C plus 2U resources including independent and

preliminary internal estimates).

We have completed additional reservoir and integrated-asset

modelling leading on to a Pre-FEED study with Xodus, a major

engineering consultancy. Work to date has defined an optimised

development concept and an initial reference base case. With

improved metrics, the base case now provides for 70MMscfd plateau

production rate, equivalent to power generation potential of

c.600MW electricity and with a reduction in the expected capex of

c.30% relative to the earlier 2019 feasibility study. Work

continues to reduce uncertainties in the range of costs, but

factoring in the already favourable fiscal regime in Morocco the

results of these studies are highly encouraging and further serve

to fully describe a highly commercially valuable project.

Discussions are ongoing with state electricity company, private

power generators and industrial users within the domestic Moroccan

gas market and through the Mahgreb-Europe pipeline to potential

off-takers in the European gas markets.

In the post period discussions have progressed with a range of

interest parties to provide development debt finance. These

discussions take into account the estimated capex required to bring

the development online, anticipated to be in the region of

US$300-500 million, but they also identify Lixus as being an

important strategic asset, with strong ESG credentials, that has

the potential to help Morocco transition to a low carbon economy,

as it seeks to satisfy an anticipated doubling in domestic demand

for energy over the next 20 years.

Separately the Company is currently engaged with a consortium of

industry players looking to participate in the Anchois Gas

Development and an active E&P partnering process is ongoing

with further groups due to attend the data room in the coming

period.

Exploration Portfolio

Whilst an impairment has been recognised in respect of the

non-core Namibian and Brazilian assets, reflecting the changing

macro environment and the strategy, Chariot will retain its

interest in the assets with no work commitments going forward and

will continue to host data-rooms for marketing of both assets.

Financial Review

The Group remains debt free and had a cash balance of US$5.8

million at 30 June 2020 (US$9.6 million at 31 December 2019), with

no remaining work commitments across the portfolio.

In light of the challenging business environment which has been

further compounded by the impact of Covid-19, exploration in both

Namibia and Brazil has been assessed as non-core with any potential

future value to be derived from drilling of offset wells by third

parties nearby, which are anticipated to spud in 2020-2021. Whilst

the Company retains the Central Blocks, Namibia and BAR-M Blocks,

Brazil and will continue to host data-rooms for potential

partnering, a non-cash impairment charges totalling US$66.7 million

have been recorded against the full book value of Namibia and

Brazil.

The Group has further assessed the carrying value of its

remaining inventory from earlier drilling campaign and has provided

fully against the remaining value, resulting in a charge of US$0.5

million.

Other administrative expenses of US$1.7 million (30 June 2019:

US$1.5 million) are slightly higher than the prior period

reflecting one-time restructuring costs incurred in the period

which are expected to decrease annual cash overhead from c.US$4.5

million to c.US$2.5 million.

Finance income of US$0.4 million (30 June 2019: US$0.1 million)

relates to the holding of higher cash balances in Sterling to meet

administrative expenses in the current year resulting in higher

foreign exchange gains. Finance expenses of less than US$0.1

million (30 June 2019: <US$0.1 million) reflect the unwinding of

the discount on the lease liability under IFRS 16.

Share-based payments charges of US$0.2 million (30 June 2019:

US$0.4 million) are marginally lower than the prior period due to

the vesting of historic awards of employee deferred shares.

Corporate

In the post period a new executive leadership team has been

assembled and as I step into the role of Acting CEO, I would like

to welcome Julian Maurice-Williams and Duncan Wallace onto the

Board as executive directors as Chief Financial Officer and

Technical Director respectively. Together with the Chariot team we

are focused and energised to deliver on the new strategy.

Outlook

The recent strides forward made in sub-surface description of

Lixus with the completion of the 3D PSDM seismic reprocessing and

independently audited resource upgrades have elevated this project

to a materiality that is grabbing the attention of the industry and

wider market. In addition to the active farm-out process,

discussions being held with gas off-takers are encouraging. The

discussions held with institutional lenders have underlined the

quality of the asset and development opportunity and we now look

ahead to the next steps in our objective to secure project

finance.

As demonstrated by the recent development concept work with a

high calibre engineering consultancy, this project has a clear path

to first gas using existing technologies and engineering design. As

all the elements of the Anchois Gas Development Project come

together and we seek out new ventures, this is an exciting time for

shareholders and all who are involved in the Company and we look

forward to providing more progress updates throughout the remainder

of 2020 as value is generated for shareholders.

