TIDMATY

RNS Number : 9408N

Athelney Trust PLC

01 August 2014

Embargoed 7am Friday 1 August 2014

ATHELNEY TRUST plc: INTERIM RESULTS

Athelney Trust plc, the investment company focussed on small

companies and junior markets, announces its unaudited results for

the six months ended 30 June 2014.

Main points:

-- Unaudited Net Asset Value ("NAV") up 35.2 per cent at 224.8p (2013: 166.2p)

-- Gross revenue up 23.25 per cent at GBP101,530 (2013: GBP82,384)

-- Revenue return per ordinary share rose 27.3 per cent to 4.2p (2013: 3.3p)

-- Final dividend of 5.5p per share paid in April 2014

Chairman Hugo Deschampsneufs said: "The market is exhibiting an

eerie calm, Zen like stillness I find unnerving. Look around the

world at Syria/Iraq, Israel/Palestine, Somalia/Kenya Russia/Ukraine

and Nigeria. Now China has laid claim to the whole of the South

China Sea and is already in dispute with Japan, the Philipines,

Vietnam and just about everyone else.

"Then there is the slowing Chinese economy with 107 million tons

of iron ore on various docksides. QE has finished in the UK and

will do so in America later this year. We have the Scottish

referendum and the General Election is now just months away.

"And to make sure your cup runneth over the Chinese property

boom is the most important factor in the global economy. In the

past few years predictions that the sector is about to explode have

not been borne out but it really could happen this time.

"Against that can be set that every investor is seemingly

searching the world for dividend yield and the world is awash with

liquidity - so that's all right then!

"Britain must seem like a Treasure Island in a sea of troubles.

Nevertheless there is a problem. Either central banks are right to

be worried about the economy so wish to keep interest rates low or

they are wrong and will be forced to raise interest rates faster

than the market expects.

"Either way seems likely to lead to more uncertainty and

volatility. Until the outlook becomes clearer investors will not

want to give up on what has been a winning strategy of holding

equities for capital growth and increasing income. Equity investors

are reluctant 'bulls' but there seems no alternative. Hold".

-ends-

For further information:

Robin Boyle, Managing Director

Athelney Trust 020 7628 7937

Paul Quade 07947 186694

CityRoad Communications 020 7248 8010

CHAIRMAN'S STATEMENT AND BUSINESS REVIEW

I announce the unaudited results for the six months to 30 June

2014. The salient points are as follows:

-- Unaudited Net Asset Value (NAV) is 224.8p per share (31

December 2013: 219.3p, 30 June 2013: 166.2p), an increase of 2.5

per cent for the half year and an increase of 35.2 per cent over

the past year.

-- Gross Revenue increased by 23.25 per cent to GBP101,530

compared with the half year ended 30 June 2013 of GBP82,384 (full

year to 31 December 2013 GBP155,571).

-- Revenue return per ordinary share was 4.2p, an increase of

27.3 per cent from the previous half year to 30 June 2013 (31

December 2013: 6.1p, 30 June 2013: 3.3p).

-- A final dividend of 5.5p was paid in April 2014 (2013: final dividend 5p).

Review of 1 January 2014 to 30 June 2014

When management with a reputation for brilliance tackles a

business with a reputation for poor fundamentals, it is the

reputation of the business which remains intact - Warren

Buffett

If Hitler invaded Hell, I would make at least a favourable

reference to the Devil in the House of Commons - Winston

Churchill.

The opera started at 8. At midnight I looked at my watch. It

said 8.15. The observation by Hollywood producer Billy Wilder on

watching Wagner's Ring Cycle.

He is a complete professional and the best of his type by a

million miles - Andy Coulson, then editor of News of the World,

gave a glowing endorsement for the cover of now disgraced public

relations consultant Max Clifford's autobiography Read All About It

in 2006.

The market is exhibiting an eerie, calm, Zen-like stillness that

I find quite unnerving. Look around the world at Syria/Iraq,

Israel/Palestine, Somalia/Kenya, Russia/Ukraine and Nigeria: now

China has laid claim to the whole of the South China Sea and is

already in dispute with Japan, the Philippines, Vietnam and just

about everyone else. Then there is the slowing Chinese economy with

107 million tons of iron-ore on various dock-sides. QE has finished

in the UK and will do so in America later this year. We have the

Scottish referendum to look forward to (not) and the General

Election is now just months away.

