TIDMCCL

June 18, 2020

CARNIVAL CORPORATION & PLC REPORTS SUMMARY SECOND QUARTER RESULTS AND OTHER

MATTERS

Carnival Corporation & plc (the "company") is disclosing summary preliminary

financial information for the quarter ended May 31, 2020, on Form 8-K with the

U.S. Securities and Exchange Commission ("SEC").

* Schedule A contains Carnival Corporation & plc's summary preliminary

financial information for the quarter ended May 31, 2020

The Directors consider that within the Carnival Corporation and Carnival plc

dual listed company arrangement, the most appropriate presentation of Carnival

plc's results and financial position is by reference to the Carnival

Corporation & plc U.S. GAAP consolidated financial statements.

MEDIA CONTACT INVESTOR RELATIONS CONTACT

Roger Frizzell Beth Roberts

001 305 406 7862 001 305 406 4832

The Form 8-K is available for viewing on the SEC website at www.sec.gov under

Carnival Corporation or Carnival plc or the Carnival Corporation & plc website

at www.carnivalcorp.com or www.carnivalplc.com.

Carnival Corporation & plc is one of the world's largest leisure travel

companies with a portfolio of nine of the world's leading cruise lines. With

operations in North America, Australia, Europe and Asia, its portfolio features

- Carnival Cruise Line, Princess Cruises, Holland America Line, P&O Cruises

(Australia), Seabourn, Costa Cruises, AIDA Cruises, P&O Cruises (UK) and

Cunard.

Additional information can be found on www.carnivalcorp.com,

www.carnivalsustainability.com, www.carnival.com, www.princess.com,

www.hollandamerica.com, www.pocruises.com.au, www.seabourn.com,

www.costacruise.com, www.aida.de, www.pocruises.com and www.cunard.com.

SCHEDULE A

SECOND QUARTER 2020 SUMMARY PRELIMINARY INFORMATION

* U.S. GAAP net loss of $(4.4) billion, or $(6.07) diluted EPS, for the

second quarter of 2020, which includes $2.0 billion of non-cash impairment

charges.

* Second quarter 2020 adjusted net loss of $(2.4) billion, or $(3.30)

adjusted EPS.

* Total revenues for the second quarter of 2020 were $0.7 billion, lower than

$4.8 billion in the prior year.

* The company's guest cruise operations have been in a pause for a majority

of the second quarter. In addition, the company is unable to definitively

predict when it will return to normal operations. As a result, the company

is currently unable to provide an earnings forecast. The pause in guest

operations is continuing to have material negative impacts on all aspects

of the company's business. The longer the pause in guest operations

continues the greater the impact on the company's liquidity and financial

position. The company expects a net loss on both a U.S. GAAP and adjusted

basis for the second half of 2020.

* Cash burn rate in the second quarter 2020 was generally in line with the

previously disclosed expectation.

* Second quarter 2020 ended with $7.6 billion of available liquidity, and the

company expects to further enhance future liquidity, including through

refinancing scheduled debt maturities. In addition, the company has $8.8

billion of committed export credit facilities that are available to fund

ship deliveries originally planned through 2023.

* Total customer deposits balance at May 31, 2020 was $2.9 billion, including

$475 million related to cruises during the second half of 2020.

PREPARATION FOR THE RESUMPTION OF GUEST OPERATIONS

The company expects to resume guest operations, after collaboration with both

government and health authorities, in a phased manner, with specific ships and

brands returning to service over time to provide its guests with enjoyable

vacation experiences. The company anticipates that initial sailings will be

from a select number of easily accessible homeports. The company expects future

capacity to be moderated by the phased re-entry of its ships, the removal of

capacity from its fleet and delays in new ship deliveries.

In connection with its capacity optimization strategy, the company intends to

accelerate the removal of ships in fiscal 2020 which were previously expected

to be sold over the ensuing years. The company already has preliminary

agreements for the disposal of 6 ships which are expected to leave the fleet in

the next 90 days and is currently working toward additional agreements.

Health and Safety Protocols

In preparation for the resumption of its cruises, and consistent with its

commitment to provide its guests with a safe and healthy environment, the

company is proactively consulting and working in close cooperation with various

medical policy experts and public health authorities to develop enhanced

procedures and protocols for health and safety onboard its ships. The company

appreciates the excellent working relationship with the health authorities of

federal states and local port authorities in Germany, as well as the Italian

Coast Guard, Italian Ministry of Transportation, Italian Ministry of Health and

others around the world. A comprehensive restart protocol may include areas

such as medical care, screening, testing, mitigation and sanitization

addressing arrival and departure at cruise terminals, the boarding and

disembarkation process, onboard experiences and shore excursions.