Adonis Pouroulis

Acting Chief Executive Officer

28 September 2020

Chariot Oil & Gas Limited

Consolidated statement of comprehensive income for the six

months ended 30 June 2020

Six months Six months Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Share based payments (236) (355) (651)

Provision against inventory (524) - -

Impairment of exploration

asset 4 (66,666) - -

Other administrative expenses (1,736) (1,543) (3,395)

--------------------------------------- ------- -------------- -------------- ---------------

Total operating expenses (69,162) (1,898) (4,046)

--------------------------------------- ------- -------------- -------------- ---------------

Loss from operations (69,162) (1,898) (4,046)

Finance income 361 102 190

Finance expense (38) (69) (183)

--------------------------------------- ------- -------------- -------------- ---------------

Loss for the period before

taxation (68,839) (1,865) (4,039)

Tax expense (1) (11) (11)

--------------------------------------- ------- -------------- -------------- ---------------

Loss for the period and total

comprehensive loss for the

period attributable to equity

owners of the parent (68,840) (1,876) (4,050)

--------------------------------------- ------- -------------- -------------- ---------------

Loss per ordinary share attributable 3 US$(0.19) US$(0.01) US$(0.01)

to the equity holders of the

parent - basic and diluted

--------------------------------------- ------- -------------- -------------- ---------------

Chariot Oil & Gas Limited

Consolidated statement of changes in equity for the six months

ended 30 June 2020

Share Total

based Foreign attributable

Share Share Contributed payment exchange Retained to equity

capital premium equity reserve reserve deficit holders of

the parent

US$000 US$000 US$000 US$000 US$000 US$000 US$000

---------------- ---------- ---------- -------------- ---------- ----------- ----------- --------------

For the six

months ended

30 June 2020

(unaudited)

As at 1

January 2020 6,268 356,503 796 5,408 (1,241) (281,174) 86,560

Loss and total

comprehensive

loss for the

period - - - - - (68,840) (68,840)

Share based

payments - - - 236 - - 236

Transfer of

reserves due

to issue of

share awards 157 2,101 - (2,258) - - -

As at 30 June

2020 6,425 358,604 796 3,386 (1,241) (350,014) 17,956

---------------- ---------- ---------- -------------- ---------- ----------- ----------- --------------

For the six

months ended

30 June 2019

(unaudited)

As at 1

January 2019 6,264 356,336 796 4,928 (1,241) (277,124) 89,959

Loss and total

comprehensive

loss for the

period - - - - - (1,876) (1,876)

Share based

payments - - - 355 - - 355

Transfer of

reserves due

to issue of

share awards 4 167 - (171) - - -

As at 30 June

2019 6,268 356,503 796 5,112 (1,241) (279,000) 88,438

---------------- ---------- ---------- -------------- ---------- ----------- ----------- --------------

For the year

ended 31

December 2019

(audited)

As at 1

January 2019 6,264 356,336 796 4,928 (1,241) (277,124) 89,959

Loss and total

comprehensive

loss for the

year - - - - - (4,050) (4,050)

Share based

payments - - - 651 - - 651

Transfer of

reserves due

to issue of

share awards 4 167 - (171) - - -

As at 31

December 2019 6,268 356,503 796 5,408 (1,241) (281,174) 86,560

---------------- ---------- ---------- -------------- ---------- ----------- ----------- --------------

Chariot Oil & Gas Limited

Consolidated statement of financial position as at 30 June

2020

30 June 30 June 31 December

2020 2019 2019

US$000 US$000 US$000

Notes Unaudited Unaudited Audited

Non-current assets

Exploration and appraisal

costs 4 12,311 76,006 78,264

Property, plant and equipment 59 134 94

Right of use asset: office

lease 819 1,147 983

------------------------------------ ------- ----------- ----------- ------------

Total non-current assets 13,189 77,287 79,341

------------------------------------ ------- ----------- ----------- ------------

Current assets

Trade and other receivables 711 1,347 781

Inventory - 524 524

Cash and cash equivalents 5 5,845 12,137 9,635

------------------------------------ ------- ----------- ----------- ------------

Total current assets 6,556 14,008 10,940

------------------------------------ ------- ----------- ----------- ------------

Total assets 19,745 91,295 90,281

------------------------------------ ------- ----------- ----------- ------------

Current liabilities

Trade and other payables 848 1,549 2,535

Lease liability: office lease 355 339 366

------------------------------------ ------- ----------- ----------- ------------

Total current liabilities 1,203 1,888 2,901

------------------------------------ ------- ----------- ----------- ------------