And to make sure that your cup runneth over, Chinese property is

the most important factor in the global economy. In the past few

years, predictions that the sector was about to explode have not

been borne out, but it really could happen this time (more below).

Against that can be set that every investor is seemingly searching

the world for dividend yield and the world is awash with liquidity

- so that's all right then.

For the six months ended 30 June 2014, New York and London edged

up by 2.4 per cent and 1 per cent respectively but other major

markets did less well with Tokyo down by 5.7 per cent and Shanghai

by 2.6 per cent. In smaller markets, Argentina, India and Denmark

improved by 51.3 per cent, 22.1 per cent and 20.2 per cent

respectively. Venezuela, on the other hand, fell by 22.3 per cent.

Returning to London, the Athelney Trust unaudited net asset value

rose by 2.5 per cent (or 5 per cent with income reinvested) and the

FTSE Small Cap, Fledgling and AIM All-share indices improved by 0.3

per cent, 1.8 per cent and 0.8 per cent respectively.

I am indebted to Private Eye and its Brazil correspondent Rio de

Ferdinand for the following.

When the England team flew into Brazil and began to acclimatize

to the very different conditions in the developing world, there was

a real sense of shock at this first impression. I couldn't believe

how poor they were said one Brazilian eye witness. In this day and

age it is difficult to believe that they are allowed to get in this

state. The poverty of their defence is genuinely shocking and as

for their forwards, well, it beggars belief. Another Brazilian

observer admitted to feeling guilty when confronted by the England

squad. You have to feel sorry for them. It's a pitiful sight but

we've been told not to give them any goals because that sort of

charity doesn't work.

The year 2014 is a momentous one: it is the 100th anniversary of

the start of the Great War, the 70th anniversary of D-Day and the

25th anniversaries of the collapse of the Soviet empire and the

savage crackdown in Tiananmen Square. One hundred years ago,

Europe's fragile order fell apart. Seventy years ago, the

democracies launched an assault on Fascist Europe. Twenty-five

years ago, Europe became whole and free, while China chose a

strange combination of market economics and the party state.

In 1913, Western Europe was the economic and political centre of

the world with European empires controlling vast colonies. This

world was torn apart by the Great War to be replaced by America,

which became the world's largest creditor.

The post-second World war division of Europe was a tragedy,

though an inevitable one - America was never going to fight the

Soviet Union immediately after its alliance with it. But the U.S.

did protect Western Europe through NATO, the Marshall Plan, the

OECD and the General Agreement on Tariffs and Trade (GATT).

We have now lived for a quarter of a century in an era of global

capitalism driven by the acceptance of the market economy and the

digital revolution. This happened under the EU and global

institutions such as the International Monetary Fund and the World

Trade Organization. However, the pressures of our times are

becoming clearer. The Great Recession, like the Great Depression

before it, has damaged globalization. Russia is now revanchist

(seeking to recover lost territory) and China (see above) is

increasingly assertive.

If there is one lesson to be drawn from this brief history, it

is that we must learn to co-operate, yet we remain tribal. If John

Maynard Keynes were alive today, he would sigh at the risks of this

economic and political nationalism.

Black cab drivers protested in June against Uber, a web-based

minicab company. They did so by driving slowly around London,

causing traffic jams. But I thought that's what they did

anyway...............

Chinese property is the most important sector in the global

economy. It has been essential to the country's economic

development and has sucked in commodity imports from all over the

world. But property activity has been falling from mid-2013 and a

simple downturn now threatens to turn into a bust. There are risks

in the so-called shadow banking sector (i.e. any lending

organization which is not a bank) and the rapid rise in local

government debt. Property investment has grown to about 13 per cent

of GDP (roughly double the situation in the U.S. at the height of

the property bubble) and 16 per cent if one includes steel, cement,

construction materials and machinery and accounts for about 25 per

cent of all capital investment. It also accounts for about 20 per

cent of all commercial bank loans but is used as security in 40 per

cent of all lending. Now the position is that the overhang of

unsold properties in the Tier 2 cities has risen to about 15

months' supply and 24 months in Tier 3 and Tier 4 cities. Beijing's

resolve not to respond to weakening prices and activity is unlikely

to hold: we should expect extra spending on infrastructure and

environmental programmes, faster urbanization, relaxation on

home-buying restraints and mortgage deposits and, perhaps later,

more monetary easing.

