BP Reports Rise in 3Q Profit; $1.25 Billion Buyback -- Update

November 02 2021 - 4:27AM

Dow Jones News

By Sabela Ojea

BP PLC on Tuesday reported a rise in third-quarter profit,

beating forecasts, and said that it continues to expect a decline

in reported full-year upstream production.

The FTSE 100 energy group also said that it is planning an

additional $1.25 billion share buyback before it announces its

fourth-quarter results and that it expects upstream underlying

production to be slightly higher than in 2020. This will be driven

by a "ramp up of major projects, primarily in gas regions, partly

offset by the impacts of reduced capital investment and decline in

lower-margin gas assets," it said.

BP added that the board remains committed to using 60% of 2021

surplus cash flow for share buybacks.

The British oil-and-gas major made an underlying replacement

cost profit of $3.32 billion in the three months through to the end

of September, up from $2.80 billion in the previous quarter and $86

million in the third quarter of 2020.

This was above market consensus of $3.06 billion, provided by

the company and averaged from the forecasts of 25 analysts.

The company swung to a net loss of $2.54 billion reflecting high

gas prices toward the end of the quarter. This compares with a net

profit of $3.12 billion in the immediately prior quarter, it

added.

Sales and other operating revenues decreased slightly to $36.17

billion from $36.47 billion, it added.

The board has declared a dividend of 5.46 cents per ordinary

share, to be paid in the fourth quarter.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

November 02, 2021 04:12 ET (08:12 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

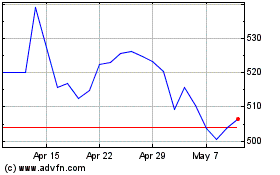

Bp (LSE:BP.)

Historical Stock Chart

From Mar 2024 to Apr 2024

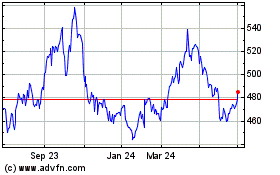

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2023 to Apr 2024