TIDMCCL

Carnival Corporation & plc Announces Extension of Maturity of an Additional $87

Million of 2023 Convertible Notes at Existing 5.75% Rate

The 2023 Notes will be exchanged for New 2024 Notes with the same coupon and no

dilution to shareholders at scheduled maturity versus the 2023 Notes and no

upfront cost

MIAMI, October 31, 2022 /PRNewswire/ -- Carnival Corporation & plc (NYSE/LSE:

CCL; NYSE: CUK) today announced that Carnival Corporation (the "Company"),

Carnival plc and certain of their subsidiaries (the "Subsidiary Guarantors")

have entered into separate, privately negotiated exchange agreements with

certain holders of the Company's outstanding 5.75% Convertible Senior Notes due

2023 (the "2023 Notes") pursuant to which the Company will exchange $87 million

in aggregate principal amount of 2023 Notes for $87 million in aggregate

principal amount of new 5.75% Convertible Senior Notes due October 2024 (the

"New 2024 Notes" and such exchange, the "Exchange").

The New 2024 Notes will have the same initial conversion price as the 2023

Notes, representing no dilution to shareholders at scheduled maturity versus

the 2023 Notes, the same coupon and no upfront cost to the Company. As a result

of the eighteen-month extension, the New 2024 Notes will mature on October 1,

2024 and be fully and unconditionally guaranteed on a senior unsecured basis by

Carnival plc and the Subsidiary Guarantors. Following the closing of the

Exchange, $96 million in aggregate principal amount of 2023 Notes will remain

outstanding. The Exchange is expected to close on November 1, 2022, subject to

customary closing conditions.

The New 2024 Notes will be issued pursuant to the Company's Indenture, dated

August 22, 2022, will have the same terms as the Company's outstanding $339

million aggregate principal amount of 5.75% Convertible Senior Notes due 2024

(the "Existing 2024 Notes") and will be treated as a single class of securities

trading under the same CUSIP number as the Existing 2024 Notes. The New 2024

Notes were offered pursuant to an exemption from the registration requirements

under the Securities Act of 1933, as amended (the "Securities Act"). The New

2024 Notes and the shares of common stock issuable upon conversion of the New

2024 Notes, if any, will not be registered under the Securities Act or any

state securities laws and may not be offered or sold in the United States

absent registration or an applicable exemption from the registration

requirements of the Securities Act and applicable state laws.

PJT Partners is serving as independent financial advisor to the Company and

Carnival plc.

This press release does not constitute an offer to sell or a solicitation of an

offer to buy the New 2024 Notes or any other securities and shall not

constitute an offer, solicitation or sale in any jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to the registration and

qualification under the securities laws of such state or jurisdiction.

About Carnival Corporation & plc

Carnival Corporation & plc is one of the world's largest leisure travel

companies with a portfolio of nine of the world's leading cruise lines. With

operations in North America, Australia, Europe and Asia, its portfolio features

Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises

(Australia), Seabourn, Costa Cruises, AIDA Cruises, P&O Cruises (UK) and

Cunard.

Cautionary Note Concerning Factors That May Affect Future Results

Carnival Corporation and Carnival plc and their respective subsidiaries are

referred to collectively in this press release as "Carnival Corporation & plc,"

"our," "us" and "we." Some of the statements, estimates or projections

contained in this press release are "forward-looking statements" that involve

risks, uncertainties and assumptions with respect to us, including some

statements concerning the financing transactions described herein, future

results, operations, outlooks, plans, goals, reputation, cash flows, liquidity

and other events which have not yet occurred. These statements are intended to

qualify for the safe harbors from liability provided by Section 27A of the

Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical facts are

statements that could be deemed forward-looking. These statements are based on

current expectations, estimates, forecasts and projections about our business

and the industry in which we operate and the beliefs and assumptions of our

management. We have tried, whenever possible, to identify these statements by

using words like "will," "may," "could," "should," "would," "believe,"

"depends," "expect," "goal," "aspiration," "anticipate," "forecast," "project,"

"future," "intend," "plan," "estimate," "target," "indicate," "outlook," and

similar expressions of future intent or the negative of such terms.