Temporary relief, perhaps, but these measures may undermine the

essential strategy of rebalancing the economy towards consumer

spending and the negative effects would be larger and last longer.

China is different from a western economy in so many different ways

but the real results of a burst bubble are the same the world over.

Beijing will have to cope with them in the coming years but the

rest of us will worry about the deflationary consequences in a

still fragile global economic recovery.

I was sad to see the report of the early death of comic actor

Rik Mayall. I well remember his wonderful portrayal of Alan

Beresford B'Stard, Thatcherite MP, and his quote, "The really great

thing about a fudged coalition is that neither of us need to carry

out a single promise of our election manifestoes."

For most of the 20th century ICI was Britain's leading

industrial company. It was formed in 1926 through the merger of

four chemical companies - Brunner Mond, Nobel Explosives, United

Alkali and British Dyestuffs. After the war, the ICI board decided

that the new frontier of chemistry was pharmaceuticals (pharma).

James Black, a young physiologist, was recruited for the new team:

despite the high quality of its research chemists, the pharma

division lost money for nearly twenty years. In the 1960s, Black

discovered beta-blockers, the first effective drug for treating

high blood pressure.

Other products followed and the division became the fastest

growing part of ICI. Black moved on to SmithKline, where he

discovered Tagamet, which relieved many from the misery of stomach

ulcers. Glaxo later discovered Zantac and Astra of Sweden the

proton pump inhibitor, both treatments for ulcers.

In 1991, ICI was under threat of a take-over so spun off pharma

(now called Zeneca) which subsequently merged with Astra. The rump

chemicals business of ICI started its long decline into oblivion.

But the world of pharma was changing: Pfizer was the company that

many admired - cutting costs and filling gaps in its range via

acquisitions were to be preferred to, for instance, Merck's great

research history.

But business built to last is about people and products, not

corporate adventures and tax advantages. Sir James Black, I am

sure, created more shareholder value than any financier or

deal-maker in the history of British business. For that reason,

Astra Zeneca's board and most of its shareholders were quite right

to turn down the Pfizer take-over offer.

Is London's new issue market turning into a racket? Prospectuses

are frequently published only after conditional dealings have

started, hard-bitten investment analysts are brought on board, thus

stifling criticism while any potential investor asking awkward

questions is likely to be left out altogether. Tempted by the

latest one? Perhaps you should go and lie on a hot beach until the

feeling goes away.

In 1931, Hugh Macmillan, a Scottish judge, wrote in his report

that British engineering and shipbuilding businesses were doing

badly compared with their German and American competitors because

of the lack of finance, the so-called Macmillan gap. It can come as

no surprise that the gap is still there 83 years later. If

anything, things are getting worse - bank lending to SMEs (small

and medium enterprises) has been falling for four years and by a

quarter to all businesses. SMEs have been the ugly duckling of the

banking world, representing only 2 per cent of bank assets. SME

lending officers seem to have disappeared off the map: where once

we had banks that liked to say yes now we have computers programmed

to say no.

One idea to improve matters is to create a high quality

data-base on companies' credit history and revenues making it

freely available to prospective lenders, both old and new. Why

would one do this? Because about 80 per cent of SMEs' banking

relationships are with the big four banks: data is not shared at

present which makes life hard for new entrants to get a foot in the

SME door. Measures proposed by the Government last year might help

but it would be good to go further and create a one-stop-shop for

information on companies available to all lenders. This would be

called a credit register.

Lowering barriers to entry would boost competition in the SME

lending market, reducing costs and improving access to credit. For

the U.K., it would be a big step but, as usual, we are behind

everyone else. Almost 100 countries already have a credit register,

including over half of the countries in the EU. The Macmillan gap

has probably existed for about a century - let us close it once and

for all.

The modern Greek state has spent more than half its existence in

default on its debt. Even before its historic restructuring in

2012, Greece had defaulted five times since the 1820s - in 1826,

1843, 1860, 1893 and 1932. Yet in April, investors were desperate

for the chance to buy new Greek debt despite growth rates too

sluggish to make a serious dent in the country's steep debt pile.

Alexander Pope's Hope springs eternal comes to mind...........