Non-current liabilities

Lease liability: office lease 586 969 820

------------------------------------ ------- ----------- ----------- ------------

Total non-current liabilities 586 969 820

------------------------------------ ------- ----------- ----------- ------------

Total liabilities 1,789 2,857 3,721

------------------------------------ ------- ----------- ----------- ------------

Net assets 17,956 88,438 86,560

------------------------------------ ------- ----------- ----------- ------------

Capital and reserves attributable

to equity holders of the parent

Share capital 6 6,425 6,268 6,268

Share premium 358,604 356,503 356,503

Contributed equity 796 796 796

Share based payment reserve 3,386 5,112 5,408

Foreign exchange reserve (1,241) (1,241) (1,241)

Retained deficit (350,014) (279,000) (281,174)

------------------------------------ ------- ----------- ----------- ------------

Total equity 17,956 88,438 86,560

------------------------------------ ------- ----------- ----------- ------------

Chariot Oil & Gas Limited

Consolidated cash flow statement for the six months ended 30

June 2020

Six months Six months Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

US$000 US$000 US$000

Unaudited Unaudited Audited

-------------------------------------------- -------------- -------------- ---------------

Operating activities

Loss for the period before taxation (68,839) (1,865) (4,039)

Adjustments for:

Provision against inventory 524 - -

Impairment of exploration asset 66,666 - -

Finance income (361) (102) (190)

Finance expense 38 69 183

Depreciation and amortisation 198 196 401

Share based payments 236 355 651

Net cash outflow from operating

activities before changes in working

capital (1,538) (1,347) (2,994)

Decrease in trade and other receivables 67 479 1,036

(Decrease) / increase in trade and

other payables (1,100) 120 930

Cash outflow from operating activities (2,571) (748) (1,028)

Tax payment (1) (11) (11)

-------------------------------------------- -------------- -------------- ---------------

Net cash outflow from operating

activities (2,572) (759) (1,039)

-------------------------------------------- -------------- -------------- ---------------

Investing activities

Finance income 29 124 217

Payments in respect of property,

plant and equipment - (66) (67)

Payments in respect of intangible

assets (1,300) (6,752) (8,828)

Net cash outflow used in investing

activities (1,271) (6,694) (8,678)

-------------------------------------------- -------------- -------------- ---------------

Financing activities

Payment of lease liabilities (245) (164) (287)

Finance expense on lease (38) (52) (97)

Net cash outflow from financing

activities (283) (216) (384)

-------------------------------------------- -------------- -------------- ---------------

Net decrease in cash and cash equivalents

in the period (4,126) (7,669) (10,101)

Cash and cash equivalents at start

of the period 9,635 19,822 19,822

Effect of foreign exchange rate

changes on cash and cash equivalent 336 (16) (86)

Cash and cash equivalents at end

of the period 5,845 12,137 9,635

-------------------------------------------- -------------- -------------- ---------------

Chariot Oil & Gas Limited

Notes to the interim financial statements for the six months

ended 30 June 2020

1. Accounting policies

Basis of preparation

The interim financial statements have been prepared using

policies based on International Financial Reporting Standards (IFRS

and IFRIC interpretations) issued by the International Accounting

Standards Board (IASB) as adopted for use in the EU.

The interim financial information has been prepared using the

accounting policies which were applied in the Group's statutory

financial statements for the year ended 31 December 2019. The Group

has not adopted IAS 34: Interim Financial Reporting in the

preparation of the interim financial statements.

There has been no impact on the Group of any new standards,

amendments or interpretations that have become effective in the

period. The Group has not early adopted any new standards,

amendments or interpretations.

2. Financial reporting period

The interim financial information for the period 1 January 2020

to 30 June 2020 is unaudited. The financial statements also

incorporate the unaudited figures for the interim period 1 January

2019 to 30 June 2019 and the audited figures for the year ended 31

December 2019.

The financial information contained in this interim report does

not constitute statutory accounts as defined by sections 243-245 of

the Companies (Guernsey) Law 2008.

The figures for the year ended 31 December 2019 are not the

Group's full statutory accounts for that year. The auditors' report

on those accounts was unqualified, did not contain references to

matters to which the auditors drew attention by way of emphasis and

did not contain a statement under section 263 (3) of the Companies

(Guernsey) Law 2008.

3. Loss per share

The calculation of the basic earnings per share is based on the

loss attributable to ordinary shareholders divided by the weighted

average number of shares in issue during the period.

