By Rory Jones and Summer Said

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 18, 2020).

In the coronavirus pandemic's financial fallout, Saudi Arabia's

$300 billion sovereign-wealth fund has emerged as one of the

world's biggest bargain hunters, taking minority stakes worth

billions of dollars in American corporations.

The Public Investment Fund in the first quarter bought shares

valued at about half a billion dollars each in Facebook Inc., Walt

Disney Co., Marriott International Inc. and Cisco Systems Inc.,

according to a U.S. regulatory filing late Friday.

The fund bought financial stocks, investing $522 million in

Citigroup Inc. and $488 million in Bank of America Corp., while

also spending $714 million on a stake in Boeing Co.

The purchases, reported in a filing with the Securities and

Exchange Commission, follow disclosures last month of stakes each

valued at nearly $500 million in cruise operator Carnival Corp. and

concert promoter Live Nation Entertainment Inc.

Crown Prince Mohammed bin Salman, the kingdom's day-to-day

ruler, tasked the sovereign-wealth fund in 2015 with diversifying

the country's economy away from oil by investing in companies and

industries untethered to hydrocarbons.

PIF's recent buying spree highlights a bold strategy of piling

into global stocks even as the novel coronavirus and a crash in oil

prices mean that Saudi Arabia's financial position is now the most

precarious in a decade. The Saudi government last week tripled its

value-added tax rate and cut subsidies to state employees as it

contends with lower oil revenue and an economy weakening under

coronavirus lockdown.

While PIF has dipped into stocks in recent years, the fund has

focused more on private equity, allocating capital to managers such

as SoftBank Group Corp. Its record is mixed. PIF's $45 billion

investment in the Vision Fund has suffered losses and its

pre-listing investment in Uber Technologies Inc. of $3.5 billion is

currently down 40%.

PIF's move into equities is particularly bold as few funds

appear to be buying, according to Javier Capapé, director of

sovereign wealth research at Spain's IE University.

Sovereign-wealth funds used the financial crisis 10 years ago as an

opportunity to snap up cheap stakes in many Western companies, but

the wider impact of the current crisis means many nations with

rainy-day funds aren't out buying, said Mr. Capapé.

"So far only PIF has made these big and bold movements," he

added.

Many of the stocks that PIF has targeted are trading at historic

lows, bruised by the fallout from the coronavirus and rock-bottom

oil prices that have battered stocks of energy companies this

year.

PIF's recent equity purchases in oil companies also have bucked

Prince Mohammed's original mandate for the fund. It set out to

invest in nonoil companies that can help establish new industries

in technology, tourism and entertainment, or act as a hedge against

the decline of oil, the kingdom's biggest asset.

However, The Wall Street Journal last month reported that the

fund had bought undisclosed stakes in a bevy of energy companies,

including Equinor ASA, Royal Dutch Shell PLC, Total SA and Eni

SpA.

PIF invested $484 million in Shell, $222 million in Total and

previously unreported stakes of $828 million in BP PLC, $481

million in Suncor Energy Inc. and $408 million in Canadian Natural

Resources Ltd., according to the U.S. filing.

"We actively seek strategic opportunities both in Saudi Arabia

and globally that have strong potential to generate significant

long-term returns while further benefiting the people of Saudi

Arabia and driving the country's economic growth," a PIF

spokesperson said.

The Saudi fund invested in oil stocks during a period when

Prince Mohammed attempted to assert control over the oil market.

Saudi Arabia and Russia failed to agree on production cuts in early

March, so the prince flooded the market with cheap crude, creating

a glut of supply as the pandemic lowered global demand.

The price of Brent, the global benchmark, fell by half to $25 a

barrel in the middle of March, driving down share prices of major

oil companies. Saudi Arabia subsequently attempted to revive the

oil market by agreeing to production curbs in a deal on April

12.

According to the U.S. filing, PIF bought shares in oil companies

during the first three months of the year, though it isn't clear

whether the fund bought those stocks after the market sentiment had

weakened. It purchased the stake in Norway's Equinor between March

30 and April 6.

Outside the oil industry, PIF bought stakes in the first three

months of the year worth $496 million in Disney, $522 million in

Facebook, $491 million in Cisco and $514 million in Marriott, the

filing shows.

It also purchased shares valued at roughly $80 million each in

Warren Buffett's Berkshire Hathaway Inc.; chip makers Broadcom Inc.

and Qualcomm Inc.; International Business Machines Corp.; drugmaker

Pfizer Inc.; Starbucks Corp.; railroad company Union Pacific Corp.;

outsourcer Automatic Data Processing Inc.; and Booking Holdings

Inc., the parent company of Booking.com.

The Saudi fund's public investments in the first quarter look

well timed. It likely made the purchases ahead of the U.S. stock

market's March 23 low, caused by growing concerns about the

economic impact of the coronavirus. U.S. markets have rallied

since. Disney and Facebook are up 13% and 26%, respectively, since

March's end, and Marriott, which cut tens of thousands of jobs

because of the pandemic, is up 6.6%. Facing a prolonged period of

tepid global demand from airlines for its planes, Boeing is down

19% since the end of March.

PIF's spending comes months after Saudi Arabia listed national

oil company Aramco, helping raise nearly $30 billion for the fund

to deploy. But the kingdom's finances have deteriorated since then,

and the government expects to draw down $32 billion from foreign

reserves and borrow billions from capital markets this year. The

fund is also facing a lower windfall from the sale of the kingdom's

national petrochemical company to Aramco, a transaction previously

valued at $69 billion that the two sides are renegotiating to a

lower price.

On top of the stakes in public companies, PIF is also awaiting

regulatory approval for a roughly GBP300 million ($363 million)

buyout of U.K. Premier League soccer team Newcastle United F.C.

Write to Rory Jones at rory.jones@wsj.com and Summer Said at

summer.said@wsj.com

(END) Dow Jones Newswires

May 18, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

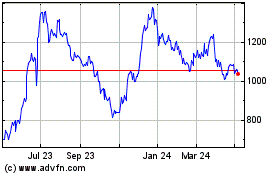

Carnival (LSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carnival (LSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024