Anyone who enjoys the sight of economists eating their hat is in

for a treat soon. When the U.K. adopts new international standards

for national income accounting, three great truths are likely to be

shown up as being wrong. Some of the changes have been flagged for

years. The level of gross domestic product (GDP) will rise because

things like research and development, the manufacture of weapons

systems and intangibles like prostitution and drug dealing will be

included for the first time. If that was it, the overall effect

would be small (somewhere between 2.5 and 5 per cent) but there is

another much more important change.

Now you must read carefully because I shall be asking questions

later! We are moving from cash to accruals accounting principles

for funded pension schemes. There, I knew it - you've fallen

asleep! The three great truths are: households do not save;

companies are sitting on huge piles of cash and household incomes

have stopped rising with GDP. None are true. Including funded

pension schemes will increase household saving from 5.5 per cent of

disposable income to about 11 per cent. British households will

ditch their reputation for profligacy overnight.

Correspondingly, the savings of the corporate sector will

decline. Since incomes will appear higher, much of the puzzle of

why households did not appear to benefit from recent rises to GDP

will disappear. We should go further and include central

government's unfunded final salary schemes in the same way, which

would make the U.K.'s public financed look even uglier than they

are.

The last time Britain attempted to control bank lending by

administrative fiat, Spandau Ballet were in the charts, the

Conservative government had just given council house tenants the

right to buy their properties and Margaret Thatcher was still to

make her not for turning speech. Did it work last time? No, don't

think that it did........

A new smartphone app will be popular with manufacturers keen to

make money from energy ministers' inability to plan. The app will

tell industrialists when the power distributor will pay them for

not making things so that the domestic householder can continue to

brew tea while ignoring the TV ads. It reminds me of Joseph

Heller's great novel Catch 22. Discovering that the U.S government

paid subsidies to reduce alfalfa production, he worked without rest

at not growing alfalfa.....and soon was not growing more alfalfa

than any man in the country.

National Grid implies that there is a danger of the lights going

out in 2015/16. That winter, it expects to have recruited

sufficient manufacturers to reduce demand by 1,800 megawatts at any

point if needed. They will receive GBP10,000 for each MW they

forswear regardless of whether National Grid actually calls on them

plus another up to GBP15,000 per MW hour for power actually

forfeited. At a time when we are desperate to encourage

manufacturing industry, you couldn't make it up, could you?

Results

Gross revenue increased to GBP101,530 compared to the same

period last year of GBP82,384.

Number

Companies paying dividends 71

Companies purchased (therefore no true comparison) 5

Increased total dividends in the half year 38

Reduced total dividends in the half year 9

No change in dividend 19

Dividends accrued 17

Portfolio Review

Holdings of Games Workshop, UK Commercial Property Trust, Novae

Group, McColls Retail Group, Hiscox, Brit, Beazley and Andrews

Sykes Group were all purchased for the first time. Additional

holdings of Vianet, Amlin, Catlin, Schroder Real Estate Investment

Trust, Lancashire Holdings, Londonmetric, M & C Saatchi and

Picton Property Income were also acquired. Arbuthnot Banking Group,

H & T Group and Macfarlane Group, were sold, Abbey Protection

was taken over. In addition a total of 15 holdings were top-sliced

to provide capital for new purchases.

Dividend

As is the Board's practice, consideration of a dividend will be

left until the final results are known.

Risks

The Company's assets consist mainly of listed securities and its

principal risks are therefore market-related. The Company is also

exposed to currency risk in respect of a small number of

investments held in overseas markets.

The major risks associated with the Company are market and

liquidity risk. The Company has established a framework for

managing these risks. The directors have guidelines for the

management of investments and financial instruments.

Market Risk

Market risk arises from changes in interest rates, valuations

awarded to equities, movements in prices and the liquidity of

financial instruments.

Liquidity Risk

Liquidity Risk is the risk that the Company may have difficulty

in meeting obligations associated with financial liabilities. The

Company has no borrowings; therefore there is no exposure to

interest rate changes.

The company is able to reposition its investment portfolio when

required so as to accommodate liquidity needs.

Outlook

Britain (and America, come to think of it) must seem like a

Treasure Island in a sea of troubles. Nevertheless, there is a

problem: either central banks are right to be worried about the

economy so wish to keep interest rates low or they are wrong and

will be forced to raise rates faster than markets expect. Either

way seems likely to lead to more uncertainty and volatility. Until

the outlook becomes clear, investors will not want to give up on

what has been a winning strategy of holding equities for capital

growth and an increasing income. Equity investors are reluctant

'bulls' but there seems no alternative. Hold.