Update on Bookings

The company's brands have announced various incentives and flexibility for

certain booking payments on select sailings to support guest confidence in

making new bookings. These incentives vary by brand and sailing and include

onboard credits and reduced or refundable deposits. In addition, the company is

providing flexibility to guests with bookings on sailings cancelled due to the

pause by allowing guests to receive enhanced future cruise credits ("FCC") or

elect to receive refunds in cash. Enhanced FCCs increase the value of the

guest's original booking or provide incremental onboard credits. As of May 31,

2020, approximately half of guests affected have requested cash refunds.

Despite substantially reduced marketing and selling spend, the company is

seeing growing demand from new bookings for 2021. For the six weeks ending May

31, 2020, approximately two-thirds of 2021 bookings were new bookings. The

remaining 2021 booking volumes resulted from guests applying their FCCs to

specific future cruises.

As of May 31, 2020, the current portion of customer deposits was $2.6 billion

with $121 million relating to third quarter sailings and $353 million relating

to fourth quarter sailings. The company expects any decline in the customer

deposits balance in the second half of 2020, all of which is expected to occur

in the third quarter, to be significantly less than the decline in the second

quarter of 2020.

As of May 31, 2020, cumulative advanced bookings for the full year of 2021

capacity currently available for sale are within historical ranges at prices

that are down in the low to mid-single digits range including the negative

yield impact of FCCs and onboard credits applied, on a comparable basis. For

the full year of 2021, booking volumes for the six weeks ending May 31, 2020,

were running meaningfully behind the prior year. However, the company saw an

improvement in booking volumes for the six weeks ending May 31, 2020 compared

to the prior six weeks.

COVID-19 RESPONSE

In the face of the impact of the COVID-19 global pandemic, the company paused

its guest cruise operations in mid-March. In response to this unprecedented

situation, the company acted to ensure the health and safety of guests and

shipboard team members, optimize the pause in guest operations and maximize its

liquidity position.

Ensuring the Health and Safety of Guests and Team Members

During this period the company has taken and will continue to take the

following actions:

* Returned over 260,000 guests to their homes, coordinating with a large

number of countries around the globe. The company chartered aircraft,

utilized commercial flights and even used its ships to sail home guests who

could not fly

* Working around the clock with various local governmental authorities to

repatriate shipboard team members as quickly as possible. 49 cruise ships

have traveled more than 400,000 nautical miles and the company has

chartered hundreds of planes to repatriate approximately 60,000 of its

shipboard team members to more than 130 countries around the globe. The

company expects substantially all of the approximately 21,000 remaining

shipboard team members to be able to return home by the end of June. The

safe manning team members will remain on the company's ships

* For those shipboard team members experiencing extended stays onboard, the

company is focusing on their physical and mental health. The company is

providing most shipboard team members with single occupancy cabin

accommodations, many with a window or balcony. Shipboard team members have

access to fresh air and other areas of the ship, movies and internet, and

available counseling

Optimizing the Pause in Guest Operations

The company estimates that its ongoing ship operating and administrative

expenses will be approximately $250 million per month once all ships are in

paused status. The company continues to seek ways to further reduce this

monthly requirement.

Reduced Operating Expenses

The company has taken significant actions to reduce operating expenses during

the pause in guest operations:

While maintaining safety, environmental protection and compliance, the company

significantly reduced ship operating expenses, including crew payroll, food,

fuel, insurance and port charges by transitioning ships into paused status,

either at anchor or in port and staffed at a safe manning level

* Currently 62 of the company's ships are in their final expected pause

location. The company expects substantially all of its ships to reach their

full pause status during the third quarter

* Significantly reduced marketing and selling expenses

* Implemented a combination of layoffs, furloughs, reduced work weeks and

salary and benefit reductions across the company, including senior

management

* Instituted a hiring freeze across the organization, significantly reduced

consultant and contractor roles

Reduced Capital Expenditures

The company has reduced capital expenditures and estimates $300 million of

non-newbuild capital expenditures during the second half of 2020, which largely

consists of previously committed expenditures.

The company previously had four ships scheduled to be delivered between May and

October of 2020. The company believes COVID-19 has impacted shipyard operations

and will result in delivery delays of the ships this year and is working with

the shipyards on revised timing. The company has committed future financing,

comprised of ship export credit facilities, associated with these newbuilds.