Forward-looking statements include those statements that relate to our outlook

and financial position including, but not limited to, statements regarding:

* Pricing * Goodwill, ship and trademark fair values

* Booking levels * Liquidity and credit ratings

* Occupancy * Adjusted earnings per share

* Interest, tax and fuel expenses * Return to guest cruise operations

* Currency exchange rates * Impact of the COVID-19 coronavirus global

* Estimates of ship depreciable pandemic on our financial condition and

lives and residual values results of operations

Because forward-looking statements involve risks and uncertainties, there are

many factors that could cause our actual results, performance or achievements

to differ materially from those expressed or implied by our forward-looking

statements. This note contains important cautionary statements of the known

factors that we consider could materially affect the accuracy of our

forward-looking statements and adversely affect our business, results of

operations and financial position. Additionally, many of these risks and

uncertainties are currently, and in the future may continue to be, amplified by

COVID-19. It is not possible to predict or identify all such risks. There may

be additional risks that we consider immaterial or which are unknown. These

factors include, but are not limited to, the following:

* COVID-19 has had, and is expected to continue to have, a significant impact

on our financial condition and operations. The current, and uncertain

future, impact of COVID-19, including its effect on the ability or desire

of people to travel (including on cruises), is expected to continue to

impact our results, operations, outlooks, plans, goals, reputation,

litigation, cash flows, liquidity, and stock price;

* events and conditions around the world, including war and other military

actions, such as the current invasion of Ukraine, inflation, higher fuel

prices, higher interest rates and other general concerns impacting the

ability or desire of people to travel have led and may in the future lead,

to a decline in demand for cruises, impacting our operating costs and

profitability;

* incidents concerning our ships, guests or the cruise industry have in the

past and may, in the future, impact the satisfaction of our guests and crew

and lead to reputational damage;

* changes in and non-compliance with laws and regulations under which we

operate, such as those relating to health, environment, safety and

security, data privacy and protection, anti-corruption, economic sanctions,

trade protection and tax have in the past and may, in the future, lead to

litigation, enforcement actions, fines, penalties and reputational damage;

* factors associated with climate change, including evolving and increasing

regulations, increasing global concern about climate change and the shift

in climate conscious consumerism and stakeholder scrutiny, and increasing

frequency and/or severity of adverse weather conditions could adversely

affect our business;

* inability to meet or achieve our sustainability related goals, aspirations,

initiatives, and our public statements and disclosures regarding them, may

expose us to risks that may adversely impact our business;

* breaches in data security and lapses in data privacy as well as disruptions

and other damages to our principal offices, information technology

operations and system networks and failure to keep pace with developments

in technology may adversely impact our business operations, the

satisfaction of our guests and crew and may lead to reputational damage;

* the loss of key employees, our inability to recruit or retain qualified

shoreside and shipboard employees and increased labor costs could have an

adverse effect on our business and results of operations;

* increases in fuel prices, changes in the types of fuel consumed and

availability of fuel supply may adversely impact our scheduled itineraries

and costs;

* we rely on supply chain vendors who are integral to the operations of our

businesses. These vendors and service providers are also affected by

COVID-19 and may be unable to deliver on their commitments which could

impact our business;

* fluctuations in foreign currency exchange rates may adversely impact our

financial results;

* overcapacity and competition in the cruise and land-based vacation industry

may lead to a decline in our cruise sales, pricing and destination options;

* inability to implement our shipbuilding programs and ship repairs,

maintenance and refurbishments may adversely impact our business operations

and the satisfaction of our guests; and

* the risk factors included in Carnival Corporation's and Carnival plc's

Annual Report on Form 10-K filed with the SEC on January 27, 2022 and

Carnival Corporation's and Carnival plc's Quarterly Reports on Form 10-Q

filed with the SEC on March 28, 2022, June 29, 2022 and September 30, 2022.

The ordering of the risk factors set forth above is not intended to reflect our

indication of priority or likelihood.

Forward-looking statements should not be relied upon as a prediction of actual

results. Subject to any continuing obligations under applicable law or any

relevant stock exchange rules, we expressly disclaim any obligation to

disseminate, after the date of this document, any updates or revisions to any

such forward-looking statements to reflect any change in expectations or

events, conditions or circumstances on which any such statements are based.

Forward-looking and other statements in this document may also address our

sustainability progress, plans and goals (including climate change and

environmental-related matters). In addition, historical, current and

forward-looking sustainability-related statements may be based on standards for

measuring progress that are still developing, internal controls and processes

that continue to evolve, and assumptions that are subject to change in the

future.

SOURCE Carnival Corporation & plc

Carnival Corporation & plc Media Contacts: Jody Venturoni, Carnival

Corporation, jventuroni@carnival.com, (469) 797-6380; Ellie Beuerman, LDWW,

ellie@ldww.co, (214) 758-7001

Carnival Corporation & plc Investor Relations Contact: Beth Roberts, Carnival

Corporation, eroberts@carnival.com, (305) 406-4832

END

(END) Dow Jones Newswires

October 31, 2022 03:00 ET (07:00 GMT)

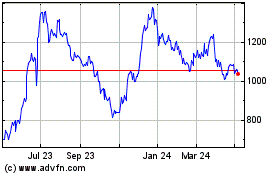

Carnival (LSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carnival (LSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024