H.B. Deschampsneufs

31 July 2014

HALF YEARLY INCOME STATEMENT

(INCORPORATING THE REVENUE ACCOUNT)

Audited

Year ended

Unaudited Unaudited 31 December

6 months ended 30 June 6 months ended 30 June

2014 2013 2013

Revenue Capital Total Revenue Capital Total Total

GBP GBP GBP GBP GBP GBP GBP

Gains on investments

held at fair

value - 309,890 309,890 - 104,470 104,470 1,466,773

Income from

investments 101,530 - 101,530 82,384 - 82,384 155,571

Investment

Management

expenses (2,780) (25,432) (28,212) (2,829) (25,913) (28,742) (58,799)

Other expenses (14,441) (21,056) (35,497) (14,309) (22,356) (36,665) (70,726)

Net return

on ordinary

activities

before taxation 84,309 263,402 347,711 65,246 56,201 121,447 1,492,819

Taxation - - - - - - -

Net return

on ordinary

activities

after taxation 84,309 263,402 347,711 65,246 56,201 121,447 1,492,819

Dividends Paid:

Dividend (109,069) - (109,069) (99,154) - (99,154) (99,154)

Transferred

to reserves (24,760) 263,402 238,642 (33,908) 56,201 22,293 1,393,665

========== ============ ========== ========= =========== ========= ============

Return per

ordinary share 4.2p 13.3p 17.5p 3.3p 2.8p 6.1p 75.3p

The total column of this statement is the profit and loss

account for the Company.

All revenue and capital items in the above statement derive from

continuing operations.

No operations were acquired or discontinued during the above

financial periods.

A Statement of Total Recognised Gains and Losses is not required

as all gains and losses of the Company have been reflected in the

above Statement.

HALF-YEARLY RECONCILIATION OF SHAREHOLDERS' FUNDS

For the Six Months Ended 30 June 2014 (Unaudited)

Called-up Capital Capital Total

Share Share reserve reserve Revenue Shareholders'

Capital Premium realised unrealised Reserve Funds

GBP GBP GBP GBP GBP GBP

Balance at 1 January

2014 495,770 545,281 953,991 2,108,854 245,797 4,349,693

Net gains on realisation

of investments - - 309,890 - - 309,890

Decrease in unrealised

Appreciation - - - (129,917) - (129,917)

Expenses allocated

to

Capital - - (46,488) - - (46,488)

Profit for the

period - - - - 84,309 84,309

Dividend paid in

year - - - - (109,069) (109,069)

Shareholders' Funds

at 30 June 2014 495,770 545,281 1,217,393 1,978,937 221,037 4,458,418

========== ======== ========== =========== ========== ==============

HALF YEARLY BALANCE SHEET AS AT 30 JUNE 2014

Audited

Unaudited Unaudited 31 December

30 June 30 June

2014 2013 2013

GBP GBP GBP

Fixed assets

Investments held at

fair value through

profit and loss 4,372,861 3,256,734 4,298,919

---------- ---------- ------------

Current assets

Debtors 50,399 34,526 41,782

Cash at bank and in

hand 47,410 17,971 24,709

97,809 52,497 66,491

Creditors: amounts falling

due within one year (12,252) (12,847) (15,717)

---------- ---------- ------------

Net current assets 85,557 39,650 50,774

---------- ---------- ------------

Total assets less current

liabilities 4,458,418 3,296,384 4,349,693

Provisions for liabilities

and charges - - -

Net assets 4,458,418 3,296,384 4,349,693

========== ========== ============

Capital and reserves

Called up share capital 495,770 495,770 495,770

Share premium account 545,281 545,281 545,281

Other reserves (non

distributable)

Capital reserve - realised 1,217,393 808,229 953,991

Capital reserve - unrealised 1,978,937 1,257,945 2,108,854

Revenue reserve 221,037 189,159 245,797

Shareholders' funds

- all equity 4,458,418 3,296,384 4,349,693

========== ========== ============

Net Asset Value per

share 224.8p 166.2p 219.3p

Number of shares in

issue 1,983,081 1,983,081 1,983,081

HALF YEARLY CASHFLOW STATEMENT FOR THE SIX MONTHS ENDING

30 JUNE 2014

Unaudited Unaudited Audited

Year ended

6 months ended 6 months ended 31 December

30 June 2014 30 June 2013 2013

GBP GBP GBP GBP GBP

Net cash inflow from

operating activities 25,738 70,286 74,969

Taxation

Corporation tax

paid - - -

Financial Investment

Purchases of investments (426,702) (189,204) (722,310)