Maximizing Liquidity

The company has taken and continues to take actions to improve its liquidity

including:

* Completed offerings of $6.6 billion through the issuance of first-priority

senior secured notes, senior convertible notes and Carnival Corporation

common stock

* Fully drew down its $3.0 billion multi-currency revolving credit facility

* Qualified for a government commercial paper program providing over $700

million of liquidity

* Early settled outstanding derivatives, receiving proceeds of $220 million

* Extended a $166 million euro-denominated bank loan, originally maturing in

2020, to March 2021

* Certain export credit agencies have offered 12-month debt amortization and

a financial covenant holiday ("Debt Holiday"). The Debt Holiday amendments

that have been finalized to date will defer $300 million of principal

repayments otherwise due through May 2021 with repayments made over the

following four years. The company has also obtained financial covenant

waivers for these loans for an initial term through March 2021 and waivers

of the interest coverage financial covenant for certain of its bank loans

through November 2021. The company is working to arrange additional

financial covenant waivers and additional debt holiday agreements deferring

principal repayments of approximately $300 million through March 2021

* Suspended the payment of dividends on, and the repurchase of, Carnival

Corporation common stock and Carnival plc ordinary shares

* The company is also working on potential sales of non-ship assets

As of May 31, 2020, the company has a total of $7.6 billion of available

liquidity. In addition, the company has $8.8 billion of committed export credit

facilities that are available to fund ship deliveries originally planned

through 2023.

Cash Burn Rate

During the pause in guest operations, the monthly average cash burn rate for

the second half of 2020 is estimated to be approximately $650 million. This

rate includes ongoing ship operating and administrative expenses, committed

capital expenditures (net of committed export credit facilities), interest

expense and excludes changes in customer deposits and scheduled debt

maturities. In addition to the refinancings discussed above and the in-process

Debt Holiday arrangements, the company also expects to refinance approximately

$2.4 billion of debt maturities coming due over the next twelve months, half of

which matures in the second half of 2020.

Cautionary Note Concerning Factors That May Affect Future Results

Carnival Corporation and Carnival plc and their respective subsidiaries are

referred to collectively in this document as "Carnival Corporation & plc,"

"our," "us" and "we." Some of the statements, estimates or projections

contained in this document are "forward-looking statements" that involve risks,

uncertainties and assumptions with respect to us, including some statements

concerning future results, operations, outlooks, plans, goals, reputation, cash

flows, liquidity and other events which have not yet occurred. These statements

are intended to qualify for the safe harbors from liability provided by Section

27A of the Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. All statements other than statements of historical facts are

statements that could be deemed forward-looking. These statements are based on

current expectations, estimates, forecasts and projections about our business

and the industry in which we operate and the beliefs and assumptions of our

management. We have tried, whenever possible, to identify these statements by

using words like "will," "may," "could," "should," "would," "believe,"

"depends," "expect," "goal," "anticipate," "forecast," "project," "future,"

"intend," "plan," "estimate," "target," "indicate," "outlook," and similar

expressions of future intent or the negative of such terms.

Forward-looking statements include those statements that relate to our outlook

and financial position including, but not limited to, statements regarding:

* Net revenue yields * Estimates of ship depreciable lives and

residual values

* Booking levels * Goodwill, ship and trademark fair values

* Pricing and occupancy * Liquidity

* Interest, tax and fuel * Adjusted earnings per share

expenses

* Currency exchange rates * Impact of the COVID-19 coronavirus global

pandemic on our financial condition and

* Net cruise costs, results of operations

excluding fuel per

available lower berth day

Because forward-looking statements involve risks and uncertainties, there are

many factors that could cause our actual results, performance or achievements

to differ materially from those expressed or implied by our forward-looking

statements. This note contains important cautionary statements of the known

factors that we consider could materially affect the accuracy of our forward

looking statements and adversely affect our business, results of operations and

financial position. Additionally, many of these risks and uncertainties are

currently amplified by and will continue to be amplified by, or in the future

may be amplified by, the COVID-19 outbreak. It is not possible to predict or

identify all such risks. There may be additional risks that we consider

immaterial or which are unknown. These factors include, but are not limited to,

the following:

