TIDMARG

RNS Number : 7661J

Argos Resources Ltd

15 December 2022

This announcement contains inside information

ARGOS RESOURCES LIMITED

("Argos", the "Group" or "the Company")

Proposed Sale of North Falkland Basin Interests to JHI

Associates Inc

Argos Resources Limited (AIM: ARG.L), the Falkland Islands based

exploration company focused on the North Falkland Basin , is

pleased to announce that the Company and JHI Associates Inc.

("JHI"), a private company incorporated in Ontario, Canada, have

entered into an agreement pursuant to which it is proposed that JHI

will acquire Argos' PL001 Production Licence interests in the North

Falkland Basin (the "Transaction").

Highlights

-- JHI has agreed to acquire 100 per cent. of the Group's PL001

Production Licence in the North Falkland Basin, immediately to the

west of the giant Sea Lion oil field, subject to certain

conditions.

-- As consideration, JHI is proposing to issue Argos with new

shares in JHI (the "Consideration Shares"), plus a cash payment

enabling the Company to settle transaction and corporate

expenses.

-- Following completion of the Transaction, which remains

subject to the conditions set out below, the Group would gain

exposure to the Canje block, offshore Guyana, which is directly

adjacent to the prolific Stabroek block where ExxonMobil has

discovered more than 10 billion barrels of oil.

-- The Consideration Shares are expected to represent

approximately 9.3 per cent. of the enlarged share capital in JHI

following completion of the Transaction.

-- In the event that the Transaction is completed, the financial

strength of JHI is expected to underpin the extension of Licence

PL001 by two years to 31 December 2024, which was announced by the

Company earlier today.

-- The Transaction would diversify both companies' assets and

pave the way for further drilling activity in the coming years.

The Transaction remains subject to the satisfactory completion

of mutual due diligence and the parties entering into a binding

Sale & Purchase Agreement ("SPA"). In the event an SPA is

agreed, completion of the Transaction would also be subject to,

inter alia, obtaining the necessary approvals from the Falkland

Islands Government and Secretary of State to the transfer of

Licence PL001 to JHI. Accordingly, there is no certainty that the

Transaction will complete on the terms indicated, or at all.

Next Steps & AIM Rule 15

It is anticipated that the proposed Transaction would constitute

a fundamental change of business pursuant to AIM Rule 15, as the

effect of the Transaction would be to divest the Company of its

sole asset. The Transaction would therefore also require the

consent of Argos' shareholders being given in general meeting. Upon

signing an SPA, the Company will issue a further announcement and

publish a circular containing details of the disposal, the proposed

change to the business and convene the general meeting.

Next Steps & AIM Rule 41

In the event all conditions associated with the Transaction are

satisfied, the Group's sole asset would be a minority shareholding

in JHI. The Company's Board of Directors have concluded that in

this scenario the costs associated with maintaining an AIM listing

would not be justified. Therefore, following completion of the

Transaction the Board intends to seek cancellation of the Company's

securities from admission to trading on AIM ("Cancellation").

Cancellation would be conditional upon the consent of not less than

75 per cent. of votes cast by the Company's shareholders given in

general meeting. Following Cancellation, it would be the Directors

intention to liquidate the Company and distribute the Consideration

Shares proportionately to Argos' shareholders on the register at

the relevant time.

Ian Thomson, Chairman of Argos commented:

"This is an attractive transaction for both companies, and I

strongly recommend that ARL shareholders vote in favour when asked

to do so in a general meeting. JHI has ample cash reserves which

are more than sufficient to cover the investments required to

advance the exploration activities on Licence PL001 and to meet the

financial capability criteria to support a licence extension to 31

December 2024.

In addition to the North Falkland Basin Licence PL001, the

transaction gives ARL shareholders access to potential upside in

the Canje licence, offshore Guyana, in a basin that has been the

highlight of the oil industry for several years, enjoying prolific

success from numerous giant oil discoveries."

Information on JHI

JHI is a private company incorporated in Ontario and

headquartered in Toronto, Canada. JHI owns a 17.5 per cent.

interest in the Canje block, offshore Guyana, operated by Esso

Exploration & Production Guyana Ltd. (35 per cent.), a

subsidiary of ExxonMobil Corp. The other partners in the block are

TotalEnergies E&P Guyana BV (35 per cent.) and Mid-Atlantic Oil

& Gas Inc. (12.5 per cent.). The Canje block covers

approximately 4,800 square kilometres and is located approximately

180 to 300 kilometres offshore Guyana in water depths ranging from

1,700 to 3,000 metres.

The Canje block is a large and significant licence adjacent and

immediately east of multiple ExxonMobil discoveries in the Stabroek

block. 6,100 square kilometres of 3D seismic data has been shot

over the Canje block, from which over three dozen prospects have

been mapped in four proven plays in the Lower Tertiary and Upper

Cretaceous confined channels, Lower Cretaceous carbonate structures

and, with the recent drilling of Sapote-1 well and Stabroek

discoveries, the block now offers the opportunity of yet deeper

prospectivity.

As of 31 December 2021, JHI's audited financial statements

indicate total gross assets of approximately US$30.7 million, of

which approximately US$27 million in cash and investments, and

total liabilities of approximately US$500,000.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISDDBDDBXBDGDS

(END) Dow Jones Newswires

December 15, 2022 02:01 ET (07:01 GMT)

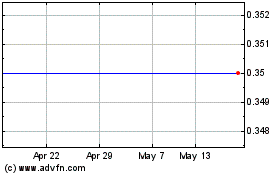

Argos Resources (LSE:ARG)

Historical Stock Chart

From Jan 2025 to Feb 2025

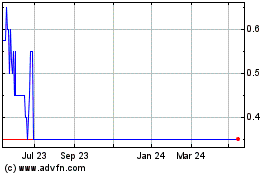

Argos Resources (LSE:ARG)

Historical Stock Chart

From Feb 2024 to Feb 2025