Sales of investments 532,734 214,674 749,835

Net cash inflow from

Financial Investment 106,032 25,470 27,525

Dividends paid (109,069) (99,154) (99,154)

Financing

Issue of ordinary

share capital - - -

Share issue costs

----------

Decrease in cash in

the year 22,701 (3,398) 3,340

========== ========= =============

Reconciliation of operating

net revenue to

net cash inflow/ (outflow)

from operating activities GBP GBP GBP

Revenue return on ordinary

activities before taxation 84,309 65,246 121,884

Increase/(decrease) in

debtors (8,618) 55,683 48,427

Decrease in creditors (3,465) (2,374) 496

Investment management expenses

charged

to capital (25,432) (25,913) (53,034)

Other expenses charged to

capital (21,056) (22,356) (42,804)

25,738 70,286 74,969

========== ========= =============

Reconciliation of net cashflow to

movement in net fund

Net funds at 31/12/13 Cashflow Net fund at 30/6/14

GBP GBP

GBP

Cash at bank and

in hand 24,709 22,701 47,410

NOTES TO THE HALF YEARLY FINANCIAL STATEMENTS

1. The financial information contained in these Half Yearly

Financial Statements comprises non-statutory accounts as defined in

Sections 434 to 436 of the Companies Act 2006. The financial

information for the year ended 31 December 2013 has been extracted

from the statutory accounts which have been filed with the

Registrar of Companies and which contain an unqualified Auditors'

Report and do not contain a statement under Sections 498(2) or

498(3) of the Companies Act 2006.

2. The condensed financial statements for the period ended 30

June 2014 have been prepared on the basis of the same accounting

policies adopted as set out in the Annual Report for the year ended

31 December 2013 and in accordance with the Financial Reporting

Council's Statement "Half Yearly Financial Reports". They have not

been audited or reviewed by the auditors pursuant to the Auditing

Practices Board Guidance on "Review of Interim Financial

Information

3. To the best of our knowledge and belief there are no related

party transactions within the meaning required by the Disclosure

and Transparency Rules 4.2.8R (disclosure of related party

transactions and changes therein).

4. The calculation of earnings per share for the six months

ended 30 June 2014 is based on the attributable return on ordinary

activities after taxation and on the weighted average number of

shares in issue during the period.

6 months ended 30 June 6 months ended 30 June

2014 (Unaudited) 2013 (Unaudited)

Revenue Capital Total Revenue Capital Total

GBP GBP GBP GBP GBP GBP

Attributable return

on

ordinary activities

after taxation 84,309 263,402 347,711 65,246 56,201 121,447

Weighted average

number of shares 1,983,081 1,983,081

Return per ordinary

share 4.2p 13.3p 17.5p 3.3p 2.8p 6.1p

12 months ended 31 December

2013 (Audited)

Revenue Capital Total

GBP GBP GBP

Attributable return

on

ordinary activities

after taxation 121,884 1,370,935 1,492,819

Weighted average

number of shares 1,983,081

Return per ordinary

share 6.1p 69.1p 75.3p

5. Net Asset Value (NAV) per share is calculated by dividing

shareholders' funds by the weighted average number of shares in

issue at 30 June 2014 of 1,983,081 (30 June 2013: 1,983,081 and 31

December 2013: 1,983,081).

6. Copies of the Half Yearly Financial Statements for the six

months ended 30 June 2014 will be available on the Company's

website www.athelneytrust.co.uk as soon as practicable.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BUGDRXXXBGSB

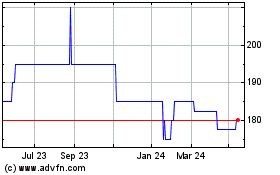

Athelney (LSE:ATY)

Historical Stock Chart

From Aug 2024 to Sep 2024

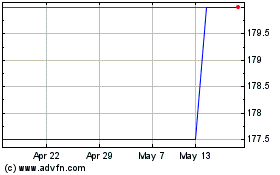

Athelney (LSE:ATY)

Historical Stock Chart

From Sep 2023 to Sep 2024