* COVID-19 has had, and is expected to continue to have, a significant impact

on our financial condition and operations, which impacts our ability to

obtain acceptable financing to fund resulting reductions in cash from

operations. The current, and uncertain future, impact of the COVID-19

outbreak, including its effect on the ability or desire of people to travel

(including on cruises), is expected to continue to impact our results,

operations, outlooks, plans, goals, growth, reputation, litigation, cash

flows, liquidity, and stock price

* As a result of the COVID-19 outbreak, we have paused our guest cruise

operations, and if we are unable to re-commence normal operations in the

near-term, and further extend covenant waivers for certain agreements for

which waivers do not currently cover periods after March 2021 (if needed),

we may be out of compliance with a maintenance covenant in certain of our

debt facilities

* World events impacting the ability or desire of people to travel may lead

to a decline in demand for cruises

* Incidents concerning our ships, guests or the cruise vacation industry as

well as adverse weather conditions and other natural disasters may impact

the satisfaction of our guests and crew and lead to reputational damage

* Changes in and non-compliance with laws and regulations under which we

operate, such as those relating to health, environment, safety and

security, data privacy and protection, anti-corruption, economic sanctions,

trade protection and tax may lead to litigation, enforcement actions,

fines, penalties, and reputational damage

* Breaches in data security and lapses in data privacy as well as disruptions

and other damages to our principal offices, information technology

operations and system networks and failure to keep pace with developments

in technology may adversely impact our business operations, the

satisfaction of our guests and crew and lead to reputational damage

* Ability to recruit, develop and retain qualified shipboard personnel who

live away from home for extended periods of time may adversely impact our

business operations, guest services and satisfaction

* Increases in fuel prices, changes in the types of fuel consumed and

availability of fuel supply may adversely impact our scheduled itineraries

and costs

* Fluctuations in foreign currency exchange rates may adversely impact our

financial results

* Overcapacity and competition in the cruise and land-based vacation industry

may lead to a decline in our cruise sales, pricing and destination options

* Geographic regions in which we try to expand our business may be slow to

develop or ultimately not develop how we expect

* Inability to implement our shipbuilding programs and ship repairs,

maintenance and refurbishments may adversely impact our business operations

and the satisfaction of our guests

The ordering of the risk factors set forth above is not intended to reflect our

indication of priority or likelihood.

Forward-looking statements should not be relied upon as a prediction of actual

results. Subject to any continuing obligations under applicable law or any

relevant stock exchange rules, we expressly disclaim any obligation to

disseminate, after the date of this document, any updates or revisions to any

such forward-looking statements to reflect any change in expectations or

events, conditions or circumstances on which any such statements are based.

The financial information for the quarter ended May 31, 2020 is based on the

company's internal management accounts and reporting as of and for the 2020

second quarter, as compared to the company's reviewed results for, or financial

metrics derived from, the company's 2019 second quarter. The company has not

yet completed its financial statement review procedures for the 2020 second

quarter and the foregoing preliminary financial and other data for the 2020

second quarter has been prepared by, and is the responsibility of, management

based on currently available information. The preliminary results of operations

are subject to revision as it prepares its financial statements and disclosure

for the 2020 second quarter, and such revisions may be significant. In

connection with its quarterly closing and review process for the fiscal quarter

with its independent auditors, the company may identify items that would

require it to make adjustments to the preliminary results of operations set

forth above. As a result, the final results and other disclosures for the 2020

second quarter may differ materially from this preliminary data. This

preliminary financial data should not be viewed as a substitute for all

financial statements prepared in accordance with U.S. GAAP.

CARNIVAL CORPORATION & PLC

NON-GAAP FINANCIAL MEASURES

Three Months Ended Six Months Ended

May 31, May 31,

(in millions, except per share data) 2020 2019 2020 2019

Net income (loss)

U.S. GAAP net income (loss) $ (4,374) $ 451 $ (5,155) $ 787

(Gains) losses on ship sales and 1,953 (16) 2,882 (14)

impairments

Restructuring expenses 39 - 39 -

Other - 22 3 22

Adjusted net income (loss) $ (2,382) $ 457 $ (2,231) $ 795

Weighted-average shares outstanding 721 693 702 694

Earnings per share

U.S. GAAP diluted earnings per $ (6.07) $ 0.65 $ (7.34) $ 1.13

share

(Gains) losses on ship sales and 2.71 (0.02) 4.10 (0.02)

impairments

Restructuring expenses 0.05 - 0.06 -

Other - 0.03 - 0.03

Adjusted earnings per share $ (3.30) $ 0.66 $ (3.18) $ 1.15

Explanations of Non-GAAP Financial Measures

Non-GAAP Financial Measures

We use adjusted net income and adjusted earnings per share as non-GAAP

financial measures of our cruise segments' and the company's financial

performance. These non-GAAP financial measures are provided along with U.S.

GAAP net income (loss) and U.S. GAAP diluted earnings per share.

We believe that gains and losses on ship sales, impairment charges,

restructuring costs and other gains and expenses are not part of our core

operating business and are not an indication of our future earnings

performance. Therefore, we believe it is more meaningful for these items to be

excluded from our net income (loss) and earnings per share and, accordingly, we

present adjusted net income and adjusted earnings per share excluding these

items.

The presentation of our non-GAAP financial information is not intended to be

considered in isolation from, as substitute for, or superior to the financial

information prepared in accordance with U.S. GAAP. It is possible that our

non-GAAP financial measures may not be exactly comparable to the like-kind

information presented by other companies, which is a potential risk associated

with using these measures to compare us to other companies.

END

(END) Dow Jones Newswires

June 18, 2020 06:12 ET (10:12 GMT)

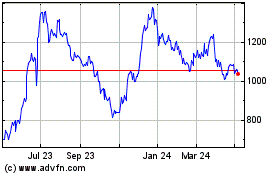

Carnival (LSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carnival (LSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024