TIDMBOO

RNS Number : 2369O

boohoo group plc

08 February 2021

FOR IMMEDIATE RELEASE 8 February 2021

The information contained within this announcement is deemed by

the company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 ("MAR") and the retained

UK law version of MAR pursuant to the Market Abuse (Amendment) (EU

Exit) Regulations 2019 (SI 2019/310) ("UK MAR"). Upon the

publication of this announcement via the Regulatory Information

Service, this inside information is now considered to be in the

public domain. For the purposes of MAR, UK MAR, Article 2 of

Commission Implementing Regulation (EU) 2016/1055 and the UK

version of Commission Implementing Regulation (EU) 2016/1055, the

person responsible for releasing this announcement is Neil Catto,

Chief Financial Officer of boohoo group plc.

boohoo group plc

("boohoo" or "the Group")

Acquisition of British heritage brands Dorothy Perkins, Wallis

and Burton out of administration

boohoo, a leading online fashion retailer, is pleased to

announce that it has agreed to acquire all of the e-commerce and

digital assets and associated intellectual property rights,

including customer data, related business information and inventory

of the Burton, Dorothy Perkins and Wallis brands ("the Brands")

from the joint administrators of Arcadia Group Limited (in

administration) and its relevant subsidiaries ("the Transaction").

boohoo will pay GBP25.2 million in cash, funded from existing cash

resources, on completion.

Strategic Rationale

-- Significant opportunity to grow boohoo's market share across a broader demographic

o The Brands had over two million active customers in 2020

o Strengthens boohoo's position as a leader in the global

fashion e-commerce market with over 15 brands across the Group's

scalable multi-brand platform

-- Strengthening boohoo's menswear proposition

o Burton is an established brand which will enhance boohoo's

menswear portfolio in addition to boohooMAN and the recently

acquired Maine and Mantaray brands

-- Additional own label brands to support the Group's new Debenhams marketplace

o Two routes to market across pureplay websites and the Group's

marketplace

John Lyttle, CEO, commented:

"We are delighted to announce the acquisition of the assets

associated with the online businesses of the three established

brands Burton, Dorothy Perkins and Wallis. Acquiring these

well-known brands in British fashion out of administration ensures

their heritage is sustained, while our investment aims to transform

them into brands that are fit for the current market environment.

We have a successful track record of integrating British heritage

fashion brands onto our proven multi-brand platform, and we are

looking forward to bringing these brands on board."

Mahmud Kamani, Executive Chairman, commented:

"This is a great acquisition for the Group as we extend our

market share across a broader demographic, capitalising on growth

opportunities as more and more customers shop online. We continue

to grow our portfolio of brands and customer base, strengthening

our position as a leader in global fashion e-commerce."

Key Transaction Details

The Transaction is expected to complete on 9 February 2021,

after which the relevant operations for the Dorothy Perkins, Wallis

and Burton brands will continue as the Group integrates them onto

its platform in the first quarter of its financial year ending 28

February 2022.

The Transaction will be financed through the Group's existing

cash resources, which stood at GBP386.9 million on 31 December 2020

prior to the acquisition of Debenhams for GBP55 million announced

on 25 January 2021. The Group will only be acquiring the Brands and

associated intellectual property rights, the Transaction does not

include the HIIT brand and the Brands' retail stores, concessions

or franchises.

Financial Information

The Transaction is expected to contribute modest revenues over

the final few weeks of the Group's current financial year, with

continuity of service being provided to customers through a

Transitional Services Agreement ("TSA"). The integration and TSA

are expected to last for a period of up to three months, and the

Group expects to incur one-off transaction and restructuring costs

in the region of GBP10 million to GBP15 million during this

time.

The Group will provide a further update at its Full Year results

in early May 2021 when it expects to have concluded the integration

of the Brands onto its platform.

In the most recent financial year to 29 August 2020, the Brands

generated unaudited revenues of approximately GBP427.8 million

across all channels and an unaudited EBITDA loss of GBP14.3

million. The ongoing businesses for the Brands generated unaudited

revenues of approximately GBP178.8 million over the same

period.

Enquiries

boohoo group plc

Neil Catto, Chief Financial Officer Tel: +44 (0)161 233

2050

Alistair Davies, Investor Relations Tel: +44 (0)161 233

2050

Clara Melia, Investor Relations Tel: +44 (0)20 3289

5520

Zeus Capital - Nominated adviser and

joint broker

Nick Cowles/Andrew Jones (Corporate Finance) Tel: +44 (0)161 831

1512

John Goold/Benjamin Robertson (Corporate Tel: +44 (0)20 3829

Broking) 5000

Jefferies - Joint broker

Philip Noblet/Max Jones Tel: +44 (0)20 7029

8000

Buchanan - Financial PR adviser boohoo@buchanan.uk.com

Richard Oldworth / Kim Looringh-van Beeck Tel: +44 (0)20 7466

/ Toto Berger / Sophie Wills 5000

About boohoo group plc

"Leading the fashion eCommerce market"

Founded in Manchester in 2006, boohoo is an inclusive and

innovative brand targeting young, value-orientated customers. Since

2006, boohoo has been pushing boundaries to bring its customers

up-to-date and inspirational fashion, 24/7. boohoo has grown

rapidly in the UK and internationally, expanding its offering with

range extensions into menswear, through boohooMAN.

In early 2017 the Group extended its customer offering through

the acquisitions of the vibrant fashion brand PrettyLittleThing,

and free-thinking brand Nasty Gal. In March 2019 the Group acquired

the MissPap brand, in August 2019 the Karen Millen and Coast brands

and in June 2020 the Warehouse and Oasis brands, all complementary

to the Group's scalable, multi-brand platform. United by a shared

customer value proposition, our brands design, source, market and

sell great quality clothes, shoes and accessories at affordable

prices. These investment propositions have helped us grow from a

single brand, into a major multi-brand online retailer, leading the

fashion e-commerce market for 16 to 40-year-olds with a global

presence. As at 31 August 2020, the Group had just over 17 million

active customers across all its brands around the world.

In January 2021, the Group acquired the intellectual property

assets of Debenhams, with the goal of transforming a leading UK

fashion and beauty retailer into an online marketplace through a

new capital light and low risk operating model that is

complementary to the Group's highly successful direct-to-consumer

multi-brand platform. In February 2021, the Group acquired the

intellectual property assets of UK brands Burton, Dorothy Perkins

and Wallis.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFFFILFDIDIIL

(END) Dow Jones Newswires

February 08, 2021 02:00 ET (07:00 GMT)

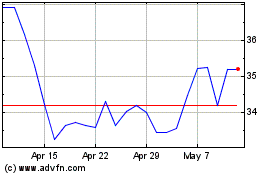

Boohoo (LSE:BOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

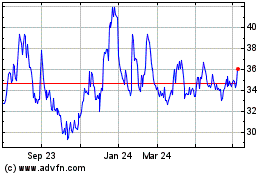

Boohoo (LSE:BOO)

Historical Stock Chart

From Apr 2023 to Apr 2024