Six months Six months Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

Loss for the period US$000 (68,840) (1,876) (4,050)

------------- ------------- --------------

Weighted average number of

shares 371,519,129 367,274,992 367,405,011

------------- ------------- --------------

Loss per share, basic and diluted* US$(0.19) US$(0.01) US$(0.01)

------------- ------------- --------------

*Inclusion of the potential ordinary shares would result in a

decrease in the loss per share and, as such, is considered to be

anti-dilutive. Consequently a separate diluted loss per share has

not been presented.

4. Exploration and appraisal costs

30 June 2020 30 June 2019 31 December 2019

US$000 US$000 US$000

-------------- -------------- ------------------

Balance brought forward 78,264 74,236 74,236

-------------- -------------- ------------------

Additions 713 1,770 4,028

-------------- -------------- ------------------

Impairment (66,666) - -

-------------- -------------- ------------------

Net book value 12,311 76,006 78,264

-------------- -------------- ------------------

As at 30 June 2020 the net book values of the three cost pools

are Morocco US$12.3 million (31 December 2019: US$11.5 million),

Central Blocks offshore Namibia US$Nil (31 December 2019: US$51.1

million), and Brazil US$Nil (31 December 2019: US$15.7

million).

In light of the challenging conditions since Covid-19 and

general lack of appetite in the market for oil exploration, the

activities in Namibia and Brazil have been assessed as non-core and

as such full impairments have been recorded against each respective

cost pool.

5. Cash and cash equivalents

As at 30 June 2020 the cash balance of US$5.8 million (31

December 2019: US$9.6 million ) contains the following cash

deposits that are secured against bank guarantees given in respect

of exploration work to be carried out:

30 June 2020 30 June 2019 31 December 2019

US$000 US$000 US$000

-------------- -------------- ------------------

Moroccan licences 650 650 650

-------------- -------------- ------------------

650 650 650

-------------- -------------- ------------------

The funds are freely transferrable but alternative collateral

would need to be put in place to replace the cash security.

6. Share capital

Allotted, called up and fully paid

At At At At 31 December 31

30 June 30 June 30 June 30 June 2019 December

2020 2020 2019 2019 2019

--------------- ---------- --------------- ---------- --------------- -----------

Number US$000 Number US$000 Number US$000

--------------- ---------- --------------- ---------- --------------- -----------

Ordinary

shares

of 1p

each 378,868,721 6,425 367,532,909 6,268 367,532,909 6,268

--------------- ---------- --------------- ---------- --------------- -----------

Details of the Ordinary shares issued during the six month

period to 30 June 2020 are given in the table below:

Date Description Price No of shares

US$

1 January

2020 Opening Balance 367,532,909

----------------------- ------- --------------

27 April

2020 Issue of share award 0.18 463,768

----------------------- ------- --------------

27 April

2020 Issue of share award 0.42 133,334

----------------------- ------- --------------

27 April

2020 Issue of share award 0.53 154,285

----------------------- ------- --------------

27 April

2020 Issue of share award 4.38 42,000

----------------------- ------- --------------

27 April

2020 Issue of share award 0.50 913,822

----------------------- ------- --------------

27 April

2020 Issue of share award 0.33 700,000

----------------------- ------- --------------

27 April

2020 Issue of share award 0.39 937,500

----------------------- ------- --------------

27 April

2020 Issue of share award 0.12 1,352,875

----------------------- ------- --------------

27 April

2020 Issue of share award 0.20 1,369,541

----------------------- ------- --------------

27 April

2020 Issue of share award 0.05 864,134

----------------------- ------- --------------

27 April

2020 Issue of share award 0.02 2,958,329

----------------------- ------- --------------

27 April

2020 Issue of share award 0.11 278,082

----------------------- ------- --------------

27 April

2020 Issue of share award 0.19 1,168,142

----------------------- ------- --------------

30 June 2020 378,868,721

------- --------------

The ordinary shares have a nominal value of 1p. The share

capital has been translated at the historic rate at the date of

issue, or, in the case of the LTIP, the date of grant.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QVLFLBKLFBBE

(END) Dow Jones Newswires

September 29, 2020 02:00 ET (06:00 GMT)

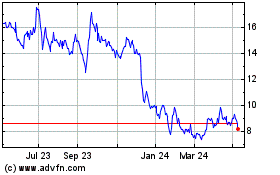

Chariot (LSE:CHAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

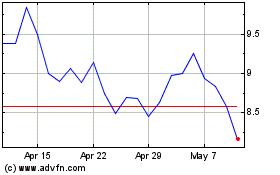

Chariot (LSE:CHAR)

Historical Stock Chart

From Apr 2023 to Apr 2024